Professional Documents

Culture Documents

Finance 2 Formula Sheet Final

Finance 2 Formula Sheet Final

Uploaded by

9bpj6qfyhwCopyright:

Available Formats

You might also like

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Test Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso DownloadDocument65 pagesTest Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso Downloadjasondaviskpegzdosmt100% (30)

- Johnson & Johnson Equity Research ReportDocument13 pagesJohnson & Johnson Equity Research ReportPraveen R V100% (3)

- Problem Set 2Document2 pagesProblem Set 2nskabra0% (1)

- CFA Level II Cheat Sheet: Equity Fixed IncomeDocument1 pageCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095No ratings yet

- RSM 333 Fall 2019 Formula SheetDocument2 pagesRSM 333 Fall 2019 Formula SheetJoe BobNo ratings yet

- FIN205 Formula SheetDocument5 pagesFIN205 Formula SheetAamir SaeedNo ratings yet

- Introduction To Finance Formula SheetDocument2 pagesIntroduction To Finance Formula SheetKhanh LinhNo ratings yet

- Cm1 Assignment Y1 q1 - Solution (Final)Document79 pagesCm1 Assignment Y1 q1 - Solution (Final)Swapnil SinghNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- Accounting For Price Level ChangesDocument5 pagesAccounting For Price Level ChangesIndu Gupta100% (1)

- Cash Flow PV R CF PV RG: FCF NPV Initial T RDocument2 pagesCash Flow PV R CF PV RG: FCF NPV Initial T RMindaugas PinčiukovasNo ratings yet

- CF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceDocument4 pagesCF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceJoana MouraNo ratings yet

- CFFM Formula Sheet 2017Document1 pageCFFM Formula Sheet 2017Thibault MHNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- Formula Sheet FMDocument3 pagesFormula Sheet FMAbdullah ShahNo ratings yet

- FormulaDocument2 pagesFormulamarwin73No ratings yet

- Formula Sheet MAF 302 Corporate FinanceDocument2 pagesFormula Sheet MAF 302 Corporate FinanceWill LeeNo ratings yet

- Managerial Fin 2Document5 pagesManagerial Fin 2api-3698549No ratings yet

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- Formulae SheetDocument1 pageFormulae Sheetsolid_foxNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- FormulaeDocument1 pageFormulaeArnab HazraNo ratings yet

- CFA L3 FormulaDocument17 pagesCFA L3 Formulashrikrishna.b.98No ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- Formulas For QuizzesDocument3 pagesFormulas For QuizzesSufyan KhanNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- Chapter7 3Document12 pagesChapter7 3khan lisedNo ratings yet

- L2-Formula SheetDocument4 pagesL2-Formula SheetShumaila FurqanNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- Formula Sheet Short-Term Solvency RatiosDocument2 pagesFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhNo ratings yet

- FormulasDocument3 pagesFormulasДля ФігніNo ratings yet

- Formula Sheet V2Document1 pageFormula Sheet V2Moe kurdiNo ratings yet

- Exam 2 EquationsDocument1 pageExam 2 EquationsFatma SulaimanNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Formula SheetDocument7 pagesFormula SheetAbraham RodriguezNo ratings yet

- Cheat Sheet FinanceDocument1 pageCheat Sheet FinanceGhitaNo ratings yet

- Final Formula SheetDocument1 pageFinal Formula SheetFaryalNo ratings yet

- 1 CapitalstructureDocument4 pages1 CapitalstructureAlex Luque RodriguezNo ratings yet

- Formula SheetDocument2 pagesFormula SheetkaylovelluNo ratings yet

- Formula Sheet - Study Version. - Portfolio Management PDFDocument2 pagesFormula Sheet - Study Version. - Portfolio Management PDFAnhthu DangNo ratings yet

- FIN620 FormulasDocument1 pageFIN620 FormulasPinkera -No ratings yet

- For Mel BladDocument1 pageFor Mel BladRasmus SjövillNo ratings yet

- Formula Sheet 311Document1 pageFormula Sheet 311thivarNo ratings yet

- Formulae sheet: σ r a) 1 (r a r Document1 pageFormulae sheet: σ r a) 1 (r a r Linh NguyễnNo ratings yet

