Professional Documents

Culture Documents

Assignments Chapter 14

Assignments Chapter 14

Uploaded by

Mohammed Nader0 ratings0% found this document useful (0 votes)

6 views6 pagesThe document

Original Description:

Assignments Chapter 14

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views6 pagesAssignments Chapter 14

Assignments Chapter 14

Uploaded by

Mohammed NaderThe document

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

M14-1

Answer

Revenue = $1,665,000gross profit percentage = 44 %Gross profit percentage = Gross Profit/Net Sales

Gross Profit = Net sales - Cost of goods sold Gross profit percentage = (Net sales - Cost of goods sold)

/Net Sales Gross profit percentage x Net Sales = Net sales - Cost of goods sold Cost of goods sold = Net

sales - Gross profit percentage x Net Sales Cost of goods sold = 1,665,000 – 0.44 x 1,665,000 = $932,400

M14-8

Answer

Earnings per share (2011)= $9.50

Price of the Stock (2011) = $228

Earnings per share (2012)= $9.50 x 1.13 = $10.735

Price of the Stock (2012) = $228 x 1.13 = $257.64

E14-5

Answer

1 Profit margin A. Net Income (before extraordinary items) ÷ Net Sales

2 Inventory turnover ratio H. Cost of Goods Sold ÷ Average Inventory

3 Average collection period B. Days in Year ÷ Receivable Turnover Ratio

4 Dividend yield ratio L. Dividends per Share ÷ Market Price per Share

5 Return on equity C. Net Income ÷ Average Stockholders’ Equity

6 Current ratio G. Current Assets ÷ Current Liabilities

7 Debt-to-equity ratio K. Total Liabilities ÷ Stockholders’ Equity

8 Price/earnings ratio M. Current Market Price per Share ÷ Earnings per Share

9 Financial leverage E. Return on Equity − Return on Assets

percentage

10 Receivable turnover ratio I. Net Credit Sales ÷ Average Net Receivables

11 Average days’ supply of J. Days in Year ÷ Inventory Turnover Ratio

inventory

12 Earnings per share D. Net Income ÷ Average Number of Shares of Common Stock

Outstanding

13 Return on assets N. [Net Income + Interest Expense (net of tax)] ÷ AverageTotal

Assets

14 Quick ratio F. Quick Assets ÷ Current Liabilities

15 Times interest earned Q. (Net Income + Interest Expense + Income Tax Expense) ÷

Interest Expense

16 Cash coverage ratio O. Cash from Operating Activities (before interest and taxes) ÷

Interest Paid

17 Fixed asset turnover ratio P. Net Sales Revenue ÷ Net Fixed Assets

E14-9

Answer

Turnover for the accounts receivable = receivable turnover ratio

= Net Credit Sales / Average Net Receivables

= (76,476 x 0.9) /(( 6,629 + 5,725)/2) = 11.14

Turnover for the inventory = inventory turnover ratio

= Cost of Goods Sold / Average Inventory

Cost of goods sold = Net sales - Gross Profit

Gross Profit = Gross profit percentage x Net Sales

Cost of goods sold = Net sales - Gross profit percentage x Net Sales

= 76,476 - 76,476 x 0.52 = $36,708.48

Average Inventory=((6,819 + 6,291)/2)=$6,555

Turnover for the inventory = 36,708.48/ 6,555= 5.6

Average age of receivables = Days in a year / receivable turnover ratio

= 365 / 11.14 = 32.76 days

Average days’ supply of inventory = Days in a year / inventory turnover ratio

= 365 / 5.6 = 65.18 days

P14-5

Answer

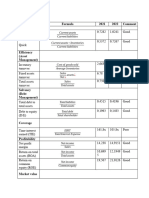

Ratio Definition Price Warehouse

Company company

1. Profit margin A. Net Income (before extraordinary 0.1 0.12

items) ÷ Net Sales

2. Inventory turnover H. Cost of Goods Sold ÷ Average 2.56 9.05

ratio Inventory

3. Average collection B. Days in Year ÷ Receivable Turnover 44.09 51.88

period Ratio

4. Dividend yield ratio L. Dividends per Share ÷ Market Price 12.47 23.87

per Share

5. Return on equity C. Net Income ÷ Average 0.19 0.13

Stockholders’ Equity

6. Current ratio G. Current Assets ÷ Current Liabilities 1.41 8.18

