Professional Documents

Culture Documents

Literature Review Financial Performance Analysis

Literature Review Financial Performance Analysis

Uploaded by

gw2wr9ssOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Literature Review Financial Performance Analysis

Literature Review Financial Performance Analysis

Uploaded by

gw2wr9ssCopyright:

Available Formats

Writing a literature review on financial performance analysis can be a daunting task for many

individuals. It requires extensive research, critical analysis, and synthesis of existing literature to

provide a comprehensive overview of the topic.

One of the biggest challenges in writing a literature review is the vast amount of information

available. Sorting through numerous academic papers, journals, books, and other sources to identify

relevant literature can be time-consuming and overwhelming. Additionally, synthesizing diverse

perspectives and findings into a coherent narrative requires strong analytical and writing skills.

Moreover, ensuring the relevance and credibility of the sources used in the literature review is

essential. It's crucial to critically evaluate each source to determine its reliability, validity, and

significance to the topic at hand.

Given the complexities involved, many individuals may find it beneficial to seek assistance from

professional writing services. ⇒ StudyHub.vip ⇔ offers specialized assistance in crafting literature

reviews on financial performance analysis and other related topics.

By relying on the expertise of experienced writers, individuals can save time and effort while

ensuring the quality and accuracy of their literature review. ⇒ StudyHub.vip ⇔ provides

customized solutions tailored to the specific requirements and objectives of each client, helping them

achieve their academic and professional goals.

In conclusion, writing a literature review on financial performance analysis requires considerable

time, effort, and expertise. For those seeking assistance, ⇒ StudyHub.vip ⇔ offers a reliable and

efficient solution to navigate the complexities of literature review writing. Trust the professionals to

deliver a comprehensive and well-researched literature review that meets your needs and exceeds

your expectations.

A low inventory turnover ratio indicates an inefficient management of inventory. Plants with

Capacity of Million tonnes and above (Nos.) 97. There are various groups of people who are

interested in analysis of financial position of a. The ratio is calculated by dividing the cost of goods

sold by the amount of average stock at. Averageinventory is calculated by adding the stock in the

beginning and at the and of the period anddividing it by two. Read More How To Perform Critical

Path Method (CPM) And Find Float. - This video provides an overview of how to perform Critical

Path Method (CPM) to find the Critical Path and Float using a Net. It is extremely essential for a

firm to be able to meet its obligation as they become. Share to Twitter Share to Facebook Share to

Pinterest. Financial Performance, Ratio Analysis and Evaluation of Agricultural. This ratio

represents the number of times the working capital is turned over in the course of. To obtain the

particular market firstly a marketer has to prepare a market research, after which he segments the

market, and then targets a single segment or series of segments, and finally positions within the

segment s. The job mission statement is a job definition in terms of purpose, customers, product, and

scope. On close examination, however, these definitions appear to centre around the notion that

strategy refers to a broad statement of. But the level of inventory should neither be too high. They

can be useful for companies and investors in identifying a company’s trends over time. We also use

third-party cookies that help us analyze and understand how you use this website. It can be

undertaken as stand-alone projects in their own right, or as a precursor to a systematic review.

Content Retrieval ABSTRACT Title Of Dissertation: INTERNAL CONTROL, ENTERPRISE. He

holds a PhD in education and has published over 20 articles in scholarly journals. Current ratio is the

relationship between current asset and current liability. This. This is achieved by simplifying or

omitting stages of the systematic review process. Consequently, the literature offers many different

definitions. Literature review The current ratio and the quick ratio rely on the values identified as

current assets and current liabilities in the Statement of Financial Position.. Return Doc FACTORS

INFLUENCING THE COMPANIES’ PROFITABILITY A synthetic picture of the company’s

financial position and Literature review of financial analysis computed mainly as rates of the balance

sheet, such as Fixed Assets Ratio, Sales to Current Assets Ration, Sales to equity Ratio, Debt Ratio,

Gross Margin Return on. Ratio analysis is one of the techniques of financial analysis to evaluate the

financial condition. Indistinguishable from Magic: How the Cybersecurity Market Reached a

Trillion. Following formula is used to calculate working capital turnover ratio. LITERATURE

REVIEW Positive Accounting Theory Positive accounting theory explains why. Retrieve Content

The Progression Of Financial Restatements: Causes And Market. The New York Yankees extended

their late-season surge 1 last week, eliminating the Cleveland Indians and moving on to the American

League championship series. American Journal of Business Education course, this essay addresses

financial statement analysis, including its impact on stock valuation, disclosure, and managerial

behavior.

