Professional Documents

Culture Documents

Small Business Loan Application Form For Individual - Sole - BDO

Small Business Loan Application Form For Individual - Sole - BDO

Uploaded by

junco111222Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Small Business Loan Application Form For Individual - Sole - BDO

Small Business Loan Application Form For Individual - Sole - BDO

Uploaded by

junco111222Copyright:

Available Formats

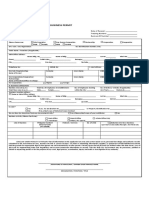

SMALL BUSINESS LOAN APPLICATION FORM

FOR INDIVIDUAL / SOLE PROPRIETOR

REFERRAL INFORMATION

Unit/Branch: ______________ Broker: _______________ Direct: _______________ Developer: ______________ AO/LA: ________________

LOAN DETAILS

Loan Amount: __________________ Term: __________________ Fixing Period: _______________

Purpose of Loan

Construction or Renovation of

Working Capital Business Expansion

Acquisition of Property Please add information

for Business or specify other purposes

Property will serve as collateral Purchase of Fixed Assets

Property will not serve as collateral or Equipment

COLLATERAL DETAILS

Collateral 1

Property Address: ____________________________________________________________________________________________________________

Present Registered Owner: _______________________________________ Contact Person: ______________________________

TCT/CCT No.: ___________________________________________________ Contact No.: _____________________________

Type of Collateral Lot Only House & Lot Townhomes Condominium

Commercial Building Mixed Commercial/Residential Others

Collateral 2

Property Address: ______________________________________________________________________________________________

Present Registered Owner: _______________________________________ Contact Person: ______________________________

TCT/CCT No.: ___________________________________________________ Contact No.: _____________________________

Type of Collateral Lot Only House & Lot Townhomes Condominium

Commercial Building Mixed Commercial/Residential Others

BORROWER’S INFORMATION

Name: ________________________________________________ SSS/GSIS No.: ____________________ TIN: _________________________

First Middle Last

Company Name: _______________________________________________ Birthdate: _________________ Birthplace: ___________________

(mm/dd/yy)

Citizenship: ________________ Gender: Male Female Civil Status: Single Married Widow/er Separated

No. of Dependents: ________________ Highest Educational Attainment: _____________________________

Present Address: _________________________________________________________________ Length of Stay: _____ years

Residence is: Owned Rented Living w/ Parents/Relatives

Tel No.: ____________________ Mobile No.: ________________ Fax No.: ________________ Email Address: _______________________

Area Code Number

Previous Address: ________________________________________________________________________________ Length of Stay: _____ years

Local Address (For OFW/Immigrant): _______________________________________________________________ Length of Stay: _____ years

SPOUSE’S INFORMATION

Name: ________________________________________________________________________ SSS/GSIS No.: _____________________________

First Middle Last

TIN: _______________________ * Birthdate: _______________________ Gender: Male Female

(mm/dd/yy)

Citizenship: ___________________ Tel. No.: ______________________ Mobile Number : ________________________

Mobile Number: _______________________ Highest Educational Attainment: _______________________

BUSINESS / EMPLOYMENT DETAILS

BORROWER SPOUSE

EMPLOYED

Employer Type Private Immigrant/OFW Private Immigrant/OFW

Government Government

Employer

Tel./Fax No.

Address

Position

Years of Employment

Nature of Business

BUSINESS

Type of Business Single Proprietorship Corporation Single Proprietorship Corporation

Partnership Partnership

Business Name

Tel./Fax No.

Address

Years in Operation

Nature of Business

TRADE REFERENCES

Major Customers Contact Person/Position Contact No.

Major Suppliers Contact Person/Position Contact No.

