Professional Documents

Culture Documents

TYBMS SEM5 CDM NOV18cc

TYBMS SEM5 CDM NOV18cc

Uploaded by

teyim37538Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TYBMS SEM5 CDM NOV18cc

TYBMS SEM5 CDM NOV18cc

Uploaded by

teyim37538Copyright:

Available Formats

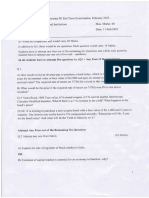

Paper / Subject Code: 46006 / tr'inance:Commodity & Derivatives Maiket

Durationz 2L/z IJts l.Marks:Z5

Note: 1)All Questions are compulsory subject to internal choice

2) Figures to right indicate full marks

Q.l (A) State weather the following statement are True or False.(Any B) (o8)

1. It is very dif{icult to take long or short position in the derivatives s compared to other assets.

2. For-wards are over the counter instrument.

3. Expiration day is the last trading day of the contracr.

4. The spot price is the future market price of the underiying asset.

( Price of each security x contract )

5. Contract price - Lot size

6. Payoff on a position is likely profit/ loss that would accrue to a market participant with change in

the price of the underlying asset at expiry.

7. Speculators take large, calculated risks as they trade based on anticipated future price

movements.

8. In options, execution of contract can be done any time before the expiry of the agreed date.

9. An option premium is the income received by an investor who holds the option contract.

1O. The strike price is specified in the option contract and does change over time.

B) Match the following (Any 7) (O7)

Column A Column B

1 No margin requirement a rUnlimited profit

2 Contract size b Highlv risky

J Settlement of forward contract C Lot size

+ A

Speculation d Flieher option premium

5 Arbitrage e Cash or delivery

6 Option writer f Forwards

7 Option holder o

b Directly proportional to spot price

B Deep in the money h Short position

9 Futures contract 1 Operating leverage

10 Financial risk j Symmetrical pavoffs

55658 Page 1 of3

Paper / Subject Code: 46006 / Finance:Commodity & Derivatives

Market

':

Q.2 (A) Discuss the participants in derivative market? .

(o8)

Q.2 (B) Distinguish between Forward & Future (o7l

OR

Q.2(c) write note on different types of derivative traded in India. (o8)

Q.2(D) Define commodity Market. Explain its history & growth in India

loTl

Q.3(A) Explain the following Terminologies: (OS)

1. Initial Margin

2. Contract Size

3. Settlement price

4. Option premium

Q'3(B) What is imperfect hedge ? what are the reasons for imperfect hedge?

r---- (OZ)

oR

Q'3 (c) The spot price of gold is Rs 3i,0oo/- the locker rent is Rs50o and the insurance charges arc

Rs 750' The interest rate on the borrowed funds is l4o/op.a.

compounded on monthly basis. whar

will be the fair value of futures after 3 months? (08)

Q'3(D) Naman shorts a call option of VST Ltd at an exercise price of Rs 1020 with a premium

of Rs

50' calculate the profit or loss for Naman if the spot price o,

"*orf

* t"rr"*s: Rs. 970, Rs. 980,

Rs' 990' Rs' 1000, Rs. 1010, Rs. lo2o,Rs. 1030, Rs. 1040, ns. ""

roso. Also draw the payoff diagram

for the same. (o7l

Q'4 (A) Explain w'hat is meant by intrinsic value or moneyness of an option contract lozl

Q'4 (B) Distinguish between Binomial option Pricing Model & Black Scholes option Pricing Model

(o8)

OR

Q'4 (ClThe spot price of copper is Rs 4,600 per kg, the store room rent is Rs6,000 paid semi-

annually' The interest rate on the borrowed funds is t2ohp.a. compounded

on monthly basis. what

will be the fair value of futures after 3 months?

