Professional Documents

Culture Documents

BIZ Plan CFL Summary 2023.2028

BIZ Plan CFL Summary 2023.2028

Uploaded by

rj.ashoorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIZ Plan CFL Summary 2023.2028

BIZ Plan CFL Summary 2023.2028

Uploaded by

rj.ashoorCopyright:

Available Formats

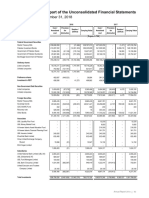

Tair Airways Cash Flow Chart 285,520,499

300,000,000 263,501,851 -

250,000,000 230,228,535

208,209,887

(50,000,000)

200,000,000 164,404,987

150,000,000 (100,000,000)

100,000,000 (124,632,764) (130,552,776)

(144,065,128) (150,000,000)

50,000,000 (159,943,484)

(173,129,534)

- (200,000,000)

1 2 3 4 5

Series1 164,404,987 208,209,887 230,228,535 263,501,851 285,520,499

Series2

Series3 (124,632,764) (130,552,776) (144,065,128) (159,943,484) (173,129,534)

Years 1 2 3 4 5

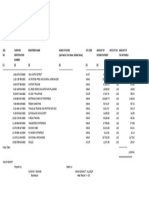

Tair Airways Net Cashflow 2023-2028 2023-2024 2024-2025 2025-2026 2026-2027 2027-2028

net cash inflow from operations (before corp tax) 164,404,987 208,209,887 230,228,535 263,501,851 285,520,499 1,151,865,760

Debt Leverage - financing (50,000,000)

net cash outflow from operations ( (+) corp tax) (103,550,000) (124,632,764) (130,552,776) (144,065,128) (159,943,484) (173,129,534) (732,323,686)

net cash flow (153,550,000) 39,772,223 77,657,111 86,163,407 103,558,367 112,390,965

Cumulative cash flow 39,772,223 117,429,335 203,592,742 307,151,109 419,542,074

Tair Airways IRR - leveraged 38%

Tair Airways NVP-IRR - leveraged 0%

Tair Airways MIRR - leveraged 37%

You might also like

- Capitec Statement NewDocument4 pagesCapitec Statement NewCindyNo ratings yet

- AdmissionLetter - 23070900177 GLA UniversityDocument2 pagesAdmissionLetter - 23070900177 GLA UniversityAyush AryanNo ratings yet

- CMA - Case Study Blades PTY LTDDocument6 pagesCMA - Case Study Blades PTY LTDRizaNurfadliWirasasmita67% (3)

- Moderna Inc DCF ValuationDocument4 pagesModerna Inc DCF ValuationFabianNo ratings yet

- 423 BOD & Budget ForecastDocument19 pages423 BOD & Budget ForecastshariqwaheedNo ratings yet

- Purchase Accrual Subsequent PositionDocument51 pagesPurchase Accrual Subsequent PositionArslanNo ratings yet

- Neraca Saldo No - Akun Keterangan: PT Peta 31 DESEMBER 2012 DAN 2011Document11 pagesNeraca Saldo No - Akun Keterangan: PT Peta 31 DESEMBER 2012 DAN 2011Rimba TistaNo ratings yet

- Acson Catalogue Ducted Blower Standard CAT-ADB-1301Document20 pagesAcson Catalogue Ducted Blower Standard CAT-ADB-1301Dak SerikNo ratings yet

- TIMOR (29112023) - 100mwDocument24 pagesTIMOR (29112023) - 100mwhuskyjackNo ratings yet

- Ent300 - Business Plan - CashDocument2 pagesEnt300 - Business Plan - CashNUR SYAZREEN MOHD JURAINANo ratings yet

- May Project Reports FinalDocument70 pagesMay Project Reports FinalWilton MwaseNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- Terjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TDocument9 pagesTerjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TYudhi SutanaNo ratings yet

- FY2005 BudgetDocument18 pagesFY2005 BudgetCity of Santa CruzNo ratings yet

- UBL Annual Report 2018-94Document1 pageUBL Annual Report 2018-94IFRS LabNo ratings yet

- Five Year Summary - Group: Balance SheetDocument1 pageFive Year Summary - Group: Balance SheetSab KeelsNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Island Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Document4 pagesIsland Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Ruma RashydNo ratings yet

- Cash Priority ProgramDocument2 pagesCash Priority ProgramDianne TorresNo ratings yet

