Professional Documents

Culture Documents

FOREX With HEDGING Recognized Asset and Liab Illustrations

FOREX With HEDGING Recognized Asset and Liab Illustrations

Uploaded by

Lovely Jaze SalgadoCopyright:

Available Formats

You might also like

- ACCT 251 Practice Set 2021 - 1Document28 pagesACCT 251 Practice Set 2021 - 1Earl Justine FerrerNo ratings yet

- Chapter 9 - Audit of Liabilities RoqueDocument77 pagesChapter 9 - Audit of Liabilities RoqueCristina Ramirez91% (11)

- Advance Acctg Foreign Currency ProblemsDocument6 pagesAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- FinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDocument33 pagesFinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDaniel LópezNo ratings yet

- Stevenson, W. J. - Operations Management. (14th Ed.) - McGraw-Hill-Mcgraw-Hill (2021)Document164 pagesStevenson, W. J. - Operations Management. (14th Ed.) - McGraw-Hill-Mcgraw-Hill (2021)Mohit ChorariaNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- FOREXQUIZ2021Document6 pagesFOREXQUIZ2021rodell pabloNo ratings yet

- Moulton Corporation Engaged in The Following Seven Transactions During DecemberDocument1 pageMoulton Corporation Engaged in The Following Seven Transactions During Decembertrilocksp SinghNo ratings yet

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- Motor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreDocument1 pageMotor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreSheik SalmanNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Asmeet Singh BhatiaDocument20 pagesAsmeet Singh BhatiaUtkarsh KhandelwalNo ratings yet

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzNo ratings yet

- Accounting For Business Combinations Part 2 - Course AssessmentDocument8 pagesAccounting For Business Combinations Part 2 - Course AssessmentArn KylaNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- FOREX - LectureDocument4 pagesFOREX - LectureJEP WalwalNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- Advacc 3 Chapter 4fDocument3 pagesAdvacc 3 Chapter 4fMikol MikolNo ratings yet

- Quiz 3 - Problems & SollutionsDocument12 pagesQuiz 3 - Problems & SollutionsRiezel PepitoNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- Forex Exchange Rate Risk Review QuestionsDocument14 pagesForex Exchange Rate Risk Review QuestionsEdga WariobaNo ratings yet

- Mga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Document12 pagesMga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Hannah Jane UmbayNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- ForexDocument3 pagesForexhotdog kaNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- C7 Hedging Foreign Currency Exchange Rate Risk With AnswersDocument2 pagesC7 Hedging Foreign Currency Exchange Rate Risk With AnswerskimberlyroseabianNo ratings yet

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- Acctg405 Q6Document2 pagesAcctg405 Q6Baron MirandaNo ratings yet

- Foreign Currency - QuestionsDocument4 pagesForeign Currency - QuestionsMakita BatitaNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- Assignments 4Document4 pagesAssignments 4HabibaNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Aec 22 - Take Home Long Quiz: Trading SecuritiesDocument4 pagesAec 22 - Take Home Long Quiz: Trading SecuritiesOriel Ricky GallardoNo ratings yet

- Financial LiabilitiesDocument22 pagesFinancial LiabilitiesPeter Banjao100% (1)

- On August 1 Year 1 Huntington Corporation Placed An OrderDocument1 pageOn August 1 Year 1 Huntington Corporation Placed An OrderFreelance Worker0% (1)

- SỐ 26-30. KTTC3Document15 pagesSỐ 26-30. KTTC3Yen HaiNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Activity To PrintDocument2 pagesActivity To PrintJuly LumantasNo ratings yet

- Examples Self IFRS 9 PDFDocument9 pagesExamples Self IFRS 9 PDFErslanNo ratings yet

- AccountingDocument5 pagesAccountingMaitet CarandangNo ratings yet

- Test 2022Document2 pagesTest 2022dangkimtrang2002No ratings yet

- Soal GSLC-13 Advanced AccountingDocument7 pagesSoal GSLC-13 Advanced AccountingEunice ShevlinNo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Jun-10, Dec-10, Jun-11, Dec 11Document64 pagesJun-10, Dec-10, Jun-11, Dec 11Celena Daiton83% (6)

