Professional Documents

Culture Documents

Policy Details PDF

Policy Details PDF

Uploaded by

adminCopyright:

Available Formats

You might also like

- Narayana Hrudayalaya Heart Hospital: - Case AnalysisDocument11 pagesNarayana Hrudayalaya Heart Hospital: - Case Analysiskaustav kundu100% (1)

- PHM MediSavers 2015 BrochureDocument4 pagesPHM MediSavers 2015 BrochureNazim SalehNo ratings yet

- Plasma Pen Fibroblast Eyes ContourDocument4 pagesPlasma Pen Fibroblast Eyes Contouralejandro Gonzàlez100% (1)

- A Plus Recover EN 0111Document2 pagesA Plus Recover EN 0111testNo ratings yet

- ProHealth V7 Accordian April'23 02Document8 pagesProHealth V7 Accordian April'23 02Sreeraj P SNo ratings yet

- Ahm Lite CoverDocument13 pagesAhm Lite CoverjeideyNo ratings yet

- A Pro in Every Way.: A Comprehensive Health Insurance Solution For Your Illness As Well As WellnessDocument8 pagesA Pro in Every Way.: A Comprehensive Health Insurance Solution For Your Illness As Well As WellnessSnehaAnilSurveNo ratings yet

- 24 Policy Wording EnglishDocument4 pages24 Policy Wording EnglishIsrael DoteNo ratings yet

- Floater Health Insurance Analysis ReportDocument8 pagesFloater Health Insurance Analysis Reportenumula kumarNo ratings yet

- Health Wallet BrochureDocument8 pagesHealth Wallet BrochureKanchan ChoudhuryNo ratings yet

- Reliance HealthGain Policy-BrochureDocument11 pagesReliance HealthGain Policy-BrochurePradeep Kumar SharmaNo ratings yet

- Leaflet - Medisure Plus - 150914Document2 pagesLeaflet - Medisure Plus - 150914Rajarshi GuhaNo ratings yet

- Manipalcigna Prohealth Insurance: A Pro in Every WayDocument8 pagesManipalcigna Prohealth Insurance: A Pro in Every Wayaniket shahNo ratings yet

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDocument2 pagesSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuNo ratings yet

- Reliance Healtwise Policy BrochureDocument9 pagesReliance Healtwise Policy BrochurenandasantoshinaNo ratings yet

- Health Insurance 12 Points Check ListDocument3 pagesHealth Insurance 12 Points Check ListmcsrNo ratings yet

- Benefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)Document25 pagesBenefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)suchit.singhNo ratings yet

- MedisurePlusbrochure PDFDocument18 pagesMedisurePlusbrochure PDFcrejocNo ratings yet

- HeathGuard BrochureDocument2 pagesHeathGuard BrochureKumud GandhiNo ratings yet

- Religare Care - More DetailsDocument5 pagesReligare Care - More Detailst0ysoldierNo ratings yet

- 2012 Hsa Benefit TableDocument3 pages2012 Hsa Benefit Tableapi-41207808No ratings yet

- Benefits DescriptionDocument16 pagesBenefits DescriptionKenneth Del RioNo ratings yet

- What Is Health InsuranceDocument3 pagesWhat Is Health InsuranceDaniel BowieNo ratings yet

- HealthDocument68 pagesHealthKvvPrasadNo ratings yet

- Guardme Drug Card Policy Wording English - 1650685539Document4 pagesGuardme Drug Card Policy Wording English - 1650685539gagan dhillonNo ratings yet

- Company Profile: Bajaj Allianz General Insurance Company LinitedDocument27 pagesCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- My+Health+Medisure+Classic Web+Brochure 02Document16 pagesMy+Health+Medisure+Classic Web+Brochure 02Preeti KatiyarNo ratings yet

- What Our Members Are Saying... : Tribute® PlanDocument6 pagesWhat Our Members Are Saying... : Tribute® PlanlocalonNo ratings yet

- Care (Health Insurance Product) - BrochureDocument10 pagesCare (Health Insurance Product) - Brochuresanjay4u4allNo ratings yet