- Formula SheetDocument3 pagesFormula SheetCarlos GamioNo ratings yet

- Time Value of Money: CFA Level 1 2006 - Formula SheetDocument18 pagesTime Value of Money: CFA Level 1 2006 - Formula SheetGautam MehtaNo ratings yet

- BANK3011 Formula SheetDocument2 pagesBANK3011 Formula SheetZahraaNo ratings yet

- Formular MT 2019Document1 pageFormular MT 20195658780qazNo ratings yet

- Formulas TrymDocument44 pagesFormulas Trymmadelen.fredriksen97No ratings yet

- Formula Sheet: BFW1001 Foundations of Finance - Semester 1, 2022Document2 pagesFormula Sheet: BFW1001 Foundations of Finance - Semester 1, 2022Liy TehNo ratings yet

- Formulae Part ThreeDocument5 pagesFormulae Part ThreeShiva SeshasaiNo ratings yet

- ICS - Modigliani Miller Propositions 2023-04-20Document8 pagesICS - Modigliani Miller Propositions 2023-04-20cullerbent0wNo ratings yet

- Corporate Finance Theory: Formula SheetDocument6 pagesCorporate Finance Theory: Formula SheetteratakbalqisNo ratings yet

- Formula Sheet 301 Common Exam - 1Document2 pagesFormula Sheet 301 Common Exam - 1siputvwNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- FV PV: LN LN (1)Document2 pagesFV PV: LN LN (1)Danneek BillingsNo ratings yet

- Time Value of Money FormulasDocument3 pagesTime Value of Money FormulasRahat IslamNo ratings yet

- Ac PDFDocument192 pagesAc PDFAnkan BhuniaNo ratings yet

- Principles of Finance 2024 - Exam FormularyDocument3 pagesPrinciples of Finance 2024 - Exam Formularykhalid.abdizaNo ratings yet

- Controls Combined Lecture NotesDocument312 pagesControls Combined Lecture NotesA FNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Chapter 6Document71 pagesChapter 6Messa Marianka80% (5)

- Conanan Bookstore Price List PDFDocument6 pagesConanan Bookstore Price List PDFJulie VelasquezNo ratings yet

- Ariya-Contoh Soal Analisis LeverageDocument3 pagesAriya-Contoh Soal Analisis Leverageariya ropi husnaNo ratings yet

- Deloitte Model Financial Statements 31dec2020 rdr2 PDFDocument126 pagesDeloitte Model Financial Statements 31dec2020 rdr2 PDFRatu RushdiNo ratings yet

- 11 Accountancy English 2020 21Document376 pages11 Accountancy English 2020 21Tanishq Bindal100% (1)

- I. Title: "A Study On The Feasibility of Establishing A Dairy Goat Farm in Barangay Meysulao, Calumpit, Bulacan"Document31 pagesI. Title: "A Study On The Feasibility of Establishing A Dairy Goat Farm in Barangay Meysulao, Calumpit, Bulacan"Joama Febrille DinNo ratings yet

- Implementing Strategies: Marketing, Finance/Accounting, R&D, MISDocument77 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, MISCharlesLuongNo ratings yet

- Jawaban UAS Akuntansi Lanjutan 2Document6 pagesJawaban UAS Akuntansi Lanjutan 2DANIEL TEJANo ratings yet

- All NotebookDocument88 pagesAll NotebookmsjoyevangelistaNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Shareholders' EquityDocument9 pagesShareholders' EquityLeah Hope CedroNo ratings yet

- NFRS 5Document14 pagesNFRS 5abhilekh2055No ratings yet

- Modul AKLII-6 - Intercompany Plant AssetDocument30 pagesModul AKLII-6 - Intercompany Plant AssetPutri Shinta IndryaniNo ratings yet

- Curriculum For BSADocument5 pagesCurriculum For BSAEphreen Grace MartyNo ratings yet