- Fund and Other Investments & DerivativesDocument4 pagesFund and Other Investments & DerivativesShaira BugayongNo ratings yet

- Week 2 Quiz - October 2016 - Intermediate Financial Reporting 5Document4 pagesWeek 2 Quiz - October 2016 - Intermediate Financial Reporting 5Huy Trần100% (1)

- Effect of Changes in Foreign Currency Exchange RatesDocument5 pagesEffect of Changes in Foreign Currency Exchange RatesArn KylaNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Unit 3 Hedging InstrumentDocument1 pageUnit 3 Hedging InstrumentAndrea BreisNo ratings yet

- Fa-Investment Accounting-Tybcom-Firoz SirDocument4 pagesFa-Investment Accounting-Tybcom-Firoz Sirmanoj parmarNo ratings yet

- Derivatives & HedgingDocument10 pagesDerivatives & HedgingKimberly IgnacioNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- Far QualifyingDocument6 pagesFar QualifyingErica FlorentinoNo ratings yet

- Summary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionFrom EverandSummary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionNo ratings yet

- Day Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)From EverandDay Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)No ratings yet

- How to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongFrom EverandHow to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongNo ratings yet

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- LESSON 1 Convention of Maritime PollutionDocument37 pagesLESSON 1 Convention of Maritime PollutionLovely Jaze SalgadoNo ratings yet

- LESSON 4 Principles of Environmental ProtectionDocument5 pagesLESSON 4 Principles of Environmental ProtectionLovely Jaze SalgadoNo ratings yet

- LESSON 3 MARPOL ConventionsDocument7 pagesLESSON 3 MARPOL ConventionsLovely Jaze SalgadoNo ratings yet

- Additional IllustrationsDocument3 pagesAdditional IllustrationsLovely Jaze SalgadoNo ratings yet

- Valves and FittingsDocument60 pagesValves and FittingsLovely Jaze SalgadoNo ratings yet

- LESSON 3.1 (Iron Ore and Pig Iron) (Autosaved)Document27 pagesLESSON 3.1 (Iron Ore and Pig Iron) (Autosaved)Lovely Jaze SalgadoNo ratings yet

- Oily Water Separator Operation (OWS) Group2Document14 pagesOily Water Separator Operation (OWS) Group2Lovely Jaze SalgadoNo ratings yet

- LESSON 2.2 (Elastic Material and Sample Problems)Document30 pagesLESSON 2.2 (Elastic Material and Sample Problems)Lovely Jaze SalgadoNo ratings yet

- LESSON 4.2 Types of Air CompressorDocument34 pagesLESSON 4.2 Types of Air CompressorLovely Jaze SalgadoNo ratings yet

- LESSON 4.1 Air Compressor and Its ComponentsDocument30 pagesLESSON 4.1 Air Compressor and Its ComponentsLovely Jaze SalgadoNo ratings yet

- Topic 3 ThyristorsDocument12 pagesTopic 3 ThyristorsLovely Jaze SalgadoNo ratings yet

- THYRISTORDocument26 pagesTHYRISTORLovely Jaze SalgadoNo ratings yet

- Binary Numeral SystemDocument72 pagesBinary Numeral SystemLovely Jaze SalgadoNo ratings yet

- Salgado, Lovely Jaze A. - Global Media CulturesDocument2 pagesSalgado, Lovely Jaze A. - Global Media CulturesLovely Jaze SalgadoNo ratings yet

- CA 1 Module I FinishDocument3 pagesCA 1 Module I FinishLovely Jaze SalgadoNo ratings yet

- Deck MachineriesDocument26 pagesDeck MachineriesLovely Jaze SalgadoNo ratings yet

- Oblicon - Chapter 1Document57 pagesOblicon - Chapter 1Lovely Jaze SalgadoNo ratings yet

