Professional Documents

Culture Documents

DLW 1109 Assignment Oct 2021

DLW 1109 Assignment Oct 2021

Uploaded by

smovknox554Copyright:

Available Formats

You might also like

- ProblemsDocument19 pagesProblemsJames CastañedaNo ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- CASE STUDY ANALYSIS REPORT Rev 1Document23 pagesCASE STUDY ANALYSIS REPORT Rev 1Faishal Dzaky AffiantoNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Acc 112 RevisionDocument16 pagesAcc 112 RevisionhamzaNo ratings yet

- Form 2 AccDocument5 pagesForm 2 AccDavid MutandaNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- BT Tự LuyệnDocument4 pagesBT Tự LuyệnNguyen TrangNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- SummerAssignmentClass11th (2014 15)Document18 pagesSummerAssignmentClass11th (2014 15)Niti AroraNo ratings yet

- Wa0033.Document5 pagesWa0033.HarshanNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Form 1 ACCDocument3 pagesForm 1 ACCDavid MutandaNo ratings yet

- Ac 119 Tutorial Questions.Document3 pagesAc 119 Tutorial Questions.adhiza83No ratings yet

- Cash Book WorksheetDocument8 pagesCash Book WorksheetGodfreyFrankMwakalingaNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Exercises (Chapter 3) 2021Document12 pagesExercises (Chapter 3) 2021claudiazdeandresNo ratings yet

- Introduction To Accounting EXE 1Document6 pagesIntroduction To Accounting EXE 1ntxthuy04No ratings yet

- TN Cô Cho ThêmDocument3 pagesTN Cô Cho ThêmDĩm MiNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument3 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- LB301 2015 05Document3 pagesLB301 2015 05Clayton MutsenekiNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Final Mock Test BBUSDocument19 pagesFinal Mock Test BBUSGia LâmNo ratings yet

- HW2 - Ch2 The Recording Process NewDocument17 pagesHW2 - Ch2 The Recording Process Newvico lorenzoNo ratings yet

- Afm Assignment 1Document3 pagesAfm Assignment 1ನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Accounting I Terminal Spring 2021Document3 pagesAccounting I Terminal Spring 2021GuryiaNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Accounts Paper 1 June 2000Document9 pagesAccounts Paper 1 June 2000JuniorNo ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Um22ac142b 20230217121409Document21 pagesUm22ac142b 20230217121409Vismaya SNo ratings yet

- Exercises Before Mid-TermDocument6 pagesExercises Before Mid-TermSalmo AbdallaNo ratings yet

- Chapters 4 and 5 The LedgerDocument14 pagesChapters 4 and 5 The LedgerSneha DasNo ratings yet

- Name - Id - No. - Sign. - : Project OneDocument2 pagesName - Id - No. - Sign. - : Project OneBereket MamoNo ratings yet

- Assignment For 2nd Yr Eco. StudentsDocument3 pagesAssignment For 2nd Yr Eco. StudentsMan SanchoNo ratings yet

- Grade 9 2T Exam ACCOUNTINGDocument8 pagesGrade 9 2T Exam ACCOUNTINGhailtonfernandes97No ratings yet

- 2020 AnswerDocument15 pages2020 Answertanjimalomturjo1No ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Lesson3-Posting & Balance TransactionDocument21 pagesLesson3-Posting & Balance TransactionQu'est Ce-QueNo ratings yet

- Chapter 2Document2 pagesChapter 2Ngọc LinhNo ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- Guess PaperDocument17 pagesGuess PaperVinay ChawlaNo ratings yet

- CH 2 3 ReviewDocument3 pagesCH 2 3 ReviewKiệt Mai AnhNo ratings yet

- 2 AssingmentDocument3 pages2 AssingmentABM MOZAHIDNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Group AssignmentDocument2 pagesGroup AssignmentibsaashekaNo ratings yet

- Expanded EquationDocument4 pagesExpanded EquationĐinh Hà Phương UyênNo ratings yet