(o7l

55658 Page 2 of3

Paper / Subject Code: 46006 / Finance:Commodity & Derivatives Market

Q.4 {D)An investor takes position in the futures market through the followihg transactions

a. Buys 6 contracts of Tata Steel Ltd at Rs 3125 with a lot size of ?pQ.r which expires at a fina1

settlement price of Rs 315O

b. Sells 7 contracts of Canara Bank at Rs 675 with a 1ot size of 1OO which expires at 665

Determine the net profit or loss for the investor from both the positions draw payoff diagram for

respective positions

Q.5 (A) What are the types of Order?

(B) What are objectives of NSCCL

Q.5 Write short notes on any three of the following

1. Backwardation

2. Reverse Cash & Carry Arbitrage

3. Tlpes of Underlying Assets.

4. MCX

5. Cost of Carry Model

5s6s8 Page 3 of3

You might also like

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- DateExtension Summer 2021 09-09-2021Document2 pagesDateExtension Summer 2021 09-09-2021Grishma BhindoraNo ratings yet

- Old Paper 2597121Document2 pagesOld Paper 2597121IlyasNo ratings yet

- ECDDDocument2 pagesECDDGauravNo ratings yet

- FIN 425 Global Financial Risk Management - Sample Exam IDocument3 pagesFIN 425 Global Financial Risk Management - Sample Exam IIbrahim KhatatbehNo ratings yet

- Kshitiz Int'L College Quiz I, Set A Sub: Financial Derivatives Semester: ViiiDocument2 pagesKshitiz Int'L College Quiz I, Set A Sub: Financial Derivatives Semester: ViiiUbraj NeupaneNo ratings yet

- Test 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTDocument6 pagesTest 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTprakhar rawatNo ratings yet

- Summer 2019 (06-05-2019)Document2 pagesSummer 2019 (06-05-2019)Grishma BhindoraNo ratings yet

- Mba 3 Sem Security Analysis and Portfolio Management 2830203 Summer 2019Document3 pagesMba 3 Sem Security Analysis and Portfolio Management 2830203 Summer 2019It's AnimeboyNo ratings yet

- Risk 2840202 Jan 2021Document3 pagesRisk 2840202 Jan 2021PILLO PATELNo ratings yet

- Futures & Options MidtermDocument12 pagesFutures & Options MidtermLaten CruxyNo ratings yet

- Ch02 Fundamentals of Futures and Options MarketsDocument14 pagesCh02 Fundamentals of Futures and Options Marketspoosama123No ratings yet

- Assignment 1Document2 pagesAssignment 1WINFRED KYALONo ratings yet

- Chapter 1 (1) - TaggedDocument57 pagesChapter 1 (1) - TaggedranjanNo ratings yet

- Question Paper: Bms College of EngineeringDocument2 pagesQuestion Paper: Bms College of EngineeringShivaNo ratings yet

- Tybbi Sem5 FSM Nov19Document2 pagesTybbi Sem5 FSM Nov19parchavinit35No ratings yet

- Commerce Bcom Banking and Insurance Semester 5 2022 November International Banking Finance CbcgsDocument2 pagesCommerce Bcom Banking and Insurance Semester 5 2022 November International Banking Finance CbcgssamymadheNo ratings yet

- XtraaDocument4 pagesXtraa2203029No ratings yet

- Cid2 V21a Sample - DerivativesDocument39 pagesCid2 V21a Sample - Derivativesparseghianmayda8No ratings yet

- st62005-2009 0Document263 pagesst62005-2009 0chan chadoNo ratings yet

- Hedging Strategies Using FuturesDocument18 pagesHedging Strategies Using FuturesQuynh NgaNo ratings yet

- T 2 GCM 13 MJ 1 R PYIx Q9 E9 M EDnzi HQ EZUwp Vo 4 U37 D KDocument2 pagesT 2 GCM 13 MJ 1 R PYIx Q9 E9 M EDnzi HQ EZUwp Vo 4 U37 D KJerry DjondoNo ratings yet

