Professional Documents

Culture Documents

Foreign Currency Revaluation SAP FICO - Ambikeya

Foreign Currency Revaluation SAP FICO - Ambikeya

Uploaded by

gnafoo2003Copyright:

Available Formats

You might also like

- SAP S/4HANA Retail: Processes, Functions, CustomisingFrom EverandSAP S/4HANA Retail: Processes, Functions, CustomisingRating: 3 out of 5 stars3/5 (1)

- E-Mail Notification For PR - PO Approver - SAP BlogsDocument20 pagesE-Mail Notification For PR - PO Approver - SAP Blogsmohamed hassballah100% (1)

- Output Management in SAP S - 4HANADocument38 pagesOutput Management in SAP S - 4HANAmohamed hassballahNo ratings yet

- Configuration Guide For Connector For SAP Multi-Bank ConnectivityDocument54 pagesConfiguration Guide For Connector For SAP Multi-Bank ConnectivitymichellemoliveiraNo ratings yet

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesFrom EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNo ratings yet

- Document: Uses of Special Period in SAP PDFDocument9 pagesDocument: Uses of Special Period in SAP PDFswainsatyaranjanNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Bank Integration With SAP Multi-Bank Connectivity (16R - US) : Test Script SAP S/4HANA - 02-09-19Document29 pagesBank Integration With SAP Multi-Bank Connectivity (16R - US) : Test Script SAP S/4HANA - 02-09-19Hassan AliNo ratings yet

- Invoice Verification For SAPDocument18 pagesInvoice Verification For SAPalejandro10450% (2)

- SAP Intercompany ReconciliationDocument23 pagesSAP Intercompany ReconciliationRajeev MenonNo ratings yet

- AucDocument15 pagesAucJyotiraditya BanerjeeNo ratings yet

- Accounting For Managers Notes - UNit IDocument25 pagesAccounting For Managers Notes - UNit Ibalu_narasimhap91% (11)

- Chemmanur and Fulghieri 1994Document24 pagesChemmanur and Fulghieri 1994Sanyam TripathiNo ratings yet

- Group Reporting - Financial Consolidation (1SG - XX)Document80 pagesGroup Reporting - Financial Consolidation (1SG - XX)Muhammad El-SayedNo ratings yet

- Welcome To The Course On The Bank Statement Processing SetupDocument36 pagesWelcome To The Course On The Bank Statement Processing SetupficosatyaNo ratings yet

- HanseOrgaWhitePaperFinal PDFDocument24 pagesHanseOrgaWhitePaperFinal PDFmiriam lopezNo ratings yet

- Procedure Foreign Currency TranslationDocument15 pagesProcedure Foreign Currency TranslationmshareefaliNo ratings yet

- FIGL 322 Bank Reconciliation v07 PDFDocument92 pagesFIGL 322 Bank Reconciliation v07 PDFsandeep swamyNo ratings yet

- Sap Fi General Ledger Frequently Used ProceduresDocument88 pagesSap Fi General Ledger Frequently Used Proceduresvenkat6299No ratings yet

- Certification Guidance - FinanceDocument171 pagesCertification Guidance - FinanceJaime RodriguezNo ratings yet

- A - GL - Training Docs (AP1)Document174 pagesA - GL - Training Docs (AP1)Regis Nemezio100% (1)

- SAP Accounts Payable Master Data HTTP Sapdocs InfoDocument22 pagesSAP Accounts Payable Master Data HTTP Sapdocs Infoeng_khalidseifNo ratings yet

- Sap - Cash JournalDocument12 pagesSap - Cash Journalashok100% (1)

- Asset Acquisition Through Direct Capitalization in SAP CLOUDDocument72 pagesAsset Acquisition Through Direct Capitalization in SAP CLOUDRaju Raj RajNo ratings yet

- Extension Ledgers in S/4 HANA: CommunityDocument9 pagesExtension Ledgers in S/4 HANA: CommunitySrinivas MsrNo ratings yet

- SAP ERP Financials Common Errors in APP PDFDocument10 pagesSAP ERP Financials Common Errors in APP PDFSharad TiwariNo ratings yet

- Instructor Led Training Presentation Sample - TSVDocument97 pagesInstructor Led Training Presentation Sample - TSVelsays0No ratings yet

- Asset AccountingDocument16 pagesAsset AccountingSarf FaizalNo ratings yet

- Financial Accounting - SlideshowDocument41 pagesFinancial Accounting - SlideshowHARIKUMARNo ratings yet

- Sap Fi Retained Earnings AccountsDocument1 pageSap Fi Retained Earnings AccountsDebabrata SahooNo ratings yet

