Professional Documents

Culture Documents

Question PDF

Question PDF

Uploaded by

श्रीनाथ राजाराम दाते0 ratings0% found this document useful (0 votes)

12 views3 pagesThe document outlines various business transactions of GL Consultancy & Services, including purchasing office supplies, hiring employees, paying rent and utility expenses, and providing manpower services to two clients - recording revenues, expenses, and applicable taxes. Cash, cheque, and credit transactions are listed, along with relevant supplier and client GSTIN numbers.

Original Description:

Original Title

question pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines various business transactions of GL Consultancy & Services, including purchasing office supplies, hiring employees, paying rent and utility expenses, and providing manpower services to two clients - recording revenues, expenses, and applicable taxes. Cash, cheque, and credit transactions are listed, along with relevant supplier and client GSTIN numbers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesQuestion PDF

Question PDF

Uploaded by

श्रीनाथ राजाराम दातेThe document outlines various business transactions of GL Consultancy & Services, including purchasing office supplies, hiring employees, paying rent and utility expenses, and providing manpower services to two clients - recording revenues, expenses, and applicable taxes. Cash, cheque, and credit transactions are listed, along with relevant supplier and client GSTIN numbers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

TALLY HOME & INSTITUTE – YOUTUBE CHANNEL

INTRODUCTION TRANSACTIONS

Business Primary Activity- Man Power Supply (Human Resource)

1. Gaurav start a company in the name of GL Consultancy & Services

(GSTIN No. 09BRTPS1884F2Z2), Capital Introduced by Gaurav in cash Rs.

1000000.

2. Opened a bank account in SBI by depositing cash Rs. 200000.

(Account No. 72571011000777)

3. Purchased stationery in cash of Rs. 1000 (Inclusive of GST@18%) from

SITA STATIONERY, Agra GSTIN – 09LMNPS1234A1B1

Invoice no. -02

4. Purchased following Furniture from Raj furniture (09CYMPS9401F2Z2)

house on Credit.

Office table Rs 6000

Office Chair Rs 1200

Waiting Chair Rs. 7000

Taxes (18% extra) (Invoice no. 54) (Total Value= 16756)

5. Purchased a computer in cash Rs. 22500 (Inclusive of Taxes 28%) from

SEHGAL COMPUTER (GSTIN no. 09CYMPS9454F2Z2) (Invoice no. 62)

6. Hired an office space for Rs. 3000 per month & paid Rs. 6000 by cheque

no. 02 as security deposit.

TALLY HOME & INSTITUTE – YOUTUBE CHANNEL

Expenses or Purchase Transaction

1. Businessman issue an employment advertisement on AMARUJALA

newspaper by paying cheque No.03 of Rs. 2500 (inclusive of 18% GST) to

Sagar advertisement

(GSTIN – 09BRTFA9400P2S1)

invoice no. 23

2. Purchase candidate data from Naurki.Com (GSTIN- 07AALCN4721E1Z2)

Invoice number- 52

Taxable Value- 31000 NOTE- TDS TO BE DEDUCTED ON INVOICE

BECAUSE VALUE IS ABOVE Rs. 30000

GST @18% - 5580

Total invoice amt- 36580

Note: - Invoice Amount paid to Naukri.com by cheque.

3. Appointed two employee for following post

Aman Kumar (Manager)- 9000

Pramod Kumar (Accountant)-6500

4. Cash Expenses for the month as following

1. Shop Rent- 3000

2. Electricity Bill- 500

3. Employee salary- 15500

4. Petrol Expenses- 2000

TALLY HOME & INSTITUTE – YOUTUBE CHANNEL

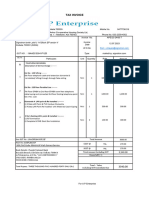

SALE TRANSACTION

1. Invoice issue to Gaurav Traders (GSTIN 09ABCPG1212E1Z2),AGRA(U.P.)

Number of Employee- 2

Post Name- Account Assistant

Taxable value- 15000

GST @18% - 2700

Total Amount- 17700

2. Invoice Issue to ABC & CO., Delhi (GSTIN no. 07ABCFA1234E1Z2)

Number of Employee- 2

Post name- Account manager

Taxable value- 45000

GST@18% - 8100

Total Amount – 53100

3. Amount of Rs. 52650 received from ABC & CO. by Cheque after TDS

Deduction.

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Welcome Kit Term Plan-PS - PDF2Document34 pagesWelcome Kit Term Plan-PS - PDF2Abhishek Sengupta0% (1)

- (Signature of Truck Driver/Conductor) (Prepared By)Document11 pages(Signature of Truck Driver/Conductor) (Prepared By)patel vimalNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- MR Gomez Bradly Blones Apt/Blk 620 Woodlands Drive 52 #02-90 SINGAPORE 730620Document2 pagesMR Gomez Bradly Blones Apt/Blk 620 Woodlands Drive 52 #02-90 SINGAPORE 730620Bradly Blones GomezNo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

- Garg FKC00172-L - 9045101918Document2 pagesGarg FKC00172-L - 9045101918Sanju DhatwaliaNo ratings yet

- Invoice 12837168247011292422Document2 pagesInvoice 12837168247011292422juhi2781No ratings yet