- Drill PressDocument50 pagesDrill PressLovely Jaze SalgadoNo ratings yet

- Name: Salgado, Lovely Jaze A. Course & Year: Bsa 1B Kenken Puzzle. Solve Each of The Following Puzzles. Follow The Following RulesDocument1 pageName: Salgado, Lovely Jaze A. Course & Year: Bsa 1B Kenken Puzzle. Solve Each of The Following Puzzles. Follow The Following RulesLovely Jaze SalgadoNo ratings yet

- PHILIPPINE LITERATURE - The Scent of ApplesDocument6 pagesPHILIPPINE LITERATURE - The Scent of ApplesLovely Jaze SalgadoNo ratings yet

- Manual 3 - Federal Accounting System Chapter 10. TransactionsDocument47 pagesManual 3 - Federal Accounting System Chapter 10. TransactionsKumera Dinkisa ToleraNo ratings yet

- DONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutDocument603 pagesDONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutRita Cahill100% (1)

- Cooperative Bank of Surigao Del SurDocument4 pagesCooperative Bank of Surigao Del SurAnonymous iScW9lNo ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument13 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaYoonus MaheesNo ratings yet

- Pacana Vs Pascual LopezDocument2 pagesPacana Vs Pascual LopezJani MisterioNo ratings yet

- Bank Al Habib LTDPDFDocument82 pagesBank Al Habib LTDPDFAshif abaanNo ratings yet

- Chapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationDocument3 pagesChapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationCynthia CarranzaNo ratings yet

- Activity Statement For Joel Tendo Sheebe 04Dec2023-30Jan2024Document1 pageActivity Statement For Joel Tendo Sheebe 04Dec2023-30Jan2024Joel TendoNo ratings yet

- Sustainable Livelihood Framework SRDocument32 pagesSustainable Livelihood Framework SRS.Rengasamy100% (7)

- MR Economics SlidesDocument170 pagesMR Economics SlidesMahmud ShetuNo ratings yet

- File 5286Document2 pagesFile 5286Ash MarkNo ratings yet

- TN Bus Tender 2022 - TD Irt205138 RFP 1771 Diesel Bsvi Standard Floor DocumentDocument157 pagesTN Bus Tender 2022 - TD Irt205138 RFP 1771 Diesel Bsvi Standard Floor DocumentDisability Rights AllianceNo ratings yet

- Comp Himanshu Aggarwal 23-24Document4 pagesComp Himanshu Aggarwal 23-24prateek gangwaniNo ratings yet

- MBA 631rift Valley OutlineDocument4 pagesMBA 631rift Valley OutlineTatekia DanielNo ratings yet

- 24 GARS How To Make Slot Markets WorksDocument1 page24 GARS How To Make Slot Markets WorksW.J. ZondagNo ratings yet

- 7110 s08 Ms 2Document8 pages7110 s08 Ms 2meelas123No ratings yet

- Jextra FinalDocument3 pagesJextra Finalmd habibur rahmanNo ratings yet

- PDFDocument75 pagesPDFMd. Jahangir Alam100% (1)

- Chapter III Taxation and Depreciation AccountingDocument11 pagesChapter III Taxation and Depreciation AccountingJOHNNo ratings yet

- Bcip 2022Document241 pagesBcip 2022Akuntansi DhianNo ratings yet

- Which of The Following Is An Operating BudgetDocument3 pagesWhich of The Following Is An Operating Budgetshuvo dasNo ratings yet

- GM 016 344575 PDFDocument15 pagesGM 016 344575 PDFeunha allaybanNo ratings yet

- 75776bos61307 p7Document31 pages75776bos61307 p7wareva7754No ratings yet

- 5460Document70 pages5460alicewilliams83nNo ratings yet

FOREX With HEDGING Recognized Asset and Liab Illustrations

FOREX With HEDGING Recognized Asset and Liab Illustrations

Uploaded by

Lovely Jaze SalgadoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FOREX With HEDGING Recognized Asset and Liab Illustrations

FOREX With HEDGING Recognized Asset and Liab Illustrations

Uploaded by

Lovely Jaze SalgadoCopyright:

Available Formats

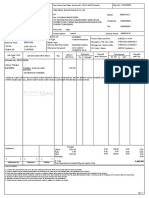

Forward Contracts – Exposed Liability/Asset

Illustration #1

hindinadeclare Company purchased chocolates from Thailand for

200,000 bahts on December 1, 20x9. Payment is due on January 30,

20y0. On December 1, 20x9, the company also entered into a 60-day

forward contract to purchase 200,000 bahts. The forward contract is

not designated as a hedge. The rates were as follows:

Requirement: Journal Entries.

