Professional Documents

Culture Documents

14 Shareholders' Equity

14 Shareholders' Equity

Uploaded by

randomlungs121223Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 Shareholders' Equity

14 Shareholders' Equity

Uploaded by

randomlungs121223Copyright:

Available Formats

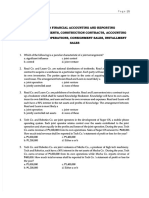

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

CPA Review Batch 45 May 2023 CPA Licensure Examination

FINANCIAL ACCOUNTING & REPORTING / AUDITING PRACTICE S. IRENEO G. MACARIOLA C. ESPENILLA J. BINALUYO

SHAREHOLDERS’ EQUITY

Elements of Shareholders’ Equity:

1. Share Capital or Capital Stock

a) Ordinary share capital or common stock

b) Preference share capital or preferred stock

2. Share Capital Not Yet Fully Paid or Subscribed Capital Stock

3. Share Premium Reserve or Additional Paid In Capital

a) Excess of par (issue price over par)

b) On re-issue of treasury shares

c) On share or stock dividend

d) Share options outstanding

e) Share warrants outstanding

f) Donated Capital

g) On retirement of share capital

4. Other Equity Reserves:

a) Appropriation reserves

b) Revaluation reserves

c) Translation reserves

d) Unrealized gain or loss on available for sale

e) Actuarial gains and losses

5. Accumulated Profits and Losses or Retained Earnings

Measure of Share Capital When Issued or Subscribed: With par – at par any excess to Share Premium

Without par but with a stated value:

1. At stated value any excess to Share Premium Reserve

2. At total amount or proceeds on the issue of the share

Measure of the Consideration Received in Exchange for Shares:

a) For cash or receivable–at face

b) For non-cash – at the FMV of the non-cash or FMV of the shares issued whichever is clearly determinable.

c) For services rendered – at the FMV of the services rendered or market value of the shares issued

whichever is clearly determinable.

Share capital transaction – any gain on the reissue (treasury share), retirement, conversion of share is credited

to the account Share Premium Reserve or any other appropriate account, any loss is charged against Share

Premium (for the reissue of treasury), if any, any remaining loss to Accumulated Profits and Losses, any loss

identified to other share capital transaction other than re-issue of treasury, is debited directly to the account

Accumulated Profits and Losses.

Issuance of Ordinary and Preference Shares for a Basket Price: Both Securities are treated as equity:

1. If the market values of both equity shares are known, the basket price is allocated using their market

value ratio.

2. When only one security has a known market value, the basket price or proceeds is allocated to the

securities by deducting the market value of the security with a known market value (the market value of

that security will be its assigned value) the excess will the assigned value of the security without a known

market value.

Preference Shares are treated as Debt:

The residual method is used to allocate the proceeds between the Ordinary Share Capital (equity) and the

Preference Share (debt). The fair value of the Preference Share (debt) is deducted from the total proceeds in

arriving at the fair value of the Ordinary Share Capital (equity).

Issuance of Preference Share with a Share Warrant: Preference Share is treated as Equity:

1. If the market value of the preference share and the market value of the warrants are known – the

proceeds is allocated to the securities using their market value ratio.

2. When only one security has a known market value, the proceeds is allocated to the securities by

deducting the market value of the security with a known market value (the market value of that security

will be its assigned value) the excess will the assigned value of the security without a known market

value.

Preference Share is treated as Debt:

The residual method is used to allocate the proceeds between the Share Warrants (equity) and the Preference

Share (debt). The fair value of the Preference Share (debt) is deducted from the total proceeds in arriving at the

fair value of the Share Warrants (equity).

Page 1 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

Measure of Treasury Share – at cost which is equal to the face value of cash or fair market value of non-cash

asset surrendered in reacquiring shares of the company.

Disposal of treasury share thru re-issuance - the re-issue price less the cost of treasury share. Any positive

excess is credited to Share Premium- from Treasury. Any negative excess is debited to Share Premium-Treasury

to the extent of an existing credit balance prior to re-issuance, any remaining negative excess is debited to

Retained Earnings or Accumulated Profits or Losses account.

Disposal of treasury share thru retirement - the carrying value of the share to which to the treasury share

belongs less cost of the treasury. Any positive excess is credited to Share Premium- from Retirement. Any

negative excess is debited to Accumulated Profits and Losses.

* The carrying value of the share includes the Par and the Share Premium at the time the shares were originally issued.

Conversion of a Class of Own Equity to another Class of Own Equity:

The carrying value of the converted class of equity is transferred to the newly issued class of equity. Gain or loss

on the conversion is not recognized.

Share Rights - is an issue of new shares with the terms of issue giving shareholders the right to an additional

number of shares in proportion to their current shareholdings. Rights issue may be renounceable or non-

renounceable. If renounceable, existing shareholders may sell their rights to the new shares to another party

during the offer period. If the rights issue is non-renounceable, a shareholder is not allowed to sell his or her

rights to the new shares and must either accept or reject the offer to acquire new shares in the company.

Accounting for Share Rights:

1. Upon issuance – no formal entry is necessary, only a memorandum entry is required

2. Upon exercise – formal entry is required to record the issue of new shares.

3. Upon redemption – formal entry is required to record the “as if” payment of cash dividends.

4. Upon expiration – no formal entry is necessary.

Bonus issue – is an issue of shares to existing shareholders in proportion to their current shareholdings at no

cost to the shareholders. The company uses its reserves balances or retained earnings to make the issue. The

bonus issue is a transfer from one equity account to another, so it does not increase or decrease the shareholders’

equity of the enterprise. Bonus issue is a transaction that will only affect the components of the equity or a

transaction inside the shareholders’ equity. The result of the bonus issue increases the share capital and decreases

another equity account of the entity.

Equity-Settled Share-Based Payment: (Share Options):

The entity shall measure the services received, and the corresponding increase in equity, directly, at the fair value

of the services received, unless the fair value cannot be estimated reliably. If the entity cannot estimate reliably

the fair value of the services received, the entity shall measure their fair value and the corresponding increase in

equity, indirectly, by reference to the fair value of the equity instruments granted. Because of the difficulty of

directly measuring the cost of the service directly, the entity shall measure the fair value of the employee services

received by reference to the fair value of the equity instruments granted. However, in rare cases, the entity may

be unable to estimate reliably the fair value of the equity instruments granted at the measurement date, the

entity shall instead measure the equity instruments at their intrinsic value.

