Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsW David Hall Methanex v. United States 6-4-2013

W David Hall Methanex v. United States 6-4-2013

Uploaded by

Akarshan Magotra 7625-LSUF-19This document provides a summary of the case Methanex v. United States brought under NAFTA articles 1102, 1105, and 1110. Methanex, a Canadian methanol producer, claimed that California measures banning MTBE, an oxygenate made from methanol, discriminated against foreign methanol producers and expropriated their investments. The tribunal rejected Methanex's claims, finding no evidence the measures intentionally discriminated or were arbitrary. It determined the measures were a non-discriminatory regulation enacted for public purposes in response to water pollution concerns from MTBE.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Sandal Magna Primary SchoolDocument36 pagesSandal Magna Primary SchoolsaurabhNo ratings yet

- Bike Lane CaseDocument3 pagesBike Lane CaseDodgeSanchezNo ratings yet

- Chapter 1 of Dissertation PDFDocument8 pagesChapter 1 of Dissertation PDFAkib HAWALDARNo ratings yet

- API v. SEC (Section 1504 Complaint)Document39 pagesAPI v. SEC (Section 1504 Complaint)Mike KoehlerNo ratings yet

- Environmental Policy Implications of Investor-State 2007Document31 pagesEnvironmental Policy Implications of Investor-State 2007Desiyantri Siti PinundiNo ratings yet

- United States Court of Appeals, First CircuitDocument15 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- ATT LawsuitDocument81 pagesATT LawsuitArnessa GarrettNo ratings yet

- 120702petroleumstaffletter PDFDocument7 pages120702petroleumstaffletter PDFMark ReinhardtNo ratings yet

- Oposa vs. Factoran Case Digest (G.R. No. 101083, July 30, 1993)Document10 pagesOposa vs. Factoran Case Digest (G.R. No. 101083, July 30, 1993)Jocelyn Baliwag-Alicmas Banganan BayubayNo ratings yet

- Tatad v. Sec. of Doe - 281 Scra 330 (1997)Document16 pagesTatad v. Sec. of Doe - 281 Scra 330 (1997)Gol Lum100% (1)

- Economics of Pollution PreventionDocument4 pagesEconomics of Pollution PreventionDownload DataNo ratings yet

- In Re New Mexico Natural Gas Antitrust Litigation. State of New Mexico Ex Rel. Department of Finance and Administration v. Southern Union Company, 620 F.2d 794, 10th Cir. (1980)Document5 pagesIn Re New Mexico Natural Gas Antitrust Litigation. State of New Mexico Ex Rel. Department of Finance and Administration v. Southern Union Company, 620 F.2d 794, 10th Cir. (1980)Scribd Government DocsNo ratings yet

- Francisco Tatad Vs Secretary of The Department of Energy RESOLUTION 281 SCRA 330Document9 pagesFrancisco Tatad Vs Secretary of The Department of Energy RESOLUTION 281 SCRA 330Kathleen Ebilane PulangcoNo ratings yet

- ita0529Document307 pagesita0529snitharshanan01No ratings yet

- MethanexDocument307 pagesMethanexKylie Kaur Manalon DadoNo ratings yet

- United States Court of Appeals, Eleventh Circuit.: Nos. 79-2568, 79-3237, 80-1573, 80-7491 and 80-7528Document16 pagesUnited States Court of Appeals, Eleventh Circuit.: Nos. 79-2568, 79-3237, 80-1573, 80-7491 and 80-7528Scribd Government DocsNo ratings yet

- Environmental Regulation An Evolutionary ApproachDocument5 pagesEnvironmental Regulation An Evolutionary ApproachTamash MajumdarNo ratings yet

- Member StatesDocument5 pagesMember StatesGoutami SolankiNo ratings yet

- Tatad VS DoeDocument20 pagesTatad VS DoeAronJamesNo ratings yet

- Cases Aug 11.odtDocument11 pagesCases Aug 11.odtdollyccruzNo ratings yet

- Digby Neck Quarry Bilcon Case, Tribunal Decision and DissentDocument9 pagesDigby Neck Quarry Bilcon Case, Tribunal Decision and DissentART'S PLACENo ratings yet

- 14 Va Envtl J225 Green Balance SheetDocument125 pages14 Va Envtl J225 Green Balance SheetJunard Balangitao PabasNo ratings yet

- Ac Testimony Grimm Bill Hearing 20110511Document10 pagesAc Testimony Grimm Bill Hearing 20110511Project On Government OversightNo ratings yet

- 124870-1997-Tatad v. Secretary of The Department ofDocument24 pages124870-1997-Tatad v. Secretary of The Department ofJohn Anthony B. LimNo ratings yet

- Nypirg Urges Governor Cuomo and Lawmakers To Return To Session and Act On Key IssuesDocument5 pagesNypirg Urges Governor Cuomo and Lawmakers To Return To Session and Act On Key IssuesAmanda FriesNo ratings yet

