Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 views5th Sem Last Long

5th Sem Last Long

Uploaded by

mdanss1244Financial statements provide an overview of a company's financial performance and position over a period of time. They include key documents like the income statement, balance sheet, statement of cash flows, and statement of changes in equity. Financial statement analysis can be classified into different types based on objectives, methods, and focus, including horizontal analysis, vertical analysis, ratio analysis, cross-sectional analysis, and time-series analysis. Each type of analysis offers unique insights into a company's financials to help stakeholders make informed decisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Analysis of MRFDocument69 pagesFinancial Analysis of MRFBALRAJ100% (4)

- Financial Statement AnalysisDocument33 pagesFinancial Statement Analysisfirst name100% (3)

- Ratio Analysis Project Shankar - NewDocument15 pagesRatio Analysis Project Shankar - NewShubham SinghalNo ratings yet

- A Project Report On: Presented by Gautam KasundraDocument19 pagesA Project Report On: Presented by Gautam Kasundrapunit_4489No ratings yet

- SIRUTHULIDocument20 pagesSIRUTHULIdeepika DeepuNo ratings yet

- F. Understanding The Financial Statement and Its Components Sahid P.ADocument10 pagesF. Understanding The Financial Statement and Its Components Sahid P.Aantonette.escobia17No ratings yet

- A Study On Financial PerformanceDocument73 pagesA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- Financial Statement AnalysisDocument17 pagesFinancial Statement Analysisshrinidhisenthil2001No ratings yet

- Pre Test: Biliran Province State UniversityDocument6 pagesPre Test: Biliran Province State Universitymichi100% (1)

- Accounting For ManagersDocument5 pagesAccounting For Managersphugga01No ratings yet

- Chapter 3Document30 pagesChapter 3shaik iftiNo ratings yet

- Financial State Wps OfficeDocument14 pagesFinancial State Wps OfficeJoan DardoNo ratings yet

- Managerial Accounting 114-2017Document32 pagesManagerial Accounting 114-2017TanvirNo ratings yet

- Financial Analysis Techniques or ToolsDocument38 pagesFinancial Analysis Techniques or ToolsFreddierick JuntillaNo ratings yet

- Financial Statment Analysis of Hero MotocorpDocument66 pagesFinancial Statment Analysis of Hero MotocorpWebsoft Tech-HydNo ratings yet

- Mahindra and MahindraDocument60 pagesMahindra and MahindraAparna TumbareNo ratings yet

- Answer To Financial ManagementDocument11 pagesAnswer To Financial ManagementJc LanuzaNo ratings yet

- Analysis of Financial StatementDocument86 pagesAnalysis of Financial StatementSandipan Basu100% (2)

- 09 - Chapter 1Document28 pages09 - Chapter 1Ankita GaikwadNo ratings yet

- Chapter 2 Part III (FS) - 9f4c795a b66d 4d54 9441 Ef329c8dda7fDocument10 pagesChapter 2 Part III (FS) - 9f4c795a b66d 4d54 9441 Ef329c8dda7fBHAWNANo ratings yet

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocument13 pagesFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaApoorva A NNo ratings yet

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocument13 pagesFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula Anithawawa1303No ratings yet

- Sample Bcom Project PDFDocument13 pagesSample Bcom Project PDFRahul KamathNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementHarish.PNo ratings yet

- A Study On Financial Performance For Axis BankDocument20 pagesA Study On Financial Performance For Axis BankJayaprabhu PrabhuNo ratings yet

- Analysis of Financial Statements of Harvest Investments CompanyDocument86 pagesAnalysis of Financial Statements of Harvest Investments CompanyHarish AdithanNo ratings yet

- Aom AssignmentDocument7 pagesAom AssignmentAkanksha PalNo ratings yet

- Theory On Financial Analysis - 240516 - 210216Document28 pagesTheory On Financial Analysis - 240516 - 210216manjubhaii12No ratings yet

- Financial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureDocument11 pagesFinancial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureBonDocEldRicNo ratings yet

- FMTEXINDUNIT4Document29 pagesFMTEXINDUNIT4Gopika RaviNo ratings yet

- My ProjectDocument72 pagesMy ProjectPrashob Koodathil0% (1)

- 18ME1E0047Document68 pages18ME1E0047QUIZ CRRNo ratings yet

- Key Terms and Chapter Summary 2 1Document4 pagesKey Terms and Chapter Summary 2 1Neel DudhatNo ratings yet

- Project Ratio Analysis 3Document57 pagesProject Ratio Analysis 3anusuyanag2822100% (1)

- Financial AnalysisDocument46 pagesFinancial Analysisanand_lihinarNo ratings yet

- Main EditeddddDocument73 pagesMain Editeddddammukhan khanNo ratings yet

- Table of Content Title Page NoDocument26 pagesTable of Content Title Page Nopradeep110No ratings yet

- Financial AnalysisDocument3 pagesFinancial Analysisyashaswisharma68No ratings yet

- Module 3 Analysis and Interpretation of Financial StatementsDocument23 pagesModule 3 Analysis and Interpretation of Financial StatementsRonald Torres100% (1)

- Financial AnalysisDocument4 pagesFinancial AnalysisManaliAshokNo ratings yet

- IntroductionDocument23 pagesIntroductionYASIN CAFENo ratings yet

- Executive SummaryDocument34 pagesExecutive SummaryRachit KhareNo ratings yet

- Ratio Analysis of Amararaja BatteriesDocument72 pagesRatio Analysis of Amararaja BatteriesE.GOPINADH100% (4)

- Project On Project ManagementDocument92 pagesProject On Project ManagementSrinath Navada100% (1)

- 12 Chapter3 PDFDocument12 pages12 Chapter3 PDFFranklin BanisterNo ratings yet

- Fin Statement AnalysisDocument26 pagesFin Statement AnalysisBhagaban DasNo ratings yet

- 1.1 Introduction To Financial StatementsDocument21 pages1.1 Introduction To Financial StatementsPRIYAM XEROXNo ratings yet

- 8 RatioAnalysisDocument22 pages8 RatioAnalysisDr. Bhavana Raj KNo ratings yet

- Accounting A2Document15 pagesAccounting A2thngnNo ratings yet

- Financial Statement AnalysisDocument89 pagesFinancial Statement AnalysiseshuNo ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- A Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyDocument62 pagesA Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyeshuNo ratings yet

- CH-2 FaDocument16 pagesCH-2 FakirubelyitayalNo ratings yet

- Particulars Number CertificateDocument63 pagesParticulars Number CertificatekeerthiNo ratings yet

- Chapter-Two Financial AnalysisDocument94 pagesChapter-Two Financial AnalysisDejene GurmesaNo ratings yet

- Finanacial AccountingDocument189 pagesFinanacial AccountingRatish Kakkad100% (6)

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Accounting Short 2 PageDocument2 pagesAccounting Short 2 Pagemdanss1244No ratings yet

