Professional Documents

Culture Documents

Halo-Kola Class Template Reorg

Halo-Kola Class Template Reorg

Uploaded by

adithi.manjunath10 ratings0% found this document useful (0 votes)

4 views1 pageThis document analyzes the valuation of a proposed zero-calorie soda project over 5 years. It provides annual sales projections, operating expenses, cash flows, working capital requirements and sensitivity analysis. The project has an initial investment of 50 million pesos for equipment. It generates positive operating cash flows each year from sales of 7.2 million units. The net present value is calculated to be positive, with an internal rate of return above the cost of capital, indicating the project should be accepted.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document analyzes the valuation of a proposed zero-calorie soda project over 5 years. It provides annual sales projections, operating expenses, cash flows, working capital requirements and sensitivity analysis. The project has an initial investment of 50 million pesos for equipment. It generates positive operating cash flows each year from sales of 7.2 million units. The net present value is calculated to be positive, with an internal rate of return above the cost of capital, indicating the project should be accepted.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageHalo-Kola Class Template Reorg

Halo-Kola Class Template Reorg

Uploaded by

adithi.manjunath1This document analyzes the valuation of a proposed zero-calorie soda project over 5 years. It provides annual sales projections, operating expenses, cash flows, working capital requirements and sensitivity analysis. The project has an initial investment of 50 million pesos for equipment. It generates positive operating cash flows each year from sales of 7.2 million units. The net present value is calculated to be positive, with an internal rate of return above the cost of capital, indicating the project should be accepted.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

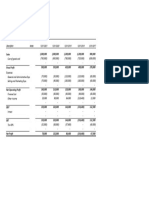

Hola Kola - The Valuation of the Zero-Calorie Soda Project

Monthly Sales (units) 600,000 Cost of New Equipment (pesos) 50,000,000

Increase (Decrease) in Sales Volume 0% Resale Value of Equipment (pesos 4,000,000

Unit Sale Price (pesos) 5 % Overhead to Sales 1%

Increase (Decrease) in Sales Price 0% Building Rental (pesos) 60,000

Unit Raw Material Cost (pesos) 1.8 Average Collection Period (Days) 45

Increase (Decrease) in Raw Material Costs 0% Average Payment Period (Days) 36

Monthly Labor Costs (pesos) 180,000 Years of Straight-line Depreciation 5

Increase (Decrease) in Direct Labor Costs 0% Cost of Capital 18.2%

Monthly Energy Costs (pesos) 50,000 Tax Rate 30%

Increase (Decrease) in Energy Costs 0% Erosion (pesos) 800,000

Year 0 1 2 3 4 5

Annual Sales (Units) 7,200,000 7,200,000 7,200,000 7,200,000

Annual Sales Revenue (pesos) 36,000,000 36,000,000 36,000,000 36,000,000

Operating Expenses (pesos)

Raw Material Costs (12,960,000) (12,960,000) (12,960,000) (12,960,000)

Direct Labor Costs (2,160,000) (2,160,000) (2,160,000) (2,160,000)

Energy Costs (600,000) (600,000) (600,000) (600,000)

Building Rental (Opportunity Costs) (60,000) (60,000) (60,000) (60,000)

Depreciation (10,000,000) (10,000,000) (10,000,000) (10,000,000)

General Administrative and Selling Expenses (300,000) (300,000) (300,000) (300,000)

Overhead Expenses (360,000) (360,000) (360,000) (360,000)

Total Operating Expenses (pesos) - (26,440,000) (26,440,000) (26,440,000) (26,440,000)

Operating Profit Before Tax (pesos) - 9,560,000 9,560,000 9,560,000 9,560,000

Taxes (pesos) - (2,868,000) (2,868,000) (2,868,000) (2,868,000)

Operating Profit After Tax (pesos) - 6,692,000 6,692,000 6,692,000 6,692,000

Project's Operating Cash Flow (pesos)

Depreciation (pesos) - 10,000,000 10,000,000 10,000,000 10,000,000

Erosion of Existing Sales (pesos) (800,000) (800,000) (800,000) (800,000) (800,000)

Total Operating Cash Flow (pesos) (800,000) 15,892,000 15,892,000 15,892,000 15,892,000

Cost of New Equipment (pesos)

Resale Value of Equipment (pesos)

Working Capital Requirements (pesos)

Receivables ((Sales/365)*Avg Collection Period) (4,438,356) (4,438,356) (4,438,356) (4,438,356)

Inventories (One month materials costs) (1,080,000) (1,080,000) (1,080,000) (1,080,000)