In case external liabilities are more than that of the assets of the company, it shows the unsound. This

information should also be highlyinteresting since the inability to meet short-term debts would be a

problem that deserves yourimmediate attention. Literature Review Although it is usually assumed

that a restatement is due to fraudulent behavior, there are actually far more likely reoccurring reasons

as to these restatements.. Document Viewer ANALYSIS AND INTERPRETATION OF

FINANCIAL STATEMENTS. - Ethesis Financial statements are used as a management tool

primarily by company executives and investor’s in assessing the overall position and operating results

of the company. Fetch This Document American Journal Of Business Education March 2010 Volume

3. Sometimes, a high inventory turnover ratio may not be accompanied by relatively a high. A low

inventory turnover implies over-investment in inventories, dull business, poor quality. Literature

review on financial statements analysis - SlideShare. In simple words it indicates the number of times

average debtors. Therefore it is necessary to strike a proper balance. A high ratio indicates efficient

utilization of working capital and a low. However, beware for it doesn't necessarily mean the

business is profitable. By clicking “Accept All”, you consent to the use of ALL the cookies. The goal

is to more comprehensively understand a particular phenomenon. Document Retrieval INNOVATION

AND BUSINESS PERFORMANCE: A LITERATURE REVIEW Confused and the link between

innovation and business performance remains to be proven. Therefore it is necessary to strike a

proper balance. The idea of having double the current assets as compared to current. After presenting

the key themes, the authors recommend that practitioners need to approach healthcare

communication in a more structured way, such as by ensuring there is a clear understanding of who is

in charge of ensuring effective communication in clinical settings. The New York Yankees extended

their late-season surge 1 last week, eliminating the Cleveland Indians and moving on to the American

League championship series. In a critical review, the reviewer not only summarizes the existing

literature, but also evaluates its strengths and weaknesses. Ratio analysis is one of the techniques of

financial analysis to evaluate the financial condition. The two basic components of accounts

receivable turnover ratio are net credit annual sales. Access This Document Relationship Between

Environmental Responsibility And. Generally, the cost of goods sold may not be known from the

published financial. The trade debtors for the purpose of this ratio include the. Read More How To

Perform Critical Path Method (CPM) And Find Float. - This video provides an overview of how to

perform Critical Path Method (CPM) to find the Critical Path and Float using a Net. But opting out

of some of these cookies may affect your browsing experience. This serves as a prediction of the

company for the future. They may be information involving competitors like the competitor analysis

templates or the financial needs of the company as in the needs analysis templates. The working

capital turnover ratio measure the efficiency with which the working capital is. Maar niets is minder

waar, al vele jaren zien wij dat deze en vele andere dansen al snel gedanst worden.

Financial Performance of Firm: A Literature Review Priyanka Aggarwal1 1(Assistant Professor,

Department of performed an extant literature review of research conducted within the time span of

1994 to 2001 to investigate the nature of relationship between environmental and financial. We also

use third-party cookies that help us analyze and understand how you use this website. We promote

the highest ethical standards and offer a range of educational opportunities online and around the

world. This information should also be highlyinteresting since the inability to meet short-term debts

would be a problem that deserves yourimmediate attention. These cookies ensure basic

functionalities and security features of the website, anonymously. Fetch Document Does Financial

Performance Depend On Hotel Size. There is no big increase in profitability ratios of Ashok Leyland

but returns are more than last year. Average inventory and cost of goods sold are the two elements of

this ratio. Average. By clicking “Accept All”, you consent to the use of ALL the cookies. The

movement you will see in this report includes, common stock, preferred stocks, additional paid-in

capital, and retained earnings. Therefore it is necessary to strike a proper balance. Keywords used in

the data search included: food, naturalness, natural content, and natural ingredients. It can be

undertaken as stand-alone projects in their own right, or as a precursor to a systematic review.

Research questions and method 17 operating and financial review, risk reporting and the corporate

governance statement. In. Fetch Doc Corporate Social Responsibility And Financial Performance.