- Michael Kors PresentationDocument21 pagesMichael Kors PresentationJeremy_Edwards11No ratings yet

- IAII FINAL EXAM Maual SET BDocument9 pagesIAII FINAL EXAM Maual SET BClara MacallingNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- Case Study MGT 345Document14 pagesCase Study MGT 345NUR SHAFFIQAH MOHD HANAFIAHNo ratings yet

- Financial AccountingDocument71 pagesFinancial AccountingHoàng My Trần100% (1)

- Accounting GeniusDocument9 pagesAccounting Geniusryan angelica allanicNo ratings yet

- Sesi 2 Akuntansi Manajemen - Rev1Document32 pagesSesi 2 Akuntansi Manajemen - Rev1Dian Permata SariNo ratings yet

- Name: Fundamentals of Finance Quiz 1-B ID: Group Date: Multiple Choice QuestionsDocument5 pagesName: Fundamentals of Finance Quiz 1-B ID: Group Date: Multiple Choice Questionsrana ahmedNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument8 pagesFixed Asset and Depreciation Schedule: Instructions: InputsFaruk RhamadanNo ratings yet

Finance 2 Formula Sheet Final

Finance 2 Formula Sheet Final

Uploaded by

9bpj6qfyhwOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance 2 Formula Sheet Final

Finance 2 Formula Sheet Final

Uploaded by

9bpj6qfyhwCopyright:

Available Formats

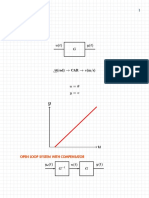

Formula Sheet Finance 2 FINAL EXAM

NPV T

FCFt

NPV = − Initial cos t

t =1 (1 + r )t

Perpetuity Cash Flow

PV0 =

r

Growing perpetuity CF1

PV0 =

r−g

Annuity 1 1

PV0 = CF −

r r (1 + r )

t

Expected return of a value of investment i

portfolio E RP = i xi E Ri , where xi =

total value of portfolio

Variance and standard

deviation of a stock

CAPM E ( Ri ) = ri = rf + iMkt (E ( RMkt ) − rf )

Beta

SD(Ri ) Corr (Ri ,RMkt ) Cov(Ri ,RMkt )

iMkt =

SD(RMkt ) Var (RMkt )

Unlevered beta without

E D

taxes A = U = E + D

E + D E + D

Pre-tax WACC:

E D

rU = rA = pre − tax rwacc = rE + rD

E + D E + D

Levered return on equity

D

rE = rU + (rU − rD )

E

After-tax WACC

E D D

after − tax rwacc = rE + (1 − c ) rD = rU − c rD

E + D E + D V

Debt capacity

Dt = d Vt L

Put-Call Parity C = S + P − PV ( K ) − PV ( Div)

One-period Binomial

Tree model

Su + (1 + rf )B = Cu

Sd + (1 + rf )B = Cd

C − Cd C − Sd

= u and B = d

Su − S d 1 + rf

→ C = S + B

You might also like

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Test Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso DownloadDocument65 pagesTest Bank For Intermediate Accounting Volume 2 12th Canadian by Kieso Downloadjasondaviskpegzdosmt100% (30)

- Johnson & Johnson Equity Research ReportDocument13 pagesJohnson & Johnson Equity Research ReportPraveen R V100% (3)

- Problem Set 2Document2 pagesProblem Set 2nskabra0% (1)

- CFA Level II Cheat Sheet: Equity Fixed IncomeDocument1 pageCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095No ratings yet

- RSM 333 Fall 2019 Formula SheetDocument2 pagesRSM 333 Fall 2019 Formula SheetJoe BobNo ratings yet

- FIN205 Formula SheetDocument5 pagesFIN205 Formula SheetAamir SaeedNo ratings yet

- Introduction To Finance Formula SheetDocument2 pagesIntroduction To Finance Formula SheetKhanh LinhNo ratings yet

