Professional Documents

Culture Documents

Partnership

Partnership

Uploaded by

abhishekanandsingh123goOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership

Partnership

Uploaded by

abhishekanandsingh123goCopyright:

Available Formats

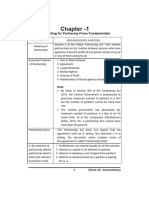

Chapter

Preparation of Financial Statements – Partnership

Meaning of Partnership

• When two or more persons join hands to set up a business and share its profits and losses, they are said to be

in partnership.

• Section 4 of the Indian Partnership Act 1932 defines partnership as the ‘relation between persons who have

agreed to share the profits of a business carried on by all or any of them acting for all’.

• Persons who have entered into partnership with one another are called individually, "partners" and

collectively "a firm", and the name under which their business is carried on is called the "firm-name".

• A partnership firm has no separate legal entity, apart from the partners constituting it.

Features of Partnership

1. Two or More Persons: In order to form partnership, there should be at least two persons coming together for

a common goal.

Minimum number of partners in a firm can be 2.

Minimum number of partners in a firm can be 50. [Rule 10 of The Companies (Miscellaneous) Rules,

2014]

2. Agreement: Partnership is the result of an agreement between two or more persons to do business and share

its profits and losses. It is not necessary that such agreement is in written form. An oral agreement is equally

valid.

Agreement means every promise and every set of promises, forming the consideration for each

other.

Contract is an agreement enforceable by law

3. Business: The agreement should be to carry on some business. Mere co- ownership of a property does not

amount to partnership. For example, if Rohit and Sachin jointly purchase a plot of land, they become the joint

owners of the property and not the partners. But if they are in the business of purchase and sale of land for

the purpose of making profit, they will be called partners.

Prepared by: Raman Luthra

Chartered Accountant

4. Mutual Agency: The business of a partnership concern may be carried on by all the partners or any of them

acting for all. This statement has two important implications.

Every partner is entitled to participate in the conduct of the affairs of its business.

There exists a relationship of mutual agency between all the partners

Each partner carrying on the business is the principal as well as the agent for all the other partners. He can

bind other partners by his acts and also is bound by the acts of other partners with regard to business of the

firm. Relationship of mutual agency is so important that one can say that there would be no partnership, if

the element of mutual agency is absent.

5. Sharing of Profit: Another important element of partnership is that, the agreement between partners must be

to share profits and losses of a business.

Section13 Mutual Right and Liabilities - The Partnership Act, 1932. Subject to contract between the

partners -

Profit Sharing Ratio: If the partnership deed is silent about the profit-sharing ratio, the profits and

losses of the firm are to be shared equally by partners, irrespective of their capital contribution in the

firm.

Interest on Capital: No partner is entitled to claim any interest on the amount of capital contributed

by him in the firm as a matter of right. However, interest can be allowed when it is expressly agreed

to by the partners. Thus, no interest on capital is payable if the partnership deed is silent on the issue.

Interest on Drawings: No interest is to be charged on the drawings made by the partners, if there is

no mention in the Deed.

Interest on Loan: If any partner has advanced loan to the firm for the purpose of business, he/she

shall be entitled to get an interest on the loan amount at the rate of 6 per cent per annum.

Remuneration for Firm’s Work: No partner is entitled to get salary or other remuneration for taking

part in the conduct of the business of the firm unless there is a provision for the same in the Partnership

Deed.

Apart from the above, the Indian Partnership Act specifies that subject to contract between the partners:

If a partner derives any profit for him/her self from any transaction of the firm or from the use of the

property or business connection of the firm or the firm name, he/she shall account for the profit and

pay it to the firm.

If a partner carries on any business of the same nature as and competing with that of the firm, he/she

shall account for and pay to the firm, all profit made by him/her in that business.

6. Liability of Partners: Each partner is liable jointly with all the other partners and also severally to the third

party for all the acts of the firm done while he is a partner. Not only that the liability of a partner for acts of

the firm is also unlimited. This implies that his private assets can also be used for paying off the firm’s debts.

Prepared by: Raman Luthra

Chartered Accountant

Trading and Profit and Loss Account

Trading Account

The trading account ascertains the result from basic operational activities of the business. The basic operational

activity involves the manufacturing, purchasing and selling of goods.

Profit and Loss Account

Profit & loss account is an account, representing the actual profit earned or loss sustained by the business during the

accounting period.