- Week 2 NotesDocument20 pagesWeek 2 NotescalebNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- Required:: Page 1 of 3Document62 pagesRequired:: Page 1 of 3binary78650% (2)

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Exercises Chapter 23Document13 pagesExercises Chapter 23Le TrungNo ratings yet

- Indonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectDocument81 pagesIndonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectSwastik GroverNo ratings yet

- SOP-Bibak NeupaneDocument6 pagesSOP-Bibak NeupaneSamik ShresthaNo ratings yet

- Chap 1 5 CompleteDocument50 pagesChap 1 5 CompleteRhaza Franccine FamorcanNo ratings yet

- Telephone BILLDocument12 pagesTelephone BILLachinNo ratings yet

- Chapter 15 - The Marketing Mix - PromotionDocument18 pagesChapter 15 - The Marketing Mix - PromotionHassan ShahidNo ratings yet

- TCWD ReportingDocument15 pagesTCWD Reportingcatherine nuevoNo ratings yet

- Receipt 881055181200946Document1 pageReceipt 881055181200946Shashikiran MNo ratings yet

- Jurnal Eng 9 - Big Data Analytics in Auditing and The Consequences For Audit Quality A Study Using The Technology Acceptance Model (TAM)Document16 pagesJurnal Eng 9 - Big Data Analytics in Auditing and The Consequences For Audit Quality A Study Using The Technology Acceptance Model (TAM)Therezia Tri RahayuNo ratings yet

- Karnataka Housing Board, Bangalore-09.: Name of The FirmDocument7 pagesKarnataka Housing Board, Bangalore-09.: Name of The Firmpankaj kadkolNo ratings yet

- CSU2021 Audit ReportDocument155 pagesCSU2021 Audit ReportMiss_AccountantNo ratings yet

- 7.2 MODULE 5.3 Connecting and Reaching Out To InfluencersDocument15 pages7.2 MODULE 5.3 Connecting and Reaching Out To InfluencersMuhammad FaisalNo ratings yet

- Chapter 3 Time Value of MoneyDocument17 pagesChapter 3 Time Value of MoneywubeNo ratings yet

- Assessment 1 - Business Function and Procedures - Docx FORDDocument3 pagesAssessment 1 - Business Function and Procedures - Docx FORDBrett ViceNo ratings yet

- 1 - Best Practices RUPDocument29 pages1 - Best Practices RUPsplustecNo ratings yet

- Elasticity of Demand & SupplyDocument36 pagesElasticity of Demand & SupplyChitraksh MahajanNo ratings yet

- Financial - Result - For The Financial Year Ended 31st March 2021Document20 pagesFinancial - Result - For The Financial Year Ended 31st March 2021Priyanshu PalNo ratings yet

- Growth IQ Webcast With Tiffani ABSOLUTE FINALDocument22 pagesGrowth IQ Webcast With Tiffani ABSOLUTE FINALSON OksuNo ratings yet

- Abbey Secondary School Study Guides Final History PDFDocument16 pagesAbbey Secondary School Study Guides Final History PDFPeter LwandaNo ratings yet

- Madura Chapter 2 PDFDocument31 pagesMadura Chapter 2 PDFMahmoud AbdullahNo ratings yet

- Economics Paper 2 HL MarkschemeDocument20 pagesEconomics Paper 2 HL MarkschemeZhaoNo ratings yet

- Cloud ComputingDocument9 pagesCloud ComputingManal FaluojiNo ratings yet

- Reducing Waiting Time at An Emergency Department Using Design For Six Sigma and Discrete Event SimulationDocument15 pagesReducing Waiting Time at An Emergency Department Using Design For Six Sigma and Discrete Event SimulationMarwa El SayedNo ratings yet

- Footware Market18Document9 pagesFootware Market18Vartika VermaNo ratings yet

- CLA 180 AMG Line Executive Coupé Specification SheetDocument3 pagesCLA 180 AMG Line Executive Coupé Specification SheetHassan ShahzadNo ratings yet

- List of Activities 2014Document3 pagesList of Activities 2014Muhammad.SaimNo ratings yet

