Professional Documents

Culture Documents

Topic 2 Prelim Activity 2

Topic 2 Prelim Activity 2

Uploaded by

Bryce ApitCopyright:

Available Formats

You might also like

- Specification For Sheet Metal Ductwork DW 144Document102 pagesSpecification For Sheet Metal Ductwork DW 144Baladaru Krishna Prasad100% (2)

- NCBA RA 7653 Summary v2.0Document18 pagesNCBA RA 7653 Summary v2.0Cha BL80% (5)

- Module 2 - Functions of BSPDocument14 pagesModule 2 - Functions of BSPQuenie De la CruzNo ratings yet

- Damayanti Nasita DISC and MotivatorsDocument11 pagesDamayanti Nasita DISC and Motivatorss.ratihNo ratings yet

- !. BSP (Banko Sentral NG Pilipinas) ORGANIZATIONAL CHARTDocument4 pages!. BSP (Banko Sentral NG Pilipinas) ORGANIZATIONAL CHARTedgar godinezNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- BSP ReportDocument20 pagesBSP ReportRosemarie CabahugNo ratings yet

- Bank Negara MalaysiaDocument17 pagesBank Negara MalaysiaMohammad Fairuz100% (3)

- Pre Final HandoutsDocument9 pagesPre Final HandoutsPauline Jane RigodonNo ratings yet

- Module 1 3Document35 pagesModule 1 3hikunanaNo ratings yet

- Bangko Sentral NG PilipinasDocument4 pagesBangko Sentral NG PilipinasHanaNo ratings yet

- Final Lesson 7 Money and Monetary PolicyDocument18 pagesFinal Lesson 7 Money and Monetary PolicyKerby Christian Araneta OndoyNo ratings yet

- Banking Laws: The New Central Bank Act (Rep. Act No. 7653) (The "BSP Law") The BSPDocument23 pagesBanking Laws: The New Central Bank Act (Rep. Act No. 7653) (The "BSP Law") The BSPSweet EmmeNo ratings yet

- Regulation of Financial SystemDocument39 pagesRegulation of Financial SystemRamil ElambayoNo ratings yet

- Finmar Quiz MidtermDocument1 pageFinmar Quiz MidtermNune SabanalNo ratings yet

- Summary of The Bangko Sentral NG PilipinasDocument3 pagesSummary of The Bangko Sentral NG PilipinasAnne Laraga LuansingNo ratings yet

- Banking Law Notes (2,3,4,5)Document17 pagesBanking Law Notes (2,3,4,5)Afiqah IsmailNo ratings yet

- Money AND Monetary PolicyDocument17 pagesMoney AND Monetary PolicyAnna BartolomeNo ratings yet

- Central Monetary Authority (Group 1)Document26 pagesCentral Monetary Authority (Group 1)Jay Aura BalcitaNo ratings yet

- Banking and Financial Institution: Midterms ReviewerDocument9 pagesBanking and Financial Institution: Midterms ReviewerLyka FaneNo ratings yet

- UST Golden Notes - Banking LawsDocument20 pagesUST Golden Notes - Banking LawsAntrex GuroNo ratings yet

- Term Paper - AMLA and Banking Laws - Jason Oliver SunDocument6 pagesTerm Paper - AMLA and Banking Laws - Jason Oliver SunJason SunNo ratings yet

- CB-03 Central Monetary AuthorityDocument7 pagesCB-03 Central Monetary AuthorityJHERRY MIG SEVILLANo ratings yet

- Chapter 4 and 5 - BSP and Monetary Supply - FINAL VersionDocument85 pagesChapter 4 and 5 - BSP and Monetary Supply - FINAL Version乙คckคrψ YTNo ratings yet

- Finmar BSPDocument3 pagesFinmar BSPLeafar NagaliNo ratings yet

- Rinna oDocument4 pagesRinna oOlea RinnaNo ratings yet

- Ust Golden Notes Banking LawsDocument23 pagesUst Golden Notes Banking LawsMil Roilo B EspirituNo ratings yet

- Group Report - BEC 113Document40 pagesGroup Report - BEC 113Jester LabanNo ratings yet

- Banking Laws Notes 2019Document21 pagesBanking Laws Notes 2019Jannah Mae NeneNo ratings yet

