Professional Documents

Culture Documents

523-Article Text-1803-1-10-20230105

523-Article Text-1803-1-10-20230105

Uploaded by

Muhammad Harun al rasyidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

523-Article Text-1803-1-10-20230105

523-Article Text-1803-1-10-20230105

Uploaded by

Muhammad Harun al rasyidCopyright:

Available Formats

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Jurnal Manajemen dan Bisnis

Vol. 11, No. 2, Desember 2022, pp. 288-295

https://journal.stieindragiri.ac.id/index.php/jmbi/issue/view/25

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS,

CLIENT COMPANY SIZE, MANAGEMENT CHANGE AND KAP SIZE

ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange

for the 2017-2021 period)

Revi Arfamaini

Widya Kartika University, Surabaya

reviarfamaini@widyakartika.ac.id

Submited: 2022.12.23 Reviewed: 2023.01.03 Accepted: 2023.01.05

https://doi.org/10.34006/jmbi.v11i2.523

ABSTRACT

Auditor independence issue most often made debate of auditor rotation. This auditor rotation is related to

the company action to do auditor switching. This research empirically examines the effect of the audit opinion,

financial distress, size of client companies, management changes, and KAP size on Auditor switching on

manufacturing companies that are listed at the Indonesian Stock Exchange (IDX) from 2017 to 2021. This

research is explanatory quantitative research with a data collection technique using purposive sampling. A total

of 39 manufacturing firms are used as sample firms. This research uses the SPSS ver.18 application and uses

logistic regression to test the hypothesis because the independent variable is a combination of metric and no

metric. The result of this study indicates that the independent variable that affect the provision of auditor switching

is audit opinion. While other independent variables are financial distress, size of client companies, management

changes, and KAP size do not affect auditor switching.

Keywords: Auditor switching, voluntary, and KAP big four.

INTRODUCTION

Financial statements are the basis for those who use financial reports to make decisions. Financial reports

are needed by parties with an interest in the economic performance and success of the company, (2018:04).

Therefore, company management, especially companies going public, are responsible for presenting financial

reports fairly and for ratifying the financial reports reported to Bapepam-LK. The obligation to submit financial

reports has been stipulated in the Decree of the Minister of Industry and Trade of the Republic of Indonesia

Number 121/MPP/kep/2/2002 concerning provisions for submitting company annual financial reports that must

be audited by public accountants or government agencies or state high institutions that have the authority to issue

accounting reports. based on the applicable laws and regulations.

Auditors are required to act with integrity, objectivity and independent by the Public Accountant Professional

Standards (IAPI, 2018). Auditor independence began to be doubted after the case at Enron in December 2001

where KAP Arthur Andersen violated the code of ethics of the public accounting profession. From this case, the

United States government issued a law in 2002 called The Sarbanes-Oxley Act (SOX). In Indonesia, it is also

mandatory for companies to rotate auditors with the issuance of Minister of Finance Regulation Number

17/PMK.01/2008, which limits the period of service provision, namely that KAPs provide services for a maximum

of 6 (six) years and public accountants for a maximum of 3 (three) years. There is an obligation to rotate auditors,

so companies do auditor switching. Auditor switching is a transfer of auditors to other auditors carried out by

companies either mandatory or voluntary. If the company does voluntary auditor switching, what are the factors

that influence the company to change auditors before the time determined by the government? Several factors can

influence companies to switch auditors, including: audit opinion, financial distress, client company size,

management turnover, and KAP size.

Audit opinion influences auditor switching, this is proven in the research of Hudaib and Cooke (2005),

Hermawan and Fitriany (2020), and Buchari (2021), where Buchari (2021) states that if the auditor does not give

Vol. 11, No. 2, December 2022, pp. 288-295 288

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

an unqualified opinion (not with the company's expectations), Companies tend to move KAPs who may be able

to provide opinions by what the company expects.

Financial distressinfluencing auditor switching, this is proven in the research of Hudaib and Cooke (2005),

Sinarwati (2017), Hermawan and Fitriany (2020), where Sinarwati (2017) states that uncertainty in business for

companies that are threatened with bankruptcy (having financial difficulties) encourages companies to change

auditors.

The size of the client company affects auditor switching, this is proven in the research by Nasser et.al. (2005)

Prahartini (2020) Juliantari and Rasmini (2020), where Juliantari and Rasmini (2020) state that companies with

small total assets tend to move to non-big four KAPs, while companies with large total assets will move to big

four KAPs as their auditors.

Management changes affect auditor switching, this is proven in the research of Hudaib and Cooke (2005),

Wijayanti (2017), Wijayani and January (2018), Hermawan and Fitriany (2020), Olivia (2021), Priambardi and

Haryanto (2021) where Wijayanti ( 2017) stated that a change in management was also followed by a change in

company policy in selecting KAPs.

KAP size affects auditor switching, this is proven in research by Nasser et.al. (2006), Wijayanti (2017),

Wijayani and January (2018), Pratitis (2019), Aprilia (2020), Juliantari and Rasmini (2020), and Buchari (2021),

where Buchari (2021) states that companies that have not used KAP big four services have the possibility of

switching auditors KAP big four have a high quality so that high reputation companies owned by big four KAPs

generate positive reactions from investors.

