Professional Documents

Culture Documents

Classification List of Major Heads

Classification List of Major Heads

Uploaded by

Sam PitraudaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classification List of Major Heads

Classification List of Major Heads

Uploaded by

Sam PitraudaCopyright:

Available Formats

Basis of accounting-Classification

Main Divisions of Govt. Accounts

Classifications

Budget and Accounts Identity

Difference in heads of classification.

Form of Accounts - Main Divisions of Accounts

Government accounts shall be kept in the

following three parts:-

Part I Consolidated of India (including Union

Fund Territory Administration or of

Part II Contingency the State or Union Territory

Fund Government concerned

Part III Public of India (including Union

Account Territory Administration

/Government) or of the State

concerned.

NOTE:-There being no separate Public Account in the case of

Union Territory Governments, the transactions pertaining to this

account shall be booked in the Public Account of the Central

Government.

Part I

Consolidated Fund

division

Capital, Public Dept &

Revenue

Loan

Section

Section

Receipt Head Expenditure

(Revenue Account) Head Receipt Head Expenditure Head Public Dept,

(Revenue (Capital Account) (Capital Account) Loans &

Account) Advances

Deals with the Deals to

proceeds of Deals with Deals with expenditure Which comprises

expenditure met receipts of

taxation & other there from met usually from of loan raised &

receipts classed as Capital nature borrowed fund with the their repayment

Revenue object of increasing by Govt. such as

concrete assets of a Internal Debt etc.

material & permanent

Character

Transaction are grouped into Sectors such as “General Services"," Social Services”, “Economic Services”

which is sub-divided into Major Head of Accounts. However, in some cases, the Sectors are futher sub-divided

into Sub-Sectors before their division into Major Head of Accounts. The Sectors/Sub-Sectors shall be

distinguished by letter of the Alphabet.

0, or 1 2, or 3 4000 4, or 5 6 or 7

0005 to 2011 to 4046 to 6001 to

1999 3999 5999 7999

Example of Sector/Sub-Sectors

Part I Consolidated Fund division

Receipt Heads (Revenue Accounts) Section

A. Tax Revenue Sector

(a) Goods and Service Tax Sub-Sector

Part I Consolidated Fund division

Expenditure Heads (Revenue Accounts) Section

A. General Services Sector

(b) Fiscal Services Sub-Sector

(iii) Collection of Taxes on Commod * Services Sub-Sub-

Sector

Part - II

Contingency Fund

Transactions connected with the Contingency Fund set up by the

Government of India or of a State or Union Territory Government under

Article 267 of the Constitution/ Section 48 of the Union Territories Act,

1963.

Major Head Code 8000

Part III

Shall records the transactions

Debt (Other in respect of which Government incurs a

than those liability to repay the moneys received or

included in Part has a claim to recover the amounts paid,

I), together with the repayments of (Debt and

'Deposits', Deposits) and the recoveries of

(Advances)

'Advances',

'Suspense’ such transactions as remittances of cash

between treasuries and currency chests

'Remittances@ and transfer between different accounting

circles.

@The initial debits or credits to these heads will be cleared

eventually by corresponding receipts or payments either within

the same circle of account or in another account circle.

Major Head Code 8001-8999

Sectors and Sub-sectors of Accounts

(a) Within each of the Divisions and sections of the

Consolidated Fund the transactions shall be grouped into

Sectors such as, "General Services", "Social Services",

"Economic Services", under which specific functions or services

shall be grouped. The Sectors shall be sub-divided into Major

Heads of Account, in some cases the Sectors are, in addition, sub-

divided into sub-sectors before their division into Major Heads of

Account. Each Sector in a section shall be distinguished by a letter

of the Alphabet.

(b) In Part II—Contingency Fund, there shall be a single

Major Head and all the transactions met out of the Contingency

Fund shall be recorded under it.

(c) In the case of Part III—Public Account, the transactions

shall be grouped into sectors and sub-sectors, which shall be

further sub-divided into Major Heads of Account. The

Sectors/Sub-Sectors shall be distinguished by letters of the

alphabet.

Example of Sector of Part III

Part III Public Account

I Small Savings Provident Funds etc.

