Professional Documents

Culture Documents

U.S. Nonresident Alien Income Tax Return: Filing Status

U.S. Nonresident Alien Income Tax Return: Filing Status

Uploaded by

camilacorredor1998Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

U.S. Nonresident Alien Income Tax Return: Filing Status

U.S. Nonresident Alien Income Tax Return: Filing Status

Uploaded by

camilacorredor1998Copyright:

Available Formats

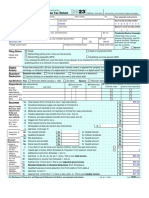

1040-NR U.S.

Nonresident Alien Income Tax Return 2022

Form Department of the Treasury—Internal Revenue Service

IRS Use Only—Do not write

OMB No. 1545-0074 or staple in this space.

See separate

For the year Jan. 1–Dec. 31, 2022, or other tax year beginning , 2022, ending , 20 instructions.

Filing ✔ Single Married filing separately (MFS) Qualifying surviving spouse (QSS) Estate Trust

Status

If you checked the QSS box, enter the child’s name if the qualifying person is a child but not your dependent:

Check only

one box.

Your first name and middle initial Last name Your identifying number

(see instructions)

Home address (number and street). If you have a P.O. box, see instructions. Apt. no.

City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

Digital Assets At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or

otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) . . . . . . Yes ✔ No

Dependents (4) Check the box if qualifies for (see inst.):

(2) Dependent’s Credit for other

(see instructions): Child tax credit

(1) First name Last name identifying number (3) Relationship to you dependents

If more than four

dependents, see

instructions and

check here

Income 1a Total amount from Form(s) W-2, box 1 (see instructions) . . . . . . . . . . . . . 1a

Effectively b Household employee wages not reported on Form(s) W-2 . . . . . . . . . . . . . 1b

Connected c Tip income not reported on line 1a (see instructions) . . . . . . . . . . . . . . 1c

With U.S. d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) . . . . . . . . 1d

Trade or e Taxable dependent care benefits from Form 2441, line 26 . . . . . . . . . . . . . 1e

Business f Employer-provided adoption benefits from Form 8839, line 29 . . . . . . . . . . . 1f

g Wages from Form 8919, line 6 . . . . . . . . . . . . . . . . . . . . . 1g

Attach

h Other earned income (see instructions) . . . . . . . . . . . . . . . . . . 1h

Form(s) W-2,

1042-S, i Reserved for future use . . . . . . . . . . . . . . . 1i

SSA-1042-S, j Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 1j

RRB-1042-S,

and 8288-A k Total income exempt by a treaty from Schedule OI (Form 1040-NR), item L,

here. Also line 1(e) . . . . . . . . . . . . . . . . . . . 1k

attach z Add lines 1a through 1h . . . . . . . . . . . . . . . . . . . . . . . 1z

Form(s)

2a Tax-exempt interest . . . 2a b Taxable interest . . . . . . 2b

1099-R if

tax was 3a Qualified dividends . . . 3a b Ordinary dividends . . . . . 3b

withheld. 4a IRA distributions . . . . 4a b Taxable amount . . . . . . 4b

If you did not 5a Pensions and annuities . . 5a b Taxable amount . . . . . . 5b

get a Form 6 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 6

W-2, see

instructions. 7 Capital gain or (loss). Attach Schedule D (Form 1040) if required. If not required, check here . . 7

8 Other income from Schedule 1 (Form 1040), line 10 . . . . . . . . . . . . . . . 8

9 Add lines 1z, 2b, 3b, 4b, 5b, 7, and 8. This is your total effectively connected income . . . . 9

10 Adjustments to income:

a From Schedule 1 (Form 1040), line 26 . . . . . . . . . . . 10a

b Reserved for future use . . . . . . . . . . . . . . . 10b

c Reserved for future use . . . . . . . . . . . . . . . 10c

d Enter the amount from line 10a. These are your total adjustments to income . . . . . . . 10d

11 Subtract line 10d from line 9. This is your adjusted gross income . . . . . . . . . . 11

12 Itemized deductions (from Schedule A (Form 1040-NR)) or, for certain residents of India, standard

deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . 12

13a Qualified business income deduction from Form 8995 or Form 8995-A . 13a

b Exemptions for estates and trusts only (see instructions) . . . . . 13b

c Add lines 13a and 13b . . . . . . . . . . . . . . . . . . . . . . . 13c

14 Add lines 12 and 13c . . . . . . . . . . . . . . . . . . . . . . . 14

15 Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income . . . . . 15

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11364D Form 1040-NR (2022)