7. Debt-to-equity ratio K. Total Liabilities ÷ Stockholders’ 0.69 0.16

Equity

8. Price/earnings ratio M. Current Market Price per Share ÷ 0.73 1.59

Earnings per Share

9. Financial leverage E. Return on Equity − Return on 0.04 -0.02

percentage Assets

10. Receivable turnover I. Net Credit Sales ÷ Average Net 8.28 7.04

ratio Receivables

11. Average days’ supply J. Days in Year ÷ Inventory Turnover 142.37 40.35

of inventory Ratio

12. Earnings per share D. Net Income ÷ Average Number of 23.18 9.43

Shares of Common Stock

Outstanding

13. Return on assets N. [Net Income + Interest Expense 0.15 0.15

(net of tax)] ÷ Average Total Assets

14. Quick ratio F. Quick Assets ÷ Current Liabilities 0.41 K7.37

15. Times interest earned Q. (Net Income + Interest Expense + 15.26 14.48

Income Tax Expense) ÷ Interest

Expense

16. Cash coverage ratio O. Cash from Operating Activities 1.24 0.14

(before interest and taxes) ÷ Interest

Paid

17. Fixed asset turnover P. Net Sales Revenue ÷ Net Fixed 5.32 2.63

ratio Assets

You might also like

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Final Exam Cheat-SheetDocument1 pageFinal Exam Cheat-SheetPaolo TipoNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- WA0003.encDocument16 pagesWA0003.encNoman Abdul RazzaqNo ratings yet

- Rapala Catalog 2018Document164 pagesRapala Catalog 2018gcu93No ratings yet

- Workflow - Technical Design TemplateDocument10 pagesWorkflow - Technical Design TemplateKrishna MurthyNo ratings yet

- PS51 - 20 Dec 2012Document564 pagesPS51 - 20 Dec 2012paulfarrellNo ratings yet

- Financial Ratio ListDocument2 pagesFinancial Ratio Listgnachev_4No ratings yet

- Cfa Program Level II Financial Ratio List20Document2 pagesCfa Program Level II Financial Ratio List20ArijitNo ratings yet

- Appendix II - Table of Financial RatiosDocument1 pageAppendix II - Table of Financial RatiosLai ChanNo ratings yet

- 000 REC Working Formula Compiled by GMRCDocument12 pages000 REC Working Formula Compiled by GMRCbhobot riveraNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosNguyễn Như NgọcNo ratings yet

- Formulae A Level BusinessDocument1 pageFormulae A Level BusinesscoconutfoldersNo ratings yet

- Ratio Analysis: Meaning, Classification and Limitation of Ratio AnalysisDocument26 pagesRatio Analysis: Meaning, Classification and Limitation of Ratio AnalysisRajShikharSrivastavaNo ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Current Ratio : 365 DaysDocument2 pagesCurrent Ratio : 365 DaysElle VernezNo ratings yet

- Formula SheetDocument1 pageFormula SheetJESSICA MHIA TUTNo ratings yet

- Chapters 2 and 3 HandoutsDocument8 pagesChapters 2 and 3 HandoutsCarter LeeNo ratings yet

- Liquidity RatiosDocument2 pagesLiquidity RatiosXara KhanNo ratings yet

- Financial Management Ratio AnalysisDocument1 pageFinancial Management Ratio AnalysisAmrita GhartiNo ratings yet

- Financial Analysis1Document21 pagesFinancial Analysis1Umay PelitNo ratings yet

- RatiosDocument2 pagesRatiosashish_20kNo ratings yet

- I) Short Term Solvency or Liquidity Ratios Or: InterestDocument2 pagesI) Short Term Solvency or Liquidity Ratios Or: InterestSonia DalviNo ratings yet

- Chap 3 6Document1 pageChap 3 6tranthuhuong.88.1989No ratings yet

- Formulae Sheet: Page 1 of 1Document1 pageFormulae Sheet: Page 1 of 1lady mathsNo ratings yet

- Ratio Analysis: Important FormulaDocument4 pagesRatio Analysis: Important FormulaHarsh Vardhan KatnaNo ratings yet

- CH 05Document50 pagesCH 05Gaurav KarkiNo ratings yet

- GMR Operating Revenue Operating Expense Sales N MR Net Profit Sales Roa Profit Assets DE Total Debt Total Equity Liabilities EquityDocument4 pagesGMR Operating Revenue Operating Expense Sales N MR Net Profit Sales Roa Profit Assets DE Total Debt Total Equity Liabilities EquityShahreyar YawarNo ratings yet

