Professional Documents

Culture Documents

Carve Out Ind As Ifrs

Carve Out Ind As Ifrs

Uploaded by

maninderpnnCopyright:

Available Formats

You might also like

- American Society of Mechanical Engineers-The Guide To Hydropower Mechanical Design-H C I Pubns (1996) PDFDocument384 pagesAmerican Society of Mechanical Engineers-The Guide To Hydropower Mechanical Design-H C I Pubns (1996) PDFUmesh Shrestha100% (3)

- Welcome To The 60's-Páginas-141-150Document10 pagesWelcome To The 60's-Páginas-141-150Anonymous ad6Ap8rNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Investingunplugged PDFDocument225 pagesInvestingunplugged PDFWilliam MercerNo ratings yet

- 65-C Bucyrus-Erie-Truck-Cranes-Spec-2ea121Document4 pages65-C Bucyrus-Erie-Truck-Cranes-Spec-2ea121Rothsby Hoyos GomezNo ratings yet

- Vampire FB.30 Modifications List Pt.1Document526 pagesVampire FB.30 Modifications List Pt.1Left VentricleNo ratings yet

- RML Rev 3Document102 pagesRML Rev 3Fitri BukhriNo ratings yet

- Adobe Scan 11. Mai 2022Document2 pagesAdobe Scan 11. Mai 2022Enver AbdyliNo ratings yet

- Reinfocement Details Slab CulvertDocument1 pageReinfocement Details Slab Culvertlakshmi naryanaNo ratings yet

- Adobe Scan 01 Dec 2021Document8 pagesAdobe Scan 01 Dec 2021anushree4989No ratings yet

- Big Dipper 2Document2 pagesBig Dipper 2Rémi BolducNo ratings yet

- K Fsu / J: i.lJ!ADocument2 pagesK Fsu / J: i.lJ!AChristjohn VillaluzNo ratings yet

- Tusuwiin NegtgelDocument507 pagesTusuwiin NegtgelLeo Rich MongoliaNo ratings yet

- Saikumar DocumentsDocument23 pagesSaikumar DocumentsSaikumar PatilNo ratings yet

- Geo Half Yearly Map Work Class 9Document4 pagesGeo Half Yearly Map Work Class 9Shivansh SinghNo ratings yet

- 10th MarksheetDocument1 page10th MarksheetRanjeet Singh ChouhanNo ratings yet

- 20091AA058 Kartheeka KundamDocument2 pages20091AA058 Kartheeka Kundam20-68 AishwaryaNo ratings yet

- ShowTransactionImageFile PDFDocument20 pagesShowTransactionImageFile PDFMatthew WhittenNo ratings yet

- Chapter 6Document3 pagesChapter 6Gururaj P KundapurNo ratings yet

- HR Assignment Udhr Three Gen of RightsDocument16 pagesHR Assignment Udhr Three Gen of RightsDEvanshiNo ratings yet

- Petroleum FluidsDocument295 pagesPetroleum FluidsItmar ViguerasNo ratings yet

- Wiring Diagram MGS7310-1Document12 pagesWiring Diagram MGS7310-1ULPLTD LUWUKNo ratings yet

- 872-08 09 15-លក្ខន្តិកៈគតិយុត្តនៃគ្រឹះស្ថានសាធារណៈរដ្ឋបាលDocument15 pages872-08 09 15-លក្ខន្តិកៈគតិយុត្តនៃគ្រឹះស្ថានសាធារណៈរដ្ឋបាលnyka495No ratings yet

- Frost Design in Canada: PracticeDocument32 pagesFrost Design in Canada: PracticeMearg NgusseNo ratings yet

- DrawingsDocument7 pagesDrawingsAnkit SinghNo ratings yet

- A3186 Service ManualDocument75 pagesA3186 Service ManualJose Luis SaldiasNo ratings yet

- Adobe Scan 6 Jan 2023Document14 pagesAdobe Scan 6 Jan 2023Sama HodekarNo ratings yet

- Screenshot 2020-11-04 at 7.17.24 PMDocument9 pagesScreenshot 2020-11-04 at 7.17.24 PMYash VardhanNo ratings yet

