Professional Documents

Culture Documents

Bank Document - 1024889356736934991

Bank Document - 1024889356736934991

Uploaded by

alexanderlucasnicolasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Document - 1024889356736934991

Bank Document - 1024889356736934991

Uploaded by

alexanderlucasnicolasCopyright:

Available Formats

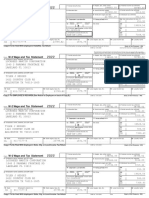

Your 2022 forms W-2 are enclosed

Happy new year! Gusto’s here to make sure you have what you need for the upcoming tax season.

Attached are your 2022 W-2 forms.

What you should do with Forms W-2

This package includes three copies of the W-2. Here’s how to use each of them:

Copy B: File this copy with your federal tax return by April 15th, 2023.

Copy 2: File this copy with your state tax return by April 15th, 2023.

Copy C: Keep this copy safe for your personal records.

How to read Form W-2

The W-2 can be a bit confusing. Here’s some information to help clarify:

Box a: Please ensure that your employee’s SSN is accurate.

Box 1: Shows total wages that are subject to federal income tax. This amount does not include

contributions to Medical, Dental, and Vision insurance under Section 125 plans, or

contributions to retirement plans such as 401(k).

Box 3: Shows total wages subject to Social Security. It has a maximum of

$147,000 in 2022. This amount does not include contributions to Medical, Dental, and

Vision insurance under Section 125 plans.

Box 5: Shows total wages subject to Medicare. This amount does not include contributions to

Medical, Dental, and Vision insurance under Section 125 plans.

We hope this helps make tax season easier. If you have any questions about your W-2, please reach out to

your employer.

© Gusto www.gusto.com All

rights reserved

a Employee’s social security number Safe, accurate, Visit the IRS website at

OMB No. 1545-0008 FAST! Use www.irs.gov/efile

616-15-5642

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

82-1718996 29008.05 2239.40

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Knauf Ventures LLC 28991.05 1798.50

5 Medicare wages and tips 6 Medicare tax withheld

158 Almonte Blvd 29008.05 420.62

7 Social security tips 8 Allocated tips

Mill Valley CA 94941 17.00

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

o

d

Mihaela Boboc e

13 Statutory Retirement Third-party 12b

employee plan sick pay C

o

d

1 Janet Way, Apt.29 e

14 Other 12c

C

o

CA SDI: 319.10 d

e

12d

C

Tiburon CA 94920 o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

CA 079-8708-4 29008.05 362.82

Form W-2 Wage and Tax Statement

Copy B—To Be Filed With Employee’s FEDERAL Tax Return.

2022 Department of the Treasury—Internal Revenue Service

This information is being furnished to the Internal Revenue Service.

Notice to Employee Corrections. If your name, SSN, or address is incorrect, correct

Copies B, C, and 2 and ask your employer to correct your

Do you have to file? Refer to the Form 1040 instructions to employment record. Be sure to ask the employer to file Form

determine if you are required to file a tax return. Even if you W-2c, Corrected Wage and Tax Statement, with the SSA to

don’t have to file a tax return, you may be eligible for a refund if correct any name, SSN, or money amount error reported to the

box 2 shows an amount or if you are eligible for any credit. SSA on Form W-2. Be sure to get your copies of Form W-2c

Earned income credit (EIC). You may be able to take the EIC from your employer for all corrections made so you may file

for 2022 if your adjusted gross income (AGI) is less than a them with your tax return. If your name and SSN are correct but

certain amount. The amount of the credit is based on income aren’t the same as shown on your social security card, you

and family size. Workers without children could qualify for a should ask for a new card that displays your correct name at

smaller credit. You and any qualifying children must have valid any SSA office or by calling 800-772-1213. You may also visit

social security numbers (SSNs). You can’t take the EIC if your the SSA website at www.SSA.gov.

investment income is more than the specified amount for 2022 Cost of employer-sponsored health coverage (if such cost is

or if income is earned for services provided while you were an provided by the employer). The reporting in box 12, using

inmate at a penal institution. For 2022 income limits and more code DD, of the cost of employer-sponsored health coverage is

information, visit www.irs.gov/EITC. See also Pub. 596, Earned for your information only. The amount reported with code DD

Income Credit. Any EIC that is more than your tax liability is is not taxable.

refunded to you, but only if you file a tax return.