- New LedgerDocument42 pagesNew LedgerMADHURA RAULNo ratings yet

- Advanced Substitutions in FIDocument2 pagesAdvanced Substitutions in FIShankar Kolla100% (1)

- Retained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDocument6 pagesRetained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDipankar DasNo ratings yet

- C S4FIN 2021 - Financial Accounting Associates SAP S4HANA 2021Document17 pagesC S4FIN 2021 - Financial Accounting Associates SAP S4HANA 2021Oriol CasesNo ratings yet

- General Ledger Accounting Training Manual: Author: Ask SAP ExpertDocument78 pagesGeneral Ledger Accounting Training Manual: Author: Ask SAP Expertsaif RashidNo ratings yet

- Bad Debt Configuration in SapDocument4 pagesBad Debt Configuration in Sapchintan05ec100% (1)

- Sap S4hana Finance-1Document14 pagesSap S4hana Finance-1Nawair IshfaqNo ratings yet

- Customizing SHANA TreasuryDocument850 pagesCustomizing SHANA Treasuryadhonay perezNo ratings yet

- F.13 GRIR ClearingDocument17 pagesF.13 GRIR Clearingbernard murindaNo ratings yet

- Thesis Arjun Gope PDFDocument225 pagesThesis Arjun Gope PDFJayesh PatelNo ratings yet

- SAP FICO Financial AccountingDocument4 pagesSAP FICO Financial AccountingNeelesh KumarNo ratings yet

- Automatic PaymentsDocument12 pagesAutomatic PaymentsfinerpmanyamNo ratings yet

- Recurring EntriesDocument10 pagesRecurring EntriesAB100% (1)

- SAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauDocument20 pagesSAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauSubramanian ChandrasekarNo ratings yet

- Asset Accounting ConfigurationDocument145 pagesAsset Accounting ConfigurationShaily DubeyNo ratings yet

- Accounting and Financial Close (J58)Document14 pagesAccounting and Financial Close (J58)Ahmed Al-SherbinyNo ratings yet

- SAP Finance Controlling Module MaterialDocument182 pagesSAP Finance Controlling Module MaterialSarosh0% (1)

- SAP DunningDocument13 pagesSAP DunningFarhad012No ratings yet

- What Is Special GL TransactionDocument4 pagesWhat Is Special GL TransactionRaj ShettyNo ratings yet

- Work Flow Creation Steps in SAP FICODocument23 pagesWork Flow Creation Steps in SAP FICObhaskarSNo ratings yet

- GFKL Co Sap - CoDocument107 pagesGFKL Co Sap - CoRenu BhasinNo ratings yet

- ANIRUDDHADocument68 pagesANIRUDDHAAniruddha ChakrabortyNo ratings yet

- Subcontracting Process With Challan - GSTDocument19 pagesSubcontracting Process With Challan - GSTAmit GuptaNo ratings yet

- C TS4FI 2021demoDocument2 pagesC TS4FI 2021demoFelipeJonasNo ratings yet

- E - 20180425 S4TWL - Credit ManagementDocument5 pagesE - 20180425 S4TWL - Credit ManagementericNo ratings yet

- BPC Embebido PDFDocument160 pagesBPC Embebido PDFDiana Marcela Maya PatinoNo ratings yet

- Sap FicoDocument73 pagesSap FicoKishore NandaNo ratings yet

- Sap Fi-Gl PDFDocument4 pagesSap Fi-Gl PDFpavan8412No ratings yet

- The SAP Finance Value Guide - Enter The Era of Intelligent Finance by Moving To SAP S - 4HANADocument33 pagesThe SAP Finance Value Guide - Enter The Era of Intelligent Finance by Moving To SAP S - 4HANAAMOUSSOUNo ratings yet

- Bankreconciliationconfiguration PDFDocument7 pagesBankreconciliationconfiguration PDFJan HarvestNo ratings yet

- Configuring SAP ERP Financials and ControllingFrom EverandConfiguring SAP ERP Financials and ControllingRating: 4 out of 5 stars4/5 (4)

- The Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITFrom EverandThe Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITNo ratings yet

- Types of Transport Request: 2. CustomizingDocument12 pagesTypes of Transport Request: 2. Customizingmohamed hassballahNo ratings yet

- NM 2Document1 pageNM 2mohamed hassballahNo ratings yet

- SAP MM Pricing ProcedureDocument43 pagesSAP MM Pricing Proceduremohamed hassballah100% (1)

