Professional Documents

Culture Documents

Form+Quarrying Production Report

Form+Quarrying Production Report

Uploaded by

japhethadadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form+Quarrying Production Report

Form+Quarrying Production Report

Uploaded by

japhethadadCopyright:

Available Formats

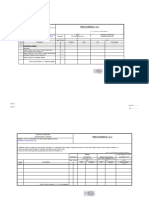

Ministry of Energy and Resources Saskatchewan

QUARRY PRODUCTION REPORT

Disposition Numbers: Y-

Disposition Holder:

Address:

For Quarter Ending: Year:

LEASE No. Y Y Y Y Y Y-

Mineral Type

C. Factor*

Starting Stock t t t t t t

Production t t t t t t

Adjustments t t t t t t

For Disposal t t t t t t

SALES to

- Sask. t t t t t t

$ Value

Outside Sask. t t t t t t

$ Value

- Export t t t t t t

$ Value

Total Sales $ Value t t t t t t

Ending Stock t t t t t t

Note: Production returns are required quarterly. “Nil” must be reported where there was zero production.

*Conversion factor used: 1 tonne = ? cubic yard t, rounded to the nearest tonne.

QUARRYING ROYALTY REPORT

QUANTITY OF QUARRIABLE SUBSTANCES

(Total from Above Leases) Quantity

Royalty Royalty

Sales Value Rate Dollars

(A) Exempt cubic yds

(B) Quarriabel substances

completely processed or

Manufactured in

Saskatchewan (s30(1)(b)) cubic yds @ $0.05

(C) Quarriable substances

Shipped outside Sask. in a raw or

paritially processed state

(s30(1)(a)) cubic yds $ @ 2%

(D) Royalty under Section 30A tons @ $0.60

TOTAL

Contact Person: Position:

Signature: Tel. No. Date:

This form is authorized under Section 21 and the royalties payable under Section 22 of The Quarrying Regulations, 1957. All information provided

is for internal use only and will be kept confidential. Any published information will be in provincial totals and not on a company basis.

Two copies are to be submitted to the Mineral Tenure Branch, Saskatchewan Ministry of the Economy mailed to 1000-2103 11th Ave. Regina, SK S4P

3Z8 within 30 days following the end of each quarter (March 31, June 30, September 30, December 31). Delayed payment charges will be assessed in

accordance with the Delayed Payment Charge Regulations, 1970 at a rate of 1 ½% per month or part month thereof. Minimum charge is $10.00

Form EM 711 Jan. 2015

You might also like

- Svnas 8e Ism Chapter 06Document117 pagesSvnas 8e Ism Chapter 06김성수100% (1)

- Adobe Scan 08 May 2023Document5 pagesAdobe Scan 08 May 2023Swatantra PandeyNo ratings yet

- 01A Flow of Economic ActivitiesDocument11 pages01A Flow of Economic ActivitiesShrey JoshiNo ratings yet

- Number of Periods: Technique Formulas SymbolsDocument3 pagesNumber of Periods: Technique Formulas SymbolsBillie JeanNo ratings yet

- Corporate Finance Theory: Formula SheetDocument5 pagesCorporate Finance Theory: Formula SheeticeslothNo ratings yet

- 01A Flow of Economic ActivitiesDocument11 pages01A Flow of Economic Activitiesaashutosh sawantNo ratings yet

- Tax Planning PapersDocument14 pagesTax Planning PapersPrem ManiNo ratings yet

- Reserve EstimationDocument24 pagesReserve Estimationzeeshan tanOli (shani)No ratings yet

- ABE-36 MIR Request LogDocument180 pagesABE-36 MIR Request LogFranklyn GenoveNo ratings yet

- Cutting Plan & Weld MapDocument5 pagesCutting Plan & Weld Mapsap prueNo ratings yet

- OTC Unilab ICS With Rented and Regular JAN 2023Document5 pagesOTC Unilab ICS With Rented and Regular JAN 2023Erica CarridoNo ratings yet

- Formulasheetforquiz1 PDFDocument2 pagesFormulasheetforquiz1 PDFDheeraj Kumar ReddyNo ratings yet

- Digital Modulation: Oleh Warsun NajibDocument11 pagesDigital Modulation: Oleh Warsun Najibazira_1989No ratings yet

- Formula Sheet: Managerial Finance FRL 300Document6 pagesFormula Sheet: Managerial Finance FRL 300Tooba JabeenNo ratings yet

- ACTIVITY NO. 1 (Moredo) : Variable/PeriodDocument7 pagesACTIVITY NO. 1 (Moredo) : Variable/PeriodEloisa Joy MoredoNo ratings yet

- KR10802 Fundamentals of Electrical Engineering: Chapter 6: RLCDocument69 pagesKR10802 Fundamentals of Electrical Engineering: Chapter 6: RLCPenziiNo ratings yet