- Accident Claim#002373921 Stephen Forde OCB1 FormDocument32 pagesAccident Claim#002373921 Stephen Forde OCB1 FormTanya GlennNo ratings yet

- American Financial Security Life Insurance Company: Certificate of CoverageDocument14 pagesAmerican Financial Security Life Insurance Company: Certificate of CoverageNick OrzechNo ratings yet

- Medi Claim FAQsDocument9 pagesMedi Claim FAQsMOVIES BRONo ratings yet

- COPY : Name/Names of Covered Member Date of BirthDocument4 pagesCOPY : Name/Names of Covered Member Date of Birththeloser2188No ratings yet

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Your Policy ExplainedDocument29 pagesYour Policy ExplaineddeonptNo ratings yet

- Policy DocumentDocument11 pagesPolicy DocumentPrakhar SNo ratings yet

- Health InsuranceDocument27 pagesHealth Insurancelittlemaster1982No ratings yet

- 1) Coverage Amount/Sum Insured (SI)Document4 pages1) Coverage Amount/Sum Insured (SI)shaileshNo ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookvinaysekharNo ratings yet

- Family Health Secure Plan - 4Document2 pagesFamily Health Secure Plan - 4Irfan OmerNo ratings yet

- Healthcare Deposit AccountDocument12 pagesHealthcare Deposit AccountdeonptNo ratings yet

- Background of D TipicDocument3 pagesBackground of D TipicSandeep GuptaNo ratings yet

- Even Plans OverviewDocument11 pagesEven Plans OverviewAbigale YoungbloodNo ratings yet

- New Products Launch by New IndiaDocument52 pagesNew Products Launch by New IndiaNewindia assuranceNo ratings yet

- Health InsuranceDocument21 pagesHealth Insuranceadhitya0% (1)

- Takaful Health2Document34 pagesTakaful Health2yusofprubsnNo ratings yet

- Keymed: Time Insurance Company John Alden Life Insurance CompanyDocument8 pagesKeymed: Time Insurance Company John Alden Life Insurance CompanyRuthStewart100% (2)

- 07937assure - Ci - BrochureDocument6 pages07937assure - Ci - Brochurebasantjain12345No ratings yet

- DISI - Policy Wording - EN - 1123Document7 pagesDISI - Policy Wording - EN - 1123sima.nourbakhshNo ratings yet

- Relationship: Start A Life LongDocument10 pagesRelationship: Start A Life LongRajesh Kumar RamaswamyNo ratings yet

- Heartbeat Silver BrochureDocument10 pagesHeartbeat Silver Brochuresubs007No ratings yet

- Health InsuranceDocument11 pagesHealth InsurancedishaNo ratings yet

- Heart and CancerDocument70 pagesHeart and CancerAnurag AggarwalNo ratings yet

- Heart and Cancer PDFDocument70 pagesHeart and Cancer PDFsathish guptaNo ratings yet

- Unit 2 Health Insurance ProductsDocument25 pagesUnit 2 Health Insurance ProductsShivam YadavNo ratings yet

- Group Mediclaim Policy Coverages For Employees of Century PlyDocument2 pagesGroup Mediclaim Policy Coverages For Employees of Century PlyUDAYNo ratings yet

- Family Health Insurance Plans Buy Mediclaim Policy OnlineDocument1 pageFamily Health Insurance Plans Buy Mediclaim Policy OnlinesainithinvaddiNo ratings yet

- The New India Assurance Co. LTDDocument17 pagesThe New India Assurance Co. LTDvishal shahNo ratings yet

- New Era Hospital IncomeDocument2 pagesNew Era Hospital IncomeHihiNo ratings yet

- Ps12 BP: Guidelines On Smoking As Related To The Perioperative Period Background PaperDocument15 pagesPs12 BP: Guidelines On Smoking As Related To The Perioperative Period Background PaperJane KoNo ratings yet

- Peripheral Vascular Disease-1Document52 pagesPeripheral Vascular Disease-1Johiarra Madanglog Tabigne100% (1)

