Professional Documents

Culture Documents

Task Performace Corporation

Task Performace Corporation

Uploaded by

Jim LubianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task Performace Corporation

Task Performace Corporation

Uploaded by

Jim LubianoCopyright:

Available Formats

BASIC ACCOUNTING

TASK PERFORMANCE

Direction: Prepare journal entries for the below transactions using Memo entry method and prepare the

shareholder’s Equity using IAS recommendation.

Jan 1. ABC corporation was formed and authorized to issue 50,000 convertible cumulative non-

participating 10% preference shares with a par value of 150 per share and 100,000 ordinary shares with

stated value of 100 per share.

Jan 2. The incorporators subscribed 12,500 preference shares and 25,000 ordinary shares.

Jan 3. The incorporators paid 25% of their subscriptions.

Jan 4. Issued 100 preference shares to a lawyer who drafted the articles of incorporation whose

bill for the services rendered was 25,000.

Jan 5. Cash subscription received, 10,000 preference shares at 155 per share and 20,000

ordinary shares at 105 per share.

Jan 6. Received subscriptions for 10,000 ordinary shares at 105 per share, receiving a 25% down

payment. The balance will be paid in June of the same year.

Jan 7. Received subscriptions for 5,000 preference shares at 155 per share, receiving a 40%

down payment. The balance will be paid in Feb next year.

Jan 8. Sold 100 preference shares for cash at 155 per share and 200 ordinary shares at 105.

Jan 9. Issued 2,000 ordinary shares to Mr. A in exchange for furniture with market value of 250,000.

Jan 10. The incorporators paid the remaining balance of their subscription on Jan 2 and the corresponding

stocks certificates were issued.

Jan 19. ABC corporation acquired 100 shares of its own ordinary shares at 150 per share.

Jan 20. ABC corporation acquired 100 shares of its own ordinary shares at 90 per share.

Jan 21. Mr. A owed ABC corporation amounting to 10,000. He surrendered his certificate for 90 of his

ordinary shares.

Jan 22. ABC corporation reissued the 100 shares acquired on Jan 20 @ 155 per share.

Jan 23. ABC corporation reissued the 90 shares acquired on Jan 21 @ 85 per share.

Jan 24. ABC corporation retired and cancelled the 5 shares acquired on Jan 21.

Jan 25. The corporation earned 5,000,000 net income and it is closed to Retained earnings account.

Jan 26. The board of directors declared cash dividend amounting to 1,000,000.

Jan 27. Merchandise costing 50,000 was declared as dividends.

Jan 28. 10% ordinary stock dividend is declared and the market price of ordinary share capital 120 per

share.

Jan 29. ABC corporation decided to change the capital structure of ordinary shares from stated value of

100 to 120 par value.

Jan 30. ABC corporation decided to reduce the par value of preference shares from 150 to 145.

Jan 31. ABC corporation appropriated 1,000,000 for plant expansion and 500,000 for future contingency.

You might also like

- Michael Burry Investment Strategy Vintage Value InvestingDocument3 pagesMichael Burry Investment Strategy Vintage Value Investingluli_kbreraNo ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- DividendsDocument3 pagesDividendsjano_art2125% (8)

- Leverage - The Rich and PowerfulDocument23 pagesLeverage - The Rich and Powerfulmarco poloNo ratings yet

- 1Document6 pages1sufyanbutt0070% (1)

- Activity CorporationDocument1 pageActivity CorporationKHRISTINE JOYCE GUMASINGNo ratings yet

- Shareholer's EquityDocument5 pagesShareholer's EquityRaffy Roi Martagon67% (3)

- ACCT 115 Accounting For Corporations Exercises 1sdsdDocument3 pagesACCT 115 Accounting For Corporations Exercises 1sdsdMigs CristobalNo ratings yet

- Problem 14-2A Corporate Expansion Stockholders' Equity Section of Balance SheetDocument3 pagesProblem 14-2A Corporate Expansion Stockholders' Equity Section of Balance SheetJames HarperNo ratings yet

- AudtheoDocument3 pagesAudtheokath grangerNo ratings yet

- Chapter 15 - Supplementart QuestionsDocument2 pagesChapter 15 - Supplementart QuestionsRaj PatelNo ratings yet

- 162.materials 1.SHE 001Document2 pages162.materials 1.SHE 001jpbluejnNo ratings yet

- Accounting 34 Module 9 AssignmentDocument1 pageAccounting 34 Module 9 AssignmentCristel GesmundoNo ratings yet

- ch.13 Practice QuestionsDocument4 pagesch.13 Practice QuestionsAshNo ratings yet

- Exercise No. 1:: Required: Journal Entries Using Two Methods of Recording Stock TransactionsDocument4 pagesExercise No. 1:: Required: Journal Entries Using Two Methods of Recording Stock TransactionsCarlos ReyesNo ratings yet