- The New Central Bank Act PDFDocument8 pagesThe New Central Bank Act PDFitsmenatoyNo ratings yet

- The Philippine Financial System ReportDocument28 pagesThe Philippine Financial System Reportvalerie joy camemoNo ratings yet

- Interest Rate & Role of BNMDocument57 pagesInterest Rate & Role of BNMAinnur HaziqahNo ratings yet

- Governance of The Bank: Liquidity ManagementDocument1 pageGovernance of The Bank: Liquidity ManagementJerald-Edz Tam AbonNo ratings yet

- RBI Second Quarter Review of Monetary Policy 2010-11Document36 pagesRBI Second Quarter Review of Monetary Policy 2010-11tamirisaarNo ratings yet

- IR2qtr 2018 PDFDocument67 pagesIR2qtr 2018 PDFDarrelNo ratings yet

- Chapter 1 The Financial SystemDocument38 pagesChapter 1 The Financial SystemJonamay FactorNo ratings yet

- Chapter 8 Basic Finance 2023 2024Document9 pagesChapter 8 Basic Finance 2023 2024PACIOLI-EDRADA, BEANo ratings yet

- CB-03 Central Monetary AuthorityDocument7 pagesCB-03 Central Monetary AuthorityJHERRY MIG SEVILLANo ratings yet

- Group 7Document15 pagesGroup 7CPAREVIEWNo ratings yet

- Chapter 3 Central BankDocument34 pagesChapter 3 Central Bankandrei cajayonNo ratings yet

- Banking in The Philippines: Avec M. John Darrel Rillo EconomicsDocument30 pagesBanking in The Philippines: Avec M. John Darrel Rillo EconomicsWes Harven MaravillaNo ratings yet

- Dennis Tuble II Monetary Policy IndividualDocument1 pageDennis Tuble II Monetary Policy IndividualTuble, Dennis II, C.No ratings yet

- Bangko Sentral NG PilipinasDocument28 pagesBangko Sentral NG PilipinasJay Mar Isorena100% (1)

- Handouts For Capital MarketsDocument6 pagesHandouts For Capital MarketsfroelanangusatiNo ratings yet

- University of Rizal SystemDocument10 pagesUniversity of Rizal SystemFitz Clark LobarbioNo ratings yet

- PFQR16 Q 1 TeDocument10 pagesPFQR16 Q 1 TeanthonmirandasNo ratings yet

- Bangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsDocument17 pagesBangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsMichelle GoNo ratings yet

- Ole and Unctions of The: R F BSPDocument9 pagesOle and Unctions of The: R F BSPEllimac AusadebNo ratings yet

- Ctivity#3 Financial MarketsDocument8 pagesCtivity#3 Financial MarketsMj BauaNo ratings yet

- Bispap 111Document132 pagesBispap 111gggNo ratings yet

- FIN MAR MODULE 2 and Ass.Document28 pagesFIN MAR MODULE 2 and Ass.hellokittysaranghaeNo ratings yet

- Demonetization FinalDocument12 pagesDemonetization FinalRuhaan RajputNo ratings yet

- Module 3Document10 pagesModule 3Kim EllaNo ratings yet

- Bangko Sentral NG Pilipinas (BSP) Tour Reaction Paper: Khalil Jailani - BS IE 1Document1 pageBangko Sentral NG Pilipinas (BSP) Tour Reaction Paper: Khalil Jailani - BS IE 1Jaya Porsche Ignacio AlegarbesNo ratings yet

- Role of Regulation in Financial System: Financial Regulation Is A Type of Regulation Whereby Rules and Standards WereDocument8 pagesRole of Regulation in Financial System: Financial Regulation Is A Type of Regulation Whereby Rules and Standards WereshanksNo ratings yet

- Role of Centrel Bank and Monetary Policy - ClassDocument52 pagesRole of Centrel Bank and Monetary Policy - ClassalioNo ratings yet

- Fin Mar Module 2 and Ass.Document28 pagesFin Mar Module 2 and Ass.hellokittysaranghaeNo ratings yet

- Monetary Policy and Banking EssayDocument4 pagesMonetary Policy and Banking EssayMaria Elena Sitoy BarroNo ratings yet