- Tracheostomy Care GuidelinesDocument38 pagesTracheostomy Care GuidelinesYamete KudasaiNo ratings yet

- Vas Uhc Sample Letter Medical NecessityDocument5 pagesVas Uhc Sample Letter Medical NecessityJasonNo ratings yet

- Using Diode Laser For Soft Tissue Incision of Oral Cavity: Case ReportDocument8 pagesUsing Diode Laser For Soft Tissue Incision of Oral Cavity: Case ReportAndhika GilangNo ratings yet

- Comparing Breast-Conserving Surgery With Radical MastectomyDocument6 pagesComparing Breast-Conserving Surgery With Radical MastectomyRonald Cariaco FlamesNo ratings yet

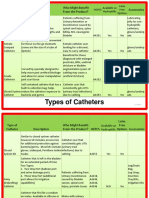

- Types of CathetersDocument2 pagesTypes of CathetersLorie Fadol100% (1)

- InnoFit® Lodestar Plus Kit (LR)Document12 pagesInnoFit® Lodestar Plus Kit (LR)Vishruti PobaruNo ratings yet

- F1800 1479757-1Document6 pagesF1800 1479757-1Thaweekarn ChangthongNo ratings yet

- CA OesophagusDocument47 pagesCA OesophagusAnsif KNo ratings yet

- LindaparadisDocument9 pagesLindaparadiskevin lindaparadisgroupNo ratings yet

- Hemodialysis PDFDocument20 pagesHemodialysis PDFGiri Siva71% (7)

- Or Ward Class Kidney TransplantDocument89 pagesOr Ward Class Kidney TransplantChristy Mutia AlumbroNo ratings yet

- Cesarean SectionDocument20 pagesCesarean Sectionjeribob1823No ratings yet

- JIAP January 2014 - Biological Implant Complications and Their ManagementDocument10 pagesJIAP January 2014 - Biological Implant Complications and Their ManagementChaudhari SonaliNo ratings yet

- AnnexureDocument8 pagesAnnexureSrijesh SinghNo ratings yet

- Ade Mira Nur Alina-1-13Document13 pagesAde Mira Nur Alina-1-13selaza rubbyNo ratings yet

- Early Cardiac Complications of Coronary Artery Bypass Graft Surgery - UpToDateDocument16 pagesEarly Cardiac Complications of Coronary Artery Bypass Graft Surgery - UpToDateAnca StanNo ratings yet

- Post-Operative Instructions: Laparoscopic CholecystectomyDocument2 pagesPost-Operative Instructions: Laparoscopic Cholecystectomyrizwan234No ratings yet

- Histopathology Lab Lesson 2Document12 pagesHistopathology Lab Lesson 2christian Jay HorseradaNo ratings yet

- BASCO, Aila O. - Assignment 2 - OAMT 40033 MEDICAL TRANSCRIPTIONDocument3 pagesBASCO, Aila O. - Assignment 2 - OAMT 40033 MEDICAL TRANSCRIPTIONAila BascoNo ratings yet

- ObturatorDocument97 pagesObturatorNikhita NarayananNo ratings yet

- Minimally Invasive Management of Uterine Fibroids Role of Transvaginal Radiofrequency AblationDocument5 pagesMinimally Invasive Management of Uterine Fibroids Role of Transvaginal Radiofrequency AblationHerald Scholarly Open AccessNo ratings yet

- Bennett Fractures: A Review of ManagementDocument7 pagesBennett Fractures: A Review of ManagementIshan BramhbhattNo ratings yet

- Or DR Nclex FormsDocument6 pagesOr DR Nclex FormsClarence MangíoNo ratings yet

- List of Empanelled HCOs-Chennai (Dec 2022)Document7 pagesList of Empanelled HCOs-Chennai (Dec 2022)Munusamy RajiNo ratings yet

- Cardiovascular Surgical InstrumentatorDocument3 pagesCardiovascular Surgical Instrumentatorapi-626421480No ratings yet

- Anterior Cruciate Ligament Revision ReconstructionDocument9 pagesAnterior Cruciate Ligament Revision ReconstructionCésar ArveláezNo ratings yet

Policy Details PDF

Policy Details PDF

Uploaded by

adminOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Policy Details PDF

Policy Details PDF

Uploaded by

adminCopyright:

Available Formats

Jul 05, 2023

Your Referrence: _9c44f

NIB

Basic Essential Hospital Plus

Product ID : 39028

SINGLE in VIC

Hi! Thanks for comparing with

Compare Club.