- Republic of The Philippines Office of The City Mayor Bacolod CityDocument10 pagesRepublic of The Philippines Office of The City Mayor Bacolod CityJapheth CuaNo ratings yet

- Highrise Building Approved Elec Drawing - AddcDocument21 pagesHighrise Building Approved Elec Drawing - AddcJothi VelNo ratings yet

- JBL Pulse 1 ManualDocument8 pagesJBL Pulse 1 Manualjev_ssNo ratings yet

- D. Scarlatti - Le VioletteDocument5 pagesD. Scarlatti - Le VioletteAlek IsakovicNo ratings yet

- Adobe Scan 5 Mar 2024Document1 pageAdobe Scan 5 Mar 2024Deepak ChaudharyNo ratings yet

- S A MWL : ABH/N (/VDocument1 pageS A MWL : ABH/N (/VAnonymous oVxZDZuechNo ratings yet

- S A MWL : ABH/N (/VDocument1 pageS A MWL : ABH/N (/VAnonymous 0pMVwY0OcoNo ratings yet

- Volume 2 Notes On GermanDocument103 pagesVolume 2 Notes On GermanKasa Satu100% (1)

- Planetario Apron Feeder Minera EscondidaDocument16 pagesPlanetario Apron Feeder Minera Escondidanelson troncoso galdamesNo ratings yet

- Harris SchmedlenDocument1 pageHarris SchmedlenRock QuarryNo ratings yet

- Midway Space Invader SchematicsDocument3 pagesMidway Space Invader SchematicsThomas C WalkerNo ratings yet

- Tag List For EquipmentsDocument5 pagesTag List For EquipmentskapsarcNo ratings yet

- ' (1 T'Far': B MRD Bd2FcdDocument8 pages' (1 T'Far': B MRD Bd2FcdGerson GomesNo ratings yet

- The Honorable Members: BacolodDocument13 pagesThe Honorable Members: BacolodChristjohn VillaluzNo ratings yet

- Turbine TG Data SheetDocument5 pagesTurbine TG Data Sheetshinki31000No ratings yet

- 062 - R - 301 - 302 - 303 ManuelDocument303 pages062 - R - 301 - 302 - 303 Manuelshinki31000No ratings yet

- Forever I Will SingDocument3 pagesForever I Will SingAlen Matthew AndradeNo ratings yet

- FX-3600Pv El-Kitabi IngDocument21 pagesFX-3600Pv El-Kitabi IngSaim PAKERNo ratings yet

- Drag Coefficent of Cables and Ropes PDFDocument67 pagesDrag Coefficent of Cables and Ropes PDFnhy.mail2709No ratings yet

- Croquis D'immunitéDocument2 pagesCroquis D'immunitéCamille SiropNo ratings yet

- Adobe Scan 23 Dec 2021Document1 pageAdobe Scan 23 Dec 2021AFRAHNo ratings yet

- ImagesDocument4 pagesImagesAimaan MisbaNo ratings yet

- Adobe Scan 13-Dec-2021Document18 pagesAdobe Scan 13-Dec-2021abdulmuheed006No ratings yet

- Kármàn (1929)Document9 pagesKármàn (1929)Marcelo De Oliveira PredesNo ratings yet

- Kármàn (1929) PDFDocument9 pagesKármàn (1929) PDFMarcelo De Oliveira PredesNo ratings yet

- Pages From Dorman Longs - Handbook For Constructional Engineers - 1895-52Document1 pagePages From Dorman Longs - Handbook For Constructional Engineers - 1895-52Fornvald TamasNo ratings yet

- SMR Apex 2300 Service ManualDocument108 pagesSMR Apex 2300 Service ManualCamila MapuraNo ratings yet

- Tiptur: .,,.r:dfliDocument1 pageTiptur: .,,.r:dflisai kiranNo ratings yet

- Photo Copy Request For ShahristanDocument1 pagePhoto Copy Request For ShahristanasadullahNo ratings yet

- IS3521Document11 pagesIS3521MayurNo ratings yet

- R "'2oif: Office of The Ci!Ry MayorDocument3 pagesR "'2oif: Office of The Ci!Ry MayorsecrecyrussiaNo ratings yet