J Reserve Funds

K Deposits and Advances

L. Suspense and Miscellaneous

M. Remittances

Allotment of Code to each Major Head and range of

Code Number

A four digit Code has been allotted to the Major Head, the

first digit indicating whether the Major Head is a Receipts Head

or Revenue Expenditure Head, or Capital Expenditure Head or

Loans and Advances. Head or it pertains to Public Account, if

the first digit is '0' or '1', the Head of Account will represent

Revenue Receipt; '2' or '3' will represent Revenue Expenditure;

'4' or '5' Capital Expenditure; '6' or '7' Loans and Advances

Head; (4000 for Capital Receipt) and '8' will represent

Contingency Fund and Public Account—(8000 for Contingency

Fund).

Adding 2 to the first digit of the Revenue Receipt will give

the Code Number allotted to corresponding Revenue

Expenditure Head; adding another 2—the Capital Expenditure

Head and another 2—the Loans and Advances Head of

Accounts; e.g.

0401 represents the Receipt Head for Crop Husbandry

2401 represents the Revenue Expenditure Head for Crop

Husbandry

4401 represents the Capital Outlay on Crop Husbandry

6401 represents Loans for Crop Husbandry.

Allotment of Code to each Major Head and

range of Code Number

Such a pattern is however, not relevant for those

departments which are not operating Capital/Loan Head

of accounts e.g. Department of Supply. In a few cases,

however, where receipt/expenditure is not heavy, certain

Major Heads have been combined under and single

number, the Major Heads themselves forming sub-major

heads under that number.

Example

Receipt Heads (Revenue Account\)

0070 Other Administrative Services

Expenditure Heads (Revenue Account)

2015 Election

Expenditure Heads (Capital Account)

4059 Public Works

Major, Minor and Detailed Heads

(a) The main unit of classification in accounts shall

be the major head

which shall be divided into minor heads,

each of which shall have a number of

subordinate heads, generally known as sub-

heads.

The sub-heads are further divided into detailed

heads and object heads.

Sometimes major heads may be divided into

'sub-major heads' before their further division

into minor heads.

The Sectors, Major heads, Minor heads, Sub-

heads and Detailed heads and object heads

together constitute a six tier arrangement of

the classification structure of Government

Accounts.

Major, Minor, Detailed and Object Heads

(b) Major heads of account falling within the Consolidated Fund

shall generally correspond to 'Functions' of Government, such

as different services like “Education”, "Crop Husbandry",

'Defence' provided by Government,

while minor heads subordinate to them shall identify the

'Programme' undertaken to achieve the objectives of the

function represented by the major head.

A programme may consist of a number of schemes or

activities and these shall, generally, correspond to 'sub-

heads' below the minor head represented by the

programme.

In certain cases, especially in regard to non-developmental

expenditure or expenditure of an administrative nature, the

sub-heads may further divided into detailed heads to show

the components of a programme, such as 'Organisations' or

the different 'Wings of Administration'.

Major, Minor, Detailed and Object Heads

(c) On the expenditure side of the accounts particularly in respect of

heads of accounts within the Consolidated Fund, object heads are

primarily meant for itemised control over expenditure and indicate the

object or nature of expenditure on a scheme or activity or organisation

in terms of inputs such as 'Salaries', 'Office Expenses', 'Grants-in-aid',

'Loans'. 'Investments'.

(d) The detailed classification of account heads in Government

Accounts and the order in which the Major and Minor heads shall

appear in all account records shall be such as are prescribed by the

Central Government from time to time on the advice of the

Comptroller and Auditor General of India. The 'List of Major and

Minor Heads of Account of Union and States contains the classification

prescribed in this regard. The classification prescribed (including the

code No. assigned up to the major heads and minor heads there under)

should be strictly followed.

Example of unit of Classification in accounts

Part I Consolidated Fund Divisions/

B. Social Services Sector

(a) Education, Sports, Arts and Culture

2202 – General Education Functions

01 – Elementary Education

101 – Government Primary School Programme

01 – Expenditure on Primary School Scheme or Activity

01 – Salaries

02 – Wages Object

11 - Travel Expenses Classification

Six tier fifteen digit classification

Accounts Classification Activity level Code structure

Major head: Function 4-Digit Code

Sub-Major Head Sub-Function 2-digit Code

Minor Head Programme 3-Digit Code

Sub-Minor Head Scheme 2-Digit Code

Detailed Head Sub-scheme 2-Digit Code

Object Head Object of expenditure 2-Digit Code

Classification of expenditure as "Charged" or

as "Voted“

Expenditure which under the provisions of the

Constitution is subject to the vote of the

Legislature shall be shown in the accounts

separately from expenditure which is

"Charged" (on the Consolidated Fund of India

or of a State or Union Territory Government).

