Professional Documents

Culture Documents

Monetary Policy

Monetary Policy

Uploaded by

768balochCopyright:

Available Formats

You might also like

- Economic PoliciesDocument9 pagesEconomic PoliciesMeherji DuvvuriNo ratings yet

- Discount Rate), Changes in Variable Reserve Ration. Briefly Speaking Open MarketDocument3 pagesDiscount Rate), Changes in Variable Reserve Ration. Briefly Speaking Open MarketHitisha agrawalNo ratings yet

- Monetary & Fiscal PolicyDocument10 pagesMonetary & Fiscal Policyaruna koliNo ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- All Print Macro Nad MicroDocument15 pagesAll Print Macro Nad MicrosmitaNo ratings yet

- Monetary Policy: DefinitionDocument4 pagesMonetary Policy: Definitionhasan hashmyNo ratings yet

- Monetary Policy in India - BlackbookDocument65 pagesMonetary Policy in India - BlackbookKinnari SinghNo ratings yet

- Monetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheDocument7 pagesMonetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheKikujo KikuNo ratings yet

- Money and Banking Assignment 1Document2 pagesMoney and Banking Assignment 1Anonymous NTzW01No ratings yet

- Monetary Policy of IndiaDocument13 pagesMonetary Policy of IndiaNannu Sharma100% (1)

- Monetary Policy New 1Document15 pagesMonetary Policy New 1Abdul Kader MandolNo ratings yet

- Final ProjectDocument42 pagesFinal ProjectAnonymous g7uPednINo ratings yet

- ECO120 - ScriptDocument3 pagesECO120 - ScriptNrainatasha 25No ratings yet

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazNo ratings yet

- Monetary and Fiscal Polocies EconomicsDocument4 pagesMonetary and Fiscal Polocies EconomicsRitvik Anuraag JanarajupalliNo ratings yet

- Presentation Development 20Document8 pagesPresentation Development 20Hussain RizviNo ratings yet

- Monetary PolicyDocument1 pageMonetary PolicyHennessy VasquezNo ratings yet

- Ec4303 Group 1 AssignmentDocument8 pagesEc4303 Group 1 AssignmentLekhutla TFNo ratings yet

- Monetary Policy (Assignment)Document5 pagesMonetary Policy (Assignment)Waleed AamirNo ratings yet

- Monetary and Fiscal Policies TemplateDocument2 pagesMonetary and Fiscal Policies TemplateDeryl GalveNo ratings yet

- MBA510 AssignmentDocument10 pagesMBA510 AssignmentNafiz Al SayemNo ratings yet

- Assignment on fiscalDocument3 pagesAssignment on fiscalamnajamil0001No ratings yet

- Financial MarketsDocument15 pagesFinancial MarketsKeziaNo ratings yet

- Business EnviromentDocument19 pagesBusiness EnviromentHarshit YNo ratings yet

- Lectures of Monetary PolicyDocument4 pagesLectures of Monetary PolicyMughees AhmedNo ratings yet

- Monetary Policy in IndiaDocument4 pagesMonetary Policy in IndiaRenuka KhatkarNo ratings yet

- Macroeconomics MONETARY POLICYDocument16 pagesMacroeconomics MONETARY POLICYTehreem BukhariNo ratings yet

- Economics of EducationDocument7 pagesEconomics of Educationdarwaxa5No ratings yet

- Monetary Policies Shaping Economies and Navigating ChallengesDocument2 pagesMonetary Policies Shaping Economies and Navigating ChallengesRadosavljevic Dimitrije DidiNo ratings yet

- Effectiveness of Economic Policies To Reduce InflationDocument7 pagesEffectiveness of Economic Policies To Reduce InflationAnushkaa DattaNo ratings yet

- Fiscal Policy NewDocument11 pagesFiscal Policy NewAnusha UNo ratings yet

- Group 5 Monetary Central BankingDocument19 pagesGroup 5 Monetary Central BankingAurea Espinosa ErazoNo ratings yet

- MEBD - Fiscal PolicyDocument26 pagesMEBD - Fiscal PolicyCharles RussellNo ratings yet

- Monetary and Banking PolicyDocument2 pagesMonetary and Banking PolicyBunnyNo ratings yet