- Cash Flows: Using Compound Interest To Be An Annuity, Cash Flows Must Be EQUALDocument1 pageCash Flows: Using Compound Interest To Be An Annuity, Cash Flows Must Be EQUALNicole Allyson AguantaNo ratings yet

- Chapter 2: Nature of Financial Accounting Principles: 3.8 Matching ConceptsDocument6 pagesChapter 2: Nature of Financial Accounting Principles: 3.8 Matching ConceptsRavikumar GandhiNo ratings yet

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoNo ratings yet

- LP - Entrepreneurship Week 16Document9 pagesLP - Entrepreneurship Week 16Romnick SarmientoNo ratings yet

- 63 Huỳnh Nhật Trường 22DH202493 CF 3.02Document14 pages63 Huỳnh Nhật Trường 22DH202493 CF 3.02taylormit1242003No ratings yet

- Ratio Analysis FormulaeDocument3 pagesRatio Analysis FormulaeKalyani ShindeNo ratings yet

- Accounting Formulas: Short Term Solvency or Liquidity RatiosDocument2 pagesAccounting Formulas: Short Term Solvency or Liquidity RatiosTambro IsbNo ratings yet

- FSA RatiosDocument4 pagesFSA RatiosShrey DattaNo ratings yet

- Financial Statement Analysis (Ch.2)Document14 pagesFinancial Statement Analysis (Ch.2)TianyiNo ratings yet

- FIN 300 - Cheat SheetDocument2 pagesFIN 300 - Cheat SheetStephanie NaamaniNo ratings yet

- 1 Retention Ratio 1 Dividend Payout Ratio: Equity Common Stock + Retained Earnings + Paying CapitalDocument4 pages1 Retention Ratio 1 Dividend Payout Ratio: Equity Common Stock + Retained Earnings + Paying CapitalEliana Katerine Martinez VillamilNo ratings yet

- Final Exam Ibrahim Helmy, Advanced FinanceDocument30 pagesFinal Exam Ibrahim Helmy, Advanced FinanceIbrahim HelmyNo ratings yet

- O o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Document3 pagesO o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Ana C. RichiezNo ratings yet

- Formula List For Week 11Document9 pagesFormula List For Week 11NidhiNo ratings yet

- RecipeDocument4 pagesRecipesasyedaNo ratings yet

- Exam 1 Formula SheetDocument3 pagesExam 1 Formula SheetYingfanNo ratings yet

- CH 02 Financial AnalysisDocument41 pagesCH 02 Financial AnalysisAnis SurianaNo ratings yet

- GSFSD 2 SDocument32 pagesGSFSD 2 SJay SmithNo ratings yet

- INFIMAN Assignment 1Document10 pagesINFIMAN Assignment 1Christian TanNo ratings yet

- Ratio Analysis TemplateDocument5 pagesRatio Analysis TemplateAdil AliNo ratings yet

- A Basic Set of Financial RatiosDocument3 pagesA Basic Set of Financial RatiosNazar LypkoNo ratings yet

- Finman Formulas Prelims 3Document3 pagesFinman Formulas Prelims 3eiaNo ratings yet

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisHinata UzumakiNo ratings yet

- RatiosDocument3 pagesRatiosMithilesh ShindeNo ratings yet

- Accounting PrinciplesDocument36 pagesAccounting PrinciplesPrisca ApriliaNo ratings yet

- Welcome To The Presentation On Valuation Section A Group 1Document37 pagesWelcome To The Presentation On Valuation Section A Group 1Nayeem Md SakibNo ratings yet

- Rumus Manajemen KeuanganDocument1 pageRumus Manajemen KeuanganHestika Setia AlfianiNo ratings yet

- Finance Group AssignmentDocument7 pagesFinance Group AssignmentAreej AJNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- Acctg 14 NotesDocument22 pagesAcctg 14 NotesJeciel Mae M. CalubaNo ratings yet

- Strategic FinanceDocument11 pagesStrategic FinanceMahrukh RasheedNo ratings yet

- Ratio WorkDocument6 pagesRatio WorkNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- Appendix BDocument6 pagesAppendix Bapi-308136216No ratings yet

- V-Carve Garota e GolfDocument332 pagesV-Carve Garota e GolfCarlos CardiauNo ratings yet

- Working Paper No. 561 PDFDocument34 pagesWorking Paper No. 561 PDFdilipkumar boinwadNo ratings yet

- Possessive Case / Possessive Pronouns / Question Word: Whose / Clothes, Footwear and AccessoriesDocument2 pagesPossessive Case / Possessive Pronouns / Question Word: Whose / Clothes, Footwear and AccessoriesManuela MarquesNo ratings yet