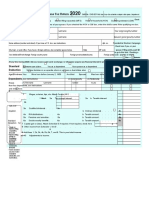

Form 1040-NR (2022) Page 2

Tax and 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16

Credits 17 Amount from Schedule 2 (Form 1040), line 3 . . . . . . . . . . . . . . . . . 17

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Child tax credit or credit for other dependents from Schedule 8812 (Form 1040) . . . . . . 19

20 Amount from Schedule 3 (Form 1040), line 8 . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Subtract line 21 from line 18. If zero or less, enter -0- . . . . . . . . . . . . . . 22

23a Tax on income not effectively connected with a U.S. trade or business from

Schedule NEC (Form 1040-NR), line 15 . . . . . . . . . . 23a

b Other taxes, including self-employment tax, from Schedule 2 (Form 1040),

line 21 . . . . . . . . . . . . . . . . . . . . 23b

c Transportation tax (see instructions) . . . . . . . . . . . 23c

d Add lines 23a through 23c . . . . . . . . . . . . . . . . . . . . . . 23d

24 Add lines 22 and 23d. This is your total tax . . . . . . . . . . . . . . . . . 24

Payments 25 Federal income tax withheld from:

a Form(s) W-2 . . . . . . . . . . . . . . . . . . 25a

b Form(s) 1099 . . . . . . . . . . . . . . . . . . 25b

c Other forms (see instructions) . . . . . . . . . . . . . 25c

d Add lines 25a through 25c . . . . . . . . . . . . . . . . . . . . . . 25d

e Form(s) 8805 . . . . . . . . . . . . . . . . . . . . . . . . . . 25e

f Form(s) 8288-A . . . . . . . . . . . . . . . . . . . . . . . . . 25f

g Form(s) 1042-S . . . . . . . . . . . . . . . . . . . . . . . . . 25g

26 2022 estimated tax payments and amount applied from 2021 return . . . . . . . . . . 26

27 Reserved for future use . . . . . . . . . . . . . . . 27

28 Additional child tax credit from Schedule 8812 (Form 1040) . . . . 28

29 Credit for amount paid with Form 1040-C . . . . . . . . . 29

30 Reserved for future use . . . . . . . . . . . . . . . 30

31 Amount from Schedule 3 (Form 1040), line 15 . . . . . . . . 31

32 Add lines 28, 29, and 31. These are your total other payments and refundable credits . . . . 32

33 Add lines 25d, 25e, 25f, 25g, 26, and 32. These are your total payments . . . . . . . . 33

Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid . . 34

35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . . . 35a

Direct deposit? b Routing number c Type: Checking Savings

See instructions.

d Account number

e If you want your refund check mailed to an address outside the United States not shown on page 1,

enter it here.

36 Amount of line 34 you want applied to your 2023 estimated tax . . 36

Amount 37 Subtract line 33 from line 24. This is the amount you owe.

You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions . . . . . . . . 37

38 Estimated tax penalty (see instructions) . . . . . . . . . . 38

Third Do you want to allow another person to discuss this return with the IRS? See instructions. Yes. Complete below. No

Party Designee’s Phone Personal identification

Designee name no. number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign Your signature Date Your occupation If the IRS sent you an Identity

Here Protection PIN, enter it here

(see inst.)

Phone no. Email address

Preparer’s name Preparer’s signature Date PTIN Check if:

Paid

Self-employed

Preparer

Firm’s name Phone no.

