Professional Documents

Culture Documents

CGST Act Summary of Sections

CGST Act Summary of Sections

Uploaded by

Murali Krishnan R0 ratings0% found this document useful (0 votes)

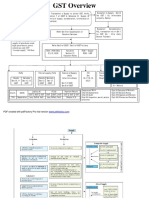

3 views1 pageThe document summarizes the Central Goods and Services Tax Act of 2017 in India. It contains 21 chapters covering topics like administration, levy and collection of tax, registration, returns, payments, refunds, assessments, audits, inspections, demands and recovery, offenses and penalties, transitional provisions, and miscellaneous items. Schedules I, II, and III further define activities to be treated as supply even without consideration as well as activities that are neither a supply of goods nor services.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the Central Goods and Services Tax Act of 2017 in India. It contains 21 chapters covering topics like administration, levy and collection of tax, registration, returns, payments, refunds, assessments, audits, inspections, demands and recovery, offenses and penalties, transitional provisions, and miscellaneous items. Schedules I, II, and III further define activities to be treated as supply even without consideration as well as activities that are neither a supply of goods nor services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageCGST Act Summary of Sections

CGST Act Summary of Sections

Uploaded by

Murali Krishnan RThe document summarizes the Central Goods and Services Tax Act of 2017 in India. It contains 21 chapters covering topics like administration, levy and collection of tax, registration, returns, payments, refunds, assessments, audits, inspections, demands and recovery, offenses and penalties, transitional provisions, and miscellaneous items. Schedules I, II, and III further define activities to be treated as supply even without consideration as well as activities that are neither a supply of goods nor services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

GST

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

Chapters Title Sections

I Preliminary 1-2

II Administration 3-6

III Levy and Collection of Tax 7-11

IV Time and Value of Supply 12-15

V Input Tax credit 16-21

VI Registration 22-30

VII Tax Invoice, Credit and Debit notes 31-34

VIII Accounts and Records 35-36

IX Returns 37-48

X Payment of Tax 49-53

XI Refunds 54-58

XII Assessment 59-64

XIII Audit 65-66

XIV Inspection, Search , Seizure and arrest 67-72

XV Demands and Recovery 73-84

XVI Liability to Pay in certain cases 85-94

XVII Advance Ruling 95-106

XVIII Appeals and Revision 107-121

XIX Offences and Penalties 122-138

XX Transitional Provisions 139-142

XXI Miscellaneous 143-174

Schedule I Activities to be treated as supply even if made without consideration

Schedule II Activities to be treated as supply of goods or supply of services

Schedule III Activities or Transactions which shall be treated neither as a Supply of Goods nor

a Supply of Services

______________________________________________________ Page 7_____________________________________________________

MK

Version 7.07

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Case Digest Week 2 CommodatumDocument3 pagesCase Digest Week 2 CommodatumAnonymous b4ycWuoIcNo ratings yet

- Chapter 28&29 America On The World Stage Progressivism & Republican RooseveltDocument10 pagesChapter 28&29 America On The World Stage Progressivism & Republican RooseveltAnna LeeNo ratings yet

- GFR Vol I PDFDocument156 pagesGFR Vol I PDFsaddamNo ratings yet

- KGSTAct2017notificatins 010118 - EngDocument737 pagesKGSTAct2017notificatins 010118 - EngabcdNo ratings yet

- 6272 - Article by Rathi-Gst Act & Rule SummaryDocument3 pages6272 - Article by Rathi-Gst Act & Rule SummaryDevdas NairNo ratings yet

- FinancialCodeVol 1Document130 pagesFinancialCodeVol 1AbhinavNo ratings yet

- MMM ManualDocument285 pagesMMM Manualganesan19754573No ratings yet

- Summary Book - IDT - May 2024 - by CA Yachana Mutha - CompressedDocument287 pagesSummary Book - IDT - May 2024 - by CA Yachana Mutha - Compressedmonudeep aggarwalNo ratings yet

- CGST Rules 30aug2017Document415 pagesCGST Rules 30aug2017chanduabcNo ratings yet