Cash-Settled Share-Based Payments:

The entity shall measure the goods or services acquired and the liability incurred at the fair value of the liability.

Until the liability is settled, the entity shall remeasure the fair value of the liability at each reporting date and at

the date of settlement, with any changes in fair value recognized in profit or loss for the period.

Share-Based Payment with Cash Alternatives:

For share-based payment transactions in which the terms of the arrangement provide either the entity or the

counter party with the choice of whether the entity settles the transaction in cash (or other asset) or by issuing

equity instruments, the entity shall account for that transaction, or the components of that transactions, as a

cash-settled share-based payment transactions if, and to the extent that, the entity has incurred a liability to

settle in cash or other assets, or as equity-settled share-based payment transaction if, and to the extent that, no

such liability has been incurred.

Share-Based Payment–The Counter Party with a Choice of Settlement:

If an entity granted the counterparty the right to choose whether a share-based payment transaction is settled

in cash or by issuing equity instruments, the entity has granted a compound financial instrument, which includes

a debt component and equity component. For transaction with parties other than employees, in which the fair

value of the goods or services received is measured directly, the entity shall measure the equity component of

the compound financial instrument as the difference between the fair value of the goods or services received and

the fair value of the debt component, at the date when the goods or services are received.

For transactions, including transactions with employees, the entity shall measure the fair value of the compound

financial instrument at the measurement date, taking into account the terms and conditions on which the rights

to cash or equity instruments were granted. The entity shall first measure the fair value of the debt component

and then measure the fair value of the equity component, taking into account that the counterparty must forfeit

the right to receive cash in order to receive the equity instruments.

Page 2 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

Share-Based Payment – The Entity with a Choice of Settlement:

If the terms of the arrangement provide an entity with the choice of whether to settle in cash or by issuing equity

instruments, the entity shall determine whether it has a present obligation to settle in cash and account for the

share-based payment transaction accordingly. The entity has a present obligation to settle in cash if the choice

of settlement in equity instrument has no commercial substance (e.g. because the entity is legally prohibited from

issuing shares), or the entity has a past practice or a stated policy of settling in cash, or generally settles in cash

whenever the counterparty asks for cash settlement. If the entity has a present obligation to settle cash, it shall

account for the transaction in accordance with the requirements applying cash- settled share-based payment

transactions. If no such obligation, the entity shall account for transaction in accordance with the requirements

applying equity-settled share-based payment transactions.

FINANCIAL ACCOUNTING & REPORTING-THEORIES

1. Total shareholders’ equity represents

a. a claim to specific assets contributed by the owners.

b. the maximum amount that can be borrowed by the enterprise.

c. a claim against a portion of the total assets of an enterprise.

d. only the amount of earnings that have been retained in the business.

2. A primary source of shareholders’ equity is

a. income retained by the corporation.

b. appropriated retained earnings.

c. contributions by shareholders.

d. both income retained by the corporation and contributions by holders.

3. Which of the following represents the total number of shares that a corporation may issue under the terms of

its charter?

a. authorized shares c. unissued shares

b. issued shares d. outstanding shares

4. When treasury shares are purchased for more than the par value of the shares and the cost method is used

to account for treasury shares, what account(s) should be debited?

a. Treasury shares for the par value and share premium for the excess of the purchase price over the

par value.

b. share premium for the purchase price.

c. Treasury shares for the purchase price.

d. Treasury shares for the par value and retained earnings for the excess of the purchase price over the

par value.

5. In January 2021, Foler Corporation, a newly formed company, issued 10,000 shares of its P10 par ordinary

shares for P15 per share. On July 1, 2021, Foler Corporation reacquired 1,000 shares of its outstanding shares

for P12 per share. The acquisition of these treasury shares

a. decreased total shareholders’ equity c. did not change total shareholders’ equity

b. increased total shareholders’ equity d. decreased the number of issued shares

6. Treasury shares are

a. shares held as an investment by the treasurer of the corporation.

b. shares held as an investment of the corporation.

c. issued and outstanding shares.

d. issued but not outstanding shares.

7. When treasury shares are purchased for more than the par value of the shares and the cost method is used

to account for treasury shares, what account(s) should be debited?

a. Treasury shares for the par value and share premium for the excess of the purchase price over the

par value.

b. share premium for the purchase price.

c. Treasury shares for the purchase price.

d. Treasury shares for the par value and retained earnings for the excess of the purchase price over the

par value.

8. At its date of incorporation, Solid, Inc. issued 100,000 shares of its P10 par ordinary shares at P11 per share.

During the current year, Solid acquired 20,000 ordinary shares at a price of P16 per share and accounted for

them by the cost method. Subsequently, these shares were reissued at a price of P12 per share. There have

been no other issuances or acquisitions of its own ordinary shares. What effect does the reissuance of the

shares have on the following accounts?

Retained Earnings Share Premium

a. Decrease Decrease

b. No effect Decrease

c. Decrease No effect

d. No effect No effect

9. Contributed capital consists of the following major components?

a. legal and stated capital c. legal capital and additional paid-in capital

b. retained earnings and legal capital d. additional paid-in capital and retained earnings

10. How should the excess of subscription price over the value of ordinary shares subscribed be recorded?

a. as share premium when the share capital is issued

b. as share premium when the subscription is received

c. as share premium when the subscription is collected

d. as retained earnings when the subscription is received

Page 3 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

11. Treasury share was acquired for cash at a price in excess of its par value. The treasury share was

subsequently sold for cash at a price in excess of its acquisition price. Assuming that the cost method of

accounting for treasury share transactions is used, what is the effect on total shareholders’ equity?

