Professional Documents

Culture Documents

Commission Order No. 2021 1 AD

Commission Order No. 2021 1 AD

Uploaded by

mica43826Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commission Order No. 2021 1 AD

Commission Order No. 2021 1 AD

Uploaded by

mica43826Copyright:

Available Formats

Rl I’Uh!

1C OI I NI Pllll imNlS

Tariff Commission

COMMISSION ORDER NO. 2021 -01

SUBJECT: REVISED RULES OF PROCEDURE FOR THE CONDUCT OF FORMAL

INVESTIGATIONS PURSUANT TO REPUBLIC ACT NO. 8752

Pursuant to Republic Act (RA) No. 8752 {Anti-Dumping Act of 1999), as adopted in

Section 711 of RA No. 10863 (Customs Modernization and Tariff Act), and its

Implementing Rules and Regulations (IRRs), the following rules of procedure are hereby

promulgated to govern the conduct of investigations by the Tariff Commission;

Section 1. Definition of Terms. For purposes of this Order, the following terms are

defined as follows:

(a) "Anti-Dumping Duty" refers to a special duty imposed on the importation of a

product into the Philippines at less than its normal value when destined for

domestic consumption in the country of export or origin, it being the difference

between the export price and the normal value of such product.

(b) “Causal Link" refers to a finding that the material injury suffered by the domestic

industry is the direct result of the importation of the dumped product.

(c) "Commission" refers to the Tariff Commission.

(d) "Comparable Price" refers to the domestic price of the like product in the country

of export or origin at the same level of trade, normally at the ex-factory level, and

in respect of sales made at the same time as, or as near as possible to, the date

of exportation to the Philippines.

(e) "Country of Export" is the country where the allegedly dumped product was

shipped to the Philippines, regardless of the location of the seller. The country of

export and the country of origin may be the same, but not in all instances.

(f) "Country of Origin" is the country where the allegedly dumped product either was

wholly obtained or where the last substantial transformation took place. The

country of origin and the country of export may be the same, but not in all

instances. In the case of transshipment where a product is shipped from a third

country that is not the country where the product was manufactured or processed,

the country of origin will be different from the country of export.

OI

< I nil rMiiiri"

4th Floor, West Insula Condominium, 135 West Avenue, Quezon City. UCG I’l

Td. Nos.: (632) 8926-8731 / (632) 8928-8419 / (632) 8936-3315 / (632) 8936-3318 v

SOCOTCC

Website: taiiffcommission.gov.ph • F’hilippine Tariff Finder: finder.tanmwnniiHwfMi^w

Email Address: TC.Assist@mail.tariffcommission,gov.|0ERXIFIED T UE

CVrWCATMi

MARICAI^.El 5UMBILLO

■?Adininiskrativo Officer V

(Recoils Offict'i Ml)

You might also like

- (C.i.s.) Client Information Sheet - Modelo 1Document4 pages(C.i.s.) Client Information Sheet - Modelo 1Aldo Rodrigo Algandona80% (5)

- Odds Enhancers' Worksheet - 20170401Document1 pageOdds Enhancers' Worksheet - 20170401Anonymous rB0wZQjxZFNo ratings yet

- Customs Modernization & Tariff Act PDFDocument76 pagesCustoms Modernization & Tariff Act PDFCheryl BaguilatNo ratings yet

- AspenTech - Compressor Modeling in Aspen HYSYS DynamicsDocument26 pagesAspenTech - Compressor Modeling in Aspen HYSYS DynamicsTaniadi SuriaNo ratings yet

- Excise Duty Bill 2015Document41 pagesExcise Duty Bill 2015Michael MbuguaNo ratings yet

- CUSTOMS ACT & Regulation 2073 EnglishDocument272 pagesCUSTOMS ACT & Regulation 2073 EnglishShristiNo ratings yet

- Shipment of Export CargoDocument5 pagesShipment of Export CargoSammir MalhotraNo ratings yet

