Professional Documents

Culture Documents

Map

Map

Uploaded by

ddi40275Copyright:

Available Formats

You might also like

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Chapter 1 5 Mylab Homework Exam 1 Fin 4604Document11 pagesChapter 1 5 Mylab Homework Exam 1 Fin 4604Mit DaveNo ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- Ratio Analysis Gamble Part 2Document20 pagesRatio Analysis Gamble Part 2dubduybfNo ratings yet

- Reading 24 - Understanding Balance SheetDocument1 pageReading 24 - Understanding Balance Sheetmaimaitaan120201No ratings yet

- To Test Name of Ratio Formula Parties Interested Industr y NormDocument4 pagesTo Test Name of Ratio Formula Parties Interested Industr y NormMohit SachdevNo ratings yet

- Unit-3 Financial RatiosDocument25 pagesUnit-3 Financial Ratiosbhargav.bhut112007No ratings yet

- FIN - Chap 4 - Analyzing Financial StatementsDocument1 pageFIN - Chap 4 - Analyzing Financial Statementsduyennthds170525No ratings yet

- Financial Gap CalculationDocument1 pageFinancial Gap CalculationRoberto F Chedid FilhoNo ratings yet

- Financial Risk ManagementDocument90 pagesFinancial Risk Managementmorrisonkaniu8283No ratings yet

- Accounting For Management: UniversityDocument14 pagesAccounting For Management: UniversityMehak SharmaNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosyohan_phillipsNo ratings yet

- FAR 03 - Cash and Cash EquivalentsDocument7 pagesFAR 03 - Cash and Cash EquivalentsCarlos Lois SebastianNo ratings yet

- Afm - 21421134Document13 pagesAfm - 21421134Mehak SharmaNo ratings yet

- Ch8 Circular Reference - DVDocument42 pagesCh8 Circular Reference - DVElf CanNo ratings yet

- Financial RatiosDocument38 pagesFinancial Ratiosserixa ewanNo ratings yet

- MM Financial Market and Products V1Document23 pagesMM Financial Market and Products V1Imran MobinNo ratings yet

- Chapter 12 Cost of Capital Mind MapDocument2 pagesChapter 12 Cost of Capital Mind MapShahaer MumtazNo ratings yet

- MapDocument1 pageMapddi40275No ratings yet

- Cheat Sheet - EXAM Version - BARBARADocument2 pagesCheat Sheet - EXAM Version - BARBARAJosé António Cardoso RodriguesNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Cách Tính Ratios C A OCBDocument6 pagesCách Tính Ratios C A OCBTrình LimboNo ratings yet

- Ratio Analysis: A Tool For Analysis and Interpretation of Financial StatementsDocument54 pagesRatio Analysis: A Tool For Analysis and Interpretation of Financial StatementsAjijur RahmanNo ratings yet

- Part 2 Financial AnalysisDocument32 pagesPart 2 Financial AnalysisMilad KarimyNo ratings yet

- Note On Financial Ratio FormulaDocument5 pagesNote On Financial Ratio FormulachthakorNo ratings yet

- ResuméDocument11 pagesResuméyouss efNo ratings yet

- Note on Financial Ratio FormulaDocument5 pagesNote on Financial Ratio FormulaBISHAL ROYNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- Financial Analysis & Planning - Ratio AnalysisDocument15 pagesFinancial Analysis & Planning - Ratio AnalysisPriyanka SharmaNo ratings yet

- Ratios - FormulasDocument14 pagesRatios - FormulasNivedita AgarwalNo ratings yet

- Proyectos de InversiónDocument9 pagesProyectos de InversiónmrevillacNo ratings yet

- Valuation: Lecture Note Packet 1 Intrinsic ValuationDocument308 pagesValuation: Lecture Note Packet 1 Intrinsic ValuationAlvaro MedinaNo ratings yet

- Key-Terms and Chapter Summary-4Document5 pagesKey-Terms and Chapter Summary-4samyakkatariaamityNo ratings yet

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- Key Financial Ratios (VIP)Document10 pagesKey Financial Ratios (VIP)Ahmed HeshamNo ratings yet

- Program On ALM Concepts For Members of Alco: Risk Management DepartmentDocument55 pagesProgram On ALM Concepts For Members of Alco: Risk Management DepartmentHimank SharmaNo ratings yet