Purchase of treasury share Sale of treasury share

a. Increase Decrease

b. Decrease No effect

c. Decrease Increase

d. No effect No effect

12. At the date of the financial statements, ordinary shares issued would exceed ordinary shares outstanding as

a result of the

a. declaration of a share split c. purchase of treasury shares

b. declaration of share dividend d. payment in full of subscribed shares

13. How would a share split affect each of the following?

Assets Total Shareholders’ Equity Share Premium

a. Increase Increase No effect

b. No effect No effect No effect

c. No effect No effect Increase

d. Decrease Decrease Decrease

FINANCIAL ACCOUNTING & REPORTING - PROBLEMS

Problem 1: Brown Corporation was organized on January 2, 2022, with authorized capital of 200,000 shares of

P10 par value ordinary share. During 2022, Brown had the following transactions:

Jan. 12 Issued 80,000 shares for P12 per share

Apr 23 Issued 4,000 shares for legal services when the market price was P14 per share

What should be the amount of share premium at December 31, 2022?

a. 16,000. b. 56,000. c. 160,000. d. 176,000

Problem 2: Orange Corporation issued 80,000, P10 par value, ordinary shares when it began operation in 2020

and issued an additional 40,000 shares in 2021. Orange also issued 20,000, P5 par value, preference share

convertible into 40,000 ordinary shares. In 2022, Orange purchased 30,000 ordinary shares and held it in the

treasury.

At December 31, 2022, what is the total par value of Orange ordinary shares outstanding?

a. 1,600,000. b. 1,300,000. c. 1,200,000 d. 900,000

Problem 3: On April 1, 2022, Indigo, a newly formed company, had the following shares issued and outstanding

• Ordinary share, no par, P1 stated value, 20,000 shares originally issued for P30 per share

• Preference share, P10 par value, 6,000 shares originally issued for P50 per share

Indigo’s April 1, 2022 statement of shareholders’ equity should report

Ordinary share Preference share Share premium

a. 20,000 60,000 820,000

b. 20,000 300,000 580,000

c. 600,000 300,000 -0–

d. 600,000 60,000 240,000

Problem 4: The Beige Company was incorporated on January 1, 2022, with the following authorized

capitalization:

• 80,000 ordinary shares, no par value, stated value, P40 per share

• 20,000 5% cumulative preference share, par value P10 per share

During 2022, Beige issued 48,000 ordinary shares for a total of P2,400,000 and 12,000 preference shares at P16

per share. In addition, on December 31, 2022, subscriptions for 4,000 shares of preference share were taken at

a purchase price of P17. These subscribed shares were paid for on January 2, 2023.

What should Beige report as total contributed capital on its December 31, 2022 statement of financial position?

a. 2,800,000. b. 2,524,000. c. 2,592,000. d. 2,660,000.

Problem 5: Gray Company was organized on January 1, 2022, with an authorization of 400,000 shares of

ordinary share with a par value of P6 per share

During 2022, the corporation had the following capital transactions:

January 5 Issued 300,000 shares at P10 per share

April 6 Issued 100,000 shares at P12 per share

June 8 Issued 100,000 shares at P14 per share

July 28 Purchased 40,000 shares at P11 per share

December 31 Sold the 40,000 shares held in treasury at P18 per share

Gray used the cost method to record the purchase and reissuance of the treasury shares. What is the total

amount of share premium as of December 31, 2022?

a. 0. b. 2,320,000. c. 2,600,000. d. 2,880,000.

Page 4 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

Problem 6: Red Corporation was organized on January 1, 2021, at which date it issued 200,000 shares of P10

par ordinary shares at P15 per share. During the period January 1, 2021, through December 31, 2021, Red

reported net income of P900,000 and paid cash dividends of P460,000. On January 10, 2022, Red purchased

12,000 shares of its ordinary share at P12 per share. On December 31, 2022, Red sold 8,000 treasury shares at

P8 per share. Red uses the cost method of accounting for treasury shares.

What is Red’s total shareholders’ equity on December 31, 2022?

a. 3,340,000. b. 3,408,000 c. 3,376,000. d. 3,360,000.

Problem 7: Polo Company, a public limited company, has granted share options to its employees with a fair

value of P12,000,000. The options vest in three years’ time. The company uses the Monte-Carlo model to estimate

the fair value of the options, the number of employees that will vest and the revision of estimates such as the

following:

1. Grant date – January 1, 2020, estimate of employees leaving the company during the vesting period – 5%.

2. Revision of estimate – January 1, 2021 – estimate of employees leaving the company during the vesting

period – 6%.

3. Actual number of employees leaving the company - December 31, 2022 – 5%.

What would be the amount of expense charged in the profit or loss for the year ended December 31, 2022?

a. 3,760,000. b. 3,800,000 c. 3,880,000 d. 4,000,000.

Problem 8: On January 1, 2020, Nikko, Inc. granted 80,000 cash shares appreciation rights to the executives

on condition that the executives remain in its employ for the next three years. The entity estimates that the fair

value of the share appreciation rights at the end of each year in which a liability exists are as follows:

2020 2021 2022

Fair value P15 P18 P20

Compensation expense relating to the plan is to be recorded over a three-year period beginning January 1, 2020.

1. What amount of compensation expense should Nikko recognize for the year ended December 31, 2021?

a. 400,000. b. 560,000, c. 640,000. d. 1,440,000

2. What amount of compensation expense should Nikko recognize for the year ended December 31, 2022?

a. 400,000 b. 560,000. c. 640,000. d. 1,440,000.

AUDITING PRACTICE

Significant Business Process: Other Business Processes – Financing Cycle

PROBLEM 1: (SFP PRESENTATION; SHARE ISSUE)

Determine the adjusted balance of the following based on the balances as of December 31, 2020 below:

1. Total additional paid-in capital

2. Total contributed capital

3. Total stockholders’ equity

Ordinary shares (see audit note a) ?

Preference shares (see audit note a) ?

Subscribed ordinary shares (see audit note b) ?

Subscribed preference shares (see audit note b) ?

Subscriptions receivable – Ordinary shares (see audit note b) ?

Subscriptions receivable – Preference shares (see audit note b) ?

Share premium – Ordinary shares ?

Share premium – Preference shares ?

Bonds payable, Due December 31, 2025 2,000,000

Premium on bonds payable 200,000

Share premium - Treasury share transactions 240,000

Additional paid-in capital - bond conversion option 120,000

Donated capital 150,000

Ordinary share options outstanding 180,000

Ordinary share warrants outstanding 25,000

Accumulated unrealized holding loss on financial asset at FVOCI 130,000

Accumulated revaluation surplus/reserves 600,000

Accumulated net remeasurement gain on accumulated benefits 90,000

obligation and plan assets

Accumulated foreign exchange translation reserves, credit 300,000

Accumulated hedging reserves, debit 265,000

Treasury shares (see audit note c) ?

