Professional Documents

Culture Documents

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

Uploaded by

hemangppatelCopyright:

Available Formats

You might also like

- PROBLEM SOLVING Financial Analysis 2Document1 pagePROBLEM SOLVING Financial Analysis 2Arminda Villamin67% (3)

- Stewart, 1994, EVA Fact and FantasyDocument16 pagesStewart, 1994, EVA Fact and FantasyAnonymous nTGsxV100% (1)

- The Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierFrom EverandThe Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierNo ratings yet

- Hard Rock CafeDocument10 pagesHard Rock CafeAditya YadavNo ratings yet

- Star River Electronics Ltd.Document26 pagesStar River Electronics Ltd.Zairah AcuñaNo ratings yet

- Digital Minds - 12 Things Every Business Needs To Know About Digital MarketingDocument266 pagesDigital Minds - 12 Things Every Business Needs To Know About Digital MarketingEmilia Supuran100% (1)

- Financial Analysis - Intro Part IIDocument29 pagesFinancial Analysis - Intro Part IIHYUN JUNG KIMNo ratings yet

- Domtar Corporation - Industry and Company ReportDocument9 pagesDomtar Corporation - Industry and Company ReportHussainhakimNo ratings yet

- Ebook PDF Commercial Applications of Company Law 2019 20th Edition PDFDocument41 pagesEbook PDF Commercial Applications of Company Law 2019 20th Edition PDFrobert.gonzales146100% (40)

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Case Study IM (Mini)Document1 pageCase Study IM (Mini)siti safikaNo ratings yet

- WSJ Newspaper 8-17-2023Document34 pagesWSJ Newspaper 8-17-2023Caroline ErstwhileNo ratings yet

- Wall Street Journal-3Document56 pagesWall Street Journal-3Mukund MundhraNo ratings yet

- 2020-TA-c-ALL (Local 241)Document8 pages2020-TA-c-ALL (Local 241)Chicago Transit Justice CoalitionNo ratings yet

- Bridgewater Associates - WikipediaDocument14 pagesBridgewater Associates - WikipediaJavier NietoNo ratings yet

- ATRA's Powertrain EXPO Wrap: 2004 Maxima in FailsafeDocument68 pagesATRA's Powertrain EXPO Wrap: 2004 Maxima in FailsafeRodger Bland100% (1)

- SANDcreditsuisse July 20 2017Document22 pagesSANDcreditsuisse July 20 2017theredcornerNo ratings yet

- IO: Barriers To Entry and Exit in MarketsDocument4 pagesIO: Barriers To Entry and Exit in MarketsSamuel Liël OdiaNo ratings yet

- PRTM Cfo Capex 2008Document5 pagesPRTM Cfo Capex 2008Jb FleckNo ratings yet

- Adani Group Key Ratios BadDocument1 pageAdani Group Key Ratios BadAjay BhattNo ratings yet

- Shaping The Battleground For GS100 SPDocument3 pagesShaping The Battleground For GS100 SPGlobalServicesNo ratings yet

- Road and RailDocument38 pagesRoad and RailsamathagondiNo ratings yet

- Wallstreetjournaleurope 20170721 TheWallStreetJournal-EuropeDocument38 pagesWallstreetjournaleurope 20170721 TheWallStreetJournal-EuropestefanoNo ratings yet

- KPMG Taxation Handbook - Finance Act 2019Document85 pagesKPMG Taxation Handbook - Finance Act 2019Fatema JidnaNo ratings yet

- wmk6UkrlEgbd7IGHnbwh WSJNewsPaper 5 14 2024Document30 pageswmk6UkrlEgbd7IGHnbwh WSJNewsPaper 5 14 2024Himadri PalNo ratings yet

- Welspun Group PresentationDocument30 pagesWelspun Group Presentationonetwo threefourNo ratings yet

- Edmond Sun 20171209 A04 2Document1 pageEdmond Sun 20171209 A04 2Price LangNo ratings yet

- Wallstreetjournal 20230720 TheWallStreetJournalDocument32 pagesWallstreetjournal 20230720 TheWallStreetJournalRazvan Catalin CostinNo ratings yet

- Ground Round Has Full Plate: Crosstech Reaches Turning PointDocument2 pagesGround Round Has Full Plate: Crosstech Reaches Turning Pointapi-71966639No ratings yet