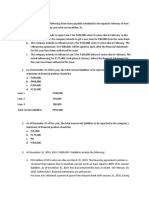

Illustration #2

Batmaypasok Enterprises purchases inventory of 1,000,000 foreign

currency units (FCUs) from a foreign supplier on August 13 with

payment due on November 1. Management of Batmaypasok Enterprises

immediately enters into a forward contract to hedge this

transaction. Batmaypasok prepares quarterly financial statements

with a December 31 year-end. The relevant exchange rates and forward

contract fair values are as follows:

Nov. 1 Forward Contract

Date Spot Rate Forward Rate Fair Value

Aug. 13 P1.116 P1.10 P 0

Sept. 30 P1.129 P1.126 P 6,000

Nov. 1 P1.138 P1.138 P18,000

2. What is the balance in the accounts payable account on August 13?

3. What is the balance in the accounts payable account on September 30?

4. What is the amount of the exchange loss recognized with respect to the

accounts payable account on September 30?

5. What is the balance in the accounts payable account on November 1,

immediately before collection?

6. What is the amount of the exchange loss recognized with respect to the

accounts payable account on November 1?

7. What is the balance in the forward contract account on August 13?

8. What is the balance in the forward contract account on September 30?

9. What is the amount of the exchange loss or gain recognized with respect

to the forward contract on September 30?

10. What is the balance in the forward contract account on November 1?

11. What is the amount of the exchange loss or gain recognized with respect

to the forward contract on November 1?

12. What is the net increase or decrease in cash flow from having entered

into this forward contract hedge?

13. What is the amount of premium or discount on forward contract?

Illustration #3

Umasa, Inc. placed an order for inventory costing 500,000 foreign

currency (FC) with a foreign vendor on April 15 when the spot rate

was 1 FC = P0.683. Stark received the goods on May 1 when the spot

rate was 1 FC = P0.687.

Also on May 1, Umasa entered into a 90-day forward contract to

purchase 500,000 FC at a forward rate of 1 FC = P0.693. Payment was

made to the foreign vendor on August 1 when the spot rate was 1 FC =

P0.696.

Umasa has a June 30 year-end. On that date, the spot rate was 1 FC =

P0.691, and the forward rate on the contract was 1 FC = P0.695.

Changes in the current value of the forward contract are measured as

the present value of the changes in the forward rates over time. The

relevant discount rate is 6%.

1. The foreign exchange gain on hedging instrument (forward contract) on

June 30 amounted to:

2. The nominal value of the forward contract on June 30 amounted to:

3. The fair value of the forward contract on June 30 amounted to:

4. The net decrease on Umasa Corp.’s net income on June 30 income statement

amounted to:

5. The foreign exchange gain due to hedging instrument (forward contract)

on August 1 amounted to:

Illustration #4

Kapukpukis Corp. (a Philippine-based company) sold parts to a foreign

customer on December 1, 20x9, with payment of 10 million foreign currencies

to be received on March 31, 20y0. The following exchange rates apply:

Dates Spot Rate Forward rate

(for 3/31/20y0)

December 1, 20x9 P.0035 P.0034 (4 months)

December 31, 20x9 .0033 .0032 (3 month)

March 31, 20y0 .0038 N/A

Kapukpukis Corp. incremental borrowing rate is 12 percent. The present

value factor for three months at an annual rate of interest of 12 percent

(1 percent per month) is 0.9706.

Assuming that Kapukpukis Corp. entered into no forward contract, how much

foreign exchange gain or loss should it report on its 20x9 income statement

with regard to this transaction?