- Analysis of Rates DK Z DK Uke& Ftyk Kstuk 2015&16 Ds Vurzxr LQD (KH Vkwi Ls Fot Flag Jksrsyk Ds ?KJ RD Leidz Ekxz ADocument6 pagesAnalysis of Rates DK Z DK Uke& Ftyk Kstuk 2015&16 Ds Vurzxr LQD (KH Vkwi Ls Fot Flag Jksrsyk Ds ?KJ RD Leidz Ekxz AviNo ratings yet

- Iverson Ross - 1270 - ScannedDocument3 pagesIverson Ross - 1270 - ScannedZach EdwardsNo ratings yet

- Certificate of Payment: tJ6/IlDocument6 pagesCertificate of Payment: tJ6/IlAjay MedikondaNo ratings yet

- Vadodara ZoneDocument30 pagesVadodara ZoneSurajPandeyNo ratings yet

- Attachment 1Document20 pagesAttachment 1princethakur16202No ratings yet

- SolmanDocument4 pagesSolmanNichol Balani GumapacNo ratings yet

- Gains From TradeDocument21 pagesGains From Tradefr3ddy4lyfNo ratings yet

- Royalty AccountsDocument12 pagesRoyalty AccountsMonisha tNo ratings yet

- IRR calculation for CP1_pilot oven_20210524Document18 pagesIRR calculation for CP1_pilot oven_20210524Shubhajyoti SahaNo ratings yet

- New IHR IGBT TechnologyDocument4 pagesNew IHR IGBT TechnologyvittorioNo ratings yet

- Chapter 5 - Intro Capacitors - Inductors - Part IDocument52 pagesChapter 5 - Intro Capacitors - Inductors - Part ISHARENIYA A/P PRAKASH STUDENTNo ratings yet

- ProducName Vacio1Document12 pagesProducName Vacio1Fabian GarciaNo ratings yet

- VMO Draft TemplateDocument23 pagesVMO Draft TemplateJaswasi SahooNo ratings yet

- Beam FormatDocument2 pagesBeam FormatNoor asviya banu S ANo ratings yet

- 1D Steady State Conduction: Heat TransferDocument4 pages1D Steady State Conduction: Heat TransferDhamwasu TrisarnwadhanaNo ratings yet

- Ulster County IDA Kingstonian Cost Benefit AnalysisDocument24 pagesUlster County IDA Kingstonian Cost Benefit AnalysisDaily FreemanNo ratings yet

- Kingstonian Impact Analysis by DevelopersDocument64 pagesKingstonian Impact Analysis by DevelopersDaily FreemanNo ratings yet

- Formula Sheet BF FMDocument2 pagesFormula Sheet BF FMZara MoosaNo ratings yet

- Automotive Bearing-HousingDocument9 pagesAutomotive Bearing-Housingfileuse.fNo ratings yet

- Internal Reconstruction 03 - Class NotesDocument23 pagesInternal Reconstruction 03 - Class NotesRaghav PrajapatiNo ratings yet

- 4 Boq Plumbing 06.12.15Document7 pages4 Boq Plumbing 06.12.15shefali chaudharyNo ratings yet

- Probleme Control OptimalDocument2 pagesProbleme Control OptimalCostica PoienaruNo ratings yet

- PSD1Document8 pagesPSD1Naeem Ali SajadNo ratings yet

- AddendumDocument4 pagesAddendumHetauda GridNo ratings yet

- DT T Q Ka DX R: 1D Steady State ConductionDocument4 pagesDT T Q Ka DX R: 1D Steady State ConductionDhamwasu TrisarnwadhanaNo ratings yet

- TNP Q4 2018Document11 pagesTNP Q4 2018SANDESH GHANDATNo ratings yet

- Price Format 'A' (Main Equipment) For Wagon Tippler, Crushing and Conveying Plant Package For NTPC Vindhyachal STPP Stage III (2 X500 MW)Document4 pagesPrice Format 'A' (Main Equipment) For Wagon Tippler, Crushing and Conveying Plant Package For NTPC Vindhyachal STPP Stage III (2 X500 MW)istyloankurNo ratings yet

- ReportDocument11 pagesReportFabian GarciaNo ratings yet

- Formula Sheet and Tables For Heat Transfer Mwx410Document35 pagesFormula Sheet and Tables For Heat Transfer Mwx410Cornelis A KoetsierNo ratings yet

- Project Weld Status Report - (Rev.01) : Saudi Aramco Test ReportDocument1 pageProject Weld Status Report - (Rev.01) : Saudi Aramco Test ReportKoya ThangalNo ratings yet

- SHAFT GoodSod Deriv07Document11 pagesSHAFT GoodSod Deriv07Leonidas FritzNo ratings yet

- Vent Line Pressure Drop CalculationDocument4 pagesVent Line Pressure Drop CalculationRubensBoerngenNo ratings yet

- Reporting Date:-Production Report For:-: Quality Management SystemDocument4 pagesReporting Date:-Production Report For:-: Quality Management SystemsourajpatelNo ratings yet

- Ready List - GameplanDocument3 pagesReady List - GameplanJUSTME152No ratings yet

- CM0202, Compressor DWGDocument17 pagesCM0202, Compressor DWGansariiqbal9570No ratings yet

