Professional Documents

Culture Documents

WePROMOTE NPV Calculation Case Study Week 3

WePROMOTE NPV Calculation Case Study Week 3

Uploaded by

Renatus MalimbeCopyright:

Available Formats

You might also like

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - Questionsalil naik100% (1)

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Written - Week 3Document6 pagesWritten - Week 3Syed Zeeshan ul HassanNo ratings yet

- Financial Analysis May Be Used To Test TheDocument8 pagesFinancial Analysis May Be Used To Test TheJohnAllenMarilla100% (1)

- D14 F6SGP QPDocument12 pagesD14 F6SGP QPchadyudilNo ratings yet

- Bus 5111 Week 3 Assignment FinancicalDocument3 pagesBus 5111 Week 3 Assignment FinancicalMohamedNo ratings yet

- Port Folio Number 2007 MASDocument8 pagesPort Folio Number 2007 MASSasa LuNo ratings yet

- F6SGP Dec2015q PDFDocument15 pagesF6SGP Dec2015q PDFDrift SirNo ratings yet

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- FinMan Case 2Document7 pagesFinMan Case 2Arly Kurt TorresNo ratings yet

- BUS5111 Unit3 Assignment SolutionDocument2 pagesBUS5111 Unit3 Assignment SolutionSyed Zeeshan ul HassanNo ratings yet

- FM - Chapter 3 - QuizDocument8 pagesFM - Chapter 3 - QuizHausland Const. Corp.No ratings yet

- Assignment 1Document7 pagesAssignment 1REJAY89No ratings yet

- Risk Analysis, Real Options and Capital BudgetingDocument28 pagesRisk Analysis, Real Options and Capital BudgetingArnab SenNo ratings yet

- Capital Budgeting - Problems & SolutionsDocument7 pagesCapital Budgeting - Problems & SolutionsbonduamrutharaoNo ratings yet

- Cash Flows Capital BudgetingDocument55 pagesCash Flows Capital Budgetingvishal198900No ratings yet

- Taxation - Singapore (TX - SGP) : Applied SkillsDocument19 pagesTaxation - Singapore (TX - SGP) : Applied SkillsLee WendyNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- Chapter 2 Comprehensive IncomeDocument34 pagesChapter 2 Comprehensive IncomeKyla DizonNo ratings yet

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- Port Folio Number - 2007-MASDocument8 pagesPort Folio Number - 2007-MASAndreaNo ratings yet

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocument12 pagesA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineNo ratings yet

- Aditya LabDocument62 pagesAditya Labasthapatel.akpNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Taxation (Singapore) : March/June 2016 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2016 - Sample QuestionsJobsdudeNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- Table 15. Total Project CostDocument9 pagesTable 15. Total Project CostjaneNo ratings yet

- f6sgp 2017 Sep Dec Q PDFDocument10 pagesf6sgp 2017 Sep Dec Q PDFJobsdudeNo ratings yet

- Installment SalesDocument6 pagesInstallment SalesJeramae M. artNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Taxation (Singapore) : March/June 2018 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2018 - Sample QuestionsLee WendyNo ratings yet

- BTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsDocument21 pagesBTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsgatotkaNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Week 8 - TDocument6 pagesWeek 8 - TataseskiNo ratings yet

- Diaper Case StudyDocument5 pagesDiaper Case StudyAbhijeet SarodeNo ratings yet

- Amendment May - 2024Document5 pagesAmendment May - 2024VINOD KUMARNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Soal Quiz Cashflow KS-47Document6 pagesSoal Quiz Cashflow KS-47Sri Winarsih RamadanaNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Exhibits 5.9 and 5.10Document2 pagesExhibits 5.9 and 5.10Oscar PinillosNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocument12 pagesAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - Optionsnivethababu7No ratings yet

- London School of Commerce: AssignmentDocument12 pagesLondon School of Commerce: AssignmentMohammad Abu HurairaNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Taxes and Duties 2009-2010 - Layout 2Document14 pagesTaxes and Duties 2009-2010 - Layout 2Tonino Van WonterghemNo ratings yet