Trading and Profit and Loss Account of ABC for the year ended

March 31, XXXX

Dr. Cr.

Expenses/Losses Amount Revenues/Gains Amount

` `

Opening stock ..... Sales .....

Purchases .....

Wages .....

Carriage inwards/ .....

Freight inwards/cartage

Gross profit c/d1

Gross loss b/d2

xxx xxx

Gross loss c/d1 .....

Gross profit b/d .....

Rent/rates and taxes ..... Interest received .....

Salaries ..... .....

Repairs and renewals ..... Net loss2

Bad debts .....

Net profit2 (transferred to .....

capital account)

xxx xxx

1,2either of the items computed

Distribution of Profit among Partners

The profits and losses of the firm are distributed among the partners in an agreed ratio. However, if the partnership

deed is silent, the firm’s profits and losses are to be shared equally by all the partners.

Profit and Loss Appropriation Account

Profit and Loss Appropriation Account is merely an extension of the Profit and Loss Account of the firm. It shows

how the profits are appropriated or distributed among the partners. All adjustments in respect of partner’s salary,

partner’s commission, interest on capital, interest on drawings, etc. are made through this account. It starts with the

net profit/net loss as per Profit and Loss Account.

Prepared by: Raman Luthra

Chartered Accountant

Profit and Loss Appropriation Account

Dr. Cr.

Particulars Amount Particulars Amount

(Rs.) (Rs.)

Profit and Profit and xxx

Loss (if there xxx Loss (if there

is loss) is profit)

Interest on Capital xxx Interest on Drawings xxx

Salary to Partner xxx Partners’ Capital/Current

Commission to Accounts (distribution of Loss) xxx

Partner xxx

Partners’ Capital/Current

Accounts (distribution of xxx

profit)

xxxx xxxx

Maintenance of Capital Accounts of Partners

a) Fixed Capital Method: Under the fixed capital method, the capitals of the partners shall remain fixed unless

additional capital is introduced or a part of the capital is withdrawn as per the agreement among the partners.

All items like share of profit or loss, interest on capital, drawings, interest on drawings, etc. are recorded in a

separate account, called Partner’s Current Account.

Partner’s Capital Account

Dr. Cr.

Date Particulars J.F. Amount Date Particulars J.F. Amount

(Rs.) (Rs.)

Bank (permanent xxx Balance b/d xxx

withdrawal of (opening balance)

capital) xxx Bank (fresh capital xxx

Balance c/d introduced)

(closing balance)

xxx xxx

Partner’s Current Account

Dr. Cr.

Date Particulars J.F. Amount Date Particulars J.F. Amount

(Rs.) (Rs.)

Balance b/d xxx Balance b/d xxx

(in case of debit (in case of credit

opening balance) opening balance)

Drawings xxx Salary Commission xxx

Interest on xxx Interest on capital xxx

drawings Profit & xxx Profit & Loss

Loss a/c Appropriation xxx

Balance c/d (share of profit)

(in case of credit xxx Balance c/d

closing balance) (in case of debit closing xxx

balance)

xxxx xxxx

Prepared by: Raman Luthra

Chartered Accountant

b) Fluctuating Capital Method: Under the fluctuating capital method, only one account, i.e. capital account is

maintained for each partner. All the adjustments such as share of profit and loss, interest on capital, drawings,

interest on drawings, salary or commission to partners, etc are recorded directly in the capital accounts of the

partner

Partner’s Capital Account

Dr. Cr.

Date Particulars J.F. Amount Date Particulars J.F. Amount

(Rs.) (Rs.)

Balance b/d (in xxx Balance b/d (in case xxx

case of debit of credit opening

closing balance) balance)

Drawings Bank (fresh xxx

Interest on xxx capital

drawings Profit and xxx introduced) xxx

Loss Salaries xxx

A/c Interest on capital xxx

(for share of loss) xxx Profit and Loss

Balance c/d (in Appropriation

case of credit (for share of profit) xxx

closing balance) Balance b/d (in case

of debit closing

balance)

xxxx xxxx

Balance Sheet

The balance sheet is a statement prepared for showing the financial position of the business summarising its assets

and liabilities at a given date. The assets reflect debit balances and liabilities (including capital) reflect credit balances.

It is prepared at the end of the accounting period after the trading and profit and loss account have been prepared. It

is called balance sheet because it is a statement of balances of ledger accounts that have not been transferred to trading

and profit and loss account and are to be carried forward to the next year with the help of an opening entry made in

the journal at the beginning of the next year.