- 02 A Template For Structural Analysis of An IndustryDocument7 pages02 A Template For Structural Analysis of An IndustryMahathiNo ratings yet

- Ebffiledoc 3042Document53 pagesEbffiledoc 3042kevin.dunn860No ratings yet

- Low Rates, Hot Market Propel Wealthy To Step Up Borrowing: For Personal, Non-Commercial Use OnlyDocument30 pagesLow Rates, Hot Market Propel Wealthy To Step Up Borrowing: For Personal, Non-Commercial Use OnlySushíl kanikeNo ratings yet

- EPD - Schwab PDFDocument16 pagesEPD - Schwab PDFJeff SturgeonNo ratings yet

- 2021 Automotive SuppliersDocument16 pages2021 Automotive SuppliersCrains Chicago BusinessNo ratings yet

- Wallstreetjournaleurope 20170824 TheWallStreetJournal-Europe PDFDocument20 pagesWallstreetjournaleurope 20170824 TheWallStreetJournal-Europe PDFepustakakoranNo ratings yet

- GoeasyDocument26 pagesGoeasyJenny QuachNo ratings yet

- GVIP Eng 2010Document21 pagesGVIP Eng 2010Ruben Dario SortoNo ratings yet

- The New Normal:: How E-Commerce Third Party Logistics Is Evolving in The Age of COVID-19Document24 pagesThe New Normal:: How E-Commerce Third Party Logistics Is Evolving in The Age of COVID-19TayalanNo ratings yet

- Singapore Airlines and Scoot Case StudyDocument27 pagesSingapore Airlines and Scoot Case StudyTomeu Pericás100% (1)

- Hard Hat Winter 2011Document32 pagesHard Hat Winter 2011Venture PublishingNo ratings yet

- TCD Atlanta Airport Newsletter q1 2011Document3 pagesTCD Atlanta Airport Newsletter q1 2011Jan SauerNo ratings yet

- iGAP - Logistic-Tech Start-Up in Vietnam: A. Overal Vietnam Market - FY2017Document3 pagesiGAP - Logistic-Tech Start-Up in Vietnam: A. Overal Vietnam Market - FY2017Ái Thi DươngNo ratings yet

- Fence Company MBA Case StudyDocument18 pagesFence Company MBA Case StudyRobin L. M. CheungNo ratings yet

- Accenture CDP Supply Chain Report 2015Document40 pagesAccenture CDP Supply Chain Report 2015Thami KNo ratings yet

- Shareholder Letters SummaryDocument6 pagesShareholder Letters SummaryPrince RajNo ratings yet

- Analysis - Leadership - Culture - Outlook - Business Model - Strategy - Customer Interface - RecommendationsDocument40 pagesAnalysis - Leadership - Culture - Outlook - Business Model - Strategy - Customer Interface - RecommendationsvNo ratings yet

- 3G WaveDocument1 page3G WavePooja Kulkarni NazareNo ratings yet

- Printing Impressions 400 RankingDocument16 pagesPrinting Impressions 400 RankingFrancis ChastanetNo ratings yet

- Global RWD Global Strategy Summary - 20180212 VF - 3 - CDocument6 pagesGlobal RWD Global Strategy Summary - 20180212 VF - 3 - CKhoa PhanNo ratings yet

- Atlas-Copco CaseDocument15 pagesAtlas-Copco CaseSusmeet BiswasNo ratings yet

- Int Logistics 1Document22 pagesInt Logistics 1Mantasha KhanNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- NullDocument39 pagesNullapi-25975704No ratings yet

- Go Downstreamn The New Profit Imperative in ManufacturingDocument11 pagesGo Downstreamn The New Profit Imperative in ManufacturingGangadhar BituNo ratings yet

- Case StudyDocument3 pagesCase StudyRussell MonroeNo ratings yet

- TOP 100 Suppliers 2020Document17 pagesTOP 100 Suppliers 2020JNNo ratings yet

- GMA Network Inc GMA7: Last Close Fair Value Market CapDocument4 pagesGMA Network Inc GMA7: Last Close Fair Value Market Capskynyrd75No ratings yet

- Ambit RetailDocument109 pagesAmbit RetailPathanjali DiduguNo ratings yet

- The Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersFrom EverandThe Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersNo ratings yet

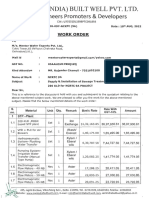

- Work Orders STPDocument112 pagesWork Orders STPRajender Chamoli100% (1)

