Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsMODULE 5 ACT - DI KO SHOREE AHH Dek

MODULE 5 ACT - DI KO SHOREE AHH Dek

Uploaded by

eumague.136515090273The document contains sales data for 4 periods including beginning inventory, net purchases, ending inventory, cost of goods sold, gross profit, operating expenses, and net income. It also includes formulas to calculate beginning inventory, cost of goods sold, net purchases, and ending inventory based on the other figures provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Pengantar Akutansi Bab5Document7 pagesPengantar Akutansi Bab5Titus SitorusNo ratings yet

- Module 8 - Home Office, Branch and Agency AccountingDocument8 pagesModule 8 - Home Office, Branch and Agency AccountingSunshine Khuletz67% (3)

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument5 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aYamateNo ratings yet

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BMark Christian BrlNo ratings yet

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BAnonn100% (2)

- Module 5.1 - Sample ProblemsDocument5 pagesModule 5.1 - Sample ProblemsRafols AnnabelleNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315arman_277276271No ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Variable Costing Case Part A SolutionDocument3 pagesVariable Costing Case Part A SolutionG, BNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet

- Answer Key. Inventory EstimationDocument3 pagesAnswer Key. Inventory EstimationVictoria CadizNo ratings yet

- ACP312 Intercompany-Sale-Of-Inventory-QuizDocument31 pagesACP312 Intercompany-Sale-Of-Inventory-QuizJocelyn GorospeNo ratings yet

- Week 09 - Inventory EstimationsDocument3 pagesWeek 09 - Inventory EstimationsPj ManezNo ratings yet

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883No ratings yet

- Confidential DataDocument12 pagesConfidential Datagayathri bangaramNo ratings yet

- Fine Manufacturing CompanyDocument4 pagesFine Manufacturing CompanyexquisiteNo ratings yet

- Akuntansi ManufakturDocument7 pagesAkuntansi ManufakturZEN AMALIANo ratings yet

- 4 Gross and Profit Method Retail Inventory MethodDocument6 pages4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNo ratings yet

- Akuntansi Tugas 1 NDocument2 pagesAkuntansi Tugas 1 NRala SuriNo ratings yet

- Confidential DataDocument10 pagesConfidential Datagayathri bangaramNo ratings yet

- Post Test - Answer KeyDocument6 pagesPost Test - Answer KeyLynn A. NuestroNo ratings yet

- Take Home Examination Bbma3203Document6 pagesTake Home Examination Bbma3203Sufian Abd RahimNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- BE Chap 5Document3 pagesBE Chap 5TIÊN NGUYỄN LÊ MỸNo ratings yet

- Cost Bookkeeping With AnswersDocument9 pagesCost Bookkeeping With AnswersHafsa HayatNo ratings yet

- Madamot Company Year 2022 (End) Year 2021 (Beg)Document11 pagesMadamot Company Year 2022 (End) Year 2021 (Beg)VonDrei MedinaNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Sales Budget Q1 Q2 Q3 Q4 Year 2021Document9 pagesSales Budget Q1 Q2 Q3 Q4 Year 2021Judith DurensNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- Problem 1Document6 pagesProblem 1Elle VernezNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Merchandising Problem 3 ANSWERDocument4 pagesMerchandising Problem 3 ANSWERBrian Gerome MercadoNo ratings yet

- Chapter 9 2Document34 pagesChapter 9 2Genie MaeNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Date Received Issued Quantity Unit Cost Amount Quantity Unit CostDocument6 pagesDate Received Issued Quantity Unit Cost Amount Quantity Unit CostLeslyne Love C. NograNo ratings yet

- Tut Mene AccDocument7 pagesTut Mene Accnatasya angelNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- 61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument17 pages61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

MODULE 5 ACT - DI KO SHOREE AHH Dek

MODULE 5 ACT - DI KO SHOREE AHH Dek

Uploaded by

eumague.1365150902730 ratings0% found this document useful (0 votes)

8 views2 pagesThe document contains sales data for 4 periods including beginning inventory, net purchases, ending inventory, cost of goods sold, gross profit, operating expenses, and net income. It also includes formulas to calculate beginning inventory, cost of goods sold, net purchases, and ending inventory based on the other figures provided.

Original Description:

Original Title

MODULE-5-ACT_DI-KO-SHOREE-AHH-dek

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains sales data for 4 periods including beginning inventory, net purchases, ending inventory, cost of goods sold, gross profit, operating expenses, and net income. It also includes formulas to calculate beginning inventory, cost of goods sold, net purchases, and ending inventory based on the other figures provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesMODULE 5 ACT - DI KO SHOREE AHH Dek

MODULE 5 ACT - DI KO SHOREE AHH Dek

Uploaded by

eumague.136515090273The document contains sales data for 4 periods including beginning inventory, net purchases, ending inventory, cost of goods sold, gross profit, operating expenses, and net income. It also includes formulas to calculate beginning inventory, cost of goods sold, net purchases, and ending inventory based on the other figures provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

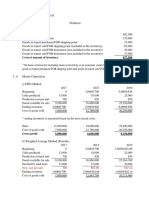

Sales Beginning Net Ending Cost of Gross Operating Net

Inventory Purchases Inventor Goods Profit Expenses Income

Sold (Net Loss)