- Empirical Impact of Monetary Policy Instruments On Economic Growth in NigeriaDocument56 pagesEmpirical Impact of Monetary Policy Instruments On Economic Growth in NigeriaFavour ChukwuelesieNo ratings yet

- What Is "Monetary Policy?"Document2 pagesWhat Is "Monetary Policy?"sajjadNo ratings yet

- Chapter 8Document54 pagesChapter 8Tegegne AlemayehuNo ratings yet

- Types of Monetary PolicyDocument1 pageTypes of Monetary PolicyVersha MalikNo ratings yet

- Macro Term PaperDocument10 pagesMacro Term PaperMoshfeqa KarimNo ratings yet

- Importance of Monetary Policy For Economic StabilizationDocument3 pagesImportance of Monetary Policy For Economic StabilizationASHWANI KUMAR IIIT DharwadNo ratings yet

- Monetary PolicyDocument3 pagesMonetary PolicyAmrin NiazNo ratings yet

- Monetary Policy & Fiscal Policy (2) DDDDDDocument10 pagesMonetary Policy & Fiscal Policy (2) DDDDDepic gamesNo ratings yet

- Fiscal and Monetary Policy PDFDocument2 pagesFiscal and Monetary Policy PDFAbbas KazmiNo ratings yet

- Introduction To Monetary PolicyDocument6 pagesIntroduction To Monetary Policykim byunooNo ratings yet

- Economic Policy - Monetary PolicyDocument17 pagesEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaNo ratings yet

- Monetary andDocument7 pagesMonetary andshashaamarilloNo ratings yet

- Moneytary and Fiscal PolicyDocument7 pagesMoneytary and Fiscal Policypremsid28No ratings yet

- StabilizationDocument21 pagesStabilizationSherali SoodNo ratings yet

- Monetory PolicyDocument10 pagesMonetory PolicyUrwa AslamNo ratings yet

- Monetary and Fiscal Policy: Smoothing The Operation of The MarketDocument15 pagesMonetary and Fiscal Policy: Smoothing The Operation of The Marketasiacup105No ratings yet

- Bisma Saleem (22L-6322)Document4 pagesBisma Saleem (22L-6322)Qamar VirkNo ratings yet

- Monetary and Fiscal PolicyDocument22 pagesMonetary and Fiscal PolicyVer Dnad JacobeNo ratings yet

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Monetary Policy NewDocument12 pagesMonetary Policy NewAbdul Kader MandolNo ratings yet

- 6363f7fbe28002. Monetary PolicyDocument9 pages6363f7fbe28002. Monetary PolicyAshoka MewadaNo ratings yet

- Monetary Policy in New ZealandDocument3 pagesMonetary Policy in New ZealandRoshNo ratings yet

- White Down The Review On Monetary Policy As Pakistan PerspectiveDocument4 pagesWhite Down The Review On Monetary Policy As Pakistan PerspectiveAmeer hamzaNo ratings yet

- Acroeconomics: Monetary Policy Vs Fiscal PolicyDocument6 pagesAcroeconomics: Monetary Policy Vs Fiscal PolicyKushal VyasNo ratings yet

- Monetary Policy and Fiscal PolicyDocument23 pagesMonetary Policy and Fiscal PolicyIam hackerNo ratings yet

- Project Presentation Empowering Education in GwadarDocument11 pagesProject Presentation Empowering Education in Gwadar768balochNo ratings yet

- Presentation KBDocument8 pagesPresentation KB768balochNo ratings yet

- Copilot: Powered by AIDocument1 pageCopilot: Powered by AI768balochNo ratings yet

- Trade PolicyDocument1 pageTrade Policy768balochNo ratings yet

- UnemploymentDocument1 pageUnemployment768balochNo ratings yet

Monetary Policy

Monetary Policy

Uploaded by

768balochOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monetary Policy

Monetary Policy

Uploaded by

768balochCopyright:

Available Formats

Powered by AI

Copilot

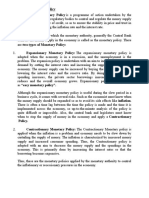

Monetary policy is a set of tools used by a nation’s central bank to control the overall money supply and promote

economic growth. It involves strategies such as revising interest rates and changing bank reserve requirements.

The primary goals of monetary policy are to achieve or maintain full employment, stabilize prices, and manage

inflation.