- 2.shwe Set 162'x30' Two Storeyed (Summary Furniture)Document4 pages2.shwe Set 162'x30' Two Storeyed (Summary Furniture)SandarNo ratings yet

- Resource Planning SystemDocument83 pagesResource Planning SystemShahmirBalochNo ratings yet

- M600 Case Report: Jeevana Jagat AdusumilliDocument12 pagesM600 Case Report: Jeevana Jagat AdusumilliDebalina GhoshNo ratings yet

- Financial and Management Accounting MB0041: Descriptive Question PaperDocument19 pagesFinancial and Management Accounting MB0041: Descriptive Question PaperEl GwekwerereNo ratings yet

- Simple InterestDocument44 pagesSimple InterestAlecs ContiNo ratings yet

- AFAR 02 Corporate LiquidationDocument3 pagesAFAR 02 Corporate LiquidationPym-Kaytitinga St. Joseph ParishNo ratings yet

- SDM Module IIIDocument124 pagesSDM Module IIIMonsters vlogsNo ratings yet

- Philippine Central Islands CollegeDocument17 pagesPhilippine Central Islands CollegeJoseph AlogNo ratings yet

- 2021 Kamara Turner ResumeDocument2 pages2021 Kamara Turner Resumeapi-435939843No ratings yet

- Product & Services of Fortis Healthcare: Quality Tertiary CareDocument5 pagesProduct & Services of Fortis Healthcare: Quality Tertiary CareTYB92BINDRA GURSHEEN KAUR R.No ratings yet

- BUSS1g Calculating Costs 2Document1 pageBUSS1g Calculating Costs 2Jack NokéNo ratings yet

- Dynamic Nature of Motivation: Buying Motives Meaning and DefinitionDocument13 pagesDynamic Nature of Motivation: Buying Motives Meaning and DefinitionShivamNo ratings yet

- Procure To Pay Process Flow in Oracle FusionDocument4 pagesProcure To Pay Process Flow in Oracle FusionDellibabu DNo ratings yet

- Present Real/Present Unreal ConditionalDocument2 pagesPresent Real/Present Unreal ConditionalZerinaNo ratings yet

- 2 Data Mining ProcessDocument5 pages2 Data Mining Processakmam.haqueNo ratings yet

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- HasassaDocument35 pagesHasassabojaNo ratings yet

- Asian Paints - Group 6Document16 pagesAsian Paints - Group 6Rahul DesaiNo ratings yet

- Major Term Papers/Research Work/Projects:: Akif ShaikhDocument1 pageMajor Term Papers/Research Work/Projects:: Akif ShaikhMuhammad RaahimNo ratings yet

- Reference No: 923839: American International University - BangladeshDocument1 pageReference No: 923839: American International University - BangladeshNayeem IslamNo ratings yet

- OPM 01.1 Operations ManagementDocument53 pagesOPM 01.1 Operations ManagementMinh VõNo ratings yet

- WOR Annual Report 2022Document220 pagesWOR Annual Report 2022ALNo ratings yet

- Daily Rejection Data For The Month of January-2013: Quality Control DepartmentDocument1 pageDaily Rejection Data For The Month of January-2013: Quality Control Departmentanbusaravanan4No ratings yet

- Air BNB PaperDocument17 pagesAir BNB Paperdummyrequester3No ratings yet

- I-ADS Company PROFILEDocument10 pagesI-ADS Company PROFILEJuan Dela CruzNo ratings yet

- Trade Secrets Zink Spring 2013Document8 pagesTrade Secrets Zink Spring 2013iyesha.campbell-andriesNo ratings yet

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

Uploaded by

hemangppatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

The Rise of Regionalization How Suppliers Are Rethinking Supply Chains - Inline

Uploaded by

hemangppatelCopyright:

Available Formats

Bart Huthwaite Jim Ward

THE RISE OF REGIONALIZATION: Principal

RSM US LLP

Partner

Industrials Senior Analyst

HOW SUPPLIERS ARE bart.huthwaite@rsmus.com RSM US LLP

RETHINKING SUPPLY CHAINS james.ward@rsmus.com

For decades, auto suppliers and manufacturers of all Now, with demand surging for goods from China and palladium, for instance, which is increasingly used in catalytic What are companies doing to become

stripes extended their operational reach across the globe in elsewhere, containers themselves have become such a converters to reduce vehicle emissions. more resilient?