- Procedure - Section711 - Rev2 - 28july 2020Document3 pagesProcedure - Section711 - Rev2 - 28july 2020AceNo ratings yet

- Ra 10863Document76 pagesRa 10863KathNo ratings yet

- Primer RA8752 (AD)Document11 pagesPrimer RA8752 (AD)Mildred AlegadoNo ratings yet

- Anti DumpingDocument52 pagesAnti DumpingSamuelNo ratings yet

- Final Customs Act 1969 Dated 1182013Document248 pagesFinal Customs Act 1969 Dated 1182013Shayan Ahmad QureshiNo ratings yet

- Custom Act 1969Document236 pagesCustom Act 1969Umer EhsanNo ratings yet

- Idt SummaryDocument0 pagesIdt SummarySanu KSNo ratings yet

- Primer AntiDumpingDocument11 pagesPrimer AntiDumpingmitchitan19No ratings yet

- Module Tariff6Document13 pagesModule Tariff6J- ArtizNo ratings yet

- Events Guidelines Staging EventsDocument4 pagesEvents Guidelines Staging Eventsapi-298815178No ratings yet

- Tamil Nadu Transparency in Tenders Act, 1998Document13 pagesTamil Nadu Transparency in Tenders Act, 1998Latest Laws TeamNo ratings yet

- 1.1 - T-1 Prelim ProvDocument15 pages1.1 - T-1 Prelim ProvKesTerJeeeNo ratings yet

- Procedure Section713 Rev2 28july 2020Document3 pagesProcedure Section713 Rev2 28july 2020aim zehcnasNo ratings yet

- Customs Modernization and Tariff ActDocument133 pagesCustoms Modernization and Tariff ActBev LargosaNo ratings yet

- Anti-Dumping Act TariffDocument9 pagesAnti-Dumping Act TariffMA. LORENA CUETONo ratings yet

- October:, S 'S Il SDocument34 pagesOctober:, S 'S Il SMuhabat JunejoNo ratings yet

- Customs Modernization and Tariff Act Republic Act No. 10863Document56 pagesCustoms Modernization and Tariff Act Republic Act No. 10863Annie Ayochok Par-oganNo ratings yet

- Customs Act, Excise Duty, Travel Tax and Gift Tax - 2010-2011Document13 pagesCustoms Act, Excise Duty, Travel Tax and Gift Tax - 2010-2011Samira RahmanNo ratings yet

- CmtaDocument100 pagesCmtaChell MinsNo ratings yet

- Unit 13Document8 pagesUnit 13karishma sharmaNo ratings yet

- Congress of The Philippines: Metro ManilaDocument155 pagesCongress of The Philippines: Metro ManilaJV Reobaldez MirandaNo ratings yet

- Q and A in Tariff and Customs Law (Final 7.11.14)Document44 pagesQ and A in Tariff and Customs Law (Final 7.11.14)Castelo Banlaygas100% (2)

- Ra 10863 - CmtaDocument134 pagesRa 10863 - CmtaRobert MaestreNo ratings yet

- Customs & Excise ActDocument85 pagesCustoms & Excise ActAndrew JoriNo ratings yet

- The Basics of Tariff & Customs Laws in The PhilippinesDocument8 pagesThe Basics of Tariff & Customs Laws in The PhilippinesRaymond AndesNo ratings yet

- R.A. No. 10863Document31 pagesR.A. No. 10863Xyryah Gatela Daguimol100% (1)

- Excise Duty Act Alongwith Each Year Financial Acts Amendment 2058 2002Document271 pagesExcise Duty Act Alongwith Each Year Financial Acts Amendment 2058 2002Shraddha NepalNo ratings yet

- Full PromulgationDocument17 pagesFull PromulgationsimbiroNo ratings yet

- Chapter 18 - Paper T5Document32 pagesChapter 18 - Paper T5Kabutu ChuungaNo ratings yet