- Financial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018Document26 pagesFinancial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018salma_meiNo ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- Client: Subject: Interpretation of Financial StatementsDocument1 pageClient: Subject: Interpretation of Financial StatementsMichel Bryan SemwoNo ratings yet

- Fin QuestionsDocument22 pagesFin Questionsvikki2point9No ratings yet

- Liquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDocument47 pagesLiquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDonny Ramanto100% (1)

- FM II Class 1 Mind MapDocument1 pageFM II Class 1 Mind MapnitinNo ratings yet

- LLS 7e Global Edition Ch09Document7 pagesLLS 7e Global Edition Ch09thanh subNo ratings yet

- Flow Chart IAS 32Document1 pageFlow Chart IAS 32Hameed Ullah Khan100% (1)

- Key Financial Ratios (M.N) FinialDocument10 pagesKey Financial Ratios (M.N) FinialYousab KaldasNo ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Liquidity Ratios: ProvisionDocument3 pagesLiquidity Ratios: ProvisionFurious GamingNo ratings yet

- FIN - Chap 6 - Discount Cash Flows and ValuationDocument1 pageFIN - Chap 6 - Discount Cash Flows and Valuationduyennthds170525No ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement Normal Balance ADocument3 pagesAccount Classification and Presentation: Account Title Classification Financial Statement Normal Balance AJanine Bernadette C. Bautista3180270No ratings yet

- Alm and Liquidity RiskDocument42 pagesAlm and Liquidity Riskyogeshhooda85No ratings yet

- As 11: Effects of Changes in Foreign Exchange Rates: Concept 1: IntroductionDocument9 pagesAs 11: Effects of Changes in Foreign Exchange Rates: Concept 1: IntroductionAJNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- FM Rapid Rivision Chart BookDocument18 pagesFM Rapid Rivision Chart Booknishashetty2022No ratings yet

- Chapter 18 Valuation Closing ThoughtsDocument18 pagesChapter 18 Valuation Closing ThoughtsdemelashNo ratings yet

- Presentation 1Document22 pagesPresentation 1LitoDes LedesmaNo ratings yet

- Far 03 Cash and Cash EquivalentsDocument22 pagesFar 03 Cash and Cash EquivalentsYuri CaguioaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- Jawaban P11-4Document3 pagesJawaban P11-4nurlaeliyahrahayuNo ratings yet

- Company ReviewDocument12 pagesCompany ReviewKharyle Vianca PullidoNo ratings yet

- Revitalization of T.P.Link Canal Badly Damaged Due To Excessive Flood During Flood 2010"Document4 pagesRevitalization of T.P.Link Canal Badly Damaged Due To Excessive Flood During Flood 2010"Xshf AkNo ratings yet

- Accounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavDocument18 pagesAccounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavRavi Jaiswal0% (1)

- Bonds ValuationsDocument57 pagesBonds ValuationsarmailgmNo ratings yet

- InvestecDocument10 pagesInvestecSourav BhattacharyaNo ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- Debt RestructuringDocument518 pagesDebt RestructuringMarco Zucconi100% (4)

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSDocument27 pagesFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHNo ratings yet

- Evaluation of ProductsDocument24 pagesEvaluation of ProductsRohan Sen SharmaNo ratings yet

- Hybrid and Derivative SecuritiesDocument42 pagesHybrid and Derivative SecuritiesPaula BitorNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument39 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manualrebeccagomezearndpsjkc100% (36)

- ch2 UzdaviniaiDocument3 pagesch2 UzdaviniaiLeonid LeoNo ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/23Document20 pagesCambridge IGCSE: ACCOUNTING 0452/23Mangesh RahateNo ratings yet

- Chapter OneDocument63 pagesChapter OneMeklitNo ratings yet

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Document2 pagesCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNo ratings yet

- For 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision PracticeDocument67 pagesFor 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision Practice6D10 NG YAN HUNG 吳欣鴻No ratings yet

- What Is Share Capital?: Company Receives Through Their Equity FinancingDocument6 pagesWhat Is Share Capital?: Company Receives Through Their Equity FinancingDominique B. PeronillaNo ratings yet

- OWOTT3Document236 pagesOWOTT3Akash MukherjeeNo ratings yet

- Case 6Document3 pagesCase 6Farhanie Nordin0% (1)