- (WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 4Document6 pages(WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 4Sachin BarthwalNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- Gtu Mba 4549221 Summer 2023Document2 pagesGtu Mba 4549221 Summer 2023suvagiyaamisha16No ratings yet

- FN3023 Exam Paper - May 2023Document6 pagesFN3023 Exam Paper - May 2023dth090702No ratings yet

- Roll No. ..................................... : Part-A 1Document4 pagesRoll No. ..................................... : Part-A 1Milan vcNo ratings yet

- 4203 (Previous Year Questions)Document7 pages4203 (Previous Year Questions)Tanjid MahadyNo ratings yet

- Financial Markets & Institutions Feb.23Document2 pagesFinancial Markets & Institutions Feb.23pratik9365No ratings yet

- Revision PackDocument3 pagesRevision PackArnold MoyoNo ratings yet

- Construction Economics Finance s17Document4 pagesConstruction Economics Finance s17sgumble3007No ratings yet

- SOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本Document85 pagesSOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本cnmouldplasticNo ratings yet

- Topic 6Document5 pagesTopic 6domyduyen105No ratings yet

- Dokumen - Tips - Demo Nism 8 Equity Derivatives ModuleDocument7 pagesDokumen - Tips - Demo Nism 8 Equity Derivatives ModuleArif QureshiNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Midterm Exam 2 B PDFDocument7 pagesMidterm Exam 2 B PDFabhimani5472No ratings yet

- Tybbi Sem5 Ibf Apr19Document3 pagesTybbi Sem5 Ibf Apr19kumar shahNo ratings yet

- Adobe Scan 20-Mar-2024Document3 pagesAdobe Scan 20-Mar-2024BhagyaNo ratings yet

- Sem V Financial EconomicsDocument3 pagesSem V Financial EconomicsSuvam Roy ChowdhuriNo ratings yet

- BCF 3202 - Financial Institutions and Markets - April 2021Document4 pagesBCF 3202 - Financial Institutions and Markets - April 2021dev hayaNo ratings yet

- CFA630Document15 pagesCFA630Cfa Pankaj KandpalNo ratings yet

- TIME: 2!110VJR: 4. E Uit ShareholdersDocument10 pagesTIME: 2!110VJR: 4. E Uit ShareholdersAditi VengurlekarNo ratings yet

- Mba 4 Sem Risk Management 840203 Summer 2014Document2 pagesMba 4 Sem Risk Management 840203 Summer 2014Hansa PrajapatiNo ratings yet

- 2019 ZaDocument5 pages2019 ZaChandani FernandoNo ratings yet

- 0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial ManagementDocument60 pages0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial Management18651 SYEDA AFSHANNo ratings yet

- P14 S16Document16 pagesP14 S1674ef8465d65d1bNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security Valuationsam kapoorNo ratings yet

- Derivatives IIDocument1 pageDerivatives IIkuselvNo ratings yet

- Test 6 TCNHDocument4 pagesTest 6 TCNHThanh Thương Phạm ThịNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- TN5 Futures Risk PremiumDocument11 pagesTN5 Futures Risk PremiumsidhanthaNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- Tybms Sem5 Iapm Nov18Document3 pagesTybms Sem5 Iapm Nov18kratos42exeNo ratings yet

- CH 02 Hull Fundamentals 9 The DDocument27 pagesCH 02 Hull Fundamentals 9 The DTrang LeNo ratings yet

- Construction Economics & Finance s16Document2 pagesConstruction Economics & Finance s16sgumble3007No ratings yet

- SFM Paper May 2019 Old Syllabus FinAppDocument12 pagesSFM Paper May 2019 Old Syllabus FinAppAkshat TongiaNo ratings yet

- 03 PS4 FFDocument3 pages03 PS4 FFhatemNo ratings yet

- CM2 Mock 7 Paper ADocument6 pagesCM2 Mock 7 Paper AVishva ThombareNo ratings yet

