Professional Documents

Culture Documents

9412 Special Laws MCQs

9412 Special Laws MCQs

Uploaded by

heeeyjanengOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9412 Special Laws MCQs

9412 Special Laws MCQs

Uploaded by

heeeyjanengCopyright:

Available Formats

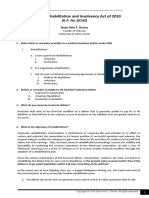

CPA REVIEW SCHOOL OF THE PHILIPPINES

REGULATORY FRAMEWORK FOR BUSINESS TRANSACTIONS

COVERAGE: Special Laws

A. Insolvency Law

a. Definition of Insolvency

b. Suspension of Payments

c. Voluntary Insolvency

d. Involuntary Insolvency

B. Corporate Rehabilitation

a. Definition of Terms

b. Stay Order

c. Receiver

d. Rehabilitation Plan

e. Contents of Petition

f. Other Types of Rehabilitation

C. Securities Regulation Code

a. Kinds of Securities

b. Protection of investors

c. Private tender offer

d. Insider trading

e. SEC Circulars and Issuances

f. Code of Corporate Governance

g. Filing of General Information Sheet

h. Filing of Audited Financial Statements

D. Intellectual Property Law (except provisions under Part 1: Intellectual Property Office)

a. The Law on Patents

b. The Law on Trademark, Service Marks and Trade Names

c. The Law on Copyright

E. Foreign Investment Act

Direction: Read and select the best answer for the following questions.

1. It shall refer to either (1) the financial condition of a debtor that is generally unable to pay its or his liabilities as

they fall due in the ordinary course of business or (2) financial condition of a debtor when he has liabilities that

are greater than its or his assets.

a. Liquidity

b. Profitability

c. Insolvency

d. Flexibility

2. What court has original jurisdiction to entertain cases in relation to Financial Rehabilitation and Insolvency Act?

a. Court of Appeals

b. Regional Trial Court

c. Court of Tax Appeals

d. Municipal Trial Court

3. It refers to a petition filed by an individual debtor who has sufficient properties to cover his liabilities but he

foresees the impossibility of meeting when they respectively fall due in order to exempt his property from

execution or attachment to be filed by his creditors.

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

4. What is the ground that must be alleged by an individual debtor in his petition to be declared in a state of

suspension of payments by the Regional Trial Court?

a. When such individual debtor does not have sufficient assets to cover his liabilities exceeding P500,000.

b. When such individual debtor has sufficient properties to cover his liabilities but he foresees the

impossibility of meeting when they respectively fall due.

c. When such individual debtor has already defaulted in the payment of his liabilities.

d. When such individual debtor has sufficient properties to cover his liabilities but he is contemplating

expanding his business.

5. Pedro Santos has total assets worth P1,000,000 and total liabilities amounting to P900,000. However, most of its

assets are in the form of fixed assets that cannot be easily sold while majority of its liabilities will mature within

one month. What legal remedy under Financial Rehabilitation and Insolvency Act shall be availed by Pedro

Santos?

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 1 of 32

6. What is the effect of issuance by Regional Trial Court of an order suspending any pending execution against

individual debtor who filed a motion for such suspension in a petition for declaration of statement of suspension

of payments?

a. As a general rule, no creditor shall sue or institute proceedings to collect claim from the individual

debtor from the time of the filing of the petition for suspension of payments and for as long as

proceedings remain pending.

b. Any creditor may sue or institute proceedings to collect claim from the individual debtor from the time of

the filing of the petition for suspension of payments and for as long as proceedings remain pending.

c. Any secured creditor cannot foreclose the secured collateral from the time of the filing of the petition for

suspension of payments and for as long as proceedings remain pending.

d. Creditors having claims for personal labor, maintenance, expense of last illness and funeral of the wife or

children of the debtor incurred in the sixty (60) days immediately prior to the filing of the petition may

not sue or institute proceedings to collect claim from the individual debtor from the time of the filing of

the petition for suspension of payments and for as long as proceedings remain pending.

7. Which of the following creditor is covered by the Regional Trial Court's order suspending any pending execution

against individual debtor who filed a motion for such suspension in a petition for declaration of statement of

suspension of payments?

a. Secured creditors

b. Unsecured creditors for electricity or water bills

c. Creditors having claims for personal labor or maintenance incurred in the sixty (60) days immediately

prior to the filing of the petition

d. Creditors having claims for expense of last illness and funeral of the wife or children of the debtor

incurred in the sixty (60) days immediately prior to the filing of the petition

8. What is the duration of the Suspension of Payments or Suspension Order issued by the Regional Trial Court in a

petition for declaration of statement of suspension of payments filed by individual debtor?

a. The suspension order shall lapse when (6) months shall have, passed without the proposed agreement

being accepted by the creditors or as soon as such agreement is denied.

b. The suspension order shall lapse when (12) months shall have, passed without the proposed agreement

being accepted by the creditors or as soon as such agreement is denied.

c. The suspension order shall lapse when (2) months shall have, passed without the proposed agreement

being accepted by the creditors or as soon as such agreement is denied.

d. The suspension order shall lapse when (3) months shall have, passed without the proposed

agreement being accepted by the creditors or as soon as such agreement is denied.

9. What is the quorum required for validity of meeting of creditors for the approval of the proposal of individual

debtor who filed a petition for declaration of statement of suspension of payments filed by individual debtor?

a. The presence of creditors holding claims amounting to at least (2/3) of the total liabilities of individual

debtor.

b. The presence of creditors holding claims amounting to at least (3/4) of the total liabilities of individual

debtor.

c. The presence of creditors holding claims amounting to at least (3/5) of the total liabilities of

individual debtor.

d. The presence of creditors holding claims amounting to at least majority of the total liabilities of individual

debtor.

10. What is the required approving vote by the creditors for the approval of the proposal of individual debtor who

filed a petition for declaration of statement of suspension of payments filed by individual debtor?

a. At least 1/3 of the creditors voting unite upon the same proposition and the claims represented by said

majority vote amount to at least 2/5 of the total liabilities of the debtor mentioned in the petition.

b. At least majority of the creditors voting unite upon the same proposition and the claims represented by

said majority vote amount to at least 2/3 of the total liabilities of the debtor mentioned in the petition.

c. At least 1/4 of the creditors voting unite upon the same proposition and the claims represented by said

majority vote amount to at least 3/4 of the total liabilities of the debtor mentioned in the petition.

d. At least 2/3 of the creditors voting unite upon the same proposition and the claims represented by

said majority vote amount to at least 3/5 of the total liabilities of the debtor mentioned in the

petition.

11. What are the instances when the proposal of individual debtor who filed a petition for declaration of statement of

suspension of payments filed by individual debtor is deemed rejected by the creditors?

a. If the number of creditors required for holding a meeting (quorum of at least 3/5 of the total liabilities) do

not attend thereat.

b. If the double majorities (at least 2/3 of the creditors voting unite upon the same proposition and the claims

represented by said majority vote amount to at least 3/5 of the total liabilities of the debtor mentioned in

the petition) required for the approval of the proposed agreement have not been met.

c. Either A or B

d. Neither A nor B

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 2 of 32

12. What are the effects of creditor's approval of proposal of individual debtor who filed a petition for declaration of

statement of suspension of payments filed by individual debtor?

a. The Regional Trial court shall order that the agreement be carried out and all parties bound thereby to

comply with its terms.

b. The Regional Trial Court may also issue all orders which may be necessary or proper to enforce the

agreement on motion of any affected party.

c. Both A and B

d. Neither A nor B

13. What are the effects of individual debtor's failure to perform the creditor's approved agreement in a petition for

declaration of statement of suspension of payments filed by individual debtor?

a. All the rights which the creditors had against the individual debtor before the agreement shall revest in

them.

b. The individual debtor may be made subject to the insolvency proceedings such as liquidation proceedings

in the manner established by FRIA.

c. Both A and B.

d. Neither A nor B.