(*) Mandatory Fields

PERSONAL WORTH

Borrower’s Monthly Salary _______________ Monthly Expense _______________

Spouse’s Monthly Salary _______________ Rentals _______________

Other Monthly Income from _______________ Mortgages _______________

____________________ _______________ ________________ _______________

____________________ _______________ ________________ _______________

(A)TOTAL MONTHLY INCOME _________________ (B) TOTAL MONTHLY EXPENSES _________________

(A less B) NET MONTHLY INCOME _________________

BANK AND CREDIT REFERENCES

Bank/Branch Account No. Type of Account Date Opened Outstanding Co-Depositors

(mm/dd/yy) Deposit Balance (if any)

OTHER ASSETS

(A)Total Assets (B) Total Liabilities (A less B) Net Worth (as of ___________ 20___)

(A)Total Sales/Income (B) Total Expenses (A less B) Total Monthly Disposable Income

LOANS WITH OTHER BANKS AND FINANCIAL INSTITUTIONS

Type of Loan Bank/Financial Original Monthly Outstanding Date Granted Maturity

Institution Amount Payment Balance (mm/dd/yy) Date (mm/dd/yy)

ATTORNEY-IN-FACT / LOAN ADMINISTRATOR

Name Relationship Address Birthdate (mm/dd/yy) Telephone No.

AUTHORIZATION AND UNDERTAKING

1. I/we hereby certify that the information contained herein is/are true and correct and shall form part of the loan documents.

2. I/we authorize BDO to conduct, through its representative accredited appraisers, an appraisal of any or all of the collateral to be used for this loan.

I/we also agree that the appraisal report will be forwarded directly to the bank for its sole use only.

3. Any information given by me or other persons I authorize, which is not true or accurate, will automatically cause BDO to reject my loan or cancel its

approval.

4. I/we agree that this loan application shall be subject to BSP circulars, rules, regulations and policies of the bank and undertake to comply

with/submit all the loan requirements.

5. I/we authorize the bank to obtain relevant information as it may require concerning this application from other institutions/persons and agree that it

shall remain the bank's property whether or not the loan is granted.

7. In case of disapproval, I/we understand that BDO is under no obligation to disclose the reason/s for such disapproval.

8. The undersigned further certify that the proceeds of the loan, if this application is approved, will be used solely for the purpose stated in the

application.

9. This is to authorize the Bank to debit account # _______________________________ for appraisal fees in the amount of P _________________________.

Signature of Borrower over printed name Signature of Spouse / Co-Borrower over printed name

Date Date

DOCUMENTARY REQUIREMENTS FOR SELF EMPLOYED / OWNS BUSINESS

Kindly submit the following UPON APPLICATION:

BASIC REQUIREMENTS COLLATERAL DOCUMENTS

Photocopy of TCT/CCT

Photocopy of 1 valid government-issued ID with signature and photo

Marriage Contract of all parties to the transaction, if applicable For Construction Loans

Building Plan or Floor Plan

FOR EMPLOYED Bill of Materials and Labor Cost

Local Employed

Latest Income Tax Return OR BIR Form 2316 OR Payslip for at least a Civil Engineer

three (3) months

Others

months from date of issuance Owner’s Collateral Appraisal Authorization

Copy of Lease Contracts and Title Income from rented /leased

Employed Abroad properties (if applicable)

Latest Crew Contract & Employment History (for seamen) For refinancing/loan take-out, statement of account, and official

receipt for the last three (3) months.

Proof of remittance or allotment slips or payslips for the past three Appraisal Fee

(3) months

Kindly submit the following AFTER APPROVAL OF APPLICATION:

FOR SELF EMPLOYED / OWNS BUSINESS Original owner’s duplicate copy of TCT/CCT

Photocopy of Audited Financial Statements (AFS) for the last 2 years Original Tax Clearance

with latest ITR with BIR or Bank Stamp Photocopy of latest full year Real Estate Tax Receipt (RETR)

Master Deed of Declaration (for condominium only)

Business/Mayor’s Permit Latest copy of Tax sDeclaration on Land and Improvement

Last six (6) months bank statements or photocopy of passbook (with

account name & account number)

Business Background/Company Profile

Proof of other income (if any)

