Professional Documents

Culture Documents

Exercise - Currency Swap

Exercise - Currency Swap

Uploaded by

vikneswaran ayappan0 ratings0% found this document useful (0 votes)

12 views2 pagesThe company wishes to convert its €25 million annual euro cash flow from its Italian subsidiary into pounds. To do this, it plans to engage in a currency swap. The notional principals that would achieve this are a €12.5 million euro notional principal paying 6.5% interest semiannually and a £256.4 million pound notional principal paying 7.5% interest semiannually. This would result in the company receiving €12.5 million semiannually from the swap and paying £9.6 million semiannually, effectively converting its euro cash receipts to pounds.

Original Description:

Swap Floating and fixed rate

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe company wishes to convert its €25 million annual euro cash flow from its Italian subsidiary into pounds. To do this, it plans to engage in a currency swap. The notional principals that would achieve this are a €12.5 million euro notional principal paying 6.5% interest semiannually and a £256.4 million pound notional principal paying 7.5% interest semiannually. This would result in the company receiving €12.5 million semiannually from the swap and paying £9.6 million semiannually, effectively converting its euro cash receipts to pounds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesExercise - Currency Swap

Exercise - Currency Swap

Uploaded by

vikneswaran ayappanThe company wishes to convert its €25 million annual euro cash flow from its Italian subsidiary into pounds. To do this, it plans to engage in a currency swap. The notional principals that would achieve this are a €12.5 million euro notional principal paying 6.5% interest semiannually and a £256.4 million pound notional principal paying 7.5% interest semiannually. This would result in the company receiving €12.5 million semiannually from the swap and paying £9.6 million semiannually, effectively converting its euro cash receipts to pounds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

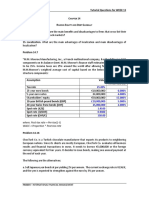

Exercise – Currency Swap

A company based in the United Kingdom has an Italian subsidiary. The

subsidiary generates €25,000,000 a year, received in equivalent semiannual

installments of €12,500,000. The British company wishes to convert the euro

cash flows to pounds twice a year. It plans to engage in a currency swap in

order to lock in the exchange rate at which it can convert the euros to pounds.

The current exchange rate is €1.5/£. The fixed rate on a plain vanilla currency

swap in pounds is 7.5 percent per year, and the fixed rate on a plain vanilla

currency swap in euros is 6.5 percent per year.

You are required to:

(a) Determine the notional principals in euros and pounds for a swap with

semiannual payments that will help achieve the objective.

(b) Determine the semiannual cash flows from this swap.

ANSWER:

a. The semiannual cash flow must be converted into pounds is

€25,000,000/2 = €12,500,000. In order to create a swap to convert

€12,500,000, the equivalent notional principals are

· Euro notional principal = €12,500,000/(0.065/2) = €384,615,385

· Pound notional principal = €384,615,385/€1.5/£ = £256,410,257

b. The cash flows from the swap will now be

· Company makes swap payment = €384,615,385(0.065/2) =

€12,500,000

· Company receives swap payment = £256,410,257(0.075/2) =

£9,615,385

The company has effectively converted euro cash receipts to pounds.

You might also like

- Chap11 Translation PbmsDocument10 pagesChap11 Translation Pbmskk100% (2)

- Mini Case: Shrewsbury Herbal Products, LTDDocument7 pagesMini Case: Shrewsbury Herbal Products, LTDSriSaraswathy100% (1)

- 10 2004 Jun QDocument7 pages10 2004 Jun QFahad SajjadNo ratings yet

- Business Calculations Level 2: LCCI International QualificationsDocument11 pagesBusiness Calculations Level 2: LCCI International QualificationsZuuko ZuuNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Chapter 17Document62 pagesChapter 17Shrief MohiNo ratings yet

- How To Read Financial Statements New Book From Scrib DDocument4 pagesHow To Read Financial Statements New Book From Scrib DShaunak DevalkarNo ratings yet

- BUU33532 - Financial Accounting II - HT - WK1 - 30.01.22Document2 pagesBUU33532 - Financial Accounting II - HT - WK1 - 30.01.22simiNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- Absorption and Marginal CostingDocument6 pagesAbsorption and Marginal CostingmehtabahmadsikanderNo ratings yet

- Example CFT Lecture 3Document1 pageExample CFT Lecture 3kami924No ratings yet

- International Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6Document54 pagesInternational Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6faycal626No ratings yet

- Management 3460: Institutions and Practices in International FinanceDocument43 pagesManagement 3460: Institutions and Practices in International Financeviki12334No ratings yet

- Abf Annual Report 2012Document120 pagesAbf Annual Report 2012ummesidNo ratings yet

- Topic 2 Lecture 3 Discounted Cash Flow ValuationDocument44 pagesTopic 2 Lecture 3 Discounted Cash Flow ValuationSyaimma Syed AliNo ratings yet

- Chapter 3 Flexible Budgets and StandardsDocument15 pagesChapter 3 Flexible Budgets and StandardsSuleyman TesfayeNo ratings yet