Using the same information above and assuming that Kapukpukis Corp. entered

into a forward contract to sell 10 million foreign currencies on December

1, 20x9, as a fair value hedge of a foreign currency receivable, what is

the net impact on its net income in 20x9 resulting from a fluctuation in

the value of the foreign currencies?

You might also like

- ACCT 251 Practice Set 2021 - 1Document28 pagesACCT 251 Practice Set 2021 - 1Earl Justine FerrerNo ratings yet

- Chapter 9 - Audit of Liabilities RoqueDocument77 pagesChapter 9 - Audit of Liabilities RoqueCristina Ramirez91% (11)

- Advance Acctg Foreign Currency ProblemsDocument6 pagesAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- FinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDocument33 pagesFinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDaniel LópezNo ratings yet

- Stevenson, W. J. - Operations Management. (14th Ed.) - McGraw-Hill-Mcgraw-Hill (2021)Document164 pagesStevenson, W. J. - Operations Management. (14th Ed.) - McGraw-Hill-Mcgraw-Hill (2021)Mohit ChorariaNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- FOREXQUIZ2021Document6 pagesFOREXQUIZ2021rodell pabloNo ratings yet

- Moulton Corporation Engaged in The Following Seven Transactions During DecemberDocument1 pageMoulton Corporation Engaged in The Following Seven Transactions During Decembertrilocksp SinghNo ratings yet

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- Motor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreDocument1 pageMotor World Private Limited.: NANDI TOYOTA, 69/5, Bommanahalli, BangaloreSheik SalmanNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Asmeet Singh BhatiaDocument20 pagesAsmeet Singh BhatiaUtkarsh KhandelwalNo ratings yet

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzNo ratings yet

- Accounting For Business Combinations Part 2 - Course AssessmentDocument8 pagesAccounting For Business Combinations Part 2 - Course AssessmentArn KylaNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- FOREX - LectureDocument4 pagesFOREX - LectureJEP WalwalNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- Advacc 3 Chapter 4fDocument3 pagesAdvacc 3 Chapter 4fMikol MikolNo ratings yet

- Quiz 3 - Problems & SollutionsDocument12 pagesQuiz 3 - Problems & SollutionsRiezel PepitoNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- Forex Exchange Rate Risk Review QuestionsDocument14 pagesForex Exchange Rate Risk Review QuestionsEdga WariobaNo ratings yet

- Mga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Document12 pagesMga Dambieee!!!!: Complete Answer Pleaseee. Thank Youuu NO. Questions Answer 1 Answer 2 If Unsure Answer 1Hannah Jane UmbayNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- ForexDocument3 pagesForexhotdog kaNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- C7 Hedging Foreign Currency Exchange Rate Risk With AnswersDocument2 pagesC7 Hedging Foreign Currency Exchange Rate Risk With AnswerskimberlyroseabianNo ratings yet

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- Acctg405 Q6Document2 pagesAcctg405 Q6Baron MirandaNo ratings yet

- Foreign Currency - QuestionsDocument4 pagesForeign Currency - QuestionsMakita BatitaNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- Assignments 4Document4 pagesAssignments 4HabibaNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Aec 22 - Take Home Long Quiz: Trading SecuritiesDocument4 pagesAec 22 - Take Home Long Quiz: Trading SecuritiesOriel Ricky GallardoNo ratings yet

- Financial LiabilitiesDocument22 pagesFinancial LiabilitiesPeter Banjao100% (1)

- On August 1 Year 1 Huntington Corporation Placed An OrderDocument1 pageOn August 1 Year 1 Huntington Corporation Placed An OrderFreelance Worker0% (1)

- SỐ 26-30. KTTC3Document15 pagesSỐ 26-30. KTTC3Yen HaiNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Activity To PrintDocument2 pagesActivity To PrintJuly LumantasNo ratings yet

- Examples Self IFRS 9 PDFDocument9 pagesExamples Self IFRS 9 PDFErslanNo ratings yet