LITERATURE REVIEW

Agency Theory

Agency theory is theoretical evidence regarding auditor switching. According to Olivia (2021), agency

relationship is a contract in which one or more people (principal) involve another person (agent) to perform some

services on their behalf and then delegate some decision-making authority to the agent where the principal is the

shareholders (shareholders). and those who act as agents are the management.

Switching Auditors

switching auditors the act of transferring auditors carried out by the company as one of the efforts used to

maintain the objectivity and independence of the auditor and to maintain public trust in the audit function due to

a long tenure. KAP replacement has two characteristics, namely voluntary and mandatory.

Audit Opinion

An audit opinion is an opinion submitted by the auditor after examining the company to assess the fairness

of the financial statements that have been made by management (Susanti, 2021). The following are several types

of accountant opinions according to (Agoes, 2019: 75). (1) Unqualified opinion. (2) Unqualified opinion with

explanatory discussion. (3) Opinion by exception. (4) Unfair opinion and (5) Disclaimer of opinion.

Financial Distress

Financial distress is the condition of a company that is experiencing financial difficulties. According to

Fahrudin (2021) that a company experiences financial distress if the company is unable to fulfill its financial

obligations, while Susanti (2021) states that the condition of a company that is threatened with bankruptcy tends

to increase the evaluation of auditor subjectivity and caution.

Client Company Size

According to Nabila (2018) The size of a client company is a scale that classifies the size of the company

related to the company's finances. Where large companies are believed to be able to solve the financial difficulties

they face more than small companies. In this case it is projected on total assets.

Change of Management

According to Olivia (2021), the term management refers to groups of individuals who actively plan,

coordinate, and control the course of client operations and transactions. In auditing, management appoints

company officials, supervisors, and key personnel as supervisors.

CAP size

According to Arsih (2015) states that audit quality can also be determined by the size of the Public

Accounting Firm itself, namely companies audited by KAPs that are included in the Big Four and KAPs that are

not included in the Big Four. The following auditors are included in the Big Four group, namely Olivia (2021)

and (Elder, 2020):

1. Delloite Touche Tohmatsu (Delloitte) is affiliated with Osman Bing Satrio & Partners.

2. Ernest & Young Global (EY) is affiliated with Purwanto, Sarwoko & Sandjaja, and Purwanto, Suherman &

Surja.

3. PricewaterhouseCoopers (PwC) is affiliated with Haryanto Sahari & Partners and Tanudiredja, Wibisana &

Partners.

4. Klyveld Peat Marwick Goerdeler (KPMG) is affiliated with Sidharta & Wijaya.

Vol. 11, No. 2, December 2022, pp. 288-295 289

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Previous Research

Hudaib and Cooke's (2005) research titled The Impact of Managing Director Changes and Financial Distress

on Audit Qualification and Auditor Switching which examines the effect of management change, financial

distress, and audit opinion on Auditor Switching was conducted on UK Listed companies between 1987 and 2001

using a stratified sampling method sampling and logistic regression analysis method with the results of audit

opinion research have a significant effect on auditor switching.

Chana Buchari and Marita (2017) research title Effect of KAP Size, Audit Opinion, Client Company Growth,

Management Change, and Client Company Size on Auditor Switching in manufacturing companies listed on the

IDX period (2007-2019) with purposive sampling method and analytical method logistic regression with the

results of audit opinion and client company size affect auditor switching. KAP size, client company growth, and

management change do not affect auditor switching.

Luki Arsih (2015) research title Effect of Going Concern Opinion, KAP Size and Profitability on Auditor

Switching in real estate and property companies listed on the IDX for the 2008-2020 period using purposive

sampling method and logistic regression analysis method with research results All variables do not affect

switching auditors

1. Relationship of Audit Opinion to Auditor Switching

According to Wijayani and Juniarti (2018), qualified opinions tend to be less liked by clients. The company's

management will change the auditor because they give an unexpected audit opinion on the company's financial

statements and will look for an easier auditor.

H1 : Audit opinion has a positive effect on auditor switching.

2. Relationship of Financial Distress to Auditor Switching

Saraswati (2017) states that bankrupt companies more often switch KAP than non-bankrupt companies.

Uncertainty in business for companies that are threatened with bankruptcy (having financial difficulties) creates

conditions that encourage companies to switch KAPs. Significant financial difficulties affect companies

threatened with bankruptcy to switch KAP.

H2:Financial distresspositive effect on auditor switching.

3. Client Firm Size RelationshipAgainst Auditor Switching

Nabila (2018) shows that there is a positive relationship between company size and the selection of audit

firms that have high quality. The larger the size of the company, the higher the management's responsibility to

investors, therefore the company will change the auditor in the hope that the new auditor will be of higher quality

to produce financial reports with high credibility as a form of management's responsibility to investors.