- Power Electronics (By Ned Mohan) 2Document127 pagesPower Electronics (By Ned Mohan) 2Мирослав Милков100% (1)

- The Corvette: A Nathaniel Drinkwater NovelFrom EverandThe Corvette: A Nathaniel Drinkwater NovelRating: 4.5 out of 5 stars4.5/5 (14)

- Fair Value Ind As 113Document1 pageFair Value Ind As 113maninderpnnNo ratings yet

- Employee Benefit Ind As 19Document2 pagesEmployee Benefit Ind As 19maninderpnnNo ratings yet

- Brief Analysis of Recent NFRA Orders 1692457542Document12 pagesBrief Analysis of Recent NFRA Orders 1692457542maninderpnnNo ratings yet

- Indian Accounting Standards Ind As An Overview 1695181348Document232 pagesIndian Accounting Standards Ind As An Overview 1695181348maninderpnnNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument29 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Resume of Chapter 6 Making Capital Investment DecisionsDocument4 pagesResume of Chapter 6 Making Capital Investment DecisionsAimé RandrianantenainaNo ratings yet

- MLPT FinanceDocument180 pagesMLPT FinanceKris ValiantoNo ratings yet

- Megaworld 3rd Quarter 2019 Financial ReportDocument32 pagesMegaworld 3rd Quarter 2019 Financial ReportRyan CervasNo ratings yet

- Solution Chapter 11Document38 pagesSolution Chapter 11Anonymous CuUAaRSNNo ratings yet

- Article FMGGDocument17 pagesArticle FMGGErmi ManNo ratings yet

- Amazon: Name: Hammad Ahmed ACCA REG. NUMBER: 2427634Document20 pagesAmazon: Name: Hammad Ahmed ACCA REG. NUMBER: 2427634Hammad AhmedNo ratings yet

- Final Report 21BCM1553Document45 pagesFinal Report 21BCM1553Guljeet SinghNo ratings yet

- Far CeggDocument17 pagesFar CeggMaurice AgbayaniNo ratings yet

- Partnership LiquidationDocument10 pagesPartnership LiquidationchristineNo ratings yet

- Meeting No. 2 - Learning Synthesis - Chapter 1 Mangerial Accounting PDFDocument4 pagesMeeting No. 2 - Learning Synthesis - Chapter 1 Mangerial Accounting PDFAnne PorterNo ratings yet

- DMCC Company Regulations - Jan 2022 - V2Document79 pagesDMCC Company Regulations - Jan 2022 - V2Laila NadifNo ratings yet

- Investment Research: Fundamental Coverage - Ifb Agro Industries LimitedDocument8 pagesInvestment Research: Fundamental Coverage - Ifb Agro Industries Limitedrchawdhry123No ratings yet

- "Dividend Decision": Synopsis OnDocument14 pages"Dividend Decision": Synopsis Onferoz khanNo ratings yet

- STRATEGIC COST MANAGEMENT - Week 12Document46 pagesSTRATEGIC COST MANAGEMENT - Week 12Losel CebedaNo ratings yet

- ACF 103 Revision Qns Solns 20141Document12 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Final Exam ConceptualDocument8 pagesFinal Exam ConceptualJun GilloNo ratings yet

- FINC521Document20 pagesFINC521Ayushi GargNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Ratio Analysis of HR TextilesDocument26 pagesRatio Analysis of HR TextilesOptimistic Eye100% (1)

- Contact Session 2 Slides - ACN100 Second Semester-1Document42 pagesContact Session 2 Slides - ACN100 Second Semester-1Ronald RamorokaNo ratings yet

- Accounting and Its Environment - PowerPoint PresentationDocument30 pagesAccounting and Its Environment - PowerPoint PresentationBhea G. ManaloNo ratings yet

- Capital Structure Analysis OFDocument35 pagesCapital Structure Analysis OFneer_teeNo ratings yet

- Book BuildingDocument19 pagesBook Buildingmonilsonaiya_91No ratings yet

- Ina 20210617 TSDocument7 pagesIna 20210617 TSPhạm Minh QuânNo ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Editor in chief,+EJBMR 1033+R300821Document7 pagesEditor in chief,+EJBMR 1033+R300821BigPalabraNo ratings yet

Carve Out Ind As Ifrs

Carve Out Ind As Ifrs

Uploaded by

maninderpnnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carve Out Ind As Ifrs

Carve Out Ind As Ifrs

Uploaded by

maninderpnnCopyright:

Available Formats

-·· - ~ - - -·-- ~·

.,.

