Professional Documents

Culture Documents

Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This Entry

Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This Entry

Uploaded by

IshanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This Entry

Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This Entry

Uploaded by

IshanCopyright:

Available Formats

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 08/2019- Central Tax (Rate)

New Delhi, the 29th March, 2019

G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 9 and sub- section

(5) of section 15 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central

Government, on the recommendations of the Council, hereby makes the following further

amendments in the notification of the Government of India in the Ministry of Finance

(Department of Revenue), No.1/2017-Central Tax (Rate), dated the 28th June, 2017, published in

the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R.

673(E), dated the 28th June, 2017, namely:-

In the said notification, in Schedule III - 9%, after serial number 452P in column (1) and the

entries relating thereto, the following serial number and entries shall be inserted, namely: -

(1) (2) (3)

“452Q Any chapter Supply of any goods other than capital goods and cement falling

under chapter heading 2523 in the first schedule to the Customs Tariff

Act, 1975 (51 of 1975), by an unregistered person to a promoter for

construction of the project on which tax is payable by the promoter as

recipient of goods under sub- section 4 of section 9 of the Central

Goods and Services Tax Act, 2017 (12 of 2017), as prescribed in

notification No. 07 / 2019- Central Tax (Rate), dated 29th March,

2019, published in Gazette of India vide G.S.R. No. _, dated 29th

March, 2019

Explanation. For the purpose of this entry,–

(i) the term “promoter” shall have the same meaning as assigned to it

in in clause (zk) of section 2 of the Real Estate (Regulation and

Development) Act, 2016 (16 of 2016).

(ii) “project” shall mean a Real Estate Project (REP) or a Residential

Real Estate Project (RREP).

(iii) the term “Real Estate Project (REP)” shall have the same

meaning as assigned to it in in clause (zn) of section 2 of the Real

Estate (Regulation and Development) Act, 2016 (16 of 2016).

(iv) “Residential Real Estate Project (RREP)” shall mean a REP in

which the carpet area of the commercial apartments is not more than

15 per cent. of the total carpet area of all the apartments in the REP.

(v) This entry is to be taken to apply to all goods which satisfy the

conditions prescribed herein, even though they may be covered by a

more specific chapter/ heading/ sub heading or tariff item elsewhere

in this notification.

2. This notification shall come into force with effect from the 1st of April, 2019.

[F. No. 354/32/2019- TRU]

(Pramod Kumar)

Deputy Secretary to the Government of India

Note: - The principal notification No.1/2017-Central Tax (Rate), dated the 28thJune, 2017 was

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number

G.S.R. 673(E), dated the 28thJune, 2017 and last amended by notification No. 24/ 2018- Central

Tax (Rate), dated the 31st December, 2018, published in the Gazette of India, Extraordinary, Part

II, Section 3, Sub-section (i) vide number G.S.R. 1261 (E), dated the 31st December, 2018.

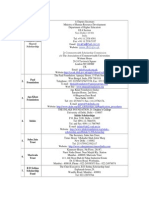

You might also like

- (Electronic Copy) : Asean-India Free Trade Area Preferential Tariff Certificate of OriginDocument10 pages(Electronic Copy) : Asean-India Free Trade Area Preferential Tariff Certificate of OriginKenneth EscamillaNo ratings yet

- Notfctn 7 2019 CGST Rate EnglishDocument2 pagesNotfctn 7 2019 CGST Rate EnglishRamprakash vishwakarmaNo ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- Notf 37 of 2017Document2 pagesNotf 37 of 2017Devdas NairNo ratings yet

- Notification No. 15/2021-Central Tax (Rate)Document2 pagesNotification No. 15/2021-Central Tax (Rate)santanu sanyalNo ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- NN 10Document1 pageNN 10JigmeNo ratings yet

- Notfctn 43 Central Tax EnglishDocument2 pagesNotfctn 43 Central Tax Englishapi-224058372No ratings yet

- Notfctn 8 Central Tax English PDFDocument2 pagesNotfctn 8 Central Tax English PDFrgurvareddyNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Notfctn 48 Central Tax English 2019Document2 pagesNotfctn 48 Central Tax English 2019CA Keshav MadaanNo ratings yet

- Notification07 Compensation Cess RateDocument2 pagesNotification07 Compensation Cess RateKritee KathuriaNo ratings yet

- Panaji, 11th January, 2018 (Pausa 21, 1939) : Government of GoaDocument28 pagesPanaji, 11th January, 2018 (Pausa 21, 1939) : Government of Goaks1962No ratings yet