Balance Sheet of as at March 31, 2XXX

Liabilities Amount Assets Amount

` `

Capital ..... Furniture .....

Add Profit ..... ..... Cash .....

Long-term loan ..... Bank .....

Short-term loan Goodwill .....

Sundry creditors ..... Sundry debtors .....

Bills payable Land and Buildings

Bank overdraft Closing stock

xxxx xxxx

Prepared by: Raman Luthra

Chartered Accountant

Multiple Choice Questions

1. [Question] X, Y and Z are partners in a firm. At the time of division of profits for the year, there was a dispute

between the partners. Profit before interest on loan was 6,000/-.

Y provided loan to the firm of INR 80,000/- and demanded interest of 20% p.a. There was no agreement on

this point. Calculate the amount payable to X, Y and Z respectively?

a) 2,000 to each partner

b) 2,000, 18,000 and 2,000 to X, Y and Z respectively

c) 2,000, 4,800 and 2,000 to X, Y and Z respectively

d) 600, 4,800 and 600 to X, Y and Z respectively

e) 400, 5,200 and 400 to X, Y and Z respectively

Answer: e.

2. [Question] On 1st January 2020, a partner advanced a loan of 1,00,000/- to the firm. In the absence of

agreement, Interest on loan for financial Year 19-20 will be?

a) Nil

b) 1,500/-

c) 3,000/-

d) 4,500/-

e) 6,000/-

Answer: b.

3. [Question] A and B are partners. According to profit and loss account, the net profit for the year is 2,00,000.

The total interest on partner’s drawing is 1000. A’s salary is 40,000 per year and B’s salary is 3,000 per month.

The net profit as per profit and loss appropriation account will be?

a) 1,23,000/-

b) 1,25,000/-

c) 1,56,000/-

d) 1,58,000/-

e) 2,01,000/-

Answer: b.

4. [Question] Drawing will be recorded ______ side of ________ account?

a) Credit, Partner’s Capital

b) Debit, Partner’s Capital

c) Credit, P&L Appropriation A/c

d) Debit, P&L Appropriation A/c

e) None of the above is correct.

Answer: b.

Prepared by: Raman Luthra

Chartered Accountant

You might also like

- FinAccUnit 3 - Partnership Accounts Lecture Notes PDFDocument8 pagesFinAccUnit 3 - Partnership Accounts Lecture Notes PDFSherona Reid100% (5)

- Credit Card BOA DuyDocument4 pagesCredit Card BOA Duynghia leNo ratings yet

- CIPP MaterialDocument334 pagesCIPP MaterialMohamed El-sirNo ratings yet

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah Basir33% (3)

- CAF 1 - Accounting For PartnershipDocument48 pagesCAF 1 - Accounting For PartnershipAhsan Kamran100% (1)

- Case Study - Stock Pitch GuideDocument7 pagesCase Study - Stock Pitch GuideMuyuchen Shi100% (1)

- Shareholders Agreement DraftDocument8 pagesShareholders Agreement DraftEnrryson SebastianNo ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Buku Nota PertnershipDocument33 pagesBuku Nota PertnershipmaiNo ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- Xii Accounts NOTESDocument13 pagesXii Accounts NOTESNavin PatidarNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah BasirNo ratings yet

- WK 1 Intro 2 PartnershipDocument6 pagesWK 1 Intro 2 PartnershipkehindeadeniyiNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- Course Materials BADVAC2X Week2Document8 pagesCourse Materials BADVAC2X Week2Mitchie FaustinoNo ratings yet

- Class 12 Subject Accountancy Partnership (Fundamentals)Document4 pagesClass 12 Subject Accountancy Partnership (Fundamentals)Asra KitabNo ratings yet

- Chapter 2 - Normal PartnershipDocument18 pagesChapter 2 - Normal PartnershipmaiNo ratings yet

- Partnership FundamentalsDocument36 pagesPartnership FundamentalsSuman Choudhary100% (1)

- Partnership AccountingDocument7 pagesPartnership AccountingZaid ZubairiNo ratings yet

- Unit 5Document37 pagesUnit 5Rej HaanNo ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- Chapter-1 (Key-Terms and Chapter Summary)Document6 pagesChapter-1 (Key-Terms and Chapter Summary)yashkumaryash11No ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- Fundamental of PatnershipDocument21 pagesFundamental of PatnershipHamza RiyazNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- Combinepdf PDFDocument189 pagesCombinepdf PDFom sharmaNo ratings yet

