Professional Documents

Culture Documents

Template For Doing A Five Forces Analysis

Template For Doing A Five Forces Analysis

Uploaded by

lehouxmanon1520 ratings0% found this document useful (0 votes)

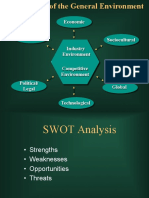

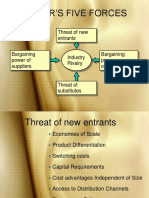

5 views5 pagesThis document provides a template for conducting a five forces analysis to evaluate the competitive environment of an industry. It includes factors to characterize the degree of rivalry among existing competitors, the threat of new entry, the pressure from substitute products and complements, and the bargaining power of suppliers and buyers. For each factor, companies would assess the current characterization and future trends to understand how these forces impact profitability.

Original Description:

template for doing a five force analysis

Original Title

Template for doing a five forces analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a template for conducting a five forces analysis to evaluate the competitive environment of an industry. It includes factors to characterize the degree of rivalry among existing competitors, the threat of new entry, the pressure from substitute products and complements, and the bargaining power of suppliers and buyers. For each factor, companies would assess the current characterization and future trends to understand how these forces impact profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views5 pagesTemplate For Doing A Five Forces Analysis

Template For Doing A Five Forces Analysis

Uploaded by

lehouxmanon152This document provides a template for conducting a five forces analysis to evaluate the competitive environment of an industry. It includes factors to characterize the degree of rivalry among existing competitors, the threat of new entry, the pressure from substitute products and complements, and the bargaining power of suppliers and buyers. For each factor, companies would assess the current characterization and future trends to understand how these forces impact profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

TEMPLATE FOR DOING A FIVE-FORCES ANALYSIS

FACTORS AFFECTING RIVALRY AMONG EXISTING COMPETITORS

To what extent does pricing rivalry or nonprice competition (e.g.,

advertising) erode the profitability of a typical firm in this industry?

Characterization Future Trend

(Current)

Degree of seller concentration?

Rate of industry growth?

Significant cost differences among firms?

Excess capacity?

Cost structure of firms: sensitivity of costs to capacity

utilization?

Degree of product differentiation among sellers?

Brand loyalty to existing sellers? Cross-price

elasticities of demand among competitors in industry?

Buyers' costs of switching from one competitor to

another?

Are prices and terms of sales transactions observable?

Can firms adjust prices quickly?

Large and/or infrequent sales orders?

Use of "facilitating practices" (price leadership,

advance announcement of price changes)?

History of "cooperative" pricing?

Strength of exit barriers?

High industry price elasticity of demand?

FACTORS AFFECTING THE THREAT OF ENTRY

To what extent does the threat or incidence of entry work to erode the

profitability of a typical firm in this industry?

Characterization Future Trend

(Current)

Significant economies of scale?

Importance of reputation or established brand

loyalties in purchase decision?

Entrants' access to distribution channels?

Entrants' access to raw materials?

Entrants' access to technology /know-how?

Entrants' access to favorable locations?

Experience-based advantages of incumbents?

Network externalities: demand-side

advantages to incumbents from large installed base?

Government protection of incumbents?

Perceptions of entrants about expected retaliation of

incumbents/reputations of incumbents for

"toughness"?

FACTORS AFFECTING OR REFLECTING PRESSURE FROM

SUBSTITUTE PRODUCTS AND SUPPORT FROM COMPLEMENTS

To what extent does competition from substitute products outside the

industry erode the profitability of a typical firm in the industry?

Characterization Future Trend

(Current)

Availability of close substitutes?

Price-value characteristics of substitutes?

Price elasticity of industry demand?

Availability of close complements?

Price-value characteristics of complements?

FACTORS AFFECTING OR REFLECTING POWER OF INPUT

SUPPLIERS

To "what extent do individual suppliers have the ability to negotiate high

input prices with typical firms in this industry? To what extent do input

prices deviate from those that would prevail in a perfectly competitive

input market in which input suppliers act as price takers?

Characterization Future Trend

(Current)

Is supplier industry more concentrated than industry it

sells to?

Do firms in industry purchase relatively small

volumes relative to other customers of supplier? Is

typical firm's purchase volume small relative to sales

of typical supplier?

Few substitutes for suppliers' input?

Do firms in industry make relationship-specific

investments to support transactions with specific

suppliers?

Do suppliers pose credible threat of forward

integration into the product market?

Are suppliers able to price-discriminate among

prospective customers according to ability/

willingness to pay for input?