Accumulated profits – appropriated for treasury shares ?

Ordinary share dividends payable (see audit note c) 290,000

Accumulated profits – appropriated for plant expansion 800,000

Accumulated profits - unappropriated 1,650,000

Accumulated profits – bonds payable repayment 500,000

Page 5 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

Audit notes:

A. India Corporation issued 100,000 ordinary shares (no par value but with a P10 stated value) and

40,000 preference shares (P20 par value) for a lump-sum amount P2.8M. The prevailing fair values of

ordinary shares and preference shares on the date of issuance was at P15 per share and P25 per share,

respectively.

B. Additional 50,000 ordinary shares and 20,000 preference shares were subscribed at P18 per share and

P30 per share, respectively. 25% of the subscriptions price for both ordinary and preference shares

remained outstanding as of December 31, 2020. The receivable balance from ordinary shares were

collectible within the next 12 months, while the receivable balance from preference shares are non-

current. None of the subscribed shares were fully paid by the end of the year.

C. There were no other transactions affecting the company’s issued and subscribed shares during the year

other than a reacquisition of 5,000 ordinary shares (as treasury shares) at P16 per share and the

declaration of 20% stock dividends on ordinary shares.

PROBLEM 2: (SHARE ISSUE; TREASURY SHARES; CONVERTIBLE PREFERENCE SHARES)

You were assigned to audit the shareholders’ equity of America Corp. for the year ended December 31, 2020.

America Corp. was incorporated in early 2019 when it was authorized by SEC to issue 1,000,000 ordinary

shares (P20 par) and 500,000 preference shares (P100 par). The following schedule reflects the company’s

capital balances as of December 31, 2019:

Ordinary shares, 120,000 shares issued at inception of operations in lieu of a P2,400,000

Land and Building with a total fair market value of P3M (40% attributed to the

Land.)

Preference shares, 40,000 shares issued in June 30, 2019 at P120 per share. 4,800,000

One preference share can be convertible to four ordinary shares

Retained earnings, which is the company’s net income in 2019 1,158,000

Total shareholders’ equity ?

Your inquiries and investigation revealed the following transactions which occurred in 2020:

a. On January 5, the company reacquired 20,000 ordinary shares at P600,000 and held them as treasury

share.

b. On March 1, the company issued 45,000 additional ordinary shares with P1M, 12% face value bonds for

a lump sum consideration amounting to P2,250,000. The bonds which pay interest every December 31

and shall mature on December 31, 2025, were currently quoted in the market at 110 (excluding

accrued interest) while each ordinary share is selling currently in the market at P30.

c. On April 5, the company reissued 6,000 of the treasury shares reacquired on January 5 at P35 per

share.

d. On July 20, the company reissued 9,000 of the treasury shares reacquired on January 5 in lieu of

professional services received from lawyers. The fair value of the services received was at P250,000

which is believed to be reflective of the prevailing fair value of the shares on that date.

e. On August 1, the company retired and reverted to unissued basis 3,000 of the treasury shares

reacquired on January 5.

f. On October 31, 8,000 of the preference shares were converted to ordinary shares.

g. The company registered an adjusted net income in 2020 at P2,798,000.

Based on the information above, determine the adjusted balance of the following as of Dec. 31, 2020:

1. Ordinary Shares

2. Preference Shares

3. Share premium – Ordinary shares

4. Share premium – Preference shares

5. Share premium – Treasury shares

6. Additional Paid-in Capital

7. Contributed Capital

8. Stockholders’ Equity

PROBLEM 3: (SHARE ISSUE; SHARE WARRANTS AND SHARE RIGHTS)

You were assigned to audit the shareholders’ equity of Indonesia Inc. for the year ended December 31, 2020.

Indonesia Inc. was incorporated in early 2019 when it was authorized by SEC to issue 500,000 ordinary shares

(P50 par) and 1,000,000 preference shares (P20 par). The following schedule reflects the company’s capital

balances as of December 31, 2019:

Ordinary shares, 100,000 shares issued 5,000,000

Preference shares, 300,000 shares issued 6,000,000

Share premium – Ordinary shares 500,000

Share premium – Preference shares 1,200,000

Retained earnings, which is the company’s net income in 2019 2,980,000

Total shareholders’ equity ?

Page 6 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

Your inquiries and investigation revealed the following transactions, which occurred in 2020:

a. On March 1, the company received subscriptions for 50,000 ordinary shares at P70 per share from five

subscribers (10,000 shares each). The subscribers were required to pay 25% of the subscriptions price

in cash as down payment with balance to be settled after 3 months.

b. June 1, the company received the balance from four subscribers on March 1. Shares were therefore

issued. The remaining subscriber defaulted on the balance. As per agreement, the company auctioned

out the defaulted shares and incurred P20,000 in auction expenses.

c. On September 1, the highest bidder on the defaulted shares was selected and the amount due was

collected. The amount due includes a 12% annual interest on the subscriptions’ receivable balance

defaulted.

d. On September 15, the company issued 20,000 preference shares for P840,000. Each preference share

was issued with five warrants. Two warrants can be exercised to purchase one ordinary share at P56

per share up to 2 years from date of issue. The preferences shares were currently selling in the market

at P34 per share while each warrant can be sold separately at P1.20 per warrant.

e. On October 12, 60% of the warrants issued with preference shares were exercised.

f. On October 31, the company issued at 12%, P2M bonds payable for a total lump sum of P2,380,000.