Use Only Firm’s address Firm’s EIN

Go to www.irs.gov/Form1040NR for instructions and the latest information. Form 1040-NR (2022)

You might also like

- Melinda Flowers 1040 PDFDocument2 pagesMelinda Flowers 1040 PDFCHRISTIAN RODRIGUEZ50% (4)

- f1040 PDFDocument2 pagesf1040 PDFCHRISTIAN RODRIGUEZNo ratings yet

- Home Loan Provisional Certificate ICICI 2019-20Document1 pageHome Loan Provisional Certificate ICICI 2019-20nikhil80% (5)

- Tax Return 2022 Mardik MardikianDocument23 pagesTax Return 2022 Mardik Mardikianyusuf Fajar100% (4)

- FTF 2023-08-12 1691895826386Document7 pagesFTF 2023-08-12 1691895826386El Guero CastroNo ratings yet

- Woolworth Payslip 2Document1 pageWoolworth Payslip 2sunny singh100% (1)

- Income Taxation Edt 2022 Sol ManDocument35 pagesIncome Taxation Edt 2022 Sol ManJessa50% (2)

- 2022 TaxReturn-1Document7 pages2022 TaxReturn-1Hengki Yono100% (3)

- TaxReturn2022 1040Document10 pagesTaxReturn2022 1040Trish Hit100% (3)

- Form 16 ExcelDocument2 pagesForm 16 Excelapi-372756271% (7)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- U.S. Individual Income Tax Return: Gregory 431-85-7104 Christopher BDocument5 pagesU.S. Individual Income Tax Return: Gregory 431-85-7104 Christopher BChris Gregory100% (2)

- LD AccountDocument5 pagesLD AccountYandisa Ngaleka0% (1)

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- U.S. Nonresident Alien Income Tax Return: Filing StatusDocument2 pagesU.S. Nonresident Alien Income Tax Return: Filing StatusFandyNo ratings yet

- 2021 Form 1040-NRDocument2 pages2021 Form 1040-NRvalentynad74No ratings yet

- Sin TítuloDocument14 pagesSin TítuloTavo MCNo ratings yet

- 2022 TaxReturnDocument9 pages2022 TaxReturnmicheelleeex3No ratings yet

- 1040eeeeeeeeez PDFDocument2 pages1040eeeeeeeeez PDF6g72ftm0No ratings yet

- Internal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnDocument2 pagesInternal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnTrish HitNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusqueennykaayaNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Status24brbarnesNo ratings yet

- 2022 Turbo Tax ReturnDocument14 pages2022 Turbo Tax ReturndsutetyrNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusqueennykaayaNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusboayoung.0820No ratings yet

- TaxReturn2022 10Document4 pagesTaxReturn2022 10Trish Hit50% (2)

- U.S. Individual Income Tax ReturnDocument4 pagesU.S. Individual Income Tax ReturnTrish HitNo ratings yet

- U.S. Individual Income Tax ReturnDocument5 pagesU.S. Individual Income Tax ReturnTrish HitNo ratings yet

- IRS Form f1040sDocument4 pagesIRS Form f1040sofficeNo ratings yet

- Doug Baber 2023 Tax ReturnDocument17 pagesDoug Baber 2023 Tax ReturnjpneebNo ratings yet

- Abdi 2022 - TaxReturnDocument19 pagesAbdi 2022 - TaxReturnAbdu AbabiloNo ratings yet

- Form 1040 SeniorDocument4 pagesForm 1040 SeniorStuti TiwariNo ratings yet

- 2023 Form 1040-SR. U.S. Tax Return For SeniorsDocument4 pages2023 Form 1040-SR. U.S. Tax Return For SeniorspatovoidNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- 2022 Signed Tax Return0.Document2 pages2022 Signed Tax Return0.Moeez MaalikNo ratings yet

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- Alternative Minimum Tax-IndividualsDocument2 pagesAlternative Minimum Tax-IndividualsBenjamín Varela UmbralNo ratings yet

- Christi Peeks 2023 ReturnDocument16 pagesChristi Peeks 2023 Returnchris.vitelaNo ratings yet

- 2023 TaxReturnDocument27 pages2023 TaxReturnLui100% (1)

- 2022 Individual Tax ReturnDocument6 pages2022 Individual Tax ReturnstephinecaustonNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusraheemtimo1No ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Benny BerniceNo ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintWEBTREE TECHNOLOGYNo ratings yet

- Form6251-2021-PDF Reader ProDocument2 pagesForm6251-2021-PDF Reader ProujehgjyiNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintMarie Carag100% (1)

- Shelby Palmer 2023 Federal Tax ReturnDocument13 pagesShelby Palmer 2023 Federal Tax ReturnsarahraebiddyNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2023 or Tax Year Beginning, 2023, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2023 or Tax Year Beginning, 2023, Ending, 20h0oud4No ratings yet