- Accounting 1st PageDocument1 pageAccounting 1st Pagemdanss1244No ratings yet

- 5th Sem Last Exam Short 2 PageDocument3 pages5th Sem Last Exam Short 2 Pagemdanss1244No ratings yet

- 19 3rd Management LongDocument2 pages19 3rd Management Longmdanss1244No ratings yet

- 3rd Long ManagementDocument2 pages3rd Long Managementmdanss1244No ratings yet

- Io-Link Hub For 8 Analog Input SignalsDocument2 pagesIo-Link Hub For 8 Analog Input SignalsGabriel CardosoNo ratings yet

- Unit 4 Problems On Combined Bending and TorsionDocument8 pagesUnit 4 Problems On Combined Bending and TorsionAnonymous mRBbdopMKf100% (1)

- Minimum Sample For Diagnostic TestDocument6 pagesMinimum Sample For Diagnostic TestLulu DjalilNo ratings yet

- Assessing The Nature of Soil AcidityDocument8 pagesAssessing The Nature of Soil AcidityPartha DebRoyNo ratings yet

- Business Ethics - A, BDocument3 pagesBusiness Ethics - A, BArnab Kumar SahaNo ratings yet

- Design of A Two-Stage Cycloidal Gear Reducer WithDocument14 pagesDesign of A Two-Stage Cycloidal Gear Reducer WithAlejandro ChavezNo ratings yet

- ArtsDocument71 pagesArtsits.me.brader07No ratings yet

- List of DictionariesDocument38 pagesList of DictionariesSaraPhoenixNo ratings yet

- Social Media and The New Product Development Dur 2021 Technological ForecastDocument15 pagesSocial Media and The New Product Development Dur 2021 Technological ForecastFaisal KeryNo ratings yet

- Beauty Care (Nail Care) Services: Quarter 1, Week 5Document17 pagesBeauty Care (Nail Care) Services: Quarter 1, Week 5Are Pee Etc100% (1)

- Fso RF - Out RXRDocument11 pagesFso RF - Out RXRRF_RAJANo ratings yet

- As I Follow Christ by Dwain N. EsmondDocument138 pagesAs I Follow Christ by Dwain N. EsmondGabor KovacsNo ratings yet

- OlatheNorth DaMo Aff 01 - Washburn Rural Round 2Document25 pagesOlatheNorth DaMo Aff 01 - Washburn Rural Round 2EmronNo ratings yet

- 1Document114 pages1Mohamed FathiNo ratings yet

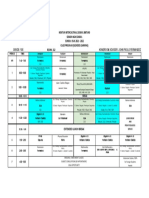

- Grade: 10E ROOM: 212 Homeroom Adviser: John Paolo FernandezDocument1 pageGrade: 10E ROOM: 212 Homeroom Adviser: John Paolo FernandezRangga NarindraNo ratings yet

- Protective Coating PhilosophyDocument10 pagesProtective Coating PhilosophyAleem QureshiNo ratings yet

- Patient Safety AjarDocument48 pagesPatient Safety AjarAngell YunitaNo ratings yet

- Tabel 1. Range Nilai Log SP, Resistivity Dan Gamma Ray No - Litologi Range Nilai Range Nilai Log Range Nilai LogDocument1 pageTabel 1. Range Nilai Log SP, Resistivity Dan Gamma Ray No - Litologi Range Nilai Range Nilai Log Range Nilai Logdody24No ratings yet

- HLARA ProcessDocument5 pagesHLARA ProcessRanjana SainiNo ratings yet

- Huawei Transmission Configuring The Built-In WDM ServiceDocument5 pagesHuawei Transmission Configuring The Built-In WDM ServiceElizabeth RichNo ratings yet

- Using MLAG in Dell Networks v1.3Document33 pagesUsing MLAG in Dell Networks v1.3Damian CostantinoNo ratings yet

- Section 3 Illumination RevisedDocument40 pagesSection 3 Illumination Revisedtesyon korjoNo ratings yet

- Ai TS NOTICE FOR CLASS IX XDocument1 pageAi TS NOTICE FOR CLASS IX XVandana SharmaNo ratings yet

- Number Theory and Public Key Cryptography: SyllabusDocument26 pagesNumber Theory and Public Key Cryptography: SyllabusGeethanjali KotaruNo ratings yet

- Dissertation Auf DeutschDocument8 pagesDissertation Auf DeutschWriteMyPaperForMeSpringfield100% (1)

- ReadmeDocument6 pagesReadmegabyorNo ratings yet

- Modeling Roundabout Intersections - AUGI - The World's Largest CAD & BIM User GroupDocument9 pagesModeling Roundabout Intersections - AUGI - The World's Largest CAD & BIM User GroupSantosh RaiNo ratings yet

- MCQDocument274 pagesMCQgganyan67% (3)

- Offshore CNY Best Practice Guidelines For ConsultationDocument28 pagesOffshore CNY Best Practice Guidelines For Consultationargus-kerberNo ratings yet

- Figure Skating Spirals in CompetitionDocument2 pagesFigure Skating Spirals in CompetitionAlexandra PurcaroiuNo ratings yet

5th Sem Last Long

5th Sem Last Long

Uploaded by

mdanss12440 ratings0% found this document useful (0 votes)

12 views2 pagesFinancial statements provide an overview of a company's financial performance and position over a period of time. They include key documents like the income statement, balance sheet, statement of cash flows, and statement of changes in equity. Financial statement analysis can be classified into different types based on objectives, methods, and focus, including horizontal analysis, vertical analysis, ratio analysis, cross-sectional analysis, and time-series analysis. Each type of analysis offers unique insights into a company's financials to help stakeholders make informed decisions.

Original Description:

Original Title

5th sem last long

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial statements provide an overview of a company's financial performance and position over a period of time. They include key documents like the income statement, balance sheet, statement of cash flows, and statement of changes in equity. Financial statement analysis can be classified into different types based on objectives, methods, and focus, including horizontal analysis, vertical analysis, ratio analysis, cross-sectional analysis, and time-series analysis. Each type of analysis offers unique insights into a company's financials to help stakeholders make informed decisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views2 pages5th Sem Last Long

5th Sem Last Long

Uploaded by

mdanss1244Financial statements provide an overview of a company's financial performance and position over a period of time. They include key documents like the income statement, balance sheet, statement of cash flows, and statement of changes in equity. Financial statement analysis can be classified into different types based on objectives, methods, and focus, including horizontal analysis, vertical analysis, ratio analysis, cross-sectional analysis, and time-series analysis. Each type of analysis offers unique insights into a company's financials to help stakeholders make informed decisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Explaim the meaning and nature of financial statement 500 words Discuss classification of financial statement analysis 500

iscuss classification of financial statement analysis 500 words

ChatGPTFinancial statements are comprehensive reports that provide an overview of the financial Financial statement analysis can be classified into different categories based on the objectives, methods, and focus of the

performance and position of a business over a specific period. These statements are essential tools for analysis. The two primary classifications are horizontal analysis and vertical analysis. Each type serves a specific purpose

assessing the health and viability of a company, aiding in decision-making processes for investors, creditors, and provides insights into different aspects of a company's financial performance.Horizontal Analysis: Horizontal analysis,

management, and other stakeholders. The primary financial statements include the income statement, also known as trend analysis, involves the comparison of financial statement line items over different periods. The main

balance sheet, statement of cash flows, and statement of changes in equity. objective is to identify trends, patterns, and changes in a company's financial performance over time. Analysts use horizontal