The expression "Charged" or "Voted" shall be

appended to the heads concerned to distinguish

the two categories of expenditure.

Classification of Transactions in accounts

The estimates of receipts and expenditure framed by

Government or in any order of Appropriation shall

indicate provisions, ordinarily against heads opened in

conformity with these rules.

Where there is divergence, the corresponding receipt or

expenditure shall be brought to account under the

appropriate major heads or minor heads or other unit of

classification as determined by the President on the advice

of the C&AG.

Example

Under Article 149 of the Constitution and the

Provisions of Section 13 of the C&AG's (DPC)

Act, 1971, the Comptroller and Auditor General

is responsible for the audit of all expenditure

from the revenues of the Union and of the States,

and of certain accounts specified in the Act. In

conducting such audit the Comptroller and

Auditor General performs a statutory function

entrusted to him and the cost of this function is a

charge of the Central Government.

Basis of classification

As a general rule, the classification of transactions in Government

accounts, shall have closer reference to the function, programme and

activity of the Government and the object of the revenue or

expenditure, rather than the department in which the revenue or

expenditure occurs.

This principle is, however, subject to such exceptions as may be

authorised specially in any individual case or class of cases

e.g. receipts representing 'Interest' are shown under "0049—

Interest Receipts" and expenditure on the maintenance and repairs

of the non-Residential buildings under the administrative control

of the Public Works Department are shown under the major head

"2059—Public Works" irrespective of the functions to which they

relate.

Important general orders governing classification of pay and

allowances (including traveling allowances) of Government

servants, expenditure on civil works, contributions made by or to

Government, refunds of revenue, shall be issued by Government

from time to time.

???

Thanks

You might also like

- Essentials of Economics 5Th Edition by Glenn P Hubbard Full ChapterDocument41 pagesEssentials of Economics 5Th Edition by Glenn P Hubbard Full Chapterwilliam.millard192100% (27)

- Joint Hindu Family Letter (State Bank of India)Document2 pagesJoint Hindu Family Letter (State Bank of India)rupeshtulshyan91% (11)

- Fa - End TermDocument21 pagesFa - End Termmadhurialamuri100% (3)

- Roshan Notes On CPWADocument89 pagesRoshan Notes On CPWAshekarj100% (9)

- Exercise 1: The Graham Co. Began Operations On May and Completed The Following Transactions During Its First Month of OperationsDocument6 pagesExercise 1: The Graham Co. Began Operations On May and Completed The Following Transactions During Its First Month of OperationsNguyen Ho Tu Anh (K16 HCM)No ratings yet

- 1 Accounting For Budgetary AccountsDocument5 pages1 Accounting For Budgetary AccountsBaron MirandaNo ratings yet

- Governmental and Not-For-profit Accounting 5th Chapter 2 SolutionDocument28 pagesGovernmental and Not-For-profit Accounting 5th Chapter 2 SolutionCathy Gu75% (8)

- Appropriation and ReappropriationDocument8 pagesAppropriation and ReappropriationNasir Nadeem100% (1)

- Structure of Accounts 20200716144654Document4 pagesStructure of Accounts 20200716144654Cris CNo ratings yet

- Basic Structure of The Form of AccountsDocument5 pagesBasic Structure of The Form of Accountsvikrant vardhanNo ratings yet

- Introduction To Government Accounting SystemDocument33 pagesIntroduction To Government Accounting SystemSumeet Tiwary100% (1)

- Budget 2Document45 pagesBudget 2Naveen MalikNo ratings yet

- Training Material On West Bengal Financial Rules and Office ProceduresDocument150 pagesTraining Material On West Bengal Financial Rules and Office Proceduresswarnendu_janaNo ratings yet

- Solution Manual For Accounting For Governmental and Nonprofit Entities 15th Edition by Earl Wilson Jacqueline Reck Susan KatteluDocument36 pagesSolution Manual For Accounting For Governmental and Nonprofit Entities 15th Edition by Earl Wilson Jacqueline Reck Susan Kattelufuze.riddle.ghik9100% (54)

- Appropriations & Re-AppropriationDocument6 pagesAppropriations & Re-AppropriationFareha RiazNo ratings yet

- Govt Accounts NotesDocument11 pagesGovt Accounts NotesManoj SainiNo ratings yet

- Government Suspense AccountsDocument63 pagesGovernment Suspense Accountsbharanivldv9No ratings yet