- Chapter 2: Project StudyDocument31 pagesChapter 2: Project StudyRandomness67% (3)

- Guildlines On Oil Pollution Damage - Comite Maritime International Maritime LawDocument6 pagesGuildlines On Oil Pollution Damage - Comite Maritime International Maritime LawAngelo AlonsoNo ratings yet

- Republic of The Philippines University of Rizal System (URS) Binangonal Campus Graduate ProgramDocument14 pagesRepublic of The Philippines University of Rizal System (URS) Binangonal Campus Graduate ProgramZamora Enguerra EmmalyneNo ratings yet

- DEC Martens LetterDocument5 pagesDEC Martens LetterJon CampbellNo ratings yet

- Teva Whistleblower (SEC Response)Document38 pagesTeva Whistleblower (SEC Response)Mike KoehlerNo ratings yet

- Essential Facilities and Trinko - Should Antitrust and Regulation PDFDocument17 pagesEssential Facilities and Trinko - Should Antitrust and Regulation PDFchristiandelossantosNo ratings yet

- Briefing Note Potential NAFTA Challenge To Quebec's Ban of 2,4-D Lawn PesticidesDocument5 pagesBriefing Note Potential NAFTA Challenge To Quebec's Ban of 2,4-D Lawn PesticidesuncleadolphNo ratings yet

- MEMO ON SEPA AND AGENCY RULE MAKINGxDocument6 pagesMEMO ON SEPA AND AGENCY RULE MAKINGxArthurS.WestNo ratings yet

- 191 F.3d 429 (4th Cir. 1999) : United States Court of Appeals For The Fourth CircuitDocument18 pages191 F.3d 429 (4th Cir. 1999) : United States Court of Appeals For The Fourth CircuitScribd Government DocsNo ratings yet

- Francisco Tatad Vs Secretary of The Department of EnergyDocument7 pagesFrancisco Tatad Vs Secretary of The Department of EnergyPrincess Joan InguitoNo ratings yet

- Submitted Via Email To: Rwg@adem - Alabama.gov Airmail@adem - Alabama.govDocument49 pagesSubmitted Via Email To: Rwg@adem - Alabama.gov Airmail@adem - Alabama.govSara LaumannNo ratings yet

- Criminal Liability For Enviromental DegradationDocument5 pagesCriminal Liability For Enviromental Degradationharshanth anandNo ratings yet

- 06 Crime As PollutionDocument21 pages06 Crime As PollutionJonathan David MartinNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument18 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusivePatricia Anne GonzalesNo ratings yet

- Oposa vs. Factoran (G.R. No. 101083, July 30, 1993)Document4 pagesOposa vs. Factoran (G.R. No. 101083, July 30, 1993)Anonymous wDganZNo ratings yet

- Law of Torts and EnvironmentDocument18 pagesLaw of Torts and Environmentshagun bhartiNo ratings yet

- IIL AnsDocument6 pagesIIL AnsHemang SinghNo ratings yet

- The Antitrust Laws and The Health IndustryDocument48 pagesThe Antitrust Laws and The Health IndustrysgdhasdhgNo ratings yet

- Greening The Corporation: Advising Companies On Compliance With Corporate Sustainability RequirementsDocument7 pagesGreening The Corporation: Advising Companies On Compliance With Corporate Sustainability RequirementsDana NewmanNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument36 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manualslipknotdartoid0wdc100% (21)

- Ag Subsidies Case Neg - Michigan7 2021 BFHPRDocument124 pagesAg Subsidies Case Neg - Michigan7 2021 BFHPRTruman ConnorNo ratings yet

- Chapter 2-The Regulatory EnvironmentDocument7 pagesChapter 2-The Regulatory Environment1954032027cucNo ratings yet

- Tatad vs. Secretary of The Department of ENERGYDocument130 pagesTatad vs. Secretary of The Department of ENERGYJuris SyebNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument12 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- 01 18 Tax Case Digests Notes Etc.Document60 pages01 18 Tax Case Digests Notes Etc.Mackz KevinNo ratings yet

- 17874-Article Text-24905-1-10-20140819Document68 pages17874-Article Text-24905-1-10-20140819Xin HuiNo ratings yet

- Traficanti v. United States, 4th Cir. (2000)Document13 pagesTraficanti v. United States, 4th Cir. (2000)Scribd Government DocsNo ratings yet

- New England Telephone and Telegraph Company, Etc. v. Public Utilities Commission of Maine, 742 F.2d 1, 1st Cir. (1984)Document15 pagesNew England Telephone and Telegraph Company, Etc. v. Public Utilities Commission of Maine, 742 F.2d 1, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- DEQ MemoWater Safety Act FinalDocument3 pagesDEQ MemoWater Safety Act FinalLisa SorgNo ratings yet