Attached to each P1,000 bonds are 20 warrants. The bonds, which pay interests annually every

December 31, are currently quoted at 104 (excluding accrued interest) without the warrant while the

warrant has a market value of P1.25 per warrant. One warrant can be exercised to purchase two

ordinary shares at P52 per share up to 2 years from date of issue.

g. On November 4, 75% of the warrants issued with bonds were exercised.

h. On December 5, a debt restructuring agreement was entered with a debtor for an overdue loans

payable outstanding amounting to P800,000 with unpaid interest of P96,000. The debtor agreed as a

concession to accept 10,000 ordinary shares in full settlement of the loan. This agreement is outside the

normal/original credit term. Ordinary shares are currently selling at this time at P78 per share.

i. On December 20, the company reacquired 30,000 ordinary shares for a lump sum of P1,560,000 and

placed them as treasury.

j. On December 30, the company issued stock rights to its ordinary shareholders. Ten share rights plus

P55 shall entitle the holder to acquire 1 ordinary share. Share rights are exercisable one year from date

of issuance.

k. The company registered an adjusted net income in 2020 at P1,390,000.

Requirements:

1. What is the credit to the share premium account as a result of the share subscription in transaction a?

2. How much is the total amount collected from the highest bidder in transaction c?

3. What is the amount allocated to the warrants issued with preference shares in transaction d?

4. What is the credit to the share premium account as a result of the share issuance in transaction e?

5. What is the amount allocated to the warrants issued with bonds in transaction f?

6. What is the net effect to total APIC as a result of the share issuance in transaction g?

7. What is the gain or loss to be reported in the profit or loss as a result of the transaction h?

8. Assuming that all but 20,000 share rights issued in transaction i were exercised the following year, what is

the credit to share premium as a result of the share issuance?

PROBLEM 4: (OPTIONS/EQUITY-SETTLED SHARE BASED PAYMENTS)

On January 1, 2020 Pakistan Co. issued 1,000 share options to each of its 24 executive officers. The options

vest at the end of a three-year period. On the date of the grant, each share option had a fair value of P13.

Pakistan Co. initially estimates that all employees will stay until the end of the vesting period, thus all share

options shall become exercisable.

Four options together with P102 per share shall entitle to holder to acquire an ordinary share (P100 par value).

Options shall expire by the end of 2024.

Requirements:

1. The salaries expense for 2020 assuming that no change in estimate occurs by the end of the year:

2. The salaries expense in 2021 assuming that 2 officers actually left 2021 and that one more officer is

expected to leave by the end of the vesting period:

3. The salaries expenses in 2022 assuming that 3 more employees actually left in 2022:

4. The credit to the share premium account as a result of the exercise of 80% of the options in 2023:

PROBLEM 5: (OPTIONS/EQUITY-SETTLED SHARE BASED PAYMENTS)

On January 1, 2020, Brazil Corporation granted 100 share options each to its employees that will vest once its

share price (fair market value of shares) reaches P90. The actual share price is currently P56 on this date. The

company has currently 120 employees.

Page 7 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

The employee is required to be employed with the company at the time the condition is met in order to receive

the options. Two options together with P75 per share entitles the holder to acquire 1 ordinary share (P50 par

value). The share options will expire in 5 years. On the date of grant, it is expected that the condition will be

satisfied in four years (estimated vesting period)

The company applies a binomial options pricing model, which takes into account the possibility that the share

price will equal/exceed P90 in four years (hence the share options become exercisable) and the possibility that

the share price will not equal/exceed P90 in four years (hence the option will be forfeited, that is reverted back

to equity). The company estimates that the market value of the stock option on the date of grant with this market

condition is P16 per option.

The following information are deemed relevant:

Estimated total number of Actual Share

employees who will leave the Price at the end

Date company by the end of 2023 of each year

Dec. 31, 2020 None 65

Dec. 31, 2021 8 78

Dec. 31, 2022 12 82

Dec. 31, 2023 15(Actual) 90

Requirements:

1. What is the compensation expense to be recognized in 2020?

2. What is the compensation expense to be recognized in 2021?

3. What is the compensation expense to be recognized in 2022?

4. What is the compensation expense to be recognized in 2023?

5. Assuming that the actual share price amounted to P89 at end of 2023, what is the compensation expense to

be recognized in 2023?

6. Assuming that the actual share price amounted to P90 at the end of 2022, what is the compensation expense

in 2022?

PROBLEM 6: (OPTIONS/EQUITY-SETTLED SHARE BASED PAYMENTS)

On January 1, 2020, Nigeria Company granted 20,000 share options to 80 employees entitling them to acquire

P100 par value shares of the company at an exercise rate of two options plus P115 per share conditional upon

the employees’ remaining in the company’s employ during the vesting period. The share options (250 options

per employee) shall vest at the end of 2020 if the company’s 2020 revenues reach P90M ; or at the end of 2021

if the company’s 2021 revenues reach P100M; or at the end of 2022 if the 2022 revenues reach P110M.

The market value of the option on the date of grant is P18. The company has a steady pattern of 25% increase

in revenues every year over the last 5 years and expects the same pattern during the vesting period.

The following information are deemed relevant:

Estimated total number of employees Actual

Year who will stay by the end of the vesting period Revenue

2020 70 P80M

2021 74 90M

2022 76(Actual) 110M

Requirements:

1. What is the salaries expense to be recognized in 2020?

2. What is the salaries expense to be recognized in 2021?

3. What is the salaries expense to be recognized in 2022?

4. Assuming that the employees exercised all their options in 2023, what is the net increase in total

APIC as a result of the exercise?

PROBLEM 7: (STOCK APPRECIATION RIGHTS/CASH-SETTLED SHARE BASED PAYMENTS)

On January 1, 2020, Bangladesh Co. issued share appreciation rights (SARs) to its 50 employees. The SARs

will vest at the end of 3 years, provided the employees remain with the company and provided that production

on the third year (in 2022) increase by 100% (based on actual production in 2019 which was 100,000 units).

The number of share appreciation rights entitlement of each employee depending upon the actual increase in

production in 2022 is:

Increase in production in 2022 No. of SARs per

(based on 2019 production) Employee

100% - 120% 1,500

121% - 150% 2,000

>150% 2,500

The company is projecting a 30% increase in annual production over the next five years considering its current

and planned production capacity.

Page 8 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

The following information are deemed relevant:

Estimated total number of employees who Fair market

Year Actual Production will leave the company by the end of 2022 value of SAR

12/31/2020 130,000 units 0 P25

12/31/2021 180,000 units 5 P30

12/31/2022 255,000 units 15(Actual) P34

Requirements:

1. Salaries expense in 2020:

2. SAR payable balance as of December 31, 2021:

3. Salaries expense in 2022:

4. Entry to record the exercise of 60% of SARs in 2023 assuming that the fair value of SAR on the exercise date

is at P38:

5. Entry to record the remeasurement of the remaining SARS by the end of 2023 assuming that the fair value

of SARs at the end of 2023 is at P32 per SAR?

