Professional Documents

Culture Documents

06 Inventories

06 Inventories

Uploaded by

Michael BongalontaCopyright:

Available Formats

You might also like

- Financial Accounting II - FARM FRESH BERHADDocument25 pagesFinancial Accounting II - FARM FRESH BERHADWOO YOKE MEINo ratings yet

- Chapter 5 PPEDocument99 pagesChapter 5 PPELay100% (1)

- IFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible AssetsDocument62 pagesIFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible Assetsmajestic accounting100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- SQB - Chapter 4 QuestionsDocument13 pagesSQB - Chapter 4 QuestionsracsoNo ratings yet

- AP - Ppe, Int. & Invest PropDocument15 pagesAP - Ppe, Int. & Invest PropJolina ManceraNo ratings yet

- Research On Academic Performance of Bsa Students of SSCDocument7 pagesResearch On Academic Performance of Bsa Students of SSCMichael BongalontaNo ratings yet

- Accounting For Insurance Contracts: Use The Following Information For The Next Two QuestionsDocument7 pagesAccounting For Insurance Contracts: Use The Following Information For The Next Two QuestionsMichael Bongalonta100% (1)

- STRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of OperationsDocument61 pagesSTRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of Operationstazeenseema75% (4)

- STRAMA Dont Like You She Likes Evreryone.. 1Document128 pagesSTRAMA Dont Like You She Likes Evreryone.. 1Jasper MonteroNo ratings yet

- Team PRTC FPB Oct 2023 - Far (Q) +Document10 pagesTeam PRTC FPB Oct 2023 - Far (Q) +Daphne PerezNo ratings yet

- MidtermS2 InventoriesDocument11 pagesMidtermS2 InventoriesQueenie Dayagro0% (2)

- ACCTG102 MidtermQ2 InventoriesDocument10 pagesACCTG102 MidtermQ2 InventoriesDayan DudosNo ratings yet

- 3 Prefinals Exam Intermediate Accounting IA Bloc 3Document3 pages3 Prefinals Exam Intermediate Accounting IA Bloc 3Lourence Lee ServidadNo ratings yet

- CE On PPE Acquisition and Depreciation CDocument3 pagesCE On PPE Acquisition and Depreciation CRedNo ratings yet

- Class No 14 & 15Document31 pagesClass No 14 & 15WILD๛SHOTッ tanvirNo ratings yet

- 2ndyr - 1stF - Intermediate Accounting 1 - 2223Document33 pages2ndyr - 1stF - Intermediate Accounting 1 - 2223hsdownshsalaNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- Depreciation and DepletionDocument8 pagesDepreciation and DepletionheythereitsclaireNo ratings yet

- I. Theoretical Questions 1Document5 pagesI. Theoretical Questions 1Tilahun GeremewNo ratings yet

- MQ1 - Topics FAR.2901 To 2915.Document7 pagesMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNo ratings yet

- ACT3110 - Adjusting Entries (S)Document40 pagesACT3110 - Adjusting Entries (S)amirah1999100% (1)

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Auditppedocxdocx PDF FreeDocument121 pagesAuditppedocxdocx PDF FreeNicolas ErnestoNo ratings yet

- Chapter 5: Audit of Property, Plant & EquipmentDocument121 pagesChapter 5: Audit of Property, Plant & EquipmentShaneen AdorableNo ratings yet

- Assessment TasksDocument5 pagesAssessment TasksLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- FAR 100 Merchandising Quiz Answer KeyDocument4 pagesFAR 100 Merchandising Quiz Answer KeyclaudellerosetteNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- Far Inventories AssignmentDocument7 pagesFar Inventories AssignmentplenostheamickaelaNo ratings yet

- AFAR Preweek Handout CpaleDocument17 pagesAFAR Preweek Handout CpaleMark Louie De La TorreNo ratings yet

- Batscpar Far3Document9 pagesBatscpar Far3Krizza MaeNo ratings yet

- Diy-Problems (Questionnaires)Document6 pagesDiy-Problems (Questionnaires)May RamosNo ratings yet

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- AccountingDocument25 pagesAccountingMaida Joy LusongNo ratings yet

- Cgu ProblemsDocument2 pagesCgu ProblemsAlizeyyNo ratings yet

- Cost Accounting Quiz 4Document4 pagesCost Accounting Quiz 4andreamrieNo ratings yet

- MitmentDocument1 pageMitmentmax pNo ratings yet

- PAS 02 InventoryDocument8 pagesPAS 02 InventoryRia GayleNo ratings yet

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- Cost Acctg ReviewerDocument14 pagesCost Acctg RevieweredrianclydeNo ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

- For Bookkeeping ProblemDocument2 pagesFor Bookkeeping ProblemDanica TomasNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting EntriesSeri CrisologoNo ratings yet

- 07 - Revenue - Consignment Sales PDFDocument17 pages07 - Revenue - Consignment Sales PDFCarla MarieNo ratings yet

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting CycleKaren MagsayoNo ratings yet

- PRTC FAR-1stPB 5.22Document9 pagesPRTC FAR-1stPB 5.22Ciatto SpotifyNo ratings yet