Payables ((Material Costs/365)*Avg Pmt Period) 1,278,247 1,278,247 1,278,247 1,278,247

- (4,240,110) (4,240,110) (4,240,110) (4,240,110) -

Change in Working Capital Requirements (pesos) - (4,240,110) - - - 4,240,110

Project's Free Cash Flow (pesos) - (5,040,110) 15,892,000 15,892,000 15,892,000 20,132,110

Cumulative Free Cash Flow (pesos)

Discount Factor

Present Value (PV) Of Project's Free Cash Flow (pesos)

Cumulative PV Of Project's Free Cash Flow (pesos)

NPV Via Excel (pesos)

NPV Computed Manually (pesos)

IRR

Payback Period (Years)

Discounted Payback Period (Years)

Profitability Index

Sensitivity Analysis (Data Table)

Price Change

-1% -0.50% 0.00% 0.50% 1.00%

16.50%

17.20%

Cost of Capital 18.20%

19.20%

20.20%

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- 2.Hola-Kola - The Capital Budgeting DecisionDocument3 pages2.Hola-Kola - The Capital Budgeting DecisionGautam D67% (3)

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- Hola KolaDocument3 pagesHola Kola17crushNo ratings yet

- Cash Business Account 1099kDocument1 pageCash Business Account 1099kgarydeservesmithNo ratings yet

- Chapter 6Document28 pagesChapter 6Faisal Siddiqui0% (1)

- Lincoln SportDocument8 pagesLincoln SportArtiar AnjaniNo ratings yet

- Yu05d S M C S T F MDocument171 pagesYu05d S M C S T F Mazam sumra100% (7)

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- Tata Steel Case StudyDocument2 pagesTata Steel Case StudySourabh NandaNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceAdrien PortemontNo ratings yet

- Variable Costing Case Part A SolutionDocument3 pagesVariable Costing Case Part A SolutionG, BNo ratings yet

- Budgets and Budgetary ControlDocument46 pagesBudgets and Budgetary ControlnehaNo ratings yet

- Case Data: The ProposalDocument13 pagesCase Data: The ProposalРодион ЗдоровецNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- RetoSA - EmirDocument21 pagesRetoSA - EmirEdward Marcell BasiaNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Expansion Project Example: Dr. C. Bulent AybarDocument10 pagesExpansion Project Example: Dr. C. Bulent AybarTricia Mae PetalverNo ratings yet

- Alternative Source of Financing, Pro-Forma, Preparation of Financial StatementsDocument3 pagesAlternative Source of Financing, Pro-Forma, Preparation of Financial StatementsAngel CastilloNo ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- ABsorption Variable COSTINGDocument12 pagesABsorption Variable COSTINGNaman SinghNo ratings yet

- HolaKola HW Model ProvideDocument4 pagesHolaKola HW Model ProvideslmedcalfeNo ratings yet

- CF AssignDocument7 pagesCF AssignKhanh LinhNo ratings yet

- Model Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleDocument11 pagesModel Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleMilind VatsiNo ratings yet

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocument12 pagesA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineNo ratings yet

- Profit and Loss Summary: Budget Summary ReportDocument6 pagesProfit and Loss Summary: Budget Summary ReportIslam Ayman AbdelwahabNo ratings yet

- Actual Cost Vs Plan Projection: Your Company NameDocument25 pagesActual Cost Vs Plan Projection: Your Company NameShamsNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- Income Statment SampleDocument1 pageIncome Statment Samplewaqas akramNo ratings yet

- Period Sales and Collections WorksheetDocument28 pagesPeriod Sales and Collections WorksheetSandra AmadorNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Chapter 13 - Gross Profit MethodDocument2 pagesChapter 13 - Gross Profit MethodBena CubillasNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- LarsenDocument4 pagesLarsenMigs CruzNo ratings yet

- LarsenDocument4 pagesLarsenMigs CruzNo ratings yet

- CF Lecture 3 AssignmentDocument5 pagesCF Lecture 3 AssignmentĐặng Thuỳ HươngNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Document11 pages202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Initial Investment:: Solution A: 1) Particulars Press ADocument12 pagesInitial Investment:: Solution A: 1) Particulars Press AFernando Barreto GuzmanNo ratings yet

- Budget Summary Report: (Company Name)Document6 pagesBudget Summary Report: (Company Name)chatree pokaew100% (1)