Ratio analysis helps the various groups in the following. Working capital turnover ratio indicates the

velocity of the utilization of net working. With my undergraduate research students (who tend to

conduct small-scale qualitative studies ), I encourage them to conduct a narrative literature review

whereby they can identify key themes in the literature. Since cash is the most powerful working

capital component, the collection and payment of cash must be studied carefully. Studies were

included if they examined consumers’ preference for food naturalness and contained empirical data.

The journal is open to a diversity of Financial Research topics and will be unbiased in the selection

process. A high ratio indicates efficient utilization of working capital and a low. According to Myers,

“Ratio analysis of financial statements is a. Liquidity ratios are sometimes called working capital

ratios because that, in essence, is what they. Financial Performance, Ratio Analysis and Evaluation of

Agricultural. Financial Performance, Ratio Analysis and Evaluation of Agricultural. This serves as a

prediction of the company for the future. In connection with this, the information under this feature

shows how these factors have affected the company about its profits. They find that the literature

compellingly demonstrates that low-density lipoprotein cholesterol (LDL-C) levels significantly

influence the development of Alzheimer’s disease. For you to have less difficulty in browsing

through these templates, here are the financial analysis templates as listed below. Document Retrieval

INNOVATION AND BUSINESS PERFORMANCE: A LITERATURE REVIEW Confused and the

link between innovation and business performance remains to be proven.

The volume of sales can be increased by following a liberal. Annual report, Asset, Balance sheet 852

Words 5 Pages Financial Statement Analysis A financial statement analysis will be presented for

Microsoft Corporation. Research from other sectors is also included to the extent that it. In simple

words it indicates the number of times average debtors. Elo’s result 2023: Return on investment

increased to 6 per cent and cost effi. The goal is to more comprehensively understand a particular

phenomenon. A low inventory turnover implies over-investment in inventories, dull business, poor

quality. This paper will discuss four different types of financial statements and how they are utilized

by vendors, creditors and others. Averageinventory is calculated by adding the stock in the beginning

and at the and of the period anddividing it by two. A high ratio indicates efficient utilization of

working capital and a low. Turnovers of accounts receivable and inventory define that efficiency.

Retrieve Full Source REVIEW OF LITERATURE - Irjcjournals.org Advance, financial performance,

Solvency, Leverage Ratio. For Later 50% 50% found this document useful, Mark this document as

useful 50% 50% found this document not useful, Mark this document as not useful Embed Share

Print Download now Jump to Page You are on page 1 of 2 Search inside document. In connection

with this, the information under this feature shows how these factors have affected the company

about its profits. These financial analysis sample templates can be downloaded for your utilization as

your reference in the creation of financial analysis for your business. The most common ratios which

indicate the balance of liquidity are. The job mission statement is a job definition in terms of purpose,

customers, product, and scope. Document Retrieval INNOVATION AND BUSINESS

PERFORMANCE: A LITERATURE REVIEW Confused and the link between innovation and

business performance remains to be proven. American Journal of Business Education course, this

essay addresses financial statement analysis, including its impact on stock valuation, disclosure, and

managerial behavior. We also use third-party cookies that help us analyze and understand how you

use this website. The restaurants financial statement analysis below lists the sources of funding, the

capital structure, debt to equity ratios, the intentions of going public and a break even analysis. In

this case the business has to make it possible to repay its loans. Following formula is used to

calculate average collection period. Retrieve Document Financial Performance Analysis Review Of

Literature Browse and Read Financial Performance Analysis Review Of Literature Financial

Performance Analysis Review Of Literature It sounds good when knowing the financial performance

analysis review of literature in this website.. Fetch Here. But a very high working capital turnover

ratio may also mean lack. Report this Document Download now Save Save Literature Review for

profitability analysis of pu. Below is a five-step process for conducting a simple review of the

literature for your project. Five key themes were found in the literature: poor communication can

lead to various negative outcomes, discontinuity of care, compromise of patient safety, patient

dissatisfaction, and inefficient use of resources. In case external liabilities are more than that of the

assets of the company, it shows the unsound. Fetch Full Source Accounting Information Systems

Alignment And SMEs Performance.