- Prepared By: Group Members No. MatricDocument14 pagesPrepared By: Group Members No. MatrickirttanaNo ratings yet

- Structure of Accounts 20200609163309Document2 pagesStructure of Accounts 20200609163309Ramesh RameshNo ratings yet

- 3 - Understanding & Preparation of Corporate Financial StatementsDocument7 pages3 - Understanding & Preparation of Corporate Financial Statementskeval.dave120812No ratings yet

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solution ManualDocument30 pagesGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solution Manualconsuelo100% (28)

- Kerala Budget Manual Preparation of Budget Part I and II - Revised EstimatesDocument17 pagesKerala Budget Manual Preparation of Budget Part I and II - Revised EstimatesmayaNo ratings yet

- Kerala Budget Manual Preparation of Budget Part I and II - Revised EstimatesDocument17 pagesKerala Budget Manual Preparation of Budget Part I and II - Revised EstimatesSmitha SreehariNo ratings yet

- Chapter 20 Beams10e SMDocument14 pagesChapter 20 Beams10e SMStendy DharmawanNo ratings yet

- Lecture 6 National AccountingDocument6 pagesLecture 6 National Accountinghossam369No ratings yet

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualDocument30 pagesGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualJessicaHardysrbxd100% (14)

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelNo ratings yet

- Government AccountingDocument2 pagesGovernment AccountingJoody CatacutanNo ratings yet

- BA322 GA Notes CH 2 - Fund AcccountingDocument7 pagesBA322 GA Notes CH 2 - Fund AcccountingZebedee TaltalNo ratings yet

- Government Accounting SummaryDocument9 pagesGovernment Accounting SummaryKenVictorino50% (2)

- Lecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASDocument11 pagesLecture Notes: Advanced Financial Accounting and Reporting G/N/E de Leon AFAR.3014 - NGASTatianaNo ratings yet

- Acc For Electricity CompanyDocument13 pagesAcc For Electricity CompanyAnnoukshya SwainNo ratings yet

- Chapter Two: Principles of Accounting and Financial Reporting For State and Local GovernmentDocument49 pagesChapter Two: Principles of Accounting and Financial Reporting For State and Local GovernmentYoseph KassaNo ratings yet

- Accounting Chap.2Document35 pagesAccounting Chap.2Tasebe GetachewNo ratings yet

- Public ch8Document8 pagesPublic ch8Firdows SuleymanNo ratings yet

- Chap002 000Document41 pagesChap002 000newonemadeNo ratings yet

- Chapter 4Document20 pagesChapter 4kratikabirleNo ratings yet

- Explanatory Memorandum On Federal ReceiptsDocument101 pagesExplanatory Memorandum On Federal ReceiptsM Sikander HaiderNo ratings yet

- LGU NGAS Chapter 1 and 2Document24 pagesLGU NGAS Chapter 1 and 2Lail PDNo ratings yet

- Final Account: With AdjustmentDocument49 pagesFinal Account: With AdjustmentPandit Niraj Dilip Sharma100% (1)

- 5 Elements of AccountingDocument14 pages5 Elements of Accountingjann_007jann8223100% (1)

- Banking Companies Financial Statements in IndiaDocument7 pagesBanking Companies Financial Statements in IndiaVinay GoyalNo ratings yet

- AccountsDocument11 pagesAccountsaashishNo ratings yet

- 8 Explanatory Memorandum of Federal Receipts 2021 22Document101 pages8 Explanatory Memorandum of Federal Receipts 2021 22Azhar AliNo ratings yet

- Introduction To Government AccountingDocument7 pagesIntroduction To Government Accountingjhoe ann trixie barredoNo ratings yet

- Introductory Note: AnnexesDocument1 pageIntroductory Note: Annexesvinit_iiitNo ratings yet

- Chapter Two FundDocument7 pagesChapter Two FundTesfaye KebebawNo ratings yet

- Chapter 3 - GovernmentDocument3 pagesChapter 3 - GovernmentMary Ann ArenasNo ratings yet

- ch1 HandoutDocument6 pagesch1 HandoutPaolo TipoNo ratings yet

- Ch02 QIA PDFDocument30 pagesCh02 QIA PDFChegg AccountNo ratings yet

- Financial Statements and Disclosure of InformationDocument7 pagesFinancial Statements and Disclosure of InformationAjit PatilNo ratings yet

