Professional Documents

Culture Documents

Solution Case 4

Solution Case 4

Uploaded by

Mariammi 1110 ratings0% found this document useful (0 votes)

7 views2 pagesThis document analyzes a company's financial performance under four scenarios: no debt/no taxes, debt/no taxes, no debt/taxes, and debt/taxes. It provides key financial metrics like EBIT, interest, taxable income, net income, EPS, equity, and ROE for the company during recession, normal, and expansion periods under each scenario.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document analyzes a company's financial performance under four scenarios: no debt/no taxes, debt/no taxes, no debt/taxes, and debt/taxes. It provides key financial metrics like EBIT, interest, taxable income, net income, EPS, equity, and ROE for the company during recession, normal, and expansion periods under each scenario.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesSolution Case 4

Solution Case 4

Uploaded by

Mariammi 111This document analyzes a company's financial performance under four scenarios: no debt/no taxes, debt/no taxes, no debt/taxes, and debt/taxes. It provides key financial metrics like EBIT, interest, taxable income, net income, EPS, equity, and ROE for the company during recession, normal, and expansion periods under each scenario.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

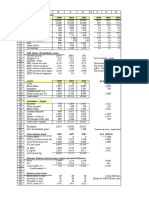

part A: No Debt, No Taxes Recession Normal Expansion

EBIT 17,400 29,000 37,700

Interest 0 0 0

EBT (Taxable Income) 17,400 29,000 37,700

Taxes 0 0 0

Net Income 17,400 29,000 37,700

Number of shares 7,400 7,400 7,400

EPS 2.35 3.92 5.09

Equity 185,000 185,000 185,000

ROE 9.41% 15.68% 20.38%

Market Price =185,000/7,400 = 25

part B: With Debt, No Taxes Recession Normal Expansion

EBIT 17,400 29,000 37,700

Interest 4,550 4,550 4,550

EBT (Taxable Income) 12,850 24,450 33,150

Taxes 0 0 0

Net Income 12,850 24,450 33,150

Number of shares 4,800 4,800 4,800

EPS 2.68 5.09 6.91

Equity 120,000 120,000 120,000

ROE 10.71% 20.38% 27.63%

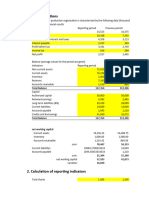

part C: No Debt, With Taxes Recession Normal Expansion

EBIT 17,400 29,000 37,700

Interest 0 0 0

EBT (Taxable Income) 17,400 29,000 37,700

Taxes at 21% 3,654 6,090 7,917

Net Income 13,746 22,910 29,783

Number of shares 7,400 7,400 7,400

EPS 1.86 3.10 4.02

Equity 185,000 185,000 185,000

ROE 7.43% 12.38% 16.10%

part C: With Debt, With Taxes Recession Normal Expansion

EBIT 17,400 29,000 37,700

Interest 4,550 4,550 4,550

EBT (Taxable Income) 12,850 24,450 33,150

Taxes at 21% 2,699 5,135 6,962

Net Income 10,152 19,316 26,189

Number of shares 4,800 4,800 4,800

EPS 2.11 4.02 5.46

Equity 120,000 120,000 120,000

ROE 8.46% 16.10% 21.82%

given

given

given

given

You might also like

- The Body ShopDocument4 pagesThe Body ShopKhalid MehmoodNo ratings yet

- DOL, DFL, DTL ExercisesDocument4 pagesDOL, DFL, DTL ExercisesDavid Cetina RoldánNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- How Does Debt Affect CPKDocument14 pagesHow Does Debt Affect CPKLâm Thanh Huyền Nguyễn100% (1)

- Case Study No. 3 PDFDocument6 pagesCase Study No. 3 PDFMuhammadZahirGulNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- Olympia CaseDocument5 pagesOlympia Caseaa1122No ratings yet

- WACC Mar 25Document6 pagesWACC Mar 25Elcah Myrrh LaridaNo ratings yet

- M.Sc. Microbiology Bio TechnologyDocument6 pagesM.Sc. Microbiology Bio Technologymmumullana0098No ratings yet

