Professional Documents

Culture Documents

PS01 Mary Rogers

PS01 Mary Rogers

Uploaded by

bahadarkhan591Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PS01 Mary Rogers

PS01 Mary Rogers

Uploaded by

bahadarkhan591Copyright:

Available Formats

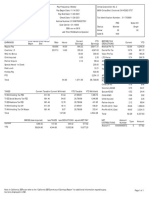

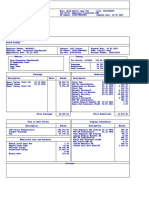

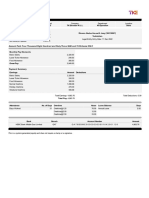

10/21/2022 D7627717

ADVICE OF DEPOSIT - NON-NEGOTIABLE $4,540.80

MARY ROGERS

PO BOX 2121

DULUTH, GA 30096

USMWAH1 310 307 A915629 CPDA-1-

NON-NEGOTIABLE

Employee Emp ID Social Security Status Res-Work Exempt/Allow Number

MARY ROGERS 911590 XXX-XX-XXXX US-S GA-M GA-2/0 D7627717

Code Paygroup Division Department Hire Date Period Start Period End Pay Date

DISH 502 310 307 04/20/20 10/02/22 10/15/22 10/21/22

Taxable Earnings Rate Hrs/Units Current Year To Date Paid Time Off Summary Hours

Regular Wk1 65.5000 38.20 2,502.10 52,544.10 Current Hours Accrued 3.08

Regular Wk2 65.5000 35.64 2,334.42 49,022.82 Current Hours Taken 3.00

Holiday - - - 890.00 Current Bank 41.00

PTO 65.5000 7.00 458.50 937.78

Sales Commissions Wk1 - - 1,153.50 18,808.48

Sales Commissions Wk2 - - 518.65 18,326.47 Paid Protected Time (Calendar YTD) Amount Hours

Overtime Wk1 - - - 927.42 Previous Calendar Year Carryover - -

Overtime Wk2 Retroactive - - - 1,398.67 Current Hours Accrued (Pay Period) - -

PPT - - - 230.56 Current Hours Earned (Cal YTD) 660.00 40.00

- - - 553.00 Current Hours Taken (Cal YTD) 651.75 39.50

Total 6,967.17 143,639.30 Current Bank - 0.50

Taxes

Federal Income Tax 1,315.49 27,625.29 Paid Protected Time is meant to comply with all

Social Security (FICA) 431.96 9,071.16 local and state Paid Sick Leave Policies.

Federal Medicare 101.02 2,121.42

Georgia Income Tax 382.04 8,022.84

Total 2,230.51 46,840.71 Memo Entries Current Year To Date

Profit Share Dollars - 1,186.46

Pre-Tax Deductions Profit Share Stock - 36.69

Medical 60.00 1,379.99 HSA Employer Contr 5.00 50.00

Dental 5.96 137.06 2020 401k Match 2021 - 258.67

Vision 0.45 10.35 401k Match - 553.12

401K 78.30 1,823.70

HSA (Single) 1.20 21.60

Total 145.91 3,372.70 Direct Deposit Accounts Amount

Checking - XXXXXXXXX7567 4,540.80

After-Tax Deductions

Life Insurance 12.77 293.72

Long Term Disability 18.27 420.21 Current Year To Date

Life Insurance - Dependent 0.02 0.47 W2 Gross 6,821.26 143,246.46

Accident 2.94 67.62

Critical Illness 11.08 254.83

Hospital Indemnity 4.87 112.00

Total 49.95 1,148.85

Current Year To Date

Net Pay 4,540.80 95,356.80

Echosphere L.L.C. - 9601 S. Meridian Blvd. Englewood, CO 80112 - (303) 723-1390

You might also like

- Payslip To Print - Report Design 10-01-2020Document1 pagePayslip To Print - Report Design 10-01-2020martin avinaNo ratings yet