- Shell Games and Fortune Tellers: The Sun Doesn't Set at The Antidumping Circus, Cato Free Trade Bulletin No. 18Document4 pagesShell Games and Fortune Tellers: The Sun Doesn't Set at The Antidumping Circus, Cato Free Trade Bulletin No. 18Cato InstituteNo ratings yet

- Tatad vs. Secretary of The Department of EnergyDocument69 pagesTatad vs. Secretary of The Department of EnergyFelix TumbaliNo ratings yet

- A Port in The Storm - The Availability of Protection For Minority Shareholders in The Commonwealth Caribbean - Nadia ChiesaDocument44 pagesA Port in The Storm - The Availability of Protection For Minority Shareholders in The Commonwealth Caribbean - Nadia ChiesaAisha Miller100% (1)

- Economtria para AbogadosDocument57 pagesEconomtria para AbogadosLuis TandazoNo ratings yet

- Water Code Case DigestDocument3 pagesWater Code Case DigestAnisah AquilaNo ratings yet

- To America's Health: A Proposal to Reform the Food and Drug AdministrationFrom EverandTo America's Health: A Proposal to Reform the Food and Drug AdministrationNo ratings yet

- CHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionDocument14 pagesCHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionRodolfo StraussNo ratings yet

- Global Clothing ZaraDocument19 pagesGlobal Clothing ZaraDaniel ArroyaveNo ratings yet

- Butterflies and MothsDocument59 pagesButterflies and MothsReegen Tee100% (3)

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Company Profile: TML Drivelines LTD (Tata Motors, Jamshedpur)Document5 pagesCompany Profile: TML Drivelines LTD (Tata Motors, Jamshedpur)Madhav NemalikantiNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Adavantages of Historical ResearchDocument2 pagesAdavantages of Historical ResearchClemence JeniferNo ratings yet

- Cooling Tower AshraeDocument18 pagesCooling Tower AshraeMAITREE JHANo ratings yet

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- HDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalDocument2 pagesHDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalMaria Amparo WarrenNo ratings yet

- Répit Transit (English Version)Document5 pagesRépit Transit (English Version)CTREQ école-famille-communautéNo ratings yet

- ISquare - Setup Guide For Fresh UsersDocument12 pagesISquare - Setup Guide For Fresh UsersWQDNo ratings yet

- HBO Types of CommunicationsDocument14 pagesHBO Types of CommunicationsJENEVIE B. ODONNo ratings yet

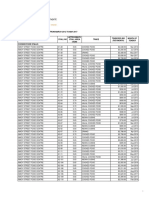

- Tender Bids From March 2012 To April 2017Document62 pagesTender Bids From March 2012 To April 2017scribd_109097762No ratings yet

- Arm Muscles OverviewDocument20 pagesArm Muscles OverviewLilian JerotichNo ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- Direct Object: Subjec T Verb ObjectDocument6 pagesDirect Object: Subjec T Verb ObjectHaerani Ester SiahaanNo ratings yet

- Lessons & Carols Service 2017Document2 pagesLessons & Carols Service 2017Essex Center UMCNo ratings yet

- FisheriesDocument31 pagesFisheriesGarima LoonaNo ratings yet

- Bahasa Inggris Lintas Minat X GenapDocument5 pagesBahasa Inggris Lintas Minat X GenapMeena ZahraNo ratings yet

- NG-PHC-PHC: C-DTP-DSRDocument4 pagesNG-PHC-PHC: C-DTP-DSRBisi AgomoNo ratings yet

- Developmental Stages of LearnersDocument5 pagesDevelopmental Stages of LearnersCarol Neng CalupitanNo ratings yet

- 100 To 1 in The Stock Market SummaryDocument28 pages100 To 1 in The Stock Market SummaryRamanReet SinghNo ratings yet

- Aseptic TechniquesDocument26 pagesAseptic TechniquesShashidhar ShashiNo ratings yet

- Expect Respect ProgramDocument2 pagesExpect Respect ProgramCierra Olivia Thomas-WilliamsNo ratings yet

- Studies On Soil Structure Interaction of Multi Storeyed Buildings With Rigid and Flexible FoundationDocument8 pagesStudies On Soil Structure Interaction of Multi Storeyed Buildings With Rigid and Flexible FoundationAayush jhaNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Lion of The North - Rules & ScenariosDocument56 pagesLion of The North - Rules & ScenariosBrant McClureNo ratings yet

W David Hall Methanex v. United States 6-4-2013

W David Hall Methanex v. United States 6-4-2013

Uploaded by

Akarshan Magotra 7625-LSUF-190 ratings0% found this document useful (0 votes)

16 views4 pagesThis document provides a summary of the case Methanex v. United States brought under NAFTA articles 1102, 1105, and 1110. Methanex, a Canadian methanol producer, claimed that California measures banning MTBE, an oxygenate made from methanol, discriminated against foreign methanol producers and expropriated their investments. The tribunal rejected Methanex's claims, finding no evidence the measures intentionally discriminated or were arbitrary. It determined the measures were a non-discriminatory regulation enacted for public purposes in response to water pollution concerns from MTBE.