- Andhra Pradesh Vat Rules 2005 PDFDocument86 pagesAndhra Pradesh Vat Rules 2005 PDFmehtajeemitNo ratings yet

- SPWD CODE-2009-Index PDFDocument6 pagesSPWD CODE-2009-Index PDFRingo Dorjee ChingapaNo ratings yet

- Level 1-2 (Contents) June 2021Document1 pageLevel 1-2 (Contents) June 2021km2222021No ratings yet

- Gs NotesDocument490 pagesGs NotesSyed BukhariNo ratings yet

- Ap Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)Document127 pagesAp Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)parul_shukla_1No ratings yet

- Delhi Metro Rail Corporation Limited Payment Advice NoteDocument16 pagesDelhi Metro Rail Corporation Limited Payment Advice NoteashishNo ratings yet

- Model GST Law: Empowered Committee of State Finance Ministers June, 2016Document190 pagesModel GST Law: Empowered Committee of State Finance Ministers June, 2016AnikBhilwarNo ratings yet

- Bill No. 57 of 2017: S Introduced IN OK AbhaDocument129 pagesBill No. 57 of 2017: S Introduced IN OK AbhaBitan GhoshNo ratings yet

- CGST Bill eDocument129 pagesCGST Bill esumit9812466976No ratings yet

- Ap Value Added Tax Act - 2005Document78 pagesAp Value Added Tax Act - 2005umdb2205No ratings yet

- Afm Final1Document9 pagesAfm Final1madhav.agarwal23hNo ratings yet

- The Telangana Goods and Services Tax ACT, 2017: CT OFDocument181 pagesThe Telangana Goods and Services Tax ACT, 2017: CT OFNitin BhatnagarNo ratings yet

- Vat Act PDFDocument256 pagesVat Act PDFMansi SinghNo ratings yet

- ModelGSTLaw DraftDocument190 pagesModelGSTLaw DraftuttamksrNo ratings yet

- Sbi Kiosk Banking Guide - 26022024Document175 pagesSbi Kiosk Banking Guide - 26022024Srinivasa Reddy KarriNo ratings yet

- Notice: Update of Terms and Conditions Governing Accounts (Applicable To Individuals)Document34 pagesNotice: Update of Terms and Conditions Governing Accounts (Applicable To Individuals)lontong4925No ratings yet

- 3rd Bipartite SettlementDocument25 pages3rd Bipartite SettlementPradeep BansalNo ratings yet

- Model MoU PPA and CAPEX Agreement DocumentDocument96 pagesModel MoU PPA and CAPEX Agreement DocumentCivic CentreNo ratings yet

- Apfc Vol IDocument296 pagesApfc Vol IRajesh BabuNo ratings yet

- Central Goods and Services Tax (CGST) Act, 2017: (Chapter-Wise)Document7 pagesCentral Goods and Services Tax (CGST) Act, 2017: (Chapter-Wise)Koshi EnterprisesNo ratings yet

- Financial CodeDocument686 pagesFinancial CodeKumarVijayNo ratings yet

- NBC TSP 1 AudPub 20160628Document23 pagesNBC TSP 1 AudPub 20160628Ana Carolina Ferreira BatistaNo ratings yet

- A2017 12 PDFDocument108 pagesA2017 12 PDFxfactor gangaarNo ratings yet

- Advances Against Goods PDFDocument73 pagesAdvances Against Goods PDFVijay P PulavarthiNo ratings yet

- Terms and Conditions Governing AccountsDocument33 pagesTerms and Conditions Governing AccountsjamesNo ratings yet

- GST Act and Rules - ComboDocument471 pagesGST Act and Rules - CombopramodgvpbaNo ratings yet

- Admas ColledgeDocument20 pagesAdmas Colledgeyonas fitaNo ratings yet

- GST Flowchart IcaiDocument17 pagesGST Flowchart Icaiprince2venkatNo ratings yet

- UntitledDocument28 pagesUntitledbithnath pattnaikNo ratings yet

- 2017 - 01 - 04 - Model MoU PPA and CAPEX Agreement Document PDFDocument96 pages2017 - 01 - 04 - Model MoU PPA and CAPEX Agreement Document PDFAndiTalettingNo ratings yet