Our product brochure outlines key benefits and limits for the product . Take a look in more detail to

understand if it's right for you, and remember , we are here to answer any questions you may have . Our

advisers are fully trained in a broad range of health insurance products and are more than happy to

answer your questions .

OUR

2018 CURRENT

SCORE*

4.6 /5

Trusted Service Provided by

Awards

1300 757 819 info@compareclub.com.au

This health insurance

is provided by:

Quote

Summary $90.69 Monthly + $500.00 excess

Your selected income tier : 0

To make private health insurance more affordable the Federal Government provides many

Australians with a Health Insurance Rebate, which is income tested and is based on the age of the

oldest person on the membership . Your quote is based on your nominated income tier and includes

the rebate as a premium reduction . The applicable income and age tiers for the Australian

Government Rebate from 1 April 2023 to 31 March 2024 are as follows :

Compare Club | Health Insurance Comparison

Please note that all prices do not include the lifetime health cover loadings . These loadings are calculated

based on the number of years that you have not had appropriate hospital cover since 31 years old . Click Here

Accident Cover: This policy also covers restricted and excluded services

for accidents where treatment is sought from a Hospital Emergency

Department within 24 hours of the accident (completed NIB Accident

Form required ). Further hospital care for accident related treatment may

Why Choose

be covered providing the patient is admitted within 90 days of the initial

This Emergency Department consult . After 90 days, the patient's normal

health cover benefits apply .

Includes Emergency Ambulance Cover

One of Australia's fastest growing health insurers

Compare Club | Health Insurance Comparison

Hospital Covers

Hospital policies help cover the cost of in-hospital treatment by your doctor and hospital costs such as

accommodation and theatre fees. Generally , any medical services listed under the Medicare Benefits Schedule (MBS)

can be covered on some form of private hospital insurance . Some services which are not listed on the MBS, such as

elective cosmetic surgery or laser eye surgery , are only covered by private hospital insurance to a limited extent or

not at all .

Hospital Level - basic plus

Hospital Cover Inclusions

Accident Override

Ambulance

Dental Surgery

Gastrointestinal Endoscopy

Gynaecology

Hernia and Appendix

Joint Reconstructions

Miscarriage and Termination of Pregnancy

Private Hospital - Private Room

Private Hospital - Shared Room

Public Hospital

Tonsils, Adenoids and Grommets

Hospital Cover Restricted

Hospital psychiatric services

Palliative Care

Rehabilitation

If your policy has restrictions for some conditions , you will be covered for treatment for those conditions , but only to a

very limited extent .

For example , if your policy restricts hip replacement , you will be covered for this as a private patient in a public

hospital . However , if you go into hospital as a private patient in a private hospital , your health fund will not pay any

benefits towards the theatre fees and only a small benefit towards your accommodation fee. This means you will face

considerable out-of-pocket costs.

Hospital Cover Exclusions

Assisted Reproductive Services

Back, Neck and Spine

Blood

Bone, Joint and Muscle

Brain and Nervous System

Breast Surgery

Cataracts

Chemotherapy for Cancer

Cosmetic Surgery

Diabetes Management

Dialysis for chronic kidney disease

Digestive System

Ear, Nose and Throat

Eye (not cataracts )

Heart and Vascular System

Implantation of hearing devices

Insulin Pumps

Joint replacements

Kidney and Bladder

Lung and Chest

Male Reproductive System

Other Common Treatments

Other Support Treatments

Pain Management

Pain Management with Device

Plastic and Reconstructive Surgery

Podiatric Surgery

Pregnancy and Birth

Skin

Sleep Studies

Travel Accommodation

Weight loss surgery

Compare Club | Health Insurance Comparison

Waiting Periods

Waiting periods refer to the amount of time you'll need to wait before you can begin claiming on your health

insurance policy .