Original Description:

Methanex v. United States Case Law

Original Title

W~David Hall~Methanex v. United States~6-4-2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of the case Methanex v. United States brought under NAFTA articles 1102, 1105, and 1110. Methanex, a Canadian methanol producer, claimed that California measures banning MTBE, an oxygenate made from methanol, discriminated against foreign methanol producers and expropriated their investments. The tribunal rejected Methanex's claims, finding no evidence the measures intentionally discriminated or were arbitrary. It determined the measures were a non-discriminatory regulation enacted for public purposes in response to water pollution concerns from MTBE.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views4 pagesW David Hall Methanex v. United States 6-4-2013

W David Hall Methanex v. United States 6-4-2013

Uploaded by

Akarshan Magotra 7625-LSUF-19This document provides a summary of the case Methanex v. United States brought under NAFTA articles 1102, 1105, and 1110. Methanex, a Canadian methanol producer, claimed that California measures banning MTBE, an oxygenate made from methanol, discriminated against foreign methanol producers and expropriated their investments. The tribunal rejected Methanex's claims, finding no evidence the measures intentionally discriminated or were arbitrary. It determined the measures were a non-discriminatory regulation enacted for public purposes in response to water pollution concerns from MTBE.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

DAVID I—IALL uly11.

Case Summary: Methanex v. United States

1. Claims — Methanex, a Canadian company and its U.S. subsidiaries, brought claim

pursuant to NAFTA Articles m6 and 1117 for $970 million USD against U.S. for two

California "measures" — a 1999 executive order and the CaRFG3 regulations adopted in

2000—that banned the use of MTBE in reformulated gasoline in California, which

Methanex claimed were adopted with the intent to discriminate against and to harm

Methanex and all foreign methanol producers and to favor domestic ethanol producers,

in violation of NAFTA Articles 1102, 1105, and mo.

Art. 1102 — National treatment — the US, through California measures, intended to deny

foreign methanol producers the best treatment it has accorded to domestic ethanol

investors

Art. 1105 — Minimum Standard of Treatment — US measures were intended to

discriminate against foreign investors and their investments, and intentional

discrimination is by definition unfair and inequitable

Art. 1110 — Expropriation and Compensation — a substantial proportion of Methanex's

investments, including its share of the California and US oxygenate markets, were taken

by discriminatory measures and hand over to the domestic ethanol industry, which

taking is at a minimum "tantamount to expropriation"

2. Timeline of Significant Events

2007 — California adopts S.521, which requires a comprehensive study of the

environmental effects of MTBE on water quality, the environment, and health, and

directs the governor to adopt an executive order to implement measures in response to

the conclusion of the report once completed

1998 — Lt. Governor Gray Davis, candidate for governor, meets with executives of

Archer Daniels Midland (ADM) at an ADM-hosted dinner in Illinois; ADM makes

campaign contributions to Davis throughout gubernatorial election cycle

1998-1999 — University of California teams conduct study pursuant to S.521

1999 — UC Report issued; finds that MTBE does not add any additional air pollution

gains relative to other CaRFG2 compliant formulas; MTBE is bad for the environment,

pollutes water; MTEB may be bad for people, but data gaps exist; the cost for treatment

of MTBE is potentially in the tens to hundreds of millions per year; all costs

considered, MTBE is the most expensive option among non-oxygenated gasoline,

ethanol-oxygenated gasoline, and MTBE-oxygenated gasoline. Conclusion: it would be

best for CA to transition to non-oxygenated gasoline, but federal law requires a 2%

oxygenation rate, so CA should conduct a comprehensive assessment of MTBE

alternatives, could implement a phase-out of MTBE, and could seek a federal waiver

from the Clean Air Act's oxygenation requirements

1999 — Four months after UC Report — Governor's Executive Order; based on findings

and recommendations of UC report; directs CA agencies to develop timetable for MTBE

phase-out by 12/31/2002, to seek a federal waiver, and to review and report on the

environmental effects of using ethanol in oxygenated gasoline

1999 — Initial request for federal waiver from oxygenation requirements; CA adopts

S.989 for MTBE protection for water, codifies executive order; 1999 Cal EPA Ethanol

Report finds than ethanol is less expensive and less harmful than MTBE

2000 - CaRFG3 Regulations adopted; prohibition on used of MTBE as of 12/31/02;

ethanol only oxygenate allowed in CA

2002 - Executive Order delaying MTBE ban for one year due to cost concerns over

available supply of ethanol-oxygenated gasoline

2003 — Amended CaRFG3 regulations expressly ban methanol as oxygenate

3. Methanex's Substantive Case

Methanex does not provide direct evidence of California's intent to discriminate against

and harm Methanex and foreign methanol producers, but urges the tribunal to infer

discrimination by "connecting the dots"

