Professional Documents

Culture Documents

Become Expert Mathematics 101 True

Become Expert Mathematics 101 True

Uploaded by

moviestp0Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Become Expert Mathematics 101 True

Become Expert Mathematics 101 True

Uploaded by

moviestp0Copyright:

Available Formats

Evidence Submitted by The Royal Society

1. The Royal Society’s Advisory Committee on Mathematics Education (RS ACME) has been

investigating the mathematical competencies that will be needed for citizens and society to thrive

in the future. Evidence gathered for this programme, Mathematical Futures, and published in

September 2023, has confirmed the importance of financial education as part of a proposed ‘new

approach to mathematical and data education’.

2. RS ACME has long held the view that an important outcome of schools and college mathematics

should be the ‘appreciation of the purpose and usefulness of mathematics and willingness to use

it’ (ACME, The Mathematical Needs of Learners, 2011). This usefulness is clear in the context of

personal finance.

3. In his written evidence to the Prime Minister’s Expert Advisory Group on Maths to 18, June 2023,

President of the Royal Society, Sir Adrian Smith, made the following statement in response to the

question ‘What knowledge do young people need to manage their own finances?’

***

It is increasingly important to empower young people by strengthening their numeracy skills so that they

understand how to manage their finances, so they can budget, save or, where necessary, challenge false

claims when making purchases, large or small. The risks to individuals who lack knowledge are heightened

by the move away from cash to ‘virtual money’, where quantities are far less tangible.

The need to be numerate is not, however, limited to financial matters. In an age of misinformation, an

informed democratic citizenry needs to be data literate, too, so they are better placed to make informed

decisions around policy issues relevant to their day-to-day decision making.

The charity National Numeracy have identified the essentials required for adult numeracy. These include

many references to personal finance to which we would draw your attention.

To manage their finances, young people need a level of numeracy suited to the complexity of the task, but

also an age-appropriate awareness of how to apply numeracy ‘tools’ to a problem involving money.

Examples of specific knowledge to be acquired by school-leaving age to support effective management of

personal finances would include:

• understanding tax calculations and how the government spends money from

taxation

• understanding discounts and rates of interest when shopping/saving

• understanding inflation

• understanding exchange rates

• knowing what to do with gifted or inherited money, property etc

• understanding risk – eg related to betting/investments

4. From the Mathematical Futures Programme paper ‘A new approach to mathematics and data

education’, the Society’s view is that is General Quantitative Literacy (GQL) underpins specific

financial education. GQL complements other aspects of mathematical and data education,

namely Foundational and Advanced Mathematics, and Domain-specific Competencies.

RS ACME defines GQL as:

‘…the ability to use and apply mathematical concepts and use digital tools to solve real-world quantitative

problems. It is developed throughout education and is essential for operating effectively in daily life and

work. Confidence and fluency in general arithmetic and proportional reasoning are its foundations, together

with an appreciation of presenting and interpreting data. GQL underpins the ability to take a critical view of

arguments that are based on mathematics and data. Examples of GQL are the ability to calculate the

affordability of a payday loan or mortgage, or the ability to critique quantitative claims made in advertising

or the media.

It is the Society’s view, therefore, that children and young people need to gain the confidence and fluency

to know when and how to apply their quantitative skills to a range of situations they will encounter in the

world beyond school. For younger children, these situations may involve saving up pocket money for a treat

or how to divide up their treat among friends; for older students it may be working out the best deal on a

mobile phone contract or calculating the time to allow for a journey on public transport.

Not all applications of quantitative skills will be finance related. We would not propose emphasising the

financial applications above all other situations where GQL has a problem-solving role.

The ability to know what and how mathematics can be used to solve different problems should be

encouraged and explicitly taught in very many areas of the curriculum – not only in mathematics lessons.

5. In response to specific questions posed by the Inquiry:

• What should we be teaching young people about money? What should financial education include

and are there any aspects missing from the current provision?

See statement above from Sir Adrian Smith.

