Professional Documents

Culture Documents

Schedule E - Rental Property CLG

Schedule E - Rental Property CLG

Uploaded by

joshmlaymanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule E - Rental Property CLG

Schedule E - Rental Property CLG

Uploaded by

joshmlaymanCopyright:

Available Formats

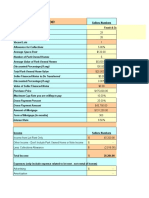

Property Address

Rental Income and Expenses

Street Address

City TAX YEAR: 202_

State Percentage For Schedule E

ZIP Code Notes Total Days Rented In Year 0 Schedule E Schedule A

Days Available to be Rented 365

Income

(100% As Received) 100% $ -

Expenses (100% as Paid)

Advertising Expense (if any) 100% $ -

Condo Fees / Monthly Maintenance Charge (if any) 0% $ - $ -

Repairs and Maintenance

Cleaning post Rentals 100% $ -

Regular Cleaning (i.e. biweekly, monthly) 0% $ - $ -

Repairs (detail in notes and Capital Improvements) 0% $ - $ -

Repair Supplies 0% $ - $ -

Real Estate Taxes (if any) 0% $ - $ -

Depreciation Determined by Costa Law Group

Homeowners' Insurance (if any) 0% $ - $ -

Mortgage Interest Paid 0% $ - $ -

Legal Expenses (if any) 0% $ - $ -

Property Agent Fees / Management Agent Fees / Real Estate Broker Fees (if

any) 100% $ -

Utilities Paid by Owner 0%

Water $ - $ -

Gas $ - $ -

Electricity $ - $ -

Oil $ - $ -

Internet $ - $ -

Cable $ - $ -

Plow Service $ - $ -

Other $ - $ -

Any Other Owner Paid Expenses?

Other Expense 1

Other Expense 2

Other Expense 3

Other Expense 4

Total $ -

PLEASE MAKE SURE THAT COSTA LAW GROUP HAS A COPY OF THE HUD-1 SETTLEMENT STATEMENT/BUYER CD (CLOSING DISCLOSURE) AND ALL CLOSING COSTS FROM THE PURCHASE

OF THE RENTAL PROPERTY

Capital improvements since purchase

Date of Improvement Type of Improvement Cost of Improvement Notes

Instructions

1. In cells B2-B5, fill in the property address of the Rental Property.

2. In cell B2, fill in the name of the Tax Payer.

3. In cell C3, fill in the Tax Year.

4. In cell F5, fill in the number of days the property was rented during the tax year.

5. In cell F6, fill in the number of days the property was available to be rented. (i.e. exclude the days the tax payer stayed at the property or days the client did not own the property, if purchased part way through

the year).

6. In cell D8, enter the amount of income received from Rental Property (100% as it was received from the renter).

7. In cell D11, enter the amount spent on advertising the Rental Property.

8. In cell D13, enter the amount paid toward fees charged for condo or association fees associated with the property upkeep, so called "condo fees."

9. In cell D16, enter the amount spent on cleaning after a renter has vacated the property.

10. In cell D17, enter the amount paid for regularly scheduled cleaning services (i.e. daily, weekly, monthly, etc.).

11. In cell D18, enter the amount spent on repairs, please also list these improvements in the section "Capital improvements since purchase" starting at Cell A56.

12. In cell D19, enter the amount spent on supplies needed to perform repairs.

13. In cell D21, enter the amount paid by the tax payer in Real Estate Taxes during the tax year.

14. In cell D25, enter the amount paid in Homeowners Insurance during the tax year.

15. In cell D27, enter the amount of interest paid toward your mortgage during the tax year. This can be found on Form 1098 from the lender.

16. In cell D29, enter the amount spent on legal services during the tax year.

17. In cell D31, enter the amount spent on agency fees for the rental property.

18. In cells D33 through D41, enter the amount paid toward the corresponding utilities.

19. In cells D43 through D47, enter any additional rental property expenses not explicitly listed above.

20. In cells A56 through D63, enter any information regarding improvements on the rental property since its purchase.

You might also like

- Simple Real Estate Company Profile SampleDocument10 pagesSimple Real Estate Company Profile Samplealiya naseem90% (10)

- Fillable SPCDocument38 pagesFillable SPCrutbut100% (6)

- Land Acquisition Guide Sanral (2008)Document167 pagesLand Acquisition Guide Sanral (2008)alwil144548100% (2)

- Valuation ReportsDocument23 pagesValuation ReportsNaga MallikNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- Excel Construction Project Management Templates Construction Budget TemplateDocument19 pagesExcel Construction Project Management Templates Construction Budget TemplateAnonymous 4e7GNjzGW100% (3)