Dot 1— CA wanted to create an in-state ethanol industry; Trib: facts don't support

conclusion that CA sought to create an in-state ethanol industry with the intent to harm

Methanex or other foreign entities

Dot 2 - Leakage of MTB from underground storage tanks was used as a pretext for

favoring the ethanol industry; Trib: facts show the "measures" were adopted based on

scientific research, and notes that Methanex doesn't challenge as a "measure" original

bill S.521 — requiring investigation of USTs and methanol, which was adopted before

Davis took office

Dot 3 — ADM executives were previously convicted for price-fixing in other industries,

and its modus operandi is to influence policy through dubious or criminal means; ADM

supported a ban on methanol, this influenced CA's decision-making process, and this is

evidence the ban was discriminatory and intended to favor ethanol and ADM; Trib:

ADM is a large company, conviction of officers in other industry has nothing to do with

methanol or impugn CA's motives

Dot 4— ADM made sequential contributions to Davis's gubernatorial campaign; though

Methanex does not allege criminal intent, it repeatedly suggests that campaign

contributions were part of a deal with Davis to aide ADM and ethanol; Trib: in the U.S.

electoral system, campaign contributions are allowed subject to disclosure rules;

contributions do not equal corruption; ADM donations were less than 1% of Davis's

campaign budget; methanol industry also contributed to his campaign

Dot 5— Davis went to a "secret" dinner with ADM executives in Chicago at which he was

influenced, or made a quid pro quo, to benefit ADM and ethanol; Trib: facts don't

support Methanex's conclusion; S. 521 adopted before Davis took office; 521 required

Exec order to be narrow and consistent with UC Report; Davis pursued federal waiver

for all oxygenates; 521 and subsequent legislation adopted by major consensus and

motivated by popular concerns over MTBE and water pollution

Dot 6— Methanex attributes a statement made by State Senator Burton to the effect that

"one could benefit from the direction the methanol industry in CA is headed by selling

Methanex stock short." Trib: unreliable "statement" is double-hearsay; even if true, one

State Senator's statement on what was obvious in political climate has no bearing on

case

3. Tribunal on NAFTA Claims

Article 1102 - National Treatment. "Each Party shall accord to investors of another

Party treatment no less favorable than that it accords, in like circumstances, to its own

investors with respect to the establishment, acquisition, expansion, management,

conduct, operation, and sale or other disposition of investments."

Trib: here the proper comparator for "like circumstances" is not the ethanol industry,

butrather, lhe U.S. methanol 'Indus Lry, whidrisiaidenticaleire Methanex:---

Ethanol is an oxygenate; CA measures banned MTBE, an oxygenate of which methanol

is a component. The ban and market effects on MTBE affected methanol producers

uniformly; there was no intent to discriminate against investors of another Party.

Article 1105 — Minimum Standard of Treatment. "Each Party shall accord to

investments of investors of another Party treatment in accordance with international

law, including fair and equitable treatment and full protection and security."

Trib: Cites 1105 standard articulated in Waste Management: "[T]he minimum standard

of treatment of fair and equitable treatment is infringed by conduct attributable to the

State and harmful to the claimant if the conduct is arbitrary, grossly unfair, unjust or

idiosyncratic, is discriminatory and exposes the claimant to sectional or racial prejudice,

or involves a lack of due process leading to an outcome which offends judicial

propriety—as might be the case with a manifest failure of natural justice in judicial

nt• —

proceedings or a complete lack of transparency and candour in any administrative

process."

Trib: Article 1105 does not mention or preclude discrimination and does not prohibit

differentiations between nationals and aliens that might otherwise be deemed legally

discriminatory; consistent with the FTC's 2001 interpretation, a violation of Article 1102

does not equal a violation of Article 1105 (even assuming Methanex had demonstrated

discrimination under 1102); Methanex has not demonstrated discrimination.

Article 1110 — Expropriation and Compensation. "No Party may directly or indirectly

nationalize or expropriate an investment of an investor of another Party in its territory

or take a measure tantamount to nationalization or expropriation of such an investment

("expropriation"), except: (a) for a public purpose; (b) on a non-discriminatory basis; (c)

in accordance with due process of law and Article 1105(1); and(d) on payment of

compensation in accordance with paragraphs 2 through 6."

Methanex: expropriation, as defined in Metalclad, includes market share, customer

base, and goodwill — CA measures are tantamount to expropriation.