H3:Firm size has a positive effect on auditor switching

4. Relationship between Management Change and Auditor Switching

Susanti (2021) states that management changes have a significant influence on auditor changes in a company.

Auditor switching can occur due to several things, namely if management is dissatisfied with the performance,

quality, and cost of the auditor or maybe management is looking for an auditor who agrees with the newly

established accounting method.

H4:Management change has a positive effect on auditor switching

5. The Relationship between KAP Size and Auditor Switching

The existence of the expertise factor in the services of large KAPs will determine the change of auditors by

companies so that companies prefer large KAPs. Large KAPs are considered to be more capable of maintaining

auditor independence compared to small KAPs because they have experience in providing various services for a

large number of clients so they do not depend on only certain clients (Priambardi and Haryanto, 2021).

H5 : KAP size has a negative effect on auditor switching

RESEARCH METHODS

This study uses explanatory quantitative research which explains the relationship between research variables

through hypothesis testing. The object of this study is manufacturing companies listed on the Indonesia Stock

Exchange for the period 2017 to 2021. In this study, the population used is manufacturing companies that have

gone public and are listed on the Indonesia Stock Exchange in the period 2017 to 2021 with a total of 126

manufacturing companies. The sampling technique this research used a purposive sampling technique which

obtained a sample of 39 manufacturing companies from 126 manufacturing companies that have gone public and

are listed on the Indonesia Stock Exchange in the period 2017 to 2021.www.idx.co.id)Data collection techniques

and instruments used are documentation from sources used, namely the company's financial reports that are used

as samples and by literature research.

Vol. 11, No. 2, December 2022, pp. 288-295 290

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

RESEARCH RESULTS AND DISCUSSION

Data analysis

The hypothesis in this study was tested using a logistic regression model (logistic regression). The aim is to

obtain a comprehensive picture of the effect of the independent variables, namely audit opinion, financial distress,

client company size, management turnover, and KAP size on the dependent variable, namely auditor switching.

Descriptive statistics

Descriptive statistical analysis was used to determine the description of research variables, namely audit

opinion, financial distress, client company size, management turnover, KAP size, and auditor switching. The

values seen from descriptive statistics are the maximum, minimum, mean, and standard deviation values.

Table 1

Descriptive statistics

N Min Max Means Std. Dev

SWITCHES 195 0 1 ,35 ,478

OPINION 195 0 1 ,37 ,485

FIDIS 195 -30,60 27.98 1.87 5,14

SIZE 195 17,61 31,17 26,28 2.83

CHANGE 195 0 1 ,19 ,393

NBFOUR 195 0 1 ,15 ,362

Valid N 195

Source: SPSS Outputs

The client company size variable has a mean greater than the standard deviation, meaning that the quality of

the variable data is quite good.

Assessing the Overall Model

The test is carried out by comparing the value between -2 Log Likelihood (-2LL) at the beginning (Block

Number = 0) with the value of -2 Log Likelihood (-2LL) at the end (Block Number = 1). The initial -2LL value

was 252.193. After entering the five independent variables, the final -2LL value decreased to 244.779. This

decrease in Likelihood (-2LL) indicates a better regression model or in other words the model is hypothesized to

be fit with the data.

Table 2

Assessing the Overall Model

Source: SPSS Outputs

Determination Coefficient Test Results

The value of the coefficient of determination in the logistic regression model is indicated by the Nagelkerke

R Square value. Nagelkerke R Square is 0.051, which means that the variability of the dependent variable that can

be explained by the independent variables is 5.1%, while the remaining 94.9% is explained by other variables

outside the research model.

Table 3

Coefficient of Determination

Summary models

step -2 log likelihoods Cox & Snell R Square Nagelkerke R Square

1 244,779a ,037 .051

Source: SPSS Outputs

Vol. 11, No. 2, December 2022, pp. 288-295 291

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Regression Model Feasibility Test Results

Table 4

Regression Model Feasibility Test

Hosmer and Lemeshow Test

step Chi-square Df Sig.

1 12,933 8 , 114

Source: SPSS Outputs

Hosmer and Lameshow's Test results. The test shows a Chi-Square value of 12.933 with a significance (p)

of 0.114. Based on these results, because the significance value is greater than 0.05, which means hypothesis 0

(H0) cannot be rejected (accepted), it can be concluded that the model is capable of predicting the observed value

or the model is acceptable because it matches the observation data so that this model can be used for further

analysis.

Multicollinearity Test Results

A good regression model is a regression with no strong correlation between the independent variables. The

following results show that there is no correlation coefficient between variables whose value is greater than 0.8,

so there are no serious symptoms of multicollinearity between the independent variables (Fahrudin, 2021).

Table 5

Multicollinearity Test

Source: SPSS Outputs

Classification Matrix Results

Table 6

Classification Matrix

Classification Tablea

Observed predicted

SWITCHES Presentation Correct

0 1

Step 1 SWITCHES 0 124 3 97.6

1 61 7 10,3

Overall Percentage 67,2

Source: SPSS Outputs

The predictive power of the regression model to predict the likelihood of a company switching auditors is

10.3%. This shows that by using the regression model used, there are as many as 7 companies (10.3%) which are

predicted to perform auditor switching out of a total of 68 companies that carry out auditor switching. The

predictive power of the model for companies that do not switch auditors is 97.6%, which means that with the

regression model used there are 124 companies (97.6%) that are predicted not to perform auditor switching out of

a total of 127 companies that do not switch auditors.