- IC Auto Repair Estimate 9256Document3 pagesIC Auto Repair Estimate 9256Mudnew EsuNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- Sujimoto Investment Brochure - VivianDocument11 pagesSujimoto Investment Brochure - VivianAdetokunbo AdemolaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- Seller Wholesaling ObjectionsDocument8 pagesSeller Wholesaling ObjectionsKay BarnesNo ratings yet

- Starbucks Reconciliation Template & Instructions v20231 - tcm137-84960Document3 pagesStarbucks Reconciliation Template & Instructions v20231 - tcm137-84960spaljeni1411No ratings yet

- Annual Expense Tenant's Pro Rata Share Tenant's Pro Rata Share of ExpenseDocument2 pagesAnnual Expense Tenant's Pro Rata Share Tenant's Pro Rata Share of Expensethe wilsons100% (1)

- Operating Expense ReportDocument3 pagesOperating Expense ReportTuba TunaNo ratings yet

- Progress Claim Excel DownloadDocument2 pagesProgress Claim Excel DownloadAlan RichardsonNo ratings yet

- Breakeven Analysis: Company Name Date: Cost Description Fixed Costs ($) Variable Costs (%) Variable CostsDocument1 pageBreakeven Analysis: Company Name Date: Cost Description Fixed Costs ($) Variable Costs (%) Variable CostsKnownUnknowns-XNo ratings yet

- Profit-And-Loss-Statement WELLS FARGODocument2 pagesProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiNo ratings yet

- MH Park Evaluation: Sellers NumbersDocument9 pagesMH Park Evaluation: Sellers NumbersRonald KahoraNo ratings yet

- Rental Property Management Tracking SheetDocument44 pagesRental Property Management Tracking SheetAlexBlagaNo ratings yet

- Personal Cash Flow WorksheetDocument1 pagePersonal Cash Flow WorksheetJerry liuNo ratings yet

- Cashflow Template For Construction IndustryDocument1 pageCashflow Template For Construction IndustryCrestNo ratings yet

- Expenses-Spreadsheet نموذج جدول النفقاتDocument11 pagesExpenses-Spreadsheet نموذج جدول النفقاتkingNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- Financial Projections Template 04Document7 pagesFinancial Projections Template 04AryanNo ratings yet

- 2018 06 07 Brians BookkeepingDocument117 pages2018 06 07 Brians Bookkeepingskmishra1981No ratings yet

- Medi 2Document4 pagesMedi 2Mere HamsafarNo ratings yet

- Estimación de Costos - FlotasDocument8 pagesEstimación de Costos - FlotasJhonny MendozaNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Application Budget Including Sample NotesDocument2 pagesApplication Budget Including Sample NotesahmedNo ratings yet

- Business Viability CalculatorDocument3 pagesBusiness Viability CalculatorKiyo AiNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- ROI Analyzer Boot Camp Version - 20200319Document65 pagesROI Analyzer Boot Camp Version - 20200319Kateryna BondarenkoNo ratings yet

- It Manage Your IT Budget ToolDocument24 pagesIt Manage Your IT Budget ToolYasser AbrahantesNo ratings yet

- Expense Budget: Personnel Budget Actual Difference ( ) Difference (%)Document8 pagesExpense Budget: Personnel Budget Actual Difference ( ) Difference (%)william oliveiraNo ratings yet

- Personal Financial StatementDocument5 pagesPersonal Financial StatementDaniel RomancikNo ratings yet

- 00 Real Estate Evaluator (New)Document7 pages00 Real Estate Evaluator (New)ryan tunNo ratings yet

- ACN Q123 InfographicDocument1 pageACN Q123 Infographicy.belausavaNo ratings yet

- Creative acquisitionDocument6 pagesCreative acquisitionjl85rodriguezNo ratings yet

- Apartment Analyse FormDocument5 pagesApartment Analyse FormWillie Adams III100% (1)

- Company OverviewDocument6 pagesCompany OverviewRamalNo ratings yet

- Frofit and Loss Statement of BankDocument2 pagesFrofit and Loss Statement of BankAvtar SNo ratings yet

- IC Auto Invoice 9174Document2 pagesIC Auto Invoice 9174Vikram Singh RathoreNo ratings yet

- BRRRR v2Document5 pagesBRRRR v2SujitKGoudarNo ratings yet

- Collection Agency Board Personal/Corporate Financial StatementDocument2 pagesCollection Agency Board Personal/Corporate Financial StatementCharles Jose MitchellNo ratings yet

- Budget Planning Worksheet - ChurchDocument4 pagesBudget Planning Worksheet - ChurchApostle Akuffo AnsahNo ratings yet

- Cash Flow Forecast TemplateDocument2 pagesCash Flow Forecast TemplatewresfrNo ratings yet

- SBBC CashflowTemplate N19Document16 pagesSBBC CashflowTemplate N19aakansha.limbasiyaNo ratings yet

