Professional Documents

Culture Documents

Msikerem

Msikerem

Uploaded by

tigistdesalegn20210 ratings0% found this document useful (0 votes)

4 views1 pageThis document contains a 10 question quiz about foreign currency transactions. The questions cover topics like the risks of forex trading, features of travelers' checks, how payables track currency gains and losses, types of exchange rate entries and exchange rates, how to report on foreign currency transactions, what are considered significant cash transactions, what cleared funds are, what a foreign currency future is, and whether hard currencies are traded less frequently.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a 10 question quiz about foreign currency transactions. The questions cover topics like the risks of forex trading, features of travelers' checks, how payables track currency gains and losses, types of exchange rate entries and exchange rates, how to report on foreign currency transactions, what are considered significant cash transactions, what cleared funds are, what a foreign currency future is, and whether hard currencies are traded less frequently.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageMsikerem

Msikerem

Uploaded by

tigistdesalegn2021This document contains a 10 question quiz about foreign currency transactions. The questions cover topics like the risks of forex trading, features of travelers' checks, how payables track currency gains and losses, types of exchange rate entries and exchange rates, how to report on foreign currency transactions, what are considered significant cash transactions, what cleared funds are, what a foreign currency future is, and whether hard currencies are traded less frequently.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

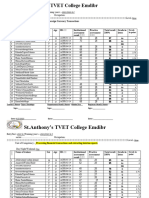

St.

Anthony’s TVET College Emdibir

Department of Accounting And Finance

Level 3. Handle Foreign Currency Transactions.

Name -----------------------------------------ID ------------------------sex -----------

1.Risks of Forex Trading

A. Transaction Costs May Not Be Clear B. Fraud C. There Is No Central Clearing

D. There Is No Central Marketplace E. All

2. Features of travellers' cheque.

A. Convenient B. Safe C. A&B D. None

3. Payables tracks currency gains and losses in your functional currency caused by exchange rate

fluctuations

A. True B. False

4. Types of Exchange Rate Entry

A. Manual. B. GL Daily Rates Table Default C. AutoRate D. All

5. Types of Exchange Rates

A. Spot B . GL Daily Rates Table Default C. Manual D. None

6. Reporting on Foreign Currency Transactions

A. Posting Hold Report B. Unrealized Gain / Loss Report, and Realized Gain / Loss

Report C. Cash Requirement Report D. All

7. Significant cash transactions involving in excess of the equivalent of Birr…..

A. 250,000 B.250,000 D. 200,000 D.All

8. The amount of money in an account that is available for withdrawal or investment

A. Currency B. Cleared funds C. option D. All

9……………… is a forward contract with standardized terms, including quantities and

settlement dates, that is traded on organized exchanges.

A. foreign currency future B. option C. Cleared funds D. Currency

10. Hard currencies such as those of less developed economies, are traded less frequently,

resulting in larger spreads.

A. True B. False

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 1 MCQS ON Forex ManagementDocument37 pages1 MCQS ON Forex ManagementPadyala Sriram67% (6)

- CFA Dec 2014 L1 - Derivatives Practice Question v.0.1Document22 pagesCFA Dec 2014 L1 - Derivatives Practice Question v.0.1Chan HL75% (4)

- Financial Institution & Investment Management - Final ExamDocument5 pagesFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)

- Certification Course in Foreign ExchangeDocument16 pagesCertification Course in Foreign ExchangeVishav Mahajan100% (7)

- Chapter 6 The Foreign Exchange MarketsDocument34 pagesChapter 6 The Foreign Exchange MarketsNyamandasimunyola100% (1)

- International Financial Management MCQDocument5 pagesInternational Financial Management MCQAshish Patel100% (4)

- Types of Exchange Rate Entry: A. True B. False 4Document1 pageTypes of Exchange Rate Entry: A. True B. False 4tigistdesalegn2021No ratings yet

- Birekab 222Document2 pagesBirekab 222tigistdesalegn2021No ratings yet

- Cross Border BnkingDocument3 pagesCross Border BnkingPenn CollinsNo ratings yet

- Foreign Exchange ManagementDocument21 pagesForeign Exchange ManagementSreekanth GhilliNo ratings yet

- Chapter6 KTQT PDF - SVDocument15 pagesChapter6 KTQT PDF - SVPhong Phạm NghĩaNo ratings yet

- Ayu 22Document3 pagesAyu 22tigistdesalegn2021No ratings yet

- 2 Forex Management McqsDocument12 pages2 Forex Management McqsPadyala Sriram100% (1)

- Chapter 7Document13 pagesChapter 7lov3m3No ratings yet

- Multiple Choice Questions Financial MarketsDocument16 pagesMultiple Choice Questions Financial Marketshannabee00No ratings yet

- Foreign Exchange Management PDFDocument2 pagesForeign Exchange Management PDFAkash RajaniNo ratings yet

- Financial Market1Document21 pagesFinancial Market1pvervint0121No ratings yet

- Pretest Ib AnswerDocument10 pagesPretest Ib AnswerCekelat UdangNo ratings yet

- BF Q3 StudentsDocument5 pagesBF Q3 StudentsCarmen Dana SuarezNo ratings yet

- International Accounting Doupnik 4th Edition Test BankDocument28 pagesInternational Accounting Doupnik 4th Edition Test BankBrianBurtoncqjk100% (35)

- Business FInance Quiz 2Document2 pagesBusiness FInance Quiz 2Pao EspiNo ratings yet

- Key From Unit 6 To Unit 10 Esp PDF FreeDocument20 pagesKey From Unit 6 To Unit 10 Esp PDF FreeTrần Đức TàiNo ratings yet