- Mcdonald'S Corp.: Consolidated Cash Flow StatementDocument2 pagesMcdonald'S Corp.: Consolidated Cash Flow StatementDhruwan ShahNo ratings yet

- Alpha ListDocument4 pagesAlpha ListJessalyn SaldoNo ratings yet

- LBO Model Cash Flow Pre LBODocument2 pagesLBO Model Cash Flow Pre LBOHamkadNo ratings yet

- ECRL DT Works - Westports Yard Discussion Freight FrequencyDocument5 pagesECRL DT Works - Westports Yard Discussion Freight FrequencyZaki 7070No ratings yet

- Bantayan BountyDocument227 pagesBantayan BountybgelbolingoNo ratings yet

- Solution For Practice QuestDocument6 pagesSolution For Practice Questabdulsammad13690No ratings yet

- Alphalis 1604E 2020Document1 pageAlphalis 1604E 2020Bhem Fernandez RomeroNo ratings yet

- PDF MTD 11012023Document1 pagePDF MTD 11012023Alex CumaNo ratings yet

- Mj-1763-Us Slab Gate Valve Technical MJ PDFDocument12 pagesMj-1763-Us Slab Gate Valve Technical MJ PDFdiuska13No ratings yet

- Budget 2023hhhhDocument27 pagesBudget 2023hhhhMajid KhanNo ratings yet

- Less Clossing Stock (23,590) (15,360)Document2 pagesLess Clossing Stock (23,590) (15,360)Elvis CharendaNo ratings yet

- Sept Pres JeanDocument5 pagesSept Pres Jeangertk6No ratings yet

- 2019 Revenue Expenses January February March April May June July August September October November DecemberDocument7 pages2019 Revenue Expenses January February March April May June July August September October November DecemberFiruza AfandiyevaNo ratings yet

- E 00175Document114 pagesE 00175Lieven VermeulenNo ratings yet

- Bengkel Trijoyo Neraca Lajur Per 31 Desember 2018Document3 pagesBengkel Trijoyo Neraca Lajur Per 31 Desember 2018NuziafNo ratings yet

- Sec 44 Trade Payabel & ReceivableDocument4 pagesSec 44 Trade Payabel & ReceivableITR MUMBAINo ratings yet

- JMA 2021 BudgetDocument8 pagesJMA 2021 BudgetJerryJoshuaDiazNo ratings yet

- Investment Detective V.01 - Syndicate 4Document6 pagesInvestment Detective V.01 - Syndicate 4Yossi OktavianiNo ratings yet

- Financial PlanDocument8 pagesFinancial Plangr.4pascalNo ratings yet

- Cash Flow For Apple Inc (AAPL) From MorningstarDocument2 pagesCash Flow For Apple Inc (AAPL) From MorningstarAswin P SubhashNo ratings yet

- Petty Expense Neev InternationalDocument4 pagesPetty Expense Neev InternationalChujja ChuNo ratings yet

- FINANCIAL PLAN - Non-FiduciaryDocument15 pagesFINANCIAL PLAN - Non-Fiduciarygr.4pascalNo ratings yet

- Super SolDocument2 pagesSuper Solacastillo1339No ratings yet

- 1077 - 1668512541506.23 - PublishDocument12 pages1077 - 1668512541506.23 - PublishjdNo ratings yet

- Boracay Newcoast - Final Budget - 03!15!21Document226 pagesBoracay Newcoast - Final Budget - 03!15!21Juan Antonio TrinidadNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- ToyWorld ClassDocument14 pagesToyWorld ClasshamedkharrazNo ratings yet

- Costing Solution: Ahmed Raza Mir, ACADocument2 pagesCosting Solution: Ahmed Raza Mir, ACAANo ratings yet

- Auto Company Model v2Document7 pagesAuto Company Model v2SobiyaNo ratings yet

- Projected Profit and Loss 2023Document6 pagesProjected Profit and Loss 2023Emmanuel LaysonNo ratings yet

- Clearing BalancingDocument5 pagesClearing BalancingIbrar HussainNo ratings yet

- PTCL WPRKDocument3 pagesPTCL WPRKMUHAMMAD ALINo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- CMA - Case Study Blades PTY LTDDocument6 pagesCMA - Case Study Blades PTY LTDRizaNurfadliWirasasmitaNo ratings yet

