Professional Documents

Culture Documents

Adv Firmer Action Warning Letter Mygov 5741076486676

Adv Firmer Action Warning Letter Mygov 5741076486676

Uploaded by

Justin EllingsenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Firmer Action Warning Letter Mygov 5741076486676

Adv Firmer Action Warning Letter Mygov 5741076486676

Uploaded by

Justin EllingsenCopyright:

Available Formats

1320022102211222123021122111010021201122202021200033313003321132013

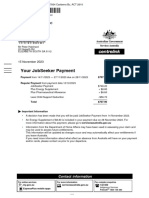

MR JUSTIN P ELLINGSEN Our reference: 5741076486676

37 COTTSWOLD AV Phone: 13 11 42

NARRE WARREN VIC 3805

Client ID: 185 451 381

10 October 2023

Pay your debt now or we will take Total overdue

$14,673.22

collection action

› You need to pay or contact us by 24 October 2023 to avoid collection action

› This can include taking money from your bank, employer or other creditor to pay

your debt

Dear JUSTIN,

PAY NOW

We have notified you previously but you still haven't paid your debts. The

total amount you owe is: Your payment reference

number (PRN) is:

001001854513819659

Account Type Amount owing

Activity Statement / 1 $14,673.22 BPAY®

Biller code: 75556

If you have paid the total balance in the last seven days, you don't need to Ref: 001001854513819659

do anything else. To find out how to view a more detailed breakdown of your

account visit ato.gov.au/howmuchyouowe Telephone & Internet Banking

- BPAY®

Contact your bank or financial

What you need to do institution to make this payment

from your cheque, savings,

By 24 October 2023 you need to pay your overdue debt of $14,673.22 in debit or credit card account.

full using one of the payment methods listed. More info: www.bpay.com.au

If you are unable to pay in full, visit ato.gov.au/payingtheato for information CREDIT OR DEBIT CARD

to help you manage your debts, including payment plans.

Pay online with your credit

Each day your debt isn't paid, it may increase. This is because general or debit card at

interest charges (GIC) may apply on any overdue balance until the whole www.governmenteasypay.

gov.au/PayATO

amount is paid. To find out more about interest including the current rate,

or phone 1300 898 089.

visit ato.gov.au/gic A card payment fee applies.

OTHER PAYMENT OPTIONS

For other payment options, visit

ato.gov.au/paymentoptions

E00000-S00000-F1378802 Page 1 of 2 70571.102123-09-2021

Need help?

If you are finding it difficult to pay your debts, you can phone us on 13 11 42 between 8.00am and 6.00pm,

Monday to Friday to discuss options to help you, including entering a payment plan if you are unable to pay the

total amount.

When you call

Please have your tax file number with you when you call. It will also be helpful if you can tell us the 'Our reference'

number at the top of this letter.

If you don't pay

We are authorised under tax law to collect this debt. We can:

› direct your bank, employer or other third party to pay money from your bank account, wages or other payment

directly to us

› recover company debts from you personally as a director of a company

› hire a debt collection agency to collect payment on our behalf, or

› begin bankruptcy or liquidation proceedings.

Most people pay their tax on time and, in doing so, help pay for the essential services we all need and use.

For information on budgeting for tax and preventing debt, you can visit ato.gov.au/managingpayments where we

have tips available to help you stay on track, including making pre-payments to get ahead.

Your rights and obligations

For information about your rights and obligations go to ato.gov.au/taxpayerscharter

Yours sincerely,

David Allen

Deputy Commissioner of Taxation

HOW TO PAY

Your payment reference number (PRN) is: 001001854513819659

BPAY® CREDIT OR DEBIT CARD

Pay online with your credit or debit card at

Biller code: 75556

www.governmenteasypay.gov.au/PayATO

Ref: 001001854513819659

To pay by phone, call the Government EasyPay service on 1300 898 089.

Telephone & Internet Banking – BPAY®

A card payment fee applies.

Contact your bank or financial institution

to make this payment from your cheque,

OTHER PAYMENT OPTIONS

savings, debit or credit card account.