Vol. 11, No. 2, December 2022, pp. 288-295 292

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Regression Test Results

Table 7

Logistic Regression Models

Variables in the Equation

B SE Wald Df Sig. Exp(B)

Step 1a OPINION ,734 ,312 5,536 1 ,019 2,082

FIDIS -.037 .033 1,292 1 ,256 ,963

SIZE ,020 .056 ,125 1 ,724 1.020

CHANGE , 192 ,388 ,244 1 ,621 1,211

NBFOUR -,242 ,440 ,302 1 ,583 ,785

Constant -1.371 1,492 ,844 1 ,358 ,254

Source: SPSS Outputs

The results of testing the regression coefficients produce the following models:

SWITCH =-1.371 + 0.734 OPINION – 0.37FIDIS + 0.020 SIZE + 0.192 CHANGE – 0.242 NBFOUR

DISCUSSION

Effect of Audit Opinion (OPINI) on Auditor Switching (SWITCH)

The audit opinion variable shows a positive regression coefficient of 0.734 with a significance level (p) of

0.019, less than α = 5%. Because the significance level (p) is less than α = 5%, the 1st hypothesis is successfully

supported. This study succeeded in proving that audit opinion has an effect on auditor switching. The results of

this study support the research results of Hudaib and Cooke (2005), Hermawan and Fitriany (2020) and Buchari

(2021).

Buchari (2021) states that if the auditor does not provide an unqualified opinion (not with the company's

expectations), the company tends to move KAP which might be able to provide an opinion in accordance with the

company's expectations. The company's management will change the auditor because they give an unexpected

audit opinion on the company's financial statements and will look for an easier auditor (Wijayani and Juniarti,

2018).

Effect of Financial Distress (FIDIS) on Auditor Switching (SWITCH)

The financial distress variable shows a negative regression coefficient of 0.037 with a significance level (p)

of 0.256, greater than α = 5%. Because the significance level (p) is greater than α = 5%, the second hypothesis is

not supported. This study failed to prove the effect of financial distress on auditor switching. The results of this

study support the results of research by Wijayanti (2017), Wijayani and Januarti (2018), Pratitis (2019), Aprilia

(2020) Olivia (2021), Priambardi and Haryanto (2021) .

Financial distressdoes not affect auditor switching because the company's poor financial condition is not a

reason for companies to conduct auditor switching because most of the companies sampled use Non Big Four

KAP services, thus auditor switching to using Big Four KAP services will further worsen the company's financial

condition due to increased services audit (Wijayanti, 2017). In addition, according to (Olivia, 2021) auditees who

experience an unhealthy financial position are more likely to bind their auditors to maintain the trust of

shareholders and creditors and reduce litigation risk.

Effect of Client Firm Size (SIZE) on Auditor Switching (SWITCH)

The client company size variable shows a positive regression coefficient of 0.020 with a significance level

(p) of 0.724, greater than α = 5%. Because the significance level (p) is greater than α = 5%, the 3rd hypothesis is

not supported. This study failed to prove the effect of client company size on auditor switching. The results of this

study support the results of research by Wijayanti (2017), Wijayani and Januarti (2018), Pratitis (2019), Buchari

(2021), Priambardi and Haryanto (2021) and Fahrudin (2021).

Wijayanti (2017) states that clients with small total assets tend to move to Non Big Four KAPs, while clients

with large total assets still choose Big Four KAPs as their auditors, which reflects the compatibility between the

KAP and their clients. The results of this failed study are suspected because most of the research sample consists

of clients with small total assets and most of them have used non-big four KAPs so that there is no tendency to

switch auditors.

Effect of Change of Management (CHANGE) on Auditor Switching (SWITCH).

The management turnover variable shows a positive regression coefficient of 0.192 with a significance level

(p) of 0.621, greater than α = 5%. Because the significance level (p) is greater than α = 5%, the 4th hypothesis is

not supported. This study failed to prove that there was an effect of management change on auditor switching.

The results of this study support the results of research by Aprilia (2020), Prahartini (2020), Juliantari and Rasmini

(2020), Buchari (2021) and Fahrudin (2021).

The results of the study show that a change in management is not always followed by a change in company

policy in using the services of a KAP. This shows that the old KAP accounting policies and reporting can still be

aligned with the new management policies by renegotiating between the two parties (Prahartini, 2020).

Vol. 11, No. 2, December 2022, pp. 288-295 293

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Effect of KAP Size (NBFOUR) on Auditor Switching (SWITCH).

The KAP size variable shows a negative regression coefficient of 0.242 with a significance level (p) of 0.583,

greater than α = 5%. Because the significance level (p) is greater than α = 5%, the 5th hypothesis is not supported.

