Professional Documents

Culture Documents

Motor Claim Form

Motor Claim Form

Uploaded by

myvivomobilefakeidCopyright:

Available Formats

You might also like

- Auto Insurance Identification Card(s)Document4 pagesAuto Insurance Identification Card(s)sanchez2002No ratings yet

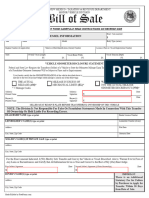

- Bill of Sale DocumentDocument2 pagesBill of Sale Documentclaudine Belisle100% (1)

- AARTO Form 14 20190130Document2 pagesAARTO Form 14 20190130Herman50% (2)

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyFrom EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyNo ratings yet

- Alberta Bill of SaleDocument2 pagesAlberta Bill of SaleDalvinder KaurNo ratings yet

- DHFL Claim FormDocument1 pageDHFL Claim FormJoginder Singh0% (1)

- Future Generali Motor-Od Claim FormDocument2 pagesFuture Generali Motor-Od Claim FormSABodyShop NagpurNo ratings yet

- Motor Claim FormDocument2 pagesMotor Claim FormAjeet Singh100% (4)

- Sbi General InsuranceDocument2 pagesSbi General Insurancegimigek401No ratings yet

- FUTURE GENERALI Motor-OD Claim FormDocument1 pageFUTURE GENERALI Motor-OD Claim FormSunetra PalNo ratings yet

- Claim FormDocument3 pagesClaim FormRandy OrtonNo ratings yet

- Motor - Claim Form PDFDocument2 pagesMotor - Claim Form PDFarvind gaikwadNo ratings yet

- Traffic Accident Situation FormDocument3 pagesTraffic Accident Situation FormThomas Daniel Cuartero100% (1)

- Motor Claim FormDocument3 pagesMotor Claim FormYCMOUNo ratings yet

- Affidavit of Ownership PacketDocument8 pagesAffidavit of Ownership PacketJeremy WebbNo ratings yet

- SQAW1Document2 pagesSQAW1mvskumar21No ratings yet

- Vehicle Insurance Claim Form - 15102019Document4 pagesVehicle Insurance Claim Form - 15102019DILIP KNo ratings yet

- SQAWh 5Document1 pageSQAWh 5mvskumar21No ratings yet

- Claim Form For Motor Vehicle: Information About InsuredDocument2 pagesClaim Form For Motor Vehicle: Information About Insurednaveen chauhanNo ratings yet

- Motor OD Claim Form: United India Insurance Company LimitedDocument1 pageMotor OD Claim Form: United India Insurance Company LimitedRitu RaniNo ratings yet

- 925821-DnD 5e AdventureLogsheetDocument2 pages925821-DnD 5e AdventureLogsheetEthanNo ratings yet

- LIBERTYDocument2 pagesLIBERTYcarcareautokingNo ratings yet

- Bharti Claim FormDocument1 pageBharti Claim Formdivitg161No ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormjavednjavedNo ratings yet

- MobileCare Claim FormDocument2 pagesMobileCare Claim FormHihiNo ratings yet

- Motor Insurance Claim Form: DdmmyyyyDocument2 pagesMotor Insurance Claim Form: Ddmmyyyysudarshan hero100% (1)

- Motor Claim FormDocument4 pagesMotor Claim FormAnsh SharmaNo ratings yet

- SmartDrive Private Motor Insurance Claim Form EngDocument3 pagesSmartDrive Private Motor Insurance Claim Form EngChong Ru YinNo ratings yet

- Reliancegeneral - Co.in 1800 3009 4890 3009: Motor Claim FormDocument4 pagesReliancegeneral - Co.in 1800 3009 4890 3009: Motor Claim FormAL SHEIKHNo ratings yet

- Mechanic's Lien Foreclosure: Vehicle InformationDocument2 pagesMechanic's Lien Foreclosure: Vehicle InformationToshiba userNo ratings yet

- Motor Claim Form Reliance General InsuranceDocument4 pagesMotor Claim Form Reliance General InsurancePraveen VanamaliNo ratings yet

- Media Asslm3sm Claim Form Motor TPLDocument3 pagesMedia Asslm3sm Claim Form Motor TPLAneeb AhmedNo ratings yet

- ACT Search of Records ApplicationDocument2 pagesACT Search of Records Applicationarslanrasheed5410No ratings yet