More info: www.bpay.com.au For other payment options, visit ato.gov.au/paymentoptions

Page 2 of 2

You might also like

- Statement - Nov 2019 2Document13 pagesStatement - Nov 2019 2Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- Walaa Network 2022 شبكة التغطية الصحية-تامين شركة ولاءDocument1 pageWalaa Network 2022 شبكة التغطية الصحية-تامين شركة ولاءMohammed SulimanNo ratings yet

- Billing Summary Contact Us: Date Item AmountDocument2 pagesBilling Summary Contact Us: Date Item AmountPrince Marcos CortezNo ratings yet

- EFT Form - Fillable - LifeDocument2 pagesEFT Form - Fillable - LifeZachNo ratings yet

- Tax Deduction Sheet Paid Money in 2021Document6 pagesTax Deduction Sheet Paid Money in 2021rasool mehrjooNo ratings yet

- FAO Reco Account Payable J285611951Document3 pagesFAO Reco Account Payable J285611951dotaemumNo ratings yet

- Bill - August 11, 2022Document6 pagesBill - August 11, 2022Kayla McKenzieNo ratings yet

- Overdue Fine: Pay Your Fine Now or Lose Your Licence, Possessions or Money From Your Bank AccountDocument2 pagesOverdue Fine: Pay Your Fine Now or Lose Your Licence, Possessions or Money From Your Bank AccountRohan Dutt SharmaNo ratings yet

- Virgin PDFDocument22 pagesVirgin PDFtarunNo ratings yet

- How To Pay: Account DetailsDocument2 pagesHow To Pay: Account DetailsBalkar DhanianNo ratings yet

- SynergyNotice 20240618 Account 000397308800 002182Document2 pagesSynergyNotice 20240618 Account 000397308800 002182chrystlecjNo ratings yet

- Virgin PDFDocument16 pagesVirgin PDFnilooferfarooqNo ratings yet

- MyDocument PDFDocument6 pagesMyDocument PDFTelc3No ratings yet

- CitiBank ApplicationDocument15 pagesCitiBank ApplicationJordan P HunterNo ratings yet

- Your Payment Information - This Is A BillDocument2 pagesYour Payment Information - This Is A BillesenombreunicoNo ratings yet

- Your Payment Information - This Is A BillDocument2 pagesYour Payment Information - This Is A BillesenombreunicoNo ratings yet

- Welcome To M&T Bank.: New Account GuideDocument49 pagesWelcome To M&T Bank.: New Account Guideraymond myoNo ratings yet

- Short Long Form Updated NP en-US PDFDocument4 pagesShort Long Form Updated NP en-US PDFbustmedicineblanketNo ratings yet

- HTP Interim Contact Letter - J305062444Document2 pagesHTP Interim Contact Letter - J305062444Shneur MorozowNo ratings yet

- Offer Confirmation Letter PDFDocument2 pagesOffer Confirmation Letter PDFHoa PhamNo ratings yet

- Alexander Ramos 211 Wymount Ter BLDG. 4C APT. 211 PROVO, UT 84604-1937 Selecthealth PO BOX 3674 SEATTLE, WA 98124-3674Document2 pagesAlexander Ramos 211 Wymount Ter BLDG. 4C APT. 211 PROVO, UT 84604-1937 Selecthealth PO BOX 3674 SEATTLE, WA 98124-3674alexander ramosNo ratings yet

- Online Account Opening Application: Universal Reference No.Document17 pagesOnline Account Opening Application: Universal Reference No.JoemelNo ratings yet

- General A211610167Document2 pagesGeneral A211610167farrrqsapolNo ratings yet

- PLACEMENT LETTER - SAMPLE - Redacted PDFDocument4 pagesPLACEMENT LETTER - SAMPLE - Redacted PDFAnonymous Jyc7y6W4xCNo ratings yet

- Account Summary: $296.35 Total Amount DueDocument170 pagesAccount Summary: $296.35 Total Amount DuelaluktheresaNo ratings yet

- Citi Payall Frequently Asked QuestionsDocument14 pagesCiti Payall Frequently Asked QuestionsM ANo ratings yet