- NIGHT STALKER Company Has A Cost Card in Relation To An InventoryDocument3 pagesNIGHT STALKER Company Has A Cost Card in Relation To An Inventorytough mamaNo ratings yet

- Depreciation: Depreciation Value Purpose of Depreciation Types of DepreciationDocument23 pagesDepreciation: Depreciation Value Purpose of Depreciation Types of DepreciationMarcial Jr. MilitanteNo ratings yet

- Logistics Sales & Procurement CASE STUDYDocument4 pagesLogistics Sales & Procurement CASE STUDYAdarsh SannagoudaraNo ratings yet

- BA991 Activity Guide Chapter 3Document12 pagesBA991 Activity Guide Chapter 3vanessaNo ratings yet

- Chapter 10Document2 pagesChapter 10Nikki RunesNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- 10 2004 Dec QDocument7 pages10 2004 Dec QMohd Bawa0% (1)

- Revision For Mid Term TestDocument5 pagesRevision For Mid Term TestNURAINA SYAKIRAH BINTI NOR AZLAN (BG)No ratings yet

- AAU Worksheet Accounting-IIDocument5 pagesAAU Worksheet Accounting-IIHaftom YitbarekNo ratings yet

- Fixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)Document4 pagesFixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)sameed mateenNo ratings yet

- MTP 10 16 Questions 1694017726Document7 pagesMTP 10 16 Questions 1694017726jiotv0050No ratings yet

- Guide (1)Document91 pagesGuide (1)Michael BongalontaNo ratings yet

- Preparation of Complete Set of Financial StatementDocument14 pagesPreparation of Complete Set of Financial StatementMichael BongalontaNo ratings yet

- Proposed Enhancement of Curriculum for BS Accountancy SIGNEDDocument12 pagesProposed Enhancement of Curriculum for BS Accountancy SIGNEDMichael BongalontaNo ratings yet

- Marketing Strategy Survey QuestionnaireDocument3 pagesMarketing Strategy Survey QuestionnaireMichael BongalontaNo ratings yet

- CHAPTER 1-3 & 5Document17 pagesCHAPTER 1-3 & 5Michael BongalontaNo ratings yet

- Grow NegosyoDocument10 pagesGrow NegosyoMichael BongalontaNo ratings yet

- Comments and SuggestionsDocument1 pageComments and SuggestionsMichael BongalontaNo ratings yet

- PROPOSED TRAINING PROGRAM FOR BUSINESS OWNERS AND STUDENTS 2024 Version 2Document9 pagesPROPOSED TRAINING PROGRAM FOR BUSINESS OWNERS AND STUDENTS 2024 Version 2Michael BongalontaNo ratings yet

- CPD Cert as Lecturer ( May 18 morning session )Document1 pageCPD Cert as Lecturer ( May 18 morning session )Michael BongalontaNo ratings yet

- INSTALLMENT SALES UpdatedDocument26 pagesINSTALLMENT SALES UpdatedMichael BongalontaNo ratings yet

- Ecommerce-Act 040924Document5 pagesEcommerce-Act 040924Michael BongalontaNo ratings yet

- Bank Secrecy Law 2023Document4 pagesBank Secrecy Law 2023Michael BongalontaNo ratings yet

- Grade HM 2024 Research ProposalDocument3 pagesGrade HM 2024 Research ProposalMichael BongalontaNo ratings yet

- Consumer Act 2023 - 040924Document5 pagesConsumer Act 2023 - 040924Michael BongalontaNo ratings yet

- Operations Audit Attendance Bsa 4Document1 pageOperations Audit Attendance Bsa 4Michael BongalontaNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- Ease of Doing Business 2023 - 040924Document4 pagesEase of Doing Business 2023 - 040924Michael BongalontaNo ratings yet

- Certificate of CompletionDocument10 pagesCertificate of CompletionMichael BongalontaNo ratings yet

- Government Accounting Finals 2021Document21 pagesGovernment Accounting Finals 2021Michael Bongalonta100% (1)

- Conducting A Feasibility Study and Crafting A BusinessDocument27 pagesConducting A Feasibility Study and Crafting A BusinessMichael BongalontaNo ratings yet

- Fundamental of Accounting 1st Year AttendanceDocument2 pagesFundamental of Accounting 1st Year AttendanceMichael BongalontaNo ratings yet

- Research Proposal Form: Sorsogon State UniversityDocument4 pagesResearch Proposal Form: Sorsogon State UniversityMichael BongalontaNo ratings yet

- Joint Arrangements Pfrs 11Document44 pagesJoint Arrangements Pfrs 11Michael BongalontaNo ratings yet

- Managerial Accounting and Control 2021Document3 pagesManagerial Accounting and Control 2021Michael BongalontaNo ratings yet

- Approved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Document4 pagesApproved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Michael BongalontaNo ratings yet

- Corporate LiquidationDocument14 pagesCorporate LiquidationMichael BongalontaNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet

- Keown 23 RP3Document24 pagesKeown 23 RP3ausantNo ratings yet

- BBQfunDocument11 pagesBBQfunRaiza BernardoNo ratings yet

- Stocks To Buy For The Coming Roaring TwentiesDocument130 pagesStocks To Buy For The Coming Roaring TwentiesvinengchNo ratings yet