FACTORS AFFECTING OR REFLECTING POWER OF BUYERS

To what extent do individual buyers have the ability to negotiate low

purchase prices -with typical firms in this industry? To what extent do

purchase prices differ from those that would prevail in a market with a

large number of fragmented buyers in which buyers act as price

takers?

Characterization Future Trend

(Current)

Is buyers' industry more concentrated than the

industry it purchases from?

Do buyers purchase in large volumes? Does a

buyer's purchase volume represent a large fraction

of the typical seller's sales revenue?

Can buyers find substitutes for industry's product?

Do firms in industry make relationship-specific

investments to support transactions with specific

buyers?

Is price elasticity of demand of buyer' s product

high or low?

Do buyers pose credible threat of backward

integration?

Does product represent significant fraction of cost

in buyer's business?

Are prices in the market negotiated between buyers

and sellers on each individual transaction, or do

sellers post a "take-it-or-leave-it" price that applies

to all transactions?

You might also like

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- 2018 REAL Trends Thousand FINAL PDFDocument78 pages2018 REAL Trends Thousand FINAL PDFJesse WilloughbyNo ratings yet

- Porter Analysis ReportingDocument5 pagesPorter Analysis ReportingMinini NestNo ratings yet

- Michael Porters Model For Industry and Competitor AnalysisDocument9 pagesMichael Porters Model For Industry and Competitor AnalysisbagumaNo ratings yet

- How Competitive Forces Shape StrategyDocument11 pagesHow Competitive Forces Shape StrategyErwinsyah RusliNo ratings yet

- Consulting Interview Case Preparation: Frameworks and Practice CasesFrom EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNo ratings yet

- MBA-2019-2021 - Student Handbook PDFDocument157 pagesMBA-2019-2021 - Student Handbook PDFtwinkle goyalNo ratings yet

- Wrigley's Eclipse Gum - Case Analysis Report: 1. Key Issues/ProblemsDocument4 pagesWrigley's Eclipse Gum - Case Analysis Report: 1. Key Issues/ProblemsAkaash HegdeNo ratings yet

- Five Forces AnalysisDocument5 pagesFive Forces Analysiswonderland123No ratings yet

- Sesión 4 - Besanko, D. Economics of Strategy, 2013. Plantilla 5 FuerzasDocument6 pagesSesión 4 - Besanko, D. Economics of Strategy, 2013. Plantilla 5 Fuerzasluis AguirreNo ratings yet

- Porter's Five ForceDocument3 pagesPorter's Five Forcerahul_naidu151No ratings yet

- Applying Michael Porters Five Forces 15091Document22 pagesApplying Michael Porters Five Forces 15091KartikNo ratings yet

- 5 Force ModelDocument14 pages5 Force Modelsrilatha212No ratings yet

- Porter Five ForcesDocument3 pagesPorter Five Forcesshahhazm553No ratings yet

- Porter-Structural Analysis of Industries PDFDocument2 pagesPorter-Structural Analysis of Industries PDFSherry SNo ratings yet

- Porters 5 ForcesDocument3 pagesPorters 5 Forcesjabbimuhammed50No ratings yet

- Porters Five Forces - Content, Application, and CritiqueDocument9 pagesPorters Five Forces - Content, Application, and CritiqueJosé Luís NevesNo ratings yet

- Category AnalysisDocument42 pagesCategory AnalysisANJALINo ratings yet

- Business EnvironmentDocument41 pagesBusiness EnvironmentHarshi MulwaniNo ratings yet

- Overview of The Five Forces ModelDocument4 pagesOverview of The Five Forces ModelAnuj SrivastavaNo ratings yet

- 5 Forces NotesDocument9 pages5 Forces NotesKshitij LalwaniNo ratings yet

- Approaches To Competitor AnalysisDocument32 pagesApproaches To Competitor AnalysisIsrar Raja100% (1)

- Porter's Five ForcesDocument5 pagesPorter's Five ForcesKris Tina100% (1)

- Bergaining Power of BuyerDocument4 pagesBergaining Power of BuyerrestuNo ratings yet

- Competitive Structure of IndustriesDocument4 pagesCompetitive Structure of IndustriesPooja SheoranNo ratings yet

- Competitive Analysis 1Document25 pagesCompetitive Analysis 1Md.Yousuf AkashNo ratings yet

- Five Forces Model by Michael PorterDocument3 pagesFive Forces Model by Michael PorterDeepika GhoshNo ratings yet