14. It refers to a petition filed by an individual debtor who does not have sufficient assets to cover his liabilities

exceeding P500,000 in order for him to be discharged from his liabilities.

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

15. What is the ground to be alleged by an individual debtor in his verified petition for voluntary liquidation of

insolvent debtor?

a. When such individual debtor does not have sufficient assets to cover his liabilities exceeding

P500,000.

b. When such individual debtor has sufficient properties to cover his liabilities but he foresees the

impossibility of meeting when they respectively fall due.

c. When such individual debtor has already defaulted in the payment of his liabilities.

d. When such individual debtor has sufficient properties to cover his liabilities but he is contemplating

expanding his business.

16. Anton Reyes has total assets worth P2,000,000 and total liabilities amounting to P3,500,000. What legal remedy

under Financial Rehabilitation and Insolvency Act shall be availed by Anton Reyes in order to be discharged from

his liabilities?

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

17. It refers to a petition filed by any creditor or group of creditors holding claims aggregating to at least P500,000

from an individual debtor who does not have sufficient assets to cover his liabilities in order to satisfy their claims

under FRIA if such individual debtor is exhibiting acts of insolvency.

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

18. Juan Tamad has total assets worth P200,000 and total liabilities amounting to P500,000. If you are a creditor of

Juan Tamad, what legal remedy will you file under Financial Rehabilitation and Insolvency Act if Juan Tamad is

exhibiting acts of insolvency?

a. Petition for declaration of statement of suspension of payments

b. Petition for voluntary liquidation of insolvent individual debtor

c. Petition for rehabilitation

d. Petition for involuntary liquidation of insolvent individual debtor

19. What is the minimum claim of a creditor or group of creditors from an insolvent individual debtor in order for

them to be allowed to file a petition for involuntary liquidation of insolvent individual debtor?

a. At least P1,000,000

b. At least P500,000

c. At least P100,000

d. At least P50,000

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 3 of 32

20. What must be posted by the petitioning creditors in an involuntary liquidation of insolvent individual debtor that

will be conditioned that if the petition for liquidation is dismissed by the court, or withdrawn by the petitioner, or

the debtor shall not be declared an insolvent, the petitioning creditors will pay to the debtor all costs, expenses,

damages occasioned by the proceedings, and attorney's fees?

a. Bail

b. Bond

c. Promise

d. Recognizance

21. Which of the following is an act of insolvency of an individual debtor that must be alleged by his creditor who

will file a petition for involuntary liquidation of insolvent individual debtor?

a. Such individual debtor is about to depart or has departed from the Republic of the Philippines,

with intent to defraud his creditors.

b. Such individual debtor is absent from the Republic of the Philippines, without intent to defraud his

creditors.

c. Such individual debtor deposits his cash or money to a bank in order to avoid robbers.

d. Such individual debtor removes his property from the Philippines in order to minimize taxes.

22. Which of the following is an not act of insolvency of an individual debtor that must be alleged by his creditor

who will file a petition for involuntary liquidation of insolvent individual debtor?

a. Such individual debtor conceals himself to avoid the service of legal process for the purpose of hindering

or delaying the liquidation or of defrauding his creditors.

b. Such individual debtor conceals, or is removing, any of his property to avoid its being attached or taken

on legal process.

c. Such individual debtor has made any assignment, gift, sale, conveyance or transfer of his estate,

property, rights or credits for charitable purposes.

That an execution having been issued against him on final judgment for money, he shall have been found

to be without sufficient property subject to execution to satisfy the judgment.

23. Which of the following is an act of insolvency of an individual debtor that must be alleged by his creditor who

will file a petition for involuntary liquidation of insolvent individual debtor?

a. That being a merchant or tradesman, he has generally defaulted in the payment of his current obligations

for a period of three (3) days.

b. That for a period of two (2) days, he has failed, after demand, to pay any moneys deposited with him or

received by him in a fiduciary capacity.

c. That he has, in contemplation of insolvency, made an payment, gift, grant, sale, conveyance or

transfer of his estate, property, rights or credits.

d. That he has paid his matured obligation in the ordinary course of business.

24. It refers to the restoration of the debtor to a condition of successful operation and solvency, if it is shown that its

continuance of operation is economically feasible and its creditors can recover by way of the present value of

payments projected in the plan, more if the debtor continues as a going concern than if it is immediately

liquidated

a. Liquidation

b. Rehabilitation

c. Incorporation

d. Dissolution

25. It is a type of rehabilitation of a financially distressed or insolvent corporation, partnership or sole proprietorship

which is under the supervision by the Regional Trial Court upon the verified petition by the proper party.

a. Court-Supervised Rehabilitation

b. Pre-negotiated Rehabilitation

c. Out-of-Court Rehabilitation or Informal Restructuring Agreement

d. Inside Rehabilitation

26. It is a type of court-supervised rehabilitation initiated by the insolvent corporation, partnership or sole

proprietorship when it is generally unable to pay its or his liabilities as they fall due in the ordinary course of

business or it has liabilities that are greater than its or his assets so that it can be restored to a condition of

successful operation and solvency.

a. Voluntary court-supervised rehabilitation

b. Involuntary court-supervised rehabilitation

c. Pre-negotiated Rehabilitation

d. Out-of-Court Rehabilitation or Informal Restructuring Agreement

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 4 of 32

27. What are the grounds that must be alleged by an insolvent corporation, partnership or sole proprietorship in its

petition for voluntary court-supervised rehabilitation?

a. It is generally unable to pay its or his liabilities as they fall due in the ordinary course of business.

b. It has liabilities that are greater than its or his assets.

c. A and/or B

d. Neither A nor B

28. What are the minimum allegations by an insolvent corporation, partnership or sole proprietorship in its petition

for voluntary court-supervised rehabilitation?

a. The petition shall be verified to establish the insolvency of the debtor.

b. The petition shall be verified to establish the viability of the rehabilitation of the insolvent debtor.

c. Both A and B.

d. Neither A nor B.