- Bid Info and Specs 01Document260 pagesBid Info and Specs 01Jose CoronaNo ratings yet

- 423 Special DutiesDocument35 pages423 Special DutiesJoyce Ann Ramos BaquiNo ratings yet

- CMTA Full TextDocument56 pagesCMTA Full TextEzer Ivan Ria BacayoNo ratings yet

- Environmental Management (And Transit of Hazardous Substances and Waste) Regulations, 2009Document6 pagesEnvironmental Management (And Transit of Hazardous Substances and Waste) Regulations, 2009HenryNo ratings yet

- CMTA RA 10863 - An Act Modernizing The Customs and Tariff AdministrationDocument63 pagesCMTA RA 10863 - An Act Modernizing The Customs and Tariff AdministrationJustin Zuniga0% (1)

- What Is Dumping? What Is An Anti-Dumping Measure?Document8 pagesWhat Is Dumping? What Is An Anti-Dumping Measure?Shaina DalidaNo ratings yet

- Second ExamDocument44 pagesSecond ExammarialeNo ratings yet

- RA 10668 - Cabotage LawDocument6 pagesRA 10668 - Cabotage LawSa KiNo ratings yet

- DBK and DeecDocument3 pagesDBK and DeecManik RajNo ratings yet

- Implementing Rules and Regulations Governing The Imposition of An Anti-Dumping Duty Under Republic Act The Anti-Dumping Act of 1999Document37 pagesImplementing Rules and Regulations Governing The Imposition of An Anti-Dumping Duty Under Republic Act The Anti-Dumping Act of 1999ALAJID, KIM EMMANUELNo ratings yet

- The General Consumption Tax ActDocument107 pagesThe General Consumption Tax ActRichie HansonNo ratings yet

- Qdoc - Tips - Customs Reviewer 2017 FinalDocument24 pagesQdoc - Tips - Customs Reviewer 2017 Finalriza mae PandianNo ratings yet

- Bureau of Customs CMO-28-2017Document1 pageBureau of Customs CMO-28-2017PortCallsNo ratings yet

- Anti Dumping Duty TCDocument18 pagesAnti Dumping Duty TCRuwen Joice Abacan BunquinNo ratings yet

- Anti Dumping LawDocument25 pagesAnti Dumping LawRyan De LeonNo ratings yet

- Chapter 403-The Customs - Management and Tariff - Act PDFDocument236 pagesChapter 403-The Customs - Management and Tariff - Act PDFEsther MaugoNo ratings yet

- Tariff and Customs LawsDocument7 pagesTariff and Customs LawsRind Bergh DevelosNo ratings yet

- Duty Act 2014Document199 pagesDuty Act 2014chrissieNo ratings yet

- TQ 1Document4 pagesTQ 1robykanaelNo ratings yet

- Cabotage LawDocument10 pagesCabotage LawPaulo BurceNo ratings yet

- Anti Dumping LawDocument15 pagesAnti Dumping LawDaria Asacta TolentinoNo ratings yet

- Valuation Ruling 1576 2021 2Document4 pagesValuation Ruling 1576 2021 2MeeNo ratings yet

- TM1 ReviewerDocument112 pagesTM1 ReviewerDonnabel FonteNo ratings yet

- Anti Dum PDFDocument22 pagesAnti Dum PDFMadhu Sudan Ks ReddyNo ratings yet

- Tariff Commission FAQsDocument7 pagesTariff Commission FAQsFrancisJosefTomotorgoGoingoNo ratings yet

- Customs Bonded Warehousing SystemDocument28 pagesCustoms Bonded Warehousing SystemAnonymous lokXJkc7l7No ratings yet

- Anita Longley's LegacyDocument4 pagesAnita Longley's LegacyJill TietjenNo ratings yet