This study failed to prove that there was an effect of management change on auditor switching. The results of this

study support the results of the research of Priambardi and Haryanto (2021) and Arsih (2015).

According to Priambardi and Haryanto, (2021) if a company is audited by a Big Four KAP, then the company

tends to maintain Big Four KAPs rather than moving to Non-Big Four KAPs because KAPs with an excellent

reputation will build investor confidence and this is very good for the company.

CONCLUSION

1. The results of the logistic regression analysis test show that it is statistically proven that there is an effect of

audit opinion on auditor switching during five years of observation (2017-2021).

2. The results of the logistic regression analysis test show that it is statistically not proven that there is an effect

of financial distress on auditor switching during five years of observation (2017-2021).

3. The results of the logistic regression analysis test show that statistically it is not proven that there is an effect

of client company size on auditor switching during five years of observation (2017-2021).

4. The results of the logistic regression analysis test show that it is statistically not proven that there is an effect

of a change in management on auditor switching during the five years of observation (2017-2021).

5. The results of the logistic regression analysis test show that statistically it is not proven that there is an effect

of KAP size on auditor switching during five years of observation (2017-2021).

REFERENCE

Agoes, Sukrisno (2019), Auditing: Practical Instructions for Examining Accountants by Public Accountants,

Fourth Edition, Salemba Empat, Jakarta.

Aprilia, E (2020), Analysis of Factors Influencing Auditor Switching, Accounting Analysis Journal, Vol.02,

No.02.

Arsih, L (2015), Effect of Going Concern Opinion, KAP Size and Profitability on Auditor Switching, Semarang

State University Thesis.

Baroroh, Ali (2020), Multivariate and Time Series Analysis with SPSS 21, PT. Gramedia, Jakarta.

Buchari, C (2021), The Effect of KAP Size, Audit Opinion, Client Company Growth, Management Change and

Client Company Size on Auditor Change, Accounting Journal.Vol.02. No.02, ISSN: 2303-2235.

Elder, RJ, Beasly, MS, Arens, AA and Jusuf AA (2020), Audit and Assurance Services, First Edition, Salemba

Empat, Jakarta.

Fahrudin, S (2021), Analysis of the Factors Influencing the Change of Public Accounting Firms, Thesis of Syarif

Hidayatullah State Islamic University.

Ghozali, Imam (2018), Application of Multivariate Analysis with the IBM SPSS 19 Program, Fifth Edition,

Diponegoro University, Semarang.

Hermawan, DA and Fitriany (2020), Analysis of Factors Influencing Upgrade, Downgrade and Samegrade Public

Accountant Office Changes in Companies Listed on the Indonesian Stock Exchange (IDX), Manado XVI

National Accounting Symposium 2020.

Hudaib, Mohammad and Cooke, TE (2005), The Impact of Managing Director Changes and Financial Distress

on Audit Qualification and Auditor Switching, Journal of Business Finance & Accounting, Vol.32 No. 9

& 10.

Juliantari, NW A & Rasmini, N. K (2020), Auditor Switching and Factors Affecting It, E-Journal of Accounting

at Udayana University, Vol.03. No.03, ISSN: 2302-8556

Minister of Industry and Trade. 2002, Decree of the Minister of Industry and Trade of the Republic of Indonesia

Number 121/MPP/kep/2002 concerning "Provisions for Submission of Financial Statements" Jakarta.

Lubis, AI (2021), Behavioral Accounting, Second Edition, Salemba Empat, Jakarta.

Minister of Finance (2003), Decree of the Minister of Finance Number 423/KMK.06/2002 jo 359/KMK.06/2003

concerning "Public Accountant Services". Jakarta.

Minister of Finance (2008), Regulation of the Minister of Finance Number 17/PMK.01/2008 concerning “Public

Accountant Services”. Jakarta.

Merchat, KA and Stede WAV (2021), Management Control Systems, Third Edition, Salemba Empat, Jakarta.

Nabila (2018), Factors Influencing Auditor Switching, Diponegoro University Thesis.

Nasser, ATA, Wahid, EA, Nazri, SNFSM and Hudaib, M (2005), Auditor-Client Relationship: The Case of Audit

Tenure and Auditor Switching in Malaysia, Managerial Auditing Journal, Vol. 21 No. 7: 721-737

Olivia. (2021), Analysis of Factors Influencing Auditor Switching in Manufacturing Companies Registered on

the IDX, Hasanuddin University Thesis.

Vol. 11, No. 2, December 2022, pp. 288-295 294

https://doi.org/10.34006/jmbi.v11i2.523

THE INFLUENCE OF AUDIT OPINION, FINANCIAL DISTRESS, CLIENT COMPANY SIZE, MANAGEMENT CHANGE

AND KAP SIZE ON AUDITOR SWITCHING

(Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2017-2021 period)

(Arfamaini)

Pradita, SAP (2015), Analysis of Auditor-Client Relationships: Factors Influencing Auditor Switching,

Diponegoro University Thesis.

Prahartini, FA (2020), Analysis of Factors Influencing Auditor Switching, Thesis of Syarif Hidayatullah State

Islamic University Jakakarta.