- Corporation LectureDocument12 pagesCorporation Lecturejoyce jabileNo ratings yet

- STTDocument3 pagesSTTScarlett ReinNo ratings yet

- HW 0309Document3 pagesHW 0309Ajeng RaraNo ratings yet

- Corporation ACCOUNTINGDocument8 pagesCorporation ACCOUNTINGmelody agravanteNo ratings yet

- Equity SoalDocument2 pagesEquity SoalVinna ZhuangNo ratings yet

- 20-1 To 20-13Document16 pages20-1 To 20-13Jesica Vargas0% (2)

- Assignmet SHEDocument3 pagesAssignmet SHEBernaise BaguioNo ratings yet

- Companies (Exercises) PDFDocument1 pageCompanies (Exercises) PDFVj TjizooNo ratings yet

- Soal Special Edition Akuntansi Keuangan Menengah IIDocument2 pagesSoal Special Edition Akuntansi Keuangan Menengah IIZephyra ViolettaNo ratings yet

- ExtrapracticeProblems Chapters15,16,17,18Document16 pagesExtrapracticeProblems Chapters15,16,17,18chloekim03No ratings yet

- Uas Akm1Document2 pagesUas Akm1kamsiah siregarNo ratings yet

- PROBLEM 31 Share CapitalDocument2 pagesPROBLEM 31 Share CapitalJean Dareel LimboNo ratings yet

- Week 11 - CH 11 QuestionsDocument2 pagesWeek 11 - CH 11 QuestionslizaNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet

- Practice Session Questions - Equity 05112022 031953pmDocument3 pagesPractice Session Questions - Equity 05112022 031953pmMeraj Ali100% (1)

- Assignment AFA IDocument4 pagesAssignment AFA IAbebeNo ratings yet

- This Study Resource Was: Invesment in Equity Securities UploadedDocument4 pagesThis Study Resource Was: Invesment in Equity Securities UploadedmerryNo ratings yet

- BMKID CorpDocument4 pagesBMKID CorpAndrew AndalNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityPanda ErarNo ratings yet

- Long Quiz Online Aud ProbDocument2 pagesLong Quiz Online Aud Probsunthatburns00No ratings yet

- Chapter 16 Homework ProblemsDocument5 pagesChapter 16 Homework ProblemsHasanAminNo ratings yet

- 162 019Document4 pages162 019Angelli LamiqueNo ratings yet

- 3.2 Accounting For Corporation Reviewer With Sample ProblemDocument82 pages3.2 Accounting For Corporation Reviewer With Sample Problemlavender hazeNo ratings yet

- CorporationDocument80 pagesCorporationEunice Lyafe PanilagNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3Sharmaine Rivera MiguelNo ratings yet

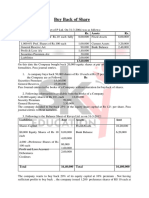

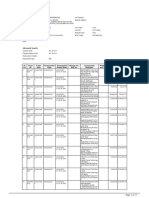

- Buy Back of ShareDocument2 pagesBuy Back of ShareRajesh ChedaNo ratings yet

- Audit of Equity ONLYDocument2 pagesAudit of Equity ONLYAstika Tamala Br TinjakNo ratings yet

- Introduction To SHE and Issuance of SharesDocument1 pageIntroduction To SHE and Issuance of Shareslei dcNo ratings yet

- This Is Part of Your Assignment For Tuesday, April 4. JOURNALIZATION of Share Capital TransactionsDocument2 pagesThis Is Part of Your Assignment For Tuesday, April 4. JOURNALIZATION of Share Capital TransactionsMiguel CabildoNo ratings yet

- Shareholders' EquityDocument16 pagesShareholders' Equitymaria evangelistaNo ratings yet

- Problems EPSDocument3 pagesProblems EPShukaNo ratings yet

- P2 Reviewer PDFDocument64 pagesP2 Reviewer PDFBeef TestosteroneNo ratings yet

- Chapter Internal ReconstructionDocument4 pagesChapter Internal ReconstructionAnonymous mTZsMOjNo ratings yet

- Chapter 10 Lab Problems BlackboardDocument2 pagesChapter 10 Lab Problems BlackboardAbdullah alhamaadNo ratings yet

- 3526 - 25114 - Textbooksolution - PDF 3Document108 pages3526 - 25114 - Textbooksolution - PDF 3dhanuka jiNo ratings yet

- Internal ReconstructionDocument5 pagesInternal ReconstructionJoshua StarkNo ratings yet

- Reviewer ExamDocument73 pagesReviewer ExamZalaR0cksNo ratings yet

- Buffet-Line CorpDocument1 pageBuffet-Line CorpFranz AppleNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityJhelRose Lasquite BrosasNo ratings yet