·-i

~VSMART .,~ .J;)r !1!1111

RIil

ACADEMY ~., (9 7887 7887 05

Mos1 ~:~c:! Updates f R Mosl RoccnlV1do o5

...

Vsm,1n Ac.aclemy p,1ge ·grouo _ IC ~Ill\•'~"'

/

v~m.1n AcJ~f'TI) ch,Hl'lCI

.., w,th th,. A,nhora Pr1nt1ng aod Publl•t"

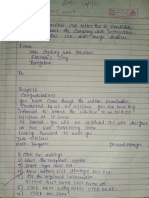

INDAS 115 v/s IFRS IS-

L-e. . - - - - - - - - - - - -0

IND AS 103 V/S IFRS 3 -

/

IND AS 32 v/s IAS 32 -

Penalties Part of Transaction Price or Not'? Gain From Bargain Purchase FCCB

_J y".

l .j.

There is a Breach in "Long Term C - - - • • - .j.

Consideration of Penalties in TreatmeOt of Gain from Bargain Conversion Option for Foreign Currency

Loan Arrangement" before Transaction Price of the contract Purchase (GBP) Denominated Bonds (FCCB)

Reporting Period which makes the Ii.

Loan Repayable on Demand and

Lender Agrees before the Approval

of Financial Statements not to As per IND AS 115, As per IFRS 15, all types · AS per IND AS 103, GBP As Per IFRS 3, GBP is to As per IND AS 32, As per lAS 32, it is

Demand Repayment. ~ r Penalty only if of Penalties ~ e is to be Transferred to be Recognised in Profit Conversion Option of treated as Financial

in determinatio.-a considered as Variable Capital Reserve (Other & Loss as Income FCCB to Acquire Fixed Liability (Derivative)

+ + of Transaction Price Consideration to Include

in Transaction Price.

Equity) through OCI

/ .

No. of Entity's Own

Equity Instruments

and P/L arising out of

such contract in

Do not Classify as Classify as

Current Liability

as per INDAS 1

Current Liability

as perIAS 1

!

Trea ted a s Equity Instrument

transferred to Statement

of Profit & Loss

+

I/

Determination of Carrying Amount of

"'-- '- -- '-~<t-L

IND AS 40 vis IAS 40 -

Fair Value Model

+

Subsequent Recognition of

-=

IND AS 21 v/s IAS 21 -

Ex. Difference

+

Recognition of Exchange Difference

0

IND AS 28 v/s IAS 28 -

Reportinl?, Period

}

Reporting Period & Accounting Policy of

Property, Plant & Equipment (PPE) Investment Property arising on Translation of Monetary Items Associate Company and Investor Company

on date of Transition from Foreign Currency to Functional

Currency

1

'--,__

+ + + l

+ -' ·"l,, ' + As per IND AS 40, As per IAS 40, Botb

+ l In IND AS 28, Phrase As per AS 28, Same

~ er IND AS 101,fui'l ~i\S per IFRS 1, Deemed only COST Model COST a[!_d Fair Value "Unlessiinpracticable to Accounting Policy is

~ is provided to~ ·for

Val u e the purpose of ,sallowed. ----:lVioclel are allow.fill_ As per IND AS 21, Option As per IAS 21, No do so" has been added required to be followed

, arrying Amount of PPE Transition can be Fair Fair Value can be to Continue para 46 of AS Such Option is Given

as per Old standards) as Value Only (No Choice to used only for 11 for difference arising

Dee med Value of such T ake Carrying Amt. as Disclosure before Transition date has

PPE on the Daw-ef per Previous GAAP) Purpose been provided i.e. E ither

'Q:aositif_!!J_::::---- Capftalise the difference

or Defer the Ddlerence

,.-~

GI - - - - - - , - - - 1..