- Welcome To HospitalityDocument8 pagesWelcome To HospitalityGabriel BurattoNo ratings yet

- Gec 102Document5 pagesGec 102bscomputersciencelsstiNo ratings yet

- Types of Market: BTEC BusinessDocument12 pagesTypes of Market: BTEC Businessnimi111No ratings yet

- ZAMEFA - Annual Report 2022Document88 pagesZAMEFA - Annual Report 2022mad eye moodyNo ratings yet

DLW 1109 Assignment Oct 2021

DLW 1109 Assignment Oct 2021

Uploaded by

smovknox554Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLW 1109 Assignment Oct 2021

DLW 1109 Assignment Oct 2021

Uploaded by

smovknox554Copyright:

Available Formats

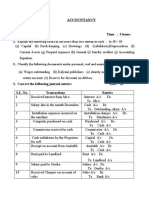

Mount Kenya University

SCHOOL OF LAW

DLW 1109: FUNDAMENTALS OF ACCOUNTING & BOOK-KEEPING

SEMESTER: Sept-Dec 2021

ASSIGNMENT

Due Date: 22nd October 2021

INSTRUCTIONS: Attempt all questions in groups of maximum 4 members

Avoid plagiarism

Offer detailed responses

QUESTION I

a) Describe the term source document, benefits associated with their use and explain the

various types of source documents

b) Discuss 5 types of books of original entry used in businesses

c) Organic Farm Ltd uses a three column cash book to record its cash and bank related

transactions. It engaged in the following transactions during the month of October 2020:

Oct 01: Cash balance $1,450 (Dr.), bank balance $1,500 (Dr.).

Oct 02: Paid Mark & Co. by check $120.

Oct 04: Received from John & Co. a check amounting to $400.

Oct 05: Deposited into bank the check received from John & Co. on March 04.

Oct 08: Purchased stationary for cash, $25 and received a 10% discount

Oct 12: Purchased merchandise for cash, $525 and was offered a 10% discount

Oct 13: Sold merchandise for cash, $1,800 and offered a 5% discount

Oct 15: Cash deposited into bank, $850.

Oct 17: Withdrew from bank for personal expenses, $40.

Oct 19: Issued a check for merchandise purchased, $630.

Oct 20: Drew from bank for office use, $150.

Oct 22: Received a check from Peter & Co. and deposited the same into bank

immediately, $880..

Required: Record the above transactions in a triple column cash book and post entries there

from into relevant ledger accounts

(Note: Don’t convert the dollars to Kes. Work as is)

QUESTION II

a) The following transactions took place in Green Farm Ltd during the month of September

2019

September 01: Credit purchases of supplements from Agrovet Ltd $2000

September 02: Credit purchases of animal feeds from Pioneer Feeds $3000

September 03: Credit purchases of farm inputs from Simlaw Seeds $ 4500

September 03: Credit sales to Tuskys $5000

September 04: Credit sales to Zucchni $1000

September 05: Credit sales to Carrefour $ 2500

September 06: Tuskys returned goods worth $1800

September 06: Return inwards from Carrefour $ 200

September 07: Returned goods to Pioneer valued $750

September 08: Return outwards to Simlaw Seeds &100

Required: Post the transactions in the books of original entry, post to personal accounts, and

show transfers to the general ledger.

QUESTION III

a) Explain the main reasons why accountants prepare the following books of account:

i. Bank reconciliation statement

ii. Three column cash book

iii. Suspense account

iv. Petty cash book

b) Explain 5 advantages of computerized accounting systems in an entity

c) Explain 5 disadvantages of computerized accounting systems in an entity

You might also like

- ProblemsDocument19 pagesProblemsJames CastañedaNo ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- CASE STUDY ANALYSIS REPORT Rev 1Document23 pagesCASE STUDY ANALYSIS REPORT Rev 1Faishal Dzaky AffiantoNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Acc 112 RevisionDocument16 pagesAcc 112 RevisionhamzaNo ratings yet