- ACCBP100 ReviewerDocument9 pagesACCBP100 ReviewerRuzuiNo ratings yet

- ASEAN+3 Information on Transaction Flows and Settlement InfrastructuresFrom EverandASEAN+3 Information on Transaction Flows and Settlement InfrastructuresNo ratings yet

- Strategies in International Business TradeDocument3 pagesStrategies in International Business TradeBryce ApitNo ratings yet

- Article 1163 - 1178Document4 pagesArticle 1163 - 1178Bryce ApitNo ratings yet

- RRLDocument2 pagesRRLBryce ApitNo ratings yet

- What Is Credit and CollectionDocument2 pagesWhat Is Credit and CollectionBryce ApitNo ratings yet

- QuestionDocument8 pagesQuestionBryce ApitNo ratings yet

- Report Guide On ARTICLE 1175-1176Document2 pagesReport Guide On ARTICLE 1175-1176Bryce ApitNo ratings yet

- Module 3 Lesson 3 EGE 1 by LCADocument50 pagesModule 3 Lesson 3 EGE 1 by LCABryce ApitNo ratings yet

- Article 1163 - 1178Document5 pagesArticle 1163 - 1178Bryce ApitNo ratings yet

- On-A-Roll Lifter Jumbo: Important FeaturesDocument2 pagesOn-A-Roll Lifter Jumbo: Important FeaturesKelvin ToledoNo ratings yet

- 02 The Accounting Equation PROBLEMSDocument7 pages02 The Accounting Equation PROBLEMSJohn Carlos Galit AdarayanNo ratings yet

- 8.3.3.3 Lab - Collecting and Analyzing NetFlow DataDocument7 pages8.3.3.3 Lab - Collecting and Analyzing NetFlow DataJorge Juan0% (1)

- MathML With HTML5Document10 pagesMathML With HTML5devendraNo ratings yet

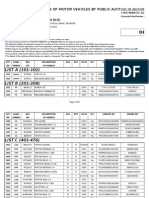

- Draft List: Proclamation of Sales of Motor Vehicles by Public AuctDocument20 pagesDraft List: Proclamation of Sales of Motor Vehicles by Public AuctHd YusNo ratings yet

- Interleaved Edge Routing in Buffered 3D Mesh & Cmesh NocDocument6 pagesInterleaved Edge Routing in Buffered 3D Mesh & Cmesh NocNEETHUNo ratings yet

- Sarcos V CastilloDocument6 pagesSarcos V CastilloTey TorrenteNo ratings yet

- Nexon-BS-VI 543858409905 Rev 00 10.01.20 PDFDocument232 pagesNexon-BS-VI 543858409905 Rev 00 10.01.20 PDFpushkar72No ratings yet

- Catalog YaweiDocument35 pagesCatalog Yaweihongngoc2003.vnNo ratings yet

- 07-Oct. ..... (Nilam...Document3 pages07-Oct. ..... (Nilam...krishna vermaNo ratings yet

- Globo PLC H1 2015 ReportDocument20 pagesGlobo PLC H1 2015 Reportjenkins-sacadonaNo ratings yet

- Innovating For A Sustainable Future: Annual Report 2018Document139 pagesInnovating For A Sustainable Future: Annual Report 2018fellandoNo ratings yet

- ISSO or COMSEC or IT ManagementDocument4 pagesISSO or COMSEC or IT Managementapi-121404646No ratings yet

- Dokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576Document25 pagesDokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576charnight 2100% (1)

- Mechanical Abbreviations and Symbols: Project Number: 629 - 247637Document30 pagesMechanical Abbreviations and Symbols: Project Number: 629 - 247637phlxuNo ratings yet

- McLaren 570S COUPE Order SummaryDocument4 pagesMcLaren 570S COUPE Order SummarysolejNo ratings yet

- Test 11Document2 pagesTest 11MariaJoseCalderonNo ratings yet

- Spawn Production of Common CarpDocument5 pagesSpawn Production of Common CarpGrowel Agrovet Private Limited.No ratings yet

- 7plus Unit 1 Lesson 1 Opposite Quantities Combine To Make ZeroDocument6 pages7plus Unit 1 Lesson 1 Opposite Quantities Combine To Make Zeroapi-261894355No ratings yet