• Where should financial education sit within the National Curriculum between the ages of 11 and 16? To

what extent does its current position within the curriculum limit the amount of delivery time it receives?

Should financial education form part of a core subject, such as mathematics?

Our proposed new approach, ‘Mathematics and data education’, would provide the tools for financial

literacy, and its relevance would extend well beyond the mathematics classroom.

• What steps should be taken to support teachers and schools in their delivery of financial education?

Changes suggested by ‘A new approach to mathematics and data education’ are long term and recognise

the need to support teachers. The Society has long advocated that teachers should be entitled to 35 hours

of subject specific professional development each year. In our vision, all teachers would take part in

professional development of GQL both within their early training (ITTECF) and ongoing CPD.

• Should the provision of financial education in schools be extended beyond key stages three and four?

Is there scope for it to be embedded more extensively at primary-school level?

Pupils and students at all ages should learn about the usefulness of mathematics and data to help

solve problems in age-appropriate contexts across the curriculum and beyond school.

• The Government has outlined proposals to ensure that all students study some form of maths up until

the age of 18 – should financial education be included in these plans and, if so, how?

Financial education should continue as part of GQL for all students until they leave school or college. Some

students will benefit from Core Maths Qualifications which use mathematical concepts in a range of

authentic real-world contexts. The Royal Society strongly advocates greater take up of these qualifications

and the development of similar qualifications at level 2 (see Summary of the Royal Society’s responses to

the Department for Education’s consultation on reforming post-16 qualifications in England | Royal

Society) .

March 2024

You might also like

- Part 4 System Approach of Educational PlanningDocument5 pagesPart 4 System Approach of Educational PlanningCherry Rose Sumalbag100% (3)

- Competency Statement 1Document2 pagesCompetency Statement 1Kawthar Kassab100% (1)

- Financial LiteracyDocument32 pagesFinancial LiteracyIllyn Lumilyn Santos100% (1)

- Eden E. Esmeralda Prof. de Guzman MEM-1EDocument2 pagesEden E. Esmeralda Prof. de Guzman MEM-1EGarden EmeraldNo ratings yet

- Financial Literacy of Students at Thainguyen University of Technology - A Literature ReviewDocument7 pagesFinancial Literacy of Students at Thainguyen University of Technology - A Literature ReviewIjbmm JournalNo ratings yet

- 8625 Paper PDFDocument10 pages8625 Paper PDFMuhammad SohaibNo ratings yet

- Improving Financial Literacy Through Teaching Materials On Managing Finance For MillennialsDocument5 pagesImproving Financial Literacy Through Teaching Materials On Managing Finance For MillennialsshandrinelobatonNo ratings yet

- 5 Chapter Thesis RenaLihayLihay#updatedDocument146 pages5 Chapter Thesis RenaLihayLihay#updatedRena LihaylihayNo ratings yet

- Finance Education Is Imperative For Enhancing Financial Capability of Indian CitizensDocument10 pagesFinance Education Is Imperative For Enhancing Financial Capability of Indian CitizensrashmiamittalNo ratings yet

- pidato.-WPS OfficeDocument3 pagespidato.-WPS OfficebramantyoponorogoNo ratings yet

- Financial Education in Malaysian Primary Schools CurriculumDocument7 pagesFinancial Education in Malaysian Primary Schools CurriculumInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- HBS Keynote TextDocument11 pagesHBS Keynote TextfeasprerNo ratings yet

- ES 20181001 Financial Literacy RecommendationsDocument21 pagesES 20181001 Financial Literacy RecommendationsNaja Gaming100% (1)

- Research 2Document11 pagesResearch 2MAXIMMIN VIERNESNo ratings yet

- Challenges in MathematicsDocument15 pagesChallenges in MathematicsFaith Pelle JaboneteNo ratings yet

- LABOUR MARKET INFORMATION SYSTEM CompilationDocument13 pagesLABOUR MARKET INFORMATION SYSTEM CompilationChidiNo ratings yet

- World Development ReportDocument22 pagesWorld Development ReportRaj AryanNo ratings yet