Pratitis, YT (2019), Auditor Switching: Analysis Based on Firm Size, Client Size and Financial Distress,

Accounting Analysis Journal, Vol.01, No.01.

Priambardi, R. B & Haryanto (2021), Determinants of Auditor Switching in Non-Financial Companies,

Diponegoro Journal Of Accounting. Vol.03. No. 03. ISSN: 2337-3806

Reeve, JM Warren, CS Jonathan .ED (2018), Introduction to Accounting, Salemba Empat, Jakarta.

Sinarwati, NK (2017), Why Manufacturing Companies Registered on the IDX Change Public Accounting Firms,

National Symposium on Accounting XIII Purwokwrto 2017.

Sugiono (2021), Quantitative Research, Qualitative R & D, Alfa Beta, Yogyakarta.

Susanti, SI (2021), Factors Influencing Auditor Switching, Diponegoro University Thesis.

Tuanakotta.TM (2015), Contemporary Audit, Salemba Empat, Jakarta.

Government of the Republic of Indonesia (2015), Government Regulation of the Republic of Indonesia Number

20 of 2015 concerning "Public Accountant Practice", Jakarta.

Wijayani, E. D & Januarti, I (2018), Analysis of Factors Influencing Companies in Indonesia Conducting Auditor

Switching, XIV Aceh National Symposium on Accounting 2018.

Wijayanti, M. P (2017), Analysis of Auditor-Client Relationships: Factors Influencing Auditor Switching in

Indonesia, Diponegoro University Thesis.

Vol. 11, No. 2, December 2022, pp. 288-295 295

https://doi.org/10.34006/jmbi.v11i2.523

You might also like

- Business Plan:: Nzyoki Janet MutanuDocument6 pagesBusiness Plan:: Nzyoki Janet MutanuDAN0% (1)

- Audit Quality On Earnings Management and Firm ValueDocument14 pagesAudit Quality On Earnings Management and Firm ValueKezia Olivia Tiffany HalimNo ratings yet

- Date: Mon, 28 Jul 2003 12:37:35 - 0400 From: "" 4fDocument4 pagesDate: Mon, 28 Jul 2003 12:37:35 - 0400 From: "" 4f9/11 Document ArchiveNo ratings yet

- Astronomy Math EquationsDocument12 pagesAstronomy Math EquationsLijin Chen100% (6)

- Artike Kedua STIEDocument11 pagesArtike Kedua STIEdarmiati indahNo ratings yet

- Jurnal Acuan Dan Hasil Turnitin - Clara Hiasinta Putri (170423292) PDFDocument130 pagesJurnal Acuan Dan Hasil Turnitin - Clara Hiasinta Putri (170423292) PDFhiasintaNo ratings yet

- 309-Article Text-1894-6-10-20220429Document10 pages309-Article Text-1894-6-10-20220429Bryan GPNo ratings yet

- The Effect of Auditor Reputation, Prior Audit Opinion, Company Growth, Leverage and Liquidity On The Going Concern Audit Opinion Acceptance With Audit Switching As Moderating VariableDocument9 pagesThe Effect of Auditor Reputation, Prior Audit Opinion, Company Growth, Leverage and Liquidity On The Going Concern Audit Opinion Acceptance With Audit Switching As Moderating VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Jurnal Akuntansi, Keuangan, Dan Manajemen (Jakman) : Martini@budiluhur - Ac.idDocument14 pagesJurnal Akuntansi, Keuangan, Dan Manajemen (Jakman) : Martini@budiluhur - Ac.idsarah ahmadNo ratings yet

- Jurnal Akuntansi, Keuangan Dan Auditing, Vol.2 (No.1), 2022, Hal: 46-62Document17 pagesJurnal Akuntansi, Keuangan Dan Auditing, Vol.2 (No.1), 2022, Hal: 46-62Rusli RusliNo ratings yet

- Implementation of Regression Logistics For Audit SwitchingDocument21 pagesImplementation of Regression Logistics For Audit SwitchingAnnisa FithriNo ratings yet

- International Journal of Environmental, Sustainability, and Social Sciences ISSN 2720-9644 (Print) ISSN 2721-0871 (Online)Document5 pagesInternational Journal of Environmental, Sustainability, and Social Sciences ISSN 2720-9644 (Print) ISSN 2721-0871 (Online)aditeguhNo ratings yet

- The Effects of Audit LagDocument16 pagesThe Effects of Audit LagAfrizar PaneNo ratings yet

- Factors Affecting Going Concern Audit Opinions: Sarah Fitriani Istiqomah Prijanto PutriDocument9 pagesFactors Affecting Going Concern Audit Opinions: Sarah Fitriani Istiqomah Prijanto PutriaijbmNo ratings yet

- Hidayawiya, Erlina, Isfenti SadaliaDocument12 pagesHidayawiya, Erlina, Isfenti SadaliaADELIA FILDZAH NADHILAHNo ratings yet

- 2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesDocument22 pages2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesasmeldiNo ratings yet