Trib: Agrees that the value of property expropriated can include intangible property

such as market share, but no expropriation or taking of property occurred here —

Methanex did not lose ownership or control of its businesses to California. Methanex

must demonstrate CA ban was tantamount to expropriation:

"7. In the Tribunal's view, Methanex is correct that an intentionally discriminatory

regulation against a foreign investor fulfills a key requirement for establishing

expropriation. But as a matter of general international law, a non-discriminatory

regulation for a public purpose, which is enacted in accordance with due process and,

which affects, inter alios, a foreign investor or investment is not deemed expropriatory

and compensable unless specific commitments had been given by the regulating

government to the then putative foreign investor contemplating investment that the

government would refrain from such regulation.

8.As the arbitration panel decided in Rever Copper & Brass, Inc. v. OPIC: 'We regard

these principles as particularly applicable where the question is, as here, whether

actions taken by a government contrary to and damaging to the economic interest of

aliens are in conflict with undertakings and assurances given in good faith to such aliens

as an inducement to their making the investments affected by the action."

Trib: No representations or reliance were made to Methanex in this case; it entered the

market with eyes wide open; the process was open and transparent and complied with

due process; measures were non-discriminatory, and the ban was made for a public

purpose. And, we don't have jurisdiction to decide any of this under NAFTA Art. not

You might also like

- Sandal Magna Primary SchoolDocument36 pagesSandal Magna Primary SchoolsaurabhNo ratings yet

- Bike Lane CaseDocument3 pagesBike Lane CaseDodgeSanchezNo ratings yet

- Chapter 1 of Dissertation PDFDocument8 pagesChapter 1 of Dissertation PDFAkib HAWALDARNo ratings yet

- API v. SEC (Section 1504 Complaint)Document39 pagesAPI v. SEC (Section 1504 Complaint)Mike KoehlerNo ratings yet

- Environmental Policy Implications of Investor-State 2007Document31 pagesEnvironmental Policy Implications of Investor-State 2007Desiyantri Siti PinundiNo ratings yet

- United States Court of Appeals, First CircuitDocument15 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- ATT LawsuitDocument81 pagesATT LawsuitArnessa GarrettNo ratings yet

- 120702petroleumstaffletter PDFDocument7 pages120702petroleumstaffletter PDFMark ReinhardtNo ratings yet

- Oposa vs. Factoran Case Digest (G.R. No. 101083, July 30, 1993)Document10 pagesOposa vs. Factoran Case Digest (G.R. No. 101083, July 30, 1993)Jocelyn Baliwag-Alicmas Banganan BayubayNo ratings yet

- Tatad v. Sec. of Doe - 281 Scra 330 (1997)Document16 pagesTatad v. Sec. of Doe - 281 Scra 330 (1997)Gol Lum100% (1)

- Economics of Pollution PreventionDocument4 pagesEconomics of Pollution PreventionDownload DataNo ratings yet

- In Re New Mexico Natural Gas Antitrust Litigation. State of New Mexico Ex Rel. Department of Finance and Administration v. Southern Union Company, 620 F.2d 794, 10th Cir. (1980)Document5 pagesIn Re New Mexico Natural Gas Antitrust Litigation. State of New Mexico Ex Rel. Department of Finance and Administration v. Southern Union Company, 620 F.2d 794, 10th Cir. (1980)Scribd Government DocsNo ratings yet

- Francisco Tatad Vs Secretary of The Department of Energy RESOLUTION 281 SCRA 330Document9 pagesFrancisco Tatad Vs Secretary of The Department of Energy RESOLUTION 281 SCRA 330Kathleen Ebilane PulangcoNo ratings yet

- ita0529Document307 pagesita0529snitharshanan01No ratings yet

- MethanexDocument307 pagesMethanexKylie Kaur Manalon DadoNo ratings yet

- United States Court of Appeals, Eleventh Circuit.: Nos. 79-2568, 79-3237, 80-1573, 80-7491 and 80-7528Document16 pagesUnited States Court of Appeals, Eleventh Circuit.: Nos. 79-2568, 79-3237, 80-1573, 80-7491 and 80-7528Scribd Government DocsNo ratings yet

- Environmental Regulation An Evolutionary ApproachDocument5 pagesEnvironmental Regulation An Evolutionary ApproachTamash MajumdarNo ratings yet

- Member StatesDocument5 pagesMember StatesGoutami SolankiNo ratings yet

- Tatad VS DoeDocument20 pagesTatad VS DoeAronJamesNo ratings yet

- Cases Aug 11.odtDocument11 pagesCases Aug 11.odtdollyccruzNo ratings yet

- Digby Neck Quarry Bilcon Case, Tribunal Decision and DissentDocument9 pagesDigby Neck Quarry Bilcon Case, Tribunal Decision and DissentART'S PLACENo ratings yet

- 14 Va Envtl J225 Green Balance SheetDocument125 pages14 Va Envtl J225 Green Balance SheetJunard Balangitao PabasNo ratings yet