- MBFS - 3Document30 pagesMBFS - 3Kaviya KaviNo ratings yet

- Sun Phrma KoreaDocument7 pagesSun Phrma KoreaSiNo ratings yet

- Sophie AssignmentDocument5 pagesSophie AssignmentLucky LuckyNo ratings yet

- Midterm in Financial Accounting 2 For PrintingDocument6 pagesMidterm in Financial Accounting 2 For PrintingMarvin CeledioNo ratings yet

- CA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2Document47 pagesCA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2rahul100% (1)

- Chapter 02 Stock Investment Investor Accounting and ReportingDocument3 pagesChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyNo ratings yet

- Annoucement For ATQ TOTDocument17 pagesAnnoucement For ATQ TOTSavana SannNo ratings yet

- IFT Summary Level 3Document17 pagesIFT Summary Level 3jigneshNo ratings yet

Map

Map

Uploaded by

ddi40275Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Map

Map

Uploaded by

ddi40275Copyright:

Available Formats

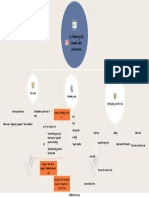

Present value of future

cash flows

Size of cash flows

Determinants of stock

Stock values Timing of cash flows

looking price per share, based price

on future expected growth and

earnings.

Valuation using P/E Riskiness of cash flows

ratio

Backward looking earnings based on

Vo = CF1 + CF2 + CF3 + … + CFn

historical data.

(1 + r)1 (1 + r)2 (1 + r)3 (1 + r)n

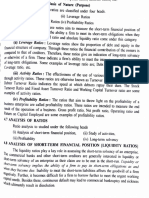

Credit

ROE = Net income /

Profitability analysis

Total equity

Liquidity

Non-performing assets

include nonaccrual

Market Risk factors banks face

loans,

Price

restructured loans, and

other real-estate owned

Interest rate

Credit risk

Loss ratio= Net chargeoffs on loans/ Total loans and leases

Funds available to

meet cash demand

Reserve ratio =Reserves for loan losses/

for loans and

Total loans and leases

deposit withdrawal

Loan and lease ratio= Net loans and

Temporary investments

leases/Total assets

ratio=liquid assets/total assets

Liquidity risk

Chapter 6: Measuring

and Evaluating Value of bond portfolios and equity capital

Trend toward less

Bank Performance most at risk

liquidity Price risk

with fast changes in market values of

bonds

Book − to − Market=Book value of

assets/Market value of assets

Impact on profit due to changes

Market risk in interest rates

Risk due to failing

computer systems,

Dollar gap ratio= Interest rate sensitive assets

errors, misconduct

Operational risk - Interest rate sensitive liabilities/Total assets

by employees,

floods, tornadoes, Interest rate risk

lightning strikes

Liabilities > assets => bank at higher risk with

rising rates

Uncertainty due to

public opinion as it

Assets > liabilities => bank at higher risk with

pertains to

Reputation risk falling rates

confidence of

customers and

creditors Legal risk – legal system

creates adverse

outcomes

P/E ratio Legal and compliance

risk

Compliance risk –

Equity to total assets

Impact of all the violations to the rules

previous risks affects and regulations

capital Capital risk

Purchases funds to total

and the bank’s survival

liabilities

chances Variation in earnings

Strategic risk due to poor

business decisions

Equity capital to risk

assets

You might also like

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Chapter 1 5 Mylab Homework Exam 1 Fin 4604Document11 pagesChapter 1 5 Mylab Homework Exam 1 Fin 4604Mit DaveNo ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- Ratio Analysis Gamble Part 2Document20 pagesRatio Analysis Gamble Part 2dubduybfNo ratings yet

- Reading 24 - Understanding Balance SheetDocument1 pageReading 24 - Understanding Balance Sheetmaimaitaan120201No ratings yet

- To Test Name of Ratio Formula Parties Interested Industr y NormDocument4 pagesTo Test Name of Ratio Formula Parties Interested Industr y NormMohit SachdevNo ratings yet

- Unit-3 Financial RatiosDocument25 pagesUnit-3 Financial Ratiosbhargav.bhut112007No ratings yet