response to multiple factors—the proliferation of the shipping hot commodity that their spot rates globally were “still

container, lower labor costs overseas, and manufacturing more than quadruple pre-pandemic levels” as of early May, Real personal consumption expenditures, In regionalization, the operating model shifts in a way that aims

durable goods and services

growth in Asia being some of the most crucial. according to FreightWaves. (Chained 2012 dollars, annual rate) to maximize service levels while minimizing the total landed cost

$10T of products, including customs, duties, tariffs and taxes. These

But now, more than two years into the pandemic, more and . 40-foot shipping container spot rates - China to U.S. are key considerations as companies determine the locations in

$9T Pre-pandemic trend

more companies are rethinking their operational strategy $18,000 100 which they want to operate.

as it has become clear that a deeply entrenched global $16,000 90

$8T

supply chain presents more risk than it used to, and that a $14,000 80 $7T Essentially, by creating more regional supply chain networks

regionalized supply chain network may better mitigate the $12,000

70

$6T closer to the end customer, manufacturers hope to give their

60

risks facing today’s customers. $10,000 operations more of a buffer from the factors at play in global

50 $5T

$8,000

40

trade—essentially establishing insurance policies against some

Auto suppliers find themselves battling numerous high- $6,000

30

$4T

of these disruptions. This will involve evaluating new sources

COVID-19

profile headwinds, given that semiconductors and rare earth $4,000 20 $3T and suppliers, tapping regional sources, and assessing the

materials used for electric vehicle batteries have been in short $2,000 10

$2T company’s manufacturing footprint overall.

supply, presenting both short- and long-term challenges. $0 0 Pre-pandemic trend

2019 2020 2021 $1T

Businesses should continually assess the changes they need January-20 July-20 January-21 July-21 January-22

Here are some important considerations and questions for

Recession Indicator Shanghai to NYC HK to LA

to make to lessen their exposure to the tangled supply chain. Services Durable goods auto suppliers—especially those in the middle market—looking

Source: Bloomberg; RSM US LLP

Source: Bloomberg; RSM US LLP to regionalize:

The downside of globalized supply chains

Pandemic lockdowns and resulting backlogs at ports in IHS Markit lowered its global automotive forecast by 2.6 million • Understand the ways in which your customers are

The rise of the shipping container in the mid-1950s helped Asia, the United States and elsewhere have cast doubt units for 2022-2023 due to the war. This is primarily because similar or different on a region-by-region basis. This will

enable the globalization of trade, especially because of on the viability of the “just-in-time” system and have of less production in Russia, but other global supply challenges help prepare the company to become more customer-

the intermodal nature of these containers. “Around the sent businesses back to embracing some “just-in-case” also play a role. centric in response to significant regional differences,

same time,” an article by supply chain platform company approaches, keeping more inventory on hand to deal with and potentially enable the capture of more market share.

Along with the war and the pandemic, companies face

Blume Global explains, “transport manufacturers began

building vehicles that could transport these containers. The

supply delays. Businesses are also embracing regionalized

supply chains to keep inventory closer to the customer. inflationary pressures and labor challenges. Manufacturers • Understand/optimize your manufacturing and

distribution footprint to minimize transportation costs,

invention of containerization was one of the main drivers are forced to rethink how they absorb prices or pass increased

transport times and total landed costs—including

in making global trade cheaper and more efficient.” The Addressing inventory issues has been especially crucial given costs along to customers, and how they can best retain talent

customs, duties, tariffs and taxes—while maximizing

Toyota production system’s “just-in-time” approach to that customers have ramped up their spending on durable in a competitive labor market. Businesses have been adapting

customer service levels.

manufacturing further drove companies to remove waste goods—and away from services—during the pandemic, with over the last two years, but continuing the move toward

in the system, resulting in more efficient, but in some cases more people shopping online and many restaurants and other regionalization may help on several fronts. • Understand the multimodal modes of transit available

service-driven businesses undergoing temporary closures. for the regions in which you plan to operate.

less resilient, value chains.