PROBLEM 8: (SHARE-BASED PAYMENTS WITH CASH ALTERNATIVE)

On January 1, 2020, Hotel Corp. grants its COO the right to choose either 10,000 ordinary shares or to receive

cash payment equal to 7,500 shares. These are to vest after rendition of two years of service. Par value of the

company’s share of stock is P100. The COO exercised his rights on September 30, 2022. The fair value

information follow:

FMV

Compound Instrument: 1/1/20 P120

Share of Stock: 1/1/20 130

12/31/20 136

12/31/21 144

9/30/22 150

Requirements:

1. What is the balance of SAR payable as of December 31, 2020 and 2021?

2. What is the balance of the ordinary share option outstanding as of December 31, 2020 and 2021?

3. What is the total salaries expense related to the share-based payments in 2020 and 2021?

4. Entry to record the exercise assuming the employee opted settlement in cash on September 30, 2022.

5. Entry to record the exercise assuming the employee opted to receive shares on September 30, 2022.

PROBLEM 9: (RAP, INTERNAL CONTROLS, SUBSTANTIVE TESTING)

1. Which of the following is generally correct regarding the rendering of other audit procedures in a typical

risk-based audit of general-purpose financial statements?

A. Where preliminary assessment of audit risk (combined risk of material misstatement in the financial

statements and planned detection risk) is placed at a high level, the auditor shall plan to render extensive

test of controls first to conclude on their effectiveness, before rendering less extensive substantive testing

which maybe done at an interim date.

B. Where preliminary audit risk assessment (based on risk assessment procedures) allows, account balances

resulting from non-routinary transaction cycles such as revenue and disbursement cycles, are usually

being audited through test of controls first before less extensive substantive testing which maybe done

at an interim date.

C. Notwithstanding the result of risk assessment procedures, account balances resulting from non-routinary

transaction cycles such as financing and investing cycles, are usually being audited through direct

substantive testing gathering less persuasive evidence (as to nature), using less extensive procedures

(as to extent) which may be rendered at an interim period (as to timing).

D. Notwithstanding the result of risk assessment procedures, account balances resulting from non-routinary

transaction cycles such as financing and investing cycles, are usually being audited through direct

substantive testing gathering more persuasive evidence (as to nature), using more extensive procedures

(as to extent) which should be rendered at year-end (as to timing).

2. Which of the following is incorrect when auditing account balances resulting from non-routinary transaction

cycle such as stockholders’ equity balances arising from financing cycle?

A. The auditor should render risk assessment procedure to understand the client’s internal control and

regardless of the design and operation, should place audit risk at a high level so as to render directly

extensive substantive testing.

B. The auditor should render risk assessment procedure to understand the client’s internal control after

which should test the control’s effectiveness where controls are potentially reliable as to design and

operation.

C. The auditor after rendering risk assessment procedure to understand the client’s internal control should

plan to gather more persuasive evidence using more extensive evidence gathering procedures.

D. The auditor after rendering risk assessment procedure to understand the client’s internal control should

plan to place the timing of his substantive test procedures at year-end.

Page 9 of 10 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY FARAP-4514

SHAREHOLDERS’ EQUITY

3. After understanding the financing cycle of China Corporation in relation to your audit of the client’s

stockholders’ equity account, you decided to place preliminary audit risk (inherent and control risk) at a high

level, which of the following is correct?

A. The auditor should next test controls’ effectiveness through further inquiry, inspection, observation and

reperformance.

B. The auditor should go directly to substantive test procedures which may be rendered to interim period

ended balances.

C. The auditor should go directly to substantive test procedures heavily relying on substantive test analytical

procedures.

D. The auditor should go directly to substantive test procedures heavily relying on substantive test of details.

4. Which of the following is correct regarding audit of stockholders’ equity transactions and related account

balances?

A. The auditor usually suspects higher risk of OVERSTATEMENT error, thus shall focus on gathering evidence

to support the managements’ COMPLETENESS and VALUATION assertions.

B. The auditor usually suspects higher risk of UNDERSTATEMENT error, thus shall focus on gathering

evidence to support managements’ COMPETENESS and VALUATION assertions.

C. The auditor usually suspects higher risk of OVERSTATEMENT error, thus shall focus on gathering evidence

to support the managements’ EXISTENCE and VALUATION assertions.

D. The auditor usually suspects higher risk of UNDERSTATEMENT error, thus shall focus on gathering

evidence to support managements’ EXISTENCE and VALUATION assertions.

5. Which of the following audit procedures is a test primarily to substantiate the occurrence/existence assertion

when auditing stockholders’ equity transactions and related account balance?

A. Vouching authorization by the board of directors of significant stockholders’ equity transactions such as

share issuance, treasury share transactions, share rights issuances, dividend declaration, among others

to the minutes of meetings of the BOD.

B. Examination of the transfer agent’s records for possible unrecorded share issuance, share

reacquisitions, or share retirements.

C. Reference to fair market value quotations for share options granted to employees.

D. Examination of stock certificate files.

6. In tests concerning the valuation of stock options, an auditor should:

A. Trace the authorization for the transaction to a vote of the board of directors.

B. Refer to market quotations

C. Verify existence of option holders in the entity’s payroll records or stock ledgers.

D. Determine that sufficient treasury stock is available to cover any new stock issued.

7. When the client-company does not maintain its own stock records, the auditor should obtain written

confirmation from the transfer agent and registrar concerning:

A. Restrictions on the payments of dividends.

B. The number of shares issued and outstanding.

C. Guarantees of preference shares liquidation value.

D. The number of shares subject to agreements to repurchase

- END -

Page 10 of 10 0915-2303213 www.resacpareview.com

You might also like

- Accounting Basics and Interview Questions AnswersDocument43 pagesAccounting Basics and Interview Questions AnswersKothapally Anusha80% (5)

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocument4 pagesChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNo ratings yet

- Unit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Document8 pagesUnit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Alyna JNo ratings yet

- Elaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Document2 pagesElaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Meghan Kaye LiwenNo ratings yet

- Essentials of Investments, 8th Edition-3Document46 pagesEssentials of Investments, 8th Edition-3Tara BrownNo ratings yet

- Final Examination in Auditing Principles and Application 1Document8 pagesFinal Examination in Auditing Principles and Application 1Anie Martinez0% (1)

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- EDP Auditing SemiFinalDocument4 pagesEDP Auditing SemiFinalErwin Labayog MedinaNo ratings yet

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- Auditing Reviewer and AnswersDocument15 pagesAuditing Reviewer and AnswersElaine Joyce GarciaNo ratings yet

- 03 Gross Profit AnalysisDocument5 pages03 Gross Profit AnalysisJunZon VelascoNo ratings yet

- FAR.2910 - Wasting Assets.Document4 pagesFAR.2910 - Wasting Assets.Edmark LuspeNo ratings yet

- Investment in Associates ProblemsDocument4 pagesInvestment in Associates ProblemsLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Pre 4 Mod 3 MiningDocument3 pagesPre 4 Mod 3 MiningClaudine AbrilNo ratings yet

- Ap106 Investments and Intangible AssetsDocument5 pagesAp106 Investments and Intangible Assetsbright SpotifyNo ratings yet

- Audit of Investments in Debt Securities - Prob 1 and 2 DoneDocument5 pagesAudit of Investments in Debt Securities - Prob 1 and 2 DoneLeonisa FuentesNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Final PPT AuditDocument29 pagesFinal PPT AuditMedha SinghNo ratings yet

- MODULE 1 2 Bonds PayableDocument10 pagesMODULE 1 2 Bonds PayableFujoshi BeeNo ratings yet

- Psa 610 Using The Work of Internal Auditors: RequirementsDocument2 pagesPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Book 9Document2 pagesBook 9Actg SolmanNo ratings yet

- Acctg 100G 02Document4 pagesAcctg 100G 02lov3m3100% (1)

- ASSIGNMENT Business CombinationDocument2 pagesASSIGNMENT Business CombinationApril ManjaresNo ratings yet

- E. Biological AssetsDocument1 pageE. Biological AssetsDerick Ocampo FulgencioNo ratings yet

- 16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Document7 pages16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Zatsumono YamamotoNo ratings yet

- FINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToDocument2 pagesFINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToAlfred Valenzuela100% (1)

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Practice Set PSA 200Document5 pagesPractice Set PSA 200Krystalah CañizaresNo ratings yet

- PSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilDocument25 pagesPSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilARLENE GARCIANo ratings yet

- AP.3403 Audit of Intangible AssetsDocument3 pagesAP.3403 Audit of Intangible AssetsMonica GarciaNo ratings yet

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument4 pagesInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNo ratings yet

- TestBank VC Module3Document7 pagesTestBank VC Module3Tochie RubianNo ratings yet

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaNo ratings yet

- Jam Althea O. Agner Prelec Output 1Document3 pagesJam Althea O. Agner Prelec Output 1JAM ALTHEA AGNERNo ratings yet

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- GovernanceDocument3 pagesGovernanceAndrea Marie CalmaNo ratings yet

- Auditing 2&3 Theories Reviewer CompilationDocument9 pagesAuditing 2&3 Theories Reviewer CompilationPaupauNo ratings yet

- 2nd Year Reviewer Midterms (Compatibility)Document11 pages2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- Intthry at Long Quiz 1 Answer Key 012718Document12 pagesIntthry at Long Quiz 1 Answer Key 012718Racel DelacruzNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Cpa Review School of The Philippines Manila Management Advisory Services Working Capital FinanceDocument11 pagesCpa Review School of The Philippines Manila Management Advisory Services Working Capital FinancezenvioNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- Cases (Cabrera)Document5 pagesCases (Cabrera)Queenie100% (1)

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Eps ProblemsDocument21 pagesEps Problemsarrowphoto8161343rejelynNo ratings yet

- Chapter06 - Answer PDFDocument6 pagesChapter06 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- Quiz Mid PDFDocument8 pagesQuiz Mid PDFsino akoNo ratings yet

- QQQQ 1111Document32 pagesQQQQ 1111Lea LunaNo ratings yet

- Financial Accounting by ValixDocument5 pagesFinancial Accounting by Valixblahblahblue0% (1)

- Corporate LiquidationDocument7 pagesCorporate LiquidationAcads PurposesNo ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- 4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostDocument11 pages4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostElvie PepitoNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Franchise Problems For DiscussionDocument4 pagesFranchise Problems For DiscussionRAGASA, John Carlo R.No ratings yet

- 2016 4083 4th Evaluation ExamDocument8 pages2016 4083 4th Evaluation ExamPatrick ArazoNo ratings yet

- FAR 4218 Shareholders Equity Retained Earnings PDFDocument11 pagesFAR 4218 Shareholders Equity Retained Earnings PDFSherri BonquinNo ratings yet

- Shareholders EquityDocument4 pagesShareholders EquityfoxtrotNo ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- c3 ReviewerDocument42 pagesc3 Reviewerrandomlungs121223No ratings yet

- Audit Theory 3 AccountingDocument6 pagesAudit Theory 3 Accountingrandomlungs121223No ratings yet

- Auditing Theory Test Bank Escala - pdf-14-18Document5 pagesAuditing Theory Test Bank Escala - pdf-14-18randomlungs121223No ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- 1 Fundamentals of Auditing and Assurance Services RESADocument5 pages1 Fundamentals of Auditing and Assurance Services RESArandomlungs121223No ratings yet

- Reo Consideration of Fraud Error and Noncompliance 9 14Document6 pagesReo Consideration of Fraud Error and Noncompliance 9 14randomlungs121223No ratings yet

- IT Audit 4ed SM Ch10Document45 pagesIT Audit 4ed SM Ch10randomlungs121223No ratings yet

- 06C Investment Property & Other InvestmentsDocument8 pages06C Investment Property & Other Investmentsrandomlungs121223No ratings yet

- 08 Identifying & Assessing The Risks of Material MisstatementDocument5 pages08 Identifying & Assessing The Risks of Material Misstatementrandomlungs121223No ratings yet