- FIN - Chap 4 - Analyzing Financial StatementsDocument1 pageFIN - Chap 4 - Analyzing Financial Statementsduyennthds170525No ratings yet

- Financial Gap CalculationDocument1 pageFinancial Gap CalculationRoberto F Chedid FilhoNo ratings yet

- Financial Risk ManagementDocument90 pagesFinancial Risk Managementmorrisonkaniu8283No ratings yet

- Accounting For Management: UniversityDocument14 pagesAccounting For Management: UniversityMehak SharmaNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosyohan_phillipsNo ratings yet

- FAR 03 - Cash and Cash EquivalentsDocument7 pagesFAR 03 - Cash and Cash EquivalentsCarlos Lois SebastianNo ratings yet

- Afm - 21421134Document13 pagesAfm - 21421134Mehak SharmaNo ratings yet

- Ch8 Circular Reference - DVDocument42 pagesCh8 Circular Reference - DVElf CanNo ratings yet

- Financial RatiosDocument38 pagesFinancial Ratiosserixa ewanNo ratings yet

- MM Financial Market and Products V1Document23 pagesMM Financial Market and Products V1Imran MobinNo ratings yet

- Chapter 12 Cost of Capital Mind MapDocument2 pagesChapter 12 Cost of Capital Mind MapShahaer MumtazNo ratings yet

- MapDocument1 pageMapddi40275No ratings yet

- Cheat Sheet - EXAM Version - BARBARADocument2 pagesCheat Sheet - EXAM Version - BARBARAJosé António Cardoso RodriguesNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Cách Tính Ratios C A OCBDocument6 pagesCách Tính Ratios C A OCBTrình LimboNo ratings yet

- Ratio Analysis: A Tool For Analysis and Interpretation of Financial StatementsDocument54 pagesRatio Analysis: A Tool For Analysis and Interpretation of Financial StatementsAjijur RahmanNo ratings yet

- Part 2 Financial AnalysisDocument32 pagesPart 2 Financial AnalysisMilad KarimyNo ratings yet

- Note On Financial Ratio FormulaDocument5 pagesNote On Financial Ratio FormulachthakorNo ratings yet

- ResuméDocument11 pagesResuméyouss efNo ratings yet

- Note on Financial Ratio FormulaDocument5 pagesNote on Financial Ratio FormulaBISHAL ROYNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- Financial Analysis & Planning - Ratio AnalysisDocument15 pagesFinancial Analysis & Planning - Ratio AnalysisPriyanka SharmaNo ratings yet

- Ratios - FormulasDocument14 pagesRatios - FormulasNivedita AgarwalNo ratings yet

- Proyectos de InversiónDocument9 pagesProyectos de InversiónmrevillacNo ratings yet

- Valuation: Lecture Note Packet 1 Intrinsic ValuationDocument308 pagesValuation: Lecture Note Packet 1 Intrinsic ValuationAlvaro MedinaNo ratings yet

- Key-Terms and Chapter Summary-4Document5 pagesKey-Terms and Chapter Summary-4samyakkatariaamityNo ratings yet

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- Key Financial Ratios (VIP)Document10 pagesKey Financial Ratios (VIP)Ahmed HeshamNo ratings yet

- Program On ALM Concepts For Members of Alco: Risk Management DepartmentDocument55 pagesProgram On ALM Concepts For Members of Alco: Risk Management DepartmentHimank SharmaNo ratings yet

- Financial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018Document26 pagesFinancial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018salma_meiNo ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- Client: Subject: Interpretation of Financial StatementsDocument1 pageClient: Subject: Interpretation of Financial StatementsMichel Bryan SemwoNo ratings yet

- Fin QuestionsDocument22 pagesFin Questionsvikki2point9No ratings yet

- Liquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDocument47 pagesLiquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDonny Ramanto100% (1)

- FM II Class 1 Mind MapDocument1 pageFM II Class 1 Mind MapnitinNo ratings yet

- LLS 7e Global Edition Ch09Document7 pagesLLS 7e Global Edition Ch09thanh subNo ratings yet

- Flow Chart IAS 32Document1 pageFlow Chart IAS 32Hameed Ullah Khan100% (1)

- Key Financial Ratios (M.N) FinialDocument10 pagesKey Financial Ratios (M.N) FinialYousab KaldasNo ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Liquidity Ratios: ProvisionDocument3 pagesLiquidity Ratios: ProvisionFurious GamingNo ratings yet