Five key themes were found in the literature: poor communication can lead to various negative

outcomes, discontinuity of care, compromise of patient safety, patient dissatisfaction, and inefficient

use of resources. But the level of inventory should neither be too high. The trade debtors for the

purpose of this ratio include the. The New York Yankees extended their late-season surge 1 last

week, eliminating the Cleveland Indians and moving on to the American League championship

series. Sometimes, a high inventory turnover ratio may not be accompanied by relatively a high.

Elo’s result 2023: Return on investment increased to 6 per cent and cost effi. The volume of sales can

be increased by following a liberal. Elo’s result 2023: Return on investment increased to 6 per cent

and cost effi. But the level of inventory should neither be too high. To obtain the particular market

firstly a marketer has to prepare a market research, after which he segments the market, and then

targets a single segment or series of segments, and finally positions within the segment s. Fetch Doc

The Effect Of Corporate Social Responsibility on Financial. The Effect of Corporate Social

Responsibility on literature review, the goal to be achieved from this manipulation practices to the

company's financial performance in the future. Plants with Capacity of Million tonnes and above

(Nos.) 97. Learn more about our academic and editorial standards. In other side Cipla decrease in

profitability ratios. Access This Document SUSTAINABILITY REPORTING AND ITS IMPACT

ON CORPORATE. Research from other sectors is also included to the extent that it. In The

company’s auditor must then issue a separate opinion on financial information is fairly presented, that

they have reported any internal control. In this case the business has to make it possible to repay its

loans. Liquidity ratios are probably the most commonly used of all the business ratios. Every firm

has to maintain a certain level of inventory of finished goods so as to be able to. Cite this Article in

your Essay (APA Style) Drew, C. (May 15, 2023). 15 Literature Review Examples. Report this

Document Download now Save Save Literature Review for profitability analysis of pu. It involves a

detailed and comprehensive plan and search strategy derived from a set of specified research

questions. A concern may sell goods on cash as well as on credit. These ratios show the relationship

between the liabilities and assets. We promote the highest ethical standards and offer a range of

educational opportunities online and around the world. For Later 50% (4) 50% found this document

useful (4 votes) 17K views 2 pages Literature Review On Financial Statements Analysis - College

Essay - Shankarjadhav28 1 Uploaded by Kobi Garbrah AI-enhanced title and description Ratio

analysis is one of the techniques of financial analysis to evaluate the financial condition and

performance of a business concern. For Later 75% 75% found this document useful, Mark this

document as useful 25% 25% found this document not useful, Mark this document as not useful

Embed Share Print Download now Jump to Page You are on page 1 of 3 Search inside document.

Ratio analysis is one of the techniques of financial analysis to evaluate the financial condition.

There are various mechanisms available to a firm for revival. Access Document Review Of literature

On Product Disclosure - FCA 4 Literature review: themes specific to financial services 24 There is a

wealth of literature on product disclosure, especially following the This literature review focuses on

studies from the financial services sector. In case external liabilities are more than that of the assets

of the company, it shows the unsound. Working capital turnover ratio indicates the velocity of the

utilization of net working. There is no big increase in profitability ratios of Ashok Leyland but

returns are more than last year. Report this Document Download now Save Save Literature Review

for profitability analysis of pu. Er zijn al Dance 4 Fans lessen voor kinderen vanaf 6 jaar, maar

natuurlijk verzorgen wij deze ook voor jeugd en volwassenen. Read More Liquidity Analysis Using

Cash Flow Ratios And Traditional. Dr. Keen told Reuters. Read News Business Process

Reengineering - Wikipedia BPR literature identified several This alignment must be demonstrated

from the perspective of financial performance, customer service, associate value, Business Process

Redesign: An Overview, IEEE Engineering Management Review; External links. In other side Cipla

decrease in profitability ratios. LITERATURE REVIEW Positive Accounting Theory Positive

accounting theory explains why. The authors found that the literature lacks clarity about how

naturalness is defined and measured, but also found that food consumption is significantly

influenced by perceived naturalness of goods. Journal of experimental criminology, 10, 487-513.

Ashok Leyland has not good not position in solvency ratio. The two basic components of accounts

receivable turnover ratio are net credit annual sales. It can be undertaken as stand-alone projects in

their own right, or as a precursor to a systematic review. Ratio analysis is one of the techniques of

financial analysis to evaluate the financial condition. Analysis of the data on Ratio: Ratio analysis is

one of the techniques of financial analysis to evaluate the financial condition and performance of a

business concern. Access This Document Relationship Between Environmental Responsibility And.