About Waiting Periods

You will only have to serve a waiting period when you

first take out a private health insurance policy , have held

cover for less than 12 months , or increased your level of

cover.

When you transfer from one fund to another at the

same level of cover there are no new waiting periods

although the balance of any waiting periods not yet

completed will most likely need to be served .

The following information is provided as a general guide

only and may include reference to waiting periods for

services not covered by your particular policy . You

should ask your Health Insurance Comparison adviser

about waiting periods for specific benefits .

I'm new to health insurance or held hospital cover for

less than 12 months

The government sets the maximum waiting periods that funds can impose for hospital treatement :

12 12 2

for pre -existing for pregnancy for psychiatric care,

Conditions rehabilitation or

Months Months Months palliative care, even

for a pre -existing

condition

0-2 2

for accidents in all other

(depending on your circumstances

Days fund) Months

People who are new to Extras cover or who upgrade their cover may need to serve waiting periods . The standard

waiting period for most Extras services is usually 2 months . For some services , like glasses , contact lenses , major

dental , orthodontics and hearing aids, the waiting period can range between 6 - 34 months . For your convenience ,

your quote includes information about waiting periods for each service .

Compare Club | Health Insurance Comparison

I'm upgrading my cover

In most cases, you will have waiting periods (including

12 months for pre-existing conditions and pregnancy )

on those services that are included on the new

cover but weren't on the old policy .

For example if you add pregnancy to the cover, you will

need to wait 12 months to claim on pregnancy , but all

other services that were on the old cover can be

claimed immediately providing you have already fully

served the waiting period for those services .

I've had my old cover for less than 12 months , and I wasn't

previously insured

Any time spent with the old fund with be recognised by the new fund, and the time spent with the old

fund will be deducted from the waiting periods that would otherwise apply . For example , if you held

the old cover for 9 months , you'd only need to wait the remaining 3 months for pre -existing conditions

when you switch to an equivalent cover.

I'm reducing my hospital excess

When you reduce your hospital excess you will need to serve waiting periods before your new lower hospital excess

can apply . The waiting periods will be:

12 12

for pre -existing for pregnancy

Conditions

Months Months

2

for psychiatric care, rehabilitation or palliative care,

even for a pre -existing condition

Months

0-2 2

for accidents in all other

(depending on circumstances

Months your fund ) Months

Compare Club | Health Insurance Comparison

I have Extras cover and have claimed some services from

my old fund this year

If you have used part or all of your annual benefits with your previous health fund, your new fund will adjust your

benefit limit accordingly . For example , if your annual benefit for optical is $200 and you have claimed $150 with your

previous health insurer , this claimed amount will be carried across to your new fund. Annual limits are reset on either

1 January or 1 July each year. Please check with your Health Insurance Comparison Consultant when your new fund

resets annual Extras limits .

Ambulance Waiting Period

1 day.

Compare Club | Health Insurance Comparison

This quote contains important information relating to this policy which you should read and retain . All

premiums quoted are subject to variation and/or rounding . A slight variation may be expected . Please contact

us on 1300 757 819 or email us at info@compareclub.com.au if you require any further information . If you

change your mind and choose to cancel within 30 days, you can receive a full refund on your Hospital and/or

Extras premiums if you haven't made a claim . Compare Club and Health Insurance Comparison pride

themselves on high quality customer service , but in the event that you need to make a complaint , please

read our complaints and dispute resolution information located on our website . For information regarding

the complaint resolution process for the funds that Compare Club and Health Insurance Comparison

represents , please visit :

AHM , Australian Unity , HCF, NIB, Peoplecare , Bupa .

Need Help

Our advisers are fully trained in all our fund's products . This means they can explain the differences between funds

and your current product . If there is something that fustrates you with this quote or your current fund , let us know

and we guarantee that we can find you a better product that will meet your needs.