. i• ..,,.

] ",

L

You might also like

- American Society of Mechanical Engineers-The Guide To Hydropower Mechanical Design-H C I Pubns (1996) PDFDocument384 pagesAmerican Society of Mechanical Engineers-The Guide To Hydropower Mechanical Design-H C I Pubns (1996) PDFUmesh Shrestha100% (3)

- Welcome To The 60's-Páginas-141-150Document10 pagesWelcome To The 60's-Páginas-141-150Anonymous ad6Ap8rNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Investingunplugged PDFDocument225 pagesInvestingunplugged PDFWilliam MercerNo ratings yet

- 65-C Bucyrus-Erie-Truck-Cranes-Spec-2ea121Document4 pages65-C Bucyrus-Erie-Truck-Cranes-Spec-2ea121Rothsby Hoyos GomezNo ratings yet

- Vampire FB.30 Modifications List Pt.1Document526 pagesVampire FB.30 Modifications List Pt.1Left VentricleNo ratings yet

- RML Rev 3Document102 pagesRML Rev 3Fitri BukhriNo ratings yet

- Adobe Scan 11. Mai 2022Document2 pagesAdobe Scan 11. Mai 2022Enver AbdyliNo ratings yet

- Reinfocement Details Slab CulvertDocument1 pageReinfocement Details Slab Culvertlakshmi naryanaNo ratings yet

- Adobe Scan 01 Dec 2021Document8 pagesAdobe Scan 01 Dec 2021anushree4989No ratings yet

- Big Dipper 2Document2 pagesBig Dipper 2Rémi BolducNo ratings yet

- K Fsu / J: i.lJ!ADocument2 pagesK Fsu / J: i.lJ!AChristjohn VillaluzNo ratings yet

- Tusuwiin NegtgelDocument507 pagesTusuwiin NegtgelLeo Rich MongoliaNo ratings yet

- Saikumar DocumentsDocument23 pagesSaikumar DocumentsSaikumar PatilNo ratings yet

- Geo Half Yearly Map Work Class 9Document4 pagesGeo Half Yearly Map Work Class 9Shivansh SinghNo ratings yet

- 10th MarksheetDocument1 page10th MarksheetRanjeet Singh ChouhanNo ratings yet

- 20091AA058 Kartheeka KundamDocument2 pages20091AA058 Kartheeka Kundam20-68 AishwaryaNo ratings yet

- ShowTransactionImageFile PDFDocument20 pagesShowTransactionImageFile PDFMatthew WhittenNo ratings yet

- Chapter 6Document3 pagesChapter 6Gururaj P KundapurNo ratings yet

- HR Assignment Udhr Three Gen of RightsDocument16 pagesHR Assignment Udhr Three Gen of RightsDEvanshiNo ratings yet

- Petroleum FluidsDocument295 pagesPetroleum FluidsItmar ViguerasNo ratings yet

- Wiring Diagram MGS7310-1Document12 pagesWiring Diagram MGS7310-1ULPLTD LUWUKNo ratings yet

- 872-08 09 15-លក្ខន្តិកៈគតិយុត្តនៃគ្រឹះស្ថានសាធារណៈរដ្ឋបាលDocument15 pages872-08 09 15-លក្ខន្តិកៈគតិយុត្តនៃគ្រឹះស្ថានសាធារណៈរដ្ឋបាលnyka495No ratings yet

- Frost Design in Canada: PracticeDocument32 pagesFrost Design in Canada: PracticeMearg NgusseNo ratings yet

- DrawingsDocument7 pagesDrawingsAnkit SinghNo ratings yet

- A3186 Service ManualDocument75 pagesA3186 Service ManualJose Luis SaldiasNo ratings yet

- Adobe Scan 6 Jan 2023Document14 pagesAdobe Scan 6 Jan 2023Sama HodekarNo ratings yet

- Screenshot 2020-11-04 at 7.17.24 PMDocument9 pagesScreenshot 2020-11-04 at 7.17.24 PMYash VardhanNo ratings yet

- Republic of The Philippines Office of The City Mayor Bacolod CityDocument10 pagesRepublic of The Philippines Office of The City Mayor Bacolod CityJapheth CuaNo ratings yet