- Industrial and Competitive AnalysisDocument20 pagesIndustrial and Competitive AnalysisPranav PahwaNo ratings yet

- Competitve Forces - Cosmetics IndustryDocument6 pagesCompetitve Forces - Cosmetics IndustryShiblee RahmanNo ratings yet

- 5 - Porter's 5 Force ModelDocument31 pages5 - Porter's 5 Force ModelSunil MauryaNo ratings yet

- The Five Competitive Forces That Shape StrategyDocument14 pagesThe Five Competitive Forces That Shape StrategyronNo ratings yet

- The Five Competitive Forces That Shape StrategyDocument14 pagesThe Five Competitive Forces That Shape StrategyatulpvermaNo ratings yet

- Porter's Five Forces Analysis: From Wikipedia, The Free EncyclopediaDocument5 pagesPorter's Five Forces Analysis: From Wikipedia, The Free EncyclopediaSamar MalikNo ratings yet

- Industry Life CycleDocument4 pagesIndustry Life CycleTANISHA KUMARI 1912177No ratings yet

- Porters 5 ForcesDocument12 pagesPorters 5 ForcesUtakarsh JayantNo ratings yet

- 71 Competitive Environment - Porter's 5 ForcesDocument19 pages71 Competitive Environment - Porter's 5 ForcesGeorge ButlerNo ratings yet

- The General, Industry, and Competitor EnvironmentsDocument6 pagesThe General, Industry, and Competitor EnvironmentsUlfa ZhafirahNo ratings yet

- Five Forces That Shape Industry Competition: Rivalry Among Existing CompetitorsDocument14 pagesFive Forces That Shape Industry Competition: Rivalry Among Existing CompetitorsNISHANT BANKANo ratings yet

- Lecture 2 SMDocument58 pagesLecture 2 SMadil azmiNo ratings yet

- Porter Five Forces Analysis: That Appear in Reliable Third-Party PublicationsDocument8 pagesPorter Five Forces Analysis: That Appear in Reliable Third-Party Publicationsas2624No ratings yet

- Strategic Mgt.Document57 pagesStrategic Mgt.preetimudgalNo ratings yet

- 5 ForceDocument5 pages5 ForceMichael YongNo ratings yet

- 3 - Analysis of External Environment - Industry and CompetitiveDocument37 pages3 - Analysis of External Environment - Industry and CompetitiveRochelle PonnamperumaNo ratings yet

- Industry AnalysisDocument25 pagesIndustry AnalysisPrashant Tejwani100% (1)

- Porters Five Forces Model For Industry CompetitionDocument15 pagesPorters Five Forces Model For Industry CompetitionShahid ChuhdryNo ratings yet

- Porter's 5 Force ModelDocument4 pagesPorter's 5 Force ModelMai Mgcini BhebheNo ratings yet

- Industry and Competitive AnalysisDocument25 pagesIndustry and Competitive AnalysisOnan Yakin AjnacNo ratings yet

- Michael Porter's Industry Structural AnalysisDocument12 pagesMichael Porter's Industry Structural AnalysisRenell John Maglalang100% (1)

- Competitive Analysis 05Document13 pagesCompetitive Analysis 05Ammarah KhanNo ratings yet

- 5 ForcesDocument42 pages5 Forcesaksr27No ratings yet

- Class #5Document6 pagesClass #5Marcin NasuroNo ratings yet

- Michael PorterDocument21 pagesMichael PorterArpit SinghNo ratings yet

- A Framework For Industry Analysis: "Five Forces" Model - Michael PorterDocument17 pagesA Framework For Industry Analysis: "Five Forces" Model - Michael Porterkusumawi2311No ratings yet

- Porter's Five ForcesDocument9 pagesPorter's Five ForcesTaVuKieuNhiNo ratings yet

- Environmental Scanning and Industrial AnalysisDocument24 pagesEnvironmental Scanning and Industrial AnalysisHimani TyagiNo ratings yet

- Ranbaxy PorterDocument4 pagesRanbaxy PorterBhanu GuptaNo ratings yet

- Strategic Management NotesDocument46 pagesStrategic Management NotesAccount SpamNo ratings yet

- Porter Five Forces AnalysisDocument3 pagesPorter Five Forces Analysisazazel28No ratings yet

- Porter Five Forces AnalysisDocument5 pagesPorter Five Forces Analysisbhatt_niranjan09No ratings yet

- PorterDocument5 pagesPorterVijitha VijayakumarNo ratings yet

- The External Environment:: Opportunities, Threats, Industry Competition, and Competitor AnalysisDocument66 pagesThe External Environment:: Opportunities, Threats, Industry Competition, and Competitor AnalysiskimsrNo ratings yet

