Professional Documents

Culture Documents

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Uploaded by

何健珩Copyright:

Available Formats

You might also like

- List of Companies: No. NameDocument7 pagesList of Companies: No. Namett100% (1)

- Candlestick Pattern Trading Strategies PDFDocument17 pagesCandlestick Pattern Trading Strategies PDFMurali100% (5)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- TAX 1203 Answers Financial Reporting vs. Tax ReportingDocument1 pageTAX 1203 Answers Financial Reporting vs. Tax Reportingrav dano100% (1)

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Taxation of Cooperatives and Other CorporatesDocument8 pagesTaxation of Cooperatives and Other CorporatesTriila manillaNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Tax SolutionDocument9 pagesTax SolutionGhulam Mohyudin KharalNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Eyatid 06activity1Document2 pagesEyatid 06activity1Allan vincent EyatidNo ratings yet

- Profits Tax Computation QuestionDocument2 pagesProfits Tax Computation Question何健珩No ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Name: Akingbesote Victoria Modupe: MATRIC NO: 178750057Document12 pagesName: Akingbesote Victoria Modupe: MATRIC NO: 178750057Akingbesote VictoriaNo ratings yet

- Practice Exam FinalsDocument2 pagesPractice Exam FinalsPauline Jasmine Sta AnaNo ratings yet

- Taxation Mid 2 Solution NUBDocument4 pagesTaxation Mid 2 Solution NUBNiizamUddinBhuiyanNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Chapter 8 Ptx1033/Business IncomeDocument9 pagesChapter 8 Ptx1033/Business IncomeNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Chapter Fifteen SolutionsDocument21 pagesChapter Fifteen Solutionsapi-3705855No ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- Tutorial 8 Answer PartnershipDocument6 pagesTutorial 8 Answer Partnership璇詠No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2016 Dec Q-7-8Document2 pages2016 Dec Q-7-8何健珩No ratings yet

- 2017 Dec Q-9-10Document2 pages2017 Dec Q-9-10何健珩No ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- 2018 Dec Q-12Document1 page2018 Dec Q-12何健珩No ratings yet

- Ilovepdf MergedDocument40 pagesIlovepdf Merged何健珩No ratings yet

- 2016 Jun Q-4Document1 page2016 Jun Q-4何健珩No ratings yet

- Acct4410 2022 Spring - Profit TaxDocument2 pagesAcct4410 2022 Spring - Profit Tax何健珩No ratings yet

- 2018 Jun Ans-5Document1 page2018 Jun Ans-5何健珩No ratings yet

- (Revised Solution) Take Home Assignment 4 (2023S)Document5 pages(Revised Solution) Take Home Assignment 4 (2023S)何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- 2018 Dec Q-14-15Document2 pages2018 Dec Q-14-15何健珩No ratings yet

- 2019 Jun Q-12-13Document2 pages2019 Jun Q-12-13何健珩No ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- Lecture Note 4aDocument5 pagesLecture Note 4a何健珩No ratings yet

- 2018 Jun Ans-4Document1 page2018 Jun Ans-4何健珩No ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- 2016 Jun Ans-3Document1 page2016 Jun Ans-3何健珩No ratings yet

- Free The FoodDocument18 pagesFree The Food何健珩No ratings yet

- Take Home Exercise No 2 - Property Tax (2023S)Document2 pagesTake Home Exercise No 2 - Property Tax (2023S)何健珩No ratings yet

- Source of ProfitsDocument1 pageSource of Profits何健珩No ratings yet

- Take Home Exercise No 1 - Tax Administration (2023S) - 1Document3 pagesTake Home Exercise No 1 - Tax Administration (2023S) - 1何健珩No ratings yet

- Lecture 10. The Goods (And Services) Market in An Open EconomyDocument35 pagesLecture 10. The Goods (And Services) Market in An Open Economy何健珩No ratings yet

- Lecture 7 - E-Commerce (FinTech)Document30 pagesLecture 7 - E-Commerce (FinTech)何健珩No ratings yet

- Lecture 9 - Digital Platform (Basics)Document30 pagesLecture 9 - Digital Platform (Basics)何健珩No ratings yet

- Lecture 13 - Big Data (Analytics For Text and Network)Document31 pagesLecture 13 - Big Data (Analytics For Text and Network)何健珩No ratings yet

- Business Plan: Social Impact Project - ShinyhkDocument24 pagesBusiness Plan: Social Impact Project - Shinyhk何健珩No ratings yet

- LABU2040 Business Case Analysis: Wk. 8-9 Writing SkillsDocument21 pagesLABU2040 Business Case Analysis: Wk. 8-9 Writing Skills何健珩No ratings yet