- Articles On The Basics of Monetary and Fiscal Policy Budget Basics: How The Books Are (Not) BalancedDocument11 pagesArticles On The Basics of Monetary and Fiscal Policy Budget Basics: How The Books Are (Not) Balancedsawhneynikita132854No ratings yet

- CH3 SolutionDocument10 pagesCH3 SolutionGabriel Aaron DionneNo ratings yet

- Definition of Terms. For The Purpose of This Manual, The: Presidential Decree (P.D.) No. 1445)Document7 pagesDefinition of Terms. For The Purpose of This Manual, The: Presidential Decree (P.D.) No. 1445)Lilliane EstrellaNo ratings yet

- Appendices of Report No 1 of 2019 State Finance Government of Arunachal PradeshDocument42 pagesAppendices of Report No 1 of 2019 State Finance Government of Arunachal Pradeshmradil744No ratings yet

- Nineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialDocument34 pagesNineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialridaNo ratings yet

- Lecture NotesDocument5 pagesLecture NotesLyaman TagizadeNo ratings yet

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresNo ratings yet

- Arm FdsDocument82 pagesArm FdsMehdi HabibianNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Species in News Whole 2023Document29 pagesSpecies in News Whole 2023Sam PitraudaNo ratings yet

- Art and Culture - 3000+ MCQsDocument17 pagesArt and Culture - 3000+ MCQsSam PitraudaNo ratings yet

- Govt. Accounting Rules 1990Document80 pagesGovt. Accounting Rules 1990Sam PitraudaNo ratings yet

- Schemes & PolicsDocument110 pagesSchemes & PolicsSam PitraudaNo ratings yet

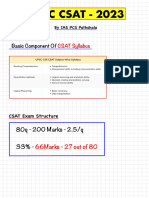

- CSAT 2023 - Plan of ActionDocument5 pagesCSAT 2023 - Plan of ActionSam PitraudaNo ratings yet

- The Hindu Newspaper April 2023 Synopsis For UPSC Prelims 2024Document6 pagesThe Hindu Newspaper April 2023 Synopsis For UPSC Prelims 2024Sam PitraudaNo ratings yet

- Indian Economy Comprehensive Notes Sankalp UPSCDocument515 pagesIndian Economy Comprehensive Notes Sankalp UPSCSam PitraudaNo ratings yet

- Security Workbook-2Document40 pagesSecurity Workbook-2Sam PitraudaNo ratings yet

- History PYQ PrelimsDocument45 pagesHistory PYQ PrelimsSam PitraudaNo ratings yet

- Constitutional Amendments by ZERO NOTESDocument4 pagesConstitutional Amendments by ZERO NOTESSam PitraudaNo ratings yet

- Research Methodology in Development StudiesDocument349 pagesResearch Methodology in Development StudiesSam PitraudaNo ratings yet

- Methodsofconcreting 180304183706Document30 pagesMethodsofconcreting 180304183706Sam PitraudaNo ratings yet

- Column Schedule First FloorDocument1 pageColumn Schedule First FloorSam PitraudaNo ratings yet

- SDEEDocument115 pagesSDEESam PitraudaNo ratings yet

- Tunneling in Soft Ground and Hard RockDocument49 pagesTunneling in Soft Ground and Hard RockSam PitraudaNo ratings yet

- Column Schedule Ground FloorDocument1 pageColumn Schedule Ground FloorSam PitraudaNo ratings yet

- Security Yearly 2023 VisionDocument81 pagesSecurity Yearly 2023 VisionSam PitraudaNo ratings yet

- Column Schedule Second FloorDocument1 pageColumn Schedule Second FloorSam PitraudaNo ratings yet

- Nupur Mec 2nd Imp.Document7 pagesNupur Mec 2nd Imp.Sam PitraudaNo ratings yet

- Footing ScheduleDocument1 pageFooting ScheduleSam PitraudaNo ratings yet

- VT ON 1ST WK - 10.07.23 (Revised)Document1 pageVT ON 1ST WK - 10.07.23 (Revised)Sam PitraudaNo ratings yet

- Floor Slab ScheduleDocument1 pageFloor Slab ScheduleSam PitraudaNo ratings yet

- Column Schedule Third FloorDocument1 pageColumn Schedule Third FloorSam PitraudaNo ratings yet

- Plinth Beams ScheduleDocument1 pagePlinth Beams ScheduleSam PitraudaNo ratings yet

- Floor Beams ScheduleDocument1 pageFloor Beams ScheduleSam PitraudaNo ratings yet