Income Statement: The income statement, also known as the profit and loss statement, presents the analysis to assess the absolute and percentage changes in individual line items, such as revenues, expenses, and net income,

company's revenues, expenses, and profits over a specific time frame. It outlines the net income or net loss from one period to another. This type of analysis is valuable for understanding the direction and magnitude of changes,

resulting from the company's operational activities. Key components include revenue, cost of goods sold, helping stakeholders identify areas of growth, decline, or stability.Example: If a company's revenues have increased by 10%

gross profit, operating expenses, and net income.Balance Sheet: The balance sheet provides a snapshot of over the past three years, while its expenses have only increased by 5%, it suggests that the company is improving its

a company's financial position at a particular point in time. It comprises assets, liabilities, and equity. Assets operational efficiency.Vertical Analysis: Vertical analysis, also known as common-size analysis, involves expressing each

encompass what the company owns, such as cash, inventory, and property. Liabilities represent what the line item of the financial statement as a percentage of a base amount within the same period. The purpose is to assess the

company owes, including debts and obligations. Equity is the residual interest of the owners in the assets relative proportion of different components within the same financial statement. In the income statement, each expense item

after deducting liabilities.Statement of Cash Flows: The statement of cash flows details the cash generated is expressed as a percentage of total revenue, while in the balance sheet, each asset or liability item is expressed as a

and used by a company during a specific period. It categorizes cash flows into operating, investing, and percentage of total assets. Vertical analysis helps in understanding the composition and structure of a company's financial

financing activities. Operating activities involve cash transactions related to the core business operations, statements.Example: If a company's cost of goods sold (COGS) is 40% of its total revenue, it indicates the proportion of

investing activities include buying or selling assets, and financing activities involve transactions with the revenue consumed by producing goods.Ratio Analysis: Ratio analysis involves calculating and interpreting various financial

company's owners and creditors.Statement of Changes in Equity: The statement of changes in equity ratios to evaluate different aspects of a company's financial performance. Ratios are derived from financial statement line

outlines the changes in the equity section of the balance sheet during a given period. It includes transactions items and provide insights into liquidity, profitability, leverage, efficiency, and other financial metrics. Common ratios

with owners, such as stock issuances and dividends, as well as other changes affecting equity. include the current ratio, quick ratio, return on equity (ROE), debt-to-equity ratio, and gross profit margin. Ratio analysis

Nature of Financial Statements: helps stakeholders make comparisons between companies, industries, or the company's own historical performance.Example:

Historical Record: Financial statements primarily provide a historical record of a company's financial A high current ratio (current assets/current liabilities) suggests strong short-term liquidity, indicating that a company can

performance. They reflect past transactions and events, allowing stakeholders to analyze trends, assess cover its short-term obligations comfortably.Cross-Sectional Analysis: Cross-sectional analysis involves comparing the

stability, and make informed decisions based on historical data.Decision-Making Tool: Investors, creditors, financial performance of different companies within the same industry or sector at a specific point in time. This type of

and management use financial statements to make informed decisions. Investors analyze them to assess the analysis helps identify relative strengths and weaknesses among competitors, benchmarking a company against industry

company's profitability and growth potential, while creditors evaluate the company's ability to meet its norms. Cross-sectional analysis is valuable for understanding how a company compares to its peers in terms of financial

obligations. Management uses financial statements for internal decision-making and performance health and performance.Example: Comparing the return on assets (ROA) of several companies in the pharmaceutical industry

evaluation.Transparency and Accountability: Financial statements contribute to transparency in a to determine which company is more effective in generating profits from its assets.Time-Series Analysis: Time-series

company's financial dealings. They hold the company accountable to its stakeholders by providing a clear analysis involves studying the financial performance of a single company over multiple periods. The objective is to identify

picture of its financial health. Transparent financial reporting is crucial for building trust with investors and trends, patterns, and variations in the company's financial statements over time. Time-series analysis is useful for assessing

maintaining a positive reputation.Comparative Analysis: Financial statements facilitate comparative the consistency and sustainability of a company's performance and for making long-term strategic decisions.Example:

analysis. By comparing current and past financial statements, stakeholders can identify trends, assess Analyzing a company's net income over the past five years to identify whether there is a consistent upward or downward

performance changes, and gauge the effectiveness of management strategies over time.Regulatory trend.

Compliance: Companies are often required by regulatory bodies to prepare and disclose financial In summary, the classification of financial statement analysis includes horizontal analysis, vertical analysis, ratio analysis,

statements in accordance with accounting standards. This ensures consistency and comparability across cross-sectional analysis, and time-series analysis. Each type of analysis provides unique insights into a company's financial

different entities and industries. performance and position, helping stakeholders make informed decisions based on different perspectives and objectives.

In conclusion, financial statements are fundamental tools for understanding and evaluating a company's what is multivarite ratio analysis ?discuss various uses and limitation of multivaiate

financial performance and position. Their nature as historical records, decision-making aids, and

instruments for transparency underscores their importance in the business world. Stakeholders rely on these

ratio analysis 500 words

Multivariate ratio analysis involves the simultaneous examination of multiple financial ratios to gain a more comprehensive

statements to make informed decisions that impact investment, lending, and strategic planning.

understanding of a company's financial performance and position. Unlike univariate analysis, which looks at one ratio at a

write a note on different type of financial statement 500 words time, multivariate ratio analysis considers the interrelationships between various ratios. This approach helps in capturing the

Financial statements are crucial documents that provide a comprehensive overview of a company's financial complex dynamics of a company's financial structure and performance. Here, we discuss the uses and limitations of

performance and position. There are several types of financial statements, each serving a specific purpose multivariate ratio analysis:

and offering insights into different aspects of a business. The main types of financial statements include the Uses of Multivariate Ratio Analysis:

income statement, balance sheet, statement of cash flows, and statement of changes in equity.Income Holistic Financial Assessment: Multivariate ratio analysis allows for a holistic examination of a company's financial health

Statement: The income statement, also known as the profit and loss statement, presents a summary of a by considering multiple financial metrics simultaneously. This approach provides a more nuanced view of the company's

company's revenues, expenses, and profits over a specific period, usually a quarter or a year. It begins with overall performance and helps in identifying patterns or trends that may not be apparent when analyzing individual ratios in

the company's total revenues and subtracts the cost of goods sold (COGS) to calculate the gross profit. isolation.Identification of Financial Trends: By analyzing multiple ratios over different periods, multivariate ratio analysis