- IT Audit CH 06Document23 pagesIT Audit CH 06randomlungs121223No ratings yet

- 04 Absorption & Variable Costing With Pricing DecisionsDocument6 pages04 Absorption & Variable Costing With Pricing Decisionsrandomlungs121223No ratings yet

- IT Audit CH 09Document23 pagesIT Audit CH 09randomlungs121223No ratings yet

- IT Audit 4ed SM Ch7Document10 pagesIT Audit 4ed SM Ch7randomlungs121223No ratings yet

- 12 Capital Budgeting With Investment Risks and ReturnsDocument18 pages12 Capital Budgeting With Investment Risks and Returnsrandomlungs121223No ratings yet

- 03 Cost-Volume-Profit AnalysisDocument6 pages03 Cost-Volume-Profit Analysisrandomlungs121223No ratings yet

- 11 Tests of ControlsDocument6 pages11 Tests of Controlsrandomlungs121223No ratings yet

- 10 Risk Assessment & Response To Assessed RisksDocument6 pages10 Risk Assessment & Response To Assessed Risksrandomlungs121223No ratings yet

- 18 Completing The AuditDocument7 pages18 Completing The Auditrandomlungs121223No ratings yet

- 19 Special Audit & Non-Audit ConsiderationsDocument7 pages19 Special Audit & Non-Audit Considerationsrandomlungs121223No ratings yet

- 15 Audit SamplingDocument7 pages15 Audit Samplingrandomlungs121223No ratings yet

- 05 Relevant Costing With Linear ProgrammingDocument9 pages05 Relevant Costing With Linear Programmingrandomlungs121223No ratings yet

- 03 FS Audit OverviewDocument4 pages03 FS Audit Overviewrandomlungs121223No ratings yet

- 02 Introduction To AuditingDocument3 pages02 Introduction To Auditingrandomlungs121223No ratings yet

- 16 Auditor's Report On General Purpose FSDocument4 pages16 Auditor's Report On General Purpose FSrandomlungs121223No ratings yet

- 07 FS Audit Process - Audit PlanningDocument6 pages07 FS Audit Process - Audit Planningrandomlungs121223No ratings yet

- 2001 Preferential Taxation (Part 1)Document6 pages2001 Preferential Taxation (Part 1)randomlungs121223No ratings yet

- 5 PDFDocument54 pages5 PDFLU YONo ratings yet

- Foreign Private Capital in Rwanda 2013Document69 pagesForeign Private Capital in Rwanda 2013Malcolm M YaduraNo ratings yet

- Yield Curve Nelson Siegel SvenssonDocument13 pagesYield Curve Nelson Siegel Svenssonbxt5ys72d8No ratings yet

- Kiss Forex How To Trade Bollinger Bands For Big ProfitsDocument50 pagesKiss Forex How To Trade Bollinger Bands For Big ProfitsRicardo_SemogNo ratings yet

- Trackinsight Global Etf Survey 2021Document113 pagesTrackinsight Global Etf Survey 2021mclaird01No ratings yet

- CQF L02P01Document18 pagesCQF L02P01Mn AbdullaNo ratings yet

- Accounting Nov 2015 Memo EngDocument15 pagesAccounting Nov 2015 Memo EngAbubakr IsmailNo ratings yet

- Finance Module 1 Definition of Finance and Identifying The Roles in A Corporate OrganizationDocument31 pagesFinance Module 1 Definition of Finance and Identifying The Roles in A Corporate OrganizationCjNo ratings yet

- Factors Determining The Working CapitalDocument4 pagesFactors Determining The Working CapitalSanctaTiffanyNo ratings yet

- Reviewer 3Rd Year - 2Nd Semester Midterm Module 4: Role of Government - QuizDocument2 pagesReviewer 3Rd Year - 2Nd Semester Midterm Module 4: Role of Government - QuizMaia Carmela JoseNo ratings yet

- Reviewer in Intermediate Accounting Mam F Revised 1docxDocument106 pagesReviewer in Intermediate Accounting Mam F Revised 1docxJessaNo ratings yet

- Mission & VisionDocument41 pagesMission & Visionparthshah123456789No ratings yet

- Stock ExchangeDocument11 pagesStock Exchangesanjay sheeNo ratings yet

- NN5 Chap 5Document41 pagesNN5 Chap 5Nguyet NguyenNo ratings yet

- FIN358 Chapter1 Introduction To Investment StudentDocument7 pagesFIN358 Chapter1 Introduction To Investment StudentMuhammad FaizNo ratings yet

- Day 7 Tactics - 7ps & 4asDocument97 pagesDay 7 Tactics - 7ps & 4asgaurav bhalotiaNo ratings yet

- Financial Futures and OptionsDocument2 pagesFinancial Futures and OptionsxcvbuiNo ratings yet

- AgendaDocument9 pagesAgendaNeera JainNo ratings yet

- Project Costing Project ExpensesDocument11 pagesProject Costing Project ExpensesRaw MaterialNo ratings yet

- Winter ProjectDocument82 pagesWinter ProjectAjNo ratings yet

- MGT604 Quizes Mega FileDocument51 pagesMGT604 Quizes Mega FileAbdul Jabbar0% (1)

- R2P BrochureDocument4 pagesR2P BrochureazovkoNo ratings yet

- Wrigley Case FinalDocument8 pagesWrigley Case FinalNicholas Reyner Tjoegito100% (4)

- Soal Asistensi Intermediate CH 5Document3 pagesSoal Asistensi Intermediate CH 5emanuelariobimoNo ratings yet

- Chap 003Document39 pagesChap 003ĐẠT HOÀNG TIẾNNo ratings yet

- June 2020: Doosan (Hydraulic Equipment Business) (29/05/2020) : Doosan's (KRX:000150) Hydraulic EquipmentDocument3 pagesJune 2020: Doosan (Hydraulic Equipment Business) (29/05/2020) : Doosan's (KRX:000150) Hydraulic Equipmentcharles arnaudNo ratings yet

- Momentum Master ApproachDocument80 pagesMomentum Master ApproachDeven ZaveriNo ratings yet

- Traditional & Modern Theory ApproachDocument12 pagesTraditional & Modern Theory Approachyash shah78% (9)