- Ac Testimony Grimm Bill Hearing 20110511Document10 pagesAc Testimony Grimm Bill Hearing 20110511Project On Government OversightNo ratings yet

- 124870-1997-Tatad v. Secretary of The Department ofDocument24 pages124870-1997-Tatad v. Secretary of The Department ofJohn Anthony B. LimNo ratings yet

- Nypirg Urges Governor Cuomo and Lawmakers To Return To Session and Act On Key IssuesDocument5 pagesNypirg Urges Governor Cuomo and Lawmakers To Return To Session and Act On Key IssuesAmanda FriesNo ratings yet

- Chapter 2: Project StudyDocument31 pagesChapter 2: Project StudyRandomness67% (3)

- Guildlines On Oil Pollution Damage - Comite Maritime International Maritime LawDocument6 pagesGuildlines On Oil Pollution Damage - Comite Maritime International Maritime LawAngelo AlonsoNo ratings yet

- Republic of The Philippines University of Rizal System (URS) Binangonal Campus Graduate ProgramDocument14 pagesRepublic of The Philippines University of Rizal System (URS) Binangonal Campus Graduate ProgramZamora Enguerra EmmalyneNo ratings yet

- DEC Martens LetterDocument5 pagesDEC Martens LetterJon CampbellNo ratings yet

- Teva Whistleblower (SEC Response)Document38 pagesTeva Whistleblower (SEC Response)Mike KoehlerNo ratings yet

- Essential Facilities and Trinko - Should Antitrust and Regulation PDFDocument17 pagesEssential Facilities and Trinko - Should Antitrust and Regulation PDFchristiandelossantosNo ratings yet

- Briefing Note Potential NAFTA Challenge To Quebec's Ban of 2,4-D Lawn PesticidesDocument5 pagesBriefing Note Potential NAFTA Challenge To Quebec's Ban of 2,4-D Lawn PesticidesuncleadolphNo ratings yet

- MEMO ON SEPA AND AGENCY RULE MAKINGxDocument6 pagesMEMO ON SEPA AND AGENCY RULE MAKINGxArthurS.WestNo ratings yet

- 191 F.3d 429 (4th Cir. 1999) : United States Court of Appeals For The Fourth CircuitDocument18 pages191 F.3d 429 (4th Cir. 1999) : United States Court of Appeals For The Fourth CircuitScribd Government DocsNo ratings yet

- Francisco Tatad Vs Secretary of The Department of EnergyDocument7 pagesFrancisco Tatad Vs Secretary of The Department of EnergyPrincess Joan InguitoNo ratings yet

- Submitted Via Email To: Rwg@adem - Alabama.gov Airmail@adem - Alabama.govDocument49 pagesSubmitted Via Email To: Rwg@adem - Alabama.gov Airmail@adem - Alabama.govSara LaumannNo ratings yet

- Criminal Liability For Enviromental DegradationDocument5 pagesCriminal Liability For Enviromental Degradationharshanth anandNo ratings yet

- 06 Crime As PollutionDocument21 pages06 Crime As PollutionJonathan David MartinNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument18 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusivePatricia Anne GonzalesNo ratings yet

- Oposa vs. Factoran (G.R. No. 101083, July 30, 1993)Document4 pagesOposa vs. Factoran (G.R. No. 101083, July 30, 1993)Anonymous wDganZNo ratings yet

- Law of Torts and EnvironmentDocument18 pagesLaw of Torts and Environmentshagun bhartiNo ratings yet

- IIL AnsDocument6 pagesIIL AnsHemang SinghNo ratings yet

- The Antitrust Laws and The Health IndustryDocument48 pagesThe Antitrust Laws and The Health IndustrysgdhasdhgNo ratings yet

- Greening The Corporation: Advising Companies On Compliance With Corporate Sustainability RequirementsDocument7 pagesGreening The Corporation: Advising Companies On Compliance With Corporate Sustainability RequirementsDana NewmanNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument36 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manualslipknotdartoid0wdc100% (21)

- Ag Subsidies Case Neg - Michigan7 2021 BFHPRDocument124 pagesAg Subsidies Case Neg - Michigan7 2021 BFHPRTruman ConnorNo ratings yet

- Chapter 2-The Regulatory EnvironmentDocument7 pagesChapter 2-The Regulatory Environment1954032027cucNo ratings yet

- Tatad vs. Secretary of The Department of ENERGYDocument130 pagesTatad vs. Secretary of The Department of ENERGYJuris SyebNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument12 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- 01 18 Tax Case Digests Notes Etc.Document60 pages01 18 Tax Case Digests Notes Etc.Mackz KevinNo ratings yet

- 17874-Article Text-24905-1-10-20140819Document68 pages17874-Article Text-24905-1-10-20140819Xin HuiNo ratings yet