Operating expenses, such as salaries, rent, and utilities, are then deducted to determine operating income. aids in identifying trends in a company's financial performance. This is valuable for stakeholders who seek to understand the

Finally, taxes and other non-operating expenses are subtracted to arrive at the net income. The income trajectory of key financial metrics and make informed predictions about future performance.Risk Assessment: Examining a

statement provides insights into a company's profitability and its ability to generate profits from its core range of financial ratios concurrently enables a more thorough assessment of a company's risk profile. Multivariate ratio

operations.Balance Sheet: The balance sheet provides a snapshot of a company's financial position at a analysis can help identify potential vulnerabilities and areas of concern that may not be evident when analyzing ratios

specific point in time, typically at the end of a fiscal quarter or year. It is divided into three main sections: individually. This is crucial for investors and creditors aiming to assess the risk associated with their investment or lending

assets, liabilities, and equity. Assets include everything the company owns, such as cash, inventory, and decisions.Comparative Analysis: Multivariate ratio analysis is useful for comparing the financial performance of different

property. Liabilities represent the company's obligations, including debts and other financial companies within the same industry or sector. By considering multiple ratios simultaneously, analysts can gain a more

responsibilities. Equity is the residual interest of the owners in the company's assets after deducting comprehensive understanding of how companies stack up against each other in terms of overall financial health and

liabilities. The balance sheet offers insights into a company's liquidity, solvency, and overall financial efficiency.Diagnostic Tool for Management: For internal purposes, multivariate ratio analysis serves as a diagnostic tool

health.Statement of Cash Flows: The statement of cash flows outlines the cash generated and used by a for management. It helps identify areas of strength and weakness, guiding management decisions regarding resource

company during a specific period. It is divided into three main sections: operating activities, investing allocation, strategic planning, and performance improvement initiatives.

activities, and financing activities. Operating activities include cash transactions related to the core business Limitations of Multivariate Ratio Analysis:

operations, such as receipts from customers and payments to suppliers. Investing activities involve buying Complexity and Interpretation: Multivariate ratio analysis can be complex due to the numerous interrelationships between

or selling assets, while financing activities include transactions with the company's owners and creditors, different ratios. Interpreting the results requires a deep understanding of financial metrics and their implications, making it

such as issuing stock or repurchasing debt. The statement of cash flows helps assess a company's ability to challenging for those without a strong financial background.Data Quality and Consistency: The effectiveness of

generate and manage cash.Statement of Changes in Equity: The statement of changes in equity details the multivariate ratio analysis relies on the availability of accurate and consistent financial data. Inconsistencies or errors in

changes in the equity section of the balance sheet during a given period. It includes transactions with owners, financial reporting can distort the results and lead to inaccurate conclusions.Industry Variability: Different industries may

such as stock issuances, dividends, and other changes affecting equity. This statement helps stakeholders have unique financial structures and operating characteristics. Applying a multivariate ratio analysis across diverse industries

understand how the company's equity has changed over time and the factors contributing to those changes. may not account for these variations, potentially leading to misinterpretations or inappropriate comparisons.Dynamic

Each financial statement serves a unique purpose, and together they provide a comprehensive view of a Business Environments: Multivariate ratio analysis may face challenges in dynamic business environments where factors

company's financial performance and position. Analyzing these statements collectively allows stakeholders such as technological advancements, regulatory changes, or economic shifts can significantly impact a company's financial

to make informed decisions about investing, lending, or managing the company. Financial statements are performance. The analysis might not capture rapid changes effectively.Limited Predictive Power: While multivariate ratio

not only essential for external parties like investors and creditors but also for internal management to assess analysis provides insights into a company's historical performance and current financial condition, it may have limitations in

the company's performance and formulate strategic plans for the future. Regular and accurate preparation predicting future events. External factors, unforeseen events, and changes in market conditions can influence a company's

of these statements is crucial for regulatory compliance and maintaining transparency in financial reporting trajectory in ways that are challenging to anticipate solely through historical ratios.

Discuss different techniques used for financial statement analysis 500 w In conclusion, multivariate ratio analysis is a powerful tool for assessing a company's financial performance from various

Financial statement analysis is a critical process that involves evaluating a company's financial statements perspectives. It offers a more nuanced understanding by considering the interplay of multiple financial ratios. However, users

to gain insights into its financial performance and position. Various techniques are employed to analyze should be aware of its complexities, potential limitations, and the need for careful interpretation, particularly in the context

financial statements, helping investors, creditors, and management make informed decisions. Here are some of industry dynamics and evolving business environments.

key techniques used in financial statement analysis:Ratio Analysis: Ratio analysis involves calculating and what is corporate reporting ? discuss briefly different type of satutory reports preparred

interpreting various financial ratios to assess different aspects of a company's performance. Common ratios

include liquidity ratios (e.g., current ratio, quick ratio), profitability ratios (e.g., return on equity, net profit by indian corporated 500 words

margin), leverage ratios (e.g., debt-to-equity ratio), and efficiency ratios (e.g., inventory turnover, accounts Corporate reporting refers to the process of communicating a company's financial and non-financial information to various

receivable turnover). These ratios provide a quantitative basis for comparing a company's performance to stakeholders, including shareholders, investors, regulators, and the general public. The purpose of corporate reporting is to

industry benchmarks or its historical performance.Common-Size Analysis: Common-size analysis provide transparency and accountability, enabling stakeholders to make informed decisions about their interactions with the

involves expressing financial statement line items as percentages of a base amount, typically total revenue company. In India, companies are required to prepare and disclose certain statutory reports in compliance with regulatory

for the income statement and total assets for the balance sheet. This technique helps in comparing the relative frameworks. Here, we discuss different types of statutory reports prepared by Indian corporations:Annual Report: The

proportions of different components within the same financial statement, making it easier to identify trends Annual Report is a comprehensive document prepared by a company at the end of its financial year. It includes the company's

and variations.Trend Analysis: Trend analysis involves evaluating a company's financial performance over financial statements, such as the balance sheet, income statement, cash flow statement, and statement of changes in equity.

multiple periods to identify trends, patterns, and potential areas of concern. By examining changes in Additionally, the Annual Report often contains a report from the board of directors, management discussion and analysis

financial statement line items over time, analysts can gain insights into a company's growth, stability, or (MD&A), auditor's report, and other relevant information about the company's operations, performance, and future outlook.

deterioration. Trend analysis is particularly valuable for assessing a company's consistency and identifying Financial Statements: Financial statements are a key component of corporate reporting and are included in the Annual

potential areas for improvement or risk.Vertical Analysis: Vertical analysis, also known as common-size Report. These statements provide a snapshot of a company's financial position and performance. The key financial statements

vertical analysis, involves expressing each line item of the financial statement as a percentage of another include:Balance Sheet: Represents the company's assets, liabilities, and equity at a specific point in time.

item within the same period. For example, in the income statement, each expense item can be expressed as o Income Statement: Outlines the revenues, expenses, and profits or losses over a specific period.