29. Which of the following is a content of the verified petition for voluntary court-supervised rehabilitation?

a. Liquidation plan

b. Rehabilitation plan

c. Dissolution plan

d. Incorporation plan

30. It refers to plan by which the financial well-being and viability of an insolvent debtor can be restored using

various means including, but not limited to, debt forgiveness, debt rescheduling, reorganization or quasi-

reorganization, dacion en pago, debt-equity conversion and sale of the business (or parts of it) as a going concern,

or setting-up of new business entity as prescribed in Section 62 of FRIA, or other similar arrangements as may be

approved by the court or creditors

a. Liquidation plan

b. Rehabilitation plan

c. Dissolution plan

d. Incorporation plan

31. Which of the following is a not content of the verified petition for voluntary court-supervised rehabilitation?

a. Inventory of all assets including receivables and claims against third parties of the insolvent debtor

b. Identification of the debtor, its principal activities and address

c. Schedule of the debtor's debts and liabilities

d. Medico legal examination results

32. Which of the following is a not content of the verified petition for voluntary court-supervised rehabilitation?

a. Statement of the fact of and the cause of insolvency of debtor

b. Grounds upon which the petition is based

c. Specific reliefs sought pursuant to FRIA

d. Specific elements of crime alleged

33. What is the minimum number of nominees to the position of rehabilitation received whose names must be stated

in the verified petition for rehabilitation?

a. At least 3 nominees

b. At least 5 nominees

c. At least 4 nominees

d. At least 2 nominees

34. It is a type of court-supervised rehabilitation initiated by the creditors of insolvent corporation, partnership or sole

proprietorship when either (1) there is no genuine issue of fact or law on the claims of the petitioner’s, and that

the due and demandable payments thereon have not been made for at least sixty (60) days or that the debtor has

failed generally to meet its liabilities as they fall due; or (2) A creditor, other than the petitioners, has initiated

foreclosure proceedings against the debtor that will prevent the debtor from paying its debts as they become due

or will render it insolvent.

a. Voluntary court-supervised rehabilitation

b. Involuntary court-supervised rehabilitation

c. Pre-negotiated Rehabilitation

d. Out-of-Court Rehabilitation or Informal Restructuring Agreement

35. What is the minimum amount of claim of any creditor or group of creditors before they may be allowed to file a

petition for involuntary court-supervised rehabilitation of insolvent corporation, partnership or sole

proprietorship?

a. At least P10,000,000 or 10% of subscribed capital stock or partner's contributions, whichever is higher

b. At least P100,000,000 or 30% of subscribed capital stock or partner's contributions, whichever is higher

c. At least P100,000 or 20% of subscribed capital stock or partner's contributions, whichever is higher

d. At least P1,000,000 or 25% of subscribed capital stock or partner's contributions, whichever is

higher

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 5 of 32

36. What are the grounds that must be alleged by any creditor or group of creditors in their petition for involuntary

court-supervised rehabilitation of insolvent corporation, partnership or sole proprietorship?

a. There is no genuine issue of fact or law on the claims of the petitioner’s, and that the due and demandable

payments thereon have not been made for at least sixty (60) days or that the debtor has failed generally to

meet its liabilities as they fall due.

b. A creditor, other than the petitioners, has initiated foreclosure proceedings against the debtor that will

prevent the debtor from paying its debts as they become due or will render it insolvent.

c. Either A or B.

d. Neither A nor B.

37. Which of the following is not a content in a petition for involuntary court-supervised rehabilitation?

a. Identification of the debtor, its principal activities and its address

b. Rehabilitation plan

c. Names of at least 3 nominees for the position of rehabilitation receiver

d. The circumstances sufficient to support the liquidation of the insolvent debtor

38. When will the court-supervised rehabilitation proceedings of an insolvent corporation, partnership or sole

proprietorship commence?

a. Upon filing of petition for rehabilitation before Regional Trial Court

b. Upon issuance by the Regional Trial Court of Commencement Order

c. Upon verification of the petition for rehabilitation

d. Upon docketing for petition for rehabilitation

39. It refers to the order issued by the Regional Trial Court evidencing the commencement of the rehabilitation

proceedings.

a. Suspension or Stay Order

b. Commencement Order

c. Liquidation Order

d. Rehabilitation Order

40. It refers to the order included in the Commencement Order issued by the Regional Trial Court in a rehabilitation

proceedings which has the effect of suspending all actions or proceedings, attachments , in court or otherwise, for

the enforcement of claims against the insolvent debtor.

a. Suspension or Stay Order

b. Liquidation Order

c. Rehabilitation Order

d. Freeze Order

41. Which of the following is the effect of issuance by the Regional Trial Court of Commencement Order in a

rehabilitation proceedings?

a. Upon issuance of the Commencement Order by the court, and until the approval of the

Rehabilitation Plan or dismissal of the petition, whichever is earlier, the imposition of all taxes and

fees, including penalties, interests mid charges thereof, due to the national government or to LGUs

shall be considered waived, in furtherance of the objectives of rehabilitation.

b. Legal compensation or setoff with the insolvent debtor may still prosper despite issuance of

commencement order.

c. Lien against debtor's property may still be perfected after the issuance of commencement order.

d. Legal or other recourse may be made by creditors in other forum outside the rehabilitation proceedings.

42. Which of the following is not an effect of issuance by the Regional Trial Court of Commencement Order in a

rehabilitation proceedings?

a. It shall prohibit, or otherwise serve as the legal basis for rendering null and void the results of any

extrajudicial activity or process to seize property, sell encumbered property, or otherwise attempt to

collect on or enforce a claim against the debtor after the commencement.

b. It shall serve as the legal basis for rendering null and void any setoff after the commencement date of any

debt owed to the debtor by any of the debtor's creditors.

c. It shall serve as the legal basis for rendering null and void the perfection of any lien against the debtor's

property after the commencement date.

d. It shall not consolidate the resolution of all legal proceedings by and against the debtor to the

rehabilitation court.

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 6 of 32

43. Which of the following is not an effect of issuance by the Regional Trial Court of Suspension or Stay Order in a

rehabilitation proceedings?

a. It shall suspend all actions or proceedings, in court or otherwise, for the enforcement of claims against the

debtor.

b. It shall suspend all actions to enforce any judgment, attachment or other provisional remedies against the

debtor.

c. It shall prohibit the debtor from selling, encumbering, transferring or disposing in any manner any of its

properties except in the ordinary course of business.

d. It shall allow the debtor from making any payment of its unsecured liabilities outstanding as of the

commencement date.

44. Which of the following pending cases against an involving an insolvent debtor is not stayed or suspended by the

Suspension or Stay Order by Rehabilitation Court in a rehabilitation proceedings?

a. Any criminal action against the individual debtor or owner, partner, director or officer of a debtor.

b. Any juridical foreclosure filed by a real estate mortgagee against the debtor before Regional Trial Court.

c. Any civil action for damages for breach of contract filed against the debtor before Municipal Trial Court.

d. Any civil action for damages for quasi-delict filed against the debtor before Metropolitatn Trial Court.

45. Which of the following pending cases against an involving an insolvent debtor is stayed or suspended by the

Suspension or Stay Order by Rehabilitation Court in a rehabilitation proceedings?

a. To cases already pending appeal in the Supreme Court as of commencement date.

b. To the enforcement of claims against sureties and other persons solidarily liable with the debtor, and third

party or accommodation mortgagors as well as issuers of letters of credit.

c. To any form of action of customers or clients of a securities market participant to recover or otherwise

claim moneys and securities entrusted to the latter in the ordinary course of the latter's business as well as

any action of such securities market participant or the appropriate regulatory agency or self-regulatory

organization to payor settle such claims or liabilities.

d. To any civil action for damages arising from quasi-contract against the debtor before Regional

Trial Court.