Monetary policy is commonly classified as either expansionary or contractionary:

Expansionary Monetary Policy: This policy is used during times of economic slowdown or recession. It

involves lowering interest rates and increasing the money supply to stimulate economic activity.

Contractionary Monetary Policy: This policy is used when the economy is experiencing high inflation. It

involves increasing interest rates and reducing the money supply to slow economic growth and decrease

inflation.

In Pakistan, the State Bank of Pakistan (SBP) is responsible for implementing monetary policy. For instance, in

2008, the SBP raised the policy rate to 10.5% to strengthen demand management. More recently, the SBP has used

a combination of fiscal policy and accommodative monetary policy to stimulate robust growth in domestic

demand indicators.

The effectiveness of monetary policy can vary depending on a range of factors, including the overall state of the

economy, the specific policy measures used, and how these measures are implemented.

You might also like

- Economic PoliciesDocument9 pagesEconomic PoliciesMeherji DuvvuriNo ratings yet

- Discount Rate), Changes in Variable Reserve Ration. Briefly Speaking Open MarketDocument3 pagesDiscount Rate), Changes in Variable Reserve Ration. Briefly Speaking Open MarketHitisha agrawalNo ratings yet

- Monetary & Fiscal PolicyDocument10 pagesMonetary & Fiscal Policyaruna koliNo ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- All Print Macro Nad MicroDocument15 pagesAll Print Macro Nad MicrosmitaNo ratings yet

- Monetary Policy: DefinitionDocument4 pagesMonetary Policy: Definitionhasan hashmyNo ratings yet

- Monetary Policy in India - BlackbookDocument65 pagesMonetary Policy in India - BlackbookKinnari SinghNo ratings yet

- Monetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheDocument7 pagesMonetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheKikujo KikuNo ratings yet

- Money and Banking Assignment 1Document2 pagesMoney and Banking Assignment 1Anonymous NTzW01No ratings yet

- Monetary Policy of IndiaDocument13 pagesMonetary Policy of IndiaNannu Sharma100% (1)

- Monetary Policy New 1Document15 pagesMonetary Policy New 1Abdul Kader MandolNo ratings yet

- Final ProjectDocument42 pagesFinal ProjectAnonymous g7uPednINo ratings yet

- ECO120 - ScriptDocument3 pagesECO120 - ScriptNrainatasha 25No ratings yet

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazNo ratings yet

- Monetary and Fiscal Polocies EconomicsDocument4 pagesMonetary and Fiscal Polocies EconomicsRitvik Anuraag JanarajupalliNo ratings yet

- Presentation Development 20Document8 pagesPresentation Development 20Hussain RizviNo ratings yet

- Monetary PolicyDocument1 pageMonetary PolicyHennessy VasquezNo ratings yet

- Ec4303 Group 1 AssignmentDocument8 pagesEc4303 Group 1 AssignmentLekhutla TFNo ratings yet

- Monetary Policy (Assignment)Document5 pagesMonetary Policy (Assignment)Waleed AamirNo ratings yet

- Monetary and Fiscal Policies TemplateDocument2 pagesMonetary and Fiscal Policies TemplateDeryl GalveNo ratings yet

- MBA510 AssignmentDocument10 pagesMBA510 AssignmentNafiz Al SayemNo ratings yet

- Assignment on fiscalDocument3 pagesAssignment on fiscalamnajamil0001No ratings yet

- Financial MarketsDocument15 pagesFinancial MarketsKeziaNo ratings yet

- Business EnviromentDocument19 pagesBusiness EnviromentHarshit YNo ratings yet

- Lectures of Monetary PolicyDocument4 pagesLectures of Monetary PolicyMughees AhmedNo ratings yet

- Monetary Policy in IndiaDocument4 pagesMonetary Policy in IndiaRenuka KhatkarNo ratings yet

- Macroeconomics MONETARY POLICYDocument16 pagesMacroeconomics MONETARY POLICYTehreem BukhariNo ratings yet

- Economics of EducationDocument7 pagesEconomics of Educationdarwaxa5No ratings yet

- Monetary Policies Shaping Economies and Navigating ChallengesDocument2 pagesMonetary Policies Shaping Economies and Navigating ChallengesRadosavljevic Dimitrije DidiNo ratings yet

- Effectiveness of Economic Policies To Reduce InflationDocument7 pagesEffectiveness of Economic Policies To Reduce InflationAnushkaa DattaNo ratings yet