- Đề trắc nghiệm TACNDocument4 pagesĐề trắc nghiệm TACN21063129No ratings yet

- Bùa Hộ Mệnh Tài ChínhDocument22 pagesBùa Hộ Mệnh Tài ChínhNguyệt Hằng HuỳnhNo ratings yet

- AFAR - ForexDocument4 pagesAFAR - ForexJoanna Rose DeciarNo ratings yet

- 7TH Nov Class Test IfrmDocument11 pages7TH Nov Class Test Ifrmabh ljknNo ratings yet

- Key From Unit 6 To Unit 10 ESPDocument19 pagesKey From Unit 6 To Unit 10 ESPHồng Anh NguyễnNo ratings yet

- Financial Market QuestionsDocument25 pagesFinancial Market Questionspvervint0121No ratings yet

- Key From Unit 6 To Unit 10 ESPDocument20 pagesKey From Unit 6 To Unit 10 ESPThong Nguyen AnNo ratings yet

- Sample 12Document96 pagesSample 12sivakumarNo ratings yet

- 0 - Tybms If Sem 6 QBDocument47 pages0 - Tybms If Sem 6 QBMangesh GuptaNo ratings yet

- Business FInance Quiz 2Document2 pagesBusiness FInance Quiz 2Pao C EspiNo ratings yet

- Fema 1999Document7 pagesFema 1999askNo ratings yet

- TYBBA (IB) (Sem V)Document11 pagesTYBBA (IB) (Sem V)ANUSUYA CHATTERJEENo ratings yet

- TBChap 003Document49 pagesTBChap 003Robert MahroukNo ratings yet

- Institute For Technology & Management: Banking Services & Operations Question PaperDocument5 pagesInstitute For Technology & Management: Banking Services & Operations Question PaperKunal ChaudhryNo ratings yet

- International Financial Management MCQ 12Document5 pagesInternational Financial Management MCQ 12Nikita RekhateNo ratings yet

- INVESTMENTDocument4 pagesINVESTMENTsteveiamidNo ratings yet

- Summary MKI Chapter 2Document2 pagesSummary MKI Chapter 2DeviNo ratings yet

- Capital Markets Activities 1Document13 pagesCapital Markets Activities 1Ian Eldrick Dela CruzNo ratings yet

- MCQ 1 SakshuDocument196 pagesMCQ 1 SakshuSakshi mishraNo ratings yet

- IBM - Multiple Choice Questions PDFDocument15 pagesIBM - Multiple Choice Questions PDFsachsanjuNo ratings yet

- Foreign-Exchange-Management (Set 2)Document6 pagesForeign-Exchange-Management (Set 2)sumitj.rcgNo ratings yet

- Quiz1 0Document3 pagesQuiz1 0Frances Nicole Segundo0% (1)

- Chapter 6Document8 pagesChapter 6Ro-Anne LozadaNo ratings yet

- BFM RecollectedDocument8 pagesBFM RecollectedGURPREET KAURNo ratings yet

- Answer Key! First Year (Easy) 1-10Document3 pagesAnswer Key! First Year (Easy) 1-10Lalaine De JesusNo ratings yet

- TestDocument47 pagesTestsamcool87No ratings yet

- COMM2021Document2 pagesCOMM2021Lakogaharry BillclintonNo ratings yet

- Lesson 2-3-4Document7 pagesLesson 2-3-4Nhi Phan TúNo ratings yet

- Foreign Exchange Management. LayoutDocument16 pagesForeign Exchange Management. LayoutNikhil JoharNo ratings yet

- Practice Multiple Choice Qs For Mid S1 2010Document5 pagesPractice Multiple Choice Qs For Mid S1 2010ElaineKongNo ratings yet

- Exam On Foreign Currency Transaction 40Document6 pagesExam On Foreign Currency Transaction 40nigusNo ratings yet

- Export Marketing - Sem Vi MCQ Module 1 - Product Planning & Pricing DecisionsDocument4 pagesExport Marketing - Sem Vi MCQ Module 1 - Product Planning & Pricing DecisionsSaniya SiddiquiNo ratings yet

- CAIIB-BFM Practice Que Set-1Document5 pagesCAIIB-BFM Practice Que Set-1Surya PillaNo ratings yet

- Take International Financial Management MCQ TestDocument15 pagesTake International Financial Management MCQ TestImtiaz100% (1)

- International Accounting 4Th Edition Doupnik Test Bank Full Chapter PDFDocument61 pagesInternational Accounting 4Th Edition Doupnik Test Bank Full Chapter PDFthuydieuazfidd100% (10)

- TG - ... Lula MeDocument7 pagesTG - ... Lula Metigistdesalegn2021No ratings yet

- ST - Anthony's TVET College EmdibrDocument2 pagesST - Anthony's TVET College Emdibrtigistdesalegn2021No ratings yet

- 12 Prepare Financial ReportsDocument48 pages12 Prepare Financial Reportstigistdesalegn2021No ratings yet

- St. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2Document2 pagesSt. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2tigistdesalegn2021No ratings yet

- ST - Anthony's TVET College EmdibrDocument4 pagesST - Anthony's TVET College Emdibrtigistdesalegn2021No ratings yet

- Ayu 22Document3 pagesAyu 22tigistdesalegn2021No ratings yet

- 2025Document2 pages2025tigistdesalegn2021No ratings yet

- Types of Exchange Rate Entry: A. True B. False 4Document1 pageTypes of Exchange Rate Entry: A. True B. False 4tigistdesalegn2021No ratings yet