- Proof of Billing PDFDocument3 pagesProof of Billing PDFAnonymous Ln1t4GNo ratings yet

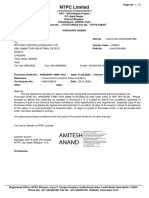

- NTPC Po - 4000236611Document10 pagesNTPC Po - 4000236611Haiti Shankar singhNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- F HarleyDocument4 pagesF HarleyShaon majiNo ratings yet

- PO - Upkeeping Mota Dahisara 236-2018Document17 pagesPO - Upkeeping Mota Dahisara 236-2018Vivek DekavadiyaNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- Po 3000124556 PDFDocument22 pagesPo 3000124556 PDFJitendra Kumar YadavNo ratings yet

- 0027 PDFDocument1 page0027 PDFThiru RajaNo ratings yet

- AA - 2019-20 - 38 FluxDocument1 pageAA - 2019-20 - 38 FluxvenkatesanmuraliNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- Screenshot 2022-10-18 at 3.10.59 PMDocument4 pagesScreenshot 2022-10-18 at 3.10.59 PMbilalahmed333No ratings yet

- Penalty U/s 271 (1) (C) Case Reference Shree Nirmal Commercial Ltd. v. CitDocument39 pagesPenalty U/s 271 (1) (C) Case Reference Shree Nirmal Commercial Ltd. v. CitCAclubindiaNo ratings yet

- InvoicesDocument6 pagesInvoicesAsifNo ratings yet

- Customer Receipt: Being Amount Paid For On Just DialDocument2 pagesCustomer Receipt: Being Amount Paid For On Just DialSurinder GhattauraNo ratings yet

- Questions On Computation of Net GST PayableDocument24 pagesQuestions On Computation of Net GST PayablesneakyblackskullNo ratings yet

- Garg JJ400276 - 9045101903Document2 pagesGarg JJ400276 - 9045101903Sanju DhatwaliaNo ratings yet

- Gateway Technolabs P LTDDocument4 pagesGateway Technolabs P LTDDayavanti Nilesh RanaNo ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- SDD Solution Design DocumentDocument5 pagesSDD Solution Design DocumentSandeep ReddyNo ratings yet

- Youngman India Private Limited: Terms & ConditionsDocument1 pageYoungman India Private Limited: Terms & ConditionsTarun BiswalNo ratings yet

- Feb 3Document1 pageFeb 3Dhaneswar MajhiNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Accounting VoucherDocument1 pageAccounting VouchersysadminNo ratings yet

- SPF 2000Document5 pagesSPF 2000sakthijack67% (3)

- Reverse Charge Mechanism Under GSTDocument7 pagesReverse Charge Mechanism Under GSTramaiahNo ratings yet

- 2016, August QnsDocument5 pages2016, August QnsTimore FrancisNo ratings yet

- Oct 2Document1 pageOct 2Dhaneswar MajhiNo ratings yet

- PantaloonsDocument2 pagesPantaloonsBala ganeshNo ratings yet

- Extra Work (RD 3F-5F)Document3 pagesExtra Work (RD 3F-5F)Chayan BhattacharyaNo ratings yet

- Sep 2Document1 pageSep 2Dhaneswar MajhiNo ratings yet

- Study Material of TaxationDocument4 pagesStudy Material of TaxationAishuNo ratings yet

- Aug 2Document1 pageAug 2Dhaneswar MajhiNo ratings yet

- Corrected Invoice: Bill SummaryDocument1 pageCorrected Invoice: Bill SummaryArbab Ali Tunio PapooNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- VK Skill Development SkillsDocument5 pagesVK Skill Development SkillsJoshua StarkNo ratings yet

- Dummy NoteDocument2 pagesDummy Noteasdssss100% (1)

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- ICT by DR.K.MALLIKARJUNA RAO PDFDocument5 pagesICT by DR.K.MALLIKARJUNA RAO PDFdr_mallikarjunaraoNo ratings yet

- SP Steel - InvoiceDocument2 pagesSP Steel - Invoiceaniketshaw228No ratings yet

- Direct Tax - Set 1Document1 pageDirect Tax - Set 1ryzen5173No ratings yet

- LD Invoice 6000094212 4000230954 BHELDocument1 pageLD Invoice 6000094212 4000230954 BHELSimhadri StoresNo ratings yet

- Feb 1Document1 pageFeb 1Dhaneswar MajhiNo ratings yet

- Muhammad Alamgeer Sahibzada 5 10 HV FinalDocument1 pageMuhammad Alamgeer Sahibzada 5 10 HV FinalasadNo ratings yet

- Consultancy Bill Period Mar'23Document1 pageConsultancy Bill Period Mar'23shubham paulNo ratings yet

- Tally Prime Smart Solutions Project - Lesson 1 To 3Document18 pagesTally Prime Smart Solutions Project - Lesson 1 To 3pave.scgroupNo ratings yet

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- Tally - Jul'19 - Set 2Document1 pageTally - Jul'19 - Set 2Asok DasNo ratings yet

- Eastern Systems & Services: Kolkata-700 016Document7 pagesEastern Systems & Services: Kolkata-700 016abhisek royNo ratings yet

- Adobe Scan 15 Dec 2023Document1 pageAdobe Scan 15 Dec 2023gandhipl74No ratings yet