Professional Documents

Culture Documents

M. Firman Ardiyansyah - Morgan Company - 1EB09

M. Firman Ardiyansyah - Morgan Company - 1EB09

Uploaded by

rully.movizar0 ratings0% found this document useful (0 votes)

11 views6 pages1) The document contains journal entries for Morgan Company for January 2020 that record various business transactions including the payment of interest, purchase and sale of inventory, payment of expenses, and payment of wages.

2) A trial balance and adjusting entries are provided to adjust accounts for interest expense, depreciation, insurance expense, and payroll taxes.

3) An adjusted trial balance, income statement, and balance sheet are presented to show the financial position and results of Morgan Company for the period.

Original Description:

Original Title

M. Firman Ardiyansyah_Morgan Company_1EB09

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document contains journal entries for Morgan Company for January 2020 that record various business transactions including the payment of interest, purchase and sale of inventory, payment of expenses, and payment of wages.

2) A trial balance and adjusting entries are provided to adjust accounts for interest expense, depreciation, insurance expense, and payroll taxes.

3) An adjusted trial balance, income statement, and balance sheet are presented to show the financial position and results of Morgan Company for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views6 pagesM. Firman Ardiyansyah - Morgan Company - 1EB09

M. Firman Ardiyansyah - Morgan Company - 1EB09

Uploaded by

rully.movizar1) The document contains journal entries for Morgan Company for January 2020 that record various business transactions including the payment of interest, purchase and sale of inventory, payment of expenses, and payment of wages.

2) A trial balance and adjusting entries are provided to adjust accounts for interest expense, depreciation, insurance expense, and payroll taxes.

3) An adjusted trial balance, income statement, and balance sheet are presented to show the financial position and results of Morgan Company for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

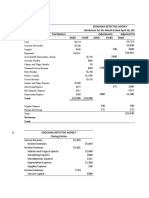

MORGAN COMPANY

Journal Entries

January 31, 2020

DATE DESCRITION DEBIT CREDIT

Jan 1 Interest Payable $ 250

2020 Cash $ 250

2 Inventory 261.100

Accounts Payable 261.100

3 Cash 440.000

Sales Revenue 411.400

Sales Tax Payable 28.600

Cost of Goods Sold 265.000

Inventory 265.000

4 Accounts Payable 230.000

Cash 230.000

5 Sales Tax Payable 17.000

Cash 17.000

6 Operating Expense 30.000

Cash 30.000

7 Salaries & Wages Expense 60.000

FICA Payable 4.590

FICA Payable:

Federal Income Tax With-held 8.900 7,65%×$60.000=$4.590

Salaries & Wages Payable 46.510

TOTAL $ 1.303.350 $ 1.303.350

MORGAN COMPANY

General Ledger

January 31, 2020

Cash Inventory Prepaid Insurance Equipment

01-01 $ 30.000 01-01 $ 250 01-01 $ 30.750 03-01 $ 265.000 01-01 $ 6.000 01-01 $ 38.000

03-01 440.000 04-01 230.000 02-01 261.100

05-01 17.000

06-01 30.000

$ 192.750 $ 26.850 $ 6.000 $ 38.000

Accounts Payable Interest Payable Notes Payable FICA Payable

04-01 $ 230.000 01-01 $ 13.750 01-01 $ 250 01-01 $ 250 01-01 $ 50.000 06-01 $ 4.590

02-01 261.100

$ 44.850 $ - $ 50.000 $ 4.590

Federal Income Tax With-held Salaries & Wages Payable Sales Tax Payable Owner's Equity

06-01 $ 8.900 06-01 $ 46.510 05-01 $ 17.000 03-01 $ 28.600 01-01 $ 40.750

$ 8.900 $ 46.510 $ 11.600 $ 40.750

Sales Revenue Cost of Goods Sold Operating Expense Salaries & Wages Expense

03-01 $ 411.400 03-01 $ 265.000 06-01 $ 30.000 06-01 $ 60.000

$ 411.400 $ 265.000 $ 30.000 $ 60.000

MORGAN COMPANY MORGAN COMPANY

Trial Balance Adjusting Entries

January 31, 2020 January 31, 2020

ACCOUNTS NAME DEBIT CREDIT DATE DESCRIPTION DEBIT CREDIT

Cash $ 192.750 - Jan 31 Interest Expense $ 250

Inventory 26.850 - 2020 Interest Payable $ 250

Prepaid Insurance 6.000 - 31 Insurance Expense 500

Equipment 38.000 - Prepaid Insurance 500

Accounts Payable - $ 44.850 31 Depreciation Expense 7.200

Interest Payable - - Accumulated Depreciation - Equipment 7.200

Notes Payable - 50.000 31 Payroll Tax Expense 8.310

FICA Payable - 4.590 FICA Payable 4.590

Federal Income Tax With-held - 8.900 State Unemployment Tax Payable 3.240

Salaries & Wages Payable - 46.510 Federal Unemployment Tax Payable 480

Sales Tax Payable - 11.600 TOTAL $ 16.260 $ 16.260

Owner's Equity - 40.750

Prepaid Insurance: State Unemployment Tax:

Sales Revenue - 411.400 1

× $6.000=$500 5,4%×$60.000=$3.240

Cost of Goods Sold 265.000 - 12

Operating Expense 30.000 - Depreciation Equipment: Federal Unemployment Tax:

$38.000−$2.000

Salaries & Wages Expense 60.000 - =$7.200 0,8%×$60.000=$480

5

TOTAL $ 618.600 $ 618.600

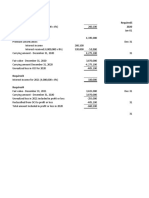

MORGAN COMPANY

Worksheet

January 31, 2020

TRIAL BALANCE ADJUSTING ENTRIES ADJUSTED TB INCOME STATEMENT BALANCE SHEET

ACCOUNTS NAME

D C D C D C D C D C

Cash $ 192.750 $ 192.750 $ 192.750

Inventory 26.850 26.850 26.850

Prepaid Insurance 6.000 $ 500 5.500 5.500

Equipment 38.000 38.000 38.000

Accounts Payable $ 44.850 $ 44.850 $ 44.850

Interest Payable - 250 250 250

Notes Payable 50.000 50.000 50.000

FICA Payable 4.590 4.590 9.180 9.180

Federal Income Tax With-held 8.900 8.900 8.900

Salaries & Wages Payable 46.510 46.510 46.510

Sales Tax Payable 11.600 11.600 11.600

Owner's Equity 40.750 40.750 40.750

Sales Revenue 411.400 411.400 $ 411.400

Cost of Goods Sold 265.000 265.000 $ 265.000

Operating Expense 30.000 30.000 30.000

Salaries & Wages Expense 60.000 60.000 60.000

TOTAL $ 618.600 $ 618.600

Accumulated Depreciation - Equipment 7.200 7.200 7.200

State Unemployment Tax Payable 3.240 3.240 3.240

Federal Unemployment Tax Payable 480 480 480

Interest Expense $ 250 250 250

Insurance Expense 500 500 500

Depreciation Expense 7.200 7.200 7.200

Payroll Tax Expense 8.310 8.310 8.310

TOTAL $ 16.260 $ 16.260 $ 634.360 $ 634.360 $ 371.260 $ 411.400 $ 263.100 $ 222.960

NET PROFIT $ 40.140 $ 40.140

TOTAL $ 411.400 $ 411.400 $ 263.100 $ 263.100

MORGAN COMPANY MORGAN COMPANY

Income Statement M. Firman Ardiyansyah Owner Equity Statement

January 31, 2020 20223971/1EB09 January 31, 2020

REVENUE: Owner's Equity Beginning (1 Jan) $ 40.750

Sales Revenue $ 411.400 Net Profit 40.140

COST OF GOODS SOLD:

Cost of Goods Sold - 265.000 Owner's Equity Ending (31 Jan) $ 80.890

GROSS PROFIT $ 146.400

EXPENSES:

Operating Expense 30.000

Salaries & Wages Expense 60.000

Interest Expense 250

Insurance Expense 500

Depreciation Expense 7.200

Payroll Tax Expense 8.310

TOTAL EXPENSES - 106.260

NET PROFIT $ 40.140

MORGAN COMPANY

M. Firman Ardiyansyah

Balance Sheet

20223971/1EB09

January 31, 2020

ASSET EQUITY & LIABILITY

Property, Plant, Equipment: Equity:

Equipment $ 38.000 Owner's Equity $ 80.890

Accumulated Depreciation - Equipment - 7.200

Total Property, Plant, Euipment $ 30.800 Total Equity $ 80.890

Current Assets: Liability:

Prepaid Insurance 5.500 Federal Unemployment Tax Payable 480

Inventory 26.850 State Unemployment Tax Payable 3.240

Cash 192.750 Federal Income Tax With-held 8.900

Total Current Assets 225.100 FICA Payable 9.180

Sales Tax Payable 11.600

Salaries & Wages Payable 46.510

Notes Payable 50.000

Interest Payable 250

Accounts Payable 44.850

Total Liabilities 175.010

TOTAL ASSETS $ 255.900 TOTAL EQUITY & LABILITY $ 255.900

You might also like

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (40)

- Fabm 2 Practice SetDocument33 pagesFabm 2 Practice SetJen Trixie Gallardo57% (7)