- Dump RawDocument198 pagesDump Rawmohamed hassballahNo ratings yet

- Dump Short ENDocument5 pagesDump Short ENmohamed hassballahNo ratings yet

- Chapter 1Document46 pagesChapter 1Aravinthan ThamasegaranNo ratings yet

- Value Vs Growth Stock in Emerging Market-SubmittedDocument72 pagesValue Vs Growth Stock in Emerging Market-Submitted0796105632No ratings yet

- The Assessment of Damage Caused by Floods in The Brazilian ContextDocument17 pagesThe Assessment of Damage Caused by Floods in The Brazilian ContextcarloscartasineNo ratings yet

- Chilean Equity Yearbook 2021Document87 pagesChilean Equity Yearbook 2021Yi Chun LinNo ratings yet

- Finance 123Document25 pagesFinance 123hind alteneijiNo ratings yet

- 2 Corporate Accounting NotesDocument26 pages2 Corporate Accounting NotesYogesh Kumpawat100% (2)

- Actuarial Methode Eng - 2Document51 pagesActuarial Methode Eng - 2Robot MarketingNo ratings yet

- Master of Business Administration (Mba)Document56 pagesMaster of Business Administration (Mba)s.muthu100% (1)

- IFRS 13 Brief PDFDocument4 pagesIFRS 13 Brief PDFsona abrahamyanNo ratings yet

- SSR-2010 LRDocument24 pagesSSR-2010 LRdavidtollNo ratings yet

- MAMF Annual Report 2017-2018 Full Version PDFDocument184 pagesMAMF Annual Report 2017-2018 Full Version PDFAzad JuthawatNo ratings yet

- Ethiopias Digital EconomyDocument75 pagesEthiopias Digital EconomySelman100% (1)

- The Role of Financial Statements On Investment Decision Making PDFDocument26 pagesThe Role of Financial Statements On Investment Decision Making PDFIrene IgbayoNo ratings yet

- HTTP Sec - Gov Archives Edg... pdf5Document175 pagesHTTP Sec - Gov Archives Edg... pdf5Shane-Charles WenzelNo ratings yet

- Members' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDocument152 pagesMembers' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDuc-Anh NguyenNo ratings yet

- Organization: Cost of CapitalDocument30 pagesOrganization: Cost of CapitalShafi Sharafudeen KadaviNo ratings yet

- Valuation Measuring and Managing The Value of Comp... - (PG 23 - 36)Document14 pagesValuation Measuring and Managing The Value of Comp... - (PG 23 - 36)Alexandra ArangoNo ratings yet

- Mercury Case Report Vedantam GuptaDocument9 pagesMercury Case Report Vedantam GuptaVedantam GuptaNo ratings yet

- Quantic Welcome Program GuideDocument18 pagesQuantic Welcome Program Guideabhi_gkNo ratings yet

- Application - Empanelment of ValuersDocument8 pagesApplication - Empanelment of ValuersMaha RajNo ratings yet

- Acquire Biannual Multiples Report Jan 2024Document39 pagesAcquire Biannual Multiples Report Jan 2024Deepak DevasiNo ratings yet

- ManPro-6 Present Worth Analysis 2019Document45 pagesManPro-6 Present Worth Analysis 2019Syifa Fauziah RustoniNo ratings yet

- Eng 111 Syllabus PDFDocument3 pagesEng 111 Syllabus PDFnadimNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument7 pagesAudit of Cash and Cash Equivalents: Internal Control Measures For CashmoNo ratings yet

- SAP MM Course ModuleDocument4 pagesSAP MM Course ModuleAyann ShomNo ratings yet

- Dividend Growth ModelDocument4 pagesDividend Growth ModelRichardDanielNo ratings yet

- As-2 Inventory Valuation: 1) IntroductionDocument17 pagesAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariNo ratings yet

Foreign Currency Revaluation SAP FICO - Ambikeya

Foreign Currency Revaluation SAP FICO - Ambikeya

Uploaded by

gnafoo2003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Currency Revaluation SAP FICO - Ambikeya

Foreign Currency Revaluation SAP FICO - Ambikeya

Uploaded by

gnafoo2003Copyright:

Available Formats

Foreign Currency

Revaluation SAP FICO

Foreign Currency Revaluation for GL Accounts

Step 1: Create three GL Masters (FS00)

SBI FC Term Loan (100502) - Liabilities

Exchange Gain (300100) - Revenues

Exchange Loss (400301) - Expenses

SBI FC Term Loan Account:

Info@ambikeya.com || www.ambikeya.com || +917746805189

And save

Exchange Gain Account:

Info@ambikeya.com || www.ambikeya.com || +917746805189

And save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Exchange Loss Account:

And save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 2: Define Accounting Principles