- Fiscal ManagementDocument43 pagesFiscal ManagementCyrell E. ToribioNo ratings yet

- Krizia Alexa WPS OfficeDocument14 pagesKrizia Alexa WPS OfficeKrizia TejereroNo ratings yet

- 1 FL Overview Complete Dec 3 2011Document51 pages1 FL Overview Complete Dec 3 2011Linda LeungNo ratings yet

- Pocket Money - A Proposal For Imparting Financial Education To School Students - WebsiteDocument6 pagesPocket Money - A Proposal For Imparting Financial Education To School Students - WebsiteBala MuruganNo ratings yet

- Final Chap 1 5 1 1Document33 pagesFinal Chap 1 5 1 1emarites ronquilloNo ratings yet

- Thiri Mon (Refine)Document4 pagesThiri Mon (Refine)Moe Myint Myint HtunNo ratings yet

- The Effectiveness of Youth Financial Education A Review of The LiteratureDocument23 pagesThe Effectiveness of Youth Financial Education A Review of The LiteratureMădălina MarincaşNo ratings yet

- Icts For Education and Building Human CapitalDocument28 pagesIcts For Education and Building Human CapitalKannan LetchmananNo ratings yet

- Bataan Peninsula State University MissionDocument8 pagesBataan Peninsula State University MissionRonnell AngelesNo ratings yet

- Mhike - Financial Education Policy of DEPEDDocument99 pagesMhike - Financial Education Policy of DEPEDRussel TamayoNo ratings yet

- Towards Digital and Financial Literacy (November-2019)Document5 pagesTowards Digital and Financial Literacy (November-2019)Periyasamy KalaivananNo ratings yet

- Research Red HorseDocument54 pagesResearch Red HorseMi-cha ParkNo ratings yet

- IndayxxDocument1 pageIndayxxJT SaguinNo ratings yet

- Methodologies of Educational PlanningDocument11 pagesMethodologies of Educational PlanningoderindeajokealiceNo ratings yet

- A2 Market Failure Tuition Fees Case StudyDocument6 pagesA2 Market Failure Tuition Fees Case Studypunte77100% (1)

- Enabling Financial Capability Along The Road To Financial InclusionDocument18 pagesEnabling Financial Capability Along The Road To Financial InclusionCenter for Financial InclusionNo ratings yet

- Financial Literacy, Management Practices of Public Elementary School Teachers: An Input To Teacher Financial Management PlanDocument3 pagesFinancial Literacy, Management Practices of Public Elementary School Teachers: An Input To Teacher Financial Management PlanKristine G. BatanesNo ratings yet

- International Review of Economics Education: Aisa Amagir, Wim Groot, Henriëtte Maassen Van Den Brink, Arie Wilschut TDocument15 pagesInternational Review of Economics Education: Aisa Amagir, Wim Groot, Henriëtte Maassen Van Den Brink, Arie Wilschut TWawanNo ratings yet

- Good Practice in Primary Mathematics: Evidence From 20 Successful SchoolsDocument4 pagesGood Practice in Primary Mathematics: Evidence From 20 Successful Schoolsapi-105903956No ratings yet

- Citi Center For Financial LiteracyDocument60 pagesCiti Center For Financial LiteracyShankar JhaNo ratings yet

- Digital Literacy Research Final 16Document20 pagesDigital Literacy Research Final 16jqrnyswqwsNo ratings yet

- Master Book of Financial Education A System To Live BetterDocument20 pagesMaster Book of Financial Education A System To Live BetterScribdTranslationsNo ratings yet

- Economics of Education Review: Annamaria Lusardi, Pierre-Carl Michaud, Olivia S. MitchellDocument13 pagesEconomics of Education Review: Annamaria Lusardi, Pierre-Carl Michaud, Olivia S. MitchellAnderson PazNo ratings yet

- GM Skills Intelligence Pack Education Jan 2022Document59 pagesGM Skills Intelligence Pack Education Jan 2022Mathew PanickerNo ratings yet