Credit for excess taxes. If you had more than one employer in

Employee’s social security number (SSN). For your 2022 and more than $9,114 in social security and/or Tier 1

protection, this form may show only the last four digits of your railroad retirement (RRTA) taxes were withheld, you may be able

SSN. However, your employer has reported your complete SSN to claim a credit for the excess against your federal income tax.

to the IRS and the Social Security Administration (SSA). See the Form 1040 instructions. If you had more than one

Clergy and religious workers. If you aren’t subject to social railroad employer and more than $5,350.80 in Tier 2 RRTA tax

security and Medicare taxes, see Pub. 517, Social Security and was withheld, you may be able to claim a refund on Form 843.

Other Information for Members of the Clergy and Religious See the Instructions for Form 843.

Workers. (See also Instructions for Employee on the back of Copy C.)

a Employee’s social security number

616-15-5642 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

82-1718996 29008.05 2239.40

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Knauf Ventures LLC 28991.05 1798.50

5 Medicare wages and tips 6 Medicare tax withheld

158 Almonte Blvd 29008.05 420.62

7 Social security tips 8 Allocated tips

Mill Valley CA 94941 17.00

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a

C

o

d

e

Mihaela Boboc Statutory Retirement Third-party

13 employee plan sick pay

12b

C

o

d

1 Janet Way, Apt.29 e

14 Other 12c

C

o

d

CA SDI: 319.10 e

12d

C

o

Tiburon CA 94920 d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

CA 079-8708-4 29008.05 362.82

Form W-2 Wage and Tax Statement

Copy 2—To Be Filed With Employee’s State, City, or Local

2022 Department of the Treasury—Internal Revenue Service

Income Tax Return

Instructions for Employee (continued from back of W—Employer contributions (including amounts the employee elected to

Copy C) contribute using a section 125 (cafeteria) plan) to your health savings

account. Report on Form 8889, Health Savings Accounts (HSAs).

Box 12 (continued) Y—Deferrals under a section 409A nonqualified deferred compensation plan

F—Elective deferrals under a section 408(k)(6) salary reduction SEP Z—Income under a nonqualified deferred compensation plan that fails to

G—Elective deferrals and employer contributions (including nonelective satisfy section 409A. This amount is also included in box 1. It is subject

deferrals) to a section 457(b) deferred compensation plan to an additional 20% tax plus interest. See the Form 1040 instructions.

H—Elective deferrals to a section 501(c)(18)(D) tax-exempt organization AA—Designated Roth contributions under a section 401(k) plan

plan. See the Form 1040 instructions for how to deduct. BB—Designated Roth contributions under a section 403(b) plan

J—Nontaxable sick pay (information only, not included in box 1, 3, or 5) DD—Cost of employer-sponsored health coverage. The amount

K—20% excise tax on excess golden parachute payments. See the reported with code DD is not taxable.

Form 1040 instructions. EE—Designated Roth contributions under a governmental section

L—Substantiated employee business expense reimbursements 457(b) plan. This amount does not apply to contributions under a tax-

(nontaxable) exempt organization section 457(b) plan.

M—Uncollected social security or RRTA tax on taxable cost of group- FF—Permitted benefits under a qualified small employer health

term life insurance over $50,000 (former employees only). See the Form reimbursement arrangement

1040 instructions. GG—Income from qualified equity grants under section 83(i)

N—Uncollected Medicare tax on taxable cost of group-term life HH—Aggregate deferrals under section 83(i) elections as of the close of

insurance over $50,000 (former employees only). See the Form 1040 the calendar year

instructions.

Box 13. If the “Retirement plan” box is checked, special limits may apply

P—Excludable moving expense reimbursements paid directly to a to the amount of traditional IRA contributions you may deduct. See Pub.

member of the U.S. Armed Forces (not included in box 1, 3, or 5) 590-A, Contributions to Individual Retirement Arrangements (IRAs).