Phone: 1300 757 819

Email: info@compareclub.com.au

Address: Level 7, 222 Pitt Street, Sydney NSW 2000, Australia

Compare Club | Health Insurance Comparison

You might also like

- Narayana Hrudayalaya Heart Hospital: - Case AnalysisDocument11 pagesNarayana Hrudayalaya Heart Hospital: - Case Analysiskaustav kundu100% (1)

- PHM MediSavers 2015 BrochureDocument4 pagesPHM MediSavers 2015 BrochureNazim SalehNo ratings yet

- Plasma Pen Fibroblast Eyes ContourDocument4 pagesPlasma Pen Fibroblast Eyes Contouralejandro Gonzàlez100% (1)

- A Plus Recover EN 0111Document2 pagesA Plus Recover EN 0111testNo ratings yet

- ProHealth V7 Accordian April'23 02Document8 pagesProHealth V7 Accordian April'23 02Sreeraj P SNo ratings yet

- Ahm Lite CoverDocument13 pagesAhm Lite CoverjeideyNo ratings yet

- A Pro in Every Way.: A Comprehensive Health Insurance Solution For Your Illness As Well As WellnessDocument8 pagesA Pro in Every Way.: A Comprehensive Health Insurance Solution For Your Illness As Well As WellnessSnehaAnilSurveNo ratings yet

- 24 Policy Wording EnglishDocument4 pages24 Policy Wording EnglishIsrael DoteNo ratings yet

- Floater Health Insurance Analysis ReportDocument8 pagesFloater Health Insurance Analysis Reportenumula kumarNo ratings yet

- Health Wallet BrochureDocument8 pagesHealth Wallet BrochureKanchan ChoudhuryNo ratings yet

- Reliance HealthGain Policy-BrochureDocument11 pagesReliance HealthGain Policy-BrochurePradeep Kumar SharmaNo ratings yet

- Leaflet - Medisure Plus - 150914Document2 pagesLeaflet - Medisure Plus - 150914Rajarshi GuhaNo ratings yet

- Manipalcigna Prohealth Insurance: A Pro in Every WayDocument8 pagesManipalcigna Prohealth Insurance: A Pro in Every Wayaniket shahNo ratings yet

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDocument2 pagesSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuNo ratings yet

- Reliance Healtwise Policy BrochureDocument9 pagesReliance Healtwise Policy BrochurenandasantoshinaNo ratings yet

- Health Insurance 12 Points Check ListDocument3 pagesHealth Insurance 12 Points Check ListmcsrNo ratings yet

- Benefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)Document25 pagesBenefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)suchit.singhNo ratings yet

- MedisurePlusbrochure PDFDocument18 pagesMedisurePlusbrochure PDFcrejocNo ratings yet

- HeathGuard BrochureDocument2 pagesHeathGuard BrochureKumud GandhiNo ratings yet

- Religare Care - More DetailsDocument5 pagesReligare Care - More Detailst0ysoldierNo ratings yet

- 2012 Hsa Benefit TableDocument3 pages2012 Hsa Benefit Tableapi-41207808No ratings yet

- Benefits DescriptionDocument16 pagesBenefits DescriptionKenneth Del RioNo ratings yet

- What Is Health InsuranceDocument3 pagesWhat Is Health InsuranceDaniel BowieNo ratings yet

- HealthDocument68 pagesHealthKvvPrasadNo ratings yet

- Guardme Drug Card Policy Wording English - 1650685539Document4 pagesGuardme Drug Card Policy Wording English - 1650685539gagan dhillonNo ratings yet

- Company Profile: Bajaj Allianz General Insurance Company LinitedDocument27 pagesCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- My+Health+Medisure+Classic Web+Brochure 02Document16 pagesMy+Health+Medisure+Classic Web+Brochure 02Preeti KatiyarNo ratings yet

- What Our Members Are Saying... : Tribute® PlanDocument6 pagesWhat Our Members Are Saying... : Tribute® PlanlocalonNo ratings yet

- Care (Health Insurance Product) - BrochureDocument10 pagesCare (Health Insurance Product) - Brochuresanjay4u4allNo ratings yet