46. He refers to the person or persons, natural or juridical, appointed as such by the rehabilitation court pursuant to

FRIA and which shall be entrusted with such powers and duties including among others to monitor the operations

and the business of the debtor to ensure that no payments or transfers of property are made other than in the

ordinary course of business.

a. Liquidator

b. Rehabilitation receiver

c. Conservator

d. Provisional director

47. Which of the following is a duty of a rehabilitation receiver appointed by rehabilitation court?

a. To take possession, custody and control, and to preserve the value of all the property of the debtor.

b. To operate the business of the debtor even without permission of the rehabilitation court.

c. To invest debtor's assets in a business different from that of debtor.

d. To misappropriate the funds of the debtor.

48. Which of the following is a not a duty of a rehabilitation receiver appointed by rehabilitation court?

a. To evaluate the validity, genuineness and true among of all the claims against the debtor

b. To have access to all information necessary, proper or relevant to the operations and business of the

debtor and for its rehabilitation

c. To monitor the operations and the business of the debtor to ensure that no payments or transfers of

property are made other than in the ordinary course of business

d. To declare and distribute dividends to the shareholders of the debtor despite the debtor's deficit

49. Who has the power to remove the appointed rehabilitation receiver?

a. Insolvent debtor

b. Rehabilitation court

c. Creditors

d. President of the Philippines

50. How may the rehabilitation court remove the appointed rehabilitation receiver?

a. Motu proprio by the rehabilitation court

b. Upon motion by any creditor’s holding more than fifty percent (50%) of the total obligations of the debtor

c. Either A or B

d. Neither A nor B

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 7 of 32

51. What is the minimum claim by any creditor before he may file a motion to the rehabilitation court for the removal

of the appointed rehabilitation receiver?

a. More than 1/3 of total obligations of the debtor

b. More than 2/3 of total obligations of the debtor

c. More than 50% of total obligations of the debtor

d. More than 3/4 of total obligations of the debtor

52. Which of the following is a ground for removal of appointed rehabilitation receiver?

a. Due diligence, and exercise of proper degree of care in the performance of his duties and powers

b. Possession of special competency required by the specific case

c. Sufficient independence that is necessary for the protection of interest of general body of the stakeholders

d. Conflict of interest that arises after his appointment

53. Which of the following is not a ground for removal of appointed rehabilitation receiver?

a. Illegal acts or conduct in the performance of his duties and powers

b. Incompetence, gross negligence, failure to perform or failure to exercise the proper degree of care in the

performance of his duties and powers

c. Religious or political belief adverse to that of the appointing judge

d. Manifest lack of independence that is detrimental to the general body of the stakeholders

54. Before the hearing for the rehabilitation court's approval of compensation for reasonable fees and expenses of

rehabilitation receiver and his direct employees and independent contractors, the receiver shall receive and his

direct employees shall receive what type of compensation?

a. Equal to that of the salary CEO or CFO of the company

b. Reasonable compensation based on quantum meruit

c. Twice that of the salary of the judge

d. 10% of net income of the debtor

55. What is the treatment of compensation for reasonable fees and expenses of rehabilitation receiver and his direct

employees and independent contractors?

a. Administrative expenses classified as unsecured claims with priority

b. Unsecured claims without priority

c. Fully secured claims

d. Partially secured claims

56. What is the required creditor's vote for the approval of proposed rehabilitation plan in a court-supervised

rehabilitation proceedings?

a. Approval by all classes of creditors whose right are adversely modified or affected by the Plan.

b. Approval by the class of unsecured creditors with priority only.

c. Approval by the class of fully secured creditors only.

d. Approval by the class of unsecured creditors with priority and by the class of fully secured creditors only.

57. For the purpose of determining whether a particular class of creditor has already approved a plan, what is the

required vote within the class of creditor for the rehabilitation plan to be deemed to have been approved by a class

of creditors?

a. If members of the said class holding more than 50% of the total claims of the said class vote in

favor of the rehabilitation plan.

b. If members of the said class holding more than 75% of the total claims of the said class vote in favor of

the rehabilitation plan.

c. If members of the said class holding more than 25% of the total claims of the said class vote in favor of

the rehabilitation plan.

d. If members of the said class holding more than 60% of the total claims of the said class vote in favor of

the rehabilitation plan.

58. May the rehabilitation court confirm the rehabilitation plan notwithstanding the rejection by some opposing

creditors to the rehabilitation plan?

a. No because it is violative of right to substantive due process of the creditors affected by the rehabilitation

plan.

b. Yes if the rehabilitation of the debtor will be more favorable to the objecting creditors than

liquidation of the creditor.

c. No because that will be tantamount to grave abuse of discretion on the part of the court.

d. Yes even if the rehabilitation plan will be prejudicial on the part of the objecting creditors.

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 8 of 32

59. Which of the following is not a requisite for rehabilitation court’s confirmation of the rehabilitation Plan

notwithstanding the rejection by some opposing creditors?

a. The rehabilitation plan complies with the requirement as specified in FRIA.

b. The rehabilitation receiver recommends the confirmation of the Rehabilitation Plan.

c. The shareholders, owners or' partners of the juridical, debtor lose at least their controlling interest as a

result of the Rehabilitation Plan.

d. The Rehabilitation Plan would likely provide the objecting class of creditors with compensation which

has a net present value greater than that which they would have receive4if the debtor were under

liquidation.

e. The rehabilitation plan is reasonably assured by the an independent auditing firm.

60. Which of the following is not a ground for objection by creditors of the rehabilitation plan?

a. The creditors' support was induced by fraud.

b. The rehabilitation plan complies with the requirement as specified in FRIA.

c. The documents or data relied upon in the rehabilitation plan are materially false or misleading.

d. The rehabilitation plan is in fact not supported by the voting creditors.

61. Which of the following is the effect of the rehabilitation court's confirmation of the rehabilitation plan?

a. The Rehabilitation Plan and its provisions shall be binding upon the debtor and all person who may

be affected by it, including the creditors, whether or not such persons have participated in the

proceedings or opposed the Rehabilitation Plan or whether or not their claims have been scheduled.

b. The debtor shall not comply with the provisions of the Rehabilitation Plan and shall take all actions

necessary to carry out the Plan.

c. Payments shall be made to the creditors in contrary to the provisions of the Rehabilitation Plan.

d. Contracts and other arrangements between the debtor and its creditors shall be interpreted as continuing to

apply even if they do conflict with the provisions of the Rehabilitation Plan.

62. Which of the following is not an effect of the rehabilitation court's confirmation of the rehabilitation plan?

a. Any compromises on amounts or rescheduling of timing of payments by the debtor shall be binding on

creditors regardless of whether or not the plan is successfully implemented.

b. Claims arising after approval of the rehabilitation plan that are otherwise not treated by the plan

are subject to any Suspension Order.

c. Contracts and other arrangements between the debtor and its creditors shall be interpreted as continuing to

apply to the extent that they do not conflict with the provisions of the Rehabilitation Plan.

d. The debtor shall comply with the provisions of the Rehabilitation Plan and shall take all actions necessary

to carry out the rehabilitation plan and payments shall be made to the creditors in accordance 'with the

provisions of the Rehabilitation Plan.

63. What is the maximum period allowed by FRIA to rehabilitation court to confirm the rehabilitation plan from the

date of filing of the petition for rehabilitation?

a. Within 6 months from the date of the filing of the petition for rehabilitation

b. Within 3 months from the date of the filing of the petition for rehabilitation

c. Within one year from the date of the filing of the petition for rehabilitation

d. Within two years from the date of the filing of the petition for rehabilitation

64. Which of the following is an instance of failure of rehabilitation justifying termination of rehabilitation

proceedings?

a. The debtor, fails to submit a Rehabilitation Plan.

b. The rehabilitation court has taken due court of the petition.

c. Under the Rehabilitation Plan submitted by the debtor, there is substantial likelihood that the debtor can

be rehabilitated within a reasonable period.

d. The commission of good faith in securing the approval of the Rehabilitation Plan or its amendment.