- PAYMENT_302481700703_278244725Document3 pagesPAYMENT_302481700703_278244725sibiyabayanda44No ratings yet

- Es Repayment ScheduleDocument1 pageEs Repayment ScheduleRene Galanza100% (1)

- Virgin PDFDocument44 pagesVirgin PDFMind MiningNo ratings yet

- Deduction StatementDocument4 pagesDeduction StatementAdam Di GiuseppeNo ratings yet

- Citi PayAll FAQs TnCsDocument12 pagesCiti PayAll FAQs TnCsrem.crebalaunionNo ratings yet

- Unknown 3 PDFDocument15 pagesUnknown 3 PDFClaude MercierNo ratings yet

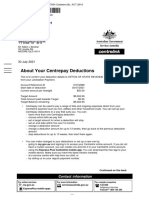

- About Your Centrepay Deductions G310936378Document2 pagesAbout Your Centrepay Deductions G310936378Adam BookerNo ratings yet

- Important Information - M269602760Document2 pagesImportant Information - M269602760jason masciNo ratings yet

- Online Account Opening Application: XNWQWG483453Document16 pagesOnline Account Opening Application: XNWQWG483453Haries Bugarin GarciaNo ratings yet

- CP 49Document2 pagesCP 49Joseph StewartNo ratings yet

- General D306K199G3Document2 pagesGeneral D306K199G3Nimesh ShresthaNo ratings yet

- Online Account Opening Application: TKJJDK360050Document16 pagesOnline Account Opening Application: TKJJDK360050Marinela Jade ManejaNo ratings yet

- Statement July 2019Document5 pagesStatement July 2019Mike Schmoronoff100% (1)

- Rent Payment 20febDocument2 pagesRent Payment 20febjadeisangryNo ratings yet

- Statement September 2019Document6 pagesStatement September 2019Mike Schmoronoff100% (1)

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocument4 pagesCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNo ratings yet

- Payment 302341852451 273710274Document3 pagesPayment 302341852451 273710274izabellawegmann05No ratings yet

- PDF DownloadDocument16 pagesPDF Downloadkeith mulleyNo ratings yet

- Detailed Statement 06-05-2022Document3 pagesDetailed Statement 06-05-2022Cato MonteleoneNo ratings yet

- Your PAYG Instalments Have ChangedDocument3 pagesYour PAYG Instalments Have ChangedkanwarNo ratings yet

- 2023-10-23T13 28 20 LoanAgreement 1398970Document11 pages2023-10-23T13 28 20 LoanAgreement 1398970Michael BlamahNo ratings yet

- Online Account Opening Application: QDWHT4644835Document16 pagesOnline Account Opening Application: QDWHT4644835Santos PinkyNo ratings yet

- The Life and Death of Michel MontaigneDocument16 pagesThe Life and Death of Michel MontaignePaul JohnNo ratings yet

- AgreementDocument2 pagesAgreementAndrit JansenNo ratings yet

- Georgia Farm Bureau Mutual Insurance Company Georgia Farm Bureau Casualty Insurance CompanyDocument1 pageGeorgia Farm Bureau Mutual Insurance Company Georgia Farm Bureau Casualty Insurance CompanySherry StoneNo ratings yet

- Online Account Opening Application: Selected ProductsDocument16 pagesOnline Account Opening Application: Selected ProductsIvanNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- Estmt - 2022 05 13 1Document6 pagesEstmt - 2022 05 13 1Pablo Neri Guardado MenjívarNo ratings yet

- Payment Schedule - 20190430 - 073337 PDFDocument2 pagesPayment Schedule - 20190430 - 073337 PDFKylyn JynNo ratings yet

- UnknownDocument17 pagesUnknownEnglcom-Barrot PublisherNo ratings yet

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessFrom EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessRating: 1 out of 5 stars1/5 (1)

- How to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesFrom EverandHow to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesRating: 3 out of 5 stars3/5 (1)

- Stock Per 17 Okt 20 HargaDocument13 pagesStock Per 17 Okt 20 HargaLutfi QamariNo ratings yet