- My - Bill - 21 Dec, 2023 - 20 Jan, 2024 - 9024803458Document2 pagesMy - Bill - 21 Dec, 2023 - 20 Jan, 2024 - 9024803458olxusenew123No ratings yet

- TNGST ACT 2017 (With Amendments)Document168 pagesTNGST ACT 2017 (With Amendments)Darshni 18No ratings yet

- KSR Vol - II PDFDocument260 pagesKSR Vol - II PDFFairoos MNo ratings yet

- Ar2014 IrelandDocument85 pagesAr2014 IrelandhenfaNo ratings yet

- Employee Benefits: International Accounting Standard 19Document120 pagesEmployee Benefits: International Accounting Standard 19Asim QaziNo ratings yet

- Termsupdate PDFDocument34 pagesTermsupdate PDFfelixnovusNo ratings yet

- WBGST Rules 2017 - Amended Upto 18.10.2017 PDFDocument411 pagesWBGST Rules 2017 - Amended Upto 18.10.2017 PDFAdesh KumarNo ratings yet

- Part 5Document85 pagesPart 5GANESH BAGNo ratings yet

- Weddings R US Accounting CycleDocument9 pagesWeddings R US Accounting CycleRaisa LidasanNo ratings yet

- Act370. Assignment. Omar Faruk Khan RafiDocument35 pagesAct370. Assignment. Omar Faruk Khan RafiOmar Faruk Khan RafiNo ratings yet

- Karnataka SGST Act 2017Document263 pagesKarnataka SGST Act 2017Rohan KulkarniNo ratings yet

- DP PreliminaryViewsRevenueRecognition1208Document119 pagesDP PreliminaryViewsRevenueRecognition1208Linh HoangNo ratings yet

- Sum - 410801092900 - 264505507811 - 20240207 (1) - 1-2Document2 pagesSum - 410801092900 - 264505507811 - 20240207 (1) - 1-2Sudhir Singh SengarNo ratings yet

- AC-Reckon 2002-2011 PDFDocument104 pagesAC-Reckon 2002-2011 PDFBASAVARAJ FLNo ratings yet

- M.C.nakrekal IntimationDocument12 pagesM.C.nakrekal IntimationSudheer RessyNo ratings yet

- Handbook of VATDocument66 pagesHandbook of VATMd SelimNo ratings yet

- Draft Model GST Law FinalDocument192 pagesDraft Model GST Law Finalsanketsancheti999No ratings yet

- Last Updated On 1-10-2022Document115 pagesLast Updated On 1-10-2022Pranav SharmaNo ratings yet

- Local GAAP Balance Sheet Profit and LossDocument4 pagesLocal GAAP Balance Sheet Profit and LossPOPNo ratings yet

- CGST Act As On 1st Oct 2022Document149 pagesCGST Act As On 1st Oct 2022Rajesh AroraNo ratings yet

- Full Download PDF of (Ebook PDF) Pearson's Federal Taxation 2020 Individuals 33rd Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Pearson's Federal Taxation 2020 Individuals 33rd Edition All Chapteranegaroosen100% (13)

- Tenderodoc 01Document91 pagesTenderodoc 01strraugust2023No ratings yet

- GST Chapterwise MarksDocument1 pageGST Chapterwise MarksMurali Krishnan RNo ratings yet

- 8 GST Tax Invoice EtcDocument7 pages8 GST Tax Invoice EtcMurali Krishnan RNo ratings yet

- 4 GST Time and Value of Supply NotesDocument6 pages4 GST Time and Value of Supply NotesMurali Krishnan RNo ratings yet

- 7 Accounts Company Accounts Etc PDFDocument19 pages7 Accounts Company Accounts Etc PDFMurali Krishnan RNo ratings yet

- GST Place of SupplyDocument73 pagesGST Place of SupplyMurali Krishnan RNo ratings yet

- CA Exams in Covid Times SICASA Meeting 12-06-2021 (2) CA R Murali KrishnanDocument19 pagesCA Exams in Covid Times SICASA Meeting 12-06-2021 (2) CA R Murali KrishnanMurali Krishnan RNo ratings yet