- Cm1 Assignment Y1 q1 - Solution (Final)Document79 pagesCm1 Assignment Y1 q1 - Solution (Final)Swapnil SinghNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- Accounting For Price Level ChangesDocument5 pagesAccounting For Price Level ChangesIndu Gupta100% (1)

- Cash Flow PV R CF PV RG: FCF NPV Initial T RDocument2 pagesCash Flow PV R CF PV RG: FCF NPV Initial T RMindaugas PinčiukovasNo ratings yet

- CF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceDocument4 pagesCF P R: Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate FinanceJoana MouraNo ratings yet

- CFFM Formula Sheet 2017Document1 pageCFFM Formula Sheet 2017Thibault MHNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- Formula Sheet FMDocument3 pagesFormula Sheet FMAbdullah ShahNo ratings yet

- FormulaDocument2 pagesFormulamarwin73No ratings yet

- Formula Sheet MAF 302 Corporate FinanceDocument2 pagesFormula Sheet MAF 302 Corporate FinanceWill LeeNo ratings yet

- Managerial Fin 2Document5 pagesManagerial Fin 2api-3698549No ratings yet

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- Formulae SheetDocument1 pageFormulae Sheetsolid_foxNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- FormulaeDocument1 pageFormulaeArnab HazraNo ratings yet

- CFA L3 FormulaDocument17 pagesCFA L3 Formulashrikrishna.b.98No ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- Formulas For QuizzesDocument3 pagesFormulas For QuizzesSufyan KhanNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- Chapter7 3Document12 pagesChapter7 3khan lisedNo ratings yet

- L2-Formula SheetDocument4 pagesL2-Formula SheetShumaila FurqanNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- Formula Sheet Short-Term Solvency RatiosDocument2 pagesFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhNo ratings yet

- FormulasDocument3 pagesFormulasДля ФігніNo ratings yet

- Formula Sheet V2Document1 pageFormula Sheet V2Moe kurdiNo ratings yet

- Exam 2 EquationsDocument1 pageExam 2 EquationsFatma SulaimanNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Formula SheetDocument7 pagesFormula SheetAbraham RodriguezNo ratings yet

- Cheat Sheet FinanceDocument1 pageCheat Sheet FinanceGhitaNo ratings yet

- Final Formula SheetDocument1 pageFinal Formula SheetFaryalNo ratings yet

- 1 CapitalstructureDocument4 pages1 CapitalstructureAlex Luque RodriguezNo ratings yet

- Formula SheetDocument2 pagesFormula SheetkaylovelluNo ratings yet

- Formula Sheet - Study Version. - Portfolio Management PDFDocument2 pagesFormula Sheet - Study Version. - Portfolio Management PDFAnhthu DangNo ratings yet

- FIN620 FormulasDocument1 pageFIN620 FormulasPinkera -No ratings yet

- For Mel BladDocument1 pageFor Mel BladRasmus SjövillNo ratings yet

- Formula Sheet 311Document1 pageFormula Sheet 311thivarNo ratings yet

- Formulae sheet: σ r a) 1 (r a r Document1 pageFormulae sheet: σ r a) 1 (r a r Linh NguyễnNo ratings yet

- Formula SheetDocument3 pagesFormula SheetCarlos GamioNo ratings yet

- Time Value of Money: CFA Level 1 2006 - Formula SheetDocument18 pagesTime Value of Money: CFA Level 1 2006 - Formula SheetGautam MehtaNo ratings yet

- BANK3011 Formula SheetDocument2 pagesBANK3011 Formula SheetZahraaNo ratings yet

- Formular MT 2019Document1 pageFormular MT 20195658780qazNo ratings yet

- Formulas TrymDocument44 pagesFormulas Trymmadelen.fredriksen97No ratings yet

- Formula Sheet: BFW1001 Foundations of Finance - Semester 1, 2022Document2 pagesFormula Sheet: BFW1001 Foundations of Finance - Semester 1, 2022Liy TehNo ratings yet

- Formulae Part ThreeDocument5 pagesFormulae Part ThreeShiva SeshasaiNo ratings yet