- Highrise Building Approved Elec Drawing - AddcDocument21 pagesHighrise Building Approved Elec Drawing - AddcJothi VelNo ratings yet

- JBL Pulse 1 ManualDocument8 pagesJBL Pulse 1 Manualjev_ssNo ratings yet

- D. Scarlatti - Le VioletteDocument5 pagesD. Scarlatti - Le VioletteAlek IsakovicNo ratings yet

- Adobe Scan 5 Mar 2024Document1 pageAdobe Scan 5 Mar 2024Deepak ChaudharyNo ratings yet

- S A MWL : ABH/N (/VDocument1 pageS A MWL : ABH/N (/VAnonymous oVxZDZuechNo ratings yet

- S A MWL : ABH/N (/VDocument1 pageS A MWL : ABH/N (/VAnonymous 0pMVwY0OcoNo ratings yet

- Volume 2 Notes On GermanDocument103 pagesVolume 2 Notes On GermanKasa Satu100% (1)

- Planetario Apron Feeder Minera EscondidaDocument16 pagesPlanetario Apron Feeder Minera Escondidanelson troncoso galdamesNo ratings yet

- Harris SchmedlenDocument1 pageHarris SchmedlenRock QuarryNo ratings yet

- Midway Space Invader SchematicsDocument3 pagesMidway Space Invader SchematicsThomas C WalkerNo ratings yet

- Tag List For EquipmentsDocument5 pagesTag List For EquipmentskapsarcNo ratings yet

- ' (1 T'Far': B MRD Bd2FcdDocument8 pages' (1 T'Far': B MRD Bd2FcdGerson GomesNo ratings yet

- The Honorable Members: BacolodDocument13 pagesThe Honorable Members: BacolodChristjohn VillaluzNo ratings yet

- Turbine TG Data SheetDocument5 pagesTurbine TG Data Sheetshinki31000No ratings yet

- 062 - R - 301 - 302 - 303 ManuelDocument303 pages062 - R - 301 - 302 - 303 Manuelshinki31000No ratings yet

- Forever I Will SingDocument3 pagesForever I Will SingAlen Matthew AndradeNo ratings yet

- FX-3600Pv El-Kitabi IngDocument21 pagesFX-3600Pv El-Kitabi IngSaim PAKERNo ratings yet

- Drag Coefficent of Cables and Ropes PDFDocument67 pagesDrag Coefficent of Cables and Ropes PDFnhy.mail2709No ratings yet

- Croquis D'immunitéDocument2 pagesCroquis D'immunitéCamille SiropNo ratings yet

- Adobe Scan 23 Dec 2021Document1 pageAdobe Scan 23 Dec 2021AFRAHNo ratings yet

- ImagesDocument4 pagesImagesAimaan MisbaNo ratings yet

- Adobe Scan 13-Dec-2021Document18 pagesAdobe Scan 13-Dec-2021abdulmuheed006No ratings yet

- Kármàn (1929)Document9 pagesKármàn (1929)Marcelo De Oliveira PredesNo ratings yet

- Kármàn (1929) PDFDocument9 pagesKármàn (1929) PDFMarcelo De Oliveira PredesNo ratings yet

- Pages From Dorman Longs - Handbook For Constructional Engineers - 1895-52Document1 pagePages From Dorman Longs - Handbook For Constructional Engineers - 1895-52Fornvald TamasNo ratings yet

- SMR Apex 2300 Service ManualDocument108 pagesSMR Apex 2300 Service ManualCamila MapuraNo ratings yet

- Tiptur: .,,.r:dfliDocument1 pageTiptur: .,,.r:dflisai kiranNo ratings yet

- Photo Copy Request For ShahristanDocument1 pagePhoto Copy Request For ShahristanasadullahNo ratings yet

- IS3521Document11 pagesIS3521MayurNo ratings yet

- R "'2oif: Office of The Ci!Ry MayorDocument3 pagesR "'2oif: Office of The Ci!Ry MayorsecrecyrussiaNo ratings yet

- Power Electronics (By Ned Mohan) 2Document127 pagesPower Electronics (By Ned Mohan) 2Мирослав Милков100% (1)