- Perhitungan Working Hours DiggerDocument120 pagesPerhitungan Working Hours Diggerosmaini sutraNo ratings yet

- LakeHouse Combined SU 6-28-16 PDFDocument1 pageLakeHouse Combined SU 6-28-16 PDFRecordTrac - City of OaklandNo ratings yet

- Wire Size and Amp Ratings PDFDocument3 pagesWire Size and Amp Ratings PDFOladunni AfolabiNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- Mte13ii Oc77 - 1331 D030 SCRD FSR 001 - 0Document4 pagesMte13ii Oc77 - 1331 D030 SCRD FSR 001 - 0Miguel Puma SuclleNo ratings yet

- Salarios y PrestacionesDocument2 pagesSalarios y PrestacionesWalner Elias Asprilla MosqueraNo ratings yet

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDocument13 pagesA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- 02-Profit & Loss Dept Eng-0323Document1 page02-Profit & Loss Dept Eng-0323Alvian FajarNo ratings yet

- Topic 5 - Working Capital Management SlidesDocument26 pagesTopic 5 - Working Capital Management SlidesDr-Wasim Abbas ShaheenNo ratings yet

- Term Paper On Financial Ratio AnalysisDocument5 pagesTerm Paper On Financial Ratio Analysisc5s8r1zc100% (1)

- Assessing Fund Based and Non Fund Based CreditDocument72 pagesAssessing Fund Based and Non Fund Based CredititsurarunNo ratings yet

- Bank of England and The British EmpireDocument196 pagesBank of England and The British Empirejuliusevola1No ratings yet

- Journal Entry QuestionsDocument2 pagesJournal Entry QuestionsFarman Afzal100% (1)

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- Stc01914 FJ Cash Evaluation Report 2023 Designed FinalDocument68 pagesStc01914 FJ Cash Evaluation Report 2023 Designed FinalDianaNo ratings yet

- 01.cashless Policy and The Nigerian PaymentDocument23 pages01.cashless Policy and The Nigerian PaymentGlory ImowoNo ratings yet

- Cash ManagementDocument13 pagesCash ManagementMeah Claire AgpuldoNo ratings yet

- Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions ManualDocument38 pagesInterpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manualhudsoncolepiu100% (19)

- Unit 1 Vouching - 1 - FinalDocument12 pagesUnit 1 Vouching - 1 - Finalshoaib shaikhNo ratings yet

- Business 10 - Module 7Document5 pagesBusiness 10 - Module 7carrisanicole2No ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- View Statement 3Document1 pageView Statement 3pierobalassone71No ratings yet

- Bom VSPD From 2010 Till Date Obtained Through Rti - PagenumberDocument48 pagesBom VSPD From 2010 Till Date Obtained Through Rti - PagenumberDIPAK VINAYAK SHIRBHATENo ratings yet

- IDBI ProjectDocument46 pagesIDBI Projectfardeenansari 646No ratings yet

- IA1-Handouts-01-Cash and Cash EquivalentsDocument5 pagesIA1-Handouts-01-Cash and Cash EquivalentsJessie John Credo Jr.No ratings yet

- Finance BE7Document23 pagesFinance BE7Yanah Zia CalachanNo ratings yet

- 9 Ems Acc Revision Test Term 2 2022 GoDocument6 pages9 Ems Acc Revision Test Term 2 2022 GoEstelle EsterhuizenNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument327 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falseadityatiwari122006No ratings yet

- FABM2 Module 5. Statement of Cash FlowsDocument7 pagesFABM2 Module 5. Statement of Cash FlowsSITTIE RAYMAH ABDULLAHNo ratings yet

- New Rules of MoneyDocument2 pagesNew Rules of MoneyTKNo ratings yet

- Tally Practical ProblemsDocument13 pagesTally Practical Problemsafreenbanukatchi100% (1)

- Digital Payments IndiaDocument23 pagesDigital Payments IndiaLakshay SolankiNo ratings yet

- Intacc 1 Notes Part 1Document13 pagesIntacc 1 Notes Part 1Crizelda BauyonNo ratings yet

- 7 July 2021Document32 pages7 July 2021Aditya PrajapatiNo ratings yet

- Randy Goode Citi Bank StatementDocument4 pagesRandy Goode Citi Bank Statementalihussle3200blxkNo ratings yet

- January 2023 Bank AccountDocument4 pagesJanuary 2023 Bank AccountleratokwNo ratings yet