- AccountingDocument5 pagesAccountingMaitet CarandangNo ratings yet

- Test 2022Document2 pagesTest 2022dangkimtrang2002No ratings yet

- Soal GSLC-13 Advanced AccountingDocument7 pagesSoal GSLC-13 Advanced AccountingEunice ShevlinNo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Jun-10, Dec-10, Jun-11, Dec 11Document64 pagesJun-10, Dec-10, Jun-11, Dec 11Celena Daiton83% (6)

- Fund and Other Investments & DerivativesDocument4 pagesFund and Other Investments & DerivativesShaira BugayongNo ratings yet

- Week 2 Quiz - October 2016 - Intermediate Financial Reporting 5Document4 pagesWeek 2 Quiz - October 2016 - Intermediate Financial Reporting 5Huy Trần100% (1)

- Effect of Changes in Foreign Currency Exchange RatesDocument5 pagesEffect of Changes in Foreign Currency Exchange RatesArn KylaNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Unit 3 Hedging InstrumentDocument1 pageUnit 3 Hedging InstrumentAndrea BreisNo ratings yet

- Fa-Investment Accounting-Tybcom-Firoz SirDocument4 pagesFa-Investment Accounting-Tybcom-Firoz Sirmanoj parmarNo ratings yet

- Derivatives & HedgingDocument10 pagesDerivatives & HedgingKimberly IgnacioNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- Far QualifyingDocument6 pagesFar QualifyingErica FlorentinoNo ratings yet

- Summary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionFrom EverandSummary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionNo ratings yet

- Day Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)From EverandDay Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)No ratings yet

- How to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongFrom EverandHow to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongNo ratings yet

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- LESSON 1 Convention of Maritime PollutionDocument37 pagesLESSON 1 Convention of Maritime PollutionLovely Jaze SalgadoNo ratings yet

- LESSON 4 Principles of Environmental ProtectionDocument5 pagesLESSON 4 Principles of Environmental ProtectionLovely Jaze SalgadoNo ratings yet

- LESSON 3 MARPOL ConventionsDocument7 pagesLESSON 3 MARPOL ConventionsLovely Jaze SalgadoNo ratings yet

- Additional IllustrationsDocument3 pagesAdditional IllustrationsLovely Jaze SalgadoNo ratings yet

- Valves and FittingsDocument60 pagesValves and FittingsLovely Jaze SalgadoNo ratings yet

- LESSON 3.1 (Iron Ore and Pig Iron) (Autosaved)Document27 pagesLESSON 3.1 (Iron Ore and Pig Iron) (Autosaved)Lovely Jaze SalgadoNo ratings yet

- Oily Water Separator Operation (OWS) Group2Document14 pagesOily Water Separator Operation (OWS) Group2Lovely Jaze SalgadoNo ratings yet

- LESSON 2.2 (Elastic Material and Sample Problems)Document30 pagesLESSON 2.2 (Elastic Material and Sample Problems)Lovely Jaze SalgadoNo ratings yet

- LESSON 4.2 Types of Air CompressorDocument34 pagesLESSON 4.2 Types of Air CompressorLovely Jaze SalgadoNo ratings yet

- LESSON 4.1 Air Compressor and Its ComponentsDocument30 pagesLESSON 4.1 Air Compressor and Its ComponentsLovely Jaze SalgadoNo ratings yet

- Topic 3 ThyristorsDocument12 pagesTopic 3 ThyristorsLovely Jaze SalgadoNo ratings yet

- THYRISTORDocument26 pagesTHYRISTORLovely Jaze SalgadoNo ratings yet

- Binary Numeral SystemDocument72 pagesBinary Numeral SystemLovely Jaze SalgadoNo ratings yet

- Salgado, Lovely Jaze A. - Global Media CulturesDocument2 pagesSalgado, Lovely Jaze A. - Global Media CulturesLovely Jaze SalgadoNo ratings yet

- CA 1 Module I FinishDocument3 pagesCA 1 Module I FinishLovely Jaze SalgadoNo ratings yet

- Deck MachineriesDocument26 pagesDeck MachineriesLovely Jaze SalgadoNo ratings yet

