Professional Documents

Culture Documents

10f02 CP 112 Proposed ENTE 2

10f02 CP 112 Proposed ENTE 2

Uploaded by

payfallusdOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10f02 CP 112 Proposed ENTE 2

10f02 CP 112 Proposed ENTE 2

Uploaded by

payfallusdCopyright:

Available Formats

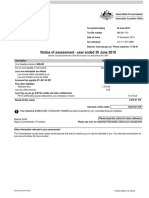

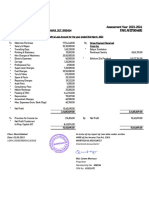

Notice CP112

Department of Treasury Tax period December 31, 2020

Internal Revenue Service Notice date July 11, 2022

IRS Ogden, UT 84201-0038 Employer ID number

To contact us

45-2695578

Phone 1-800-829-0115

008086.448642.141544.2096 1 AB 0.491 370

01899954671

ENTEGRITY HOMECARE SOLUTION INC

534 FLINT TRL STE A

JONESBORO, GA 30236-1316

006649

Changes to your December 31, 2020 Form 941

Adjusted refund: $34,629.43

We believe there's a miscalculation on your

December 31, 2020 Form 941, which affects the Summary

following area of your return:

$9,556.63

• Tax Computation

-44,186.06

We changes your return to corrects this error. As $34,629.43

a result, you are due a refund of $34,629.43

What you need to do Review this notice, and compare our changes to the information on your tax return.

If you agree with the changes we made

• You should receive a refund of $34,629.43 in 4-6 weeks as long as you don't owe

other tax or debts we're required to collect.

If you don't agree with the changes

• Call 800-829-0115 to review your account.

• If we don't hear from you, we'll assume you agree with the information in this

• notice.

Changes to your Information was changed because of the following:

December 31, 2020 tax return

• We found an error in the computation of your total Social Security/Medicare tax.

• (0407)

Continued on back…

You might also like

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Notice of Assessment 2023 04 11 11 51 12 947361Document4 pagesNotice of Assessment 2023 04 11 11 51 12 947361Amelia D. LopezNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6ÄDocument4 pagesNotice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6Äjoshiepow3llNo ratings yet

- Notice of Assessment 2024 04 15 18 45 25 562888Document4 pagesNotice of Assessment 2024 04 15 18 45 25 562888kumar k0% (1)

- Natalee Lang - Tax Notice of Assessment For 20202021Document2 pagesNatalee Lang - Tax Notice of Assessment For 20202021MWA Films100% (1)

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- Notice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Document4 pagesNotice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Therese FadelNo ratings yet

- Notice of Assessment 2023 04 11 12 04 11 210682Document6 pagesNotice of Assessment 2023 04 11 12 04 11 210682namenoname363No ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Hina Khan Unit 24 29 Nicholls Tce Woodville West Sa 5011Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Hina Khan Unit 24 29 Nicholls Tce Woodville West Sa 5011hina khanNo ratings yet

- Notice of Reassessment 2021 03 08 13 55 19 689032Document4 pagesNotice of Reassessment 2021 03 08 13 55 19 689032Chris andersonNo ratings yet

- Noa 2023-Han DongDocument2 pagesNoa 2023-Han Dongh865cqy6c9No ratings yet

- Noa 2022Document2 pagesNoa 2022ragprasathNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Document2 pagesNotice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Vaccine ScamNo ratings yet

- BSNL Salary Slip 1Document1 pageBSNL Salary Slip 1empirecot50% (2)

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do?Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do?tehtarikNo ratings yet

- Consumption Taxes: Business Tax Is A Form of Consumption TaxDocument8 pagesConsumption Taxes: Business Tax Is A Form of Consumption TaxDenvyl MangsatNo ratings yet

- UK Vs USA Common Law Vs Common SenceDocument7 pagesUK Vs USA Common Law Vs Common SenceShlomo Isachar Ovadiah100% (1)

- 10f02 CP 112 Proposed ENTE 3Document1 page10f02 CP 112 Proposed ENTE 3payfallusdNo ratings yet

- 10f02 CP 112 Proposed ENTE 4Document1 page10f02 CP 112 Proposed ENTE 4payfallusdNo ratings yet

- Notice of Amended Assessment - Year Ended 30 June 2023Document4 pagesNotice of Amended Assessment - Year Ended 30 June 2023carmenzhou2001No ratings yet

- Notice of Assessment - Year Ended 30 June 2023: MR Troy Tieppo 13 Witney ST Manoora QLD 4870Document2 pagesNotice of Assessment - Year Ended 30 June 2023: MR Troy Tieppo 13 Witney ST Manoora QLD 4870tieppotroyNo ratings yet