- ICS - Modigliani Miller Propositions 2023-04-20Document8 pagesICS - Modigliani Miller Propositions 2023-04-20cullerbent0wNo ratings yet

- Corporate Finance Theory: Formula SheetDocument6 pagesCorporate Finance Theory: Formula SheetteratakbalqisNo ratings yet

- Formula Sheet 301 Common Exam - 1Document2 pagesFormula Sheet 301 Common Exam - 1siputvwNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- FV PV: LN LN (1)Document2 pagesFV PV: LN LN (1)Danneek BillingsNo ratings yet

- Time Value of Money FormulasDocument3 pagesTime Value of Money FormulasRahat IslamNo ratings yet

- Ac PDFDocument192 pagesAc PDFAnkan BhuniaNo ratings yet

- Principles of Finance 2024 - Exam FormularyDocument3 pagesPrinciples of Finance 2024 - Exam Formularykhalid.abdizaNo ratings yet

- Controls Combined Lecture NotesDocument312 pagesControls Combined Lecture NotesA FNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Chapter 6Document71 pagesChapter 6Messa Marianka80% (5)

- Conanan Bookstore Price List PDFDocument6 pagesConanan Bookstore Price List PDFJulie VelasquezNo ratings yet

- Ariya-Contoh Soal Analisis LeverageDocument3 pagesAriya-Contoh Soal Analisis Leverageariya ropi husnaNo ratings yet

- Deloitte Model Financial Statements 31dec2020 rdr2 PDFDocument126 pagesDeloitte Model Financial Statements 31dec2020 rdr2 PDFRatu RushdiNo ratings yet

- 11 Accountancy English 2020 21Document376 pages11 Accountancy English 2020 21Tanishq Bindal100% (1)

- I. Title: "A Study On The Feasibility of Establishing A Dairy Goat Farm in Barangay Meysulao, Calumpit, Bulacan"Document31 pagesI. Title: "A Study On The Feasibility of Establishing A Dairy Goat Farm in Barangay Meysulao, Calumpit, Bulacan"Joama Febrille DinNo ratings yet

- Implementing Strategies: Marketing, Finance/Accounting, R&D, MISDocument77 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, MISCharlesLuongNo ratings yet

- Jawaban UAS Akuntansi Lanjutan 2Document6 pagesJawaban UAS Akuntansi Lanjutan 2DANIEL TEJANo ratings yet

- All NotebookDocument88 pagesAll NotebookmsjoyevangelistaNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Shareholders' EquityDocument9 pagesShareholders' EquityLeah Hope CedroNo ratings yet

- NFRS 5Document14 pagesNFRS 5abhilekh2055No ratings yet

- Modul AKLII-6 - Intercompany Plant AssetDocument30 pagesModul AKLII-6 - Intercompany Plant AssetPutri Shinta IndryaniNo ratings yet

- Curriculum For BSADocument5 pagesCurriculum For BSAEphreen Grace MartyNo ratings yet

- Michael Kors PresentationDocument21 pagesMichael Kors PresentationJeremy_Edwards11No ratings yet

- IAII FINAL EXAM Maual SET BDocument9 pagesIAII FINAL EXAM Maual SET BClara MacallingNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- Case Study MGT 345Document14 pagesCase Study MGT 345NUR SHAFFIQAH MOHD HANAFIAHNo ratings yet

- Financial AccountingDocument71 pagesFinancial AccountingHoàng My Trần100% (1)

- Accounting GeniusDocument9 pagesAccounting Geniusryan angelica allanicNo ratings yet

- Sesi 2 Akuntansi Manajemen - Rev1Document32 pagesSesi 2 Akuntansi Manajemen - Rev1Dian Permata SariNo ratings yet

- Name: Fundamentals of Finance Quiz 1-B ID: Group Date: Multiple Choice QuestionsDocument5 pagesName: Fundamentals of Finance Quiz 1-B ID: Group Date: Multiple Choice Questionsrana ahmedNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument8 pagesFixed Asset and Depreciation Schedule: Instructions: InputsFaruk RhamadanNo ratings yet