- Mac 5000Document228 pagesMac 5000anwar1971No ratings yet

- Introduction To Get Connected PDFDocument50 pagesIntroduction To Get Connected PDFOkeke Anthony Emeka100% (1)

- Member Full Version: XcopterDocument1 pageMember Full Version: Xcoptersmw54791No ratings yet

- Writing Research ProposalDocument9 pagesWriting Research ProposalsangeethamithunNo ratings yet

- MME30001 Engineering Management 1 Winter Semester, 2018Document10 pagesMME30001 Engineering Management 1 Winter Semester, 2018monkeemaiNo ratings yet

- Cabri Geometry II Plus: User ManualDocument108 pagesCabri Geometry II Plus: User ManualEdgar ParraNo ratings yet

- Mathematics P2 Nov 2016 Memo Afr & EngDocument26 pagesMathematics P2 Nov 2016 Memo Afr & EngThabiso Jimmy LengwateNo ratings yet

- Irjet V2i233 PDFDocument4 pagesIrjet V2i233 PDFAnonymous SOQFPWBNo ratings yet

- Debt SettlementDocument8 pagesDebt Settlementjackie555No ratings yet

Topic 2 Prelim Activity 2

Topic 2 Prelim Activity 2

Uploaded by

Bryce ApitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 2 Prelim Activity 2

Topic 2 Prelim Activity 2

Uploaded by

Bryce ApitCopyright:

Available Formats

Bryce Anthony L.

Apit BSBA-2FMD

FM3 Friday (9:00-10:30)

The Monetary Board

Monetary Stability Resource Supervision and Payments and

Sector Management Sector Examination Sector Currency Sector

Microfinance and Anti-money

Financial Inclusion Laundering

Bryce Anthony L. Apit BSBA-2FMD

FM3 Friday (9:00-10:30)

It is the Monetary Board of the Bangko Sentral ng Philippines that is responsible for

carrying out the central bank's primary responsibilities. The Monetary Stability Sector, the

Resource Management Sector, the Supervision and Examination Sector, and the Payments and

Currency Sector are all under its authority and are responsible for a variety of tasks. The

authorities and functions of the BSP are assigned to the Monetary Board, which is responsible

for things like the implementation of monetary policy and the regulation of the financial sector.

The Monetary Stability Sector is the one that is in responsibility of the development and

implementation of the country's monetary policy. As a framework, it utilizes inflation targeting.

In order to maintain order and a strong financial infrastructure, it is the responsibility of the

Resource Management Sector to oversee and strictly enforce the regulations governing banking

compliance. Microfinance is a program that is part of the larger banking system that aims to

reduce poverty. In addition to this, the Resource Management Sector is in responsibility of

enforcing the Anti-money laundering law, which states that money laundering is a criminal

violation that is subject to legal punishment. All financial institutions are subject to random and

ongoing inspections by the Supervision and Examination Sector of the Bangko Sentral, which is

charged with the responsibility of carrying out these inspections. It is primarily the responsibility

of the Payments and Currency Sector to uphold the stability and credibility of the Philippine

currency, as well as to guarantee a payments and cash ecosystem that operates efficiently, so as

to promote economic activity and contribute to the expansion of the economy over the long term.

Moreover, this is the sector that deals with the 19 different currencies that can be exchanged

directly for the Philippine peso.

You might also like

- Specification For Sheet Metal Ductwork DW 144Document102 pagesSpecification For Sheet Metal Ductwork DW 144Baladaru Krishna Prasad100% (2)

- NCBA RA 7653 Summary v2.0Document18 pagesNCBA RA 7653 Summary v2.0Cha BL80% (5)

- Module 2 - Functions of BSPDocument14 pagesModule 2 - Functions of BSPQuenie De la CruzNo ratings yet

- Damayanti Nasita DISC and MotivatorsDocument11 pagesDamayanti Nasita DISC and Motivatorss.ratihNo ratings yet

- !. BSP (Banko Sentral NG Pilipinas) ORGANIZATIONAL CHARTDocument4 pages!. BSP (Banko Sentral NG Pilipinas) ORGANIZATIONAL CHARTedgar godinezNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- BSP ReportDocument20 pagesBSP ReportRosemarie CabahugNo ratings yet