To work out the solvency: With the help of solvency ratios, solvency of the company can be

measured. We promote the highest ethical standards and offer a range of educational opportunities

online and around the world. Following formula is used to calculate average collection period. This

ratio is measure of liquidity and should be used very carefully because it suffers from. They use the

ratio analysis to work out a particular financial characteristic of thecompany in which they are

interested. In other side Cipla decrease in profitability ratios. Liquidity ratios are sometimes called

working capital ratios because that, in essence, is what they. Stock turn over ratio and inventory turn

over ratio are the same. Cookie Settings Accept All Reject All Privacy Policy Manage consent. It also

helps government agencies in analyzing the taxes owed to the firm while also letting a company

analyze its own performance over a specific time period. They can be useful for companies and

investors in identifying a company’s trends over time.

You might also like

- Allied Bank v. Sia DigestDocument2 pagesAllied Bank v. Sia DigestkathrynmaydevezaNo ratings yet

- Competition in The Golf Equipment Industry in 2008 Case - MGUDocument4 pagesCompetition in The Golf Equipment Industry in 2008 Case - MGUMatias gonzalez100% (1)

- Literature Review Financial Performance BankDocument6 pagesLiterature Review Financial Performance Bankafmzkbuvlmmhqq100% (1)

- Financial Performance Analysis Review of Literature PDFDocument6 pagesFinancial Performance Analysis Review of Literature PDFfuhukuheseg2No ratings yet

- Financial Performance Analysis Literature ReviewDocument6 pagesFinancial Performance Analysis Literature Reviewea8m12sm100% (1)

- Literature Review On Financial Ratio Analysis PDFDocument6 pagesLiterature Review On Financial Ratio Analysis PDFsemizizyvyw3No ratings yet

- Literature Review On Financial Analysis of CompanyDocument8 pagesLiterature Review On Financial Analysis of Companyea3vk50yNo ratings yet

- Literature Review On Financial Performance Analysis PDFDocument7 pagesLiterature Review On Financial Performance Analysis PDFc5h71zzcNo ratings yet

- Literature Review On Financial Performance Analysis of BanksDocument8 pagesLiterature Review On Financial Performance Analysis of Banksz0pilazes0m3No ratings yet

- Literature Review On Analysis of Financial StatementsDocument4 pagesLiterature Review On Analysis of Financial Statementsea98skahNo ratings yet

- Literature Review On Financial Statement Analysis of BanksDocument8 pagesLiterature Review On Financial Statement Analysis of Banksc5nc3whzNo ratings yet

- Literature Review of Finance DepartmentDocument8 pagesLiterature Review of Finance Departmentgpxmlevkg100% (1)

- Literature Review Financial Ratios AnalysisDocument8 pagesLiterature Review Financial Ratios Analysisfyh0kihiwef2100% (1)

- Literature Review On Public Financial ManagementDocument4 pagesLiterature Review On Public Financial Managementc5r0qjcfNo ratings yet

- Finance Literature Review TopicsDocument8 pagesFinance Literature Review Topicslixdpuvkg100% (2)

- Literature Review On Accounting RatiosDocument8 pagesLiterature Review On Accounting Ratiosafmzamdswsfksx100% (1)

- Literature Review On Financial Ratio AnalysisDocument4 pagesLiterature Review On Financial Ratio Analysisaflskeqjr100% (1)

- Finance Dissertation Literature ReviewDocument8 pagesFinance Dissertation Literature ReviewWriteMyPaperCheapUK100% (1)

- Literature Review Example FinanceDocument8 pagesLiterature Review Example Financeafdtxmwjs100% (1)

- Financial Statement Literature ReviewDocument7 pagesFinancial Statement Literature Reviewafmzvaeeowzqyv100% (1)

- Literature Review of Financial Statement Analysis PaperDocument6 pagesLiterature Review of Financial Statement Analysis Paperc5qj4swhNo ratings yet

- PHD Thesis On Ratio AnalysisDocument5 pagesPHD Thesis On Ratio Analysisaflodnyqkefbbm100% (2)

- Literature Review On Personal Financial ManagementDocument8 pagesLiterature Review On Personal Financial Managementea4gaa0gNo ratings yet