- Integration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceDocument7 pagesIntegration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 68-Article Text-119-1-10-20180217 PDFDocument10 pages68-Article Text-119-1-10-20180217 PDFAndiarfanNo ratings yet

- Ijsar 6048 PDFDocument10 pagesIjsar 6048 PDFInsyiraah Oxaichiko ArissintaNo ratings yet

- 121-Article Text-182-2-10-20191016Document10 pages121-Article Text-182-2-10-20191016shahfira yassmienNo ratings yet

- The Influence of Solvability, Profitability, and Prior Audit Opinion On Going Concern Audit OpinionDocument6 pagesThe Influence of Solvability, Profitability, and Prior Audit Opinion On Going Concern Audit OpinionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesDocument7 pagesThe Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesAJHSSR JournalNo ratings yet

- Article A9Document13 pagesArticle A9fisayobabs11No ratings yet

- 10 1108 - Ajar 09 2020 0078Document13 pages10 1108 - Ajar 09 2020 0078Melvin ZhenNo ratings yet

- Jurnal 7Document14 pagesJurnal 7lalu wira juniartaNo ratings yet

- Artikel 1 EnglishDocument16 pagesArtikel 1 Englishagnes novitaNo ratings yet

- 4659-Article Text-3088-1-10-20161202Document17 pages4659-Article Text-3088-1-10-20161202DeviLasria HsgNo ratings yet

- Evidence FromDocument16 pagesEvidence FromInes KatebNo ratings yet

- 348-Article Text-1570-1-10-20210202Document10 pages348-Article Text-1570-1-10-20210202Ainin NikmahNo ratings yet

- Denny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaDocument8 pagesDenny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaKarina AprilliaNo ratings yet

- 716-Article Text-1111-1-10-20190731Document16 pages716-Article Text-1111-1-10-20190731Ranho JaelaniNo ratings yet

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulNo ratings yet

- Jurnal Dirvi Surya Abbas 2Document18 pagesJurnal Dirvi Surya Abbas 2VictorOtonekwuNo ratings yet

- Jurnal Dirvi Surya Abbas 4Document21 pagesJurnal Dirvi Surya Abbas 4Lionnel AkisNo ratings yet

- Rida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaDocument8 pagesRida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaTJPRC PublicationsNo ratings yet

- 1295-Article Text-4598-1-10-20220728Document16 pages1295-Article Text-4598-1-10-20220728Amanda KarinNo ratings yet

- YaDocument18 pagesYaAnnisya KaruniawatiNo ratings yet

- Influence of Profitability Solvability and CompanyDocument9 pagesInfluence of Profitability Solvability and CompanyAhlamNo ratings yet

- Audit OpinionDocument10 pagesAudit OpinionichwanNo ratings yet

- 4490-File Utama Naskah-4764-2-10-20211109Document19 pages4490-File Utama Naskah-4764-2-10-20211109FaradillaNo ratings yet

- MTA & Fadhillah. Published in JAATDocument8 pagesMTA & Fadhillah. Published in JAATMuhammad TaufikNo ratings yet

- The Role of Firm Size As A Moderating Variable On The Effect of Working Capital Management On The Profitability of Public Companies in IndonesiaDocument16 pagesThe Role of Firm Size As A Moderating Variable On The Effect of Working Capital Management On The Profitability of Public Companies in Indonesiaindex PubNo ratings yet

- Mashita Suryani 200302049Document9 pagesMashita Suryani 200302049Mashita SuryaniNo ratings yet

- Jurnal Uts A2Document12 pagesJurnal Uts A2Maulidiah PutriNo ratings yet

- 6849 19992 2 PBDocument12 pages6849 19992 2 PBsarah ahmadNo ratings yet

- Fea76paper 4Document16 pagesFea76paper 4Chai ChaiNo ratings yet

- Pengaruh Good Corporate Governance Terhadap KualitasDocument8 pagesPengaruh Good Corporate Governance Terhadap KualitasOpiNo ratings yet

- Corporate Diversification and Financial Performance of Listed Firms in Kenya: Does Firm Size Matter?Document13 pagesCorporate Diversification and Financial Performance of Listed Firms in Kenya: Does Firm Size Matter?Widuri PutriNo ratings yet

- Effect of Internal AuditDocument11 pagesEffect of Internal AuditFontam BorisNo ratings yet

- IAR Journal of Business ManagementDocument7 pagesIAR Journal of Business ManagementfiraalyapNo ratings yet

- Pengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturDocument10 pagesPengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturHanny FadhillahNo ratings yet

- Jurnal GCGDocument19 pagesJurnal GCGRafi astonugrohoNo ratings yet

- Kholipah & Suryandari (2019)Document14 pagesKholipah & Suryandari (2019)Riyandi JoshuaNo ratings yet

- 3682-Article Text-13514-1-10-20210304Document16 pages3682-Article Text-13514-1-10-20210304shellajun22No ratings yet

- Jurnal Konsentrasi Manajemen KeuanganDocument12 pagesJurnal Konsentrasi Manajemen Keuanganangelina chandraNo ratings yet

