Professional Documents

Culture Documents

CA Inter 4 March Separate Group 1 1708585534

CA Inter 4 March Separate Group 1 1708585534

Uploaded by

Umang NagarCopyright:

Available Formats

You might also like

- Hilton7e SM Ch06 Final RevisedDocument82 pagesHilton7e SM Ch06 Final RevisedJohn100% (4)

- Financial Markets and Institutions 11th Edition Jeff Madura Test BankDocument19 pagesFinancial Markets and Institutions 11th Edition Jeff Madura Test Bankmichaelkrause22011998gdj100% (26)

- Financial Reporting R.kitDocument344 pagesFinancial Reporting R.kitLuke Shaw100% (3)

- Bergerac Case AnalysisDocument12 pagesBergerac Case Analysissiddhartha tulsyan100% (1)

- Financial AccountingDocument471 pagesFinancial AccountingJasiz Philipe Ombugu80% (10)

- Chapter 1 NotesDocument16 pagesChapter 1 NotesAnnShott100% (1)

- Part 1Document3 pagesPart 1PRETTYKO100% (1)

- Inter Separate Both Jan 26 1705658446Document9 pagesInter Separate Both Jan 26 1705658446Miloni KariyaNo ratings yet

- CA Inter 4 March Parallel Group Both 1708585642Document7 pagesCA Inter 4 March Parallel Group Both 1708585642govoni3402No ratings yet

- CA Inter Parallel Both Group 15 Feb 1707205927Document7 pagesCA Inter Parallel Both Group 15 Feb 1707205927hitendrapatil6778No ratings yet

- Final 4 March Group Both 1708585417Document7 pagesFinal 4 March Group Both 1708585417Neha JainNo ratings yet

- 2024 - 2025 ACCA Exam Practice Questions - Taxation (TX)Document9 pages2024 - 2025 ACCA Exam Practice Questions - Taxation (TX)craigsappletreeNo ratings yet

- ACCA F7 Dec12 Exam CommentaryDocument3 pagesACCA F7 Dec12 Exam CommentaryKodwoPNo ratings yet

- Finallll TTDocument118 pagesFinallll TTchocNo ratings yet

- Principles of Taxation Question Bank 2021Document243 pagesPrinciples of Taxation Question Bank 2021Khadeeza ShammeeNo ratings yet

- Financial Reporting ConceptsDocument240 pagesFinancial Reporting ConceptsDeepsikha maitiNo ratings yet

- IPCC - 33e - C.Law - Book No.5 PDFDocument315 pagesIPCC - 33e - C.Law - Book No.5 PDFRocky JaduNo ratings yet

- Kaplan - Exam Tips For Paper F5Document10 pagesKaplan - Exam Tips For Paper F5Daniyal Raza KhanNo ratings yet

- College Accounting A Practical Approach 14th Edition Slater Solutions Manual instant download all chapterDocument68 pagesCollege Accounting A Practical Approach 14th Edition Slater Solutions Manual instant download all chaptersoukkofaktor31100% (1)

- ACC 226 Apprentice Tutors/snaptutorialDocument12 pagesACC 226 Apprentice Tutors/snaptutorialflower1No ratings yet

- Fast Track RevisionDocument151 pagesFast Track Revisionashoknandi156No ratings yet

- Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument36 pagesCanadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bankampyxprimei5136100% (18)

- Schedule Starting From 25th February For May 2024240222095705Document3 pagesSchedule Starting From 25th February For May 2024240222095705madhumitap730No ratings yet

- ACCA F6UK December 2015 Notes PDFDocument264 pagesACCA F6UK December 2015 Notes PDFopentuitionID100% (2)

- Introduction To Financial and Managerial Accounting - CalendarDocument2 pagesIntroduction To Financial and Managerial Accounting - CalendarCoursePinNo ratings yet

- CA Inter Adv Acc CompilerDocument1,306 pagesCA Inter Adv Acc CompilerAnanya SharmaNo ratings yet

- 1 Test For Each Chapter 2 Full Syllabus Tests For Each Subject Scheduled Start 26th Jan May 2024 1704696385Document9 pages1 Test For Each Chapter 2 Full Syllabus Tests For Each Subject Scheduled Start 26th Jan May 2024 1704696385Anil ReddyNo ratings yet