- Accident Claim#002373921 Stephen Forde OCB1 FormDocument32 pagesAccident Claim#002373921 Stephen Forde OCB1 FormTanya GlennNo ratings yet

- American Financial Security Life Insurance Company: Certificate of CoverageDocument14 pagesAmerican Financial Security Life Insurance Company: Certificate of CoverageNick OrzechNo ratings yet

- Medi Claim FAQsDocument9 pagesMedi Claim FAQsMOVIES BRONo ratings yet

- COPY : Name/Names of Covered Member Date of BirthDocument4 pagesCOPY : Name/Names of Covered Member Date of Birththeloser2188No ratings yet

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Your Policy ExplainedDocument29 pagesYour Policy ExplaineddeonptNo ratings yet

- Policy DocumentDocument11 pagesPolicy DocumentPrakhar SNo ratings yet

- Health InsuranceDocument27 pagesHealth Insurancelittlemaster1982No ratings yet

- 1) Coverage Amount/Sum Insured (SI)Document4 pages1) Coverage Amount/Sum Insured (SI)shaileshNo ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookvinaysekharNo ratings yet

- Family Health Secure Plan - 4Document2 pagesFamily Health Secure Plan - 4Irfan OmerNo ratings yet

- Healthcare Deposit AccountDocument12 pagesHealthcare Deposit AccountdeonptNo ratings yet

- Background of D TipicDocument3 pagesBackground of D TipicSandeep GuptaNo ratings yet

- Even Plans OverviewDocument11 pagesEven Plans OverviewAbigale YoungbloodNo ratings yet

- New Products Launch by New IndiaDocument52 pagesNew Products Launch by New IndiaNewindia assuranceNo ratings yet

- Health InsuranceDocument21 pagesHealth Insuranceadhitya0% (1)

- Takaful Health2Document34 pagesTakaful Health2yusofprubsnNo ratings yet

- Keymed: Time Insurance Company John Alden Life Insurance CompanyDocument8 pagesKeymed: Time Insurance Company John Alden Life Insurance CompanyRuthStewart100% (2)

- 07937assure - Ci - BrochureDocument6 pages07937assure - Ci - Brochurebasantjain12345No ratings yet

- DISI - Policy Wording - EN - 1123Document7 pagesDISI - Policy Wording - EN - 1123sima.nourbakhshNo ratings yet

- Relationship: Start A Life LongDocument10 pagesRelationship: Start A Life LongRajesh Kumar RamaswamyNo ratings yet

- Heartbeat Silver BrochureDocument10 pagesHeartbeat Silver Brochuresubs007No ratings yet

- Health InsuranceDocument11 pagesHealth InsurancedishaNo ratings yet

- Heart and CancerDocument70 pagesHeart and CancerAnurag AggarwalNo ratings yet

- Heart and Cancer PDFDocument70 pagesHeart and Cancer PDFsathish guptaNo ratings yet

- Unit 2 Health Insurance ProductsDocument25 pagesUnit 2 Health Insurance ProductsShivam YadavNo ratings yet

- Group Mediclaim Policy Coverages For Employees of Century PlyDocument2 pagesGroup Mediclaim Policy Coverages For Employees of Century PlyUDAYNo ratings yet

- Family Health Insurance Plans Buy Mediclaim Policy OnlineDocument1 pageFamily Health Insurance Plans Buy Mediclaim Policy OnlinesainithinvaddiNo ratings yet

- The New India Assurance Co. LTDDocument17 pagesThe New India Assurance Co. LTDvishal shahNo ratings yet

- New Era Hospital IncomeDocument2 pagesNew Era Hospital IncomeHihiNo ratings yet

- Ps12 BP: Guidelines On Smoking As Related To The Perioperative Period Background PaperDocument15 pagesPs12 BP: Guidelines On Smoking As Related To The Perioperative Period Background PaperJane KoNo ratings yet

- Peripheral Vascular Disease-1Document52 pagesPeripheral Vascular Disease-1Johiarra Madanglog Tabigne100% (1)