- Icwim PDFDocument2 pagesIcwim PDFWolfgangNo ratings yet

- Heidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were CompletedDocument6 pagesHeidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were Completedlaale dijaan100% (1)

- Paystub Green 03-25-2022Document1 pagePaystub Green 03-25-2022Juan Ignacio Ramirez Jaramillo100% (2)

- ACCCOB1 Module 2 ActivitiesDocument20 pagesACCCOB1 Module 2 ActivitiesAndrei AngNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- (Kunci) Asistensi 4Document8 pages(Kunci) Asistensi 4Randomly EmailNo ratings yet

- Mba III Financial Services (14mbafm302) NotesDocument93 pagesMba III Financial Services (14mbafm302) NotesSyeda GazalaNo ratings yet

- Capital BudetingDocument12 pagesCapital BudetingChristian LimNo ratings yet

- Muhammad Zidan Akbar - Morgan Company - 1EB09Document12 pagesMuhammad Zidan Akbar - Morgan Company - 1EB09rully.movizarNo ratings yet

- Anala Rahsya Shafar - Morgan Company - 1EB09Document6 pagesAnala Rahsya Shafar - Morgan Company - 1EB09rully.movizarNo ratings yet

- Achmad Khudhori Morgan Company 1EB09Document6 pagesAchmad Khudhori Morgan Company 1EB09rully.movizarNo ratings yet

- Rafky Alfikar - Morgan Company - 1eb09Document6 pagesRafky Alfikar - Morgan Company - 1eb09rully.movizarNo ratings yet

- Tolentino Accounting Form For DemoDocument19 pagesTolentino Accounting Form For DemoarrmfarmeggcellentNo ratings yet

- Ex 2Document13 pagesEx 2Phuong Vu HongNo ratings yet

- STATEMENT-OF-CASH-FLOWS-Larosa, Trinashin U.Document11 pagesSTATEMENT-OF-CASH-FLOWS-Larosa, Trinashin U.Trinashin Umapas LarosaNo ratings yet

- Chapter 1 AccDocument11 pagesChapter 1 AccHussein BaidounNo ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- Chapter 5Document11 pagesChapter 5Your NameNo ratings yet

- Case Study 1 StudDocument11 pagesCase Study 1 StudLucNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- FS MODEL (KSP)Document106 pagesFS MODEL (KSP)Oh Oh OhNo ratings yet

- E4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Document7 pagesE4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Quynh Cao PhuongNo ratings yet

- Midterm Pretest - Cost Model-Partial Goodwill FinalDocument9 pagesMidterm Pretest - Cost Model-Partial Goodwill FinalWinnie LaraNo ratings yet

- Accounting in BusinessesDocument5 pagesAccounting in BusinessesNyesha GarbuttNo ratings yet

- BINI General Merchandise Answer Key 2Document19 pagesBINI General Merchandise Answer Key 2workwithericajaneNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Dressny IncDocument10 pagesDressny Incancla.theaalenaNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Smart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditDocument3 pagesSmart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditSt Dalfour CebuNo ratings yet

- IIMK - FA - SectionB - Assignment 4Document4 pagesIIMK - FA - SectionB - Assignment 4Jay PatelNo ratings yet

- Afe 3582Document6 pagesAfe 3582sarah josephNo ratings yet

- Kumpulan Latihan IntermediateDocument27 pagesKumpulan Latihan IntermediateRina KusumaNo ratings yet

- Final Output - Ais Elect 1Document18 pagesFinal Output - Ais Elect 1Joody CatacutanNo ratings yet

- Partnership - Jaboy - v2.1.1Document19 pagesPartnership - Jaboy - v2.1.1Van Dahuyag100% (1)

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Assignment 1 Section 2 Fall 2015 - 2016Document6 pagesAssignment 1 Section 2 Fall 2015 - 2016Aboubakr SoultanNo ratings yet

- ACTY 2100 Mid Exam Questions 2022Document6 pagesACTY 2100 Mid Exam Questions 2022Adel WesiaNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Date Particulars Dr. CR.: Answer 01Document7 pagesDate Particulars Dr. CR.: Answer 01Mursalin RabbiNo ratings yet

- Conceptual Activity 1 Journal FinalDocument2 pagesConceptual Activity 1 Journal FinalJhazreel BiasuraNo ratings yet

- Week 5 Class SolutionsDocument28 pagesWeek 5 Class SolutionsBriar RoseNo ratings yet

- Chapter 3 End of Chapter Solutions - EvensDocument4 pagesChapter 3 End of Chapter Solutions - EvensAna StitelyNo ratings yet

- Assignment 9 FARDocument23 pagesAssignment 9 FARcha618717No ratings yet

- Homework Chapter 20 - Group 8Document5 pagesHomework Chapter 20 - Group 8Thư LuyệnNo ratings yet