- Embrace - Product Sheet. EuroDocument1 pageEmbrace - Product Sheet. EuroIes GuineuetaNo ratings yet

- Woman and Socialism by August Bebel Jubilee ( (Sivh J! Edition Authorized Translation by Meta L. Stern (Hebe)Document520 pagesWoman and Socialism by August Bebel Jubilee ( (Sivh J! Edition Authorized Translation by Meta L. Stern (Hebe)J.M.G.No ratings yet

- 8 - SS - Ch-6 Effects of The British Rule in IndiaDocument41 pages8 - SS - Ch-6 Effects of The British Rule in IndiaMaddy WinnerNo ratings yet

- 1000 Manual 0407Document60 pages1000 Manual 0407Dharmesh patelNo ratings yet

- Clean Technology in The Production of Epichlorohydrin: Jowi W. Bijsterbosch, A. Das and F.P.J.M. KerkhofDocument4 pagesClean Technology in The Production of Epichlorohydrin: Jowi W. Bijsterbosch, A. Das and F.P.J.M. KerkhofProton HutabaratNo ratings yet

- 17-20513 - HJK Status Report Oct 2016 PDFDocument70 pages17-20513 - HJK Status Report Oct 2016 PDFRecordTrac - City of OaklandNo ratings yet

- Lec 1-Vapor Liquid Equilibrium-Part 1Document30 pagesLec 1-Vapor Liquid Equilibrium-Part 1DianaNo ratings yet

- Drug & Narcotics: Presented By: A K M Shawkat Islam Additional Director Department of Narcotics ControlDocument38 pagesDrug & Narcotics: Presented By: A K M Shawkat Islam Additional Director Department of Narcotics ControlFarhan ShawkatNo ratings yet

- Bridge Course Unit 1 AssignmentDocument2 pagesBridge Course Unit 1 AssignmentSrinidhi SrinivasanNo ratings yet

- Neet Major Test Plan - 2023-2024Document3 pagesNeet Major Test Plan - 2023-2024santhoshsivoNo ratings yet

- X X X X X X X X X X X X X X: Sec Tan Sin Tan Sin CSC Cot Cos CSC Cot Cot Cos Tan SecDocument7 pagesX X X X X X X X X X X X X X: Sec Tan Sin Tan Sin CSC Cot Cos CSC Cot Cot Cos Tan SecKevin Christian Plata100% (1)

- KimDocument104 pagesKimBayby SiZzle'zNo ratings yet

- Ang Pag-Aalaga NG Alimango - Beta - 356515 PDFDocument35 pagesAng Pag-Aalaga NG Alimango - Beta - 356515 PDFSamsam WaldNo ratings yet

- English 361 - 7 Pre A2 Starters Authentic Examination Papers 3 2019Document3 pagesEnglish 361 - 7 Pre A2 Starters Authentic Examination Papers 3 2019addraubay100% (1)

- Insurance Industry in BangladeshDocument17 pagesInsurance Industry in BangladeshArifuzzaman khan100% (5)

- Doh HFSRB Qop01form 2 Rev2 6172022Document1 pageDoh HFSRB Qop01form 2 Rev2 6172022Araceli TiuNo ratings yet

- SGH A188 Service SchematicsDocument22 pagesSGH A188 Service SchematicsDinesh JenekarNo ratings yet

- Exercise 5: Chapter 6, Section 6.1, Page 396Document2 pagesExercise 5: Chapter 6, Section 6.1, Page 396allauddinbaloch84No ratings yet

- B2-Hasebroock - PD Topics Completed 2015-2016Document2 pagesB2-Hasebroock - PD Topics Completed 2015-2016api-319600132No ratings yet

- Defence FOI 046 2324 - DocumentsDocument58 pagesDefence FOI 046 2324 - Documentschristopher.august.elliottNo ratings yet

- Creating A Windows 10 Boot Drive Is Easy Peasy. Here's How: Use Microsoft's Media Creation ToolDocument9 pagesCreating A Windows 10 Boot Drive Is Easy Peasy. Here's How: Use Microsoft's Media Creation TooljayaramanrathnamNo ratings yet

- Zuckerberg Responses To Commerce Committee QFRs1Document229 pagesZuckerberg Responses To Commerce Committee QFRs1TechCrunch100% (2)

- Attitudes Towards Artificial IntelligenceDocument3 pagesAttitudes Towards Artificial IntelligencePhạm Quang DuyNo ratings yet