- Winter Budget DoneeDocument11 pagesWinter Budget Doneemarkwaitz126No ratings yet

- Income Satatement /P&L (Required Net Income by Month and FinalDocument6 pagesIncome Satatement /P&L (Required Net Income by Month and FinalMauricio SernaNo ratings yet

- Monthly Budget Worksheet: HousingDocument3 pagesMonthly Budget Worksheet: HousingrizviNo ratings yet

- Kso TugasDocument7 pagesKso TugasRahmat Ramadhan RahmatNo ratings yet

- Re I Property AnalyzerDocument1 pageRe I Property AnalyzerUcok DedyNo ratings yet

- Construction Cost EstimateDocument7 pagesConstruction Cost EstimateKidusNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- IC Auto Invoice 9174Document2 pagesIC Auto Invoice 9174larisaNo ratings yet

- Masterclass Savings TrackerDocument6 pagesMasterclass Savings Trackerraghavdas726No ratings yet

- Davenport, FL 33897: 15% Down With Mi Financed ProformaDocument3 pagesDavenport, FL 33897: 15% Down With Mi Financed ProformaManuel CamachoNo ratings yet

- Personal Budget: IncomeDocument4 pagesPersonal Budget: IncomeRichard BigleteNo ratings yet

- Construction Specification InstituteDocument7 pagesConstruction Specification InstituteGeovany Mena VillagraNo ratings yet

- Crisostomo Vs VictoriaDocument3 pagesCrisostomo Vs VictoriaSORITA LAW50% (2)

- BPI V Sps CastroDocument4 pagesBPI V Sps CastroBrian TomasNo ratings yet

- 11-Article Text-50-1-10-20201209Document8 pages11-Article Text-50-1-10-20201209imaangfxNo ratings yet

- JOSEPH ESTERNON PROJECT MANAGER ResumeDocument5 pagesJOSEPH ESTERNON PROJECT MANAGER Resumeiloconstruction2020No ratings yet

- Presentation - The Related Group - 02.04.20Document28 pagesPresentation - The Related Group - 02.04.20ActionNewsJax100% (1)

- Rental Variation in Residential and Commercial Properties in UyoDocument81 pagesRental Variation in Residential and Commercial Properties in UyoUBONG FRIDAYNo ratings yet

- Vaishnavi Rent AgreementDocument3 pagesVaishnavi Rent Agreementtaxlawconsultant022No ratings yet

- Affidavit of Non - Tenancy STEVE ROGERSDocument1 pageAffidavit of Non - Tenancy STEVE ROGERSNorileisha Ramos AtienzaNo ratings yet

- Chapter 7 - Extinguishment of SaleDocument5 pagesChapter 7 - Extinguishment of SaleYounanymous DecisionNo ratings yet

- Llantino vs. Co Liong ChongDocument2 pagesLlantino vs. Co Liong ChongErika Angela GalceranNo ratings yet

- Affidavit of Loss School IdDocument1 pageAffidavit of Loss School IdBohol-rado Duran FredoNo ratings yet

- Iván Prats - 28: Marketing and Sales WarriorDocument4 pagesIván Prats - 28: Marketing and Sales WarriorIvan PratsNo ratings yet

- Jesse Braun - 153 - 27044 32nd Ave LangleyDocument2 pagesJesse Braun - 153 - 27044 32nd Ave LangleyGenaro SplendoreNo ratings yet

- Sale Deed FormatDocument2 pagesSale Deed FormatShivani PrajapatiNo ratings yet

- Vales Vs GalinatoDocument2 pagesVales Vs GalinatoKate EvangelistaNo ratings yet

- 14 Order II Frame of SuitDocument41 pages14 Order II Frame of SuitAnusha V RNo ratings yet

- My Home Nishada E-BrochureDocument24 pagesMy Home Nishada E-BrochurebodhiNo ratings yet

- Guide To Joint Development For Public Transportation Agencies (2021)Document195 pagesGuide To Joint Development For Public Transportation Agencies (2021)phillip jinNo ratings yet

- Rule 68 Foreclosure of Real Estate MortgageDocument12 pagesRule 68 Foreclosure of Real Estate Mortgagereese93No ratings yet

- ch10 Plant Assets, Natural ResourcesDocument24 pagesch10 Plant Assets, Natural ResourcesMạnh Hoàng Phi ĐứcNo ratings yet

- Kolkata Real Estate MarketDocument59 pagesKolkata Real Estate MarketSudip HatiNo ratings yet

- Rtb1 Form DluhcDocument17 pagesRtb1 Form DluhcLakshannruganNo ratings yet

- Guide To Renting Apartments in JapanDocument1 pageGuide To Renting Apartments in JapanPablo UriarteNo ratings yet

- COMPLAINT (Llarenas) 1Document14 pagesCOMPLAINT (Llarenas) 1Edward Rey Ebao100% (1)