- 2022 Turbo Tax ReturnDocument17 pages2022 Turbo Tax Returnchris.vitelaNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- U.S. Tax Return For Seniors: Filing StatusDocument2 pagesU.S. Tax Return For Seniors: Filing StatusRemyan RNo ratings yet

- Actividad 7 1040 FormDocument2 pagesActividad 7 1040 FormKevin ÁlvarezNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20Document3 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20dizzi dagerNo ratings yet

- 2022 Federal Form 1045Document5 pages2022 Federal Form 1045Lamario StillwellNo ratings yet

- F1040se DFTDocument3 pagesF1040se DFTjyoti06ranjanNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Form 1120 2022Document6 pagesForm 1120 2022DjibzlaeNo ratings yet

- 1040 Tax 2023Document2 pages1040 Tax 2023Brad DorseyNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- U.S. Tax Return For Seniors Filing StatusDocument16 pagesU.S. Tax Return For Seniors Filing StatusJonathan Mahe100% (1)

- Preview Copy Do Not File: Eduardo Valle 463 41 4299Document3 pagesPreview Copy Do Not File: Eduardo Valle 463 41 4299evalle13No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)Ciarie SalgadoNo ratings yet

- Stryker India PVT LTD: Payslip For The Month of April 2019Document4 pagesStryker India PVT LTD: Payslip For The Month of April 2019Anonymous scxyMokpNo ratings yet

- Federal Income Tax ACCT 3325 Ch. 10 HomeworkDocument2 pagesFederal Income Tax ACCT 3325 Ch. 10 HomeworkGene'sNo ratings yet

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- Introduction To Federal Taxation in CanadaDocument64 pagesIntroduction To Federal Taxation in CanadaengarbangarNo ratings yet

- RITA 32 Form-Quarterly TaxDocument2 pagesRITA 32 Form-Quarterly Taxjtu3834No ratings yet

- ToS TaxationDocument5 pagesToS TaxationJack KiraNo ratings yet

- Governtment AccountingDocument2 pagesGoverntment Accountingjessica amorosoNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Management ScienceDocument2 pagesManagement ScienceManuela MagnoNo ratings yet

- Income Tax in Myanmar LawDocument2 pagesIncome Tax in Myanmar LawICT MyanmarNo ratings yet

- Bir Train-Income TaxDocument34 pagesBir Train-Income TaxJemma SaponNo ratings yet

- Annexure VI - Form 12B - Prior EmploymentDocument1 pageAnnexure VI - Form 12B - Prior EmploymentPruthvi PrakashaNo ratings yet

- General Instructions For The Completion PDF Form 1770 SDocument14 pagesGeneral Instructions For The Completion PDF Form 1770 SHafiedz S100% (1)

- ACW2491 Lecture 4 Handout SolutionS22016Document4 pagesACW2491 Lecture 4 Handout SolutionS22016林志成No ratings yet

- W11-Module Tax Return Preparation and Tax PaymentsDocument20 pagesW11-Module Tax Return Preparation and Tax PaymentsVirgilio Jay CervantesNo ratings yet

- Prof. Mohasin A. Tamboli PIRENS Technical Campus, Loni BKDocument27 pagesProf. Mohasin A. Tamboli PIRENS Technical Campus, Loni BKadiba10mktNo ratings yet

- Case Digest TaxationDocument9 pagesCase Digest TaxationJC RamosNo ratings yet

- National Income (Notes) IMBADocument27 pagesNational Income (Notes) IMBASubham .MNo ratings yet

- No Proceeds in Tax Evasion.: Tax Avoidance, Often Called Tax Planning, Is The Use by The Taxpayer of Legally PermissibleDocument3 pagesNo Proceeds in Tax Evasion.: Tax Avoidance, Often Called Tax Planning, Is The Use by The Taxpayer of Legally PermissibleMarceline AbadeerNo ratings yet

- CDoc - Taxation Law Project TopicsDocument3 pagesCDoc - Taxation Law Project TopicsFaizan Bin Abdul HakeemNo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- Income VIVIDocument19 pagesIncome VIVISim BelsondraNo ratings yet

- Q4 Module 9Document15 pagesQ4 Module 9Derick33% (3)