- FIN - Chap 6 - Discount Cash Flows and ValuationDocument1 pageFIN - Chap 6 - Discount Cash Flows and Valuationduyennthds170525No ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement Normal Balance ADocument3 pagesAccount Classification and Presentation: Account Title Classification Financial Statement Normal Balance AJanine Bernadette C. Bautista3180270No ratings yet

- Alm and Liquidity RiskDocument42 pagesAlm and Liquidity Riskyogeshhooda85No ratings yet

- As 11: Effects of Changes in Foreign Exchange Rates: Concept 1: IntroductionDocument9 pagesAs 11: Effects of Changes in Foreign Exchange Rates: Concept 1: IntroductionAJNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- FM Rapid Rivision Chart BookDocument18 pagesFM Rapid Rivision Chart Booknishashetty2022No ratings yet

- Chapter 18 Valuation Closing ThoughtsDocument18 pagesChapter 18 Valuation Closing ThoughtsdemelashNo ratings yet

- Presentation 1Document22 pagesPresentation 1LitoDes LedesmaNo ratings yet

- Far 03 Cash and Cash EquivalentsDocument22 pagesFar 03 Cash and Cash EquivalentsYuri CaguioaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- Jawaban P11-4Document3 pagesJawaban P11-4nurlaeliyahrahayuNo ratings yet

- Company ReviewDocument12 pagesCompany ReviewKharyle Vianca PullidoNo ratings yet

- Revitalization of T.P.Link Canal Badly Damaged Due To Excessive Flood During Flood 2010"Document4 pagesRevitalization of T.P.Link Canal Badly Damaged Due To Excessive Flood During Flood 2010"Xshf AkNo ratings yet

- Accounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavDocument18 pagesAccounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavRavi Jaiswal0% (1)

- Bonds ValuationsDocument57 pagesBonds ValuationsarmailgmNo ratings yet

- InvestecDocument10 pagesInvestecSourav BhattacharyaNo ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- Debt RestructuringDocument518 pagesDebt RestructuringMarco Zucconi100% (4)

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSDocument27 pagesFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHNo ratings yet

- Evaluation of ProductsDocument24 pagesEvaluation of ProductsRohan Sen SharmaNo ratings yet

- Hybrid and Derivative SecuritiesDocument42 pagesHybrid and Derivative SecuritiesPaula BitorNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument39 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manualrebeccagomezearndpsjkc100% (36)

- ch2 UzdaviniaiDocument3 pagesch2 UzdaviniaiLeonid LeoNo ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/23Document20 pagesCambridge IGCSE: ACCOUNTING 0452/23Mangesh RahateNo ratings yet

- Chapter OneDocument63 pagesChapter OneMeklitNo ratings yet

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Document2 pagesCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNo ratings yet

- For 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision PracticeDocument67 pagesFor 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision Practice6D10 NG YAN HUNG 吳欣鴻No ratings yet

- What Is Share Capital?: Company Receives Through Their Equity FinancingDocument6 pagesWhat Is Share Capital?: Company Receives Through Their Equity FinancingDominique B. PeronillaNo ratings yet

- OWOTT3Document236 pagesOWOTT3Akash MukherjeeNo ratings yet

- Case 6Document3 pagesCase 6Farhanie Nordin0% (1)

- MBFS - 3Document30 pagesMBFS - 3Kaviya KaviNo ratings yet

- Sun Phrma KoreaDocument7 pagesSun Phrma KoreaSiNo ratings yet

- Sophie AssignmentDocument5 pagesSophie AssignmentLucky LuckyNo ratings yet

- Midterm in Financial Accounting 2 For PrintingDocument6 pagesMidterm in Financial Accounting 2 For PrintingMarvin CeledioNo ratings yet

- CA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2Document47 pagesCA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2rahul100% (1)

- Chapter 02 Stock Investment Investor Accounting and ReportingDocument3 pagesChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyNo ratings yet

- Annoucement For ATQ TOTDocument17 pagesAnnoucement For ATQ TOTSavana SannNo ratings yet

- IFT Summary Level 3Document17 pagesIFT Summary Level 3jigneshNo ratings yet