The war in Ukraine and sanctions on Russia have added

The ability to pivot will remain crucial, especially considering • Work with a third-party advisor to evaluate various

Businesses started rethinking their operating models when that supply chain bottlenecks likely aren’t going away anytime global trade scenarios and strategies for handling them.

another element of uncertainty to the mix. While the conflict soon. The RSM US Supply Chain Index rose in March but is still

the Trump administration implemented tariffs on steel and

other goods, forcing some firms to change their sourcing or is primarily affecting global energy and food supply chains, 2.76 standard deviations below neutral, RSM economist Tuan

• Take into account how your labor practices will

need to change if you are moving jobs to and from

manufacturing strategies. Changes and reassessments have it has also been particularly challenging for the automotive Nguyen wrote in early May, adding that current lockdowns in

various countries.

only become more important as the pandemic has worn on. industry, which sources rare earth metals from Russia and China and the geopolitical conflict in Ukraine “will most likely

Ukraine. Russia accounts for 45% of the global supply of assure another round of supply chain snarls ahead.”

RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International.

© 2022 RSM US LLP. All Rights Reserved.

You might also like

- PROBLEM SOLVING Financial Analysis 2Document1 pagePROBLEM SOLVING Financial Analysis 2Arminda Villamin67% (3)

- Stewart, 1994, EVA Fact and FantasyDocument16 pagesStewart, 1994, EVA Fact and FantasyAnonymous nTGsxV100% (1)

- The Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierFrom EverandThe Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierNo ratings yet

- Hard Rock CafeDocument10 pagesHard Rock CafeAditya YadavNo ratings yet

- Star River Electronics Ltd.Document26 pagesStar River Electronics Ltd.Zairah AcuñaNo ratings yet

- Digital Minds - 12 Things Every Business Needs To Know About Digital MarketingDocument266 pagesDigital Minds - 12 Things Every Business Needs To Know About Digital MarketingEmilia Supuran100% (1)

- Financial Analysis - Intro Part IIDocument29 pagesFinancial Analysis - Intro Part IIHYUN JUNG KIMNo ratings yet

- Domtar Corporation - Industry and Company ReportDocument9 pagesDomtar Corporation - Industry and Company ReportHussainhakimNo ratings yet

- Ebook PDF Commercial Applications of Company Law 2019 20th Edition PDFDocument41 pagesEbook PDF Commercial Applications of Company Law 2019 20th Edition PDFrobert.gonzales146100% (40)

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Case Study IM (Mini)Document1 pageCase Study IM (Mini)siti safikaNo ratings yet

- WSJ Newspaper 8-17-2023Document34 pagesWSJ Newspaper 8-17-2023Caroline ErstwhileNo ratings yet

- Wall Street Journal-3Document56 pagesWall Street Journal-3Mukund MundhraNo ratings yet

- 2020-TA-c-ALL (Local 241)Document8 pages2020-TA-c-ALL (Local 241)Chicago Transit Justice CoalitionNo ratings yet

- Bridgewater Associates - WikipediaDocument14 pagesBridgewater Associates - WikipediaJavier NietoNo ratings yet

- ATRA's Powertrain EXPO Wrap: 2004 Maxima in FailsafeDocument68 pagesATRA's Powertrain EXPO Wrap: 2004 Maxima in FailsafeRodger Bland100% (1)

- SANDcreditsuisse July 20 2017Document22 pagesSANDcreditsuisse July 20 2017theredcornerNo ratings yet

- IO: Barriers To Entry and Exit in MarketsDocument4 pagesIO: Barriers To Entry and Exit in MarketsSamuel Liël OdiaNo ratings yet

- PRTM Cfo Capex 2008Document5 pagesPRTM Cfo Capex 2008Jb FleckNo ratings yet

- Adani Group Key Ratios BadDocument1 pageAdani Group Key Ratios BadAjay BhattNo ratings yet

- Shaping The Battleground For GS100 SPDocument3 pagesShaping The Battleground For GS100 SPGlobalServicesNo ratings yet

- Road and RailDocument38 pagesRoad and RailsamathagondiNo ratings yet

- Wallstreetjournaleurope 20170721 TheWallStreetJournal-EuropeDocument38 pagesWallstreetjournaleurope 20170721 TheWallStreetJournal-EuropestefanoNo ratings yet

- KPMG Taxation Handbook - Finance Act 2019Document85 pagesKPMG Taxation Handbook - Finance Act 2019Fatema JidnaNo ratings yet

- wmk6UkrlEgbd7IGHnbwh WSJNewsPaper 5 14 2024Document30 pageswmk6UkrlEgbd7IGHnbwh WSJNewsPaper 5 14 2024Himadri PalNo ratings yet