- Vehicle Loan AnnexureDocument2 pagesVehicle Loan AnnexureNukamreddy Venkateswara ReddyNo ratings yet

- Gig TPL FormDocument3 pagesGig TPL FormSalmanNo ratings yet

- ia-2021.01.20-16.22-NTI Commercial Motor Claim FormDocument4 pagesia-2021.01.20-16.22-NTI Commercial Motor Claim FormJennifer McPhersonNo ratings yet

- Vehicle Loan AnnexureDocument2 pagesVehicle Loan AnnexureSaran ManiNo ratings yet

- GE23448 GREAT EV Premier Form - D15 - FinalDocument3 pagesGE23448 GREAT EV Premier Form - D15 - FinalkaychongNo ratings yet

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepNo ratings yet

- Final Motor Insurance Claim Form Two Aug2018 - 0 PDFDocument1 pageFinal Motor Insurance Claim Form Two Aug2018 - 0 PDFShiva SinghNo ratings yet

- Standard Proposal Form For "Liability Only" PolicyDocument4 pagesStandard Proposal Form For "Liability Only" PolicySubhajit ChatterjeeNo ratings yet

- Media wl4j3n4c Claim-Form-Motor-ComprehensiveDocument1 pageMedia wl4j3n4c Claim-Form-Motor-ComprehensiveRajesh ThamineediNo ratings yet

- Receipt AFQ0309Document1 pageReceipt AFQ0309ndoworerasNo ratings yet

- XTRAPOWER Application FormDocument5 pagesXTRAPOWER Application FormbiswajitNo ratings yet

- Unregistered Vehicle PemitDocument2 pagesUnregistered Vehicle Pemitmiket241No ratings yet

- Form 28Document2 pagesForm 28anandshubhamsudhirkumarNo ratings yet

- EGTB Vehicle Inspection Form, 0Document1 pageEGTB Vehicle Inspection Form, 0UstazFaizalAriffinOriginalNo ratings yet

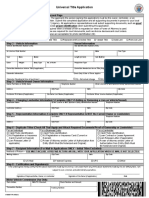

- Application For Certificate of Title For A VehicleDocument1 pageApplication For Certificate of Title For A VehiclePrajalahari PrajalahariNo ratings yet

- Windscreen Claim FormDocument1 pageWindscreen Claim FormHihiNo ratings yet

- 3556 - Etisalat - ID Exception-App Form - Eng Oct 2012Document2 pages3556 - Etisalat - ID Exception-App Form - Eng Oct 2012zahid_497No ratings yet

- Customer Application Form - Token: Date-Appt IDDocument3 pagesCustomer Application Form - Token: Date-Appt IDRamasubramanian KRNo ratings yet

- HB City - Business-License-ApplicationDocument2 pagesHB City - Business-License-ApplicationPatrick SullivanNo ratings yet

- Proposal FormDocument27 pagesProposal FormChaitanya Chaitu CANo ratings yet

- Tradewise Insurance Services LTD: Commercial Vehicle Accident Report FormDocument12 pagesTradewise Insurance Services LTD: Commercial Vehicle Accident Report FormNwachukwu ProsperNo ratings yet

- L&T Insurance Motor Claim FormDocument2 pagesL&T Insurance Motor Claim FormArchitNo ratings yet

- Os SS UtaDocument2 pagesOs SS Utaobi SalamNo ratings yet

- F3523 CFDDocument2 pagesF3523 CFDAdam Scott MillerNo ratings yet

- UnregisteredVehiclePermit 20240228 1206Document3 pagesUnregisteredVehiclePermit 20240228 1206applesshouldnotbephonesNo ratings yet

- Statement of ClaimDocument2 pagesStatement of ClaimRN SantiagoNo ratings yet

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

- Important Notice: Signature and Chop On Vehicle Registration Document (VRD)Document6 pagesImportant Notice: Signature and Chop On Vehicle Registration Document (VRD)mvikiwslnvqbhwfzwzNo ratings yet

- DOT - DMV Limousine Task Force LetterDocument4 pagesDOT - DMV Limousine Task Force LetterLarry RulisonNo ratings yet

- 7D Manual Complete 0422 0Document40 pages7D Manual Complete 0422 0Marcos NascimentoNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- Service Provider Bond FormDocument2 pagesService Provider Bond FormlawrencelazerrickNo ratings yet