65. Which of the following is not an instance of failure of rehabilitation justifying termination of rehabilitation

proceedings?

a. Dismissal of the petition by the court

b. The commission of fraud in securing the approval of the Rehabilitation Plan or its amendment

c. Under the Rehabilitation Plan submitted by the debtor, there is no substantial likelihood that the debtor

can be rehabilitated within a reasonable period

d. The Rehabilitation Plan or its amendment is approved, by the court and in the implementation

thereof, the debtor was able to perform its obligations thereunder, and there is a success in

realizing the objectives, targets or goals set forth therein, including the timelines and conditions for

the settlement of the obligations due to the creditors and other claimants.

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 9 of 32

66. What are the effects of termination of court-supervised rehabilitation proceedings?

a. The discharge of the rehabilitation receiver, subject to his submission of a final accounting.

b. The lifting of the Stay Order and any other court order holding in abeyance any action for the

enforcement of a claim against the debtor.

c. Provided, however, that if the termination of proceedings is due to failure of rehabilitation or dismissal of

the petition for reasons other than technical grounds, the rehabilitation proceedings shall be immediately

converted to liquidation proceedings as provided in Section 92 of FRIA.

d. All of the above.

67. It is a type of rehabilitation wherein an insolvent debtor, by itself or jointly with any of its creditors, files a

verified petition with the Regional Trial Court for the approval of a Pre-negotiated Rehabilitation Plan.

a. Court-Supervised Rehabilitation

b. Pre-negotiated Rehabilitation

c. Out-of-Court Rehabilitation or Informal Restructuring Agreement

d. Inside Rehabilitation

68. What is the required creditor's vote for the approval of pre-negotiated rehabilitation plan?

a. Endorsement or Approval by creditors holding at least (2/3) of the total liabilities of the debtor, including

secured creditors holding more than (50%).

b. Endorsement or Approval by the total secured claims of the debtor and unsecured creditors holding more

than (50%) of the total unsecured claims of the debtor.

c. Either A or B.

d. Neither A nor B.

69. It is a type of rehabilitation which meets the requirements prescribed by FRIA but will not involve filing of

petition before Regional Trial Court for its approval but agreed into by insolvent debtor and its creditors

informally or outside the court of law.

a. Court-Supervised Rehabilitation

b. Pre-negotiated Rehabilitation

c. Out-of-Court Rehabilitation or Informal Restructuring Agreement

d. Inside Rehabilitation

70. What are the minimum requirements for validity of Out-of-Court or Informal Rehabilitation Plans?

a. The debtor must agree to the out-of-court or informal restructuring/workout agreement or Rehabilitation

Plan.

b. It must be approved by creditors representing at least sixty-seven percent (67%) of the secured obligations

of the debtor.

c. It must be approved by creditors representing at least seventy-five percent (75%) of the unsecured

obligations of the debtor.

d. It must be approved by creditors holding at least eighty-five percent (85%) of the total liabilities, secured

and unsecured, of the debtor.

e. All of the above must be present.

71. This legal principle or legal doctrine enunciates that a restructuring/workout agreement or Rehabilitation Plan that

is approved pursuant to an informal workout framework referred to Informal Rehabilitation shall have the same

legal effect as confirmation of a Rehabilitation Plan under Court-Supervised Rehabilitation.

a. Craw down effect

b. Transcendental doctrine

c. Portability theory

d. Trust fund doctrine

72. It refers to the process of converting all the assets of an insolvent debtor into cash and distributing the available

cash to the creditors in accordance to the concurrence and preference of credits provisions of Civil Code and the

remainder to the stockholders.

a. Liquidation

b. Rehabilitation

c. Incorporation

d. Dissolution

73. It refers to a petition filed by an insolvent juridical debtor when it seeks immediate dissolution and termination of

its existence.

a. Petition for voluntary liquidation of insolvent juridical person

b. Petition for involuntary liquidation of insolvent juridical person

c. Petition for rehabilitation

d. Petition for dissolution

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 10 of 32

74. What is the ground to be alleged in the petition filed by an insolvent juridical person for voluntary liquidation?

a. Insolvency of juridical debtor either because (1) its financial condition of general inability to pay its

liabilities as they fall due in the ordinary course of business or (2) its financial condition when it has

liabilities that are greater than its or his assets.

b. Conversion of Rehabilitation Proceedings to Liquidation Proceedings by establishing that the juridical

debtor is seeking immediate dissolution and termination of its corporate existence.

c. Either A or B.

d. Neither A nor B.

75. What is the required vote for filing the petition for voluntary liquidation of insolvent juridical person?

a. At least majority vote of the members of Board of Directors/Trustees and ratification of at least 2/3

of the stockholders/members.

b. At least majority vote of the members of Board of Directors/Trustees and ratification of at least majority

of the stockholders/members.

c. At least majority 2/3 of the members of Board of Directors/Trustees and ratification of at least 2/3 of the

stockholders/members.

d. At least majority 2/3of the members of Board of Directors/Trustees and ratification of at least majority of

the stockholders/members.

76. It refers to a petition filed by creditors of insolvent juridical debtor when there is no genuine issue of fact or law

on the claim/s of the petitioner/s, and that the due and demandable payments thereon have not been made for at

least one hundred eighty (180) days or that the juridical debtor has failed generally to meet its liabilities as they

fall due and there is no substantial likelihood that the juridical debtor maybe rehabilitated.

a. Petition for voluntary liquidation of insolvent juridical person

b. Petition for involuntary liquidation of insolvent juridical person

c. Petition for rehabilitation

d. Petition for dissolution

77. What are the minimum requisites or allegations to be alleged by creditors of insolvent juridical debtor in their

petition for involuntary liquidation of insolvent juridical person?

a. There is no genuine issue of fact or law on the claim/s of the petitioner/s, and that the due and

demandable payments thereon have not been made for at least one hundred eighty (180) days or that the

debtor has failed generally to meet its liabilities as they fall due.

b. There is no substantial likelihood that the debtor maybe rehabilitated.

c. Both A and B.

d. Neither A nor B.

78. What is the minimum number of creditors and their minimum claims of creditors of insolvent juridical debtor in

order for them to be able to file a petition for involuntary liquidation of insolvent juridical person?

a. 3 or more creditors the aggregate of whose claims is at least either One million pesos (P1,000,000)

or at least twenty-five percent (25%) of the subscribed capital stock or partner's contributions of

the debtor, whichever is higher.

b. 2 or more creditors the aggregate of whose claims is at least either (P10,000,000) or at least (15%) of the

subscribed capital stock or partner's contributions of the debtor, whichever is higher.

c. 4 or more creditors the aggregate of whose claims is at least either (P100,000,000) or at least twenty-five

percent (35%) of the subscribed capital stock or partner's contributions of the debtor, whichever is higher.

d. 5 or more creditors the aggregate of whose claims is at least either (P100,000) or at least twenty-five

percent (50%) of the subscribed capital stock or partner's contributions of the debtor, whichever is higher.