- Traficanti v. United States, 4th Cir. (2000)Document13 pagesTraficanti v. United States, 4th Cir. (2000)Scribd Government DocsNo ratings yet

- New England Telephone and Telegraph Company, Etc. v. Public Utilities Commission of Maine, 742 F.2d 1, 1st Cir. (1984)Document15 pagesNew England Telephone and Telegraph Company, Etc. v. Public Utilities Commission of Maine, 742 F.2d 1, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- DEQ MemoWater Safety Act FinalDocument3 pagesDEQ MemoWater Safety Act FinalLisa SorgNo ratings yet

- Shell Games and Fortune Tellers: The Sun Doesn't Set at The Antidumping Circus, Cato Free Trade Bulletin No. 18Document4 pagesShell Games and Fortune Tellers: The Sun Doesn't Set at The Antidumping Circus, Cato Free Trade Bulletin No. 18Cato InstituteNo ratings yet

- Tatad vs. Secretary of The Department of EnergyDocument69 pagesTatad vs. Secretary of The Department of EnergyFelix TumbaliNo ratings yet

- A Port in The Storm - The Availability of Protection For Minority Shareholders in The Commonwealth Caribbean - Nadia ChiesaDocument44 pagesA Port in The Storm - The Availability of Protection For Minority Shareholders in The Commonwealth Caribbean - Nadia ChiesaAisha Miller100% (1)

- Economtria para AbogadosDocument57 pagesEconomtria para AbogadosLuis TandazoNo ratings yet

- Water Code Case DigestDocument3 pagesWater Code Case DigestAnisah AquilaNo ratings yet

- To America's Health: A Proposal to Reform the Food and Drug AdministrationFrom EverandTo America's Health: A Proposal to Reform the Food and Drug AdministrationNo ratings yet

- CHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionDocument14 pagesCHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionRodolfo StraussNo ratings yet

- Global Clothing ZaraDocument19 pagesGlobal Clothing ZaraDaniel ArroyaveNo ratings yet

- Butterflies and MothsDocument59 pagesButterflies and MothsReegen Tee100% (3)

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Company Profile: TML Drivelines LTD (Tata Motors, Jamshedpur)Document5 pagesCompany Profile: TML Drivelines LTD (Tata Motors, Jamshedpur)Madhav NemalikantiNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Adavantages of Historical ResearchDocument2 pagesAdavantages of Historical ResearchClemence JeniferNo ratings yet

- Cooling Tower AshraeDocument18 pagesCooling Tower AshraeMAITREE JHANo ratings yet

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- HDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalDocument2 pagesHDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalMaria Amparo WarrenNo ratings yet

- Répit Transit (English Version)Document5 pagesRépit Transit (English Version)CTREQ école-famille-communautéNo ratings yet

- ISquare - Setup Guide For Fresh UsersDocument12 pagesISquare - Setup Guide For Fresh UsersWQDNo ratings yet

- HBO Types of CommunicationsDocument14 pagesHBO Types of CommunicationsJENEVIE B. ODONNo ratings yet

- Tender Bids From March 2012 To April 2017Document62 pagesTender Bids From March 2012 To April 2017scribd_109097762No ratings yet

- Arm Muscles OverviewDocument20 pagesArm Muscles OverviewLilian JerotichNo ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- Direct Object: Subjec T Verb ObjectDocument6 pagesDirect Object: Subjec T Verb ObjectHaerani Ester SiahaanNo ratings yet

- Lessons & Carols Service 2017Document2 pagesLessons & Carols Service 2017Essex Center UMCNo ratings yet

- FisheriesDocument31 pagesFisheriesGarima LoonaNo ratings yet

- Bahasa Inggris Lintas Minat X GenapDocument5 pagesBahasa Inggris Lintas Minat X GenapMeena ZahraNo ratings yet

- NG-PHC-PHC: C-DTP-DSRDocument4 pagesNG-PHC-PHC: C-DTP-DSRBisi AgomoNo ratings yet

- Developmental Stages of LearnersDocument5 pagesDevelopmental Stages of LearnersCarol Neng CalupitanNo ratings yet

- 100 To 1 in The Stock Market SummaryDocument28 pages100 To 1 in The Stock Market SummaryRamanReet SinghNo ratings yet

- Aseptic TechniquesDocument26 pagesAseptic TechniquesShashidhar ShashiNo ratings yet

- Expect Respect ProgramDocument2 pagesExpect Respect ProgramCierra Olivia Thomas-WilliamsNo ratings yet

- Studies On Soil Structure Interaction of Multi Storeyed Buildings With Rigid and Flexible FoundationDocument8 pagesStudies On Soil Structure Interaction of Multi Storeyed Buildings With Rigid and Flexible FoundationAayush jhaNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Lion of The North - Rules & ScenariosDocument56 pagesLion of The North - Rules & ScenariosBrant McClureNo ratings yet