- Revision Schedule Sep24Document2 pagesRevision Schedule Sep24casuryateja1992No ratings yet

- 5a Cma Inter GST Practice Sets Series A 12th Edition 30 Sets 2024Document200 pages5a Cma Inter GST Practice Sets Series A 12th Edition 30 Sets 2024Pritam patelNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual 1Document77 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual 1jessica100% (52)

- Modern Advanced Accounting in Canada Canadian 7Th Edition Hilton Solutions Manual Full Chapter PDFDocument36 pagesModern Advanced Accounting in Canada Canadian 7Th Edition Hilton Solutions Manual Full Chapter PDFgeorge.banister430100% (11)

- Financial Perf.Document6 pagesFinancial Perf.Kaye Jay EnriquezNo ratings yet

- Semester V and VIDocument30 pagesSemester V and VIsushantpanigrahiNo ratings yet

- Taxation Law and PracticesDocument2 pagesTaxation Law and PracticesS.Ajay sharunNo ratings yet

- CA Intermediate Hourly Study Plan For December 2021 Exams: AccountingDocument6 pagesCA Intermediate Hourly Study Plan For December 2021 Exams: AccountingPrajikta KohliNo ratings yet

- Adv. Accounts M24 Revision SequenceDocument1 pageAdv. Accounts M24 Revision SequenceantiquehindustaniNo ratings yet

- Hot Topics Dece 2015Document21 pagesHot Topics Dece 2015Ashraf ValappilNo ratings yet

- Tybaf Sem V VIDocument42 pagesTybaf Sem V VIapi-292680897No ratings yet

- 4.136 T.Y.B.Com. Semester V and VI PDFDocument30 pages4.136 T.Y.B.Com. Semester V and VI PDFVishal JainNo ratings yet

- APLMF Survey On Goods Packed by Measure 2008Document13 pagesAPLMF Survey On Goods Packed by Measure 2008komang ayu ratnawatiNo ratings yet

- Possible Coverage of Revised Subjects For May 2016 CPA Board ExamDocument3 pagesPossible Coverage of Revised Subjects For May 2016 CPA Board Examsegundo sanchezNo ratings yet

- Schedule Starting From 5th April For May 202424042115556Document8 pagesSchedule Starting From 5th April For May 202424042115556Vidhi AgrawalNo ratings yet

- Guide9 P8 AnalysisDocument5 pagesGuide9 P8 AnalysisSaleema KarimNo ratings yet

- 1a Cma Intermediate Direct Tax Volume I Ay 24-25-21st EditionDocument440 pages1a Cma Intermediate Direct Tax Volume I Ay 24-25-21st EditionmaddstudioofficialNo ratings yet

- Firms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Document13 pagesFirms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Munira SheraliNo ratings yet

- Canadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument7 pagesCanadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test Bankdrkevinlee03071984jki100% (26)

- Reducing Litigation NashikDocument28 pagesReducing Litigation NashiksandipgargNo ratings yet

- 6 Trim 6 FIN - Corporate Tax PlanningDocument3 pages6 Trim 6 FIN - Corporate Tax Planning27vxjtfbh8No ratings yet

- 1700281462CA Inter Chapterwise Schedule May 24Document3 pages1700281462CA Inter Chapterwise Schedule May 24Shivaram ShivaramNo ratings yet

- Canadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument36 pagesCanadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test Bankturnoutlection80nqy100% (31)

- RESA ReviewersDocument8 pagesRESA Reviewersmommel53150% (6)

- B Com Rev Core Syl CBCS 20 Apsche FinalDocument34 pagesB Com Rev Core Syl CBCS 20 Apsche FinalVENKATESWARLUMCOMNo ratings yet

- Vital Article e Assessment Feedback Law Business and Finance From The ExaminersDocument1 pageVital Article e Assessment Feedback Law Business and Finance From The Examinerskarlr9No ratings yet

- Semester V and VI: University of MumbaiDocument52 pagesSemester V and VI: University of MumbaiMittal GohilNo ratings yet

- Schedule Starting From 05th Aug For Nov 202323082014025Document9 pagesSchedule Starting From 05th Aug For Nov 202323082014025tholsjk14No ratings yet

- Adjustment Entries GuidelinesDocument2 pagesAdjustment Entries GuidelinesSumegha KanojiaNo ratings yet