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- Pay Stub 4022018-4152018Document1 pagePay Stub 4022018-4152018lilian hutsilNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- Sspusadv PDFDocument1 pageSspusadv PDFKIMNo ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- CH2 David SMCC16ge Ppt02Document34 pagesCH2 David SMCC16ge Ppt02Yanty IbrahimNo ratings yet

- Cloud KitchensDocument24 pagesCloud KitchensAnonymous tg2wr3Yn100% (3)

- WithHolding Tax in Oracle Apps R12Document7 pagesWithHolding Tax in Oracle Apps R12Mahamood07861549No ratings yet

- Salient Features of CMTADocument7 pagesSalient Features of CMTAcarlyNo ratings yet

- Answers To Chapter 11 QuestionsDocument4 pagesAnswers To Chapter 11 QuestionsFilipe Coelho100% (3)

- Work Estimate Template Calculates TotalDocument2 pagesWork Estimate Template Calculates TotalKizzy Anne Boatswain CarbonNo ratings yet

- Paystub For Oct 2020Document1 pagePaystub For Oct 2020bahadarkhan591No ratings yet

- Capital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836Document1 pageCapital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836AmaryNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Advice of Deposit - Non-NegotiableDocument1 pageAdvice of Deposit - Non-NegotiableMolina VaneNo ratings yet

- Pay StubDocument2 pagesPay Stubsavvy.shopper.mom2No ratings yet

- US Check Writer ReportDocument2 pagesUS Check Writer ReportDhanaraaj DevelopersNo ratings yet

- Davita Payslip To Print - Report Design 03-06-2024Document1 pageDavita Payslip To Print - Report Design 03-06-2024addae.fredrickNo ratings yet

- MGZSCP000670662800 R 1919257 C5 C98621Document1 pageMGZSCP000670662800 R 1919257 C5 C98621sayedsajid653No ratings yet

- Ub23m03 689321Document1 pageUb23m03 689321RachitNo ratings yet

- Telecon Format - Project EngineerDocument1 pageTelecon Format - Project EngineerLily NguyenNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- 02475792798Document1 page02475792798Edwin Zamora PastorNo ratings yet

- TPD Fixe Aniv RomDocument1 pageTPD Fixe Aniv RomIulian TulucNo ratings yet

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Pay Statement 890853 2Document1 pagePay Statement 890853 2simonovamedNo ratings yet

- Hours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountDocument1 pageHours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountjgfNo ratings yet

- Neraca Februari 2024Document2 pagesNeraca Februari 2024k24isvillNo ratings yet

- Cellco PartnershipDocument1 pageCellco PartnershipQaisar SajjadNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- 07 Jun 2024Document1 page07 Jun 2024Donovan HepburnNo ratings yet

- 45Document1 page45Nicola LendersNo ratings yet

- Payslip 30019967 January 2023Document1 pagePayslip 30019967 January 2023RED BULLNo ratings yet

- BNK Sector NosDocument22 pagesBNK Sector NosKrishna Reddy SvvsNo ratings yet

- bajaj prev.5 yrs P&LDocument2 pagesbajaj prev.5 yrs P&Larsoni1999No ratings yet

- Nestle P and LDocument2 pagesNestle P and Lashmit gumberNo ratings yet

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Remitence reportMMJ 4.21.23Document1 pageRemitence reportMMJ 4.21.23blackson knightsonNo ratings yet

- 7 Aacb 8 FCDocument1 page7 Aacb 8 FCAmaryNo ratings yet

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionNo ratings yet

- Checkstub For Kenny Cullison - 12 - 29 - 2022Document1 pageCheckstub For Kenny Cullison - 12 - 29 - 2022kbcullison61No ratings yet

- Liabilities Assets Current Year 2019-20 Current Year 2019-20Document2 pagesLiabilities Assets Current Year 2019-20 Current Year 2019-20n dalviNo ratings yet

- Firm Balance SheetDocument5 pagesFirm Balance SheetHimanshu YadavNo ratings yet