- Executive Order 1011Document26 pagesExecutive Order 1011Dominic jarinNo ratings yet

- Jacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) SummaryDocument12 pagesJacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) Summarythe kingfishNo ratings yet

- Vsi 52 Dec 2010Document4 pagesVsi 52 Dec 20103LifelinesNo ratings yet

- Note:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationDocument2 pagesNote:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationDIPAK RAYCHURANo ratings yet

- TDC-15-S-1 Introduction To Driving R.A. No. 4136Document13 pagesTDC-15-S-1 Introduction To Driving R.A. No. 4136Santy UyNo ratings yet

- FORM 30 Transfer of Ownership (Financed)Document3 pagesFORM 30 Transfer of Ownership (Financed)torrentkidNo ratings yet

- SavitaDocument1 pageSavitaSDM GurugramNo ratings yet

- Chapter 1-3 (Commercial Vehicle Registration System)Document21 pagesChapter 1-3 (Commercial Vehicle Registration System)femiNo ratings yet

- F3520 CFDDocument5 pagesF3520 CFDPhillip NguyenNo ratings yet

- Kiarah InsuranceDocument2 pagesKiarah InsuranceBrandon BachNo ratings yet

- OrderPoint User Guide 2012Document46 pagesOrderPoint User Guide 2012jjNo ratings yet

- Excise & Taxation Department, IslamabadDocument5 pagesExcise & Taxation Department, IslamabadAbeeha RajpootNo ratings yet

- Admin, GSS, HR Accomplishment ReportDocument12 pagesAdmin, GSS, HR Accomplishment Reportkrismae fatima de castroNo ratings yet

- Kilgore College Course Registration Form: Suggested Material For The ClassDocument5 pagesKilgore College Course Registration Form: Suggested Material For The ClassKaressica grantNo ratings yet

- 14 FebDocument1 page14 Febchandra860266No ratings yet

- VAHAN 4.0 (Citizen Services) SP-MORTH-WS03 175 8015Document1 pageVAHAN 4.0 (Citizen Services) SP-MORTH-WS03 175 8015krishna salesNo ratings yet

- PPSR Search Certificate 5136546426320001Document2 pagesPPSR Search Certificate 5136546426320001iRepair Gold CoastNo ratings yet

- 123Document1 page123Anshu TeliNo ratings yet

- Malta Car Registration GuidelinesDocument38 pagesMalta Car Registration GuidelinesaquaristNo ratings yet

- Oic Grasp BrochureDocument8 pagesOic Grasp BrochureAbid HassaanNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGDocument1 pageVAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGmdneyaz9831No ratings yet

- Buying and Selling A Used Vehicle in OntarioDocument6 pagesBuying and Selling A Used Vehicle in Ontariohai_you20025946No ratings yet

- Road Safety and Motor Vehicles (Amendment) Bill 2019Document5 pagesRoad Safety and Motor Vehicles (Amendment) Bill 2019Adwitiya MishraNo ratings yet

Motor Claim Form

Motor Claim Form

Uploaded by

myvivomobilefakeidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motor Claim Form

Motor Claim Form

Uploaded by

myvivomobilefakeidCopyright:

Available Formats

www.iffcotokio.co.in Toll Free No.

18001035499

Claim No:

Motor - Claim Form

The issuance of this form is not to be taken as an admission of liability.

To be signed by the Insured (Registered Owner) of the vehicle, or where Insured (Registered Owner) is a Partnership or Corporate Body, by an

authorized signatory of such Partnership or Corporate Body along with the office seal of the concerned organization.

Please do not leave any column unanswered.

All facts and Statements must be factual not influenced or biased in any form.

The damaged vehicle must be parked at safe place to avoid any subsequent damage/loss. The Company will not be responsible for the same.

Please read carefully the attached list of documents required for faster processing of your claim.

All documents provided by the Insured must be Self Attested.

Insured Details (Please fill all the details in CAPITAL Letters)

Insured Name Policy No.

Address

City State Pin Code

Email Address Mobile No.