a percentage of total revenue. This helps in understanding the relative weight of each expense or revenue o Cash Flow Statement: Details the cash inflows and outflows from operating, investing, and financing activities.

category within the overall financial structure.Horizontal Analysis: Horizontal analysis, also known as o Statement of Changes in Equity: Shows changes in equity during the reporting period.Board of Directors' Report: The

trend analysis, compares financial statement line items across different periods. It allows analysts to assess Board of Directors' Report is a section within the Annual Report where the board provides insights into the company's

the absolute and percentage changes in each line item, helping identify areas of growth, decline, or stability. performance, strategies, risks, and future plans. It also includes a director's responsibility statement, corporate governance

Horizontal analysis is useful for understanding how individual elements contribute to overall changes in report, and other relevant information as mandated by regulatory bodies.Management Discussion and Analysis (MD&A):

financial performance.Cash Flow Analysis: Analyzing the statement of cash flows provides insights into a The MD&A is a narrative section in the Annual Report where management provides a detailed analysis of the company's

company's ability to generate and manage cash. Operating, investing, and financing activities are scrutinized financial performance, operations, and future prospects. It often includes discussions on market conditions, risk factors, and

to understand the sources and uses of cash. Positive cash flow from operating activities is generally significant events that impacted the company during the reporting period.Auditor's Report: The Auditor's Report is prepared

considered a positive sign, indicating the company can generate cash from its core business by the company's external auditors and provides an independent assessment of the company's financial statements. It includes

operations.DuPont Analysis: DuPont analysis breaks down the return on equity (ROE) into its component the auditor's opinion on whether the financial statements present a true and fair view of the company's financial position and

parts, including net profit margin, asset turnover, and financial leverage. This technique provides a more comply with accounting standards.Corporate Governance Report: Corporate governance reports provide information

detailed understanding of the factors influencing a company's return on equity, helping identify areas for about the company's governance structure, policies, and practices. It includes details about the composition of the board,

improvement or potential risks. committees, and adherence to corporate governance norms.Environmental, Social, and Governance (ESG) Reports: With

a growing emphasis on sustainability and responsible business practices, some companies in India are voluntarily preparing

In conclusion, financial statement analysis is a multifaceted process that employs various techniques to extract meaningful

ESG reports. These reports provide information on the company's environmental impact, social initiatives, and governance

insights from a company's financial statements. Each technique serves a specific purpose, whether it be assessing liquidity,

profitability, efficiency, or overall financial health. The combination of these techniques allows for a comprehensive practices, catering to stakeholders interested in the company's broader societal impact.Compliance Reports: Companies are

evaluation of a company's performance and aids stakeholders in making informed decisions. Financial analysts oftenrequired use a to prepare various compliance reports to ensure adherence to regulatory requirements. This may include reports

mix of these techniques to paint a holistic picture of a company's financial situation. related unaudited financial statements and a management discussion and analysis for the quarter.

o In summary, corporate reporting in India involves the preparation and disclosure of various statutory reports, reasonable projections about the company's future revenues, expenses, and profitability. This is essential for investors and

providing stakeholders with a comprehensive understanding of a company's financial health, governance creditors making decisions about future investments or loans.Facilitating Investment Decisions: Investors use financial

practices, and overall business operations. These reports are essential for maintaining transparency, fostering statement analysis to make informed investment decisions. By assessing a company's financial health and performance,

trust, and meeting regulatory obligations in the Indian corporate landscape. investors can gauge the potential returns and risks associated with investing in the company's stocks or bonds. Ratios like

o financial statement are the end products of accounting system elucidate 500 earnings per share (EPS) and price-to-earnings (P/E) ratio are often considered in this context.Supporting Credit Decisions:

Financial statements are indeed the end products of an accounting system, representing the culmination of Creditors and lenders rely on financial statement analysis to evaluate the creditworthiness of a company. A thorough analysis

the entire accounting process. The accounting system of a business is designed to capture, record, and report helps assess the company's ability to service its debt and meet financial obligations. Creditors may examine ratios such as

financial information in a systematic and organized manner. The generation of financial statements is a interest coverage ratio and debt service coverage ratio to gauge the company's capacity to meet interest and debt payment

critical step in this process, providing a summarized view of the financial performance and position of a obligations.Assisting Management Decision-Making: Internally, financial statement analysis is a valuable tool for

business. Here's an elucidation of how financial statements serve as the end products of the accounting management decision-making. It helps management identify areas of strength and weakness in the company's operations,

system:Data Collection and Recording: The accounting process begins with the collection of financial allocate resources effectively, and formulate strategic plans for future growth. It provides a basis for performance evaluation

data from various transactions and events that occur within a business. These transactions are then and aids in setting financial goals.Comparing Performance Against Industry Standards: Financial statement analysis

systematically recorded in the accounting system. This phase involves the use of source documents such as enables companies to compare their performance against industry benchmarks and standards. Benchmarking helps identify

invoices, receipts, and bank statements to document each financial transaction.Journal Entries: Once the areas where a company is outperforming or underperforming its peers, allowing for strategic adjustments to improve

financial data is collected, it is translated into journal entries. Journal entries are the fundamental records of competitiveness.Detecting Financial Distress: Financial statement analysis is instrumental in identifying early warning signs

accounting, capturing the debits and credits associated with each transaction. This process ensures that the of financial distress. By analyzing liquidity ratios, leverage ratios, and profitability indicators, stakeholders can detect signs of

accounting equation (Assets = Liabilities + Equity) remains in balance.Ledger Entries: Journal entries are potential financial trouble and take corrective actions to prevent a crisis.Enhancing Transparency and Accountability:

then posted to respective ledger accounts. Ledgers organize and classify transactions by account, providing Financial statement analysis promotes transparency in financial reporting, making companies more accountable to

a detailed record of individual transactions for specific assets, liabilities, equity, revenues, and stakeholders. It ensures that companies adhere to accounting standards and provide accurate and reliable financial

expenses.Trial Balance: After ledger entries are complete, a trial balance is prepared to verify that the total information.In conclusion, financial statement analysis serves multiple objectives, ranging from assessing financial

debits equal total credits. The trial balance acts as an internal control mechanism to catch any errors in the performance to supporting investment decisions and aiding internal management processes. The insights derived from this

recording process.Adjusting Entries: Adjusting entries are made to ensure that the financial statements analysis contribute to a more informed and strategic approach to managing and investing in businesses. As a dynamic and

reflect the most accurate and up-to-date information. These adjustments account for items such as accrued continuous process, financial statement analysis provides ongoing feedback for stakeholders to adapt to changing business

expenses, prepaid expenses, depreciation, and unearned revenue.Adjusted Trial Balance: Following the conditions and make well-indecision

adjusting entries, an adjusted trial balance is created to ensure that all adjustments have been properly made.