- Accounting in Business: Quick StudiesDocument13 pagesAccounting in Business: Quick StudiesAlex TseNo ratings yet

- Lecture NotesDocument111 pagesLecture NotesdoofwawdNo ratings yet

- Bcom Cbcs 2020Document52 pagesBcom Cbcs 2020someswari kumariNo ratings yet

- AF7 2022-23 Practice Test 6 (September 2021 EG) PDFDocument27 pagesAF7 2022-23 Practice Test 6 (September 2021 EG) PDFAnan Guidel AnanNo ratings yet

- Dwnload Full Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bank PDFDocument36 pagesDwnload Full Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bank PDFj9kslwright100% (18)

- AF7 2022-23 Practice Test 4 (October 2020 EG) PDFDocument28 pagesAF7 2022-23 Practice Test 4 (October 2020 EG) PDFAnan Guidel AnanNo ratings yet

- Taxation Sec A May 2024 1703224575Document10 pagesTaxation Sec A May 2024 1703224575Umang NagarNo ratings yet

- Case Study On EmilyDocument5 pagesCase Study On EmilyUmang NagarNo ratings yet

- Taxation Sec A May 2024 1703224230Document24 pagesTaxation Sec A May 2024 1703224230Umang NagarNo ratings yet

- Redemption of DebenturesDocument11 pagesRedemption of DebenturesUmang NagarNo ratings yet

- Preparation of FS of CoDocument74 pagesPreparation of FS of CoUmang NagarNo ratings yet

- Money AnswersDocument1 pageMoney AnswersAya LarosaNo ratings yet

- The Banking and Financial Sector in NigeriaDocument4 pagesThe Banking and Financial Sector in NigeriatuoizdydxNo ratings yet

- Service Marketing Sem VDocument13 pagesService Marketing Sem VAbdul RasheedNo ratings yet

- This Study Resource Was: Value Added Tax (CPAR) TheoriesDocument6 pagesThis Study Resource Was: Value Added Tax (CPAR) TheoriesAllen KateNo ratings yet

- 2023 Pharmaceutical Manufacturing Supplychain TrendsDocument11 pages2023 Pharmaceutical Manufacturing Supplychain TrendsfresultaNo ratings yet

- TCQT - Revision - Problem - For - Final - Exam 2023 Part 2Document2 pagesTCQT - Revision - Problem - For - Final - Exam 2023 Part 220070095No ratings yet

- Solution Manual For Managerial Accounting 4Th Edition Braun Tietz 0133428377 9780133428377 Full Chapter PDFDocument36 pagesSolution Manual For Managerial Accounting 4Th Edition Braun Tietz 0133428377 9780133428377 Full Chapter PDFtina.white746100% (25)

- VP Customer Success Manager-Job Description TemplateDocument2 pagesVP Customer Success Manager-Job Description TemplateMani Shankar RajanNo ratings yet

- Article Review 2, GULRA KARABIYIKDocument4 pagesArticle Review 2, GULRA KARABIYIKgülraNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- COMGA0 AssignmentDocument6 pagesCOMGA0 AssignmentgamedeziphozekhetheloNo ratings yet

- Invoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USADocument1 pageInvoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USAArmando BroncasNo ratings yet

- Project in FinAccDocument15 pagesProject in FinAccBrod Lee SantosNo ratings yet

- Capslet: Capsulized Self - Learning Empowerment ToolkitDocument15 pagesCapslet: Capsulized Self - Learning Empowerment Toolkitun knownNo ratings yet

- Bill 9578837Document1 pageBill 9578837Mik JrNo ratings yet

- Accounting For Merchandising Operations - Chapter 6 Test QuestionsDocument31 pagesAccounting For Merchandising Operations - Chapter 6 Test QuestionsNoyb71% (7)

- SCUF Beneficial Ownership - Declaration FormatDocument3 pagesSCUF Beneficial Ownership - Declaration FormatRamesh GaonkarNo ratings yet

- TD Bank StatementDocument1 pageTD Bank Statementnurulamin00023No ratings yet

- Case Study: LAZADADocument2 pagesCase Study: LAZADAPrincess AnecitoNo ratings yet

- Balance of PaymentDocument15 pagesBalance of PaymentShanaya GiriNo ratings yet

- 10th Bipartite PDFDocument59 pages10th Bipartite PDFoopsmeandyou100% (1)