Details of Vehicle

Policy No Year of Manufacture

Registration No Date of Registration

Make Model

Chassis No Engine No

Hypothecation Type of Fuel

Details of Incident (Accident / Theft)

Date DD/MM/YYYY Time 00:00 AM/PM Speed Km/hr

Policy No Exact Place Where incident occurred

Place to which the vehicle was heading for before

incident

Purpose for which vehicle was being used/parked at

the time of incident

Nature & Weight of goods carried at the time of

GVW/KG

incident (Comm. Veh)

No of people travelling at time of incident

Is it reported to the Police? Yes ☐ No ☐

(If Yes, Name & Address of Police Station)

Gen. Diary/Crime No/FIR No and Date Estimated Loss Amount Rs.

Address of the place where Insured vehicle is parked

after accident

Kindly mentioned the applicable add-ons as per claim details:

Claim

S. No. Benefits Details Amount

1

Motor - Claim Form Page 1 of 4

www.iffcotokio.co.in Toll Free No. 18001035499

2

3

4

5

Details of Driver

Name Relation with Insured

Address

City State Pin Code

Email Address Mobile No.

Driving License No Issuing RTO

License Expiry Date DD/MM/YYYY Type Permanent ☐/ Learners ☐

Class MCycle ☐ / LMV ☐ / HGV☐ / Transport ☐ / Non-Transport ☐

Please describe how the incident occurred

Other Insurance

Policy No Period of Insurance From: DD/MM/YYY am/pm to DD/MM/YYYY am/pm

Past Claim History

Was any claim reported in the past on the same vehicle during current year policy? Yes ☐ No ☐

If Yes , Please confirm nature of Loss

Undertaking

1. I/We the above named, do hereby, to the best of my/our knowledge and belief, warrant the truth of the foregoing statements in every respect and agree that if I/We

have made any false or fraudulent statement or there be any suppression or concealment of facts, the claim shall be forfeited.

2. I/We have received a list of documents with this claim Form and will provide such complete documents along with the signed Claim Form and have understood all

the requirement to be fulfilled for administration of this claim. The Company shall not be held responsible for any delay in settlement of claim due to non-fulfillment of

requirements including the submission of documents as required.

3. I/We agree to provide any additional information/documents to the Company, if and when required.

4. I/We hereby understand, agree and submit that No Claim Bonus (NCB) allowed to me/us under the Policy for which the Claim is being preferred/lodged is subject

to the fact that the own damage claim experience for the insured vehicle or my/our earlier insured vehicle (in case of transfer of No Claim Bonus from earlier insured

vehicle) in previous year policy(s) was NIL. Accordingly I/We once again submit/undertake that the “No Claim Bonus” (NCB) allowed under the current year Policy for

the Insured Vehicle for which the Claim is preferred is based on the above NIL Claim history. Further I/We undertake and submit that in case the basis of availing the

No Claim Bonus (NCB) under the current policy is incorrect, then the company may at its discretion impose suitable damages on the preferred claim which may

include forfeiture of all benefits on own damage section of policy .

Show how the Accident occurred (if any) by using below Diagram

Motor - Claim Form Page 2 of 4

www.iffcotokio.co.in Toll Free No. 18001035499

Mandate Form for Electronic Transfer of Claim Payment

Mandate Form for Electronic Transfer of Claim Payments

Insured Name:

Vehicle Registration No:

Bank Details

Bank Name

Bank Branch Account Type

IFSC Code* MICR Code*

Account Number

Bank Address

*Please also attach one Blank Cancelled Cheque for NEFT/RTGS Payment

Insured Name:

Date & Place:

(Signature/Thumb impression of Insured)

List of Documents Required for Claim Settlement

(To be submitted to the Surveyor/Customer Service Centre)

For Accident Claim Additional Documents for Theft Claims

1. Proof of insurance-Policy/Cover note copy Original Policy document

2. Copy of Registration Book, Tax Receipt[Please furnish original Original Registration Book/Certificate and Tax payment receipt

for Verification]

3. Copy of Motor Driving License [With original] of the person Previous insurance details - Policy No, insuring Office/Company, period

driving the vehicle at the time of accident of insurance

4. Police Panchanama/FIR(In case of Third Property All the sets of Key, Service Booklet, Original Purchase Invoice and Non

damage/Death/Body Injury) Repossession Letter from Financier

5. Estimate for repairs from the repairer where the vehicle is to be Police Panchanama/FIR and Final Investigation Report

repaired

6. Repair Bill and payment receipts after the job is completed Acknowledged copy of letter addressed to RTO intimating theft and

making vehicle “NON-USE”

7. Claims Discharge Cum Satisfaction Voucher Signed across a Form 28, 29 and 30 signed by the insured and Form 35 signed by the

Revenue Stamp Financer, as the case may be, undated and blank

8. Documents as required by AML Guidelines Letter of Subrogation

9. Permit, Fitness and Load Challan (in case of Commercial Consent towards agreed claim settlement value from you and financer

Vehicle)

10. NOC of Financer if claim is to be settled in your favour

11. Blank and undated “Vakalatnama”

12. Documents as required by AML Guidelines

Additional documents in specific claims shall be intimated separately.