This serves as the basis for the preparation of financial statements.Financial Statements: The financial

statements are the ultimate output of the accounting system. There are four primary financial what is the different between univariate and multivariate analysis 500 Univariate and multivariate

statementsIncome Statement: Summarizes the revenues, expenses, and net income or loss over a specific analyses are two distinct approaches used in statistical analysis to examine and understand data. They differ in their scope,

period.Balance Sheet: Presents the company's assets, liabilities, and equity at a specific point in purpose, and the number of variables they consider. Here's an explanation of the key differences between univariate and

time.Statement of Cash Flows: Details the cash inflows and outflows from operating, investing, and multivariate analysis:Univariate Analysis:Definition: Univariate analysis involves the examination of a single variable at a

financing activities.Statement of Changes in Equity: Shows the changes in equity during the reporting time. It focuses on describing and analyzing the distribution, central tendency, and dispersion of one variable without

period, including stock issuances, dividends, and other adjustments.Closing Entries: At the end of the considering the relationships with other variables.Purpose: The primary purpose of univariate analysis is to understand the

accounting period, closing entries are made to reset temporary accounts (revenues, expenses, dividends) to characteristics and behavior of individual variables. It helps in summarizing and presenting data in a meaningful way, providing

zero for the upcoming period. This ensures a clean slate for the next accounting cycle.Post-Closing Trial insights into the distribution and patterns within a single variable.Methods: Common methods used in univariate analysis

Balance: The post-closing trial balance is created to verify that the closing entries have been accurately include measures of central tendency (mean, median, mode), measures of dispersion (range, variance, standard deviation), and

made, and only permanent accounts remain open.Archiving and Reporting: Once the financial statements graphical representations such as histograms, box plots, and pie charts.

are prepared and verified, they are archived for historical reference, compliance, and audit purposes.

Simultaneously, these financial statements are disseminated to various stakeholders, including investors,

creditors, management, and regulatory authorities, providing a transparent overview of the company's Examples:

financial health and performance.

o In essence, financial statements encapsulate the financial story of a business, transforming raw transactional

data into a structured and comprehensive set of reports. The accounting system is the mechanism that Analyzing the distribution of exam scores in a class using a histogram.

ensures accuracy, consistency, and adherence to accounting principles throughout this process. Financial

statements are indispensable tools for decision-making, performance evaluation, and accountability in the

business world. Calculating the average income of a group of individuals.

o discuss the limitation of financial statement 500 words

o While financial statements are crucial tools for assessing the financial health and performance of a business, o Examining the frequency distribution of ages in a population.

it's important to recognize their limitations. Financial statements have certain constraints and inherent o Limitations:

drawbacks that stakeholders should be aware of when using them for analysis and decision-making. Here are o Univariate analysis may oversimplify complex relationships since it does not consider

some key limitations of financial statements: interactions between variables.

o Historical Information: Financial statements primarily provide historical information about a company's o It might not provide a comprehensive understanding of the factors influencing an outcome.

financial performance. They reflect past transactions and events, which may not necessarily predict future o Multivariate Analysis:

outcomes. Business environments are dynamic, and relying solely on historical data may not capture emerging o Definition: Multivariate analysis involves the simultaneous analysis of multiple variables to understand the

trends or shifts in market conditions.Qualitative Information Ignored: Financial statements focus on relationships and interactions among them. It considers the joint variation of two or more variables and aims to

quantifiable data and may overlook qualitative factors that could significantly impact a company's identify patterns or trends that may not be apparent in univariate analysis.

performance. Factors such as management competency, employee morale, brand reputation, and innovation o Purpose: The primary purpose of multivariate analysis is to explore complex relationships and dependencies

are crucial but not directly captured in financial statements. among multiple variables. It seeks to provide a more comprehensive understanding of the underlying structure

o Dependence on Accounting Policies: Financial statements are prepared based on accounting principles and of the data.

policies, and different companies may use different accounting methods. This can lead to variations in o Methods: Multivariate analysis employs a variety of statistical techniques, including regression analysis, factor

reported figures, making it challenging to make accurate comparisons between companies.Subjectivity in analysis, principal component analysis, cluster analysis, and multivariate analysis of variance (MANOVA).

Accounting Estimates: Certain elements of financial statements, such as depreciation, provisions, and These methods help in uncovering patterns, correlations, and dependencies among variables.

valuation of assets, involve management estimates. These estimates are subjective and can vary between o Examples:

companies, potentially impacting the accuracy and reliability of financial statements.Omission of Intangible o Investigating the impact of both study hours and sleep quality on academic performance.

Assets: Financial statements typically do not adequately represent a company's intangible assets, such as o Analyzing the relationships between multiple financial indicators (e.g., revenue, expenses, profit

brand value, intellectual property, or human capital. These assets can be critical contributors to a company's margin) in a company.

success but are not always reflected on the balance sheet.Lack of Current Market Values: The values of o Understanding how different demographic factors influence consumer preferences.

assets and liabilities on the balance sheet are recorded at historical cost, not their current market values. This o Advantages:

can lead to a distortion of a company's true economic value, especially for assets whose market values have o Multivariate analysis provides a more holistic view of complex data structures and relationships.

significantly changed over time.Limited Non-Financial Information: Financial statements primarily focus o It allows for the identification of patterns and trends that may not be apparent in univariate

on monetary transactions and do not provide a complete picture of a company's overall performance. Non- analysis.

financial factors, such as environmental sustainability, social responsibility, and corporate governance, are o It enables the modeling and prediction of outcomes based on the joint variation of multiple

gaining importance but are not fully captured in traditional financial statements.Inability to Measure Future variables.

Performance: Financial statements offer insights into historical performance but do not provide a concrete o Limitations:

basis for predicting future success. Market conditions, technological advancements, and other external factors o Multivariate analysis can be computationally intensive, especially with large datasets or a high

can significantly impact a company's future performance.Lack of Timeliness: Financial statements are number of variables.

typically prepared at the end of an accounting period, which may result in a delay in obtaining and analyzing o It requires careful consideration of assumptions and may be sensitive to outliers or missing data.

critical information. This lack of timeliness can be a limitation when making real-time business o Interpretation of results can be challenging due to the complexity of relationships among

decisions.Complexity and Interpretation Challenges: Financial statements can be complex, and multiple variables.

interpreting them requires a certain level of financial literacy. Stakeholders without a strong financial o Key Differences:

background may find it challenging to fully understand and analyze financial statements o Focus:

accurately.Overemphasis on Quantifiable Metrics: Financial statements often overemphasize quantitative o Univariate analysis focuses on a single variable at a time.

metrics, such as profits and revenues, while downplaying the qualitative aspects of a business. This can lead o Multivariate analysis examines multiple variables simultaneously.

to an incomplete assessment of a company's overall health and potential risks.Aggregation of Information: o Complexity:

Financial statements aggregate information, making it challenging to discern specific details about individual o Univariate analysis is simpler and provides basic summaries of individual variables.

business segments or product lines. This lack of granularity can hinder a detailed analysis of the performance o Multivariate analysis is more complex and aims to uncover intricate relationships among

of different aspects of the business. multiple variables.