- B Com To B Smart NSS Colleg Meeting 14-08-2021Document22 pagesB Com To B Smart NSS Colleg Meeting 14-08-2021Murali Krishnan RNo ratings yet

- International Contracts ModelsDocument40 pagesInternational Contracts ModelsGlobal Negotiator67% (3)

- Authorization Letter 2Document3 pagesAuthorization Letter 2Mercilita De Paz LeopardasNo ratings yet

- Residential StatusDocument102 pagesResidential StatusRahul Piyush MehtaNo ratings yet

- Statement of Shri Paras Chordiya - EditedDocument7 pagesStatement of Shri Paras Chordiya - EditedNM JHANWAR & ASSOCIATESNo ratings yet

- Piano Violin EpiphyllumDocument4 pagesPiano Violin EpiphyllumCamila KrukNo ratings yet

- Crewlink Vs TeringteringDocument1 pageCrewlink Vs TeringteringTheodore DolarNo ratings yet

- Check List ISO 31000Document14 pagesCheck List ISO 31000Mohammed alsalahiNo ratings yet

- G.R. No. L-49112 Augustin Vs EduDocument7 pagesG.R. No. L-49112 Augustin Vs EduMarkNo ratings yet

- Shriners Community Volunteering GuidelinesDocument2 pagesShriners Community Volunteering GuidelinesJuan Carlos García ArquitectoNo ratings yet

- Assault As TortDocument8 pagesAssault As TortAbhijit PatilNo ratings yet

- Asian Construction & Dev. Corp. vs. SannaedleDocument2 pagesAsian Construction & Dev. Corp. vs. SannaedleRussellNo ratings yet

- 21-23 ClauseDocument53 pages21-23 ClausezamsiranNo ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument2 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSupuni Niriella100% (1)

- Ra 7942 (CLRF)Document13 pagesRa 7942 (CLRF)Kit ChampNo ratings yet

- Nunelon R. Marquez v. Elisan Credit Corporation - 6 April 2015Document4 pagesNunelon R. Marquez v. Elisan Credit Corporation - 6 April 2015Samuel John CahimatNo ratings yet

- Limitation Act 1959Document28 pagesLimitation Act 1959FATHIR HEKSMAYARNo ratings yet

- NTSE S-2 Test-1Document8 pagesNTSE S-2 Test-1DjNo ratings yet

- Riverhead Central School District /henriquez Agreement and ResignationDocument10 pagesRiverhead Central School District /henriquez Agreement and ResignationRiverheadLOCALNo ratings yet

- Data Management, Inc. v. James H. GreeneDocument2 pagesData Management, Inc. v. James H. GreeneLuis Enrique Polanco AriasNo ratings yet

- Brent Spence RFP 2023Document660 pagesBrent Spence RFP 2023Local12wkrcNo ratings yet

- BATELEC I Vs CITDocument1 pageBATELEC I Vs CITnorieNo ratings yet

- Art. 1156 1178Document18 pagesArt. 1156 1178Vortex100% (1)

- 1 Fortegra Extended Service Contract - RTG-4WC (10.17) - FINAL PDFDocument9 pages1 Fortegra Extended Service Contract - RTG-4WC (10.17) - FINAL PDFEmad KhanNo ratings yet

- Resume - Anna Jensen SDDocument2 pagesResume - Anna Jensen SDapi-280167170No ratings yet

- Civ Pro II - NotesDocument4 pagesCiv Pro II - NotesLouray JeanNo ratings yet

- 05 Disini v. SandiganbayanDocument2 pages05 Disini v. SandiganbayanHenri VasquezNo ratings yet

- 10 - Heirs of Simplicio Santiago Vs Heirs of Mariano SantiagoDocument8 pages10 - Heirs of Simplicio Santiago Vs Heirs of Mariano SantiagoJarvin David ResusNo ratings yet

- Section 4C AssignmentDocument10 pagesSection 4C AssignmentDaniel RafidiNo ratings yet