- Class 12 Accountancy - Holiday AssignmentDocument4 pagesClass 12 Accountancy - Holiday AssignmentKritarth AgarwalNo ratings yet

- FR L9.1-9.2 Financial InstrumentsDocument9 pagesFR L9.1-9.2 Financial InstrumentsPrachanda BhandariNo ratings yet

- Working 6Document7 pagesWorking 6Hà Lê DuyNo ratings yet

- Lecture Sheet (11) - ChapterDocument2 pagesLecture Sheet (11) - Chaptermusicslave96No ratings yet

- Midterm - Quiz SolutionDocument4 pagesMidterm - Quiz SolutionANSLEY CATE C. GUEVARRANo ratings yet

- Assignment Intermediate Accounting 14,15Document4 pagesAssignment Intermediate Accounting 14,15melodi pretNo ratings yet

- EffhyDocument2 pagesEffhyJim LubianoNo ratings yet

- PPE Lang Future CpaDocument12 pagesPPE Lang Future CpaJim LubianoNo ratings yet

- Document 12Document2 pagesDocument 12Jim LubianoNo ratings yet

- 12 - Quiz - 1 (2) BuslawDocument2 pages12 - Quiz - 1 (2) BuslawJim LubianoNo ratings yet

- Results: in This IssueDocument12 pagesResults: in This IssuecetNo ratings yet

- Ch16 Financial Statement AnalysisDocument134 pagesCh16 Financial Statement AnalysisLeigh Garanchon100% (3)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Stock Exchange/Merchant Bank Wise Broker ListDocument12 pagesStock Exchange/Merchant Bank Wise Broker Listmd nuruddinNo ratings yet

- Stock ValuationDocument33 pagesStock Valuationpoona ramwaniNo ratings yet

- Ratios - GmaDocument4 pagesRatios - GmaClarisse Policios100% (2)

- Indian Stock MarketDocument48 pagesIndian Stock MarketAbhay JainNo ratings yet

- Detailed StatementDocument17 pagesDetailed Statementwolf8585.inNo ratings yet

- Fact Orders Tec Stored A To S 2022Document2,364 pagesFact Orders Tec Stored A To S 2022Mikel SUAREZ BARREIRONo ratings yet

- ACC 221 - Fourth ExaminationDocument5 pagesACC 221 - Fourth ExaminationCharlesNo ratings yet

- Resume - MatrangaDocument2 pagesResume - Matrangaapi-511275511No ratings yet

- Fin 0724Document3 pagesFin 0724alcaydediane64No ratings yet

- Top 40 Wealth Management Firms 2017Document3 pagesTop 40 Wealth Management Firms 2017JonNo ratings yet

- Lease Financing in Bangladesh: Rules & RegulationsDocument27 pagesLease Financing in Bangladesh: Rules & Regulationserrorrr00775% (4)

- Global Equities - A Canadian Investors PerspectiveDocument12 pagesGlobal Equities - A Canadian Investors PerspectivejennaNo ratings yet

- Study of Asian Financial Crisis 1997Document26 pagesStudy of Asian Financial Crisis 1997Sudeep Sahu100% (1)

- Ibbotson-Chen Returns 2002Document30 pagesIbbotson-Chen Returns 2002Xenon131No ratings yet

- Exercises 122BDocument3 pagesExercises 122BAthena Fatmah AmpuanNo ratings yet

- in Which Exchange Are Derivatives Traded in Japan?Document3 pagesin Which Exchange Are Derivatives Traded in Japan?kaungwaiphyo89No ratings yet

- Chapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)Document1 pageChapter 12, Problem 1COMP: (To Record Issuance of 4,000 Preferred Shares in Excess of Par)Varun SharmaNo ratings yet

- Cost of CapitalDocument31 pagesCost of CapitalAnamNo ratings yet

- COL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingDocument153 pagesCOL Financial Group - SECForm 17-A - 2019 - Consolidated Copy For FilingGab RielNo ratings yet

- Corporate and Other Laws 03 - Class NotesDocument194 pagesCorporate and Other Laws 03 - Class Notesforore8904No ratings yet

- The CBOE Volatility Index - VIXDocument23 pagesThe CBOE Volatility Index - VIXayaNo ratings yet

- Bearish Stop LossDocument3 pagesBearish Stop LossSyam Sundar ReddyNo ratings yet

- Scheme Information Document: Reliance Capital Builder Fund IV - Series ADocument38 pagesScheme Information Document: Reliance Capital Builder Fund IV - Series AAk KumarNo ratings yet

- Stock Verdict ACC 2021-09-20Document22 pagesStock Verdict ACC 2021-09-20ABCNo ratings yet