- Imt Covid19Document9 pagesImt Covid19vnv servicesNo ratings yet

- International Corporate Finance: © 2019 Pearson Education LTDDocument8 pagesInternational Corporate Finance: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- 2 GIPM 02 Investment AppraisalDocument50 pages2 GIPM 02 Investment AppraisalSamantha Meril PandithaNo ratings yet

- Chap08 Tutorial QuestionsDocument6 pagesChap08 Tutorial QuestionsSong PhươngNo ratings yet

- Chapter 7Document8 pagesChapter 7suleymantesfaye10No ratings yet

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- Midterm (Yassine Hammami)Document4 pagesMidterm (Yassine Hammami)hammamiyessine68No ratings yet

- Heriot-Watt University Finance - June 2013 Section II Case StudiesDocument9 pagesHeriot-Watt University Finance - June 2013 Section II Case StudiesakilNo ratings yet

- Chapter-01 Introduction Accounting Principles SDocument10 pagesChapter-01 Introduction Accounting Principles SShifatNo ratings yet

- Exercises Capital Budgeting 2 (With Solutions) PDFDocument4 pagesExercises Capital Budgeting 2 (With Solutions) PDFSam PskovskiNo ratings yet

- ACW366 - Tutorial Exercises 5 PDFDocument5 pagesACW366 - Tutorial Exercises 5 PDFMERINANo ratings yet

- Fin ManDocument4 pagesFin ManMK AsuncionNo ratings yet

- Questions On Shareholders' EquityDocument36 pagesQuestions On Shareholders' EquityAlloysius ParilNo ratings yet

- Chapter 2 - Q&PDocument36 pagesChapter 2 - Q&PHuyền ĐàoNo ratings yet

- Economic Viability Calculation AssignmentDocument3 pagesEconomic Viability Calculation Assignmentamoatengprince5No ratings yet

- Block 3 Adjustments To Company AccountsDocument49 pagesBlock 3 Adjustments To Company AccountsNguyễn Hạnh Linh100% (1)

- ACC Resit TAPDocument2 pagesACC Resit TAPabraarhasan257No ratings yet

- Operating Exposure (Or Chapter 9)Document19 pagesOperating Exposure (Or Chapter 9)sindhupallavigundaNo ratings yet

- 2016 CommentaryDocument41 pages2016 Commentaryduong duongNo ratings yet

- Management of Translation ExposureDocument41 pagesManagement of Translation ExposureYogesh ThawaitNo ratings yet

- Cost Exercises - Corrections To BookDocument3 pagesCost Exercises - Corrections To Bookchamie143No ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- Att - Bh4klhpu7yollyl3wv7jd7arq80eaxuo19 Mbn55uc8Document14 pagesAtt - Bh4klhpu7yollyl3wv7jd7arq80eaxuo19 Mbn55uc8gichangduoc612No ratings yet

- Case 8 Southampton PLCDocument2 pagesCase 8 Southampton PLCMohit RastogiNo ratings yet

- Att bH4KLhPU7YOllYL3Wv7jD7ARq80EAXuo19-mBN55uc8Document16 pagesAtt bH4KLhPU7YOllYL3Wv7jD7ARq80EAXuo19-mBN55uc8gichangduoc612No ratings yet

- Chapter 9 - Economic ExposureDocument23 pagesChapter 9 - Economic ExposurealdoNo ratings yet

- Cost of Good SaleDocument6 pagesCost of Good SaleArvin VillanuevaNo ratings yet

- Cost of Good SaleDocument6 pagesCost of Good SaleArvin VillanuevaNo ratings yet

- Helpful PDFDocument23 pagesHelpful PDFMahrukh ChohanNo ratings yet

- Cost of Capital MathDocument24 pagesCost of Capital MathAkash FAYSHAL AHAMMED -DHAKA-No ratings yet

- Accounting ApplicationsDocument8 pagesAccounting Applicationsaumit0099No ratings yet

- hw21 04Document2 pageshw21 04tgn6jxybqwNo ratings yet

- NumericalTest10 QuestionsDocument13 pagesNumericalTest10 Questionsjack robertsNo ratings yet

- Project Financial Appraisal Techniques: Delivered byDocument12 pagesProject Financial Appraisal Techniques: Delivered byHimanshu JoshiNo ratings yet

- 5a - FreddyDocument29 pages5a - Freddyaliona.simon.ousviatsevNo ratings yet

- G15Document3 pagesG15bakarngumieNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- European Investment Bank Group Sustainability Report 2021From EverandEuropean Investment Bank Group Sustainability Report 2021No ratings yet

- European Investment Bank Group Sustainability Report 2020From EverandEuropean Investment Bank Group Sustainability Report 2020No ratings yet

- Business Guide to the United Kingdom: Brexit, Investment and TradeFrom EverandBusiness Guide to the United Kingdom: Brexit, Investment and TradeNo ratings yet