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- PWC Study Fit For Growth Ecosystems in InsuranceDocument16 pagesPWC Study Fit For Growth Ecosystems in InsuranceFARA100% (1)

- Tcs Stock Market Data Analysis: 1. AbstractDocument6 pagesTcs Stock Market Data Analysis: 1. AbstractSamit DasNo ratings yet

- How To Leverage Market Contango and Backwardation - Futures MagazineDocument2 pagesHow To Leverage Market Contango and Backwardation - Futures Magazinethirusays29No ratings yet

- Bata & AB BankDocument15 pagesBata & AB BankSaqeef RayhanNo ratings yet

- General Motors Case Study 2015 PDFDocument21 pagesGeneral Motors Case Study 2015 PDFLibyaFlower100% (2)

- Sanchez v. RigosDocument2 pagesSanchez v. RigosDennis CastroNo ratings yet

- Chapter 2 (Part B - Compound Interest)Document9 pagesChapter 2 (Part B - Compound Interest)Agnes AyangNo ratings yet

- Gillette IndiaDocument1 pageGillette IndiaVicky PanditNo ratings yet

- Presented By-Akash Tyagi Gaurav Ajmera Mukund Khandelwal Riya Jain Shubham Rathi Sukriti Saraswat Vaishnav S VijayDocument15 pagesPresented By-Akash Tyagi Gaurav Ajmera Mukund Khandelwal Riya Jain Shubham Rathi Sukriti Saraswat Vaishnav S VijayShubham Rathi Jaipuria JaipurNo ratings yet

- B2B Marketing-Dr Abha WankhedeDocument59 pagesB2B Marketing-Dr Abha WankhedePriyanka ReddyNo ratings yet

- Finance Finals ExamDocument4 pagesFinance Finals Examarthur the greatNo ratings yet

- Accounting (Modular Syllabus) : Pearson EdexcelDocument16 pagesAccounting (Modular Syllabus) : Pearson Edexcelraiyan rahmanNo ratings yet

- Week 6 Tutorial QuestionsDocument3 pagesWeek 6 Tutorial QuestionsJess Xue100% (1)

- Balance Sheet Gitanjali Ventures DMCC 2010-11Document16 pagesBalance Sheet Gitanjali Ventures DMCC 2010-11Bilal AhmadNo ratings yet

- APARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS April SET-3Document43 pagesAPARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS April SET-3RohanNo ratings yet

- ProjectDocument30 pagesProjectSunilPandeyNo ratings yet

- Cost of DebtDocument2 pagesCost of DebtAdib AkibNo ratings yet

- HSBC India Roe0115Document18 pagesHSBC India Roe0115bombayaddictNo ratings yet

- Transportation Demand Module: Key AssumptionsDocument29 pagesTransportation Demand Module: Key AssumptionsAlexander SeminarioNo ratings yet

- STUDENT A. Speaking Activity: "Country Quiz": Tec/Ecl Unit English II/Prof. VindasDocument2 pagesSTUDENT A. Speaking Activity: "Country Quiz": Tec/Ecl Unit English II/Prof. VindasJoseNo ratings yet

- Young Vs Midland Textile Insurance Co.Document1 pageYoung Vs Midland Textile Insurance Co.Cari Mangalindan MacaalayNo ratings yet

- Business Development Strategy, Ready-to-Drink Tea, Your Tea, With Business Canvas Model ApproachDocument6 pagesBusiness Development Strategy, Ready-to-Drink Tea, Your Tea, With Business Canvas Model ApproachJASH MATHEWNo ratings yet

- Full Download Ebook Ebook PDF Market Design Auctions and Matching The Mit Press PDFDocument41 pagesFull Download Ebook Ebook PDF Market Design Auctions and Matching The Mit Press PDFamy.savage532100% (43)

06 Inventories

06 Inventories

Uploaded by

Michael BongalontaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 Inventories

06 Inventories

Uploaded by

Michael BongalontaCopyright:

Available Formats

Accounting 21 Intermediate Accounting 1

Inventories

PROBLEM No. 1 – Recording of Inventory Purchase

1. Journalize the following transactions for Armour Inc. using both the periodic inventory system and the perpetual inventory

system, presented in a side-by-side format shown at the end of this exercise.

Oct.7 Sold merchandise on credit to Rondo Distributors, terms n/30, FOB destination, P1,200; the cost of the

merchandise was P720.

Oct. 8 Purchased merchandise, P10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of P525

added to the invoice.

PERIODIC INVENTORY PERPETUAL INVENTORY

Accounts DR CR | DR CR

|

|

|

|

|

|

|

2. Journalize the following transactions for Dulcimer Inc. using both the periodic inventory system and the perpetual

inventory system, presented in a side-by-side format shown at the end of this exercise.

Oct. 9 Merchandise sold on October 7 accepted back from Rondo Co. for full credit and returned to merchandise

Inventory, P300; the cost of the merchandise was P180.

Nov. 5 Received payment in full of P900 from Pine Co. for sale of merchandise on Oct. 25.