- Form 2 AccDocument5 pagesForm 2 AccDavid MutandaNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- BT Tự LuyệnDocument4 pagesBT Tự LuyệnNguyen TrangNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- SummerAssignmentClass11th (2014 15)Document18 pagesSummerAssignmentClass11th (2014 15)Niti AroraNo ratings yet

- Wa0033.Document5 pagesWa0033.HarshanNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Form 1 ACCDocument3 pagesForm 1 ACCDavid MutandaNo ratings yet

- Ac 119 Tutorial Questions.Document3 pagesAc 119 Tutorial Questions.adhiza83No ratings yet

- Cash Book WorksheetDocument8 pagesCash Book WorksheetGodfreyFrankMwakalingaNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Exercises (Chapter 3) 2021Document12 pagesExercises (Chapter 3) 2021claudiazdeandresNo ratings yet

- Introduction To Accounting EXE 1Document6 pagesIntroduction To Accounting EXE 1ntxthuy04No ratings yet

- TN Cô Cho ThêmDocument3 pagesTN Cô Cho ThêmDĩm MiNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument3 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- LB301 2015 05Document3 pagesLB301 2015 05Clayton MutsenekiNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Final Mock Test BBUSDocument19 pagesFinal Mock Test BBUSGia LâmNo ratings yet

- HW2 - Ch2 The Recording Process NewDocument17 pagesHW2 - Ch2 The Recording Process Newvico lorenzoNo ratings yet

- Afm Assignment 1Document3 pagesAfm Assignment 1ನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Accounting I Terminal Spring 2021Document3 pagesAccounting I Terminal Spring 2021GuryiaNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Accounts Paper 1 June 2000Document9 pagesAccounts Paper 1 June 2000JuniorNo ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Um22ac142b 20230217121409Document21 pagesUm22ac142b 20230217121409Vismaya SNo ratings yet

- Exercises Before Mid-TermDocument6 pagesExercises Before Mid-TermSalmo AbdallaNo ratings yet

- Chapters 4 and 5 The LedgerDocument14 pagesChapters 4 and 5 The LedgerSneha DasNo ratings yet

- Name - Id - No. - Sign. - : Project OneDocument2 pagesName - Id - No. - Sign. - : Project OneBereket MamoNo ratings yet

- Assignment For 2nd Yr Eco. StudentsDocument3 pagesAssignment For 2nd Yr Eco. StudentsMan SanchoNo ratings yet

- Grade 9 2T Exam ACCOUNTINGDocument8 pagesGrade 9 2T Exam ACCOUNTINGhailtonfernandes97No ratings yet

- 2020 AnswerDocument15 pages2020 Answertanjimalomturjo1No ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Lesson3-Posting & Balance TransactionDocument21 pagesLesson3-Posting & Balance TransactionQu'est Ce-QueNo ratings yet

- Chapter 2Document2 pagesChapter 2Ngọc LinhNo ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- Guess PaperDocument17 pagesGuess PaperVinay ChawlaNo ratings yet

- CH 2 3 ReviewDocument3 pagesCH 2 3 ReviewKiệt Mai AnhNo ratings yet

- 2 AssingmentDocument3 pages2 AssingmentABM MOZAHIDNo ratings yet

- Dit 001Document6 pagesDit 001princetrojanNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Group AssignmentDocument2 pagesGroup AssignmentibsaashekaNo ratings yet

- Expanded EquationDocument4 pagesExpanded EquationĐinh Hà Phương UyênNo ratings yet

- Week 2 NotesDocument20 pagesWeek 2 NotescalebNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- Required:: Page 1 of 3Document62 pagesRequired:: Page 1 of 3binary78650% (2)

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Exercises Chapter 23Document13 pagesExercises Chapter 23Le TrungNo ratings yet

- Indonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectDocument81 pagesIndonesia Third Indonesia Fiscal Reform Development Policy Loan ProjectSwastik GroverNo ratings yet

- SOP-Bibak NeupaneDocument6 pagesSOP-Bibak NeupaneSamik ShresthaNo ratings yet

- Chap 1 5 CompleteDocument50 pagesChap 1 5 CompleteRhaza Franccine FamorcanNo ratings yet