- Notfctn 78 Central Tax English 2020Document2 pagesNotfctn 78 Central Tax English 2020Ashish Yadav & AssociatesNo ratings yet

- CST 17 2024Document1 pageCST 17 2024ndshiva22No ratings yet

- GSTNTF66Document1 pageGSTNTF66JGVNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- 01 2024 ITR Eng CorriDocument2 pages01 2024 ITR Eng Corrikk5860232No ratings yet

- G.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andDocument1 pageG.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andkumar45caNo ratings yet

- (To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Document1 page(To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Arul Kumar RajendranNo ratings yet

- Notfn 12 2019Document2 pagesNotfn 12 2019Sri CharanNo ratings yet

- Customs Tariff Notification No.13/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.13/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Import Gatt DeclarationDocument2 pagesImport Gatt Declarationishan guptaNo ratings yet

- GST CT 07 2024Document1 pageGST CT 07 2024krishanNo ratings yet

- Notification 98 2023Document1 pageNotification 98 2023tax.contactNo ratings yet

- 01 2023 CT EngDocument1 page01 2023 CT Engcadeepaksingh4No ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- GST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)Document2 pagesGST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)ARJUN ATHREYANNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- New Services Under Reverse Charge Mechanism Wef 1st January 2019 - Taxguru - inDocument4 pagesNew Services Under Reverse Charge Mechanism Wef 1st January 2019 - Taxguru - inPradeep MudiNo ratings yet

- GST CT 31 2023 3Document1 pageGST CT 31 2023 3cadeepaksingh4No ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- Central Excise Tariff Notification No.14/2014 Dated 11th July, 2014Document1 pageCentral Excise Tariff Notification No.14/2014 Dated 11th July, 2014stephin k jNo ratings yet

- 70 2019Document1 page70 2019Krishna GoyalNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- TLP Supplement GST Dec18 OldSyllabusDocument24 pagesTLP Supplement GST Dec18 OldSyllabusShreya s shettyNo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Pages From IJDCFFinalDocument8 pagesPages From IJDCFFinalIshanNo ratings yet

- IJDCFFinal 11Document1 pageIJDCFFinal 11IshanNo ratings yet

- IJDCFFinal 14Document1 pageIJDCFFinal 14IshanNo ratings yet

- Case Studies-On S 270 A - MR Jagdish Punjabi PDFDocument28 pagesCase Studies-On S 270 A - MR Jagdish Punjabi PDFIshanNo ratings yet

- IJDCFFinal 7Document1 pageIJDCFFinal 7IshanNo ratings yet

- IJDCFFinal 6Document1 pageIJDCFFinal 6IshanNo ratings yet

- IJDCFFinalDocument73 pagesIJDCFFinalIshanNo ratings yet

- Taxguru - In-Tax Treatment of Cash Credit Us 68 69 69A 69B 69C and 69DDocument4 pagesTaxguru - In-Tax Treatment of Cash Credit Us 68 69 69A 69B 69C and 69DIshanNo ratings yet

- IJDCFFinal 13Document1 pageIJDCFFinal 13IshanNo ratings yet

- Ken 2.0 - Automation PDFDocument13 pagesKen 2.0 - Automation PDFIshanNo ratings yet

- Brains Trust PPT - MR Gautam DoshiDocument31 pagesBrains Trust PPT - MR Gautam DoshiIshanNo ratings yet

- Taxguru - In-Addition Us 69A Can Only Be Made When Assessee Found To Be in Possession of Money Bullion Jewellery e PDFDocument5 pagesTaxguru - In-Addition Us 69A Can Only Be Made When Assessee Found To Be in Possession of Money Bullion Jewellery e PDFIshanNo ratings yet

- Circular 19.4.2020-Final PDFDocument1 pageCircular 19.4.2020-Final PDFIshanNo ratings yet

- Invoice 1019665494 I2527P1900066606Document1 pageInvoice 1019665494 I2527P1900066606IshanNo ratings yet

- Terms & Conditions Offer:: TH THDocument2 pagesTerms & Conditions Offer:: TH THIshanNo ratings yet

- CGST Rules 46A PDFDocument1 pageCGST Rules 46A PDFIshanNo ratings yet

- Framework Aggrement-RefDocument4 pagesFramework Aggrement-RefMoffat KangombeNo ratings yet