Q—Nontaxable combat pay. See the Form 1040 instructions for details Box 14. Employers may use this box to report information such as state

on reporting this amount. disability insurance taxes withheld, union dues, uniform payments,

R—Employer contributions to your Archer MSA. Report on Form 8853, health insurance premiums deducted, nontaxable income, educational

Archer MSAs and Long-Term Care Insurance Contracts. assistance payments, or a member of the clergy’s parsonage allowance

S—Employee salary reduction contributions under a section 408(p) and utilities. Railroad employers use this box to report railroad

SIMPLE plan (not included in box 1) retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax,

and Additional Medicare Tax. Include tips reported by the employee to

T—Adoption benefits (not included in box 1). Complete Form 8839, the employer in railroad retirement (RRTA) compensation.

Qualified Adoption Expenses, to figure any taxable and nontaxable

amounts. Note: Keep Copy C of Form W-2 for at least 3 years after the due date

for filing your income tax return. However, to help protect your social

V—Income from exercise of nonstatutory stock option(s) (included in security benefits, keep Copy C until you begin receiving social security

boxes 1, 3 (up to the social security wage base), and 5). See Pub. 525, benefits, just in case there is a question about your work record and/or

Taxable and Nontaxable Income, for reporting requirements. earnings in a particular year.

a Employee’s social security number This information is being furnished to the Internal Revenue Service. If you

are required to file a tax return, a negligence penalty or other sanction

616-15-5642 OMB No. 1545-0008 may be imposed on you if this income is taxable and you fail to report it.

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

82-1718996 29008.05 2239.40

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Knauf Ventures LLC 28991.05 1798.50

5 Medicare wages and tips 6 Medicare tax withheld

158 Almonte Blvd 29008.05 420.62

7 Social security tips 8 Allocated tips

Mill Valley CA 94941 17.00

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

o

d

e

Mihaela Boboc Statutory Retirement Third-party

13 employee plan sick pay

12b

C

o

d

1 Janet Way, Apt.29 e

14 Other 12c

C

o

CA SDI: 319.10 d

e

12d

C

o

Tiburon CA 94920 d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

CA 079-8708-4 29008.05 362.82

Form W-2 Wage and Tax Statement

Copy C—For EMPLOYEE’S RECORDS

2022 Department of the Treasury—Internal Revenue Service

Safe, accurate,

FAST! Use

(See Notice to Employee on the back of Copy B.)

Instructions for Employee received a distribution in the same calendar year, and you are or will be

age 62 by the end of the calendar year, your employer should file Form

(See also Notice to Employee on the back of Copy B.) SSA-131, Employer Report of Special Wage Payments, with the Social

Box 1. Enter this amount on the wages line of your tax return. Security Administration and give you a copy.

Box 2. Enter this amount on the federal income tax withheld line of your Box 12. The following list explains the codes shown in box 12. You may

tax return. need this information to complete your tax return. Elective deferrals

(codes D, E, F, and S) and designated Roth contributions (codes AA,

Box 5. You may be required to report this amount on Form 8959,

BB, and EE) under all plans are generally limited to a total of $20,500

Additional Medicare Tax. See the Form 1040 instructions to determine if

($14,000 if you only have SIMPLE plans; $23,500 for section 403(b)

you are required to complete Form 8959.

plans if you qualify for the 15-year rule explained in Pub. 571). Deferrals

Box 6. This amount includes the 1.45% Medicare Tax withheld on all under code G are limited to $20,500. Deferrals under code H are limited

Medicare wages and tips shown in box 5, as well as the 0.9% Additional to $7,000.

Medicare Tax on any of those Medicare wages and tips above

However, if you were at least age 50 in 2022, your employer may have

$200,000.

allowed an additional deferral of up to $6,500 ($3,000 for section

Box 8. This amount is not included in box 1, 3, 5, or 7. For information 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is

on how to report tips on your tax return, see the Form 1040 instructions. not subject to the overall limit on elective deferrals. For code G, the limit

You must file Form 4137, Social Security and Medicare Tax on on elective deferrals may be higher for the last 3 years before you reach

Unreported Tip Income, with your income tax return to report at least retirement age. Contact your plan administrator for more information.