Path: SPRO → Financial Accounting (New) → Financial Accounting Global Settings

(New) →

Ledgers → Parallel Accounting → Define Accounting Principles

And save

Step 3: Assign Accounting Principle to Ledger Group

Path: SPRO → Financial Accounting (New) → Financial Accounting Global Settings

(New) →

Ledgers → Parallel Accounting → Assign Accounting Principle to Ledger Group

And save

Step 4: Define Valuation Methods

Path: SPRO → Financial Accounting (New) → General Ledger Accounting (New) →

Periodic

Processing → Valuate → Define Valuation Methods

Whatever the exchange rate type we selected (G, B, M) under exchange rate

determination tab, the same exchange rate will applicable at the time of

revaluation

For instance, we entered exchange rates for the July month ended as below in

OB08.

Info@ambikeya.com || www.ambikeya.com || +917746805189

If we selected G under exchange rate determination tab it picks 48.00 for

revaluation

If we selected B under exchange rate determination tab it picks 49.00 for

revaluation

Select new entries

And save

Step 5: Define Valuation Areas

Path: Path: SPRO → Financial Accounting (New) → General Ledger Accounting

(New) →

Periodic Processing → Valuate → Define Valuation Areas

Info@ambikeya.com || www.ambikeya.com || +917746805189

And save

Step 6: Assign Valuation Area and Accounting Principle

Path: SPRO → Financial Accounting (New) → General Ledger Accounting (New) →

Periodic

Processing → Valuate → Assign Valuation Area and Accounting Principle

And save

Step 7: Prepare Automatic Postings for Foreign Currency Valuation (OBA1)

Double click on Exchange Rate Difference (KDB)

Enter the chart of Accounts and click on

Info@ambikeya.com || www.ambikeya.com || +917746805189

Enter the valuation Area as “YA” and continue

Specify the Exchange Gain and Exchange Loss account

And save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 8: Assign Exchange Rate Difference in SBI FC Term Loan Account (100503) (FS00)

And save

End User Area for FC Revaluation:

Step 9: FC Term Loan Receipt (F-02)

Assume company took term loan of 100,000 USD.

Info@ambikeya.com || www.ambikeya.com || +917746805189

Info@ambikeya.com || www.ambikeya.com || +917746805189

Menu → Simulate →Save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 10: Enter Exchange Rates in Forex Table (OB08)

And save

Step 11: FC Valuation (FAGL_FC_VAL)

Info@ambikeya.com || www.ambikeya.com || +917746805189

Execute (F8).

Click on Postings button

We took loan of 100,000 USD @ 46.00 (100,000*46.00 = 4,600,000).

And the exchange rate as on 30.04.2013 is 45.00 (100,000*45.00 = 4,500,000).

Info@ambikeya.com || www.ambikeya.com || +917746805189

Hence we got exchange gain of 100,000 (4,600,000 –

4,500,000) Journal Entry:

SBI FC Term Loan A/C 100,000

To Exchange Gain 100,000

Reversal Posting of Exchange Gain on 1st day of next month:

Purpose: We reverse the document only for month-end but not for year-end.

To know the foreign currency fluctuations (Gain/Loss) for every month. It will not effect

in GL balances

Execute

Click on postings button

Info@ambikeya.com || www.ambikeya.com || +917746805189

Here, we can view clearly on 1st May 2013 the entry was reversed automatically. Once we

selected the reversal postings check box

Journal entry for Reversed Document:

Exchange Gain A/C Dr 100,000

To SBI FC Term Loan A/C 100,000

Info@ambikeya.com || www.ambikeya.com || +917746805189

Posting of Documents:

Execute

Info@ambikeya.com || www.ambikeya.com || +917746805189

Click on Postings button

Menu → System → Services → Batch Input → Sessions

Select session “Kamal1” and select process button

Select process/foreground radio button and select process button

Info@ambikeya.com || www.ambikeya.com || +917746805189

Click on enter like on – Still we get message as “session completed”

Select the session “Kamal1” and click on Log

Info@ambikeya.com || www.ambikeya.com || +917746805189

Double click on session “Kamal1”

To view the posted documents (FB03):

Original Document

Reversed Document

Info@ambikeya.com || www.ambikeya.com || +917746805189

To view the Balances (FBL3N)

Note: GL Account – 100504 and select all items radio button and execute

Step 12: Partial Payment of Term Loan (F-02)

First, pay the amount of 50,000 USD on 15th May 2013 @ 46.00

Later, pay the amount of 10,000 USD on 16th May 2013 @ 45.00

Note: We have two options to enter exchanger rates: Either in Forex table or in document

it self

If we enter exchange rate both in forex table and document. Exchange rate in document

has high priority

Partial payment of 50,000 USD:

Info@ambikeya.com || www.ambikeya.com || +917746805189

Enter Exchange rate in Forex Table (OB08)

And save

Info@ambikeya.com || www.ambikeya.com || +917746805189

And click on enter and enter * in amount field and + in text

field And save

Journal entry for Payment:

SBI FC Term Loan A/C Dr

To Cash A/C

Partial Payment of 10,000 USD:

Here, we enter exchange rate directly in document itself.