PERIODIC INVENTORY PERPETUAL INVENTORY

Accounts DR CR | DR CR

|

|

|

|

|

|

|

3. Journalize the following transactions for Donnell Inc. using both the periodic inventory system and the perpetual inventory

system, presented in a side-by-side format shown at the end of this exercise.

Oct. 5 Purchased P30,000 of merchandise from Rex on account, terms 2/10, n/30.

Oct. 8 Returned merchandise purchased on account on Oct. 5 amounting to P500.

Oct. 15 Paid for purchase of Oct. 5, less Oct. 8 return and purchase discount.

PERIODIC INVENTORY PERPETUAL INVENTORY

Accounts DR CR | DR CR

|

|

|

|

|

|

|

|

|

|

Rey Joseph M. Redoblado | 1

Accounting 21 Intermediate Accounting 1

Inventories

PROBLEM No. 2 – Recording of Inventory Transactions

4. Using the perpetual inventory system, journalize the entries for the following selected transactions:

(a) Sold merchandise on account, for P12,000. The cost of the merchandise sold was P6,500.

(b) Sold merchandise to customers who used MasterCard and VISA, P9,500. The cost of the

merchandise sold was P5,300.

(c) Sold merchandise to customers who used American Express, P2,900. The cost of the merchandise

sold was P1,700.

(d) Paid an invoice from First National Bank for P385, representing a service fee for processing

MasterCard and VISA sales.

(e) Received P4,325 from American Express Company after a P115 collection fee had been deducted.

5. Merchandise with a list price of P4,200 and costing P2,300 is sold on account, subject to the following terms: FOB

destination, 2/10, n/30. The seller prepays the freight costs of P85 (debit Freight Out for the freight costs). Prior to

payment for the goods, the seller issues a credit memo for P750 to the customer for merchandise costing P425 that is

returned. The correct amount is received within the discount period. The company uses a perpetual inventory system.

Record the foregoing transactions of the seller in the sequence indicated below.

(a) Sold the merchandise, recognizing the sale and cost of merchandise sold.

(b) Paid the freight charges.

(c) Issued the credit memo.

(d) Received payment from the customer.

PROBLEM No. 3 – Payment of Purchases on Credit

6. Details of invoices for purchases of merchandise are as follows:

Returns and

Merchandise Freight Terms Allowances

(a) P800 P45 FOB shipping point, 1/10, n/30 P200

(b) 4,600 --- FOB destination, n/30 800

(c) 2,400 55 FOB shipping point, 2/10, n/30 600

(d) 7,500 --- FOB destination, 1/10, n/30

Determine the amount to be paid in full settlement of each of the invoices, assuming that credit for returns and allowances

was received prior to payment and that all invoices were paid within the discount period.

PROBLEM No. 4 – Adjustment to Inventory Balance

7. At the close of its fiscal year on March 31, 2002, Gren Industries, Inc. was in the process of relocating its plant. This

resulted in some confusion relating to the inventory cutoff, as indicated by the following:

(1) Merchandise on hand costing P1,794 was included in the inventory although the purchase

invoice was not recorded until April 12, 2002.

(2) Merchandise shipped on April 1, 1999, was included in inventory--the cost of this

merchandise was P2,219, and the sale was recorded as P3,138 on March 31, 2002.

(3) Merchandise costing P12,150 was included in the inventory although it was shipped to a

customer on March 31, 2002, FOB shipping point; the company recorded the sale of

P19,246 on that date.

(4) Merchandise costing P1,820 was not counted.

(5) Merchandise in transit (shipped to the company FOB destination) was recorded as a

purchase as of April 2, 2002, and its cost of P17,287 was not included in the March 31,

2002, inventory.

Assuming that the company does not maintain a perpetual inventory system and that the books for the fiscal year have

been closed, provide the necessary correcting entries. (Ignore income taxes.)

Rey Joseph M. Redoblado | 2

Accounting 21 Intermediate Accounting 1

Inventories

PROBLEM No. 5 – Inventory Valuation based on COST

8. Brutus Corporation, a newly formed corporation, has the following transactions during May, 2011, it’s first month of

operation.

May 1 Purchased 500 units @ P25.00 each

May 4 Purchased 300 units @ P24.00 each

May 6 Sold 400 units @ P38.00 each

May 8 Purchased 700 units @ P23.00 each

May 13 Sold 450 units @ P37.50 each

May 20 Purchased 250 units @ P25.25 each

May 22 Sold 275 units @ P36.00 each

May 27 Sold 300 units @ P37.00 each

May 28 Purchased 550 units @ P26.00 each

May 30 Sold 100 units @ P39.00 each

Calculate total sales, cost of goods sold, gross profit and ending inventory using each of the following inventory methods:

1. FIFO Perpetual

2. FIFO Periodic

3. LIFO Perpetual

4. LIFO Periodic

5. Average Cost Periodic (round average to nearest cent)

PROBLEM No. 6 – Inventory Misstatement

9. Kingston Company reported the following net income amounts:

1999 ........................................ P52,000

2000 ........................................ P38,000

2001 ........................................ P66,000

In 2002, the company discovered errors that been made in computing the ending inventories for 1999 and 2000, as

follows:

1999 Ending inventory understated by P4,000.

2000 Ending inventory understated by P8,000.

Compute the correct net incomes for (1) 1999, (2) 2000, and (3) 2001.