the allocated tip amount unless you can prove with adequate records Amounts in excess of the overall elective deferral limit must be included

that you received a smaller amount. If you have records that show the in income. See the Form 1040 instructions.

actual amount of tips you received, report that amount even if it is more Note: If a year follows code D through H, S, Y, AA, BB, or EE, you made

or less than the allocated tips. Use Form 4137 to figure the social a make-up pension contribution for a prior year(s) when you were in

security and Medicare tax owed on tips you didn’t report to your military service. To figure whether you made excess deferrals, consider

employer. Enter this amount on the wages line of your tax return. By these amounts for the year shown, not the current year. If no year is

filing Form 4137, your social security tips will be credited to your social shown, the contributions are for the current year.

security record (used to figure your benefits).

A—Uncollected social security or RRTA tax on tips. Include this tax on

Box 10. This amount includes the total dependent care benefits that Form 1040 or 1040-SR. See the Form 1040 instructions.

your employer paid to you or incurred on your behalf (including amounts

B—Uncollected Medicare tax on tips. Include this tax on Form 1040 or

from a section 125 (cafeteria) plan). Any amount over your employer’s

1040-SR. See the Form 1040 instructions.

plan limit is also included in box 1. See Form 2441.

C—Taxable cost of group-term life insurance over $50,000 (included in

Box 11. This amount is (a) reported in box 1 if it is a distribution made to

boxes 1, 3 (up to the social security wage base), and 5)

you from a nonqualified deferred compensation or nongovernmental

section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior D—Elective deferrals to a section 401(k) cash or deferred arrangement.

year deferral under a nonqualified or section 457(b) plan that became Also includes deferrals under a SIMPLE retirement account that is part

taxable for social security and Medicare taxes this year because there is of a section 401(k) arrangement.

no longer a substantial risk of forfeiture of your right to the deferred E—Elective deferrals under a section 403(b) salary reduction agreement

amount. This box shouldn’t be used if you had a deferral and a

(continued on back of Copy 2)

distribution in the same calendar year. If you made a deferral and

You might also like

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Retiret Planning Expert 202021 The Four Essential Steps To AchieveDocument304 pagesRetiret Planning Expert 202021 The Four Essential Steps To Achievesunny bhai100% (1)

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDocument16 pagesMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationNanananana100% (1)

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- 2020 W2 FormDocument7 pages2020 W2 FormMaria HowellNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Printw2 PDFDocument1 pagePrintw2 PDFJhhghiNo ratings yet

- Employee WelfareDocument18 pagesEmployee WelfareSAVI100% (2)

- Your 2021 Forms W-2 Are EnclosedDocument7 pagesYour 2021 Forms W-2 Are Enclosednethpas622No ratings yet

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Document7 pagesYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoNo ratings yet

- w2 - Blankss FillableDocument3 pagesw2 - Blankss Fillablemuhammad mudassarNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceKyngleaf DamnNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- Pyw219s Ee PDFDocument1 pagePyw219s Ee PDFBeyonceNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument9 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerImran SadiqNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceMegan AndreaNo ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument3 pagesWage and Tax Statement: Copy C-For Employee'S RecordsyoNo ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- FOLYD D Form W-2Document1 pageFOLYD D Form W-2bucks tomNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Wage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Document1 pageWage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Steven LinNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- Justin w2Document2 pagesJustin w2jusditzNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Haronymous Aaron BreaultNo ratings yet

- US Internal Revenue Service: fw2 - 2005Document10 pagesUS Internal Revenue Service: fw2 - 2005IRSNo ratings yet

- w2 PDFDocument6 pagesw2 PDFNEKRONo ratings yet

- Pyw223s EeDocument1 pagePyw223s EeSean KingNo ratings yet

- IRS W-2 (2007v) by Forms in Word 1-29-07Document11 pagesIRS W-2 (2007v) by Forms in Word 1-29-07MARIELLE ZIZZANo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- 2020 W2 Forms CaseyDocument9 pages2020 W2 Forms CaseyjuliusomotayooluwagbemiNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSADocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSAJohn LNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- IRS Form W2Document2 pagesIRS Form W2nurulamin00023No ratings yet