- National Standards For Financial LiteracyDocument42 pagesNational Standards For Financial LiteracyJun Yu LinNo ratings yet

- La Falta de Educacion FinancieraDocument3 pagesLa Falta de Educacion FinancieraLeydi Condori aroniNo ratings yet

- Thesis On School Financial ManagementDocument8 pagesThesis On School Financial Managementkimberlyharrisbaltimore100% (2)

- Financial Literacy of Teachers and School Heads in The Division of Marinduque: Basis For Financial Education Enhancement ProgramDocument12 pagesFinancial Literacy of Teachers and School Heads in The Division of Marinduque: Basis For Financial Education Enhancement ProgramPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Lecture 3 Methodologies Approaches To Educational PlanningDocument12 pagesLecture 3 Methodologies Approaches To Educational Planningsamson egoNo ratings yet

- Economics and Business Levels 9 and 10 The Australian EconomyDocument10 pagesEconomics and Business Levels 9 and 10 The Australian EconomyRaj TakhtaniNo ratings yet

- 34 1 Guest BrimbleDocument5 pages34 1 Guest BrimbleGeorge BrownNo ratings yet

- Analyze The Impact of Financial Literacy On Poverty-Prevention Strategies in Families: A Case Study in Bengaluru Rural DistrictDocument8 pagesAnalyze The Impact of Financial Literacy On Poverty-Prevention Strategies in Families: A Case Study in Bengaluru Rural District2221624No ratings yet

- Finance For EveryoneDocument50 pagesFinance For EveryoneAnujNo ratings yet

- Taking A Stand EssayDocument6 pagesTaking A Stand Essayapi-534479010No ratings yet

- Newly 2Document52 pagesNewly 2hghjsgdNo ratings yet

- Financial Management Thesis Titles PhilippinesDocument8 pagesFinancial Management Thesis Titles Philippinesdiasponibar1981100% (3)

- Approaches of Educational Planning: 1. Social Demand ApproachDocument4 pagesApproaches of Educational Planning: 1. Social Demand ApproachahllenNo ratings yet

- Thesis Topics On Financial LiteracyDocument6 pagesThesis Topics On Financial Literacyfjjf1zqp100% (2)

- Financial LiteracyDocument7 pagesFinancial LiteracyJave MamontayaoNo ratings yet

- Financial Literacy - Reserve Bank of India's InitiativesDocument4 pagesFinancial Literacy - Reserve Bank of India's InitiativesShankar JhaNo ratings yet

- Chapter 07 - Financial Literacy RBI InitiativesDocument4 pagesChapter 07 - Financial Literacy RBI Initiativesshubhram2014No ratings yet

- Thesis Topics For Bba FinanceDocument6 pagesThesis Topics For Bba Financeafjrtdoda100% (2)

- The Investment Case For SDG 4 DataDocument49 pagesThe Investment Case For SDG 4 DataANubhavNo ratings yet

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- 10.4324 9781410607218-3 ChapterpdfDocument51 pages10.4324 9781410607218-3 Chapterpdfmoviestp0No ratings yet

- 10.2478 Amns.2021.2.00268-MathematicsDocument14 pages10.2478 Amns.2021.2.00268-Mathematicsmoviestp0No ratings yet

- 10.4324 9780203012505-5 ChapterpdfDocument17 pages10.4324 9780203012505-5 Chapterpdfmoviestp0No ratings yet

- Arithmetic Advanced Exam PrepDocument14 pagesArithmetic Advanced Exam Prepmoviestp0No ratings yet

- Lesson Plan Basic Tools and Equipment - LunaDocument5 pagesLesson Plan Basic Tools and Equipment - LunaRegine Lozano LunaNo ratings yet

- Kahoot Lesson PlanDocument2 pagesKahoot Lesson Planapi-361085000No ratings yet

- Cse DISTRICT ACTION PLAN PAMANDocument3 pagesCse DISTRICT ACTION PLAN PAMANMigs MigueNo ratings yet