CLAIM DISCHARGE CUM SATISFACTION VOUCHER

Insured Name

Vehicle Registration No

Discharge Date DD/MM/YYYY

Motor - Claim Form Page 3 of 4

www.iffcotokio.co.in Toll Free No. 18001035499

My vehicle number ________________ having been repaired to my complete satisfaction, I am henceforth taking delivery of the same and authorise

my insurer IFFCO TOKIO GENERAL INSURANCE COMPANY to make payment of Rs ____________ to the ________________ garage in respect

of my aforementioned vehicle. I also confirm having paid Rs ________________ in lieu of depreciation, policy excess and any additional work

carried out at the garage.

I agree that this payment being made to the aforementioned garage is in full and final settlement of my claim.

I/we hereby voluntarily give discharge receipt to the Company in Full & Final settlement of all my/our claims present or future arising

directly/indirectly in respect of said loss/accident. I/We hereby also subrogate all my/our rights and remedies to the Company in respect of the above

loss/damages.

Signature/Thumb impression of Insured Signature and Stamp of Garage

Motor - Claim Form Page 4 of 4

You might also like

- Auto Insurance Identification Card(s)Document4 pagesAuto Insurance Identification Card(s)sanchez2002No ratings yet

- Bill of Sale DocumentDocument2 pagesBill of Sale Documentclaudine Belisle100% (1)

- AARTO Form 14 20190130Document2 pagesAARTO Form 14 20190130Herman50% (2)

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyFrom EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyNo ratings yet

- Alberta Bill of SaleDocument2 pagesAlberta Bill of SaleDalvinder KaurNo ratings yet

- DHFL Claim FormDocument1 pageDHFL Claim FormJoginder Singh0% (1)

- Future Generali Motor-Od Claim FormDocument2 pagesFuture Generali Motor-Od Claim FormSABodyShop NagpurNo ratings yet

- Motor Claim FormDocument2 pagesMotor Claim FormAjeet Singh100% (4)

- Sbi General InsuranceDocument2 pagesSbi General Insurancegimigek401No ratings yet

- FUTURE GENERALI Motor-OD Claim FormDocument1 pageFUTURE GENERALI Motor-OD Claim FormSunetra PalNo ratings yet

- Claim FormDocument3 pagesClaim FormRandy OrtonNo ratings yet

- Motor - Claim Form PDFDocument2 pagesMotor - Claim Form PDFarvind gaikwadNo ratings yet

- Traffic Accident Situation FormDocument3 pagesTraffic Accident Situation FormThomas Daniel Cuartero100% (1)

- Motor Claim FormDocument3 pagesMotor Claim FormYCMOUNo ratings yet

- Affidavit of Ownership PacketDocument8 pagesAffidavit of Ownership PacketJeremy WebbNo ratings yet

- SQAW1Document2 pagesSQAW1mvskumar21No ratings yet

- Vehicle Insurance Claim Form - 15102019Document4 pagesVehicle Insurance Claim Form - 15102019DILIP KNo ratings yet

- SQAWh 5Document1 pageSQAWh 5mvskumar21No ratings yet

- Claim Form For Motor Vehicle: Information About InsuredDocument2 pagesClaim Form For Motor Vehicle: Information About Insurednaveen chauhanNo ratings yet

- Motor OD Claim Form: United India Insurance Company LimitedDocument1 pageMotor OD Claim Form: United India Insurance Company LimitedRitu RaniNo ratings yet

- 925821-DnD 5e AdventureLogsheetDocument2 pages925821-DnD 5e AdventureLogsheetEthanNo ratings yet

- LIBERTYDocument2 pagesLIBERTYcarcareautokingNo ratings yet

- Bharti Claim FormDocument1 pageBharti Claim Formdivitg161No ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormjavednjavedNo ratings yet