- Doing Business in VietnamDocument66 pagesDoing Business in Vietnamtrantam88No ratings yet

- Mill & Coal Feeder QuestionsDocument1 pageMill & Coal Feeder QuestionsJoydev GangulyNo ratings yet

- Deal Logic First Data Corp / Fiserv Inc: WHU Finance SocietyDocument6 pagesDeal Logic First Data Corp / Fiserv Inc: WHU Finance SocietySrijanNo ratings yet

- Feb 01Document9 pagesFeb 01Mohammed GhouseNo ratings yet

- Section 1.4 (Limited Companies & Multinationals)Document20 pagesSection 1.4 (Limited Companies & Multinationals)Ei Shwe Sin PhooNo ratings yet

- Statement September 2021Document1 pageStatement September 2021Julio DelarozaNo ratings yet

- Vertical Integration Against Vs Outsourcing in Fasion IndustryDocument2 pagesVertical Integration Against Vs Outsourcing in Fasion Industrywaleed AfzaalNo ratings yet

- 10 Years of Blockchain 2010 2019 1577291956Document18 pages10 Years of Blockchain 2010 2019 1577291956Majito CandongaNo ratings yet

- A Project Report On Retailers Satisfaction and Expectation Towards HLL Distributor by Babasab Patil (Karisatte)Document80 pagesA Project Report On Retailers Satisfaction and Expectation Towards HLL Distributor by Babasab Patil (Karisatte)Prasad ZalakiNo ratings yet

- Macroeconomic Problems of India Economy ProjectDocument4 pagesMacroeconomic Problems of India Economy ProjectSatyendra Latroski Katrovisch77% (52)

- Union Bank of IndiaDocument33 pagesUnion Bank of Indiaraghavan swaminathanNo ratings yet

- W2 - Week 2 GLOBAL OPERATIONS - NewDocument30 pagesW2 - Week 2 GLOBAL OPERATIONS - NewEe Ling SawNo ratings yet

- ch-3 Public ExpenditureDocument35 pagesch-3 Public ExpenditureyebegashetNo ratings yet

- Start Up Start Company: Start Business in IndiaDocument13 pagesStart Up Start Company: Start Business in IndiaNishok NagamaniNo ratings yet

- Civil Law Review Class ProjectDocument31 pagesCivil Law Review Class ProjectDJabNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- 294 Riya RanaDocument4 pages294 Riya RanaRiya RanaNo ratings yet

- Review of JLR's 2020 and 2021 Business ResultsDocument7 pagesReview of JLR's 2020 and 2021 Business Resultsvalentin.borisavljevicNo ratings yet

- Financial Aspect Feasibility StudyDocument66 pagesFinancial Aspect Feasibility StudyRialeeNo ratings yet

- MOM Dated 13-2-23 R1Document2 pagesMOM Dated 13-2-23 R130. TANISHKA Tripathi 9CNo ratings yet

- Vol-1 Introduction To The Basics-Of ForexDocument21 pagesVol-1 Introduction To The Basics-Of ForexAbdelrahman Elkady100% (1)

- Project KenyaDocument25 pagesProject KenyaMohamed TawfikNo ratings yet

- Question Bank BKDocument8 pagesQuestion Bank BKVivek JaiswarNo ratings yet

- Persuasive Messages - Radical RewriteDocument3 pagesPersuasive Messages - Radical RewriteFarrahNo ratings yet

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- ListDocument4 pagesListNgeleka kalalaNo ratings yet

- Tata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorDocument13 pagesTata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorNIKO LAURENo ratings yet

- Final Exam Revision: Short Answer QuestionsDocument32 pagesFinal Exam Revision: Short Answer QuestionsUyển Nhi TrầnNo ratings yet

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Uploaded by

何健珩Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Profits Tax Computation Illustration 2023S - Suggested Answers Ver2

Uploaded by

何健珩Copyright:

Available Formats

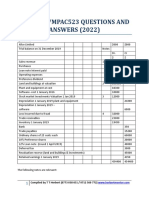

Profits Tax Computation Illustration

McMickey

Profits Tax Computation

Year of Assessment 2019/20

Basis Period: 1 April 2019 to 31 March 2020

Net loss per book - 13,810

Add:

Book depreciation 25,000

Donations 50,000

Total annual contribution to MPF 123,500

Provision for special contribution to non-approved retirement scheme 55,000

Interest for money borrowed from an overseas associate company to 7,000

finance the procurement of production machine

Foreign tax paid 2,000

Legal fee for collecting staff loan 1,400

Legal fee paid for initial lease of new office 2,000

Traffic fines 500

266,400

252,590

Less:

Non-taxable interest income $(5,500 + 3,000) 8,500

Dividend income 8,500

Allowable deductible amount re: MPF annual contribution under 61,750

s.17(1)(i)

Gains from disposal of fixed assets 50,000

128,750

123,840

Less:

Tax depreciation allowances agreed with the IRD 5,000

118,840

Less:

Approved charitable donations (subject to 35% limitation) 41,594

Net assessable profit for the year 2019/20 77,246

Less:

Accumulated tax loss b/fwd. 24,000

Net adjusted assessable profit after loss set-off 53,246

Tax payable at 8.25% (two-tiered tax rate) 4,392

Note: the tax liability should be truncated from $4,392.795 to $4,392

You might also like

- List of Companies: No. NameDocument7 pagesList of Companies: No. Namett100% (1)

- Candlestick Pattern Trading Strategies PDFDocument17 pagesCandlestick Pattern Trading Strategies PDFMurali100% (5)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- TAX 1203 Answers Financial Reporting vs. Tax ReportingDocument1 pageTAX 1203 Answers Financial Reporting vs. Tax Reportingrav dano100% (1)

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Taxation of Cooperatives and Other CorporatesDocument8 pagesTaxation of Cooperatives and Other CorporatesTriila manillaNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Tax SolutionDocument9 pagesTax SolutionGhulam Mohyudin KharalNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Eyatid 06activity1Document2 pagesEyatid 06activity1Allan vincent EyatidNo ratings yet

- Profits Tax Computation QuestionDocument2 pagesProfits Tax Computation Question何健珩No ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Name: Akingbesote Victoria Modupe: MATRIC NO: 178750057Document12 pagesName: Akingbesote Victoria Modupe: MATRIC NO: 178750057Akingbesote VictoriaNo ratings yet

- Practice Exam FinalsDocument2 pagesPractice Exam FinalsPauline Jasmine Sta AnaNo ratings yet

- Taxation Mid 2 Solution NUBDocument4 pagesTaxation Mid 2 Solution NUBNiizamUddinBhuiyanNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Chapter 8 Ptx1033/Business IncomeDocument9 pagesChapter 8 Ptx1033/Business IncomeNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Chapter Fifteen SolutionsDocument21 pagesChapter Fifteen Solutionsapi-3705855No ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- Tutorial 8 Answer PartnershipDocument6 pagesTutorial 8 Answer Partnership璇詠No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2016 Dec Q-7-8Document2 pages2016 Dec Q-7-8何健珩No ratings yet

- 2017 Dec Q-9-10Document2 pages2017 Dec Q-9-10何健珩No ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- 2018 Dec Q-12Document1 page2018 Dec Q-12何健珩No ratings yet

- Ilovepdf MergedDocument40 pagesIlovepdf Merged何健珩No ratings yet

- 2016 Jun Q-4Document1 page2016 Jun Q-4何健珩No ratings yet

- Acct4410 2022 Spring - Profit TaxDocument2 pagesAcct4410 2022 Spring - Profit Tax何健珩No ratings yet

- 2018 Jun Ans-5Document1 page2018 Jun Ans-5何健珩No ratings yet

- (Revised Solution) Take Home Assignment 4 (2023S)Document5 pages(Revised Solution) Take Home Assignment 4 (2023S)何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- 2018 Dec Q-14-15Document2 pages2018 Dec Q-14-15何健珩No ratings yet

- 2019 Jun Q-12-13Document2 pages2019 Jun Q-12-13何健珩No ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- Lecture Note 4aDocument5 pagesLecture Note 4a何健珩No ratings yet

- 2018 Jun Ans-4Document1 page2018 Jun Ans-4何健珩No ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- 2016 Jun Ans-3Document1 page2016 Jun Ans-3何健珩No ratings yet

- Free The FoodDocument18 pagesFree The Food何健珩No ratings yet

- Take Home Exercise No 2 - Property Tax (2023S)Document2 pagesTake Home Exercise No 2 - Property Tax (2023S)何健珩No ratings yet

- Source of ProfitsDocument1 pageSource of Profits何健珩No ratings yet

- Take Home Exercise No 1 - Tax Administration (2023S) - 1Document3 pagesTake Home Exercise No 1 - Tax Administration (2023S) - 1何健珩No ratings yet

- Lecture 10. The Goods (And Services) Market in An Open EconomyDocument35 pagesLecture 10. The Goods (And Services) Market in An Open Economy何健珩No ratings yet