- Wage and Tax Statement: Employee's Social Security NumberDocument6 pagesWage and Tax Statement: Employee's Social Security NumberErma MonieNo ratings yet

- Wage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Document1 pageWage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Isaac OlagbemisoyeNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidNo ratings yet

- US Internal Revenue Service: fw2 - 2001Document12 pagesUS Internal Revenue Service: fw2 - 2001IRSNo ratings yet

- 2023 Form W2-CDocument4 pages2023 Form W2-CjpneebNo ratings yet

- XXX-XX-8635 1486.48 105.99: Wage and Tax StatementDocument6 pagesXXX-XX-8635 1486.48 105.99: Wage and Tax Statementsheyla vergaraNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- Wage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentDocument2 pagesWage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentVicky KeNo ratings yet

- Chasity D EnglishDocument7 pagesChasity D EnglishbpspillkillNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Nuzhat Shaikh 57 Mcom Part II Sem IVDocument88 pagesNuzhat Shaikh 57 Mcom Part II Sem IVjunaidnuzhat nagoriNo ratings yet

- Uttar Pradesh Police - Employee Salary System2Document1 pageUttar Pradesh Police - Employee Salary System2aadi.klj.mahindra1998No ratings yet

- Meaning of Payment of Bonus ActDocument16 pagesMeaning of Payment of Bonus ActDaljeet KaurNo ratings yet

- TZ Public Service Pay and Incentive Policy. PDFDocument37 pagesTZ Public Service Pay and Incentive Policy. PDFNicole TaylorNo ratings yet

- Pay Slip For June - 2021: EarningsDocument2 pagesPay Slip For June - 2021: EarningsBagadi AvinashNo ratings yet

- Workmen's Compensation Act 1952Document68 pagesWorkmen's Compensation Act 1952wankartikaNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- 2016 Icaz Cta Unisa Taxation Tutorial 102 PDFDocument70 pages2016 Icaz Cta Unisa Taxation Tutorial 102 PDFArtwell ZuluNo ratings yet

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Police Salary SlipDocument2 pagesPolice Salary Sliphelp.unknown7No ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0varshithvarma051No ratings yet

- Tax267 FormDocument3 pagesTax267 Form2021202082No ratings yet

- Missoc SSG SE 2023 enDocument66 pagesMissoc SSG SE 2023 enEszter Léna MaczóNo ratings yet

- IA2 Income TaxesDocument1 pageIA2 Income TaxesJoey Mhey BenicoNo ratings yet

- Document GADocument2 pagesDocument GALandak LokalNo ratings yet

- FORM IX-A Abstract Under The Minimum Wages Act, 1948 (English Version)Document2 pagesFORM IX-A Abstract Under The Minimum Wages Act, 1948 (English Version)Abhishek ChaurasiaNo ratings yet

- Contingent Liabilities Meaning and TypesDocument2 pagesContingent Liabilities Meaning and Typesi readyNo ratings yet

- Deann Eller ResignationDocument1 pageDeann Eller ResignationWKYC.comNo ratings yet

- A Use The Run The Numbers Worksheet On Page 338Document1 pageA Use The Run The Numbers Worksheet On Page 338Amit PandeyNo ratings yet

- ECTSDocument17 pagesECTSsamuel debebeNo ratings yet

- Income TaxesDocument4 pagesIncome TaxesHana Grace MamangunNo ratings yet

- Phần trả lờiDocument5 pagesPhần trả lờiNguyễn Trịnh Ngọc LinhNo ratings yet

- Appendix H - The Catholic Childrens Aid Society of Toronto FS 2021Document19 pagesAppendix H - The Catholic Childrens Aid Society of Toronto FS 2021AibekNo ratings yet

- Answer Key Ic Mock Exam Set B PDFDocument9 pagesAnswer Key Ic Mock Exam Set B PDFrandomNo ratings yet

- Document PDFDocument2 pagesDocument PDFsherrimcateeNo ratings yet

- 51 Mohd Ifham Khan-Study On GST&its ImplicationDocument100 pages51 Mohd Ifham Khan-Study On GST&its ImplicationFaisal ArifNo ratings yet

- IntxDocument6 pagesIntxSophia KeratinNo ratings yet