(*) Mandatory Fields

You might also like

- BFB Housing Loan Application Form v2016.HmcDocument2 pagesBFB Housing Loan Application Form v2016.HmcJoy Ramos100% (3)

- Client Information Sheet (For Individual Buyer/S) : Are You An Existing or Previous SBC Account Holder?Document2 pagesClient Information Sheet (For Individual Buyer/S) : Are You An Existing or Previous SBC Account Holder?Nurhussein RaopanNo ratings yet

- Declaration Letter For Vendor RegistrationDocument2 pagesDeclaration Letter For Vendor RegistrationRitu MishraNo ratings yet

- Dumaguete Cathedral Credit Cooperative (Dccco) : Application For LoanDocument2 pagesDumaguete Cathedral Credit Cooperative (Dccco) : Application For LoanCatherine MedadoNo ratings yet

- Salary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)Document2 pagesSalary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)yolanda capati100% (2)

- Chem Med CaseDocument6 pagesChem Med CaseChris100% (1)

- Debt Counter Debt Enhanced Validation Letter REDDocument5 pagesDebt Counter Debt Enhanced Validation Letter REDBruce Lewis100% (9)

- Digest LIM TONG LIM Vs Phil FishingDocument1 pageDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- Florida Motion Set Aside JudgmentDocument7 pagesFlorida Motion Set Aside Judgmentwinstons2311100% (1)

- Loan Application Form With CollateralDocument4 pagesLoan Application Form With CollateralIBP Bohol ChapterNo ratings yet

- Business Visa ApplicationDocument3 pagesBusiness Visa ApplicationBlake WeberNo ratings yet

- Used Cars For Sale Offer FormDocument3 pagesUsed Cars For Sale Offer FormRaymond GabrielNo ratings yet

- Applications Form Individual HmeDocument4 pagesApplications Form Individual HmeChing CamposagradoNo ratings yet

- Bank Loan DocumentsDocument10 pagesBank Loan DocumentsSatish KanojiyaNo ratings yet

- Home Loan Application FormDocument24 pagesHome Loan Application FormVishal JaiswalNo ratings yet

- Buyer Information Sheet: Ropa Disposal CommitteeDocument3 pagesBuyer Information Sheet: Ropa Disposal CommitteeEmmy Bags WalletNo ratings yet

- Auto-Offer PSBANKDocument3 pagesAuto-Offer PSBANKAnna KristinaNo ratings yet

- Credit Application: For Individual/Single ProprietorshipDocument1 pageCredit Application: For Individual/Single Proprietorshiptim timNo ratings yet

- App Form Apna Office IndividualDocument6 pagesApp Form Apna Office IndividualKadhar AnwarNo ratings yet

- Applicationform Mortgage LoanDocument7 pagesApplicationform Mortgage LoanBijendra Singh BishtNo ratings yet

- Home Loan Nri FormDocument4 pagesHome Loan Nri FormJatin ParmarNo ratings yet

- UAF 2022 Converted - NewDocument2 pagesUAF 2022 Converted - NewMark Kevin IIINo ratings yet

- Home Loan Form NewDocument6 pagesHome Loan Form Newpatruni sureshkumarNo ratings yet

- Vendor Information Sheet (VIS)Document6 pagesVendor Information Sheet (VIS)Gina OsorioNo ratings yet

- House Rental ApplicationDocument3 pagesHouse Rental Applicationsadafsuleimani51No ratings yet

- Cis FormDocument3 pagesCis Formstewart alvarezNo ratings yet

- Membership FormDocument6 pagesMembership FormPalawan TeachersNo ratings yet

- Home Loan/Lap Application Form: Customer Name: Loan Agreement No.Document16 pagesHome Loan/Lap Application Form: Customer Name: Loan Agreement No.Shashikant JoshiNo ratings yet

- Bank of Baroda: Application Form For HOME LOANDocument12 pagesBank of Baroda: Application Form For HOME LOANpravinartwinNo ratings yet