- Theory Notes Part IDocument31 pagesTheory Notes Part ISuraj PatelNo ratings yet

- Lecture Notes - Chapter 15: Sole Trader and Partnership Fss Under Uk GaapDocument34 pagesLecture Notes - Chapter 15: Sole Trader and Partnership Fss Under Uk GaapThương ĐỗNo ratings yet

- CHP 12Document59 pagesCHP 12Usmän Mïrżä100% (1)

- XII Accountancy Notes All Chapters MR - Mohan H BaksaniDocument176 pagesXII Accountancy Notes All Chapters MR - Mohan H BaksaniALAY SINGHNo ratings yet

- Accounting For A PartnershipDocument44 pagesAccounting For A PartnershipAdugnaNo ratings yet

- Module 11 - Partnership FormationDocument15 pagesModule 11 - Partnership FormationAlfa May BuracNo ratings yet

- Partnership Accounting: Learning ObjectivesDocument31 pagesPartnership Accounting: Learning ObjectivesnuggsNo ratings yet

- Module 3 Partnership OperationsDocument17 pagesModule 3 Partnership OperationsClaire CastrenceNo ratings yet

- Partnerships: Igcse - Accounting (9-1) - Mahdi SamdaniDocument5 pagesPartnerships: Igcse - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- Complete TheoryDocument28 pagesComplete TheoryGODSPEED. AltNo ratings yet

- Accounting For Partnership-FinalDocument14 pagesAccounting For Partnership-Finalgetnet5195No ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Fundamental of Partnership Revision NotesDocument16 pagesFundamental of Partnership Revision NotesTarun SinghalNo ratings yet

- 02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountDocument14 pages02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountHOD Dept of BBA Vels UniversityNo ratings yet

- 18bco31c U4Document12 pages18bco31c U4takudzwaNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Management Accounting: Submitted To: Darell Perera SUBMITTED BY: M.Daniyal Khan Mohsin HassanDocument17 pagesManagement Accounting: Submitted To: Darell Perera SUBMITTED BY: M.Daniyal Khan Mohsin HassanDaniyal KhanNo ratings yet

- DISSOLUTION OF PARTNERSHIP, Accounts, Class 12Document13 pagesDISSOLUTION OF PARTNERSHIP, Accounts, Class 12TULIP DAHIYANo ratings yet

- Basics of PartnershipDocument20 pagesBasics of PartnershipSpider ManNo ratings yet

- Partnership FormationDocument18 pagesPartnership FormationHera AsuncionNo ratings yet

- Assessment of Partnership FirmDocument7 pagesAssessment of Partnership FirmxzdseNo ratings yet

- 18bco31c U1Document4 pages18bco31c U1sc209525No ratings yet

- Book Keeping & AccountancyDocument24 pagesBook Keeping & AccountancyElvita Pinto100% (1)

- LAS ABM - FABM12 Ie 9 Week 4Document7 pagesLAS ABM - FABM12 Ie 9 Week 4ROMMEL RABONo ratings yet

- Partnership NotesDocument35 pagesPartnership Notesa86476007No ratings yet

- Partnership-Accounting 5a21e9361723ddd448361182Document31 pagesPartnership-Accounting 5a21e9361723ddd448361182Jason Cabrera0% (1)

- Fundamental: Accounting For PartnershipDocument7 pagesFundamental: Accounting For PartnershipNeeraj PoddarNo ratings yet

- Class: XII Subject: Accountancy Notes On Partnership-FundamentalsDocument11 pagesClass: XII Subject: Accountancy Notes On Partnership-FundamentalsSurbhi DevnaniNo ratings yet

- Partnership & Corporation Accounting NotesDocument16 pagesPartnership & Corporation Accounting NotesJACQUELYN PABLITONo ratings yet

- Accounting For Partnership: Basic ConceptsDocument51 pagesAccounting For Partnership: Basic ConceptsVijay ShekarNo ratings yet

- ACC 412 Specialised Accounting IDocument148 pagesACC 412 Specialised Accounting IStephen YigaNo ratings yet

- Ahimad Najash ProposalDocument39 pagesAhimad Najash ProposalNesru SirajNo ratings yet