- Oblicon - Chapter 1Document57 pagesOblicon - Chapter 1Lovely Jaze SalgadoNo ratings yet

- Drill PressDocument50 pagesDrill PressLovely Jaze SalgadoNo ratings yet

- Name: Salgado, Lovely Jaze A. Course & Year: Bsa 1B Kenken Puzzle. Solve Each of The Following Puzzles. Follow The Following RulesDocument1 pageName: Salgado, Lovely Jaze A. Course & Year: Bsa 1B Kenken Puzzle. Solve Each of The Following Puzzles. Follow The Following RulesLovely Jaze SalgadoNo ratings yet

- PHILIPPINE LITERATURE - The Scent of ApplesDocument6 pagesPHILIPPINE LITERATURE - The Scent of ApplesLovely Jaze SalgadoNo ratings yet

- Manual 3 - Federal Accounting System Chapter 10. TransactionsDocument47 pagesManual 3 - Federal Accounting System Chapter 10. TransactionsKumera Dinkisa ToleraNo ratings yet

- DONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutDocument603 pagesDONT TRUST THIS FG MINISTER, TRAITOR of The Housing Minister Simon Coveney Is A Landlord and He Is A Liar, Devious and Evil and Commodity Landlord Who Would Sell His Own Moother OutRita Cahill100% (1)

- Cooperative Bank of Surigao Del SurDocument4 pagesCooperative Bank of Surigao Del SurAnonymous iScW9lNo ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument13 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaYoonus MaheesNo ratings yet

- Pacana Vs Pascual LopezDocument2 pagesPacana Vs Pascual LopezJani MisterioNo ratings yet

- Bank Al Habib LTDPDFDocument82 pagesBank Al Habib LTDPDFAshif abaanNo ratings yet

- Chapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationDocument3 pagesChapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationCynthia CarranzaNo ratings yet

- Activity Statement For Joel Tendo Sheebe 04Dec2023-30Jan2024Document1 pageActivity Statement For Joel Tendo Sheebe 04Dec2023-30Jan2024Joel TendoNo ratings yet

- Sustainable Livelihood Framework SRDocument32 pagesSustainable Livelihood Framework SRS.Rengasamy100% (7)

- MR Economics SlidesDocument170 pagesMR Economics SlidesMahmud ShetuNo ratings yet

- File 5286Document2 pagesFile 5286Ash MarkNo ratings yet

- TN Bus Tender 2022 - TD Irt205138 RFP 1771 Diesel Bsvi Standard Floor DocumentDocument157 pagesTN Bus Tender 2022 - TD Irt205138 RFP 1771 Diesel Bsvi Standard Floor DocumentDisability Rights AllianceNo ratings yet

- Comp Himanshu Aggarwal 23-24Document4 pagesComp Himanshu Aggarwal 23-24prateek gangwaniNo ratings yet

- MBA 631rift Valley OutlineDocument4 pagesMBA 631rift Valley OutlineTatekia DanielNo ratings yet

- 24 GARS How To Make Slot Markets WorksDocument1 page24 GARS How To Make Slot Markets WorksW.J. ZondagNo ratings yet

- 7110 s08 Ms 2Document8 pages7110 s08 Ms 2meelas123No ratings yet

- Jextra FinalDocument3 pagesJextra Finalmd habibur rahmanNo ratings yet

- PDFDocument75 pagesPDFMd. Jahangir Alam100% (1)

- Chapter III Taxation and Depreciation AccountingDocument11 pagesChapter III Taxation and Depreciation AccountingJOHNNo ratings yet

- Bcip 2022Document241 pagesBcip 2022Akuntansi DhianNo ratings yet

- Which of The Following Is An Operating BudgetDocument3 pagesWhich of The Following Is An Operating Budgetshuvo dasNo ratings yet

- GM 016 344575 PDFDocument15 pagesGM 016 344575 PDFeunha allaybanNo ratings yet

- 75776bos61307 p7Document31 pages75776bos61307 p7wareva7754No ratings yet

- 5460Document70 pages5460alicewilliams83nNo ratings yet