- Berkshire Partners Bidding For Carter S Group 6Document21 pagesBerkshire Partners Bidding For Carter S Group 6Þorgeir DavíðssonNo ratings yet

- Lab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaDocument3 pagesLab9 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissa Kamis07.30 BuPrimaFahmi GilangNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

- Key Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Document10 pagesKey Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Wassi Ademola MoudachirouNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Cap 1 TablasDocument18 pagesCap 1 TablasWILDER ENRIQUEZ POCOMONo ratings yet

- I Ntegrated Case: Financial Statement AnalysisDocument13 pagesI Ntegrated Case: Financial Statement Analysishtet sanNo ratings yet

- FinManSemis2 UmaliDocument7 pagesFinManSemis2 UmaliJenny Shane UmaliNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- UE MC 2023-2024 Exercise 10 B Solution1Document1 pageUE MC 2023-2024 Exercise 10 B Solution1Sami El YadiniNo ratings yet

- FINMANDocument11 pagesFINMANJenny Shane UmaliNo ratings yet

- Diageo Vs BritvicDocument6 pagesDiageo Vs BritvicKasturi MazumdarNo ratings yet

- CF EndTermDocument29 pagesCF EndTermakshatm27No ratings yet

- Motives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricDocument41 pagesMotives For Merger: 1. Horizontal 2. Vertical 3. Conglomerate 4. ConcentricWasif HossainNo ratings yet

- Financial Statement Analysis: I Ntegrated CaseDocument13 pagesFinancial Statement Analysis: I Ntegrated Casehtet sanNo ratings yet

- Sample 4Document7 pagesSample 4Snehashis SahaNo ratings yet

- Inputs: Problem 17.3Document4 pagesInputs: Problem 17.3Tuan HungNo ratings yet

- D.1. Financial Statement AnalysisDocument3 pagesD.1. Financial Statement AnalysisIrfan PoonawalaNo ratings yet

- Corporate Break-Up CalculationDocument5 pagesCorporate Break-Up CalculationNachiketaNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- Business Accounting ProjectDocument17 pagesBusiness Accounting ProjectAMAN KUMARNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Case F&B: Income StatementDocument3 pagesCase F&B: Income StatementDIPESH KUNWARNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Financial Modeling - Module I - Workbook 09.28.09Document38 pagesFinancial Modeling - Module I - Workbook 09.28.09rabiaasimNo ratings yet

- Ejercicios de FinanzasDocument25 pagesEjercicios de Finanzasmvelasco5172No ratings yet

- November 6 - CorporationsDocument2 pagesNovember 6 - CorporationsDarius DelacruzNo ratings yet

- Fatima FertilizersDocument18 pagesFatima FertilizersBarira AkhtarNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- September 8 - Capital Gains TaxDocument2 pagesSeptember 8 - Capital Gains TaxAlbert XuNo ratings yet

- Economicprofit BeckDocument6 pagesEconomicprofit Beckf20212960No ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- VC and IPO NumericalDocument16 pagesVC and IPO Numericaluse lnctNo ratings yet

- KalyanDocument4 pagesKalyanAnkita TiwariNo ratings yet

- Practice Capital Structure - Session - 1-2Document36 pagesPractice Capital Structure - Session - 1-2Vibhuti Anand0% (1)

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- GDL Case AnalysisDocument11 pagesGDL Case AnalysisLourdes PortaNo ratings yet

- Chapter 2. Exhibits y AnexosDocument20 pagesChapter 2. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Fina 1161Document5 pagesFina 1161anhminhngo2005No ratings yet

- Book 1Document4 pagesBook 1thihinneNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- EstimationDocument5 pagesEstimationDivyam GargNo ratings yet

- Four Seas Corporation Income Statement For The Year Ended 31 December 20x5 FCDocument9 pagesFour Seas Corporation Income Statement For The Year Ended 31 December 20x5 FCtara tiriNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- LBO Model DetailedDocument10 pagesLBO Model Detailedpre.meh21No ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Same As Consignee: Unit Price Total Price USD USDDocument1 pageSame As Consignee: Unit Price Total Price USD USDFishy09No ratings yet