- Notice of Reassessment 2021 08 16 06 13 58 681642Document4 pagesNotice of Reassessment 2021 08 16 06 13 58 681642api-676582318No ratings yet

- ViewFile 6_2_2024 8_33_47 AMDocument4 pagesViewFile 6_2_2024 8_33_47 AMk40427887No ratings yet

- Notice of Assessment 2022 03 17 11 16 57 195191Document4 pagesNotice of Assessment 2022 03 17 11 16 57 195191api-676582318No ratings yet

- Notice of Amended Assessment - Year Ended 30 June 2022: !msîzdçuy/ Î!Iu - ÄDocument4 pagesNotice of Amended Assessment - Year Ended 30 June 2022: !msîzdçuy/ Î!Iu - Äellas-dadNo ratings yet

- 1.4 Notice of Assessment - Year Ended 30 June 2019Document2 pages1.4 Notice of Assessment - Year Ended 30 June 2019jer2ywangNo ratings yet

- Notice of Reassessment 2021 08 16 06 14 40 172371Document4 pagesNotice of Reassessment 2021 08 16 06 14 40 172371api-676582318No ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103Document2 pagesNotice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103aalampathan76No ratings yet

- ViewFile 6 - 4 - 2024 8 - 12 - 18 AMDocument4 pagesViewFile 6 - 4 - 2024 8 - 12 - 18 AMkeroyukaNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- Notice of Reassessment 2021 08 16 06 14 37 290772Document4 pagesNotice of Reassessment 2021 08 16 06 14 37 290772api-676582318No ratings yet

- Noa-Iit Ob25202106140521020nzDocument1 pageNoa-Iit Ob25202106140521020nz江宗朋No ratings yet

- Notice of Reassessment 2021 08 16 06 13 55 692252Document4 pagesNotice of Reassessment 2021 08 16 06 13 55 692252api-676582318No ratings yet

- Nof 2020Document6 pagesNof 2020k1109kritiNo ratings yet

- Tax Ry 2020Document2 pagesTax Ry 2020Ruth Polimar YamutaNo ratings yet

- John Adams Irs Tax Correspondence Cp503Document1 pageJohn Adams Irs Tax Correspondence Cp503Hismichael22No ratings yet

- View FileDocument4 pagesView FileRomain RemondNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- Dig CompportalDocument4 pagesDig CompportalBornok 3No ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Cp11 EnglishDocument6 pagesCp11 Englishushakov.alexsandr228No ratings yet

- PDF Payment Summary 2022 - 2023Document1 pagePDF Payment Summary 2022 - 2023Ashley RouxNo ratings yet

- Noa-Iit Ob26202204230848372gn PDFDocument1 pageNoa-Iit Ob26202204230848372gn PDFWalter SengNo ratings yet

- Goods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeDocument3 pagesGoods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeSam StormeNo ratings yet

- NOA-IIT_OB2320210515181932B3KDocument1 pageNOA-IIT_OB2320210515181932B3Kharsshakannan27No ratings yet

- Notice of Assessment 2021 03 22 16 13 15 065002Document4 pagesNotice of Assessment 2021 03 22 16 13 15 065002kulbirsinghxxxxNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 853056Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 853056api-676582318No ratings yet

- TurboTax Free Edition 2022Document1 pageTurboTax Free Edition 2022moorevennesaNo ratings yet

- Noa-Iit Ob2620220516193754ktiDocument2 pagesNoa-Iit Ob2620220516193754ktiSelva SelvaNo ratings yet

- Property Tax Statement Fri Oct 07 2022Document2 pagesProperty Tax Statement Fri Oct 07 2022trungNo ratings yet

- GIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Document2 pagesGIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Nelly HNo ratings yet

- Notice - of - Assessment - 2022 BachDocument4 pagesNotice - of - Assessment - 2022 Bachalmostaunicorn84No ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Aun NoaDocument4 pagesAun Noatkxb2zyztsNo ratings yet

- This Agreement Is by and Between Shoebox Bookkeeping & Accounting &Document7 pagesThis Agreement Is by and Between Shoebox Bookkeeping & Accounting &NCB School of Herbalism & Holistic HealthNo ratings yet

- Lupoaeveronica 2022 1BDocument18 pagesLupoaeveronica 2022 1BBianca DuracNo ratings yet

- Rosselis ColmenaresDocument2 pagesRosselis ColmenaresjosepaticaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Business card Dec 6, 2022Document1 pageBusiness card Dec 6, 2022payfallusdNo ratings yet

- eStmt_2021-08-27 (1)Document8 pageseStmt_2021-08-27 (1)payfallusdNo ratings yet