- Account Opening FormDocument12 pagesAccount Opening FormSirajia CngNo ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- Application to Rent -Mario Fillable PDFDocument1 pageApplication to Rent -Mario Fillable PDFjustice.whitehurstNo ratings yet

- Bank of Baroda Education Form 135Document3 pagesBank of Baroda Education Form 135umesh78% (9)

- Loan Application Form: Personal DetailsDocument8 pagesLoan Application Form: Personal DetailsNihar KNo ratings yet

- Home Loan FormDocument7 pagesHome Loan FormvivebajajNo ratings yet

- Home Loan Application FormDocument7 pagesHome Loan Application Formrahulgeo05No ratings yet

- New Loan Application Form Vehicle FinanceDocument7 pagesNew Loan Application Form Vehicle FinancePrasenjit GhoshNo ratings yet

- Loan Application Form: Page 1 of 4Document4 pagesLoan Application Form: Page 1 of 4Mina Berdos SabitNo ratings yet

- Credit ApplicationDocument3 pagesCredit ApplicationALSIRAT CONTRACTINGNo ratings yet

- IDFC Application Form LAP STLAP NewDocument16 pagesIDFC Application Form LAP STLAP NewHr SusmitapaulNo ratings yet

- Handbook Retail - Final LowDocument24 pagesHandbook Retail - Final Lowchaitanya sai kumar naniNo ratings yet

- Loan Application Form: Borrower'S Personal Information (Mandatory)Document4 pagesLoan Application Form: Borrower'S Personal Information (Mandatory)HANNAH CHARIS CANOYNo ratings yet

- Rental Application: Please Fill in All FieldsDocument4 pagesRental Application: Please Fill in All FieldsThi NgoNo ratings yet

- Agency Application/Information Sheet: 711 EDSA Corner New York Street, Cubao, Quezon City, 1109, PhilippinesDocument2 pagesAgency Application/Information Sheet: 711 EDSA Corner New York Street, Cubao, Quezon City, 1109, Philippinesits LilyyyNo ratings yet

- LAP App Form IDFC Bank Bucket 3 R3Document13 pagesLAP App Form IDFC Bank Bucket 3 R3jyotigunu817No ratings yet

- New Application Form (11!23!2010)Document2 pagesNew Application Form (11!23!2010)Jessel Recelestino-EsculturaNo ratings yet

- Btìgò Atéßò BTQ Tèvt: Bank of BarodaDocument4 pagesBtìgò Atéßò BTQ Tèvt: Bank of BarodaDebargha 2027No ratings yet

- Application Form For GrihaShobha1Document6 pagesApplication Form For GrihaShobha1vijaycuteNo ratings yet

- New Application From Ericka 9.24.20Document2 pagesNew Application From Ericka 9.24.20imanimm81No ratings yet

- PNB Car Loan PNB 1055A (R)Document7 pagesPNB Car Loan PNB 1055A (R)Rehan AlliNo ratings yet

- Application Form For Vehicle Car LoanDocument9 pagesApplication Form For Vehicle Car LoanAbhishekGautamNo ratings yet

- F No - 135Document3 pagesF No - 135Treena Majumder SarkarNo ratings yet

- LoanDocument1 pageLoanSunshine MoonlightNo ratings yet

- ICEA Annuity Proposal FormDocument2 pagesICEA Annuity Proposal Formkevin muchungaNo ratings yet

- Tacoma Capital Application 030719Document2 pagesTacoma Capital Application 030719theodrostadiosNo ratings yet

- Parent Form For Covid ReliefDocument3 pagesParent Form For Covid ReliefMoosa AmirNo ratings yet

- Tenancy Application FormDocument7 pagesTenancy Application FormAnonymous aoeQQJlQNo ratings yet

- BranchDocument3 pagesBranchKabir KhanNo ratings yet

- Housing Loan Application Form Schedule ADocument1 pageHousing Loan Application Form Schedule AMadster RobertsNo ratings yet