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsFrom EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsNo ratings yet

- 2316 2021 Provi Newly HiredDocument99 pages2316 2021 Provi Newly HiredDelio Amante Jr.No ratings yet

- May 2019 2Document184 pagesMay 2019 2Velammal ITechNo ratings yet

- Child Labor Student MaterialsDocument9 pagesChild Labor Student MaterialsMerlyn ThelappillyNo ratings yet

- 11 Key Elements of A High Quality Business Investment ProposalDocument5 pages11 Key Elements of A High Quality Business Investment ProposalHari PurwadiNo ratings yet

- Pradhan Mantri Mudra Yojna: A Critical Review: Manish AgarwalDocument10 pagesPradhan Mantri Mudra Yojna: A Critical Review: Manish AgarwalkrishNo ratings yet

- Ilnas-En Iso 21528-2:2017Document8 pagesIlnas-En Iso 21528-2:2017AristaNo ratings yet

- Chapter 16Document16 pagesChapter 16soniadhingra1805No ratings yet

- 29 - NPC Vs TenorioDocument2 pages29 - NPC Vs Tenoriohigoremso giensdksNo ratings yet

- Math 11-ABM Business Math-Q2-Week-1Document16 pagesMath 11-ABM Business Math-Q2-Week-1Flordilyn DichonNo ratings yet

- Transaction HistoryDocument2 pagesTransaction HistoryRussellGreenleeNo ratings yet

- Development Economics AssignmentDocument2 pagesDevelopment Economics Assignmentyedinkachaw shferawNo ratings yet

- Tli Dore Buying ProceduresDocument2 pagesTli Dore Buying ProceduressprataNo ratings yet

- USD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastDocument7 pagesUSD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastShanMugamNo ratings yet

- Rajiv Awas YojanaDocument8 pagesRajiv Awas YojanakausiniNo ratings yet

- Consumer and Producer SurplusDocument3 pagesConsumer and Producer SurplusRonan FerrerNo ratings yet

- Slyp G SigitDocument2 pagesSlyp G SigitPrinces pasaribuNo ratings yet

- Dashboard Ence602Document314 pagesDashboard Ence602api-707678106No ratings yet

- Fleet Organisation ReportDocument12 pagesFleet Organisation Reportsandeepkrjaiswal06No ratings yet

- Botswana: An African Miracle or A Case of Mistaken Identity?Document11 pagesBotswana: An African Miracle or A Case of Mistaken Identity?João AntunesNo ratings yet

- DDPIDocument1 pageDDPIjanviangadraoNo ratings yet

- India - China Relations: Notes For UPSCDocument5 pagesIndia - China Relations: Notes For UPSCasim khanNo ratings yet

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04No ratings yet

- Finacilisationof The Wall Street ConsensusDocument37 pagesFinacilisationof The Wall Street ConsensusLuis MartinezNo ratings yet

- A Contractors Interior Decorators / Architects and A C A O I A W I C of Berger Paints India LimitedDocument210 pagesA Contractors Interior Decorators / Architects and A C A O I A W I C of Berger Paints India LimitedDestiny WorldNo ratings yet

- YPF 3Q23 Earnings Webcast PresentationDocument9 pagesYPF 3Q23 Earnings Webcast PresentationCronista.comNo ratings yet

- Loan AgreementDocument2 pagesLoan AgreementJohn Bradley GomezNo ratings yet

- Airline IndustryDocument1 pageAirline Industrypooja_patnaik237No ratings yet

- Long-Term Asset Return Study: The History and Future of DebtDocument2 pagesLong-Term Asset Return Study: The History and Future of DebtsanditaNo ratings yet

- Chapter 4Document8 pagesChapter 4Fekadegeta AdibibNo ratings yet

- 5 Consumer BehaviourDocument27 pages5 Consumer BehaviourHarshit SharmaNo ratings yet