- eStmt_2021-07-26Document6 pageseStmt_2021-07-26payfallusdNo ratings yet

- 2015_Form_940.pdfDocument4 pages2015_Form_940.pdfpayfallusdNo ratings yet

- account-statement-SURENDRA NARAYANA POOJARYDocument18 pagesaccount-statement-SURENDRA NARAYANA POOJARYpayfallusdNo ratings yet

- Tax Return Libby Muller 2019Document34 pagesTax Return Libby Muller 2019payfallusdNo ratings yet

- Navy Federal eStatement_DAVID MICHAEL 4_Document4 pagesNavy Federal eStatement_DAVID MICHAEL 4_payfallusdNo ratings yet

- _CP575Notice_1631038438207Document2 pages_CP575Notice_1631038438207payfallusdNo ratings yet

- 10f02 CP 112 Proposed ENTE 4Document1 page10f02 CP 112 Proposed ENTE 4payfallusdNo ratings yet

- 10f02 CP 112 Proposed ENTE 3Document1 page10f02 CP 112 Proposed ENTE 3payfallusdNo ratings yet

- 1 2022 DR 13 Annual Resale CertificateDocument1 page1 2022 DR 13 Annual Resale CertificatepayfallusdNo ratings yet

- TAX Calculation FY 22-23 AY23-24Document9 pagesTAX Calculation FY 22-23 AY23-24SamratNo ratings yet

- Eλλhnikη Δhmokpatia Republika Grčka Hellenic Republic Yпoypгeio Oikonomiaσ Ministarstvo Privrede I Ministry Of Economy & & Oikonomikωn Finansija FinanceDocument4 pagesEλλhnikη Δhmokpatia Republika Grčka Hellenic Republic Yпoypгeio Oikonomiaσ Ministarstvo Privrede I Ministry Of Economy & & Oikonomikωn Finansija FinanceIvanMiticNo ratings yet

- KETP Presentation For Ganesh 24-6-2020Document8 pagesKETP Presentation For Ganesh 24-6-2020Dinesh KumarNo ratings yet

- Micro Economy Policies in IndiaDocument23 pagesMicro Economy Policies in Indiaabhijeet108No ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- This Study Resource Was: Tax QuizzerDocument5 pagesThis Study Resource Was: Tax QuizzerGee-Anne GonzalesNo ratings yet

- CustomInvoice 2488574255Document1 pageCustomInvoice 2488574255Man Hok WaiNo ratings yet

- Edi Safe'I, S.Ak: BiodataDocument3 pagesEdi Safe'I, S.Ak: BiodataDenny Teguh HerlambangNo ratings yet

- Web Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)Document1 pageWeb Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)sufian bashirNo ratings yet

- Payslip Lyka Labs-Ramjeet PalDocument1 pagePayslip Lyka Labs-Ramjeet PalPankaj PandeyNo ratings yet

- Aushadhidham 2074Document1 pageAushadhidham 2074K D HERBAL & UNANINo ratings yet

- Impact of GST Law On Real EstateDocument14 pagesImpact of GST Law On Real EstateHumanyu KabeerNo ratings yet

- Pay Stub TemplateDocument1 pagePay Stub TemplateMichael ShortNo ratings yet

- Od 430486422854927100Document2 pagesOd 430486422854927100khushichoudhary5664No ratings yet

- ITAD BIR Ruling No. 141-13 Dated May 21, 2013Document9 pagesITAD BIR Ruling No. 141-13 Dated May 21, 2013KriszanFrancoManiponNo ratings yet

- Prepayment Withholding TaxDocument7 pagesPrepayment Withholding TaxCine WorldNo ratings yet

- VAT Assignment SolutionDocument2 pagesVAT Assignment SolutionJesus is LordNo ratings yet

- Wsa 40Document219 pagesWsa 40Rizal PerdanaNo ratings yet

- Witholding TaxDocument6 pagesWitholding TaxdownloademailNo ratings yet

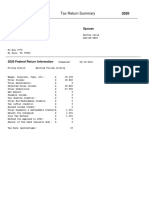

- Tax Return SummaryDocument14 pagesTax Return Summaryevalle13No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: Assessment Year: 2018-19Document6 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: Assessment Year: 2018-19ritesh shrivastavNo ratings yet

- 08 Spring 2015 BT AnsDocument8 pages08 Spring 2015 BT Anspabloescobar11yNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet

- GateDocument48 pagesGateharini ramachandraraoNo ratings yet

- Sanjib Ghosh Assessment Year: 2023-2024 PAN: AFZPG0468EDocument1 pageSanjib Ghosh Assessment Year: 2023-2024 PAN: AFZPG0468Ejdas7061No ratings yet

- Toaz - Info Chapter 10 Compensation Income True or False 1 PRDocument22 pagesToaz - Info Chapter 10 Compensation Income True or False 1 PRErna DavidNo ratings yet