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- For Year Ending December 31, 2018: Lakeside Company Income StatementDocument8 pagesFor Year Ending December 31, 2018: Lakeside Company Income StatementMark Christian Cutanda VillapandoNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Analyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsDocument46 pagesAnalyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsHana NadhifaNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1Evans mwenzeNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1Evans mwenzeNo ratings yet

- CMA - Case Study 3 - Group SFDocument2 pagesCMA - Case Study 3 - Group SFC DR100% (1)

- Case StudyDocument5 pagesCase Studyphượng nguyễn thị minhNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Process FundamentalsDocument6 pagesProcess Fundamentalsadithi.manjunath1No ratings yet

- EOQ - OnlineDocument6 pagesEOQ - Onlineadithi.manjunath1No ratings yet

- OPSM Cheat Sheet DraftDocument2 pagesOPSM Cheat Sheet Draftadithi.manjunath1No ratings yet

- 4 - Corporate Finance NotesDocument4 pages4 - Corporate Finance Notesadithi.manjunath1No ratings yet

- Invesment Decision - ExerciseDocument8 pagesInvesment Decision - Exerciseadithi.manjunath1No ratings yet

- Mock Exam C - Afternoon SessionDocument21 pagesMock Exam C - Afternoon SessionNam Hoàng ThànhNo ratings yet

- CogizantDocument2 pagesCogizantAmarinder Singh SandhuNo ratings yet

- The Need and Objective of Accounting Standards An IFRSDocument11 pagesThe Need and Objective of Accounting Standards An IFRSVicky PandeyNo ratings yet

- July - 15 Kandla ExportDocument78 pagesJuly - 15 Kandla Exportvivek_domadiaNo ratings yet

- 1.1. Course OverviewDocument11 pages1.1. Course OverviewSubha LakshmiNo ratings yet

- Observing & Evolving Digitally Through Online Hazard Hunt SystemDocument2 pagesObserving & Evolving Digitally Through Online Hazard Hunt SystembondsivamaniNo ratings yet

- Accounts PayableDocument44 pagesAccounts Payablethat_glossmk100% (2)

- Accounting Ethics and Integrity StandardsDocument6 pagesAccounting Ethics and Integrity StandardsRowie Ann TapiaNo ratings yet

- Supply Chain ManagementDocument65 pagesSupply Chain ManagementSimon FranceNo ratings yet

- Segmentation For Marketing Channel Design For Service OutputDocument25 pagesSegmentation For Marketing Channel Design For Service OutputHajiMasthanSabNo ratings yet

- SBR Kit 2025 - Mock Exam 2Document26 pagesSBR Kit 2025 - Mock Exam 2Myo NaingNo ratings yet

- Pecific Jeans Annual ReportDocument88 pagesPecific Jeans Annual ReportMemu PlayerNo ratings yet

- Nike Just Do ItDocument3 pagesNike Just Do ItTú Anh NguyễnNo ratings yet

- IFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsDocument18 pagesIFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsBruce ChengNo ratings yet

- Entrep 12 Marketing MixDocument14 pagesEntrep 12 Marketing MixZyrichNo ratings yet

- Capabilities-Driven Strategy: IMI Kolkata 22nd February 2012 Rudra ChatterjeeDocument25 pagesCapabilities-Driven Strategy: IMI Kolkata 22nd February 2012 Rudra ChatterjeetoabhishekpalNo ratings yet

- 01 - Nature of PartnershipDocument3 pages01 - Nature of PartnershipSherry BetitaNo ratings yet

- 2018 Salary Guide CA LegalDocument33 pages2018 Salary Guide CA LegalpawanNo ratings yet

- Benn Jordan - The Revolution of Greed and The Music IndustryDocument9 pagesBenn Jordan - The Revolution of Greed and The Music IndustryPedro LopezNo ratings yet

- ReviewerDocument5 pagesReviewerJeline E LansanganNo ratings yet

- Account Statement: Aarush SinghDocument1 pageAccount Statement: Aarush SinghRakibul IslamNo ratings yet

- Satish)Document3 pagesSatish)Mohit kolliNo ratings yet

- Black Book PDFDocument30 pagesBlack Book PDFSrinath PareekNo ratings yet

- Wonderworld Co34Document14 pagesWonderworld Co34Sariah MohamedNo ratings yet

- CAPE Accounting 2007 U2 P2Document7 pagesCAPE Accounting 2007 U2 P2Cool things fuh schoolNo ratings yet

- Articles of Organization: United StatesDocument2 pagesArticles of Organization: United Stateshasan jamiNo ratings yet

- Quantitative Strategic Planning MatrixDocument13 pagesQuantitative Strategic Planning Matrixkripa dudu50% (2)