- In The Matter of Lenrick Sales, Inc., A Pennsylvania Corporation, Bankrupt. James Talcott, Inc., Shapiro Bros. Factors Corp. and Crompton-Richmond Co., Inc., Factors, 369 F.2d 439, 3rd Cir. (1967)Document6 pagesIn The Matter of Lenrick Sales, Inc., A Pennsylvania Corporation, Bankrupt. James Talcott, Inc., Shapiro Bros. Factors Corp. and Crompton-Richmond Co., Inc., Factors, 369 F.2d 439, 3rd Cir. (1967)Scribd Government DocsNo ratings yet

- Error Spotting Asked in Previous Year Prelim Exams: Get High Standard Mock Test Series For All Bank ExamsDocument12 pagesError Spotting Asked in Previous Year Prelim Exams: Get High Standard Mock Test Series For All Bank ExamsTechshalaNo ratings yet

- Resume Activities ExamplesDocument9 pagesResume Activities Examplesdap0jos0waz3100% (1)

- Zoho CRM FlexDocument4 pagesZoho CRM Flexnishith.fddiNo ratings yet

- Chapter 1 The Information System An Accountant's PerspectiveDocument40 pagesChapter 1 The Information System An Accountant's PerspectiveFarah Byun100% (1)

- Aqualisa Quartz:Simply A Better Shower: Ayush Ravi Maaz Ahmad Shivam SahayDocument27 pagesAqualisa Quartz:Simply A Better Shower: Ayush Ravi Maaz Ahmad Shivam SahayAYUSH RAVINo ratings yet

- Cost Sheet Miracle MileDocument1 pageCost Sheet Miracle Milesushil aroraNo ratings yet

- R1508D933901 Assessment Point 2Document5 pagesR1508D933901 Assessment Point 2Rue Spargo Chikwakwata0% (1)

- Porters Five For NikeDocument3 pagesPorters Five For NikedishaNo ratings yet

- New Research File Complete PDFDocument42 pagesNew Research File Complete PDFTesslene Claire SantosNo ratings yet

- Standard-Bank-The-African-Wealth-Report-2020 Entrepreneuriat PDFDocument77 pagesStandard-Bank-The-African-Wealth-Report-2020 Entrepreneuriat PDFHermesNo ratings yet

- ARABIT Vs Jardine Pacific Finance Inc.Document3 pagesARABIT Vs Jardine Pacific Finance Inc.jed_sindaNo ratings yet

- Company Analysis Research PaperDocument5 pagesCompany Analysis Research Paperknoiiavkg100% (1)

- Retail Format: Presented By: Ayush Shrivastava Bhanusree Lohia Diksha Jiwtode Divisha RastogiDocument8 pagesRetail Format: Presented By: Ayush Shrivastava Bhanusree Lohia Diksha Jiwtode Divisha RastogiKrati GugnaniNo ratings yet

- TOPSIS and AHP CaseDocument11 pagesTOPSIS and AHP CaseprasannaNo ratings yet

- Enterprenuership AssignmentDocument10 pagesEnterprenuership AssignmenthamzahNo ratings yet

- RV Business Plan FinalDocument14 pagesRV Business Plan Finalapi-352273609100% (2)

- Commercial Promotion ContractDocument3 pagesCommercial Promotion ContractadminNo ratings yet

- Lawyer Barons by Lester BrickmanDocument524 pagesLawyer Barons by Lester BrickmanADNo ratings yet

- Maths Multiple Chioce Work SheetDocument4 pagesMaths Multiple Chioce Work SheettarbeecatNo ratings yet

- D Business Combinations - IFRS 3 (Revised)Document10 pagesD Business Combinations - IFRS 3 (Revised)Brook KongNo ratings yet

- Econ CH 5 ReadingDocument3 pagesEcon CH 5 ReadingAbi CalderaleNo ratings yet

- Chapter 11 Costs: Table 11.1 Description of Selected Aircraft Tires (App. A) Tire Type Aircraft Application Cost, $Document2 pagesChapter 11 Costs: Table 11.1 Description of Selected Aircraft Tires (App. A) Tire Type Aircraft Application Cost, $Raniero FalzonNo ratings yet

- 2023 Bbes JustificationDocument3 pages2023 Bbes JustificationJoji Matadling TecsonNo ratings yet

- Determinants of Consumer Choice Criteria in Retail BankingDocument24 pagesDeterminants of Consumer Choice Criteria in Retail BankingHazleen RostamNo ratings yet