- mINE mANAGEMENTDocument9 pagesmINE mANAGEMENTPRAVEEN YADAWNo ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Tugas Materi KewajibanDocument2 pagesTugas Materi Kewajibansavira andayani0% (2)

- Eco 3 28.4 PDFDocument329 pagesEco 3 28.4 PDFDean Wood0% (1)

- Feasibility StudyDocument14 pagesFeasibility StudyMaria pervaiz AwanNo ratings yet

CA Inter 4 March Separate Group 1 1708585534

CA Inter 4 March Separate Group 1 1708585534

Uploaded by

Umang NagarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Inter 4 March Separate Group 1 1708585534

CA Inter 4 March Separate Group 1 1708585534

Uploaded by

Umang NagarCopyright:

Available Formats

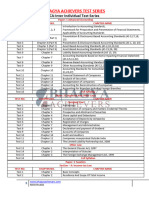

C

Date Description Hour for Today 7.15 to 9.00 AM

3/4/2024 Advanced Accounting 7-9 Hours AS-12

3/5/2024 Advanced Accounting 7-9 Hours Practice Questions

3/6/2024 Advanced Accounting 7-9 Hours Revise the Topics of Day

3/7/2024 Advanced Accounting 7-9 Hours

3/8/2024 Advanced Accounting 7-9 Hours Practice Questions

3/9/2024 Advanced Accounting 7-9 Hours Practice Questions

3/10/2024 Advanced Accounting 7-9 Hours Consolidation (AS 21,23,27)

3/11/2024 Advanced Accounting 7-9 Hours AS-7,9

3/12/2024 Advanced Accounting 7-9 Hours Accounting for Reconstruc

3/13/2024 Advanced Accounting 7-9 Hours AS-11,22

3/14/2024 Advanced Accounting 7-9 Hours Practice Questions

3/15/2024 Advanced Accounting 7-9 Hours Accounting for Branches Including For

3/16/2024

3/17/2024 CORPORATE AND OTHER LAWS 7-9 Hours Preliminary

3/18/2024 CORPORATE AND OTHER LAWS 7-9 Hours The Limited Liability Partnership Act, 2

3/19/2024 CORPORATE AND OTHER LAWS 7-9 Hours

3/20/2024 CORPORATE AND OTHER LAWS 7-9 Hours

3/21/2024 CORPORATE AND OTHER LAWS 7-9 Hours Acceptance of Deposits by companies

3/22/2024 CORPORATE AND OTHER LAWS 7-9 Hours Revise the Earlier Topics

3/23/2024 CORPORATE AND OTHER LAWS 7-9 Hours Interpretation of statutes

3/24/2024 CORPORATE AND OTHER LAWS 7-9 Hours

3/25/2024 CORPORATE AND OTHER LAWS 7-9 Hours

3/26/2024

3/27/2024

3/28/2024 INCOME TAX & GST 7-9 Hours Basic Concepts

3/29/2024 INCOME TAX & GST 7-9 Hours Ch 3: Heads of Income (Unit – 2 – Hou

3/30/2024 INCOME TAX & GST 7-9 Hours Revise the Earlier Topics

3/31/2024 INCOME TAX & GST 7-9 Hours Charge of GST

4/1/2024 INCOME TAX & GST 7-9 Hours Exemption from GST

4/2/2024 INCOME TAX & GST 7-9 Hours Revise the Earlier Topics

4/3/2024 INCOME TAX & GST 7-9 Hours Income Tax Liability – Computation &

4/4/2024 INCOME TAX & GST 7-9 Hours Time of Supply

4/5/2024 INCOME TAX & GST 7-9 Hours

4/6/2024 INCOME TAX & GST 7-9 Hours Income of Other Persons included in A

4/7/2024 INCOME TAX & GST 7-9 Hours GST - Registration

4/8/2024 INCOME TAX & GST 7-9 Hours Practice Questions

4/9/2024 INCOME TAX & GST 7-9 Hours

4/10/2024 INCOME TAX & GST 7-9 Hours Aggregation of Income, Set-off and Ca

CATestSeries.org® - CA Intermediate Hourly Study Plan May 20

New Batch of CA Final Intermediate and Foundation for May 2024 Starts Next week

We are providing questions other than ICAI Material in the test papers to check your performanc