- Telephone BILLDocument12 pagesTelephone BILLachinNo ratings yet

- Chapter 15 - The Marketing Mix - PromotionDocument18 pagesChapter 15 - The Marketing Mix - PromotionHassan ShahidNo ratings yet

- TCWD ReportingDocument15 pagesTCWD Reportingcatherine nuevoNo ratings yet

- Receipt 881055181200946Document1 pageReceipt 881055181200946Shashikiran MNo ratings yet

- Jurnal Eng 9 - Big Data Analytics in Auditing and The Consequences For Audit Quality A Study Using The Technology Acceptance Model (TAM)Document16 pagesJurnal Eng 9 - Big Data Analytics in Auditing and The Consequences For Audit Quality A Study Using The Technology Acceptance Model (TAM)Therezia Tri RahayuNo ratings yet

- Karnataka Housing Board, Bangalore-09.: Name of The FirmDocument7 pagesKarnataka Housing Board, Bangalore-09.: Name of The Firmpankaj kadkolNo ratings yet

- CSU2021 Audit ReportDocument155 pagesCSU2021 Audit ReportMiss_AccountantNo ratings yet

- 7.2 MODULE 5.3 Connecting and Reaching Out To InfluencersDocument15 pages7.2 MODULE 5.3 Connecting and Reaching Out To InfluencersMuhammad FaisalNo ratings yet

- Chapter 3 Time Value of MoneyDocument17 pagesChapter 3 Time Value of MoneywubeNo ratings yet

- Assessment 1 - Business Function and Procedures - Docx FORDDocument3 pagesAssessment 1 - Business Function and Procedures - Docx FORDBrett ViceNo ratings yet

- 1 - Best Practices RUPDocument29 pages1 - Best Practices RUPsplustecNo ratings yet

- Elasticity of Demand & SupplyDocument36 pagesElasticity of Demand & SupplyChitraksh MahajanNo ratings yet

- Financial - Result - For The Financial Year Ended 31st March 2021Document20 pagesFinancial - Result - For The Financial Year Ended 31st March 2021Priyanshu PalNo ratings yet

- Growth IQ Webcast With Tiffani ABSOLUTE FINALDocument22 pagesGrowth IQ Webcast With Tiffani ABSOLUTE FINALSON OksuNo ratings yet

- Abbey Secondary School Study Guides Final History PDFDocument16 pagesAbbey Secondary School Study Guides Final History PDFPeter LwandaNo ratings yet

- Madura Chapter 2 PDFDocument31 pagesMadura Chapter 2 PDFMahmoud AbdullahNo ratings yet

- Economics Paper 2 HL MarkschemeDocument20 pagesEconomics Paper 2 HL MarkschemeZhaoNo ratings yet

- Cloud ComputingDocument9 pagesCloud ComputingManal FaluojiNo ratings yet

- Reducing Waiting Time at An Emergency Department Using Design For Six Sigma and Discrete Event SimulationDocument15 pagesReducing Waiting Time at An Emergency Department Using Design For Six Sigma and Discrete Event SimulationMarwa El SayedNo ratings yet

- Footware Market18Document9 pagesFootware Market18Vartika VermaNo ratings yet

- CLA 180 AMG Line Executive Coupé Specification SheetDocument3 pagesCLA 180 AMG Line Executive Coupé Specification SheetHassan ShahzadNo ratings yet

- List of Activities 2014Document3 pagesList of Activities 2014Muhammad.SaimNo ratings yet

- Welcome To HospitalityDocument8 pagesWelcome To HospitalityGabriel BurattoNo ratings yet

- Gec 102Document5 pagesGec 102bscomputersciencelsstiNo ratings yet

- Types of Market: BTEC BusinessDocument12 pagesTypes of Market: BTEC Businessnimi111No ratings yet

- ZAMEFA - Annual Report 2022Document88 pagesZAMEFA - Annual Report 2022mad eye moodyNo ratings yet