- Micro Content Improvement Basic To AdvancedDocument4 pagesMicro Content Improvement Basic To AdvancedSam PitraudaNo ratings yet

- 75 Hard Mains Micro Improvement Skills Schedule-2024Document22 pages75 Hard Mains Micro Improvement Skills Schedule-2024Sam PitraudaNo ratings yet

- Column Schedule Below GroundDocument1 pageColumn Schedule Below GroundSam PitraudaNo ratings yet

- Decoding The PassageDocument1 pageDecoding The PassageSam PitraudaNo ratings yet

- Switching and Signalling OVTDocument65 pagesSwitching and Signalling OVTSam PitraudaNo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- Financial StatementDocument8 pagesFinancial StatementDarwin Dionisio ClementeNo ratings yet

- What Programmatic Acquirers Do DifferentlyDocument7 pagesWhat Programmatic Acquirers Do DifferentlyMohammed ShalawyNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountA&P ConsultancyNo ratings yet

- Mercantil Financiero Precios Titulos ValoresDocument3 pagesMercantil Financiero Precios Titulos ValoresEvelyn MantillaNo ratings yet

- The Impact of Customer Services On Customer Satisfaction in The Food Industry: A Case Study of Mcdonald'SDocument15 pagesThe Impact of Customer Services On Customer Satisfaction in The Food Industry: A Case Study of Mcdonald'SMofy AllyNo ratings yet

- Jio Invoice 290323Document2 pagesJio Invoice 290323Deepak KiniNo ratings yet

- Corporate FinanceDocument42 pagesCorporate FinanceNguyễn Thụy Ngọc HânNo ratings yet

- DAWN Editorials July 2023Document91 pagesDAWN Editorials July 2023agha_zuhaibNo ratings yet

- Servqual ModelDocument15 pagesServqual ModelWasim AkramNo ratings yet

- Imran Shehzad Tax Lectures and MaterialDocument9 pagesImran Shehzad Tax Lectures and Materialsheraz akramNo ratings yet

- ACCA SBR S20 NotesDocument159 pagesACCA SBR S20 NotesMbee100% (1)

- 26.recent Changes in BankingDocument2 pages26.recent Changes in BankingVIKASH ARYANNo ratings yet

- View Invoice - ReceiptDocument1 pageView Invoice - ReceiptashadbolajiNo ratings yet

- Import FinalDocument5 pagesImport FinalRaza AliNo ratings yet

- Tutorial 5Document165 pagesTutorial 5Irene WongNo ratings yet

- Cost Accounting QuestionsDocument14 pagesCost Accounting QuestionsMhico MateoNo ratings yet

- RSRCH-DFNDD - by Chapters Final Na JudDocument37 pagesRSRCH-DFNDD - by Chapters Final Na JudqwertyNo ratings yet

- Outward FDI From South Korea: The Relationship Between National Investment Position and Location ChoiceDocument20 pagesOutward FDI From South Korea: The Relationship Between National Investment Position and Location ChoiceLê Hoàng Thương TínNo ratings yet

- Chapter - 1 Reserve Bank of India Act, 1934Document13 pagesChapter - 1 Reserve Bank of India Act, 1934arushiNo ratings yet

- RA 7192 - Women in Development and Nation Building ActDocument9 pagesRA 7192 - Women in Development and Nation Building ActRosa Gamaro100% (2)

- (Download PDF) Managerial Accounting Asia Global 2nd Edition Garrison Solutions Manual Full ChapterDocument106 pages(Download PDF) Managerial Accounting Asia Global 2nd Edition Garrison Solutions Manual Full Chapterweymesnjanka100% (5)

- Amount Due: Wake Forest Emergency Providers Wake Forest Emergency ProvidersDocument2 pagesAmount Due: Wake Forest Emergency Providers Wake Forest Emergency ProvidersmatisseNo ratings yet

- Schools, Markets, Banks and Hospitals in Neral: Distance From Nisarg - SparshDocument3 pagesSchools, Markets, Banks and Hospitals in Neral: Distance From Nisarg - SparshKomal TawdeNo ratings yet

- Jodisec Logistics - Deal CalculationDocument1 pageJodisec Logistics - Deal CalculationXolani Radebe RadebeNo ratings yet

- Of The Day (Short Term Delivery Call) - Jupiter Wagons LTDDocument3 pagesOf The Day (Short Term Delivery Call) - Jupiter Wagons LTDdeepaksinghbishtNo ratings yet