10.00 AM to 12.00 PM 12.30 PM to 2 PM 3.30 PM to 5 PM 5.30 PM to 7.30 PM

AS 14 Practice Questions Buyback of Securities

AS- 3,17 Practice Questions AS-18,25

Any topic Left or weak or Test Paper Financial Statement of Companies

AS-1,20 Practice Questions AS- 24,2

AS-10,13 Practice Questions Practice Questions

Revise the Earlier Topics Revise the Earlier Topics Any topic Left or weak or Introduction to Accountin

(AS 21,23,27) Practice Questions Applicability of Accountin

Practice Questions Revise the Earlier Topics Any topic Left or weak or Amalgamation of companies

Practice Questions Practice Questions AS-4,5

Practice Questions Revise the Earlier Topics Any topic Left or weak or

AS-26,28 Practice Questions AS-15,29

r Branches Including Foreign BranchesPractice Questions Revise the Earlier Topics

Practice Questions Incorporation of company and matters incidental T

ability Partnership Act, 2008 Practice Questions Revise the Earlier Topics Any topic Left or weak or

Practice Questions Prospectus and Allotment of Securities Practice Questions

Practice Questions Revise the Earlier Topics Any topic Left or weak or The General Clauses Act, 1897

Deposits by companies Practice Questions Registration of Charges

Any topic Left or weak or Management and Administration Practice Questions

of statutes Practice Questions Declaration and payment of dividend

Foreign Exchange Management Act, 1999 Practice Questions

Practice Questions Audit and Auditors Revise the Earlier Topics

Practice Questions Residence and Scope of Total Income Practice Questions

f Income (Unit – 2 – House Property) Practice Questions Supply under GST

Any topic Left or weak or Ch 3: Heads of Income (Unit – 1 Salaries) Practice Questions

Practice Questions Place of Supply

Practice Questions Advance Tax, Tax Deduction at Source and Introducti

Any topic Left or weak or Ch 3: Heads of Income(Unit – 3 - PGBP) Practice Questions

ability – Computation & Optimisation Practice Questions Value of Supply

Practice Questions Provisions for filing Retu Practice Questions

Revise the Earlier Topics Any topic Left or weak or Ch 3: Heads of Income(Unit – 4 – Income from other

er Persons included in Assessee’s Tot Practice Questions Input Tax Credit Practice Questions

Practice Questions Tax deduction at source anPractice Questions Deductions from Gross Total Income

Revise the Earlier Topics Revise the Earlier Topics Any topic Left or weak or Ch 3: Heads of Income(Unit – 4 – Capital Gain)

Practice Questions Accounts and Records Practice Questions E-way Bill

f Income, Set-off and Carry Forward ofPayment of Tax Revise the Earlier Topics Revise the Earlier Topics

y Study Plan May 2024

ay 2024 Starts Next week

papers to check your performance in a fair manner

9.15 PM to 11 PM

Practice Questions

Practice Questions

AS 16

Framework for Preparation and Presentation of Financial Statements

AS-7,9

n of companies

Practice Questions

AS-19

Practice Questions

Any topic Left or weak or Test Paper

Practice Questions

Share capital and Debentures

Companies incorporated Outside India

lauses Act, 1897

Practice Questions

Practice Questions

Accounts of Companies

Any topic Left or weak or Test Paper

GST in India - An Introduction

Practice Questions

GST - Returns

Practice Questions

Practice Questions

Practice Questions

Practice Questions

Tax Invoice, Credit and Debit Notes

Practice Questions

Practice Questions

om Gross Total Income

f Income(Unit – 4 – Capital Gain)

Practice Questions

Any topic Left or weak or Test Paper

You might also like

- Hilton7e SM Ch06 Final RevisedDocument82 pagesHilton7e SM Ch06 Final RevisedJohn100% (4)

- Financial Markets and Institutions 11th Edition Jeff Madura Test BankDocument19 pagesFinancial Markets and Institutions 11th Edition Jeff Madura Test Bankmichaelkrause22011998gdj100% (26)

- Financial Reporting R.kitDocument344 pagesFinancial Reporting R.kitLuke Shaw100% (3)

- Bergerac Case AnalysisDocument12 pagesBergerac Case Analysissiddhartha tulsyan100% (1)