- The Impact of Financial Restatement On Auditor Changes: Iranian EvidenceDocument25 pagesThe Impact of Financial Restatement On Auditor Changes: Iranian EvidencehiasintaNo ratings yet

- 334-Article Text-685-1-10-20210419Document17 pages334-Article Text-685-1-10-20210419Ainin NikmahNo ratings yet

- Agency Theory - 84391Document9 pagesAgency Theory - 8439101022682327001No ratings yet

- Pengaruh Provit Likuid Solvabilitas Terhadap Opini GCDocument32 pagesPengaruh Provit Likuid Solvabilitas Terhadap Opini GCHanny FadhillahNo ratings yet

- Ilmiah SekaliDocument22 pagesIlmiah SekaliyayaNo ratings yet

- ID Analisis Faktor Faktor Yang Mempengaruhi Pergantian Kantor Akuntan Publik AuditoDocument15 pagesID Analisis Faktor Faktor Yang Mempengaruhi Pergantian Kantor Akuntan Publik Auditosarah ahmadNo ratings yet

- 2145-Article Text-6578-1-10-20210331Document15 pages2145-Article Text-6578-1-10-20210331MujahidinNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Comprehensive QuestionsDocument6 pagesComprehensive QuestionsManu ShankarNo ratings yet

- Application For Employment/Cv/ Applied For The Position Of: Applied Location: BahrdarDocument3 pagesApplication For Employment/Cv/ Applied For The Position Of: Applied Location: BahrdarYemesrach AchaNo ratings yet

- Module 2Document15 pagesModule 2Jemarie LagadoNo ratings yet

- Moody's - Government of ArgentinaDocument28 pagesMoody's - Government of ArgentinaCronista.com100% (1)

- Facebook Complaint by Pensioners and Construction UnionDocument390 pagesFacebook Complaint by Pensioners and Construction UnionGMG EditorialNo ratings yet

- 386 Advertisement Police Constable Sukkur Region PDFDocument1 page386 Advertisement Police Constable Sukkur Region PDFKhaLid Sarwar0% (1)

- iOS 6.1.6 Untethered Jailbreak - P0sixspwn Update Released On CydiaDocument4 pagesiOS 6.1.6 Untethered Jailbreak - P0sixspwn Update Released On CydiaReynaldo AmadoNo ratings yet

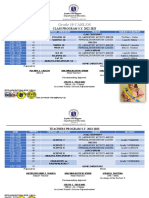

- Class and Teachers ProgramDocument2 pagesClass and Teachers ProgramKath BlancoNo ratings yet

- Brockton School Officials Asking Gov. Healey For National Guard Support To Stop Potential Tragedy'Document2 pagesBrockton School Officials Asking Gov. Healey For National Guard Support To Stop Potential Tragedy'Boston 25 DeskNo ratings yet

- Axial - CEO Guide To Debt FinancingDocument29 pagesAxial - CEO Guide To Debt FinancingcubanninjaNo ratings yet

- Surat Keterangan Pindah Rayon - PDFDocument9 pagesSurat Keterangan Pindah Rayon - PDFxerzesNo ratings yet

- Assignment No.7Document3 pagesAssignment No.7utkarshdanane4554No ratings yet

- WAMU Servicer GuideDocument136 pagesWAMU Servicer GuideHolly Hill100% (2)

- Sa Sept10 Ias16Document7 pagesSa Sept10 Ias16Muiz QureshiNo ratings yet

- Criminal Record Check-2018Document1 pageCriminal Record Check-2018api-268660135No ratings yet

- Appellant Side 1Document37 pagesAppellant Side 1Ashutosh Parvate67% (6)

- Voters Education (Ate Ann)Document51 pagesVoters Education (Ate Ann)Jeanette FormenteraNo ratings yet

- Report PDFDocument2 pagesReport PDFJBStringerNo ratings yet

- Tendernotice 1 PDFDocument3 pagesTendernotice 1 PDFark consultants maduraiNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- CompTIA Security+ SY0-501 ExamDocument12 pagesCompTIA Security+ SY0-501 Examsmantha sin100% (5)

- The Tamil Nadu Government Servants' Conduct Rules, 1973update Mar 10Document42 pagesThe Tamil Nadu Government Servants' Conduct Rules, 1973update Mar 10RAJAGURU.VNo ratings yet

- LTI ProgramDocument2 pagesLTI ProgramsplashlightningNo ratings yet

- Theoretical Perspectives of Corporate Governance: and Economics, 3 (4), 166-175Document10 pagesTheoretical Perspectives of Corporate Governance: and Economics, 3 (4), 166-175Naod MekonnenNo ratings yet

- Principal Deputy - Office of The National Coordinator For Health Information TechnologyDocument3 pagesPrincipal Deputy - Office of The National Coordinator For Health Information TechnologyBrian AhierNo ratings yet

- Cocacola Analisis PestDocument3 pagesCocacola Analisis PestJesus FnxNo ratings yet

- EMTL Lecture ScheduleDocument2 pagesEMTL Lecture ScheduleSrinivas SamalNo ratings yet