Professional Documents

Culture Documents

Salary Mock Solution - March-24

Salary Mock Solution - March-24

Uploaded by

syedameerhamza762Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Mock Solution - March-24

Salary Mock Solution - March-24

Uploaded by

syedameerhamza762Copyright:

Available Formats

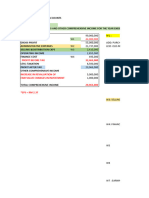

CAF-02: TAX PRACTICES

TOPIC: SALARY

MOCK SOLUTION

Answer # 01:

Taxpayer: Mr. Khan

Tax Year : NTY-2024

Residential Status: Resident Individual

(A) SALARY

- Basic Salary (300,000*6) 1,800,000

- Conveyance Allowance (50,000*6) 300,000

- Medical Allowance (10,000*6) 60,000

- Accomodation of housing

Higher of:

Fair market rent (100,000*6) 600,000

45% of B. Salary (45%*300,000*6) 810,000 810,000

- Accomodation of Car 50,000

(2,000,000*5%)*6/12

- Interest free loan 125,000

(2,500,000*10%*6/12)

- Loan waived by employer 625,000

(2,500,000*25%)

- Compensation under redundancy scheme 4,000,000

- Gratuity under unapproved gratuity scheme 1,925,000

(2,000,000-75,000) - SBOI

- Purchase of Car (1,500,000-1,000,000) 500,000

- Employee share Scheme 500,000

Amount Chargeable 10,695,000

Add: Exempt Income (75,000+180,000) 255,000

TOTAL INCOME 10,950,000

Less: Exempt Income (255,000)

TAXABLE INCOME 10,695,000

Separate Block of Income 1,925,000

Other than SBOI 8,770,000

Tax Liability (W-1) 2,334,000

Less: Advance Tax (1,837,000)

Tax Payable 497,000

W-1: Tax Liability

SBOI (1,925,000*14%) 269,500

Other than SBOI (1,095,000+35%(2,770,000) 2,064,500

Tax Liability 2,334,000

Answer # 02:

Taxpayer: Mr. Salman

Tax Year : NTY-2023

Residential Status: Resident Individual

(A) SALARY

- Basic Salary 2,400,000

- House Rent Allowance 600,000

- Annual Bonus 480,000

- Free Meals while on duty -

- Staff Discount 40,000

- Health Insurance -

- Accomodation of Car (2,000,000*5%) 100,000

- ESOS (12,000*(110-98) 144,000

- PF Contribution

Contirbution made (2,400,000*8%) 192,000

Less: Exempt - Lower of

Rs. 150,000 - 150,000

1/10th of 2,400,000 - 240,000 (150,000) 42,000

- PF Interest

Interest charged (960,000*22%) 211,200

Less: Exempt - Higher of

16%*960,000 - 153,600

1/3rd of 2,400,000 - 800,000 (800,000) -

- Culinary Chef course -

Travelling Allowance - not spent on behalf of the emplyer (250,000-100,000 150,000

Amount Chargeable 3,956,000

Add: Exempt Income (70,000+450,000+150,000+211,200) 881,200

TOTAL INCOME 4,837,200

Less: Exempt Income (881,200)

TAXABLE INCOME 3,956,000

Tax Liability (435,000+(3,956,000-3,600,000)*27.5%) 532,900

Less: Advance withholding Tax (400,000)

Tax Payable 132,900

You might also like

- Duplicate For Transporter: Unicorn Infosolutions Pvt. Ltd. Unicorn Infosolutions Pvt. LTDDocument1 pageDuplicate For Transporter: Unicorn Infosolutions Pvt. Ltd. Unicorn Infosolutions Pvt. LTDpicrush2pmNo ratings yet

- Instructions Form 1023Document1 pageInstructions Form 1023helpinghandoutreach100% (1)

- 1702 Qjuly 2008Document2 pages1702 Qjuly 2008Chona MenorNo ratings yet

- Income Tax Calculator For BangladeshDocument10 pagesIncome Tax Calculator For Bangladeshmamun3139% (18)

- Tax Test-2 Solution S24Document3 pagesTax Test-2 Solution S24jackaslam062No ratings yet

- Tax Mock (SOL-24)Document9 pagesTax Mock (SOL-24)Ali nawazNo ratings yet

- Example 2 - Tax ComputationDocument19 pagesExample 2 - Tax ComputationAminul Islam RubelNo ratings yet

- CAF 2 Autumn 2023Document8 pagesCAF 2 Autumn 2023HareemNo ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Income Tax Numericals SolutionsDocument9 pagesIncome Tax Numericals SolutionsBrown BoiNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Question 19 and 20Document3 pagesQuestion 19 and 20syedameerhamza762No ratings yet

- Question 19 and 20Document3 pagesQuestion 19 and 20syedameerhamza762No ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- ACC TUTORIAL9 Chapter 6.5 (15-12-22)Document6 pagesACC TUTORIAL9 Chapter 6.5 (15-12-22)FATIN NABILAH KHAIRUL ANWARNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2020Document8 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2020Shamail AsimNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2021Document8 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2021Mueez NaseerNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- Tax667 - SS Feb 2023Document13 pagesTax667 - SS Feb 2023hilman100% (2)