PROBLEM No. 7 – Inventory Repossession

The ESTELLA MARIE Company values its inventory at the lower of FIFO cost or net realizable value (NRV). The inventory

accounts at December 31, 2009, had the following balances.

Raw materials 650,000

Work in process 1,200,000

Finished goods 1,640,000

The following are some of the transactions that affected the inventory of the Estella Marie Company during 2010.

Jan.8 Stella Marie purchased raw materials with list price of P200,000 and was given a trade discount of 20%

and 10%; terms 2/15, n/30. Estella Marie values inventory at the net invoice price.

Feb 14 Estella Marie repossessed an inventory item from a customer who was overdue in making payment. The

unpaid balance on the sale is P15,200. The repossessed merchandise is to be refinished and replaced

on sale. It is expected that the item can be sold for P24,000 after estimated refinishing costs of P6,800.

The normal profit for this item is considered to be P3,200.

Mar. 1 Refinishing costs of P6,400 were incurred on the repossessed item.

Apr. 3 The repossessed item was resold for P24,000 on account, 20% down.

Aug. 30 A sale on account was made of finished goods that have a list price of P59,200 and a cost P38,400. A

reduction of P8,000 off the list price was granted as a trade-in allowance. The trade-in item is to be priced

to sell at P6,400 as is. The normal profit on this type of inventory is 25% of the sales price.

Rey Joseph M. Redoblado | 3

Accounting 21 Intermediate Accounting 1

Inventories

Based on the above and the result of your review, answer the following:

(Assume the client is using perpetual inventory system.)

10. The entry on Jan. 8 will include a debit to Raw Materials Inventory of

11. The repossessed inventory on Feb. 14 is most likely to be valued at

12. The journal entries on April 3 will include a

13. The trade-in inventory on Aug. 30 is most likely to be valued at

14. How much will be recorded as Sales on Aug. 30?

PROBLEM No. 8 – Inventory Valuation based on LOWER OF COST OR NET REALIZABLE VALUE (LCNRV)

You observed the inventory count of the SAL2 COMPANY as of December 31, 2010. The client prepared the summary

presented below and gave it to you for verification:

Quantity Cost (P) NRV (P) Amount (P)

A 360 units 3.60/doz. 3.64/doz. 1,310.40

B 24 units 4.70 each 4.80 each 112.80

C 28 units 16.50 each 16.50 each 1,353.00

D 43 units 5.15 each 5.20 each 176.80

E 400 units 9.10 each 8.10 each 3,640.00

F 70 dozens 2.00 each 2.00 each 140.00

G 95 grosses 144.00/gross 132.00/gross 13,780.00

15. You determine from your examination that the proper value for Item A should be

16. You have also determined that the value for item E is

17. Based on your findings, Item C should be valued at

18. Based on your working paper, the proper value of the inventory as of December 31, 2010 is

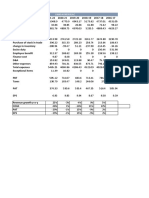

PROBLEM No. 9 – Inventory Estimation using Gross Profit Method

19. Northstar Sales Corp. was organized on January 1, 2001. On December 31, 2002, the company lost most of its inventory

in a warehouse fire just before the year-end count of inventory was to take place. Data from the records disclosed the

following:

2001 2002

Inventory, January 1 P 0 P173,120

Purchases during year 860,000 692,000

Purchase returns and allowances during year 46,120 64,600

Sales during year 788,000 836,000

Sales returns and allowances during year 16,000 20,000

On January 1, 2002, Northstar's pricing policy was changed so that the gross profit rate would be 3 percentage points

higher than the one earned in 2001.

Salvaged undamaged merchandise was marked to sell at P24,000, while damaged merchandise marked to sell at

P16,000 had an estimated net realizable value of P3,600.

Determine the company's inventory loss due to the fire that occurred on December 31, 2002.

Rey Joseph M. Redoblado | 4

Accounting 21 Intermediate Accounting 1

Inventories

PROBLEM No. 10 – Inventory Estimation using Retail Inventory Method

Presented below is information related to Carpenter Inc.

Cost Retail

Inventory, 12/31/15 P375,000 P 550,000

Purchases 1,369,000 2,050,000

Purchase returns 90,000 120,000

Purchase discounts 27,000 –

Gross sales (after employee discounts) – 2,110,000

Sales returns – 145,000

Markups – 180,000

Markup cancellations – 60,000

Markdowns – 65,000

Markdown cancellations 30,000

Freight-in 63,000 –

Employee discounts granted – 12,000

Loss from breakage (normal) – 8,000

20. Assuming that carpenter Inc. uses the conventional retail inventory (or LCNRV) method, compute the cost of its

ending inventory at December 31, 2016.

21. Assuming that carpenter Inc. uses the average method, compute the cost of its ending inventory at December 31, 2016.

22. Assuming that carpenter Inc. uses the FIFO cost method, compute the cost of its ending inventory at December 31,

2016.