- MobileCare Claim FormDocument2 pagesMobileCare Claim FormHihiNo ratings yet

- Motor Insurance Claim Form: DdmmyyyyDocument2 pagesMotor Insurance Claim Form: Ddmmyyyysudarshan hero100% (1)

- Motor Claim FormDocument4 pagesMotor Claim FormAnsh SharmaNo ratings yet

- SmartDrive Private Motor Insurance Claim Form EngDocument3 pagesSmartDrive Private Motor Insurance Claim Form EngChong Ru YinNo ratings yet

- Reliancegeneral - Co.in 1800 3009 4890 3009: Motor Claim FormDocument4 pagesReliancegeneral - Co.in 1800 3009 4890 3009: Motor Claim FormAL SHEIKHNo ratings yet

- Mechanic's Lien Foreclosure: Vehicle InformationDocument2 pagesMechanic's Lien Foreclosure: Vehicle InformationToshiba userNo ratings yet

- Motor Claim Form Reliance General InsuranceDocument4 pagesMotor Claim Form Reliance General InsurancePraveen VanamaliNo ratings yet

- Media Asslm3sm Claim Form Motor TPLDocument3 pagesMedia Asslm3sm Claim Form Motor TPLAneeb AhmedNo ratings yet

- ACT Search of Records ApplicationDocument2 pagesACT Search of Records Applicationarslanrasheed5410No ratings yet

- Vehicle Loan AnnexureDocument2 pagesVehicle Loan AnnexureNukamreddy Venkateswara ReddyNo ratings yet

- Gig TPL FormDocument3 pagesGig TPL FormSalmanNo ratings yet

- ia-2021.01.20-16.22-NTI Commercial Motor Claim FormDocument4 pagesia-2021.01.20-16.22-NTI Commercial Motor Claim FormJennifer McPhersonNo ratings yet

- Vehicle Loan AnnexureDocument2 pagesVehicle Loan AnnexureSaran ManiNo ratings yet

- GE23448 GREAT EV Premier Form - D15 - FinalDocument3 pagesGE23448 GREAT EV Premier Form - D15 - FinalkaychongNo ratings yet

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepNo ratings yet

- Final Motor Insurance Claim Form Two Aug2018 - 0 PDFDocument1 pageFinal Motor Insurance Claim Form Two Aug2018 - 0 PDFShiva SinghNo ratings yet

- Standard Proposal Form For "Liability Only" PolicyDocument4 pagesStandard Proposal Form For "Liability Only" PolicySubhajit ChatterjeeNo ratings yet

- Media wl4j3n4c Claim-Form-Motor-ComprehensiveDocument1 pageMedia wl4j3n4c Claim-Form-Motor-ComprehensiveRajesh ThamineediNo ratings yet

- Receipt AFQ0309Document1 pageReceipt AFQ0309ndoworerasNo ratings yet

- XTRAPOWER Application FormDocument5 pagesXTRAPOWER Application FormbiswajitNo ratings yet

- Unregistered Vehicle PemitDocument2 pagesUnregistered Vehicle Pemitmiket241No ratings yet

- Form 28Document2 pagesForm 28anandshubhamsudhirkumarNo ratings yet

- EGTB Vehicle Inspection Form, 0Document1 pageEGTB Vehicle Inspection Form, 0UstazFaizalAriffinOriginalNo ratings yet

- Application For Certificate of Title For A VehicleDocument1 pageApplication For Certificate of Title For A VehiclePrajalahari PrajalahariNo ratings yet

- Windscreen Claim FormDocument1 pageWindscreen Claim FormHihiNo ratings yet

- 3556 - Etisalat - ID Exception-App Form - Eng Oct 2012Document2 pages3556 - Etisalat - ID Exception-App Form - Eng Oct 2012zahid_497No ratings yet

- Customer Application Form - Token: Date-Appt IDDocument3 pagesCustomer Application Form - Token: Date-Appt IDRamasubramanian KRNo ratings yet

- HB City - Business-License-ApplicationDocument2 pagesHB City - Business-License-ApplicationPatrick SullivanNo ratings yet