- Welspun Group PresentationDocument30 pagesWelspun Group Presentationonetwo threefourNo ratings yet

- Edmond Sun 20171209 A04 2Document1 pageEdmond Sun 20171209 A04 2Price LangNo ratings yet

- Wallstreetjournal 20230720 TheWallStreetJournalDocument32 pagesWallstreetjournal 20230720 TheWallStreetJournalRazvan Catalin CostinNo ratings yet

- Ground Round Has Full Plate: Crosstech Reaches Turning PointDocument2 pagesGround Round Has Full Plate: Crosstech Reaches Turning Pointapi-71966639No ratings yet

- 02 A Template For Structural Analysis of An IndustryDocument7 pages02 A Template For Structural Analysis of An IndustryMahathiNo ratings yet

- Ebffiledoc 3042Document53 pagesEbffiledoc 3042kevin.dunn860No ratings yet

- Low Rates, Hot Market Propel Wealthy To Step Up Borrowing: For Personal, Non-Commercial Use OnlyDocument30 pagesLow Rates, Hot Market Propel Wealthy To Step Up Borrowing: For Personal, Non-Commercial Use OnlySushíl kanikeNo ratings yet

- EPD - Schwab PDFDocument16 pagesEPD - Schwab PDFJeff SturgeonNo ratings yet

- 2021 Automotive SuppliersDocument16 pages2021 Automotive SuppliersCrains Chicago BusinessNo ratings yet

- Wallstreetjournaleurope 20170824 TheWallStreetJournal-Europe PDFDocument20 pagesWallstreetjournaleurope 20170824 TheWallStreetJournal-Europe PDFepustakakoranNo ratings yet

- GoeasyDocument26 pagesGoeasyJenny QuachNo ratings yet

- GVIP Eng 2010Document21 pagesGVIP Eng 2010Ruben Dario SortoNo ratings yet

- The New Normal:: How E-Commerce Third Party Logistics Is Evolving in The Age of COVID-19Document24 pagesThe New Normal:: How E-Commerce Third Party Logistics Is Evolving in The Age of COVID-19TayalanNo ratings yet

- Singapore Airlines and Scoot Case StudyDocument27 pagesSingapore Airlines and Scoot Case StudyTomeu Pericás100% (1)

- Hard Hat Winter 2011Document32 pagesHard Hat Winter 2011Venture PublishingNo ratings yet

- TCD Atlanta Airport Newsletter q1 2011Document3 pagesTCD Atlanta Airport Newsletter q1 2011Jan SauerNo ratings yet

- iGAP - Logistic-Tech Start-Up in Vietnam: A. Overal Vietnam Market - FY2017Document3 pagesiGAP - Logistic-Tech Start-Up in Vietnam: A. Overal Vietnam Market - FY2017Ái Thi DươngNo ratings yet

- Fence Company MBA Case StudyDocument18 pagesFence Company MBA Case StudyRobin L. M. CheungNo ratings yet

- Accenture CDP Supply Chain Report 2015Document40 pagesAccenture CDP Supply Chain Report 2015Thami KNo ratings yet

- Shareholder Letters SummaryDocument6 pagesShareholder Letters SummaryPrince RajNo ratings yet

- Analysis - Leadership - Culture - Outlook - Business Model - Strategy - Customer Interface - RecommendationsDocument40 pagesAnalysis - Leadership - Culture - Outlook - Business Model - Strategy - Customer Interface - RecommendationsvNo ratings yet

- 3G WaveDocument1 page3G WavePooja Kulkarni NazareNo ratings yet

- Printing Impressions 400 RankingDocument16 pagesPrinting Impressions 400 RankingFrancis ChastanetNo ratings yet

- Global RWD Global Strategy Summary - 20180212 VF - 3 - CDocument6 pagesGlobal RWD Global Strategy Summary - 20180212 VF - 3 - CKhoa PhanNo ratings yet

- Atlas-Copco CaseDocument15 pagesAtlas-Copco CaseSusmeet BiswasNo ratings yet

- Int Logistics 1Document22 pagesInt Logistics 1Mantasha KhanNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- These Tires Mean Business: AdvertisementDocument36 pagesThese Tires Mean Business: Advertisementdavid manleyNo ratings yet