PROBLEM No. 11 – Biological Assets

23. Reed Mangus purchased the Hillside Vineyard at an estate auction in April 2015 for P1,250,000. The purchase was risky

because the growing season was coming to an end, the grapes must be harvested in the next several weeks, and Reed

has limited experience in carrying off a grape harvest.

At the end of the first quarter of operations, Reed is feeling pretty good about his early results. The first harvest was a

success; 500 bushels of grapes were harvested with a value of P50,000 (based on current local commodity prices at the

time of harvest). And, given the strong yield from area vineyards during this season, the net realizable value of Reed’s

vineyard has increased by P25,000 at the end of the quarter. After storing the grapes for a short period of time, Reed was

able to sell the entire harvest for P60,000.

Instructions

(a) Prepare the journal entries for the Hillside biological asset (grape vines) for the first quarter of operations (the

beginning carrying and net realizable value is P1,250,000).

(b) Prepare the journal entry for the grapes harvested during the first quarter.

(c) Prepare the journal entry to record the sale of the grapes harvested in the first quarter.

(d) Determine the total effect on income for the quarter related to the Hillside biological asset and agricultural produce.

-End-

Rey Joseph M. Redoblado | 5

You might also like

- Financial Accounting II - FARM FRESH BERHADDocument25 pagesFinancial Accounting II - FARM FRESH BERHADWOO YOKE MEINo ratings yet

- Chapter 5 PPEDocument99 pagesChapter 5 PPELay100% (1)

- IFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible AssetsDocument62 pagesIFRS Edition (2nd) : Plant Assets, Natural Resources, and Intangible Assetsmajestic accounting100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- SQB - Chapter 4 QuestionsDocument13 pagesSQB - Chapter 4 QuestionsracsoNo ratings yet

- AP - Ppe, Int. & Invest PropDocument15 pagesAP - Ppe, Int. & Invest PropJolina ManceraNo ratings yet

- Research On Academic Performance of Bsa Students of SSCDocument7 pagesResearch On Academic Performance of Bsa Students of SSCMichael BongalontaNo ratings yet

- Accounting For Insurance Contracts: Use The Following Information For The Next Two QuestionsDocument7 pagesAccounting For Insurance Contracts: Use The Following Information For The Next Two QuestionsMichael Bongalonta100% (1)

- STRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of OperationsDocument61 pagesSTRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of Operationstazeenseema75% (4)

- STRAMA Dont Like You She Likes Evreryone.. 1Document128 pagesSTRAMA Dont Like You She Likes Evreryone.. 1Jasper MonteroNo ratings yet

- Team PRTC FPB Oct 2023 - Far (Q) +Document10 pagesTeam PRTC FPB Oct 2023 - Far (Q) +Daphne PerezNo ratings yet

- MidtermS2 InventoriesDocument11 pagesMidtermS2 InventoriesQueenie Dayagro0% (2)

- ACCTG102 MidtermQ2 InventoriesDocument10 pagesACCTG102 MidtermQ2 InventoriesDayan DudosNo ratings yet

- 3 Prefinals Exam Intermediate Accounting IA Bloc 3Document3 pages3 Prefinals Exam Intermediate Accounting IA Bloc 3Lourence Lee ServidadNo ratings yet

- CE On PPE Acquisition and Depreciation CDocument3 pagesCE On PPE Acquisition and Depreciation CRedNo ratings yet

- Class No 14 & 15Document31 pagesClass No 14 & 15WILD๛SHOTッ tanvirNo ratings yet

- 2ndyr - 1stF - Intermediate Accounting 1 - 2223Document33 pages2ndyr - 1stF - Intermediate Accounting 1 - 2223hsdownshsalaNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- Depreciation and DepletionDocument8 pagesDepreciation and DepletionheythereitsclaireNo ratings yet

- I. Theoretical Questions 1Document5 pagesI. Theoretical Questions 1Tilahun GeremewNo ratings yet

- MQ1 - Topics FAR.2901 To 2915.Document7 pagesMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNo ratings yet

- ACT3110 - Adjusting Entries (S)Document40 pagesACT3110 - Adjusting Entries (S)amirah1999100% (1)

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Auditppedocxdocx PDF FreeDocument121 pagesAuditppedocxdocx PDF FreeNicolas ErnestoNo ratings yet

- Chapter 5: Audit of Property, Plant & EquipmentDocument121 pagesChapter 5: Audit of Property, Plant & EquipmentShaneen AdorableNo ratings yet

- Assessment TasksDocument5 pagesAssessment TasksLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- FAR 100 Merchandising Quiz Answer KeyDocument4 pagesFAR 100 Merchandising Quiz Answer KeyclaudellerosetteNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- Far Inventories AssignmentDocument7 pagesFar Inventories AssignmentplenostheamickaelaNo ratings yet

- AFAR Preweek Handout CpaleDocument17 pagesAFAR Preweek Handout CpaleMark Louie De La TorreNo ratings yet

- Batscpar Far3Document9 pagesBatscpar Far3Krizza MaeNo ratings yet

- Diy-Problems (Questionnaires)Document6 pagesDiy-Problems (Questionnaires)May RamosNo ratings yet