- Financial AccountingDocument471 pagesFinancial AccountingJasiz Philipe Ombugu80% (10)

- Chapter 1 NotesDocument16 pagesChapter 1 NotesAnnShott100% (1)

- Part 1Document3 pagesPart 1PRETTYKO100% (1)

- Inter Separate Both Jan 26 1705658446Document9 pagesInter Separate Both Jan 26 1705658446Miloni KariyaNo ratings yet

- CA Inter 4 March Parallel Group Both 1708585642Document7 pagesCA Inter 4 March Parallel Group Both 1708585642govoni3402No ratings yet

- CA Inter Parallel Both Group 15 Feb 1707205927Document7 pagesCA Inter Parallel Both Group 15 Feb 1707205927hitendrapatil6778No ratings yet

- Final 4 March Group Both 1708585417Document7 pagesFinal 4 March Group Both 1708585417Neha JainNo ratings yet

- 2024 - 2025 ACCA Exam Practice Questions - Taxation (TX)Document9 pages2024 - 2025 ACCA Exam Practice Questions - Taxation (TX)craigsappletreeNo ratings yet

- ACCA F7 Dec12 Exam CommentaryDocument3 pagesACCA F7 Dec12 Exam CommentaryKodwoPNo ratings yet

- Finallll TTDocument118 pagesFinallll TTchocNo ratings yet

- Principles of Taxation Question Bank 2021Document243 pagesPrinciples of Taxation Question Bank 2021Khadeeza ShammeeNo ratings yet

- Financial Reporting ConceptsDocument240 pagesFinancial Reporting ConceptsDeepsikha maitiNo ratings yet

- IPCC - 33e - C.Law - Book No.5 PDFDocument315 pagesIPCC - 33e - C.Law - Book No.5 PDFRocky JaduNo ratings yet

- Kaplan - Exam Tips For Paper F5Document10 pagesKaplan - Exam Tips For Paper F5Daniyal Raza KhanNo ratings yet

- College Accounting A Practical Approach 14th Edition Slater Solutions Manual instant download all chapterDocument68 pagesCollege Accounting A Practical Approach 14th Edition Slater Solutions Manual instant download all chaptersoukkofaktor31100% (1)

- ACC 226 Apprentice Tutors/snaptutorialDocument12 pagesACC 226 Apprentice Tutors/snaptutorialflower1No ratings yet

- Fast Track RevisionDocument151 pagesFast Track Revisionashoknandi156No ratings yet

- Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument36 pagesCanadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bankampyxprimei5136100% (18)

- Schedule Starting From 25th February For May 2024240222095705Document3 pagesSchedule Starting From 25th February For May 2024240222095705madhumitap730No ratings yet

- ACCA F6UK December 2015 Notes PDFDocument264 pagesACCA F6UK December 2015 Notes PDFopentuitionID100% (2)

- Introduction To Financial and Managerial Accounting - CalendarDocument2 pagesIntroduction To Financial and Managerial Accounting - CalendarCoursePinNo ratings yet

- CA Inter Adv Acc CompilerDocument1,306 pagesCA Inter Adv Acc CompilerAnanya SharmaNo ratings yet

- 1 Test For Each Chapter 2 Full Syllabus Tests For Each Subject Scheduled Start 26th Jan May 2024 1704696385Document9 pages1 Test For Each Chapter 2 Full Syllabus Tests For Each Subject Scheduled Start 26th Jan May 2024 1704696385Anil ReddyNo ratings yet

- Revision Schedule Sep24Document2 pagesRevision Schedule Sep24casuryateja1992No ratings yet

- 5a Cma Inter GST Practice Sets Series A 12th Edition 30 Sets 2024Document200 pages5a Cma Inter GST Practice Sets Series A 12th Edition 30 Sets 2024Pritam patelNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual 1Document77 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual 1jessica100% (52)

- Modern Advanced Accounting in Canada Canadian 7Th Edition Hilton Solutions Manual Full Chapter PDFDocument36 pagesModern Advanced Accounting in Canada Canadian 7Th Edition Hilton Solutions Manual Full Chapter PDFgeorge.banister430100% (11)