- Public PolicyDocument464 pagesPublic PolicyprabodhNo ratings yet

- Of IMF Recommendations: World Court Rules It Has Venezuela Border Case Jurisdiction To Hear GuyanaDocument32 pagesOf IMF Recommendations: World Court Rules It Has Venezuela Border Case Jurisdiction To Hear GuyanaAnthony SampsonNo ratings yet

- RFS Floating Solar Park 04 MW With 02 MW BESS PDFDocument123 pagesRFS Floating Solar Park 04 MW With 02 MW BESS PDFkiranNo ratings yet

- Legal Ethics Ernesto L. Pineda (2009 Edition) : PreliminariesDocument21 pagesLegal Ethics Ernesto L. Pineda (2009 Edition) : PreliminariesMhayBinuyaJuanzonNo ratings yet

- Smeaheia Dataset License - Gassnova and EquinorDocument5 pagesSmeaheia Dataset License - Gassnova and EquinorZainab AdedejiNo ratings yet

- 00 CommitteesDocument9 pages00 CommitteesMary KristineNo ratings yet

- Letter of Authority Implementation: IO-II Felix A. Espino IIIDocument7 pagesLetter of Authority Implementation: IO-II Felix A. Espino IIInievenhaspeNo ratings yet

- Sexism and Misleading MarketingDocument2 pagesSexism and Misleading MarketinganneNo ratings yet

- Making and Remaking The Balkans Nations and States Since 1878 (Robert Clegg Austin)Document241 pagesMaking and Remaking The Balkans Nations and States Since 1878 (Robert Clegg Austin)icyerabdNo ratings yet

- I. Major Changes Introduced by The Revised Corporation CodeDocument5 pagesI. Major Changes Introduced by The Revised Corporation CodeDaniel FordanNo ratings yet

- RFP NH 42 Mulkalcheruvu - MadanapalleDocument95 pagesRFP NH 42 Mulkalcheruvu - MadanapallehallmarkvenugopalNo ratings yet

- Name-Sohan Sarkar Regno-20Bec0767Document11 pagesName-Sohan Sarkar Regno-20Bec0767Binode SarkarNo ratings yet

- The Role and Impact of NGOs On The Devel PDFDocument8 pagesThe Role and Impact of NGOs On The Devel PDFMuneebNo ratings yet

- The Philippine Bill of 1902Document23 pagesThe Philippine Bill of 1902Kate Ailene G. RepuyaNo ratings yet

- Essay 1 EnglishDocument4 pagesEssay 1 Englishapi-708036981No ratings yet

- Certification ElectionDocument14 pagesCertification ElectionMarie100% (1)

- Commonwealth Shared Scholarship: New Delhi 110 001 IndiaDocument5 pagesCommonwealth Shared Scholarship: New Delhi 110 001 IndiaSohaing GaelNo ratings yet

- Bulacan Vaccination SitesDocument3 pagesBulacan Vaccination SitesLGU-MEO Santa Maria, BulacanNo ratings yet

- Mischief Rule of Interpretation Beginning of A New JurisprudenceDocument7 pagesMischief Rule of Interpretation Beginning of A New JurisprudencearunithiNo ratings yet

- Equal Only in Name - Malaysia - Full ReportDocument117 pagesEqual Only in Name - Malaysia - Full ReportZahir NakiyuddinNo ratings yet

- Cfibg TBD 2021 03Document4 pagesCfibg TBD 2021 03Muzammil KaziNo ratings yet

- OCA Circular No. 08-2023 Guideline For Qualification To Judicial OfficeDocument7 pagesOCA Circular No. 08-2023 Guideline For Qualification To Judicial OfficeTinnyNo ratings yet

- Composite Water Management Index (CWMI)Document3 pagesComposite Water Management Index (CWMI)Avinash MishraNo ratings yet

- Mental Health in The Ivy LeagueDocument46 pagesMental Health in The Ivy LeaguenerdmojoNo ratings yet

- CTY3 Inductive Grammar Charts Unit 9Document2 pagesCTY3 Inductive Grammar Charts Unit 9Dalck TorresNo ratings yet

- List of CIPPE SyllabusDocument5 pagesList of CIPPE SyllabusraotejasvinNo ratings yet

- Cathay Metal Corp V Laguna WestDocument15 pagesCathay Metal Corp V Laguna WestJade Palace TribezNo ratings yet

- G - Nationalism PDFDocument36 pagesG - Nationalism PDFsmrithiNo ratings yet