- Salaried Tax Calculator Ay 23-24Document2 pagesSalaried Tax Calculator Ay 23-24Proddut BasakNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- 4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsDocument39 pages4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsKASHISH GUPTANo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- Solution Capital StatementDocument10 pagesSolution Capital StatementhilmanNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDocument5 pages9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- TDS by MonzurDocument5 pagesTDS by MonzurSyed Shahidullah Al MahfuzNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Taxation Assignment No 1Document8 pagesTaxation Assignment No 1Ha MimNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Solution Meriah Megahacc (1) IjulDocument11 pagesSolution Meriah Megahacc (1) IjulIzzul HafizNo ratings yet

- R2 TAX ML Solution CMA June 2020 Exam.Document6 pagesR2 TAX ML Solution CMA June 2020 Exam.Pavel DhakaNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Debt Restructuring AnswersDocument3 pagesDebt Restructuring AnswersEvangelyn Joy GalgoNo ratings yet

- Partnership AccountingDocument46 pagesPartnership AccountingAether SkywardNo ratings yet

- CH10 Long Term Decision Payongayong-3Document1 pageCH10 Long Term Decision Payongayong-3Nadi HoodNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Postemployment Benefits Wendy CompanyDocument6 pagesPostemployment Benefits Wendy CompanyArmelen DeloyNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- Income Tax Seminar Sum E21CO317Document2 pagesIncome Tax Seminar Sum E21CO317vidhyasri102003No ratings yet

- Questionn 3-Dec 2018Document4 pagesQuestionn 3-Dec 2018GIROLYDIA EDDYNo ratings yet

- Penjelasan Arus KasDocument6 pagesPenjelasan Arus KasREKA CHANNELNo ratings yet

- CAF-6 Mock Solution by SkansDocument6 pagesCAF-6 Mock Solution by SkansMuhammad YahyaNo ratings yet

- Government Budgeting Process Sample ProblemsDocument3 pagesGovernment Budgeting Process Sample ProblemsYasminNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetpalkwahNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- HealthifyMe TransfrmStudio InvoiceDocument1 pageHealthifyMe TransfrmStudio InvoiceLifekeepers FoundationNo ratings yet

- Solved Indicate Whether The Following Statements Are True or False ADocument1 pageSolved Indicate Whether The Following Statements Are True or False AAnbu jaromiaNo ratings yet

- Cement Bill Birla 14.05.2023Document1 pageCement Bill Birla 14.05.2023co ainisiNo ratings yet

- Https Asclepiuswellness - Com SalesPrint - Aspx Id 1127949Document1 pageHttps Asclepiuswellness - Com SalesPrint - Aspx Id 1127949Rider HK TiwariNo ratings yet

- Problem 15-4 Multiple ChoiceDocument3 pagesProblem 15-4 Multiple ChoiceMobi Dela CruzNo ratings yet

- GST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)Document15 pagesGST Notes GST Notes: LLB 3 Years (Karnataka State Law University) LLB 3 Years (Karnataka State Law University)swetha shree chavan mNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Handout - Ease of Paying Taxes (March 8, 2024)Document31 pagesHandout - Ease of Paying Taxes (March 8, 2024)atty.francis.angelo.lopezNo ratings yet

- Income and Expenditure of JakartaDocument10 pagesIncome and Expenditure of JakartaAlfi Nur LailiyahNo ratings yet

- 24-7 Intouch India Private LimitedDocument1 page24-7 Intouch India Private LimitedMohammed JunaidNo ratings yet

- Noice Sence BillDocument3 pagesNoice Sence BillAryan BahetiNo ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- PaySlips - June 2021 - May 2022Document12 pagesPaySlips - June 2021 - May 2022ahmed arifNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- 2009 Hotrum G Form 1040 Individual Tax Return - Tax2009Document15 pages2009 Hotrum G Form 1040 Individual Tax Return - Tax2009jakeNo ratings yet

- Payslip-RS Sentosa-Jul-2022-Nur Intan-OktaviyaniDocument1 pagePayslip-RS Sentosa-Jul-2022-Nur Intan-OktaviyaniDPD NASDEM Kab. BogorNo ratings yet

- No Plastic Packaging: Tax InvoiceDocument14 pagesNo Plastic Packaging: Tax InvoiceALOK RANANo ratings yet

- GSTDocument10 pagesGSTShubham JadhavNo ratings yet

- Commissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsDocument2 pagesCommissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsBrent TorresNo ratings yet

- VAT Assignment SolutionDocument2 pagesVAT Assignment SolutionJesus is LordNo ratings yet

- Return InvoiceDocument1 pageReturn InvoiceDiptimayeeGuptaNo ratings yet

- Santhi Excel PayslipDocument14 pagesSanthi Excel PayslipKJR XEROXNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanManish ChawdaNo ratings yet

- Airtech Systems (India) Pvt. LTD.: Salary Slip For The Month of October 2018Document1 pageAirtech Systems (India) Pvt. LTD.: Salary Slip For The Month of October 2018Mohsin ShaikhNo ratings yet

- Gaan, Donjhon Jan 16-31 PayrollDocument1 pageGaan, Donjhon Jan 16-31 PayrollDonjohn GaanNo ratings yet