- Tracheostomy Care GuidelinesDocument38 pagesTracheostomy Care GuidelinesYamete KudasaiNo ratings yet

- Vas Uhc Sample Letter Medical NecessityDocument5 pagesVas Uhc Sample Letter Medical NecessityJasonNo ratings yet

- Using Diode Laser For Soft Tissue Incision of Oral Cavity: Case ReportDocument8 pagesUsing Diode Laser For Soft Tissue Incision of Oral Cavity: Case ReportAndhika GilangNo ratings yet

- Comparing Breast-Conserving Surgery With Radical MastectomyDocument6 pagesComparing Breast-Conserving Surgery With Radical MastectomyRonald Cariaco FlamesNo ratings yet

- Types of CathetersDocument2 pagesTypes of CathetersLorie Fadol100% (1)

- InnoFit® Lodestar Plus Kit (LR)Document12 pagesInnoFit® Lodestar Plus Kit (LR)Vishruti PobaruNo ratings yet

- F1800 1479757-1Document6 pagesF1800 1479757-1Thaweekarn ChangthongNo ratings yet

- CA OesophagusDocument47 pagesCA OesophagusAnsif KNo ratings yet

- LindaparadisDocument9 pagesLindaparadiskevin lindaparadisgroupNo ratings yet

- Hemodialysis PDFDocument20 pagesHemodialysis PDFGiri Siva71% (7)

- Or Ward Class Kidney TransplantDocument89 pagesOr Ward Class Kidney TransplantChristy Mutia AlumbroNo ratings yet

- Cesarean SectionDocument20 pagesCesarean Sectionjeribob1823No ratings yet

- JIAP January 2014 - Biological Implant Complications and Their ManagementDocument10 pagesJIAP January 2014 - Biological Implant Complications and Their ManagementChaudhari SonaliNo ratings yet

- AnnexureDocument8 pagesAnnexureSrijesh SinghNo ratings yet

- Ade Mira Nur Alina-1-13Document13 pagesAde Mira Nur Alina-1-13selaza rubbyNo ratings yet

- Early Cardiac Complications of Coronary Artery Bypass Graft Surgery - UpToDateDocument16 pagesEarly Cardiac Complications of Coronary Artery Bypass Graft Surgery - UpToDateAnca StanNo ratings yet

- Post-Operative Instructions: Laparoscopic CholecystectomyDocument2 pagesPost-Operative Instructions: Laparoscopic Cholecystectomyrizwan234No ratings yet

- Histopathology Lab Lesson 2Document12 pagesHistopathology Lab Lesson 2christian Jay HorseradaNo ratings yet

- BASCO, Aila O. - Assignment 2 - OAMT 40033 MEDICAL TRANSCRIPTIONDocument3 pagesBASCO, Aila O. - Assignment 2 - OAMT 40033 MEDICAL TRANSCRIPTIONAila BascoNo ratings yet

- ObturatorDocument97 pagesObturatorNikhita NarayananNo ratings yet

- Minimally Invasive Management of Uterine Fibroids Role of Transvaginal Radiofrequency AblationDocument5 pagesMinimally Invasive Management of Uterine Fibroids Role of Transvaginal Radiofrequency AblationHerald Scholarly Open AccessNo ratings yet

- Bennett Fractures: A Review of ManagementDocument7 pagesBennett Fractures: A Review of ManagementIshan BramhbhattNo ratings yet

- Or DR Nclex FormsDocument6 pagesOr DR Nclex FormsClarence MangíoNo ratings yet

- List of Empanelled HCOs-Chennai (Dec 2022)Document7 pagesList of Empanelled HCOs-Chennai (Dec 2022)Munusamy RajiNo ratings yet

- Cardiovascular Surgical InstrumentatorDocument3 pagesCardiovascular Surgical Instrumentatorapi-626421480No ratings yet

- Anterior Cruciate Ligament Revision ReconstructionDocument9 pagesAnterior Cruciate Ligament Revision ReconstructionCésar ArveláezNo ratings yet