- The Corvette: A Nathaniel Drinkwater NovelFrom EverandThe Corvette: A Nathaniel Drinkwater NovelRating: 4.5 out of 5 stars4.5/5 (14)

- Fair Value Ind As 113Document1 pageFair Value Ind As 113maninderpnnNo ratings yet

- Employee Benefit Ind As 19Document2 pagesEmployee Benefit Ind As 19maninderpnnNo ratings yet

- Brief Analysis of Recent NFRA Orders 1692457542Document12 pagesBrief Analysis of Recent NFRA Orders 1692457542maninderpnnNo ratings yet

- Indian Accounting Standards Ind As An Overview 1695181348Document232 pagesIndian Accounting Standards Ind As An Overview 1695181348maninderpnnNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument29 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Resume of Chapter 6 Making Capital Investment DecisionsDocument4 pagesResume of Chapter 6 Making Capital Investment DecisionsAimé RandrianantenainaNo ratings yet

- MLPT FinanceDocument180 pagesMLPT FinanceKris ValiantoNo ratings yet

- Megaworld 3rd Quarter 2019 Financial ReportDocument32 pagesMegaworld 3rd Quarter 2019 Financial ReportRyan CervasNo ratings yet

- Solution Chapter 11Document38 pagesSolution Chapter 11Anonymous CuUAaRSNNo ratings yet

- Article FMGGDocument17 pagesArticle FMGGErmi ManNo ratings yet

- Amazon: Name: Hammad Ahmed ACCA REG. NUMBER: 2427634Document20 pagesAmazon: Name: Hammad Ahmed ACCA REG. NUMBER: 2427634Hammad AhmedNo ratings yet

- Final Report 21BCM1553Document45 pagesFinal Report 21BCM1553Guljeet SinghNo ratings yet

- Far CeggDocument17 pagesFar CeggMaurice AgbayaniNo ratings yet

- Partnership LiquidationDocument10 pagesPartnership LiquidationchristineNo ratings yet

- Meeting No. 2 - Learning Synthesis - Chapter 1 Mangerial Accounting PDFDocument4 pagesMeeting No. 2 - Learning Synthesis - Chapter 1 Mangerial Accounting PDFAnne PorterNo ratings yet

- DMCC Company Regulations - Jan 2022 - V2Document79 pagesDMCC Company Regulations - Jan 2022 - V2Laila NadifNo ratings yet

- Investment Research: Fundamental Coverage - Ifb Agro Industries LimitedDocument8 pagesInvestment Research: Fundamental Coverage - Ifb Agro Industries Limitedrchawdhry123No ratings yet

- "Dividend Decision": Synopsis OnDocument14 pages"Dividend Decision": Synopsis Onferoz khanNo ratings yet

- STRATEGIC COST MANAGEMENT - Week 12Document46 pagesSTRATEGIC COST MANAGEMENT - Week 12Losel CebedaNo ratings yet

- ACF 103 Revision Qns Solns 20141Document12 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Final Exam ConceptualDocument8 pagesFinal Exam ConceptualJun GilloNo ratings yet

- FINC521Document20 pagesFINC521Ayushi GargNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Ratio Analysis of HR TextilesDocument26 pagesRatio Analysis of HR TextilesOptimistic Eye100% (1)

- Contact Session 2 Slides - ACN100 Second Semester-1Document42 pagesContact Session 2 Slides - ACN100 Second Semester-1Ronald RamorokaNo ratings yet

- Accounting and Its Environment - PowerPoint PresentationDocument30 pagesAccounting and Its Environment - PowerPoint PresentationBhea G. ManaloNo ratings yet

- Capital Structure Analysis OFDocument35 pagesCapital Structure Analysis OFneer_teeNo ratings yet

- Book BuildingDocument19 pagesBook Buildingmonilsonaiya_91No ratings yet

- Ina 20210617 TSDocument7 pagesIna 20210617 TSPhạm Minh QuânNo ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Editor in chief,+EJBMR 1033+R300821Document7 pagesEditor in chief,+EJBMR 1033+R300821BigPalabraNo ratings yet