Info@ambikeya.com || www.ambikeya.com || +917746805189

Info@ambikeya.com || www.ambikeya.com || +917746805189

And click on enter and enter * in amount field and + in text field

And save

GL Balances:

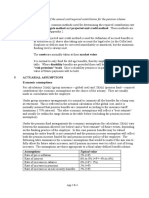

Step 13: Run FC Valuation for the month of May 2013

Info@ambikeya.com || www.ambikeya.com || +917746805189

Enter Exchange rate for the month ended May 2013 (OB08)

And save

FC Valuation (FAGL_FC_VAL)

Info@ambikeya.com || www.ambikeya.com || +917746805189

And execute

Term Loan 100,000 USD

Partial payment on 15.05.2013 50,000 USD

Partial payment on 16.05.2013 10,000 USD

Remaining Balance in USD 40,000 USD

Click on postings button

Info@ambikeya.com || www.ambikeya.com || +917746805189

Exchange Gain is 90,000. Calculation is given below:

01.04.2013 100,000 USD @ 46.00 46, 00,000

15.05.2013 50,000 USD @ 46.00 23, 00,000

23, 00,000

16.05.2013 10,000 USD @ 45.00

4, 50,000 (40,000 @ 46.00) =

18, 50,000

31.05.2013 40,000 USD @ 44.00 17, 60,000

EXCHANGE GAIN 90,000

Now, post the documents through transaction code – FAGL_FC_VAL by following the

procedure which was given in above step (Step 11)

Year End Valuation:

Enter Exchange rate for yearend (31.03.2014)

And save

FC Valuation (FAGL_FC_VAL):

Info@ambikeya.com || www.ambikeya.com || +917746805189

Note: Don’t select reverse postings check box and don’t give reversal posting date

Execute

Info@ambikeya.com || www.ambikeya.com || +917746805189

Click on Postings button

Exchange Gain is 150,000. Calculation is given below:

01.04.2013 100,000 USD @ 46.00 46, 00,000

15.05.2013 50,000 USD @ 46.00 23, 00,000

23, 00,000

16.05.2013 10,000 USD @ 45.00 4, 50,000

18, 50,000

31.03.2014 40,000 USD @ 50.00 20, 00,000

EXCHANGE GAIN 150,000

Execute the batch input session

Menu → Services → Batch input → Sessions

Info@ambikeya.com || www.ambikeya.com || +917746805189

Select “KAMAL3” session and click on process button

Select background radio button and select process button

Once session is completed status is shown as

Click on Log button

Info@ambikeya.com || www.ambikeya.com || +917746805189

Double click on “KAMAL3” Session

To view the document (FB03)

To view the balances (FBL3N)

Give the GL account as 100504 and select all items radio button and date as 31.04.2014

and execute

Info@ambikeya.com || www.ambikeya.com || +917746805189

FC Valuation for Vendors

Step 1: Create two GL masters (FS00)

Sundry Crs - FC

Info@ambikeya.com || www.ambikeya.com || +917746805189

And save

Balance Adjustment Account:

Info@ambikeya.com || www.ambikeya.com || +917746805189

Info@ambikeya.com || www.ambikeya.com || +917746805189

And save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 2: Assign sundry crs –FC account in vendor master (XK01)

And save

Note: We already created exchange gain and exchange loss accounts and also done with

remaining configurations in the above steps. (Refer, Steps 2, 3, 5, 6)

But in Step 4 and Step 7 we have to do few amendments for Vendors/customers. See

below screenshot for further reference

Step 3: Define Valuation Methods

Path: SPRO → Financial Accounting (New) → General Ledger Accounting (New) →

Periodic Processing → Valuate → Define Valuation Methods

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 4: Prepare Automatic Postings for Foreign Currency Valuation (OBA1)

Double click on Exchange Rate Difference (KDF) for open items

Enter the chart of Accounts and click on

Info@ambikeya.com || www.ambikeya.com || +917746805189

Enter the valuation Area as “YA” and continue

And save

Step 5: Enter Exchange rates (OB08)

Save

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 6: Post a vendor invoice (F-43)

And press enter and specify * in amount field and + in text field and simulate

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 7: Enter Exchange Rate (OB08)

Info@ambikeya.com || www.ambikeya.com || +917746805189

Step 8: FC Valuation (FAGL_FC_VAL)

Execute

Select on postings button

Info@ambikeya.com || www.ambikeya.com || +917746805189

Hence, we got exchange loss of 100,000

On 01.07.2013 posted vendor invoice with 4,700,000 (100,000*47.00)

On 31.07.2013 revaluation done on the basis of exchange rate available in forex table i.e.