- Proposal FormDocument27 pagesProposal FormChaitanya Chaitu CANo ratings yet

- Tradewise Insurance Services LTD: Commercial Vehicle Accident Report FormDocument12 pagesTradewise Insurance Services LTD: Commercial Vehicle Accident Report FormNwachukwu ProsperNo ratings yet

- L&T Insurance Motor Claim FormDocument2 pagesL&T Insurance Motor Claim FormArchitNo ratings yet

- Os SS UtaDocument2 pagesOs SS Utaobi SalamNo ratings yet

- F3523 CFDDocument2 pagesF3523 CFDAdam Scott MillerNo ratings yet

- UnregisteredVehiclePermit 20240228 1206Document3 pagesUnregisteredVehiclePermit 20240228 1206applesshouldnotbephonesNo ratings yet

- Statement of ClaimDocument2 pagesStatement of ClaimRN SantiagoNo ratings yet

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

- Important Notice: Signature and Chop On Vehicle Registration Document (VRD)Document6 pagesImportant Notice: Signature and Chop On Vehicle Registration Document (VRD)mvikiwslnvqbhwfzwzNo ratings yet

- DOT - DMV Limousine Task Force LetterDocument4 pagesDOT - DMV Limousine Task Force LetterLarry RulisonNo ratings yet

- 7D Manual Complete 0422 0Document40 pages7D Manual Complete 0422 0Marcos NascimentoNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- Service Provider Bond FormDocument2 pagesService Provider Bond FormlawrencelazerrickNo ratings yet

- Executive Order 1011Document26 pagesExecutive Order 1011Dominic jarinNo ratings yet

- Jacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) SummaryDocument12 pagesJacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) Summarythe kingfishNo ratings yet

- Vsi 52 Dec 2010Document4 pagesVsi 52 Dec 20103LifelinesNo ratings yet

- Note:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationDocument2 pagesNote:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationDIPAK RAYCHURANo ratings yet

- TDC-15-S-1 Introduction To Driving R.A. No. 4136Document13 pagesTDC-15-S-1 Introduction To Driving R.A. No. 4136Santy UyNo ratings yet

- FORM 30 Transfer of Ownership (Financed)Document3 pagesFORM 30 Transfer of Ownership (Financed)torrentkidNo ratings yet

- SavitaDocument1 pageSavitaSDM GurugramNo ratings yet

- Chapter 1-3 (Commercial Vehicle Registration System)Document21 pagesChapter 1-3 (Commercial Vehicle Registration System)femiNo ratings yet

- F3520 CFDDocument5 pagesF3520 CFDPhillip NguyenNo ratings yet

- Kiarah InsuranceDocument2 pagesKiarah InsuranceBrandon BachNo ratings yet

- OrderPoint User Guide 2012Document46 pagesOrderPoint User Guide 2012jjNo ratings yet

- Excise & Taxation Department, IslamabadDocument5 pagesExcise & Taxation Department, IslamabadAbeeha RajpootNo ratings yet

- Admin, GSS, HR Accomplishment ReportDocument12 pagesAdmin, GSS, HR Accomplishment Reportkrismae fatima de castroNo ratings yet

- Kilgore College Course Registration Form: Suggested Material For The ClassDocument5 pagesKilgore College Course Registration Form: Suggested Material For The ClassKaressica grantNo ratings yet

- 14 FebDocument1 page14 Febchandra860266No ratings yet

- VAHAN 4.0 (Citizen Services) SP-MORTH-WS03 175 8015Document1 pageVAHAN 4.0 (Citizen Services) SP-MORTH-WS03 175 8015krishna salesNo ratings yet

- PPSR Search Certificate 5136546426320001Document2 pagesPPSR Search Certificate 5136546426320001iRepair Gold CoastNo ratings yet

- 123Document1 page123Anshu TeliNo ratings yet

- Malta Car Registration GuidelinesDocument38 pagesMalta Car Registration GuidelinesaquaristNo ratings yet

- Oic Grasp BrochureDocument8 pagesOic Grasp BrochureAbid HassaanNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGDocument1 pageVAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGmdneyaz9831No ratings yet

- Buying and Selling A Used Vehicle in OntarioDocument6 pagesBuying and Selling A Used Vehicle in Ontariohai_you20025946No ratings yet

- Road Safety and Motor Vehicles (Amendment) Bill 2019Document5 pagesRoad Safety and Motor Vehicles (Amendment) Bill 2019Adwitiya MishraNo ratings yet