- CF Assignment 1 Group 4Document41 pagesCF Assignment 1 Group 4Radha DasNo ratings yet

- Ratio Problems 1Document6 pagesRatio Problems 1Vivek MathiNo ratings yet

- Capital Budgeting: YR Cash BenefitDocument12 pagesCapital Budgeting: YR Cash BenefitFarrukh AbbasNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Ee Assignment Lu 6Document6 pagesEe Assignment Lu 6NethiyaaRajendranNo ratings yet

- Tax On Mutual Funds and SharesDocument6 pagesTax On Mutual Funds and SharesGiri SukumarNo ratings yet

- Year of SaleDocument12 pagesYear of SaleDarius DelacruzNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Discussion Forum Unit 4Document1 pageDiscussion Forum Unit 4Renatus MalimbeNo ratings yet

- Discussion Unit 1 - Financial ManagementDocument2 pagesDiscussion Unit 1 - Financial ManagementRenatus MalimbeNo ratings yet

- PrEP PPT RVSDDocument29 pagesPrEP PPT RVSDRenatus MalimbeNo ratings yet

- Discussion Forum Unit 6Document1 pageDiscussion Forum Unit 6Renatus MalimbeNo ratings yet

WePROMOTE NPV Calculation Case Study Week 3

WePROMOTE NPV Calculation Case Study Week 3

Uploaded by

Renatus MalimbeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WePROMOTE NPV Calculation Case Study Week 3

WePROMOTE NPV Calculation Case Study Week 3

Uploaded by

Renatus MalimbeCopyright:

Available Formats

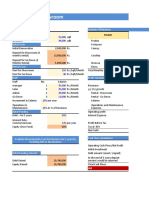

BUS 5110 Written Assignment 6 Solution

Required Rate of Return 8%

Given

$70,000 for the equipment with useful life of 5 years and no salvage value.

Expected annual revenues to be $30,000 per year

Expected annnual cash outflows to be $11,000 excluding deepreciation

Annual depreciation by straight-line method $14,000

Tax rate 30%

Dicount rate 6%

Revenues are estimated to be: Year 1 Year 2 Year 3 Year 4 Year 5

30,000 30,000 30,000 30,000 30,000

Cash Flows

Year 1 Year 2 Year 3 Year 4 Year 5 NPV

Purchase Price (70,000) - - - - -

Cash Outflows - (11,000) (11,000) (11,000) (11,000) (11,000)

Salvage Value - - - - - -

Cash Inflows - 30,000 30,000 30,000 30,000 30,000

Before Tax and Depreciation (70,000) 19,000 19,000 19,000 19,000 19,000

Depreciation (14,000) (14,000) (14,000) (14,000) (14,000)

Income Before Tax 5,000 5,000 5,000 5,000 5,000

Income Tax at 30% rate 1,500 1,500 1,500 1,500 1,500

Income After Tax 3,500 3,500 3,500 3,500 3,500

Cash Flows After Tax 17,500 17,500 17,500 17,500 17,500

Rate per Period at 6% 1.0000 0.9434 0.8900 0.8396 0.7921 0.7473

NetCashFlowXRate (70,000) 16,509 15,575 14,693 13,862 13,077 3,716

You might also like

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - Questionsalil naik100% (1)

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Written - Week 3Document6 pagesWritten - Week 3Syed Zeeshan ul HassanNo ratings yet

- Financial Analysis May Be Used To Test TheDocument8 pagesFinancial Analysis May Be Used To Test TheJohnAllenMarilla100% (1)

- D14 F6SGP QPDocument12 pagesD14 F6SGP QPchadyudilNo ratings yet

- Bus 5111 Week 3 Assignment FinancicalDocument3 pagesBus 5111 Week 3 Assignment FinancicalMohamedNo ratings yet

- Port Folio Number 2007 MASDocument8 pagesPort Folio Number 2007 MASSasa LuNo ratings yet

- F6SGP Dec2015q PDFDocument15 pagesF6SGP Dec2015q PDFDrift SirNo ratings yet

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- FinMan Case 2Document7 pagesFinMan Case 2Arly Kurt TorresNo ratings yet