46.00

4,600,000 (100,000*46.00)

Exchange Gain = 4,700,000 – 4,600,000 =

100,000 Create Postings:

Execute and run the batch input sessions

Info@ambikeya.com || www.ambikeya.com || +917746805189

To view the documents (FB03):

31.10.2013 (Normal posting)

01.11.2013 (Reversal posting)

Here, we can observe clearly that balances were posted to balance adjustment account

(100005) but not to sundry crs (100004) because we cannot directly post to

reconciliation accounts.

Hence we created balance adjustment account (100005) and given in

OBA1 – KDF To view the GL Balances (FBL3N):

Info@ambikeya.com || www.ambikeya.com || +917746805189

Info@ambikeya.com || www.ambikeya.com || +917746805189

Info@ambikeya.com || www.ambikeya.com || +917746805189

You might also like

- SAP S/4HANA Retail: Processes, Functions, CustomisingFrom EverandSAP S/4HANA Retail: Processes, Functions, CustomisingRating: 3 out of 5 stars3/5 (1)

- E-Mail Notification For PR - PO Approver - SAP BlogsDocument20 pagesE-Mail Notification For PR - PO Approver - SAP Blogsmohamed hassballah100% (1)

- Output Management in SAP S - 4HANADocument38 pagesOutput Management in SAP S - 4HANAmohamed hassballahNo ratings yet

- Configuration Guide For Connector For SAP Multi-Bank ConnectivityDocument54 pagesConfiguration Guide For Connector For SAP Multi-Bank ConnectivitymichellemoliveiraNo ratings yet

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesFrom EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNo ratings yet

- Document: Uses of Special Period in SAP PDFDocument9 pagesDocument: Uses of Special Period in SAP PDFswainsatyaranjanNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Bank Integration With SAP Multi-Bank Connectivity (16R - US) : Test Script SAP S/4HANA - 02-09-19Document29 pagesBank Integration With SAP Multi-Bank Connectivity (16R - US) : Test Script SAP S/4HANA - 02-09-19Hassan AliNo ratings yet

- Invoice Verification For SAPDocument18 pagesInvoice Verification For SAPalejandro10450% (2)

- SAP Intercompany ReconciliationDocument23 pagesSAP Intercompany ReconciliationRajeev MenonNo ratings yet

- AucDocument15 pagesAucJyotiraditya BanerjeeNo ratings yet

- Accounting For Managers Notes - UNit IDocument25 pagesAccounting For Managers Notes - UNit Ibalu_narasimhap91% (11)

- Chemmanur and Fulghieri 1994Document24 pagesChemmanur and Fulghieri 1994Sanyam TripathiNo ratings yet

- Group Reporting - Financial Consolidation (1SG - XX)Document80 pagesGroup Reporting - Financial Consolidation (1SG - XX)Muhammad El-SayedNo ratings yet

- Welcome To The Course On The Bank Statement Processing SetupDocument36 pagesWelcome To The Course On The Bank Statement Processing SetupficosatyaNo ratings yet

- HanseOrgaWhitePaperFinal PDFDocument24 pagesHanseOrgaWhitePaperFinal PDFmiriam lopezNo ratings yet

- Procedure Foreign Currency TranslationDocument15 pagesProcedure Foreign Currency TranslationmshareefaliNo ratings yet

- FIGL 322 Bank Reconciliation v07 PDFDocument92 pagesFIGL 322 Bank Reconciliation v07 PDFsandeep swamyNo ratings yet

- Sap Fi General Ledger Frequently Used ProceduresDocument88 pagesSap Fi General Ledger Frequently Used Proceduresvenkat6299No ratings yet

- Certification Guidance - FinanceDocument171 pagesCertification Guidance - FinanceJaime RodriguezNo ratings yet

- A - GL - Training Docs (AP1)Document174 pagesA - GL - Training Docs (AP1)Regis Nemezio100% (1)

- SAP Accounts Payable Master Data HTTP Sapdocs InfoDocument22 pagesSAP Accounts Payable Master Data HTTP Sapdocs Infoeng_khalidseifNo ratings yet

- Sap - Cash JournalDocument12 pagesSap - Cash Journalashok100% (1)