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- AccountingDocument25 pagesAccountingMaida Joy LusongNo ratings yet

- Cgu ProblemsDocument2 pagesCgu ProblemsAlizeyyNo ratings yet

- Cost Accounting Quiz 4Document4 pagesCost Accounting Quiz 4andreamrieNo ratings yet

- MitmentDocument1 pageMitmentmax pNo ratings yet

- PAS 02 InventoryDocument8 pagesPAS 02 InventoryRia GayleNo ratings yet

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- Cost Acctg ReviewerDocument14 pagesCost Acctg RevieweredrianclydeNo ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

- For Bookkeeping ProblemDocument2 pagesFor Bookkeeping ProblemDanica TomasNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting EntriesSeri CrisologoNo ratings yet

- 07 - Revenue - Consignment Sales PDFDocument17 pages07 - Revenue - Consignment Sales PDFCarla MarieNo ratings yet

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting CycleKaren MagsayoNo ratings yet

- PRTC FAR-1stPB 5.22Document9 pagesPRTC FAR-1stPB 5.22Ciatto SpotifyNo ratings yet

- NIGHT STALKER Company Has A Cost Card in Relation To An InventoryDocument3 pagesNIGHT STALKER Company Has A Cost Card in Relation To An Inventorytough mamaNo ratings yet

- Depreciation: Depreciation Value Purpose of Depreciation Types of DepreciationDocument23 pagesDepreciation: Depreciation Value Purpose of Depreciation Types of DepreciationMarcial Jr. MilitanteNo ratings yet

- Logistics Sales & Procurement CASE STUDYDocument4 pagesLogistics Sales & Procurement CASE STUDYAdarsh SannagoudaraNo ratings yet

- BA991 Activity Guide Chapter 3Document12 pagesBA991 Activity Guide Chapter 3vanessaNo ratings yet

- Chapter 10Document2 pagesChapter 10Nikki RunesNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- 10 2004 Dec QDocument7 pages10 2004 Dec QMohd Bawa0% (1)

- Revision For Mid Term TestDocument5 pagesRevision For Mid Term TestNURAINA SYAKIRAH BINTI NOR AZLAN (BG)No ratings yet

- AAU Worksheet Accounting-IIDocument5 pagesAAU Worksheet Accounting-IIHaftom YitbarekNo ratings yet

- Fixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)Document4 pagesFixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)sameed mateenNo ratings yet

- MTP 10 16 Questions 1694017726Document7 pagesMTP 10 16 Questions 1694017726jiotv0050No ratings yet

- Guide (1)Document91 pagesGuide (1)Michael BongalontaNo ratings yet

- Preparation of Complete Set of Financial StatementDocument14 pagesPreparation of Complete Set of Financial StatementMichael BongalontaNo ratings yet

- Proposed Enhancement of Curriculum for BS Accountancy SIGNEDDocument12 pagesProposed Enhancement of Curriculum for BS Accountancy SIGNEDMichael BongalontaNo ratings yet

- Marketing Strategy Survey QuestionnaireDocument3 pagesMarketing Strategy Survey QuestionnaireMichael BongalontaNo ratings yet

- CHAPTER 1-3 & 5Document17 pagesCHAPTER 1-3 & 5Michael BongalontaNo ratings yet

- Grow NegosyoDocument10 pagesGrow NegosyoMichael BongalontaNo ratings yet

- Comments and SuggestionsDocument1 pageComments and SuggestionsMichael BongalontaNo ratings yet

- PROPOSED TRAINING PROGRAM FOR BUSINESS OWNERS AND STUDENTS 2024 Version 2Document9 pagesPROPOSED TRAINING PROGRAM FOR BUSINESS OWNERS AND STUDENTS 2024 Version 2Michael BongalontaNo ratings yet

- CPD Cert as Lecturer ( May 18 morning session )Document1 pageCPD Cert as Lecturer ( May 18 morning session )Michael BongalontaNo ratings yet

- INSTALLMENT SALES UpdatedDocument26 pagesINSTALLMENT SALES UpdatedMichael BongalontaNo ratings yet

- Ecommerce-Act 040924Document5 pagesEcommerce-Act 040924Michael BongalontaNo ratings yet

- Bank Secrecy Law 2023Document4 pagesBank Secrecy Law 2023Michael BongalontaNo ratings yet

- Grade HM 2024 Research ProposalDocument3 pagesGrade HM 2024 Research ProposalMichael BongalontaNo ratings yet

- Consumer Act 2023 - 040924Document5 pagesConsumer Act 2023 - 040924Michael BongalontaNo ratings yet

- Operations Audit Attendance Bsa 4Document1 pageOperations Audit Attendance Bsa 4Michael BongalontaNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- Ease of Doing Business 2023 - 040924Document4 pagesEase of Doing Business 2023 - 040924Michael BongalontaNo ratings yet

- Certificate of CompletionDocument10 pagesCertificate of CompletionMichael BongalontaNo ratings yet

- Government Accounting Finals 2021Document21 pagesGovernment Accounting Finals 2021Michael Bongalonta100% (1)