- KKK Traders Servicing SetDocument17 pagesKKK Traders Servicing SetJeanette KimoNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Practice 4 Cash Flow Statement TestDocument4 pagesPractice 4 Cash Flow Statement TestAndini OleyNo ratings yet

- Tugas Accounting 1 With NotesDocument14 pagesTugas Accounting 1 With Notesvico lorenzoNo ratings yet

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytNo ratings yet

- Partnership Formation - Activity PDFDocument2 pagesPartnership Formation - Activity PDFWilliam TabuenaNo ratings yet

- HRMODocument4 pagesHRMOSum WhosinNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- MYOB Group AssignmentDocument7 pagesMYOB Group AssignmentSwastika PoonamNo ratings yet

- MHODocument4 pagesMHOSum WhosinNo ratings yet

- Class Exercise SolutionDocument10 pagesClass Exercise SolutionChristina KaukareNo ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- Abraar Dairy and Farming Financial Template-1Document13 pagesAbraar Dairy and Farming Financial Template-1Ganacsi KaabNo ratings yet

- Partnership Worksheet 7Document4 pagesPartnership Worksheet 7Timo wernereNo ratings yet

- MeoDocument4 pagesMeoSum WhosinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Financial AdvisoryDocument3 pagesFinancial Advisorybhavesh.sahuNo ratings yet

- Article PMDocument9 pagesArticle PMferoz khanNo ratings yet

- University of Lagos: School of Postgraduate StudiesDocument17 pagesUniversity of Lagos: School of Postgraduate StudiesAguda Henry OluwasegunNo ratings yet

- ARMY - Annual Report - 2017 PDFDocument149 pagesARMY - Annual Report - 2017 PDFjamaluddinNo ratings yet

- Project Management MCQ 2Document6 pagesProject Management MCQ 2Muskan SaiyedNo ratings yet

- Accounting For Changes in Acctg Policy and Estimate and Subsequent EventsDocument20 pagesAccounting For Changes in Acctg Policy and Estimate and Subsequent EventsGonzalo Jr. RualesNo ratings yet

- BE AnalysisDocument44 pagesBE Analysissahu.tukun003No ratings yet

- List of Mutual FundsDocument2 pagesList of Mutual FundsrajaraeshNo ratings yet

- Batch 2018 Comprehensive Exam Review ChecklistDocument4 pagesBatch 2018 Comprehensive Exam Review ChecklistChun PlayNo ratings yet

- Detailed Unit Price Analysis (Dupa)Document1 pageDetailed Unit Price Analysis (Dupa)Jonamene JuayongNo ratings yet

- Godawari PowerDocument6 pagesGodawari PowerKanika ChaddaNo ratings yet

- Multi Currency in TallyDocument10 pagesMulti Currency in TallyMahendra50% (2)

- Dimayuga TV Repair ShopDocument6 pagesDimayuga TV Repair ShoptakycabrejasNo ratings yet

- Chapter 4 - Audit of InvestmentsDocument45 pagesChapter 4 - Audit of InvestmentsClene DoconteNo ratings yet

- Bollinger Band Keltner Cheat SheetDocument2 pagesBollinger Band Keltner Cheat SheetMian Umar RafiqNo ratings yet

- Kotak PMS Special Situations Value Presentation - Jan 18Document36 pagesKotak PMS Special Situations Value Presentation - Jan 18kanna275No ratings yet

- Tire City INCDocument3 pagesTire City INCReetik ParekhNo ratings yet

- Anog Nove Angel TolitsDocument3 pagesAnog Nove Angel TolitsArlene GarciaNo ratings yet

- Chapter 5 - Option Pricing Model - Black Scholes Merton ModelDocument7 pagesChapter 5 - Option Pricing Model - Black Scholes Merton ModelHolban AndreiNo ratings yet

- CH22 IsmDocument5 pagesCH22 IsmLeanne TehNo ratings yet

- Kotak International REIT FOF PresentationDocument32 pagesKotak International REIT FOF PresentationRohan RautelaNo ratings yet

- R29 CFA Level 3Document12 pagesR29 CFA Level 3Ashna0188No ratings yet

- Assessment of Marketing Practices of Sari-Sari StoreDocument7 pagesAssessment of Marketing Practices of Sari-Sari StoreAngel Cris BulanonNo ratings yet

- Fixed AssetsDocument46 pagesFixed AssetsSprancenatu Lavinia0% (1)

- Rivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockDocument5 pagesRivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockMuskan ValbaniNo ratings yet

- Olivier Blanchard - Macroeconomics (8th Edition) - Pearson (2020) - Kafa-128-150Document23 pagesOlivier Blanchard - Macroeconomics (8th Edition) - Pearson (2020) - Kafa-128-150mrizalputraajiNo ratings yet