- Lecture 7 - E-Commerce (FinTech)Document30 pagesLecture 7 - E-Commerce (FinTech)何健珩No ratings yet

- Lecture 9 - Digital Platform (Basics)Document30 pagesLecture 9 - Digital Platform (Basics)何健珩No ratings yet

- Lecture 13 - Big Data (Analytics For Text and Network)Document31 pagesLecture 13 - Big Data (Analytics For Text and Network)何健珩No ratings yet

- Business Plan: Social Impact Project - ShinyhkDocument24 pagesBusiness Plan: Social Impact Project - Shinyhk何健珩No ratings yet

- LABU2040 Business Case Analysis: Wk. 8-9 Writing SkillsDocument21 pagesLABU2040 Business Case Analysis: Wk. 8-9 Writing Skills何健珩No ratings yet

- Doing Business in VietnamDocument66 pagesDoing Business in Vietnamtrantam88No ratings yet

- Mill & Coal Feeder QuestionsDocument1 pageMill & Coal Feeder QuestionsJoydev GangulyNo ratings yet

- Deal Logic First Data Corp / Fiserv Inc: WHU Finance SocietyDocument6 pagesDeal Logic First Data Corp / Fiserv Inc: WHU Finance SocietySrijanNo ratings yet

- Feb 01Document9 pagesFeb 01Mohammed GhouseNo ratings yet

- Section 1.4 (Limited Companies & Multinationals)Document20 pagesSection 1.4 (Limited Companies & Multinationals)Ei Shwe Sin PhooNo ratings yet

- Statement September 2021Document1 pageStatement September 2021Julio DelarozaNo ratings yet

- Vertical Integration Against Vs Outsourcing in Fasion IndustryDocument2 pagesVertical Integration Against Vs Outsourcing in Fasion Industrywaleed AfzaalNo ratings yet

- 10 Years of Blockchain 2010 2019 1577291956Document18 pages10 Years of Blockchain 2010 2019 1577291956Majito CandongaNo ratings yet

- A Project Report On Retailers Satisfaction and Expectation Towards HLL Distributor by Babasab Patil (Karisatte)Document80 pagesA Project Report On Retailers Satisfaction and Expectation Towards HLL Distributor by Babasab Patil (Karisatte)Prasad ZalakiNo ratings yet

- Macroeconomic Problems of India Economy ProjectDocument4 pagesMacroeconomic Problems of India Economy ProjectSatyendra Latroski Katrovisch77% (52)

- Union Bank of IndiaDocument33 pagesUnion Bank of Indiaraghavan swaminathanNo ratings yet

- W2 - Week 2 GLOBAL OPERATIONS - NewDocument30 pagesW2 - Week 2 GLOBAL OPERATIONS - NewEe Ling SawNo ratings yet

- ch-3 Public ExpenditureDocument35 pagesch-3 Public ExpenditureyebegashetNo ratings yet

- Start Up Start Company: Start Business in IndiaDocument13 pagesStart Up Start Company: Start Business in IndiaNishok NagamaniNo ratings yet

- Civil Law Review Class ProjectDocument31 pagesCivil Law Review Class ProjectDJabNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- 294 Riya RanaDocument4 pages294 Riya RanaRiya RanaNo ratings yet

- Review of JLR's 2020 and 2021 Business ResultsDocument7 pagesReview of JLR's 2020 and 2021 Business Resultsvalentin.borisavljevicNo ratings yet

- Financial Aspect Feasibility StudyDocument66 pagesFinancial Aspect Feasibility StudyRialeeNo ratings yet

- MOM Dated 13-2-23 R1Document2 pagesMOM Dated 13-2-23 R130. TANISHKA Tripathi 9CNo ratings yet

- Vol-1 Introduction To The Basics-Of ForexDocument21 pagesVol-1 Introduction To The Basics-Of ForexAbdelrahman Elkady100% (1)

- Project KenyaDocument25 pagesProject KenyaMohamed TawfikNo ratings yet

- Question Bank BKDocument8 pagesQuestion Bank BKVivek JaiswarNo ratings yet

- Persuasive Messages - Radical RewriteDocument3 pagesPersuasive Messages - Radical RewriteFarrahNo ratings yet

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- ListDocument4 pagesListNgeleka kalalaNo ratings yet

- Tata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorDocument13 pagesTata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorNIKO LAURENo ratings yet

- Final Exam Revision: Short Answer QuestionsDocument32 pagesFinal Exam Revision: Short Answer QuestionsUyển Nhi TrầnNo ratings yet