- Conducting A Feasibility Study and Crafting A BusinessDocument27 pagesConducting A Feasibility Study and Crafting A BusinessMichael BongalontaNo ratings yet

- Fundamental of Accounting 1st Year AttendanceDocument2 pagesFundamental of Accounting 1st Year AttendanceMichael BongalontaNo ratings yet

- Research Proposal Form: Sorsogon State UniversityDocument4 pagesResearch Proposal Form: Sorsogon State UniversityMichael BongalontaNo ratings yet

- Joint Arrangements Pfrs 11Document44 pagesJoint Arrangements Pfrs 11Michael BongalontaNo ratings yet

- Managerial Accounting and Control 2021Document3 pagesManagerial Accounting and Control 2021Michael BongalontaNo ratings yet

- Approved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Document4 pagesApproved Proposal The Liquidity Issues by Michael Bongalonta - As Revised 2018Michael BongalontaNo ratings yet

- Corporate LiquidationDocument14 pagesCorporate LiquidationMichael BongalontaNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet

- Keown 23 RP3Document24 pagesKeown 23 RP3ausantNo ratings yet

- BBQfunDocument11 pagesBBQfunRaiza BernardoNo ratings yet

- Stocks To Buy For The Coming Roaring TwentiesDocument130 pagesStocks To Buy For The Coming Roaring TwentiesvinengchNo ratings yet

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- PWC Study Fit For Growth Ecosystems in InsuranceDocument16 pagesPWC Study Fit For Growth Ecosystems in InsuranceFARA100% (1)

- Tcs Stock Market Data Analysis: 1. AbstractDocument6 pagesTcs Stock Market Data Analysis: 1. AbstractSamit DasNo ratings yet

- How To Leverage Market Contango and Backwardation - Futures MagazineDocument2 pagesHow To Leverage Market Contango and Backwardation - Futures Magazinethirusays29No ratings yet

- Bata & AB BankDocument15 pagesBata & AB BankSaqeef RayhanNo ratings yet

- General Motors Case Study 2015 PDFDocument21 pagesGeneral Motors Case Study 2015 PDFLibyaFlower100% (2)

- Sanchez v. RigosDocument2 pagesSanchez v. RigosDennis CastroNo ratings yet

- Chapter 2 (Part B - Compound Interest)Document9 pagesChapter 2 (Part B - Compound Interest)Agnes AyangNo ratings yet

- Gillette IndiaDocument1 pageGillette IndiaVicky PanditNo ratings yet

- Presented By-Akash Tyagi Gaurav Ajmera Mukund Khandelwal Riya Jain Shubham Rathi Sukriti Saraswat Vaishnav S VijayDocument15 pagesPresented By-Akash Tyagi Gaurav Ajmera Mukund Khandelwal Riya Jain Shubham Rathi Sukriti Saraswat Vaishnav S VijayShubham Rathi Jaipuria JaipurNo ratings yet

- B2B Marketing-Dr Abha WankhedeDocument59 pagesB2B Marketing-Dr Abha WankhedePriyanka ReddyNo ratings yet

- Finance Finals ExamDocument4 pagesFinance Finals Examarthur the greatNo ratings yet

- Accounting (Modular Syllabus) : Pearson EdexcelDocument16 pagesAccounting (Modular Syllabus) : Pearson Edexcelraiyan rahmanNo ratings yet

- Week 6 Tutorial QuestionsDocument3 pagesWeek 6 Tutorial QuestionsJess Xue100% (1)

- Balance Sheet Gitanjali Ventures DMCC 2010-11Document16 pagesBalance Sheet Gitanjali Ventures DMCC 2010-11Bilal AhmadNo ratings yet

- APARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS April SET-3Document43 pagesAPARCHIT SUPER CURRENT AFFAIRS 350+ WITH FACTS April SET-3RohanNo ratings yet

- ProjectDocument30 pagesProjectSunilPandeyNo ratings yet

- Cost of DebtDocument2 pagesCost of DebtAdib AkibNo ratings yet

- HSBC India Roe0115Document18 pagesHSBC India Roe0115bombayaddictNo ratings yet

- Transportation Demand Module: Key AssumptionsDocument29 pagesTransportation Demand Module: Key AssumptionsAlexander SeminarioNo ratings yet

- STUDENT A. Speaking Activity: "Country Quiz": Tec/Ecl Unit English II/Prof. VindasDocument2 pagesSTUDENT A. Speaking Activity: "Country Quiz": Tec/Ecl Unit English II/Prof. VindasJoseNo ratings yet

- Young Vs Midland Textile Insurance Co.Document1 pageYoung Vs Midland Textile Insurance Co.Cari Mangalindan MacaalayNo ratings yet

- Business Development Strategy, Ready-to-Drink Tea, Your Tea, With Business Canvas Model ApproachDocument6 pagesBusiness Development Strategy, Ready-to-Drink Tea, Your Tea, With Business Canvas Model ApproachJASH MATHEWNo ratings yet

- Full Download Ebook Ebook PDF Market Design Auctions and Matching The Mit Press PDFDocument41 pagesFull Download Ebook Ebook PDF Market Design Auctions and Matching The Mit Press PDFamy.savage532100% (43)