- BUS5111 Unit3 Assignment SolutionDocument2 pagesBUS5111 Unit3 Assignment SolutionSyed Zeeshan ul HassanNo ratings yet

- FM - Chapter 3 - QuizDocument8 pagesFM - Chapter 3 - QuizHausland Const. Corp.No ratings yet

- Assignment 1Document7 pagesAssignment 1REJAY89No ratings yet

- Risk Analysis, Real Options and Capital BudgetingDocument28 pagesRisk Analysis, Real Options and Capital BudgetingArnab SenNo ratings yet

- Capital Budgeting - Problems & SolutionsDocument7 pagesCapital Budgeting - Problems & SolutionsbonduamrutharaoNo ratings yet

- Cash Flows Capital BudgetingDocument55 pagesCash Flows Capital Budgetingvishal198900No ratings yet

- Taxation - Singapore (TX - SGP) : Applied SkillsDocument19 pagesTaxation - Singapore (TX - SGP) : Applied SkillsLee WendyNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- Chapter 2 Comprehensive IncomeDocument34 pagesChapter 2 Comprehensive IncomeKyla DizonNo ratings yet

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- Port Folio Number - 2007-MASDocument8 pagesPort Folio Number - 2007-MASAndreaNo ratings yet

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocument12 pagesA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineNo ratings yet

- Aditya LabDocument62 pagesAditya Labasthapatel.akpNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Taxation (Singapore) : March/June 2016 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2016 - Sample QuestionsJobsdudeNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- Table 15. Total Project CostDocument9 pagesTable 15. Total Project CostjaneNo ratings yet

- f6sgp 2017 Sep Dec Q PDFDocument10 pagesf6sgp 2017 Sep Dec Q PDFJobsdudeNo ratings yet

- Installment SalesDocument6 pagesInstallment SalesJeramae M. artNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Taxation (Singapore) : March/June 2018 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2018 - Sample QuestionsLee WendyNo ratings yet

- BTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsDocument21 pagesBTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsgatotkaNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Week 8 - TDocument6 pagesWeek 8 - TataseskiNo ratings yet

- Diaper Case StudyDocument5 pagesDiaper Case StudyAbhijeet SarodeNo ratings yet

- Amendment May - 2024Document5 pagesAmendment May - 2024VINOD KUMARNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Soal Quiz Cashflow KS-47Document6 pagesSoal Quiz Cashflow KS-47Sri Winarsih RamadanaNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Exhibits 5.9 and 5.10Document2 pagesExhibits 5.9 and 5.10Oscar PinillosNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocument12 pagesAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - Optionsnivethababu7No ratings yet

- London School of Commerce: AssignmentDocument12 pagesLondon School of Commerce: AssignmentMohammad Abu HurairaNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Taxes and Duties 2009-2010 - Layout 2Document14 pagesTaxes and Duties 2009-2010 - Layout 2Tonino Van WonterghemNo ratings yet

- CF Assignment 1 Group 4Document41 pagesCF Assignment 1 Group 4Radha DasNo ratings yet

- Ratio Problems 1Document6 pagesRatio Problems 1Vivek MathiNo ratings yet

- Capital Budgeting: YR Cash BenefitDocument12 pagesCapital Budgeting: YR Cash BenefitFarrukh AbbasNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Ee Assignment Lu 6Document6 pagesEe Assignment Lu 6NethiyaaRajendranNo ratings yet

- Tax On Mutual Funds and SharesDocument6 pagesTax On Mutual Funds and SharesGiri SukumarNo ratings yet

- Year of SaleDocument12 pagesYear of SaleDarius DelacruzNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Discussion Forum Unit 4Document1 pageDiscussion Forum Unit 4Renatus MalimbeNo ratings yet

- Discussion Unit 1 - Financial ManagementDocument2 pagesDiscussion Unit 1 - Financial ManagementRenatus MalimbeNo ratings yet

- PrEP PPT RVSDDocument29 pagesPrEP PPT RVSDRenatus MalimbeNo ratings yet

- Discussion Forum Unit 6Document1 pageDiscussion Forum Unit 6Renatus MalimbeNo ratings yet