- Aplicacion Corto 3Document5 pagesAplicacion Corto 3Garbel LemusNo ratings yet

- Abdellatif Kashkoush SMDocument5 pagesAbdellatif Kashkoush SMRacha BadrNo ratings yet

- SPAR International Annual Report 2018 PDFDocument56 pagesSPAR International Annual Report 2018 PDFCristian Cucos CucosNo ratings yet

- Weekly Meal Planner TemplateDocument11 pagesWeekly Meal Planner TemplateAshok JagtapNo ratings yet

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Beg Unit5 RevisionDocument2 pagesBeg Unit5 RevisionSimina EnăchescuNo ratings yet

- An Electronic AmplifierDocument26 pagesAn Electronic Amplifierriz2010No ratings yet

- 10000020383Document77 pages10000020383Chapter 11 DocketsNo ratings yet

- English 7 Pronouncing Words With The Correct Word StressDocument18 pagesEnglish 7 Pronouncing Words With The Correct Word StressDhariLyn Macanas Paghubasan AbeLongNo ratings yet

- Submitted By: Youssef Mohamed BahaaDocument14 pagesSubmitted By: Youssef Mohamed BahaaRouu SamirNo ratings yet

- Workbook Answer Key Unit 8 AcbeuDocument1 pageWorkbook Answer Key Unit 8 AcbeuLuisa Mari AlvamoreNo ratings yet

- Road Safety FundamentalsDocument122 pagesRoad Safety Fundamentalssmanoj354100% (3)

- Torque Spiral Wound GSKT TableDocument2 pagesTorque Spiral Wound GSKT TableCarlos Roberto Tamariz100% (1)

- 22 Passage 2 - Western Immigration of Canada Q14-26Document6 pages22 Passage 2 - Western Immigration of Canada Q14-26Cương Nguyễn DuyNo ratings yet

- Q2-COT-LP-Health7 - Wk4 (Malnutrition and Micronutrients Deficiency)Document4 pagesQ2-COT-LP-Health7 - Wk4 (Malnutrition and Micronutrients Deficiency)ivonneNo ratings yet

- Asian School Change in Profit Sharing Ratio Sample PaperDocument2 pagesAsian School Change in Profit Sharing Ratio Sample PaperMan your voice is breaking kuttyNo ratings yet

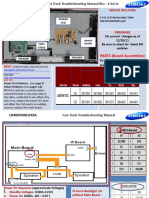

- Samsung LN46D550K1FXZA Fast Track Guide (SM)Document4 pagesSamsung LN46D550K1FXZA Fast Track Guide (SM)Carlos OdilonNo ratings yet

- CAPM in Capital BudgetingDocument2 pagesCAPM in Capital BudgetingNaga PraveenNo ratings yet

- Timothy StainbrookDocument1 pageTimothy Stainbrookapi-548131304No ratings yet

- National: Cadet CorpsDocument6 pagesNational: Cadet CorpsVikesh NautiyalNo ratings yet

- Nabawan PDFDocument2 pagesNabawan PDFAssui KinabaluNo ratings yet

- A Proposal On Reusable Sanitary PADSDocument16 pagesA Proposal On Reusable Sanitary PADSMike AbbeyNo ratings yet

- Behavioral Modeling of A Comparator Using Verilig-AMSDocument88 pagesBehavioral Modeling of A Comparator Using Verilig-AMSPriNo ratings yet

- MONITOR LCD Philips 192E1SB Chassis Meridian 5Document88 pagesMONITOR LCD Philips 192E1SB Chassis Meridian 5Ronan-PUC NolascoNo ratings yet

- Eis - Summary Notes - SampleDocument7 pagesEis - Summary Notes - SampledhishancommerceacademyNo ratings yet

- 28-Tax-Capitol Wireless Inc vs. Provincial Treas. of BatangasDocument2 pages28-Tax-Capitol Wireless Inc vs. Provincial Treas. of BatangasJoesil Dianne SempronNo ratings yet