Professional Documents

Culture Documents

2023 PP Topik 2 Firma

2023 PP Topik 2 Firma

Uploaded by

RLin MeeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 PP Topik 2 Firma

2023 PP Topik 2 Firma

Uploaded by

RLin MeeCopyright:

Available Formats

Genap 2022/2023 Pengantar Akuntansi 2

UNIVERSITAS INDONESIA

PROGRAM PENDIDKAN VOKASI

PROGRAM STUDI ADMINISTRASI PERPAJAKAN

PENGANTAR AKUNTANSI II

SOAL PEMICU TOPIK 2

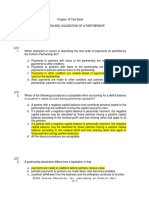

1. Financial Statement Penner and Torres decide to merge their proprietorships into a partnership

called Pentor Company. The balance sheet of Torres Co. shows:

Accounts receivable $16,000; Less: Allowance for doubtful accounts 1,200 $14,800

Equipment 20,000; Less: Accumulated depreciation—equip. 7,000 13,000

Journalize entries in forming a partnership.

Prepare portion of opening balance sheet for partnership.

2. Frontenac Company reported net income of $75,000. The partnership agreement provides for

salaries of $25,000 to Miley and $18,000 to Guthrie. They divide the remainder 40% to Miley and

60% to Guthrie. Miley asks your help to divide the net income between the partners and to prepare

the closing entry.

3. Nabb & Fry Co. reports net income of $31,000. Interest allowances are Nabb $7,000 and Fry $5,000,

salary allowances are Nabb $15,000 and Fry $10,000, and the remainder is shared equally. Show

the distribution of income and prepare journal for distribution of income

4. BE12.6 (LO 3) After liquidating noncash assets and paying creditors, account balances in the Mann

Co. are Cash $21,000; A, Capital (Cr.) $8,000; B, Capital (Cr.) $9,000; and C, Capital (Cr.) $4,000. The

partners share income equally. Journalize the final distribution of cash to the partners.

5. Gamma Co. capital balances are Barr $30,000, Croy $25,000, and Eubank $22,000. The partners

share income equally. Tovar is admitted to the firm by purchasing one-half of Eubank’s interest

for $13,000. Journalize the admission of Tovar to the partnership.

6. In Eastwood Co., capital balances are Irey $40,000 and Pedigo $50,000. The partners share income

equally. Vernon is admitted to the fi rm with a 45% interest by an investment of cash of $58,000.

Journalize the admission of Vernon.

7. Capital balances in Pelmar Co. are Lango $40,000, Oslo $30,000, and Fernetti $20,000. Lango and

Oslo each agree to pay Fernetti $12,000 from their personal assets. Lango and Oslo each receive

50% of Fernetti’s equity. The partners share income equally. Journalize the with drawal of Fernetti.

8. Data pertaining to Pelmar Co. are presented in exercise 7. Instead of payment from per sonal

assets, assume that Fernetti receives $24,000 from partnership assets in withdrawing from the

firm. Journalize the withdrawal of Fernetti.

You might also like

- Parcor 003Document26 pagesParcor 003Vincent Larrie MoldezNo ratings yet

- CH 12Document3 pagesCH 12vivien0% (1)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- The Old Partners Get The Bonus and Contribute The GoodwillDocument7 pagesThe Old Partners Get The Bonus and Contribute The GoodwillMaria Beatriz Munda0% (1)

- BAC 522 Mid Term ExamDocument9 pagesBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- SEC Form F-100Document2 pagesSEC Form F-100Jheng Nuqui50% (2)

- 2 ACCT 2A&B P. OperationDocument6 pages2 ACCT 2A&B P. OperationBrian Christian VillaluzNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- PartnershipDocument6 pagesPartnershipايهاب غزالةNo ratings yet

- AC1 Reviewer Sample QuestionsDocument3 pagesAC1 Reviewer Sample QuestionsVia EmbienNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Financial Accounting and Reporting ExamDocument6 pagesFinancial Accounting and Reporting ExamVye DumaleNo ratings yet

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- AFAR Assessment October 2020Document8 pagesAFAR Assessment October 2020FelixNo ratings yet

- Wesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorDocument4 pagesWesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorelminvaldezNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- Acctg 2 - 2nd MimeoDocument4 pagesAcctg 2 - 2nd MimeoJon Dumagil Inocentes, CPANo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument12 pagesPartnerships - Formation, Operations, and Changes in Ownership InterestsJEFFERSON CUTENo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocument6 pagesAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Review of PartnershipDocument13 pagesReview of PartnershipKristine BlancaNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Reviewer OverallDocument11 pagesReviewer OverallMah2SetNo ratings yet

- Part I. Partnership Formation (Theories)Document5 pagesPart I. Partnership Formation (Theories)Ella AlmazanNo ratings yet

- ExamDocument3 pagesExamshaylieeeNo ratings yet

- Afar 1 Sw3 Mle01 PDF FreeDocument9 pagesAfar 1 Sw3 Mle01 PDF FreeBrian TorresNo ratings yet

- Quiz Partn OerationDocument6 pagesQuiz Partn OerationTommy OngNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipCzaeshel Edades0% (2)

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- Acc 30 CorporationDocument8 pagesAcc 30 CorporationGerlie BonleonNo ratings yet

- Partnership Accounting Question & Answer As Mention in This FileDocument7 pagesPartnership Accounting Question & Answer As Mention in This FileSadraShahidNo ratings yet

- Soal AKLDocument3 pagesSoal AKLErica Lesmana100% (1)

- Accounting 5 8Document1 pageAccounting 5 8gon_freecs_4No ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument23 pagesChapter 16 Dissolution and Liquidation of PartnershipKristine LuntaoNo ratings yet