79. It refers to the order issued by the Regional Trial Court evidencing the commencement of the liquidation

proceedings.

a. Suspension or Stay Order

b. Commencement Order

c. Liquidation Order

d. Rehabilitation Order

80. Which of the following is the effect of issuance of liquidation order by the Regional Trial Court?

a. The juridical debtor shall be deemed dissolved and its corporate or juridical existence terminated.

b. Legal title to and control of all the assets of the juridical debtor, except those that may be exempt from

execution, shall be deemed vested in stockholders or members of the juridical person.

c. Foreclosure proceeding shall be allowed within a period of one hundred eighty (180) days from the

issuance of liquidation order.

d. All contracts of the juridical debtor shall be deemed continuous, unless the liquidator, within ninety (90)

days from the date of his assumption of office, declares otherwise that the contracts are terminated.

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 11 of 32

81. Which of the following is not an effect of issuance of liquidation order by the Regional Trial Court?

a. Legal title to and control of all the assets of the debtor, except those that may be exempt from execution,

shall be deemed vested in the liquidator or, pending his election or appointment with the court.

b. All contracts of the debtor shall be deemed terminated and/or breached, unless the liquidator, within

ninety (90) days from the date of his assumption of office, declares otherwise the contracting party agrees.

c. No foreclosure proceeding shall be allowed for a period of one hundred eighty (180) days from issuance

of liquidation order.

d. Separate action for the collection of an unsecured claim may be allowed in a court other than the

liquidation court.

82. It refers to a claim of a creditor which is secured by a lien or collateral whose realizable value is higher than the

amount of the claim.

a. Unsecured claim without priority

b. Unsecured claim with priority

c. Partially secured claim

d. Fully secured claim

83. It refers to a claim of a creditor which is secured by a lien or collateral whose realizable value is lower than the

amount of the claim.

a. Unsecured claim without priority

b. Unsecured claim with priority

c. Partially secured claim

d. Fully secured claim

84. It refers to a claim of a creditor which is not secured by a lien or collateral but prioritize according to the

provisions of Civil Code in the concurrence and preference of credit.

a. Unsecured claim without priority

b. Unsecured claim with priority

c. Partially secured claim

d. Fully secured claim

85. It refers to a claim of a creditor which is not secured by a lien or collateral but without priority according to the

provisions of Civil Code in the concurrence and preference of credit.

a. Unsecured claim without priority

b. Unsecured claim with priority

c. Partially secured claim

d. Fully secured claim

86. What are the rights of secured creditors in case of liquidation proceedings?

a. They may waive his rights under the security or lien, prove his claim in the liquidation proceedings and

share in the distribution of the assets of the debtor.

b. They may maintain his rights under his security or lien.

c. Either A or B.

d. Neither A nor B.

87. Which of the following is an unsecured claim without priority?

a. Civil liability for utility bills

b. Liability for employee benefits

c. Obligation for taxes

d. Civil obligation for quasi-delict

88. Which of the following is an unsecured claim with priority?

a. Accounts payable

b. Civil liability for corporate crime

c. Interest payable of bond indenture

d. Unearned revenue

89. Which of the following unsecured claims with priority shall be paid first?

a. Employee benefits

b. Civil damages for corporate crime

c. Liability for taxes

d. Civil obligation for quasi-delict

e. Notarized or judgment debt

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 12 of 32

90. He is the person either appointed by the liquidation court or elected by the creditors of an insolvent debtor with

the obligation to convert the assets of the insolvent debtor into cash and then apply the proceeds to the creditors

on the basis of Civil Code provisions on concurrence and preference of credits.

a. Rehabilitation receiver

b. Conservator

c. Liquidator

d. Rehabilitator

91. If the insolvent debtor under liquidation and creditor are mutually debtor and creditor of each other, what legal

remedy shall be applied during liquidation proceedings?

a. Right of off-set

b. Right of aggregation

c. Right of segregation

d. Right of priority

92. What is the period for submission of liquidation plan by the liquidator to the liquidation court?

a. Within 3 months from liquidator's assumption in office

b. Within 6 months from liquidator's assumption in office

c. Within 1 month from liquidator's assumption in office

d. Within 12 months from liquidator's assumption in office

93. As a general rule, where shall the unencumbered assets of the insolvent debtor be sold and converted the into

money?

a. Public auction

b. Private sale

c. Private market

d. Public market

94. Which of the following is not an objective of Securities Regulation Code a.k.a. R.A. No. 8799?

a. To establish a socially conscious, free market that regulates itself

b. To encourage the widest participation of ownership in enterprises

c. To enhance the democratization of wealth

d. To promote monopoly and oligopoly

95. Which of the following is not an objective of Securities Regulation Code a.k.a. R.A. No. 8799?

a. To promote the development of the capital market

b. To protect investors

c. To ensure full and fair disclosure about securities

d. To encourage insider trading and other fraudulent or manipulative devices and practices which

create distortions in the free market

96. Under Securities Regulation Code, they are defined as shares, participation or interests in a corporation or in a

commercial enterprise or profit-making venture and evidenced by a certificate, contract, instruments, whether

written or electronic in character.

a. Securities

b. Instruments

c. Documents

d. Papers

97. Which of the following is considered a security under Securities Regulation Code?

a. Inventory

b. Options and warrants

c. Investment property

d. Prepaid asset

98. Which of the following is not considered a security under Securities Regulation Code?

a. Shares of stocks, bonds, debentures, notes evidences of indebtedness, asset-backed securities

b. Investment contracts, certificates of interest or participation in a profit sharing agreement, certifies of

deposit for a future subscription

c. Fractional undivided interests in oil, gas or other mineral rights

d. Biological asset

99. Which of the following is not considered a security under Securities Regulation Code?

a. Certificates of assignments, certificates of participation, trust certificates, voting trust certificates or

similar instruments

b. Derivatives like option and warrants

c. Agricultural produce

d. Proprietary or nonproprietary membership certificates in corporations

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 13 of 32

100. He refers to the originator, maker, obligor or creator of the security.

a. Issuer

b. Broker

c. Dealer

d. Associated person of a broker or dealer

101. He refers to the person engaged in the business of buying and selling securities for the account of others.

a. Issuer

b. Broker

c. Dealer

d. Associated person

102. He refers to person who buys sells securities for his/her own account in the ordinary course of business.

a. Issuer

b. Broker

c. Dealer

d. Associated person of a broker or dealer

103. He refers to an employee therefor whom, directly exercises control of supervisory authority, but does not include

a salesman, or an agent or a person whose functions are solely clerical or ministerial.

a. Issuer

b. Broker

c. Dealer

d. Associated person of a broker or dealer

104. He refers to a natural person, employed as such as an agent, by a dealer, issuer or broker to buy and sell securities

a. Issuer

b. Broker

c. Salesman

d. Associated person of a broker or dealer

105. He refers to any person who acts as intermediary in making deliveries upon payment effect settlement in

securities transactions.

a. Exchange

b. Clearing agency

c. Market

d. Auction

106. It refers to an organized market place or facility that brings together buyers and sellers and executes trade of

securities and/or commodities.

a. Exchange

b. Auction

c. Mall

d. Store

107. They refer to contracts which provide for the performance of future services of or the payment of future monetary

considerations at the time actual need, for which plan holders pay in cash or installment at stated prices, with

or without interest or insurance coverage and includes life, pension, education, interment, and other plans

which the Commission may from time to time approve

a. Insurance policies

b. Investment schemes

c. Pre-need plans

d. Money market placements

108. He refers to a person who, acting alone or with others, takes initiative in founding and organizing the business or

enterprise of the issuer and receives consideration therefor.