- Application For Housing Loan Under Griha ShobhaDocument7 pagesApplication For Housing Loan Under Griha ShobhaDr BusinessNo ratings yet

- Final Terms Condition For Sub BrokerDocument7 pagesFinal Terms Condition For Sub Brokersandeep_bhandariNo ratings yet

- F M S Investment Appraisal: Inancial AnagementDocument50 pagesF M S Investment Appraisal: Inancial AnagementsaadaltafNo ratings yet

- RMC 13-80Document2 pagesRMC 13-80matinikkiNo ratings yet

- CB Consent CibcgeneratedDocument2 pagesCB Consent CibcgeneratedJonathan CristanchoNo ratings yet

- Economy Lecture HandoutDocument38 pagesEconomy Lecture HandoutEdward GallardoNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Merger of Community Bank and Company, OFR Petition For Public HearingDocument346 pagesMerger of Community Bank and Company, OFR Petition For Public HearingNeil Gillespie0% (1)

- Current LiabilitiesDocument2 pagesCurrent LiabilitiesAvox EverdeenNo ratings yet

- Chapter Two-Four Sector EconomyDocument27 pagesChapter Two-Four Sector Economynotes.mcpu0% (1)

- Reliance Nippon Life Fixed Money BackbroucherDocument4 pagesReliance Nippon Life Fixed Money BackbroucherVenkata SagarNo ratings yet

- Test Series Practice UPSCDocument101 pagesTest Series Practice UPSCamoeba_iitkgpNo ratings yet

- András Róna-Tas-An Old Turkic Name of KievDocument6 pagesAndrás Róna-Tas-An Old Turkic Name of KievMurat SaygılıNo ratings yet

- Introduction To T24 - Accounts - R11.1 1Document35 pagesIntroduction To T24 - Accounts - R11.1 1SwapnaliNo ratings yet

- 63 Golf Drive - Haryana Government Approved Affordable Group Housing Project Sector 63 GurgaonDocument17 pages63 Golf Drive - Haryana Government Approved Affordable Group Housing Project Sector 63 GurgaonSushil BedarwalNo ratings yet

- Final 1Document49 pagesFinal 1Aphrodite ArgennisNo ratings yet

- What Is A Corporation?Document7 pagesWhat Is A Corporation?Dominic EmbodoNo ratings yet

- Yigal Lelah Sapphire Road Development Veterans Place City of Dallas City Council Housing Committee Briefing Documents.Document19 pagesYigal Lelah Sapphire Road Development Veterans Place City of Dallas City Council Housing Committee Briefing Documents.SchutzeNo ratings yet

- Chap 004Document95 pagesChap 004kwathom1100% (2)

- Chile HandbookDocument106 pagesChile HandbookAlejandro Quezada VerdugoNo ratings yet

- DR Finan's A Basic Course in The Theory of Interest and Derivatives MarketsDocument677 pagesDR Finan's A Basic Course in The Theory of Interest and Derivatives MarketsErick Castillo100% (1)

- Byf Student Book 4Document53 pagesByf Student Book 4sritraderNo ratings yet

- Cohen Finance Workbook FALL 2013Document124 pagesCohen Finance Workbook FALL 2013Nayef AbdullahNo ratings yet

- United States Court of Appeals First CircuitDocument3 pagesUnited States Court of Appeals First CircuitScribd Government DocsNo ratings yet

- #2 CREDIT TRANSACTIONS LECTURE NOTES - 20220121 838pmDocument49 pages#2 CREDIT TRANSACTIONS LECTURE NOTES - 20220121 838pmBuboy FabiNo ratings yet

- Managing Personal FinanceDocument40 pagesManaging Personal FinanceDylan AdrianNo ratings yet

- Current Quick Ratio ProblemDocument5 pagesCurrent Quick Ratio ProblemKae Min HyoNo ratings yet

- Chapter 13 CPWD ACCOUNTS CODEDocument6 pagesChapter 13 CPWD ACCOUNTS CODEarulraj1971No ratings yet