- Financial Perf.Document6 pagesFinancial Perf.Kaye Jay EnriquezNo ratings yet

- Semester V and VIDocument30 pagesSemester V and VIsushantpanigrahiNo ratings yet

- Taxation Law and PracticesDocument2 pagesTaxation Law and PracticesS.Ajay sharunNo ratings yet

- CA Intermediate Hourly Study Plan For December 2021 Exams: AccountingDocument6 pagesCA Intermediate Hourly Study Plan For December 2021 Exams: AccountingPrajikta KohliNo ratings yet

- Adv. Accounts M24 Revision SequenceDocument1 pageAdv. Accounts M24 Revision SequenceantiquehindustaniNo ratings yet

- Hot Topics Dece 2015Document21 pagesHot Topics Dece 2015Ashraf ValappilNo ratings yet

- Tybaf Sem V VIDocument42 pagesTybaf Sem V VIapi-292680897No ratings yet

- 4.136 T.Y.B.Com. Semester V and VI PDFDocument30 pages4.136 T.Y.B.Com. Semester V and VI PDFVishal JainNo ratings yet

- APLMF Survey On Goods Packed by Measure 2008Document13 pagesAPLMF Survey On Goods Packed by Measure 2008komang ayu ratnawatiNo ratings yet

- Possible Coverage of Revised Subjects For May 2016 CPA Board ExamDocument3 pagesPossible Coverage of Revised Subjects For May 2016 CPA Board Examsegundo sanchezNo ratings yet

- Schedule Starting From 5th April For May 202424042115556Document8 pagesSchedule Starting From 5th April For May 202424042115556Vidhi AgrawalNo ratings yet

- Guide9 P8 AnalysisDocument5 pagesGuide9 P8 AnalysisSaleema KarimNo ratings yet

- 1a Cma Intermediate Direct Tax Volume I Ay 24-25-21st EditionDocument440 pages1a Cma Intermediate Direct Tax Volume I Ay 24-25-21st EditionmaddstudioofficialNo ratings yet

- Firms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Document13 pagesFirms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Munira SheraliNo ratings yet

- Canadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument7 pagesCanadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test Bankdrkevinlee03071984jki100% (26)

- Reducing Litigation NashikDocument28 pagesReducing Litigation NashiksandipgargNo ratings yet

- 6 Trim 6 FIN - Corporate Tax PlanningDocument3 pages6 Trim 6 FIN - Corporate Tax Planning27vxjtfbh8No ratings yet

- 1700281462CA Inter Chapterwise Schedule May 24Document3 pages1700281462CA Inter Chapterwise Schedule May 24Shivaram ShivaramNo ratings yet

- Canadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument36 pagesCanadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test Bankturnoutlection80nqy100% (31)

- RESA ReviewersDocument8 pagesRESA Reviewersmommel53150% (6)

- B Com Rev Core Syl CBCS 20 Apsche FinalDocument34 pagesB Com Rev Core Syl CBCS 20 Apsche FinalVENKATESWARLUMCOMNo ratings yet

- Vital Article e Assessment Feedback Law Business and Finance From The ExaminersDocument1 pageVital Article e Assessment Feedback Law Business and Finance From The Examinerskarlr9No ratings yet

- Semester V and VI: University of MumbaiDocument52 pagesSemester V and VI: University of MumbaiMittal GohilNo ratings yet

- Schedule Starting From 05th Aug For Nov 202323082014025Document9 pagesSchedule Starting From 05th Aug For Nov 202323082014025tholsjk14No ratings yet

- Adjustment Entries GuidelinesDocument2 pagesAdjustment Entries GuidelinesSumegha KanojiaNo ratings yet

- Accounting in Business: Quick StudiesDocument13 pagesAccounting in Business: Quick StudiesAlex TseNo ratings yet

- Lecture NotesDocument111 pagesLecture NotesdoofwawdNo ratings yet

- Bcom Cbcs 2020Document52 pagesBcom Cbcs 2020someswari kumariNo ratings yet

- AF7 2022-23 Practice Test 6 (September 2021 EG) PDFDocument27 pagesAF7 2022-23 Practice Test 6 (September 2021 EG) PDFAnan Guidel AnanNo ratings yet

- Dwnload Full Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bank PDFDocument36 pagesDwnload Full Canadian Tax Principles 2015 2016 Edition Volume I and Volume II 1st Edition Byrd Test Bank PDFj9kslwright100% (18)