- Project Report: SamsungDocument15 pagesProject Report: SamsungDaniel Morales FernándezNo ratings yet

- Pandora's Box: Controls SwitchesDocument5 pagesPandora's Box: Controls SwitchesEddie IgrasNo ratings yet

- Shear Wall Sample OutputDocument2 pagesShear Wall Sample OutputOsama MamdouhNo ratings yet

- 2008 Jan MsDocument16 pages2008 Jan MsRahman RazNo ratings yet

- SHAFT-GoodSod Deriv07Document11 pagesSHAFT-GoodSod Deriv07Raj Bahadur YadavNo ratings yet

- Invoice Copy: S.No Item Progress This Bill Contract (RS.)Document45 pagesInvoice Copy: S.No Item Progress This Bill Contract (RS.)muthupalaniappanNo ratings yet

- Stack Elbow 90° 45°: Variation 1: Variation 2Document4 pagesStack Elbow 90° 45°: Variation 1: Variation 2Abhishek SinghNo ratings yet

- 03 Tiongson Cayetano Et Al Vs Court of Appeals Et AlDocument6 pages03 Tiongson Cayetano Et Al Vs Court of Appeals Et Alrandelrocks2No ratings yet

- Financial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionDocument41 pagesFinancial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionryoguNo ratings yet

- Week 9 Jose Rizal's Second Travel AbroadDocument6 pagesWeek 9 Jose Rizal's Second Travel AbroadShervee PabalateNo ratings yet

- Cat Menes - Google SearchDocument1 pageCat Menes - Google SearchShanzeh ZehraNo ratings yet

- 4th Chapter Business Government and Institutional BuyingDocument17 pages4th Chapter Business Government and Institutional BuyingChristine Nivera-PilonNo ratings yet

- Sasmo 2020 Grade 8 RankDocument7 pagesSasmo 2020 Grade 8 RankEtty SabirinNo ratings yet

- 2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyDocument10 pages2023 California Model Year 1978 or Older Light-Duty Vehicle SurveyNick PopeNo ratings yet

- Bancassurance PDFDocument251 pagesBancassurance PDFdivyansh singh33% (3)

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Lecture Notes On Vat As AmendedDocument7 pagesLecture Notes On Vat As Amendedbubblingbrook100% (1)

- The Israel Lobby ControversyDocument2 pagesThe Israel Lobby ControversysisinjhaaNo ratings yet

- Ronquillo - Et Al. vs. Roco - Et Al.Document11 pagesRonquillo - Et Al. vs. Roco - Et Al.Court JorsNo ratings yet

- Oisd STD 235Document110 pagesOisd STD 235naved ahmed100% (5)

- Gulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsDocument20 pagesGulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsmurphygtNo ratings yet

- Global WarmingDocument50 pagesGlobal WarmingLeah Oljol RualesNo ratings yet

- Introduction - Online Car Booking Management SystemDocument5 pagesIntroduction - Online Car Booking Management SystemTadese JegoNo ratings yet

- Leadership Case Study - Adolf HitlerDocument2 pagesLeadership Case Study - Adolf Hitlerlufegas0% (1)

- Manual On Settlement of Land DisputesDocument120 pagesManual On Settlement of Land Disputescookbooks&lawbooks100% (1)

- Tenses For Talking About The NewsDocument5 pagesTenses For Talking About The NewsThunder BurgerNo ratings yet

- Unit-5 Pollution Notes by AmishaDocument18 pagesUnit-5 Pollution Notes by AmishaRoonah KayNo ratings yet

- Khelo India Event Wise Bib ListDocument20 pagesKhelo India Event Wise Bib ListSudhit SethiNo ratings yet

- University of Caloocan City - : An Analysis Paper OnDocument7 pagesUniversity of Caloocan City - : An Analysis Paper OnKylieNo ratings yet

- Week 3 Digital Consumers, Communities and Influencers Workshop-1Document46 pagesWeek 3 Digital Consumers, Communities and Influencers Workshop-1rjavsgNo ratings yet

- Islam A Case of Mistaken Identity.Document29 pagesIslam A Case of Mistaken Identity.AndrewNo ratings yet

- S R S M: Arah Owell and Cott AckenzieDocument7 pagesS R S M: Arah Owell and Cott AckenzieEduardo MBNo ratings yet

- Milvik ProposalDocument29 pagesMilvik ProposalMin HajNo ratings yet

- Indian Institute of Information Technology, Surat: SVNIT Campus, Ichchanath, Surat - 395007Document1 pageIndian Institute of Information Technology, Surat: SVNIT Campus, Ichchanath, Surat - 395007gopalgeniusNo ratings yet

- STUDENT 2021-2022 Academic Calendar (FINAL)Document1 pageSTUDENT 2021-2022 Academic Calendar (FINAL)Babar ImtiazNo ratings yet

- ProjectDocument3 pagesProjectKimzee kingNo ratings yet

- Startup Ecosystem in IndiaDocument17 pagesStartup Ecosystem in IndiaDimanshu BakshiNo ratings yet