- November 2022 16 - 30 PayslipDocument1 pageNovember 2022 16 - 30 PayslipRRF Construction Co.No ratings yet

- Pay Stub 2Document2 pagesPay Stub 2Antionette JewelNo ratings yet

- COLESpayslipDocument1 pageCOLESpaysliphienvvuNo ratings yet

- 7 TSSCP000520409612 R 19144799836 F521Document1 page7 TSSCP000520409612 R 19144799836 F521cruzernesto3645No ratings yet

- Remitence Report 5.19.23Document1 pageRemitence Report 5.19.23blackson knightsonNo ratings yet

- ULTJ 2022 AUDIT - PJLSN Prbhan LBH DR 20persenDocument3 pagesULTJ 2022 AUDIT - PJLSN Prbhan LBH DR 20persenzhugeNo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Revolving Fund Inventory: LinksDocument12 pagesRevolving Fund Inventory: Linksxavy villegasNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Budget Detail FY2014 Book IDocument1,086 pagesBudget Detail FY2014 Book Ifarhood ranjbarkhanghahNo ratings yet

- Quantum REDocument32 pagesQuantum REBenjaminRavaruNo ratings yet

- Export Development Act of 1994Document4 pagesExport Development Act of 1994DaLe AbellaNo ratings yet

- Gosta Esping-AndersenDocument289 pagesGosta Esping-AndersenForce MapuNo ratings yet

- Taxation As A Fiscal Policy FinalDocument34 pagesTaxation As A Fiscal Policy FinalLetsah BrightNo ratings yet

- Complete GST NotesDocument19 pagesComplete GST NotesWenlang SwerNo ratings yet

- 2.2 Fiscal Policy: Done By: Tristan & ZaishanDocument11 pages2.2 Fiscal Policy: Done By: Tristan & ZaishanGhala AlHarmoodiNo ratings yet

- Doctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaDocument2 pagesDoctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaElla CanuelNo ratings yet

- COIDocument1 pageCOIajay2726No ratings yet

- SAP STD Invoice FormatDocument2 pagesSAP STD Invoice FormatVASEEMNo ratings yet

- MSEDCL - Bill Info June-2020Document4 pagesMSEDCL - Bill Info June-2020pavan rautNo ratings yet

- Final Individual Assignment - Tan Wei Hang 20035101Document10 pagesFinal Individual Assignment - Tan Wei Hang 20035101マスラオMasuraoNo ratings yet

- CV RSalonoyDocument4 pagesCV RSalonoyNoushad N HamsaNo ratings yet

- Financethesis StevensDocument56 pagesFinancethesis StevensSaadBourouisNo ratings yet

- Accounting 2013 PDFDocument153 pagesAccounting 2013 PDFtrs12340% (1)

- ILIT Power Point October 2010Document8 pagesILIT Power Point October 2010Christopher GuestNo ratings yet

- McDonald's Horizontal Analysis For Income Statement For The Years 2010 To 2020Document5 pagesMcDonald's Horizontal Analysis For Income Statement For The Years 2010 To 2020Jezza GebeNo ratings yet

- Dividend Income - Income TAXDocument36 pagesDividend Income - Income TAXDon TiansayNo ratings yet

- Canada EngDocument3 pagesCanada Engpaolomarabella8No ratings yet

- Department of Finance and Administration: Withholding TaxDocument3 pagesDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaNo ratings yet

- Basic Principles of TaxationDocument2 pagesBasic Principles of TaxationYamateNo ratings yet

- Cir vs. BenguetDocument2 pagesCir vs. BenguetCaroline A. LegaspinoNo ratings yet

- George Reisman's Blog On Economics, Politics, Society, and Culture - Piketty's Capital - Wrong Theory - Destructive ProgramDocument25 pagesGeorge Reisman's Blog On Economics, Politics, Society, and Culture - Piketty's Capital - Wrong Theory - Destructive ProgramrarescraciuNo ratings yet