- Bank Negara MalaysiaDocument17 pagesBank Negara MalaysiaMohammad Fairuz100% (3)

- Pre Final HandoutsDocument9 pagesPre Final HandoutsPauline Jane RigodonNo ratings yet

- Module 1 3Document35 pagesModule 1 3hikunanaNo ratings yet

- Bangko Sentral NG PilipinasDocument4 pagesBangko Sentral NG PilipinasHanaNo ratings yet

- Final Lesson 7 Money and Monetary PolicyDocument18 pagesFinal Lesson 7 Money and Monetary PolicyKerby Christian Araneta OndoyNo ratings yet

- Banking Laws: The New Central Bank Act (Rep. Act No. 7653) (The "BSP Law") The BSPDocument23 pagesBanking Laws: The New Central Bank Act (Rep. Act No. 7653) (The "BSP Law") The BSPSweet EmmeNo ratings yet

- Regulation of Financial SystemDocument39 pagesRegulation of Financial SystemRamil ElambayoNo ratings yet

- Finmar Quiz MidtermDocument1 pageFinmar Quiz MidtermNune SabanalNo ratings yet

- Summary of The Bangko Sentral NG PilipinasDocument3 pagesSummary of The Bangko Sentral NG PilipinasAnne Laraga LuansingNo ratings yet

- Banking Law Notes (2,3,4,5)Document17 pagesBanking Law Notes (2,3,4,5)Afiqah IsmailNo ratings yet

- Money AND Monetary PolicyDocument17 pagesMoney AND Monetary PolicyAnna BartolomeNo ratings yet

- Central Monetary Authority (Group 1)Document26 pagesCentral Monetary Authority (Group 1)Jay Aura BalcitaNo ratings yet

- Banking and Financial Institution: Midterms ReviewerDocument9 pagesBanking and Financial Institution: Midterms ReviewerLyka FaneNo ratings yet

- UST Golden Notes - Banking LawsDocument20 pagesUST Golden Notes - Banking LawsAntrex GuroNo ratings yet

- Term Paper - AMLA and Banking Laws - Jason Oliver SunDocument6 pagesTerm Paper - AMLA and Banking Laws - Jason Oliver SunJason SunNo ratings yet

- CB-03 Central Monetary AuthorityDocument7 pagesCB-03 Central Monetary AuthorityJHERRY MIG SEVILLANo ratings yet

- Chapter 4 and 5 - BSP and Monetary Supply - FINAL VersionDocument85 pagesChapter 4 and 5 - BSP and Monetary Supply - FINAL Version乙คckคrψ YTNo ratings yet

- Finmar BSPDocument3 pagesFinmar BSPLeafar NagaliNo ratings yet

- Rinna oDocument4 pagesRinna oOlea RinnaNo ratings yet

- Ust Golden Notes Banking LawsDocument23 pagesUst Golden Notes Banking LawsMil Roilo B EspirituNo ratings yet

- Group Report - BEC 113Document40 pagesGroup Report - BEC 113Jester LabanNo ratings yet

- Banking Laws Notes 2019Document21 pagesBanking Laws Notes 2019Jannah Mae NeneNo ratings yet

- The New Central Bank Act PDFDocument8 pagesThe New Central Bank Act PDFitsmenatoyNo ratings yet

- The Philippine Financial System ReportDocument28 pagesThe Philippine Financial System Reportvalerie joy camemoNo ratings yet

- Interest Rate & Role of BNMDocument57 pagesInterest Rate & Role of BNMAinnur HaziqahNo ratings yet

- Governance of The Bank: Liquidity ManagementDocument1 pageGovernance of The Bank: Liquidity ManagementJerald-Edz Tam AbonNo ratings yet

- RBI Second Quarter Review of Monetary Policy 2010-11Document36 pagesRBI Second Quarter Review of Monetary Policy 2010-11tamirisaarNo ratings yet

- IR2qtr 2018 PDFDocument67 pagesIR2qtr 2018 PDFDarrelNo ratings yet

- Chapter 1 The Financial SystemDocument38 pagesChapter 1 The Financial SystemJonamay FactorNo ratings yet