- Fiscal Policy NewDocument11 pagesFiscal Policy NewAnusha UNo ratings yet

- Group 5 Monetary Central BankingDocument19 pagesGroup 5 Monetary Central BankingAurea Espinosa ErazoNo ratings yet

- MEBD - Fiscal PolicyDocument26 pagesMEBD - Fiscal PolicyCharles RussellNo ratings yet

- Monetary and Banking PolicyDocument2 pagesMonetary and Banking PolicyBunnyNo ratings yet

- Empirical Impact of Monetary Policy Instruments On Economic Growth in NigeriaDocument56 pagesEmpirical Impact of Monetary Policy Instruments On Economic Growth in NigeriaFavour ChukwuelesieNo ratings yet

- What Is "Monetary Policy?"Document2 pagesWhat Is "Monetary Policy?"sajjadNo ratings yet

- Chapter 8Document54 pagesChapter 8Tegegne AlemayehuNo ratings yet

- Types of Monetary PolicyDocument1 pageTypes of Monetary PolicyVersha MalikNo ratings yet

- Macro Term PaperDocument10 pagesMacro Term PaperMoshfeqa KarimNo ratings yet

- Importance of Monetary Policy For Economic StabilizationDocument3 pagesImportance of Monetary Policy For Economic StabilizationASHWANI KUMAR IIIT DharwadNo ratings yet

- Monetary PolicyDocument3 pagesMonetary PolicyAmrin NiazNo ratings yet

- Monetary Policy & Fiscal Policy (2) DDDDDDocument10 pagesMonetary Policy & Fiscal Policy (2) DDDDDepic gamesNo ratings yet

- Fiscal and Monetary Policy PDFDocument2 pagesFiscal and Monetary Policy PDFAbbas KazmiNo ratings yet

- Introduction To Monetary PolicyDocument6 pagesIntroduction To Monetary Policykim byunooNo ratings yet

- Economic Policy - Monetary PolicyDocument17 pagesEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaNo ratings yet

- Monetary andDocument7 pagesMonetary andshashaamarilloNo ratings yet

- Moneytary and Fiscal PolicyDocument7 pagesMoneytary and Fiscal Policypremsid28No ratings yet

- StabilizationDocument21 pagesStabilizationSherali SoodNo ratings yet

- Monetory PolicyDocument10 pagesMonetory PolicyUrwa AslamNo ratings yet

- Monetary and Fiscal Policy: Smoothing The Operation of The MarketDocument15 pagesMonetary and Fiscal Policy: Smoothing The Operation of The Marketasiacup105No ratings yet

- Bisma Saleem (22L-6322)Document4 pagesBisma Saleem (22L-6322)Qamar VirkNo ratings yet

- Monetary and Fiscal PolicyDocument22 pagesMonetary and Fiscal PolicyVer Dnad JacobeNo ratings yet

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Monetary Policy NewDocument12 pagesMonetary Policy NewAbdul Kader MandolNo ratings yet

- 6363f7fbe28002. Monetary PolicyDocument9 pages6363f7fbe28002. Monetary PolicyAshoka MewadaNo ratings yet

- Monetary Policy in New ZealandDocument3 pagesMonetary Policy in New ZealandRoshNo ratings yet

- White Down The Review On Monetary Policy As Pakistan PerspectiveDocument4 pagesWhite Down The Review On Monetary Policy As Pakistan PerspectiveAmeer hamzaNo ratings yet

- Acroeconomics: Monetary Policy Vs Fiscal PolicyDocument6 pagesAcroeconomics: Monetary Policy Vs Fiscal PolicyKushal VyasNo ratings yet

- Monetary Policy and Fiscal PolicyDocument23 pagesMonetary Policy and Fiscal PolicyIam hackerNo ratings yet

- Project Presentation Empowering Education in GwadarDocument11 pagesProject Presentation Empowering Education in Gwadar768balochNo ratings yet

- Presentation KBDocument8 pagesPresentation KB768balochNo ratings yet

- Copilot: Powered by AIDocument1 pageCopilot: Powered by AI768balochNo ratings yet

- Trade PolicyDocument1 pageTrade Policy768balochNo ratings yet

- UnemploymentDocument1 pageUnemployment768balochNo ratings yet