1 P350,000.- 300,000- P170,000.- P120,000.- 350,000- P180,000.- 56,000- P124,000.-

2 536,000- P124,000.- 328,000- 136,000.- P316,000- 220,000.- 80,000.- 140,000.-

3 280,000.- 72,000.- 217,000.- 100,000- 189,000- 100,000.- 49,000- 51,000.-

4 880,000.- 180,000.- 220,000- 220,000.- 180,000- 700,000- 340,000.- 180,000.-

Formulas:

Beginning Inventory = Sales (COGS) + Ending Inventory - Purchases (inventory added to

stock)

A - (350,000+120,000-170,000) = 300,000-

Cost of Goods Sold = Beginning Inventory + Purchased Inventory - Ending Inventory. OR

Net Income - Gross Profit

B- (300,000+170,000-120,000) = 350,000-

G- (72,000+217,000−100,000) = 189,000-

J- (880,000−700,000)= 180,000-

Operating Expense = Gross Profit - Net Income

C- (180,000-124,000) = 56,000-

H- (100,000-51,000) = 49,000-

Sales = COGS + Gross Profit

D- (316,000+220,000) = 536,000

Net Purchases = COGS + Ending Inventory - Beginning Inventory

E- (316,000+136,000-124,000) = 328,000-

I- Since Gross Profit is not directly given, let's find it using the Net Income:

Gross Profit=Sales−Net Income

Gross Profit=(880,000−180,000)= 700,000-

Now, we can use Gross Profit to find COGS:

COGS=Sales−Gross Profit

COGS=(880,000−700,000)= 180,000-

Finally, use COGS to find Net Purchases:

Net Purchases=COGS+Ending Inventory−Beginning Inventory

Net Purchases=(180,000+220,000−180,000)= 220,000-

Ending Inventory = Beginning inventory + net purchases – COGS

F- (72,000+217,000-189,000) = 100,000-

Gross Profit = Net Sales - COGS

K- (880,000−180,000)= 700,000-

You might also like

- Pengantar Akutansi Bab5Document7 pagesPengantar Akutansi Bab5Titus SitorusNo ratings yet

- Module 8 - Home Office, Branch and Agency AccountingDocument8 pagesModule 8 - Home Office, Branch and Agency AccountingSunshine Khuletz67% (3)

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument5 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aYamateNo ratings yet

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BMark Christian BrlNo ratings yet

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BAnonn100% (2)

- Module 5.1 - Sample ProblemsDocument5 pagesModule 5.1 - Sample ProblemsRafols AnnabelleNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315arman_277276271No ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Variable Costing Case Part A SolutionDocument3 pagesVariable Costing Case Part A SolutionG, BNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet

- Answer Key. Inventory EstimationDocument3 pagesAnswer Key. Inventory EstimationVictoria CadizNo ratings yet

- ACP312 Intercompany-Sale-Of-Inventory-QuizDocument31 pagesACP312 Intercompany-Sale-Of-Inventory-QuizJocelyn GorospeNo ratings yet

- Week 09 - Inventory EstimationsDocument3 pagesWeek 09 - Inventory EstimationsPj ManezNo ratings yet

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883No ratings yet

- Confidential DataDocument12 pagesConfidential Datagayathri bangaramNo ratings yet

- Fine Manufacturing CompanyDocument4 pagesFine Manufacturing CompanyexquisiteNo ratings yet

- Akuntansi ManufakturDocument7 pagesAkuntansi ManufakturZEN AMALIANo ratings yet

- 4 Gross and Profit Method Retail Inventory MethodDocument6 pages4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNo ratings yet

- Akuntansi Tugas 1 NDocument2 pagesAkuntansi Tugas 1 NRala SuriNo ratings yet

- Confidential DataDocument10 pagesConfidential Datagayathri bangaramNo ratings yet

- Post Test - Answer KeyDocument6 pagesPost Test - Answer KeyLynn A. NuestroNo ratings yet

- Take Home Examination Bbma3203Document6 pagesTake Home Examination Bbma3203Sufian Abd RahimNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- BE Chap 5Document3 pagesBE Chap 5TIÊN NGUYỄN LÊ MỸNo ratings yet

- Cost Bookkeeping With AnswersDocument9 pagesCost Bookkeeping With AnswersHafsa HayatNo ratings yet

- Madamot Company Year 2022 (End) Year 2021 (Beg)Document11 pagesMadamot Company Year 2022 (End) Year 2021 (Beg)VonDrei MedinaNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Sales Budget Q1 Q2 Q3 Q4 Year 2021Document9 pagesSales Budget Q1 Q2 Q3 Q4 Year 2021Judith DurensNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- Problem 1Document6 pagesProblem 1Elle VernezNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Merchandising Problem 3 ANSWERDocument4 pagesMerchandising Problem 3 ANSWERBrian Gerome MercadoNo ratings yet

- Chapter 9 2Document34 pagesChapter 9 2Genie MaeNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Date Received Issued Quantity Unit Cost Amount Quantity Unit CostDocument6 pagesDate Received Issued Quantity Unit Cost Amount Quantity Unit CostLeslyne Love C. NograNo ratings yet

- Tut Mene AccDocument7 pagesTut Mene Accnatasya angelNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- 61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument17 pages61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)