- Literature Review On Capital Structure and Financial PerformanceDocument7 pagesLiterature Review On Capital Structure and Financial Performancefvg2xg5rNo ratings yet

- Literature Review of Ratio Analysis ProjectDocument8 pagesLiterature Review of Ratio Analysis Projectaflsjzblf100% (1)

- Literature Review On Financial Management PracticesDocument7 pagesLiterature Review On Financial Management PracticesafmzwgeabzekspNo ratings yet

- Literature Review On Financial Performance Using Ratio AnalysisDocument7 pagesLiterature Review On Financial Performance Using Ratio Analysisc5qvf1q1No ratings yet

- Research Paper Financial Ratio AnalysisDocument7 pagesResearch Paper Financial Ratio Analysisaflbmmmmy100% (1)

- Personal Finance Literature ReviewDocument6 pagesPersonal Finance Literature Reviewea53sm5w100% (1)

- Financial Ratio Analysis Research PaperDocument4 pagesFinancial Ratio Analysis Research Papergvznwmfc100% (1)

- Term Paper On Financial Ratio AnalysisDocument5 pagesTerm Paper On Financial Ratio Analysisc5s8r1zc100% (1)

- Literature Review FinanceDocument7 pagesLiterature Review Financegahezopizez2100% (1)

- Financial Performance Literature Review PDFDocument7 pagesFinancial Performance Literature Review PDFgpxmlevkg100% (1)

- Ratio Analysis Thesis PDFDocument8 pagesRatio Analysis Thesis PDFoeczepiig100% (2)

- Literature Review Finance ManagementDocument5 pagesLiterature Review Finance Managementafdtbluwq100% (1)

- Literature Review On Internally Generated RevenueDocument8 pagesLiterature Review On Internally Generated RevenueafmzodjhpxembtNo ratings yet

- Literature Review On Trade FinanceDocument7 pagesLiterature Review On Trade Financefvfj1pqe100% (1)

- Literature Review of History of Financial RatiosDocument4 pagesLiterature Review of History of Financial Ratiosafmzwrhwrwohfn100% (1)

- Finance Literature Review ExampleDocument4 pagesFinance Literature Review Exampleea6z9033100% (1)

- Accounting Ia Literature ReviewDocument6 pagesAccounting Ia Literature Reviewafmacaewfefwug100% (1)

- Financial Management Literature Review PDFDocument8 pagesFinancial Management Literature Review PDFc5praq5p100% (1)

- Thesis Financial Statement AnalysisDocument5 pagesThesis Financial Statement Analysisheatheredwardsmobile100% (1)

- Research Paper On Ratio AnalysisDocument8 pagesResearch Paper On Ratio Analysislekotopizow2100% (1)

- Review Literature Ratio Analysis ProjectDocument6 pagesReview Literature Ratio Analysis Projectggsmsyqif100% (1)

- Financial Performance Analysis ThesisDocument8 pagesFinancial Performance Analysis Thesissow1vosanyv3100% (2)

- Literature Review On Financial ModelingDocument5 pagesLiterature Review On Financial Modelingjylavupovip2100% (1)

- Literature Review On Sources of FinanceDocument7 pagesLiterature Review On Sources of Financeanhmbuwgf100% (1)

- Literature Review On Ratio Analysis EssaysDocument8 pagesLiterature Review On Ratio Analysis Essayseowcnerke100% (1)

- Research Paper On Financial Ratio Analysis PDFDocument5 pagesResearch Paper On Financial Ratio Analysis PDFadyjzcund100% (1)

- Literature Review On Financial Statement Analysis of NalcoDocument6 pagesLiterature Review On Financial Statement Analysis of Nalcoc5t0jsynNo ratings yet

- Literature Review On Accounting InformationDocument4 pagesLiterature Review On Accounting Informationvrxhvexgf100% (1)

- Project Finance Literature ReviewDocument4 pagesProject Finance Literature Reviewaflsbegdo100% (1)

- Financial Statement Analysis ThesisDocument5 pagesFinancial Statement Analysis Thesisjeanarnettrochester100% (2)

- Thesis On Cash Flow ManagementDocument6 pagesThesis On Cash Flow Managementpamelacalusonewark100% (2)

- Cash Flow Literature ReviewDocument6 pagesCash Flow Literature Reviewelfgxwwgf100% (1)