a. Promoter

b. Underwriter

c. Incorporator

d. Founder

109. He refers to a person who guarantees on a firm commitment and/or declared best effort basis the distribution and

sale of securities of any kind by another company.

a. Promoter

b. Underwriter

c. Incorporator

d. Founder

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 14 of 32

110. Which government agency is entrusted with the administration of the Securities Regulation Code?

a. Board of Accountancy

b. Securities and Exchange Commission

c. Bangko Sentral ng Pilipinas

d. Insurance Commission

111. Which of the following is a function of Securities and Exchange Commission?

a. To approve, reject, suspend, revoke or require amendments to registration statements, and

registration and licensing applications

b. To convict a person of criminal violation of Securities Regulation Code

c. To entertain intra-corporate disputes and election contests

d. To reverse the decision of board of directors in matters of corporate management

112. Which of the following is not a function of Securities and Exchange Commission?

a. To prepare, approve, amend or repeal rules, regulations and orders, and issue opinions and provide

guidance on and supervise compliance with such rules, regulation and orders in relation to Securities

Regulation Code

b. To compel the officers of any registered corporation or association to call meetings of stockholders or

members thereof under its supervision

c. To suspend or revoke, after proper notice and hearing the franchise or certificate of registration of

corporations, partnership or associations, upon any of the grounds provided by law

d. To enact law amending the Securities Regulation Code and the Corporation Code of the Philippines

113. What is the condition precedent before securities will be allowed to be sold or offered for sale or distribution

within the Philippines?

a. It must be guaranteed by the Government of the Republic of the Philippines.

b. The securities must be risk-free.

c. The securities must be registered first before the Securities and Exchange Commission.

d. The securities must be profitable in all cases.

114. It refers to the application for the registration of securities required to be filed with the Securities and Exchange

Commission before these securities be allowed to be sold or offered for sale or distributed within the

Philippines.

a. Certificate of registration

b. Application form

c. Registration statement

d. Articles of registration

115. It refers to the document made by or an behalf of an issuer, underwriter or dealer to sell or offer securities for sale

to the public through registration statement filed with the Securities and Exchange Commission.

a. Prospectus

b. Brochure

c. Table of specification

d. Syllabus

116. Which of the following may not be done by Securities and Exchange Commission regarding the application for

registration of securities by issuer?

a. The SEC may specify the terms and conditions under which any written communication, including any

summary prospectus, shall be deemed not to constitute an offer for sale.

b. The SEC may audit the financial statements, assets and other information of firm applying for registration

of its securities whenever it deems the same necessary to insure full disclosure or to protect the interest of

the investors and the public in general.

c. The SEC shall deny any application for registration of securities if the applicant is a not a Filipino

citizen.

d. The SEC shall keep Register Securities which shall record the registration of securities and such register

and all documents or information with the respect to the securities registered therein shall be open to

public inspection at reasonable hours on business days.

117. Which of the following securities is required to be registered before the Securities and Exchange Commission?

a. Any security issued or guaranteed by the Government of the Philippines, or by any political subdivision

or agency thereof, or by any person controlled or supervised by, and acting as an instrumentality of said

Government

b. Shares of stocks issued by a banking institution

c. Certificates issued by a receiver or by a trustee in bankruptcy duly approved by the proper adjudicatory

body

d. Any security issued or guaranteed by the government of any country with which the Philippines maintains

diplomatic relations, or by any state, province or political subdivision thereof on the basis of reciprocity

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 15 of 32

118. Which of the following securities is exempted from registration before Securities and Exchange Commission?

a. Insurance policy

b. Bond indenture

c. Share warrants and share options

d. Fractional undivided interest in oil or mineral rights

119. Which of the following securities is exempted from registration before Securities and Exchange Commission?

a. Participation in profit sharing agreement in a partnership

b. Investment contracts issued by a networking company

c. Trust certificates and voting trust certificates in a mining company

d. Certificate of time deposit or money market placement issued by a bank

120. Which of the following sale of securities is subject to registration with Securities and Exchange Commission?

a. At any judicial sale, or sale by an executor, administrator, guardian or receiver or trustee in insolvency or

bankruptcy

b. The distribution by a corporation actively engaged in the business authorized by its articles of

incorporation, of securities to its stockholders or other security holders as a stock dividend or other

distribution out of surplus

c. The sale of capital stock of a corporation to its own stockholders exclusively, where no commission or

other remuneration is paid or given directly or indirectly in connection with the sale of such capital stock

d. The sale of securities by an issuer to more than twenty (20) persons in the Philippines during any

twelve-month period

121. Which of the following sale of securities is subject to registration with Securities and Exchange Commission?

a. The issuance of bonds or notes secured by mortgage upon real estate or tangible personal property, when

the entire mortgage together with all the bonds or notes secured thereby are sold to a single purchaser at a

single sale

b. Broker’s transaction, executed upon customer’s orders, on any registered Exchange or other trading

market

c. The exchange of securities by the issuer with the new security holders where commission or other

remuneration is paid or given directly or indirectly for soliciting such exchange

d. An isolated transaction in which any security is sold, offered for sale, subscription or delivery by the

owner therefore, or by his representative for the owner’s account, such sale or offer for sale or offer for

sale, subscription or delivery not being made in the course of repeated and successive transaction of a like

character by such owner, or on his account by such representative and such owner or representative not

being the underwriter of such security

122. Which of the following sale of securities is exempted from registration with Securities and Exchange

Commission?

a. By or for the account of a pledge holder, or mortgagee or any of a pledge lien holder selling of

offering for sale or delivery in the ordinary course of business and not for the purpose of avoiding

the provision of this Code, to liquidate a bonafide debt, a security pledged in good faith as security

for such debt

b. Sale of investment contracts to numerous investors by a networking company

c. Sale of subscription contracts by a prospective corporation to the public

d. Subscriptions for shares of the capitals stocks of a corporation prior to the incorporation thereof or in

pursuance of an increase in its authorized capital stocks under the Corporation Code, when expense is

incurred, or commission, compensation or remuneration is paid or given in connection with the sale or

disposition of such securities, and when the purpose for soliciting, giving or taking of such subscription is

other than to comply with the requirements of such law as to the percentage of the capital stock of a

corporation which should be subscribed before it can be registered and duly incorporated, or its

authorized, capital increase

123. In which of the following buyers of securities is sale of securities still required to be registered with Securities and

Exchange Commission?

a. Bank

b. Registered investment house or investment company

c. Insurance company

d. Professionals

124. In which of the following buyers of securities is sale of securities exempted from registration with Securities and

Exchange Commission?

a. Pension fund or retirement plan of Government of the Philippines or any of its political subdivision

b. Real estate company

c. Educational institution

d. Farmers

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 16 of 32

125. Which of the following is not a ground for the rejection of the registration statement and refuse registration of the

securities of the issuer by the Securities and Exchange Commission?

a. The issuer has been judicially declared solvent.

b. The issuer has violated any of the provision of Securities Regulation Code.

c. The issuer has been or is engaged or about to engage in fraudulent transactions.

d. The issuer has failed to comply with the conditions imposed by SEC for registration of security.