- Asset Acquisition Through Direct Capitalization in SAP CLOUDDocument72 pagesAsset Acquisition Through Direct Capitalization in SAP CLOUDRaju Raj RajNo ratings yet

- Extension Ledgers in S/4 HANA: CommunityDocument9 pagesExtension Ledgers in S/4 HANA: CommunitySrinivas MsrNo ratings yet

- SAP ERP Financials Common Errors in APP PDFDocument10 pagesSAP ERP Financials Common Errors in APP PDFSharad TiwariNo ratings yet

- Instructor Led Training Presentation Sample - TSVDocument97 pagesInstructor Led Training Presentation Sample - TSVelsays0No ratings yet

- Asset AccountingDocument16 pagesAsset AccountingSarf FaizalNo ratings yet

- Financial Accounting - SlideshowDocument41 pagesFinancial Accounting - SlideshowHARIKUMARNo ratings yet

- Sap Fi Retained Earnings AccountsDocument1 pageSap Fi Retained Earnings AccountsDebabrata SahooNo ratings yet

- New LedgerDocument42 pagesNew LedgerMADHURA RAULNo ratings yet

- Advanced Substitutions in FIDocument2 pagesAdvanced Substitutions in FIShankar Kolla100% (1)

- Retained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDocument6 pagesRetained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDipankar DasNo ratings yet

- C S4FIN 2021 - Financial Accounting Associates SAP S4HANA 2021Document17 pagesC S4FIN 2021 - Financial Accounting Associates SAP S4HANA 2021Oriol CasesNo ratings yet

- General Ledger Accounting Training Manual: Author: Ask SAP ExpertDocument78 pagesGeneral Ledger Accounting Training Manual: Author: Ask SAP Expertsaif RashidNo ratings yet

- Bad Debt Configuration in SapDocument4 pagesBad Debt Configuration in Sapchintan05ec100% (1)

- Sap S4hana Finance-1Document14 pagesSap S4hana Finance-1Nawair IshfaqNo ratings yet

- Customizing SHANA TreasuryDocument850 pagesCustomizing SHANA Treasuryadhonay perezNo ratings yet

- F.13 GRIR ClearingDocument17 pagesF.13 GRIR Clearingbernard murindaNo ratings yet

- Thesis Arjun Gope PDFDocument225 pagesThesis Arjun Gope PDFJayesh PatelNo ratings yet

- SAP FICO Financial AccountingDocument4 pagesSAP FICO Financial AccountingNeelesh KumarNo ratings yet

- Automatic PaymentsDocument12 pagesAutomatic PaymentsfinerpmanyamNo ratings yet

- Recurring EntriesDocument10 pagesRecurring EntriesAB100% (1)

- SAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauDocument20 pagesSAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauSubramanian ChandrasekarNo ratings yet

- Asset Accounting ConfigurationDocument145 pagesAsset Accounting ConfigurationShaily DubeyNo ratings yet

- Accounting and Financial Close (J58)Document14 pagesAccounting and Financial Close (J58)Ahmed Al-SherbinyNo ratings yet

- SAP Finance Controlling Module MaterialDocument182 pagesSAP Finance Controlling Module MaterialSarosh0% (1)

- SAP DunningDocument13 pagesSAP DunningFarhad012No ratings yet

- What Is Special GL TransactionDocument4 pagesWhat Is Special GL TransactionRaj ShettyNo ratings yet

- Work Flow Creation Steps in SAP FICODocument23 pagesWork Flow Creation Steps in SAP FICObhaskarSNo ratings yet

- GFKL Co Sap - CoDocument107 pagesGFKL Co Sap - CoRenu BhasinNo ratings yet

- ANIRUDDHADocument68 pagesANIRUDDHAAniruddha ChakrabortyNo ratings yet

- Subcontracting Process With Challan - GSTDocument19 pagesSubcontracting Process With Challan - GSTAmit GuptaNo ratings yet

- C TS4FI 2021demoDocument2 pagesC TS4FI 2021demoFelipeJonasNo ratings yet

- E - 20180425 S4TWL - Credit ManagementDocument5 pagesE - 20180425 S4TWL - Credit ManagementericNo ratings yet

- BPC Embebido PDFDocument160 pagesBPC Embebido PDFDiana Marcela Maya PatinoNo ratings yet

- Sap FicoDocument73 pagesSap FicoKishore NandaNo ratings yet

- Sap Fi-Gl PDFDocument4 pagesSap Fi-Gl PDFpavan8412No ratings yet

- The SAP Finance Value Guide - Enter The Era of Intelligent Finance by Moving To SAP S - 4HANADocument33 pagesThe SAP Finance Value Guide - Enter The Era of Intelligent Finance by Moving To SAP S - 4HANAAMOUSSOUNo ratings yet