- Setswana: Tel: 011 484 6245 Info@molteno - Co.za WWW - Vulabula.co - ZaDocument63 pagesSetswana: Tel: 011 484 6245 Info@molteno - Co.za WWW - Vulabula.co - ZaTendai TaruvingaNo ratings yet

- Ph.D. RegulationsDocument28 pagesPh.D. RegulationsHarikrishna Rajan67% (3)

- Essay: Is Co-Education Better For Students Than Single-Sex EducationDocument3 pagesEssay: Is Co-Education Better For Students Than Single-Sex EducationYan TongNo ratings yet

- How To Apply: Degree Programmes Held in English Without Admission ExamDocument10 pagesHow To Apply: Degree Programmes Held in English Without Admission ExamMuhammad AslamNo ratings yet

- EssentialismDocument23 pagesEssentialismAya MinaNo ratings yet

- BhuDocument8 pagesBhuDeepak ThakurNo ratings yet

- REFLECTION JOURNAL First QuarterDocument2 pagesREFLECTION JOURNAL First QuarterGeriza RicoNo ratings yet

- Adapted Group Kickball Lesson PlanDocument7 pagesAdapted Group Kickball Lesson Planapi-645685343No ratings yet

- 100+ Decision Making Questions With Solution: Daily VisitDocument29 pages100+ Decision Making Questions With Solution: Daily VisitDrKirti SharmaNo ratings yet

- CCRB - Nextstepplan - Next Step Plan Template FormDocument5 pagesCCRB - Nextstepplan - Next Step Plan Template Formlea bantingNo ratings yet

- Peer Observation 1Document4 pagesPeer Observation 1api-315857509No ratings yet

- Computer Skills Assessment For TeachersDocument7 pagesComputer Skills Assessment For TeachersShena Kerl VioletaNo ratings yet

- NCMB 419 Midterm ReviewerDocument45 pagesNCMB 419 Midterm ReviewerMARIA KYLA PAMA100% (1)

- Classification of Educational ResearchDocument60 pagesClassification of Educational ResearchMuhammad Hidayatul Rifqi67% (9)

- A Mental Model of Predict-Observe-Explain (POE) Strategy As Thinking Skill To Promote Scientific LiteracyDocument13 pagesA Mental Model of Predict-Observe-Explain (POE) Strategy As Thinking Skill To Promote Scientific LiteracyPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Formatierung Dissertation Hu BerlinDocument7 pagesFormatierung Dissertation Hu BerlinBuyPapersOnlineCanada100% (1)

- Brigada Action Plan - ReaDocument4 pagesBrigada Action Plan - Reaglecy alquizaNo ratings yet

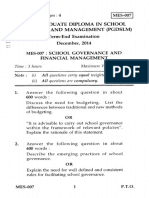

- Mes 007Document4 pagesMes 007dr_ashishvermaNo ratings yet

- Essay B1 B2 C1 Writing Reference Gold B2 0Document13 pagesEssay B1 B2 C1 Writing Reference Gold B2 0Carmen ReinaNo ratings yet

- Disciplines and Ideas in The Applied Social SciencesDocument23 pagesDisciplines and Ideas in The Applied Social SciencesAndrelle Josh Rosaceña100% (1)

- Strategic Trajectories An In-Depth Exploration - Fix EditingDocument15 pagesStrategic Trajectories An In-Depth Exploration - Fix Editingjillian.neatheyNo ratings yet

- Eumind Group 2Document5 pagesEumind Group 2api-538632185No ratings yet

- International Association of Universities #1Document21 pagesInternational Association of Universities #1icetscribdNo ratings yet

- Business Finance - PDF 1Document339 pagesBusiness Finance - PDF 1Paul RicoNo ratings yet

- Text 1Document3 pagesText 1N.T. Loan100% (1)

- Q3 Week 2 Day3 English 8 Propaganda TechniquesDocument5 pagesQ3 Week 2 Day3 English 8 Propaganda TechniquestakiawansofiaNo ratings yet