- Unit3 Industry AnalysisDocument83 pagesUnit3 Industry AnalysisAbhishek AcharyaNo ratings yet

- Porters 5 Forces AnalysisDocument6 pagesPorters 5 Forces AnalysisRobi MatiNo ratings yet

- New Ad Case StudiesDocument6 pagesNew Ad Case StudiesPraveen KadarakoppaNo ratings yet

- ShubhamDocument4 pagesShubhamUtkarsh RaiNo ratings yet

- C5 AsianPaints FINALDocument15 pagesC5 AsianPaints FINALLalit A PoddarNo ratings yet

- Marketing Environment PlanningDocument31 pagesMarketing Environment PlanningNipuni PeirisNo ratings yet

- Coca-Cola Global Marketing Strategy: Assignment SampleDocument3 pagesCoca-Cola Global Marketing Strategy: Assignment Samplejudemc100% (1)

- Ekt Trade & Investment PLC Project Customer Satisfaction Survey FormDocument4 pagesEkt Trade & Investment PLC Project Customer Satisfaction Survey FormSisay Tesfaye100% (1)

- CV - Angshuman Kashyap PDFDocument2 pagesCV - Angshuman Kashyap PDFMohit DhonifNo ratings yet

- S Balaji: Seven Plus Years Experience in Corporate Hospital Marketing and PharmaDocument5 pagesS Balaji: Seven Plus Years Experience in Corporate Hospital Marketing and PharmaSg BalajiNo ratings yet

- Tesco Vs Reliance Retail StoresDocument49 pagesTesco Vs Reliance Retail StoresSameerKashyupNo ratings yet

- (Case Study) Shinsegae Department Korea - RT100Document4 pages(Case Study) Shinsegae Department Korea - RT100kobaNo ratings yet

- Indonesia EV Market Competition by DSIDocument10 pagesIndonesia EV Market Competition by DSILeonardi IndrakamaNo ratings yet

- This Study Resource Was: Management Information System MCQDocument9 pagesThis Study Resource Was: Management Information System MCQPrakash prajapati0% (1)

- Open Loyalty Loyalty Trends 2020 Shared by WorldLine TechnologyDocument39 pagesOpen Loyalty Loyalty Trends 2020 Shared by WorldLine TechnologyLê ThaoNo ratings yet

- B.A. Prog. Sem. II CBCS 02 Principles of Microeconomics II 2018Document3 pagesB.A. Prog. Sem. II CBCS 02 Principles of Microeconomics II 2018Mihir MehraNo ratings yet

- Integrating AdvertisingDocument10 pagesIntegrating AdvertisingMahmoud TaqyNo ratings yet

- Questions Answered IncorrectlyDocument2 pagesQuestions Answered IncorrectlyHimanshuNo ratings yet

- Bench Marking InnovationDocument11 pagesBench Marking InnovationM. Wasif ChauhdaryNo ratings yet

- Manager Purchasing Procurement Sourcing in Boston MA Resume Charles HollemanDocument1 pageManager Purchasing Procurement Sourcing in Boston MA Resume Charles HollemanCharlesHollemanNo ratings yet

- Company ProfileDocument9 pagesCompany Profilearichandranagilan539No ratings yet

- Mktg. MGT Lesson 1Document27 pagesMktg. MGT Lesson 1ShinjiNo ratings yet

- Practice Test - Media Buying - BDocument22 pagesPractice Test - Media Buying - Blesia.kovalenko05No ratings yet

- Wholesale Fruit Suppliers in Bangalore - Glee ImpexDocument2 pagesWholesale Fruit Suppliers in Bangalore - Glee ImpexGlee ImpexNo ratings yet

- PVR CinemasDocument17 pagesPVR CinemasSatish Singh ॐNo ratings yet

- Assignment One Strategic Marketing PlanDocument13 pagesAssignment One Strategic Marketing PlanFaizan MustafaNo ratings yet

- Pricing Products: Pricing Considerations, Approaches, and StrategyDocument36 pagesPricing Products: Pricing Considerations, Approaches, and Strategydeeprbs83% (6)

- IC e Commerce Sales Forecast Template 10708Document3 pagesIC e Commerce Sales Forecast Template 10708Ankit VermaNo ratings yet

- Design Manufacturing: Computer-IntegratedDocument667 pagesDesign Manufacturing: Computer-IntegratedAlexander CasallasNo ratings yet