- AF7 2022-23 Practice Test 4 (October 2020 EG) PDFDocument28 pagesAF7 2022-23 Practice Test 4 (October 2020 EG) PDFAnan Guidel AnanNo ratings yet

- Taxation Sec A May 2024 1703224575Document10 pagesTaxation Sec A May 2024 1703224575Umang NagarNo ratings yet

- Case Study On EmilyDocument5 pagesCase Study On EmilyUmang NagarNo ratings yet

- Taxation Sec A May 2024 1703224230Document24 pagesTaxation Sec A May 2024 1703224230Umang NagarNo ratings yet

- Redemption of DebenturesDocument11 pagesRedemption of DebenturesUmang NagarNo ratings yet

- Preparation of FS of CoDocument74 pagesPreparation of FS of CoUmang NagarNo ratings yet

- Money AnswersDocument1 pageMoney AnswersAya LarosaNo ratings yet

- The Banking and Financial Sector in NigeriaDocument4 pagesThe Banking and Financial Sector in NigeriatuoizdydxNo ratings yet

- Service Marketing Sem VDocument13 pagesService Marketing Sem VAbdul RasheedNo ratings yet

- This Study Resource Was: Value Added Tax (CPAR) TheoriesDocument6 pagesThis Study Resource Was: Value Added Tax (CPAR) TheoriesAllen KateNo ratings yet

- 2023 Pharmaceutical Manufacturing Supplychain TrendsDocument11 pages2023 Pharmaceutical Manufacturing Supplychain TrendsfresultaNo ratings yet

- TCQT - Revision - Problem - For - Final - Exam 2023 Part 2Document2 pagesTCQT - Revision - Problem - For - Final - Exam 2023 Part 220070095No ratings yet

- Solution Manual For Managerial Accounting 4Th Edition Braun Tietz 0133428377 9780133428377 Full Chapter PDFDocument36 pagesSolution Manual For Managerial Accounting 4Th Edition Braun Tietz 0133428377 9780133428377 Full Chapter PDFtina.white746100% (25)

- VP Customer Success Manager-Job Description TemplateDocument2 pagesVP Customer Success Manager-Job Description TemplateMani Shankar RajanNo ratings yet

- Article Review 2, GULRA KARABIYIKDocument4 pagesArticle Review 2, GULRA KARABIYIKgülraNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- COMGA0 AssignmentDocument6 pagesCOMGA0 AssignmentgamedeziphozekhetheloNo ratings yet

- Invoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USADocument1 pageInvoice 0092000202: Camposol Fresh USA INC. 5555 Anglers Avenue Suite 20 FL 33301 - USAArmando BroncasNo ratings yet

- Project in FinAccDocument15 pagesProject in FinAccBrod Lee SantosNo ratings yet

- Capslet: Capsulized Self - Learning Empowerment ToolkitDocument15 pagesCapslet: Capsulized Self - Learning Empowerment Toolkitun knownNo ratings yet

- Bill 9578837Document1 pageBill 9578837Mik JrNo ratings yet

- Accounting For Merchandising Operations - Chapter 6 Test QuestionsDocument31 pagesAccounting For Merchandising Operations - Chapter 6 Test QuestionsNoyb71% (7)

- SCUF Beneficial Ownership - Declaration FormatDocument3 pagesSCUF Beneficial Ownership - Declaration FormatRamesh GaonkarNo ratings yet

- TD Bank StatementDocument1 pageTD Bank Statementnurulamin00023No ratings yet

- Case Study: LAZADADocument2 pagesCase Study: LAZADAPrincess AnecitoNo ratings yet

- Balance of PaymentDocument15 pagesBalance of PaymentShanaya GiriNo ratings yet

- 10th Bipartite PDFDocument59 pages10th Bipartite PDFoopsmeandyou100% (1)

- mINE mANAGEMENTDocument9 pagesmINE mANAGEMENTPRAVEEN YADAWNo ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Tugas Materi KewajibanDocument2 pagesTugas Materi Kewajibansavira andayani0% (2)

- Eco 3 28.4 PDFDocument329 pagesEco 3 28.4 PDFDean Wood0% (1)

- Feasibility StudyDocument14 pagesFeasibility StudyMaria pervaiz AwanNo ratings yet