- Bankreconciliationconfiguration PDFDocument7 pagesBankreconciliationconfiguration PDFJan HarvestNo ratings yet

- Configuring SAP ERP Financials and ControllingFrom EverandConfiguring SAP ERP Financials and ControllingRating: 4 out of 5 stars4/5 (4)

- The Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITFrom EverandThe Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITNo ratings yet

- Types of Transport Request: 2. CustomizingDocument12 pagesTypes of Transport Request: 2. Customizingmohamed hassballahNo ratings yet

- NM 2Document1 pageNM 2mohamed hassballahNo ratings yet

- SAP MM Pricing ProcedureDocument43 pagesSAP MM Pricing Proceduremohamed hassballah100% (1)

- Dump RawDocument198 pagesDump Rawmohamed hassballahNo ratings yet

- Dump Short ENDocument5 pagesDump Short ENmohamed hassballahNo ratings yet

- Chapter 1Document46 pagesChapter 1Aravinthan ThamasegaranNo ratings yet

- Value Vs Growth Stock in Emerging Market-SubmittedDocument72 pagesValue Vs Growth Stock in Emerging Market-Submitted0796105632No ratings yet

- The Assessment of Damage Caused by Floods in The Brazilian ContextDocument17 pagesThe Assessment of Damage Caused by Floods in The Brazilian ContextcarloscartasineNo ratings yet

- Chilean Equity Yearbook 2021Document87 pagesChilean Equity Yearbook 2021Yi Chun LinNo ratings yet

- Finance 123Document25 pagesFinance 123hind alteneijiNo ratings yet

- 2 Corporate Accounting NotesDocument26 pages2 Corporate Accounting NotesYogesh Kumpawat100% (2)

- Actuarial Methode Eng - 2Document51 pagesActuarial Methode Eng - 2Robot MarketingNo ratings yet

- Master of Business Administration (Mba)Document56 pagesMaster of Business Administration (Mba)s.muthu100% (1)

- IFRS 13 Brief PDFDocument4 pagesIFRS 13 Brief PDFsona abrahamyanNo ratings yet

- SSR-2010 LRDocument24 pagesSSR-2010 LRdavidtollNo ratings yet

- MAMF Annual Report 2017-2018 Full Version PDFDocument184 pagesMAMF Annual Report 2017-2018 Full Version PDFAzad JuthawatNo ratings yet

- Ethiopias Digital EconomyDocument75 pagesEthiopias Digital EconomySelman100% (1)

- The Role of Financial Statements On Investment Decision Making PDFDocument26 pagesThe Role of Financial Statements On Investment Decision Making PDFIrene IgbayoNo ratings yet

- HTTP Sec - Gov Archives Edg... pdf5Document175 pagesHTTP Sec - Gov Archives Edg... pdf5Shane-Charles WenzelNo ratings yet

- Members' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDocument152 pagesMembers' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDuc-Anh NguyenNo ratings yet

- Organization: Cost of CapitalDocument30 pagesOrganization: Cost of CapitalShafi Sharafudeen KadaviNo ratings yet

- Valuation Measuring and Managing The Value of Comp... - (PG 23 - 36)Document14 pagesValuation Measuring and Managing The Value of Comp... - (PG 23 - 36)Alexandra ArangoNo ratings yet

- Mercury Case Report Vedantam GuptaDocument9 pagesMercury Case Report Vedantam GuptaVedantam GuptaNo ratings yet

- Quantic Welcome Program GuideDocument18 pagesQuantic Welcome Program Guideabhi_gkNo ratings yet

- Application - Empanelment of ValuersDocument8 pagesApplication - Empanelment of ValuersMaha RajNo ratings yet

- Acquire Biannual Multiples Report Jan 2024Document39 pagesAcquire Biannual Multiples Report Jan 2024Deepak DevasiNo ratings yet

- ManPro-6 Present Worth Analysis 2019Document45 pagesManPro-6 Present Worth Analysis 2019Syifa Fauziah RustoniNo ratings yet

- Eng 111 Syllabus PDFDocument3 pagesEng 111 Syllabus PDFnadimNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument7 pagesAudit of Cash and Cash Equivalents: Internal Control Measures For CashmoNo ratings yet

- SAP MM Course ModuleDocument4 pagesSAP MM Course ModuleAyann ShomNo ratings yet

- Dividend Growth ModelDocument4 pagesDividend Growth ModelRichardDanielNo ratings yet

- As-2 Inventory Valuation: 1) IntroductionDocument17 pagesAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariNo ratings yet