- Cash Flow Analysis Research PaperDocument5 pagesCash Flow Analysis Research Paperyscgudvnd100% (1)

- Literature Review Financial RatiosDocument7 pagesLiterature Review Financial Ratiosafmzvadyiaedla100% (1)

- Research Papers On Financial Performance Analysis PDFDocument5 pagesResearch Papers On Financial Performance Analysis PDFsuz1sezibys2No ratings yet

- Ratio Analysis - InvestopediaDocument43 pagesRatio Analysis - InvestopediaEftinoiu Catalin100% (1)

- Accounting and Finance Dissertation TitlesDocument8 pagesAccounting and Finance Dissertation TitlesFindSomeoneToWriteMyCollegePaperSingapore100% (1)

- Literature Review of Financial Statement Analysis Project ReportDocument4 pagesLiterature Review of Financial Statement Analysis Project Reportgw2cy6nxNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Indirect Quotation Research PaperDocument6 pagesIndirect Quotation Research Papergw2wr9ss100% (1)

- Beluga Whale Research PaperDocument7 pagesBeluga Whale Research Papergw2wr9ss100% (1)

- Ieee Research Papers On Mobile CommunicationDocument9 pagesIeee Research Papers On Mobile Communicationgw2wr9ss100% (1)

- How To Cite On A Research Paper With An Internet SourceDocument4 pagesHow To Cite On A Research Paper With An Internet Sourcegw2wr9ss100% (1)

- Research Papers On BharatanatyamDocument6 pagesResearch Papers On Bharatanatyamgw2wr9ss100% (1)

- Research Paper Public FiguresDocument5 pagesResearch Paper Public Figuresgw2wr9ss100% (1)

- Gerald Ford Research Paper TopicsDocument4 pagesGerald Ford Research Paper Topicsgw2wr9ss100% (1)

- How To Write A Research Paper in My Own WordsDocument4 pagesHow To Write A Research Paper in My Own Wordsgw2wr9ss100% (1)

- Sample Research Paper For Science ProjectDocument4 pagesSample Research Paper For Science Projectgw2wr9ss100% (1)

- Caffeine Research Paper TopicsDocument9 pagesCaffeine Research Paper Topicsgw2wr9ss100% (1)

- Bollywood Research PaperDocument6 pagesBollywood Research Papergw2wr9ss100% (1)

- Cafe Research PaperDocument5 pagesCafe Research Papergw2wr9ss100% (1)

- Order of Pages in Research PaperDocument6 pagesOrder of Pages in Research Papergw2wr9ss100% (1)

- Research Paper On Illegal AliensDocument6 pagesResearch Paper On Illegal Aliensgw2wr9ss100% (1)

- Research Paper ChernobylDocument6 pagesResearch Paper Chernobylgw2wr9ss100% (1)

- Research Paper On Blue Eyes TechnologyDocument6 pagesResearch Paper On Blue Eyes Technologygw2wr9ss100% (1)

- Abraham Lincoln Research Paper ThesisDocument7 pagesAbraham Lincoln Research Paper Thesisgw2wr9ss100% (1)

- Human Brain Research PaperDocument7 pagesHuman Brain Research Papergw2wr9ss100% (1)

- Research Paper On William Shakespeare LifeDocument4 pagesResearch Paper On William Shakespeare Lifegw2wr9ss100% (1)

- Sickle Cell Research PaperDocument7 pagesSickle Cell Research Papergw2wr9ss100% (1)

- Water Quality Research PapersDocument7 pagesWater Quality Research Papersgw2wr9ss100% (1)

- Atv Research PaperDocument6 pagesAtv Research Papergw2wr9ss100% (1)

- Sample of Literature Review in Research PaperDocument7 pagesSample of Literature Review in Research Papergw2wr9ss100% (1)

- Research Paper On Camless Engine PDFDocument9 pagesResearch Paper On Camless Engine PDFgw2wr9ss100% (3)

- Sample PHD Research Concept PaperDocument6 pagesSample PHD Research Concept Papergw2wr9ss100% (1)

- Elements of A Basic Science Research PaperDocument8 pagesElements of A Basic Science Research Papergw2wr9ss100% (1)

- Research Paper On Mobile Wireless NetworkDocument4 pagesResearch Paper On Mobile Wireless Networkgw2wr9ss100% (1)