o In conclusion, while financial statements are invaluable tools for assessing a company's financial position and o Objective:

performance, stakeholders must recognize their limitations. Relying solely on financial statements without o Univariate analysis aims to describe and analyze the characteristics of a single variable.

considering qualitative factors, market dynamics, and potential biases in accounting practices may lead to o Multivariate analysis aims to explore relationships, dependencies, and patterns among multiple

incomplete or inaccurate assessments of a company's true condition. It is essential to supplement financial variables.

statement analysis with a holistic approach that considers both financial and non-financial aspects of a o Methods:

business o Univariate analysis uses basic statistical measures and graphical representations.

o EXPLAIN THE objective of financial statement ? o Multivariate analysis employs advanced statistical techniques and models.

o In summary, while univariate analysis is useful for understanding individual variables in isolation, multivariate

analysis is essential for exploring the complex interrelationships among multiple variables, providing a more

Financial statement analysis is a systematic process of reviewing and evaluating a company's financial statements to make comprehensive and nuanced understanding of the data. The choice between univariate and multivariate analysis

informed business decisions. The primary objective of financial statement analysis is to extract meaningful insights and

information that can aid various stakeholders in assessing the financial health, performance, and future prospects of a business. depends on the research or analytical goals and the nature of the data being examined .

Here are the key objectives of financial statement analysis:Assessing Profitability and Performance: One of the primary

objectives of financial statement analysis is to evaluate a company's profitability. Analysts examine the income statement to

understand the company's ability to generate profits from its operations. Key indicators such as net profit margin, return on

assets (ROA), and return on equity (ROE) are used to assess the overall performance and efficiency of the business.Evaluating

Liquidity and Solvency: Financial statement analysis helps stakeholders assess a company's liquidity and solvency. The

balance sheet provides information about a company's current assets and liabilities, enabling the calculation of liquidity ratios

such as the current ratio and quick ratio. These ratios help determine the company's ability to meet short-term and long-term

financial obligations.Understanding Financial Structure: The analysis of financial statements provides insights into a

company's financial structure. Stakeholders can assess the proportion of debt and equity used to finance operations by

examining the debt-to-equity ratio. Understanding the financial structure is crucial for evaluating the risk and sustainability of

a company's capitalization.Forecasting Future Performance: Financial statement analysis aims to provide a basis for

forecasting a company's future performance. By identifying trends and patterns in historical financial data, analysts can make

You might also like

- Financial Analysis of MRFDocument69 pagesFinancial Analysis of MRFBALRAJ100% (4)

- Financial Statement AnalysisDocument33 pagesFinancial Statement Analysisfirst name100% (3)

- Ratio Analysis Project Shankar - NewDocument15 pagesRatio Analysis Project Shankar - NewShubham SinghalNo ratings yet

- A Project Report On: Presented by Gautam KasundraDocument19 pagesA Project Report On: Presented by Gautam Kasundrapunit_4489No ratings yet

- SIRUTHULIDocument20 pagesSIRUTHULIdeepika DeepuNo ratings yet

- F. Understanding The Financial Statement and Its Components Sahid P.ADocument10 pagesF. Understanding The Financial Statement and Its Components Sahid P.Aantonette.escobia17No ratings yet

- A Study On Financial PerformanceDocument73 pagesA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- Financial Statement AnalysisDocument17 pagesFinancial Statement Analysisshrinidhisenthil2001No ratings yet

- Pre Test: Biliran Province State UniversityDocument6 pagesPre Test: Biliran Province State Universitymichi100% (1)

- Accounting For ManagersDocument5 pagesAccounting For Managersphugga01No ratings yet

- Chapter 3Document30 pagesChapter 3shaik iftiNo ratings yet

- Financial State Wps OfficeDocument14 pagesFinancial State Wps OfficeJoan DardoNo ratings yet

- Managerial Accounting 114-2017Document32 pagesManagerial Accounting 114-2017TanvirNo ratings yet

- Financial Analysis Techniques or ToolsDocument38 pagesFinancial Analysis Techniques or ToolsFreddierick JuntillaNo ratings yet

- Financial Statment Analysis of Hero MotocorpDocument66 pagesFinancial Statment Analysis of Hero MotocorpWebsoft Tech-HydNo ratings yet

- Mahindra and MahindraDocument60 pagesMahindra and MahindraAparna TumbareNo ratings yet

- Answer To Financial ManagementDocument11 pagesAnswer To Financial ManagementJc LanuzaNo ratings yet

- Analysis of Financial StatementDocument86 pagesAnalysis of Financial StatementSandipan Basu100% (2)

- 09 - Chapter 1Document28 pages09 - Chapter 1Ankita GaikwadNo ratings yet

- Chapter 2 Part III (FS) - 9f4c795a b66d 4d54 9441 Ef329c8dda7fDocument10 pagesChapter 2 Part III (FS) - 9f4c795a b66d 4d54 9441 Ef329c8dda7fBHAWNANo ratings yet

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocument13 pagesFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaApoorva A NNo ratings yet

- Financial Analysis - A Study: Dr. Donthi Ravinder, Muskula AnithaDocument13 pagesFinancial Analysis - A Study: Dr. Donthi Ravinder, Muskula Anithawawa1303No ratings yet

- Sample Bcom Project PDFDocument13 pagesSample Bcom Project PDFRahul KamathNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementHarish.PNo ratings yet

- A Study On Financial Performance For Axis BankDocument20 pagesA Study On Financial Performance For Axis BankJayaprabhu PrabhuNo ratings yet

- Analysis of Financial Statements of Harvest Investments CompanyDocument86 pagesAnalysis of Financial Statements of Harvest Investments CompanyHarish AdithanNo ratings yet

- Aom AssignmentDocument7 pagesAom AssignmentAkanksha PalNo ratings yet

- Theory On Financial Analysis - 240516 - 210216Document28 pagesTheory On Financial Analysis - 240516 - 210216manjubhaii12No ratings yet

- Financial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureDocument11 pagesFinancial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureBonDocEldRicNo ratings yet

- FMTEXINDUNIT4Document29 pagesFMTEXINDUNIT4Gopika RaviNo ratings yet

- My ProjectDocument72 pagesMy ProjectPrashob Koodathil0% (1)

- 18ME1E0047Document68 pages18ME1E0047QUIZ CRRNo ratings yet

- Key Terms and Chapter Summary 2 1Document4 pagesKey Terms and Chapter Summary 2 1Neel DudhatNo ratings yet

- Project Ratio Analysis 3Document57 pagesProject Ratio Analysis 3anusuyanag2822100% (1)

- Financial AnalysisDocument46 pagesFinancial Analysisanand_lihinarNo ratings yet

- Main EditeddddDocument73 pagesMain Editeddddammukhan khanNo ratings yet

- Table of Content Title Page NoDocument26 pagesTable of Content Title Page Nopradeep110No ratings yet

- Financial AnalysisDocument3 pagesFinancial Analysisyashaswisharma68No ratings yet