- MINI PROJECT REPORT DoucmentDocument78 pagesMINI PROJECT REPORT DoucmentVarshini VuraNo ratings yet

- MGT 3110: Exam 3 Study Guide Discussion QuestionsDocument13 pagesMGT 3110: Exam 3 Study Guide Discussion QuestionsSihle GwazelaNo ratings yet

- Module 1Document35 pagesModule 1anjuNo ratings yet

- Caf-8 All Test (Sp-24)Document87 pagesCaf-8 All Test (Sp-24)hashmiabdullah4948No ratings yet

- Section 2, Art. Iii: Searches and Seizures Go V. Ca: Topic Author Case Title GR No Tickler Date DoctrineDocument3 pagesSection 2, Art. Iii: Searches and Seizures Go V. Ca: Topic Author Case Title GR No Tickler Date DoctrineLoreen DanaoNo ratings yet

- Vector AdditionDocument6 pagesVector AdditionKevin Habaluyas100% (1)

- 7 Crystal Reports Interview Questions and AnswersDocument5 pages7 Crystal Reports Interview Questions and AnswersshyamVENKAT0% (1)

- Je Hyung Yoo ComplaintDocument11 pagesJe Hyung Yoo ComplaintEmily Babay0% (1)

- US V DichaoDocument3 pagesUS V Dichaorgtan3No ratings yet

- GFuture Compression Station FinalDocument51 pagesGFuture Compression Station FinalronmashNo ratings yet

- استردادDocument2 pagesاستردادnn1129374No ratings yet

- Bid Doc PrintingSolutionDocument61 pagesBid Doc PrintingSolutionAbdul RehmanNo ratings yet

- After Cooler InspectionAE3Document1 pageAfter Cooler InspectionAE3boy qsiNo ratings yet

- Analysis of Audible Noise and Magnetic Fields: Vollmer Substation and Transmission Line ProjectDocument20 pagesAnalysis of Audible Noise and Magnetic Fields: Vollmer Substation and Transmission Line ProjecteNo ratings yet

- DS-7204/7208HVI-SH Series DVR Technical SpecificationDocument10 pagesDS-7204/7208HVI-SH Series DVR Technical Specificationandres alberto figueroa foreroNo ratings yet

- Safe PT DesignDocument646 pagesSafe PT DesignHiếu TrầnNo ratings yet

- East Timor and The " Slippery Slope" Problem, Cato Foreign Policy Briefing No. 55Document12 pagesEast Timor and The " Slippery Slope" Problem, Cato Foreign Policy Briefing No. 55Cato InstituteNo ratings yet

- At-The-Restaurant A2Document4 pagesAt-The-Restaurant A2Mjn AbbasiNo ratings yet

- Testing Directional Overcurrent Relays From ValenceDocument8 pagesTesting Directional Overcurrent Relays From ValenceM Kumar MarimuthuNo ratings yet

- The Verb Have GotDocument2 pagesThe Verb Have GotIsabel Dias100% (1)

- Geremek - Poverty, A History - Blackwell 1994 4Document1 pageGeremek - Poverty, A History - Blackwell 1994 4Kopija KopijaNo ratings yet

- Caso 2 - Gerencia de Operaciones 2023Document3 pagesCaso 2 - Gerencia de Operaciones 2023Eyner PeñaNo ratings yet

- Bhide CVDocument3 pagesBhide CVtorosterudNo ratings yet

- Case Study For 1st AssignmentDocument17 pagesCase Study For 1st AssignmentMaher Ahmed100% (1)

- An Analysis of The Bhopal AccidentDocument13 pagesAn Analysis of The Bhopal AccidenthiryanizamNo ratings yet

- Design IIDocument16 pagesDesign IIPrasant0% (1)

- Share Go Director Raftaar Training Module Jan 2023Document64 pagesShare Go Director Raftaar Training Module Jan 2023Shravan Khilledar100% (1)

- Reading Worksheet About Shopping My Year With No Shopping (Answer Key 4)Document2 pagesReading Worksheet About Shopping My Year With No Shopping (Answer Key 4)denisse2cevallos67% (6)