- Chapter 8 Basic Finance 2023 2024Document9 pagesChapter 8 Basic Finance 2023 2024PACIOLI-EDRADA, BEANo ratings yet

- CB-03 Central Monetary AuthorityDocument7 pagesCB-03 Central Monetary AuthorityJHERRY MIG SEVILLANo ratings yet

- Group 7Document15 pagesGroup 7CPAREVIEWNo ratings yet

- Chapter 3 Central BankDocument34 pagesChapter 3 Central Bankandrei cajayonNo ratings yet

- Banking in The Philippines: Avec M. John Darrel Rillo EconomicsDocument30 pagesBanking in The Philippines: Avec M. John Darrel Rillo EconomicsWes Harven MaravillaNo ratings yet

- Dennis Tuble II Monetary Policy IndividualDocument1 pageDennis Tuble II Monetary Policy IndividualTuble, Dennis II, C.No ratings yet

- Bangko Sentral NG PilipinasDocument28 pagesBangko Sentral NG PilipinasJay Mar Isorena100% (1)

- Handouts For Capital MarketsDocument6 pagesHandouts For Capital MarketsfroelanangusatiNo ratings yet

- University of Rizal SystemDocument10 pagesUniversity of Rizal SystemFitz Clark LobarbioNo ratings yet

- PFQR16 Q 1 TeDocument10 pagesPFQR16 Q 1 TeanthonmirandasNo ratings yet

- Bangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsDocument17 pagesBangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsMichelle GoNo ratings yet

- Ole and Unctions of The: R F BSPDocument9 pagesOle and Unctions of The: R F BSPEllimac AusadebNo ratings yet

- Ctivity#3 Financial MarketsDocument8 pagesCtivity#3 Financial MarketsMj BauaNo ratings yet

- Bispap 111Document132 pagesBispap 111gggNo ratings yet

- FIN MAR MODULE 2 and Ass.Document28 pagesFIN MAR MODULE 2 and Ass.hellokittysaranghaeNo ratings yet

- Demonetization FinalDocument12 pagesDemonetization FinalRuhaan RajputNo ratings yet

- Module 3Document10 pagesModule 3Kim EllaNo ratings yet

- Bangko Sentral NG Pilipinas (BSP) Tour Reaction Paper: Khalil Jailani - BS IE 1Document1 pageBangko Sentral NG Pilipinas (BSP) Tour Reaction Paper: Khalil Jailani - BS IE 1Jaya Porsche Ignacio AlegarbesNo ratings yet

- Role of Regulation in Financial System: Financial Regulation Is A Type of Regulation Whereby Rules and Standards WereDocument8 pagesRole of Regulation in Financial System: Financial Regulation Is A Type of Regulation Whereby Rules and Standards WereshanksNo ratings yet

- Role of Centrel Bank and Monetary Policy - ClassDocument52 pagesRole of Centrel Bank and Monetary Policy - ClassalioNo ratings yet

- Fin Mar Module 2 and Ass.Document28 pagesFin Mar Module 2 and Ass.hellokittysaranghaeNo ratings yet

- Monetary Policy and Banking EssayDocument4 pagesMonetary Policy and Banking EssayMaria Elena Sitoy BarroNo ratings yet

- ACCBP100 ReviewerDocument9 pagesACCBP100 ReviewerRuzuiNo ratings yet

- ASEAN+3 Information on Transaction Flows and Settlement InfrastructuresFrom EverandASEAN+3 Information on Transaction Flows and Settlement InfrastructuresNo ratings yet

- Strategies in International Business TradeDocument3 pagesStrategies in International Business TradeBryce ApitNo ratings yet

- Article 1163 - 1178Document4 pagesArticle 1163 - 1178Bryce ApitNo ratings yet

- RRLDocument2 pagesRRLBryce ApitNo ratings yet

- What Is Credit and CollectionDocument2 pagesWhat Is Credit and CollectionBryce ApitNo ratings yet

- QuestionDocument8 pagesQuestionBryce ApitNo ratings yet

- Report Guide On ARTICLE 1175-1176Document2 pagesReport Guide On ARTICLE 1175-1176Bryce ApitNo ratings yet

- Module 3 Lesson 3 EGE 1 by LCADocument50 pagesModule 3 Lesson 3 EGE 1 by LCABryce ApitNo ratings yet