- Module 3 Analysis and Interpretation of Financial StatementsDocument23 pagesModule 3 Analysis and Interpretation of Financial StatementsRonald Torres100% (1)

- Financial AnalysisDocument4 pagesFinancial AnalysisManaliAshokNo ratings yet

- IntroductionDocument23 pagesIntroductionYASIN CAFENo ratings yet

- Executive SummaryDocument34 pagesExecutive SummaryRachit KhareNo ratings yet

- Ratio Analysis of Amararaja BatteriesDocument72 pagesRatio Analysis of Amararaja BatteriesE.GOPINADH100% (4)

- Project On Project ManagementDocument92 pagesProject On Project ManagementSrinath Navada100% (1)

- 12 Chapter3 PDFDocument12 pages12 Chapter3 PDFFranklin BanisterNo ratings yet

- Fin Statement AnalysisDocument26 pagesFin Statement AnalysisBhagaban DasNo ratings yet

- 1.1 Introduction To Financial StatementsDocument21 pages1.1 Introduction To Financial StatementsPRIYAM XEROXNo ratings yet

- 8 RatioAnalysisDocument22 pages8 RatioAnalysisDr. Bhavana Raj KNo ratings yet

- Accounting A2Document15 pagesAccounting A2thngnNo ratings yet

- Financial Statement AnalysisDocument89 pagesFinancial Statement AnalysiseshuNo ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- A Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyDocument62 pagesA Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyeshuNo ratings yet

- CH-2 FaDocument16 pagesCH-2 FakirubelyitayalNo ratings yet

- Particulars Number CertificateDocument63 pagesParticulars Number CertificatekeerthiNo ratings yet

- Chapter-Two Financial AnalysisDocument94 pagesChapter-Two Financial AnalysisDejene GurmesaNo ratings yet

- Finanacial AccountingDocument189 pagesFinanacial AccountingRatish Kakkad100% (6)

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Accounting Short 2 PageDocument2 pagesAccounting Short 2 Pagemdanss1244No ratings yet

- Accounting 1st PageDocument1 pageAccounting 1st Pagemdanss1244No ratings yet

- 5th Sem Last Exam Short 2 PageDocument3 pages5th Sem Last Exam Short 2 Pagemdanss1244No ratings yet

- 19 3rd Management LongDocument2 pages19 3rd Management Longmdanss1244No ratings yet

- 3rd Long ManagementDocument2 pages3rd Long Managementmdanss1244No ratings yet

- Io-Link Hub For 8 Analog Input SignalsDocument2 pagesIo-Link Hub For 8 Analog Input SignalsGabriel CardosoNo ratings yet

- Unit 4 Problems On Combined Bending and TorsionDocument8 pagesUnit 4 Problems On Combined Bending and TorsionAnonymous mRBbdopMKf100% (1)

- Minimum Sample For Diagnostic TestDocument6 pagesMinimum Sample For Diagnostic TestLulu DjalilNo ratings yet

- Assessing The Nature of Soil AcidityDocument8 pagesAssessing The Nature of Soil AcidityPartha DebRoyNo ratings yet

- Business Ethics - A, BDocument3 pagesBusiness Ethics - A, BArnab Kumar SahaNo ratings yet

- Design of A Two-Stage Cycloidal Gear Reducer WithDocument14 pagesDesign of A Two-Stage Cycloidal Gear Reducer WithAlejandro ChavezNo ratings yet

- ArtsDocument71 pagesArtsits.me.brader07No ratings yet

- List of DictionariesDocument38 pagesList of DictionariesSaraPhoenixNo ratings yet

- Social Media and The New Product Development Dur 2021 Technological ForecastDocument15 pagesSocial Media and The New Product Development Dur 2021 Technological ForecastFaisal KeryNo ratings yet

- Beauty Care (Nail Care) Services: Quarter 1, Week 5Document17 pagesBeauty Care (Nail Care) Services: Quarter 1, Week 5Are Pee Etc100% (1)

- Fso RF - Out RXRDocument11 pagesFso RF - Out RXRRF_RAJANo ratings yet

- As I Follow Christ by Dwain N. EsmondDocument138 pagesAs I Follow Christ by Dwain N. EsmondGabor KovacsNo ratings yet

- OlatheNorth DaMo Aff 01 - Washburn Rural Round 2Document25 pagesOlatheNorth DaMo Aff 01 - Washburn Rural Round 2EmronNo ratings yet

- 1Document114 pages1Mohamed FathiNo ratings yet

- Grade: 10E ROOM: 212 Homeroom Adviser: John Paolo FernandezDocument1 pageGrade: 10E ROOM: 212 Homeroom Adviser: John Paolo FernandezRangga NarindraNo ratings yet

- Protective Coating PhilosophyDocument10 pagesProtective Coating PhilosophyAleem QureshiNo ratings yet

- Patient Safety AjarDocument48 pagesPatient Safety AjarAngell YunitaNo ratings yet

- Tabel 1. Range Nilai Log SP, Resistivity Dan Gamma Ray No - Litologi Range Nilai Range Nilai Log Range Nilai LogDocument1 pageTabel 1. Range Nilai Log SP, Resistivity Dan Gamma Ray No - Litologi Range Nilai Range Nilai Log Range Nilai Logdody24No ratings yet

- HLARA ProcessDocument5 pagesHLARA ProcessRanjana SainiNo ratings yet

- Huawei Transmission Configuring The Built-In WDM ServiceDocument5 pagesHuawei Transmission Configuring The Built-In WDM ServiceElizabeth RichNo ratings yet

- Using MLAG in Dell Networks v1.3Document33 pagesUsing MLAG in Dell Networks v1.3Damian CostantinoNo ratings yet

- Section 3 Illumination RevisedDocument40 pagesSection 3 Illumination Revisedtesyon korjoNo ratings yet

- Ai TS NOTICE FOR CLASS IX XDocument1 pageAi TS NOTICE FOR CLASS IX XVandana SharmaNo ratings yet

- Number Theory and Public Key Cryptography: SyllabusDocument26 pagesNumber Theory and Public Key Cryptography: SyllabusGeethanjali KotaruNo ratings yet

- Dissertation Auf DeutschDocument8 pagesDissertation Auf DeutschWriteMyPaperForMeSpringfield100% (1)

- ReadmeDocument6 pagesReadmegabyorNo ratings yet

- Modeling Roundabout Intersections - AUGI - The World's Largest CAD & BIM User GroupDocument9 pagesModeling Roundabout Intersections - AUGI - The World's Largest CAD & BIM User GroupSantosh RaiNo ratings yet

- MCQDocument274 pagesMCQgganyan67% (3)

- Offshore CNY Best Practice Guidelines For ConsultationDocument28 pagesOffshore CNY Best Practice Guidelines For Consultationargus-kerberNo ratings yet

- Figure Skating Spirals in CompetitionDocument2 pagesFigure Skating Spirals in CompetitionAlexandra PurcaroiuNo ratings yet