- SPMM 2006Document11 pagesSPMM 2006Amit KumarNo ratings yet

- Contract To Sell Helen CagayanDocument3 pagesContract To Sell Helen CagayanMarton Emile DesalesNo ratings yet

- Strategic Alliances and Joint VenturesDocument40 pagesStrategic Alliances and Joint VenturesmnikumbhaNo ratings yet

- x1 English Conservation Dialog Logic Test 1 With AnswersDocument3 pagesx1 English Conservation Dialog Logic Test 1 With AnswersAleksandrNo ratings yet

- B0701C PDF EngDocument5 pagesB0701C PDF EngRohit PanditNo ratings yet

- STEP-NC-Compliant Systems For The Manufacturing Environment: AbstractDocument6 pagesSTEP-NC-Compliant Systems For The Manufacturing Environment: AbstractNatarajan KrishnanNo ratings yet

- Apparel Production Planning Control AE 405Document56 pagesApparel Production Planning Control AE 405ইসলামিক টিভিNo ratings yet

- Customer Satisfaction Level in Accel: Project Report OnDocument53 pagesCustomer Satisfaction Level in Accel: Project Report OnAnubhav SonyNo ratings yet

- Minimum Expense Form 2020-2021: School of Graduate StudiesDocument3 pagesMinimum Expense Form 2020-2021: School of Graduate StudiesTHE ROOT OF PIENo ratings yet

- Teaching Hours: 5 Hours Per WeekDocument47 pagesTeaching Hours: 5 Hours Per WeekChandana CharaNo ratings yet

- Standard Chartered BankDocument41 pagesStandard Chartered BankGovind Tyagi100% (1)

- PHS AsnDocument10 pagesPHS AsnPurzuNo ratings yet

- Lawteacher InsuranceDocument39 pagesLawteacher InsuranceWanangwa ChiumeNo ratings yet

- Short Call Condor: Short 1 Itm Call + Long 1 Itm Call + Long 1 Otm Call + Short 1 Otm CallDocument7 pagesShort Call Condor: Short 1 Itm Call + Long 1 Itm Call + Long 1 Otm Call + Short 1 Otm Callmanpreet1810878135No ratings yet

- Asian RegionalismDocument15 pagesAsian RegionalismAngelica Sambo100% (2)

- Group 3 - Pham Thuy LinhDocument3 pagesGroup 3 - Pham Thuy LinhThuy Linh PhamNo ratings yet

- Quiz Bowl - Acctg 3Document2 pagesQuiz Bowl - Acctg 3sharen jill montero100% (1)

- KEY-QMS-03 Training and CompetencyDocument5 pagesKEY-QMS-03 Training and CompetencyMenuka SiwaNo ratings yet

- Hazards and Operability (HAZOP) StudyDocument28 pagesHazards and Operability (HAZOP) StudyXiang Jintao100% (1)

- Rmit University Graduates 2021Document452 pagesRmit University Graduates 2021butlicker1000No ratings yet

- 5518 13450 1 SMDocument15 pages5518 13450 1 SMRisma RahayuNo ratings yet

- EPAS For Compliance: ISO/IEC 27001Document12 pagesEPAS For Compliance: ISO/IEC 27001Costin EnacheNo ratings yet

- Storage Handling & TransportationDocument4 pagesStorage Handling & TransportationAzzeddine GundNo ratings yet

- 11A. HDFC Estatement FEB 2018Document6 pages11A. HDFC Estatement FEB 2018Nanu PatelNo ratings yet

- Accounting: NO Judul PengarangDocument14 pagesAccounting: NO Judul Pengarangkartini11No ratings yet

- Industrial and Labor Economics For TYBA Paper VI Sem V - 2019Document65 pagesIndustrial and Labor Economics For TYBA Paper VI Sem V - 2019Jaga SwainNo ratings yet

- EFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Document4 pagesEFF. DT. 02/03/2020 LO# 0831 1 Soc. Sec. No.: Xxx-Xx-680-43-5671 ER NO. E00-00000Ismail AhmedNo ratings yet

- Mass Balance Recycle Paper 2Document8 pagesMass Balance Recycle Paper 2Rahmah Tasha FebrinaNo ratings yet