- Article 1163 - 1178Document5 pagesArticle 1163 - 1178Bryce ApitNo ratings yet

- On-A-Roll Lifter Jumbo: Important FeaturesDocument2 pagesOn-A-Roll Lifter Jumbo: Important FeaturesKelvin ToledoNo ratings yet

- 02 The Accounting Equation PROBLEMSDocument7 pages02 The Accounting Equation PROBLEMSJohn Carlos Galit AdarayanNo ratings yet

- 8.3.3.3 Lab - Collecting and Analyzing NetFlow DataDocument7 pages8.3.3.3 Lab - Collecting and Analyzing NetFlow DataJorge Juan0% (1)

- MathML With HTML5Document10 pagesMathML With HTML5devendraNo ratings yet

- Draft List: Proclamation of Sales of Motor Vehicles by Public AuctDocument20 pagesDraft List: Proclamation of Sales of Motor Vehicles by Public AuctHd YusNo ratings yet

- Interleaved Edge Routing in Buffered 3D Mesh & Cmesh NocDocument6 pagesInterleaved Edge Routing in Buffered 3D Mesh & Cmesh NocNEETHUNo ratings yet

- Sarcos V CastilloDocument6 pagesSarcos V CastilloTey TorrenteNo ratings yet

- Nexon-BS-VI 543858409905 Rev 00 10.01.20 PDFDocument232 pagesNexon-BS-VI 543858409905 Rev 00 10.01.20 PDFpushkar72No ratings yet

- Catalog YaweiDocument35 pagesCatalog Yaweihongngoc2003.vnNo ratings yet

- 07-Oct. ..... (Nilam...Document3 pages07-Oct. ..... (Nilam...krishna vermaNo ratings yet

- Globo PLC H1 2015 ReportDocument20 pagesGlobo PLC H1 2015 Reportjenkins-sacadonaNo ratings yet

- Innovating For A Sustainable Future: Annual Report 2018Document139 pagesInnovating For A Sustainable Future: Annual Report 2018fellandoNo ratings yet

- ISSO or COMSEC or IT ManagementDocument4 pagesISSO or COMSEC or IT Managementapi-121404646No ratings yet

- Dokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576Document25 pagesDokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576charnight 2100% (1)

- Mechanical Abbreviations and Symbols: Project Number: 629 - 247637Document30 pagesMechanical Abbreviations and Symbols: Project Number: 629 - 247637phlxuNo ratings yet

- McLaren 570S COUPE Order SummaryDocument4 pagesMcLaren 570S COUPE Order SummarysolejNo ratings yet

- Test 11Document2 pagesTest 11MariaJoseCalderonNo ratings yet

- Spawn Production of Common CarpDocument5 pagesSpawn Production of Common CarpGrowel Agrovet Private Limited.No ratings yet

- 7plus Unit 1 Lesson 1 Opposite Quantities Combine To Make ZeroDocument6 pages7plus Unit 1 Lesson 1 Opposite Quantities Combine To Make Zeroapi-261894355No ratings yet

- Mac 5000Document228 pagesMac 5000anwar1971No ratings yet

- Introduction To Get Connected PDFDocument50 pagesIntroduction To Get Connected PDFOkeke Anthony Emeka100% (1)

- Member Full Version: XcopterDocument1 pageMember Full Version: Xcoptersmw54791No ratings yet

- Writing Research ProposalDocument9 pagesWriting Research ProposalsangeethamithunNo ratings yet

- MME30001 Engineering Management 1 Winter Semester, 2018Document10 pagesMME30001 Engineering Management 1 Winter Semester, 2018monkeemaiNo ratings yet

- Cabri Geometry II Plus: User ManualDocument108 pagesCabri Geometry II Plus: User ManualEdgar ParraNo ratings yet

- Mathematics P2 Nov 2016 Memo Afr & EngDocument26 pagesMathematics P2 Nov 2016 Memo Afr & EngThabiso Jimmy LengwateNo ratings yet

- Irjet V2i233 PDFDocument4 pagesIrjet V2i233 PDFAnonymous SOQFPWBNo ratings yet

- Debt SettlementDocument8 pagesDebt Settlementjackie555No ratings yet