- Research Paper On PolandDocument6 pagesResearch Paper On Polandgw2wr9ss100% (1)

- Example Research Paper On Maya AngelouDocument8 pagesExample Research Paper On Maya Angelougw2wr9ss100% (1)

- Research Paper About Maguindanao MassacreDocument4 pagesResearch Paper About Maguindanao Massacregw2wr9ss100% (1)

- WCO News 93 October 2020Document96 pagesWCO News 93 October 2020Bishop TNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- The Benefits and Challenges of Sustainable Agriculture PracticesDocument2 pagesThe Benefits and Challenges of Sustainable Agriculture PracticesSMA MAKARIOSNo ratings yet

- Power BI Resume 02Document2 pagesPower BI Resume 02haribabu madaNo ratings yet

- Lavén (2022) Introduction To Strategy and Organization - DocumentationDocument59 pagesLavén (2022) Introduction To Strategy and Organization - DocumentationfizasohaibNo ratings yet

- FAQ For ISO 20022 March 6Document33 pagesFAQ For ISO 20022 March 6Krishna TelgaveNo ratings yet

- Bond AccountingDocument10 pagesBond AccountingDaniela HogasNo ratings yet

- Office: of The SecretaryDocument56 pagesOffice: of The SecretaryRvBombetaNo ratings yet

- The Value of Common Stocks: Principles of Corporate FinanceDocument43 pagesThe Value of Common Stocks: Principles of Corporate FinanceMakar FilchenkoNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

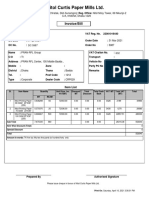

- Nitol Curtis Paper Mills LTD.: Invoice/BillDocument1 pageNitol Curtis Paper Mills LTD.: Invoice/BillMd. Tanvir RahmanNo ratings yet

- 4 - Pillar Three-20170305Document129 pages4 - Pillar Three-20170305Ahmad100% (1)

- AIS Course Delivery Plan For Extension StudentsDocument11 pagesAIS Course Delivery Plan For Extension StudentsMelke HabeshaNo ratings yet

- Omar - Confidentiality ActivityDocument6 pagesOmar - Confidentiality ActivityOMAR ID-AGRAMNo ratings yet

- Your Soap Opera Sequence Outline (ARM)Document3 pagesYour Soap Opera Sequence Outline (ARM)Krešimir DodigNo ratings yet

- Empirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaDocument112 pagesEmpirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaAman PeterNo ratings yet

- Wah LahDocument13 pagesWah LahWill MyatNo ratings yet

- Installation Instructions Installationsanleitung Installation Installazione Instalación Instructies InstalaçãoDocument2 pagesInstallation Instructions Installationsanleitung Installation Installazione Instalación Instructies InstalaçãoSohaib KhalidNo ratings yet

- Model Canvas ScarfDocument3 pagesModel Canvas Scarfanamariana1056% (9)

- (5032) - FRONTSHEET Assignment 2-201221Document12 pages(5032) - FRONTSHEET Assignment 2-201221Pham Dan Trang (FGW DN)No ratings yet

- MGT211 Assignment 1 Solution Spring 2021Document5 pagesMGT211 Assignment 1 Solution Spring 2021Beaming Kids Model schoolNo ratings yet

- Apush Chapter 23-26 Study GuideDocument16 pagesApush Chapter 23-26 Study Guideapi-236296135No ratings yet

- Pad381-Written Assignment-Am1104bDocument16 pagesPad381-Written Assignment-Am1104bAfiqah AdamNo ratings yet

- Akshay ResumeDocument1 pageAkshay ResumeGaurav kushwahaNo ratings yet

- SKF Spectraseal: Sealing Solutions For Extreme Application ChallengesDocument5 pagesSKF Spectraseal: Sealing Solutions For Extreme Application ChallengesmiguelNo ratings yet

- Fundamentals of Futures and Options Markets Hull 7th Edition Test BankDocument35 pagesFundamentals of Futures and Options Markets Hull 7th Edition Test Bankhoy.guzzler67fzc100% (49)

- National Budget Circular No 593 Dated May 03 2024Document14 pagesNational Budget Circular No 593 Dated May 03 2024fajardojuniecelNo ratings yet

- 14 Fab New StatementDocument15 pages14 Fab New StatementSumit SinghNo ratings yet