126. Which of the following is a ground for the rejection of the registration statement and refuse registration of the

securities of the issuer by the Securities and Exchange Commission?

a. The issuer has been profitable during the year.

b. The issuer has abided with the lawful order of SEC.

c. The issuer has made any false or misleading representation of material facts in any prospectus

concerning the issuer or its securities

d. The issuer is a non-resident and non-Philippine national juridical person.

127. It means a publicly announced intention by a person acting alone or in concert with other persons to acquire

outstanding equity securities of a public company, or outstanding equity securities of an associate or related

company of such public company which controls the said public company.

a. Tender offer

b. Insider trading

c. Fraudulent practices

d. Issuer tender offer

128. It means a publicly announced intention by an Issuer to reacquire any of its own class of equity securities, or by

an associate of such Issuer to acquire such securities.

a. Tender offer

b. Insider trading

c. Fraudulent practices

d. Issuer tender offer

129. In which of the following instances is tender offer mandatory?

a. Any person or group of persons acting in concert, who intends to acquire (15 %) of equity

securities in a public company in one or more transactions within a period of twelve (12)

months.

b. Any person or group of persons acting in concert, who intends to acquire (5%) of the outstanding

voting shares or such outstanding voting shares that are sufficient to gain control of the board in a

public company in one or more transactions within a period of twelve (12) months.

c. Any person or group of persons acting in concert, who intends to acquire (5%) of the outstanding

voting shares or such outstanding voting shares that are sufficient to gain control of the board in a

public company directly from one or more stockholders.

d. Any acquisition that would result in ownership of over (10%) of the total outstanding equity securities

of a public company

130. In which of the following instances is tender offer not mandatory?

a. Any person or group of persons acting in concert, who intends to acquire (15 %) of equity securities

in a public company in one or more transactions within a period of twelve (12) months.

b. Any person or group of persons acting in concert, who intends to acquire (35%) of the outstanding

voting shares or such outstanding voting shares that are sufficient to gain control of the board in a

public company in one or more transactions within a period of twelve (12) months.

c. Any person or group of persons acting in concert, who intends to acquire (35%) of the outstanding

voting shares or such outstanding voting shares that are sufficient to gain control of the board in a

public company directly from one or more stockholders.

d. Any acquisition that would result in ownership of over (50%) of the total outstanding equity securities

of a public company

e. Any person or group of persons acting in concert, who intends to acquire thirty five percent

(35%) of the outstanding voting shares or such outstanding voting shares that are sufficient to

gain control of the board in a public company through the Exchange trading system if such

person or group of persons acting in concert acquire the remainder through a block sale but

after acquisition through the Exchange trading system, they fail to acquire their target of thirty

five percent (35%) or such outstanding voting shares that is sufficient to gain control of the

board.

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 17 of 32

131. Which of the following transactions is subject to mandatory tender offer?

a. Any acquisition that would result in ownership of over (50%) of the total outstanding equity

securities of a public company

b. Any purchase of securities from an increase in authorized capital stock

c. Purchase in connection with foreclosure proceedings involving a duly constituted pledge or security

arrangement where the acquisition is made by the debtor or creditor

d. Purchases in connection with corporate rehabilitation under court supervision

e. Purchases in the open market at the prevailing market price

132. Which of the following transactions is exempted from mandatory tender offer?

a. Any purchase of securities from the unissued capital stock even if the acquisition will result to a fifty

percent (50%) or more ownership of securities by the purchaser or such percentage that is sufficient

to gain control of the board

b. Merger or consolidation

c. Any purchase from a publicly listed company

d. Purchase from the biggest company

133. Which of the following transactions is exempted from mandatory tender offer?

a. Purchases in connection with a privatization undertaken by the government of the Philippines

b. Purchases in connection with a banking institutions

c. Purchases that will result to control of a publicly listed company

d. Purchases that will result to parent-subsidiary relationship

134. What is the condition precedent in the tender offer by an Issuer or buyback or reacquisition or repurchase by an

Issuer of its own securities?

a. Presence of unrestricted retained earnings in its books

b. Presence of contributed capital in its books

c. Solvency of the issuer

d. Liquidity of the issuer

135. Which of the following is not a purpose of tender offer by an Issuer or buyback or reacquisition or repurchase by

an Issuer of its own securities?

a. To implement a stock option or stock purchase plan

b. To meet short-term obligations which can be settled by the re-issuance of the repurchased shares

c. To pay dissenting or withdrawing stockholders entitled to payment for their securities under the

Corporation Code

d. To dissolve the corporation

136. Where and when shall the terms and conditions of the tender offer be published by the offeror or issuer in a tender

offer?

a. An Offeror or Issuer shall publish the terms and conditions of the tender offering in (2) national

newspapers of general circulation in the Philippines on the date of commencement of the tender

offer and for (2) consecutive days

b. An Offeror or Issuer shall publish the terms and conditions of the tender offering in (1) national

newspaper of general circulation in the Philippines on the date of commencement of the tender offer

and for (1) day

c. An Offeror or Issuer shall publish the terms and conditions of the tender offering in (3) national

newspapers of general circulation in the Philippines on the date of commencement of the tender offer

and for (3) consecutive days

d. An Offeror or Issuer shall publish the terms and conditions of the tender offering in (4) national

newspapers of general circulation in the Philippines on the date of commencement of the tender offer

and for (4) consecutive days

137. Unless withdrawn earlier, what is the validity or expiration period of tender offer?

a. At least twenty (20) business days from its commencement; Provided, that an offer should as much as

possible be completed within sixty (60) business days from the date the intention to make such offer

is publicly announced

b. At least ten (10) business days from the date the notice of a change in the percentage of the class of

securities being sought or in the consideration offered is first published, sent or given to security

holders

c. Either A or B

d. Neither A nor B

CPAR – Regulatory Framework for Business Transactions (RFBT 9412) Page 18 of 32

138. In a mandatory tender offer, what price of shares of stocks shall the Offeror shall be compelled to offer?

a. The highest price paid by him for such securities during the preceding six (6) months

b. The lowest price paid by him for such securities during the preceding six (6) months

c. The average price paid by him for such securities during the preceding six (6) months

d. The lowest price paid by him for such securities during the preceding three (3) months

139. What are the requirements of tender offer?

a. Tender offer shall be open to all security holders of the class of securities subject to the tender offer.

b. The consideration paid to any security holder pursuant to the tender offer shall be the highest

consideration paid to any other security holder during such tender offer.

c. Both A and B.

d. Neither A nor B.

140. It refers to the company subject of the tender offer.

a. Target company

b. Desired company

c. Prospective company

d. Forecasted company

141. In case of a tender offer other than by an Issuer, the subject of the tender offer ("the target company") shall not

engage in any of the following transactions during the course of a tender offer, or before its commencement if

its board has reason to believe that an offer might be imminent, except

a. Issue any authorized but unissued shares

b. Issue or grant options in respect to any unissued shares

c. Create or issue, or permit the creation or issuance of, any securities carrying rights of conversion into,

or subscription to shares

d. Sell, dispose of or acquire, or agree to acquire, any asset whose value amounts to five percent (5 %)

or more of the total value of the assets prior to acquisition

e. Enter into contracts that are in the ordinary course of business

142. It refers to the act of an insider or selling or buying a security of the issuer, while in possession of material