- NullDocument39 pagesNullapi-25975704No ratings yet

- Go Downstreamn The New Profit Imperative in ManufacturingDocument11 pagesGo Downstreamn The New Profit Imperative in ManufacturingGangadhar BituNo ratings yet

- Case StudyDocument3 pagesCase StudyRussell MonroeNo ratings yet

- TOP 100 Suppliers 2020Document17 pagesTOP 100 Suppliers 2020JNNo ratings yet

- GMA Network Inc GMA7: Last Close Fair Value Market CapDocument4 pagesGMA Network Inc GMA7: Last Close Fair Value Market Capskynyrd75No ratings yet

- Ambit RetailDocument109 pagesAmbit RetailPathanjali DiduguNo ratings yet

- The Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersFrom EverandThe Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersNo ratings yet

- Work Orders STPDocument112 pagesWork Orders STPRajender Chamoli100% (1)

- 2.shwe Set 162'x30' Two Storeyed (Summary Furniture)Document4 pages2.shwe Set 162'x30' Two Storeyed (Summary Furniture)SandarNo ratings yet

- Resource Planning SystemDocument83 pagesResource Planning SystemShahmirBalochNo ratings yet

- M600 Case Report: Jeevana Jagat AdusumilliDocument12 pagesM600 Case Report: Jeevana Jagat AdusumilliDebalina GhoshNo ratings yet

- Financial and Management Accounting MB0041: Descriptive Question PaperDocument19 pagesFinancial and Management Accounting MB0041: Descriptive Question PaperEl GwekwerereNo ratings yet

- Simple InterestDocument44 pagesSimple InterestAlecs ContiNo ratings yet

- AFAR 02 Corporate LiquidationDocument3 pagesAFAR 02 Corporate LiquidationPym-Kaytitinga St. Joseph ParishNo ratings yet

- SDM Module IIIDocument124 pagesSDM Module IIIMonsters vlogsNo ratings yet

- Philippine Central Islands CollegeDocument17 pagesPhilippine Central Islands CollegeJoseph AlogNo ratings yet

- 2021 Kamara Turner ResumeDocument2 pages2021 Kamara Turner Resumeapi-435939843No ratings yet

- Product & Services of Fortis Healthcare: Quality Tertiary CareDocument5 pagesProduct & Services of Fortis Healthcare: Quality Tertiary CareTYB92BINDRA GURSHEEN KAUR R.No ratings yet

- BUSS1g Calculating Costs 2Document1 pageBUSS1g Calculating Costs 2Jack NokéNo ratings yet

- Dynamic Nature of Motivation: Buying Motives Meaning and DefinitionDocument13 pagesDynamic Nature of Motivation: Buying Motives Meaning and DefinitionShivamNo ratings yet

- Procure To Pay Process Flow in Oracle FusionDocument4 pagesProcure To Pay Process Flow in Oracle FusionDellibabu DNo ratings yet

- Present Real/Present Unreal ConditionalDocument2 pagesPresent Real/Present Unreal ConditionalZerinaNo ratings yet

- 2 Data Mining ProcessDocument5 pages2 Data Mining Processakmam.haqueNo ratings yet

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- HasassaDocument35 pagesHasassabojaNo ratings yet

- Asian Paints - Group 6Document16 pagesAsian Paints - Group 6Rahul DesaiNo ratings yet

- Major Term Papers/Research Work/Projects:: Akif ShaikhDocument1 pageMajor Term Papers/Research Work/Projects:: Akif ShaikhMuhammad RaahimNo ratings yet

- Reference No: 923839: American International University - BangladeshDocument1 pageReference No: 923839: American International University - BangladeshNayeem IslamNo ratings yet

- OPM 01.1 Operations ManagementDocument53 pagesOPM 01.1 Operations ManagementMinh VõNo ratings yet

- WOR Annual Report 2022Document220 pagesWOR Annual Report 2022ALNo ratings yet

- Daily Rejection Data For The Month of January-2013: Quality Control DepartmentDocument1 pageDaily Rejection Data For The Month of January-2013: Quality Control Departmentanbusaravanan4No ratings yet

- Air BNB PaperDocument17 pagesAir BNB Paperdummyrequester3No ratings yet

- I-ADS Company PROFILEDocument10 pagesI-ADS Company PROFILEJuan Dela CruzNo ratings yet

- Trade Secrets Zink Spring 2013Document8 pagesTrade Secrets Zink Spring 2013iyesha.campbell-andriesNo ratings yet