- A 2 OperationsDocument6 pagesA 2 OperationsAngela DucusinNo ratings yet

- 1 PartnershipDocument6 pages1 PartnershipJem Valmonte100% (3)

- Regina Mondi College, Inc.: Final Exam Financial Accounting & Reporting Name: Permit No. - Course/YearDocument7 pagesRegina Mondi College, Inc.: Final Exam Financial Accounting & Reporting Name: Permit No. - Course/YearMrendy SantosNo ratings yet

- Question Bank 2021 E2 6Document8 pagesQuestion Bank 2021 E2 6Abanoub AbdallahNo ratings yet

- Week 15 Q1Document11 pagesWeek 15 Q1Carlo AgravanteNo ratings yet

- Accounting 2 (Admission &withdrawal of Partners)Document6 pagesAccounting 2 (Admission &withdrawal of Partners)Zyka SinoyNo ratings yet

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- AFAR 1st Monthly AssessmentDocument6 pagesAFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Partnership Dissolution QuestionsDocument3 pagesPartnership Dissolution QuestionsArkkkNo ratings yet

- Accounting For Partnership - UnaDocument13 pagesAccounting For Partnership - UnaJastine Beltran - PerezNo ratings yet

- Partnership Accounting PDFDocument4 pagesPartnership Accounting PDFPamela BugarsoNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- AFAR 1st Monhtly AssessmentDocument5 pagesAFAR 1st Monhtly AssessmentCriza MayNo ratings yet

- BSA 23C-AFAR ReviewerDocument102 pagesBSA 23C-AFAR ReviewerKlint HandsellNo ratings yet

- 15 Chapter Partnerships FormationDocument13 pages15 Chapter Partnerships Formationmurtle0% (1)

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- Case Study Assessment 6Document2 pagesCase Study Assessment 6Christian John Resabal BiolNo ratings yet

- Why Technical Analysis Is 100% Bullshit - F.S. ComeauDocument28 pagesWhy Technical Analysis Is 100% Bullshit - F.S. ComeauOnepiece TsikenNo ratings yet

- Seatwork Chapter 9 - Accounting Cycle of A Service BusinessDocument3 pagesSeatwork Chapter 9 - Accounting Cycle of A Service BusinessANNANo ratings yet

- Urbanization and Economic Growth: The Arguments and Evidence For Africa and AsiaDocument19 pagesUrbanization and Economic Growth: The Arguments and Evidence For Africa and AsiamaizansofiaNo ratings yet

- Bank Confirmation BCA GF - GMDocument2 pagesBank Confirmation BCA GF - GMSeptyana MariaNo ratings yet

- Chapter 9Document12 pagesChapter 9fatoumatta jaitehNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationTyra Joyce Revadavia100% (1)

- 7 Product PortfoliosDocument22 pages7 Product PortfoliosPruthviraj RathoreNo ratings yet

- BSIE Cost AccountingDocument5 pagesBSIE Cost AccountingJoovs JoovhoNo ratings yet

- Group Interview With An EntrepreneurDocument2 pagesGroup Interview With An EntrepreneurDoom RefugeNo ratings yet

- The Indian Shrimp Industry Organizes To Fight TheDocument9 pagesThe Indian Shrimp Industry Organizes To Fight TheVaibhav RakhejaNo ratings yet

- PWC Vietnam Pocket Tax Book 2013Document43 pagesPWC Vietnam Pocket Tax Book 2013Angie NguyenNo ratings yet

- International and Dutch Standards On Business and Human RightsDocument3 pagesInternational and Dutch Standards On Business and Human RightsjosienkapmaNo ratings yet

- ch01R StudentDocument70 pagesch01R StudentChuan ShihNo ratings yet

- Project Report Business Development Analysis": NashikDocument60 pagesProject Report Business Development Analysis": NashikHarish BhagwatNo ratings yet

- BOQ Format For Surat Phase-1Document2 pagesBOQ Format For Surat Phase-1rishabhNo ratings yet

- Bonus Ch15Document34 pagesBonus Ch15Yonica Salonga De BelenNo ratings yet

- 2015 Blue Orchid Business Plan Template Word OnlyDocument18 pages2015 Blue Orchid Business Plan Template Word OnlyPrince Horwolabi HifeoluwahNo ratings yet

- E - Commerce Chapter 11Document19 pagesE - Commerce Chapter 11Md. RuHul A.No ratings yet

- Business Ethics/ Social Responsibility/ Environmental SustainabilityDocument28 pagesBusiness Ethics/ Social Responsibility/ Environmental SustainabilityEnnAoeihG PajarinNo ratings yet

- Fin Statement Analysis - Atlas BatteryDocument34 pagesFin Statement Analysis - Atlas BatterytabinahassanNo ratings yet

- Mba Project Report On HDFC BankDocument78 pagesMba Project Report On HDFC BankRabiaNo ratings yet

- The Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007Document13 pagesThe Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007alexjones365No ratings yet

- Redbus: The Next Step For GrowthDocument7 pagesRedbus: The Next Step For GrowthraviNo ratings yet

- 6 Miscellaneous TransactionsDocument4 pages6 Miscellaneous TransactionsRichel ArmayanNo ratings yet

- Money Supply and Credit CreationDocument12 pagesMoney Supply and Credit CreationP Janaki RamanNo ratings yet

- A03Document16 pagesA03Vũ Hồng NhungNo ratings yet

- Global Cities: Prof. Stephen Graham Stephen GrahamDocument27 pagesGlobal Cities: Prof. Stephen Graham Stephen GrahamMel SateNo ratings yet

- Anti-Bribery AssignmentDocument11 pagesAnti-Bribery AssignmentDyani Nabyla WidyaputriNo ratings yet