Professional Documents

Culture Documents

HW1

HW1

Uploaded by

shruthisreehk0 ratings0% found this document useful (0 votes)

7 views1 pageGorgon Inc. is projecting its 2024 financial statements based on information from 2023. Revenue is projected to grow 5% to $21,000. EBITDA margin will increase to 13% of revenue from 12%. Depreciation remains at 5% of fixed assets. Interest is 12.5% of the prior year's total debt. Working capital accounts increase proportionally to revenue growth but cash, prepaid expenses, and fixed assets remain unchanged.

Gorgon does not require any new debt in 2024 to fund 5% sales growth as existing debt and equity can support the increased working capital needs. ROA is projected to be 2% for 2024 while ROE is projected to be 27% due

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGorgon Inc. is projecting its 2024 financial statements based on information from 2023. Revenue is projected to grow 5% to $21,000. EBITDA margin will increase to 13% of revenue from 12%. Depreciation remains at 5% of fixed assets. Interest is 12.5% of the prior year's total debt. Working capital accounts increase proportionally to revenue growth but cash, prepaid expenses, and fixed assets remain unchanged.

Gorgon does not require any new debt in 2024 to fund 5% sales growth as existing debt and equity can support the increased working capital needs. ROA is projected to be 2% for 2024 while ROE is projected to be 27% due

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageHW1

HW1

Uploaded by

shruthisreehkGorgon Inc. is projecting its 2024 financial statements based on information from 2023. Revenue is projected to grow 5% to $21,000. EBITDA margin will increase to 13% of revenue from 12%. Depreciation remains at 5% of fixed assets. Interest is 12.5% of the prior year's total debt. Working capital accounts increase proportionally to revenue growth but cash, prepaid expenses, and fixed assets remain unchanged.

Gorgon does not require any new debt in 2024 to fund 5% sales growth as existing debt and equity can support the increased working capital needs. ROA is projected to be 2% for 2024 while ROE is projected to be 27% due

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

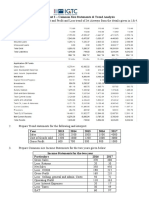

F650 – HW1

Use the following information to make projections regarding Gorgon Inc. 2024. Assume that revenue

growth is 5%, depreciation is 5% of fixed assets, EBITDA margin increases from 12% to 13% of revenue,

interest is 12.5% of the prior year’s total debt. Cash, prepaid expenses, and fixed assets are unchanged,

all working capital accounts increase as a fixed % of revenue. The tax rate is 34% (if applicable).

2023 Income Statement 2023 Balance Sheet

Revenue 20000 Assets Liabilities & Equity

EBITDA 2400 Cash 215 Accounts Payable 7500

depreciation 600 Prepaid Expenses 1300 Short Term Debt 5400

Interest 1740 Accounts Receivable 3750 Long Term Debt 7265

EBT 60 Inventory 4850 Retained Earnings 150

Taxes 20.4 Fixed Assets 12000 Paid in Cap 1800

Net Income 39.6 Total 22115 Total 22115

a) How much (if any) new debt does Gorgon require in 2024 to fund its sales growth? (5 marks)

b) Calculate both ROA and ROE for 2024. Why are these two ratios so different? (5 marks)

You might also like

- Forecasting ProblemsDocument7 pagesForecasting ProblemsJoel Pangisban0% (3)

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Assignment 1 Preparing Financial StatementsDocument3 pagesAssignment 1 Preparing Financial Statements吴静怡0% (1)

- R31 Free Cash Flow Valuation Q Bank PDFDocument8 pagesR31 Free Cash Flow Valuation Q Bank PDFZidane Khan100% (1)

- Sic 2 Ej. BusinessDocument2 pagesSic 2 Ej. Businesstomasdales44No ratings yet

- BT B Sung Chapter 45Document2 pagesBT B Sung Chapter 45Yến Nhi VũNo ratings yet

- Financial Planning - ForecastingDocument4 pagesFinancial Planning - ForecastingPrathamesh411No ratings yet

- Fina H 6th-Sem 2022Document4 pagesFina H 6th-Sem 2022dapurva134No ratings yet

- Fin Q2Document6 pagesFin Q2Pulkit SethiaNo ratings yet

- Afm Paper DalmiaDocument5 pagesAfm Paper DalmiaasheetakapadiaNo ratings yet

- c3 Mergers and Acquisitions Review QuestionsDocument7 pagesc3 Mergers and Acquisitions Review Questionscharlesmicky82No ratings yet

- Cover PageDocument209 pagesCover PageABHISHREE JAINNo ratings yet

- Quiz 1 FIN 440 2Document2 pagesQuiz 1 FIN 440 2Anowarul IslamNo ratings yet

- Lectures 4&5-External Sector - 2017Document106 pagesLectures 4&5-External Sector - 2017Mark EllyneNo ratings yet

- Long Term Loan Details TermDocument67 pagesLong Term Loan Details TermPranjal GuptaNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- Lorent PracticeDocument17 pagesLorent PracticeagneswahyuNo ratings yet

- M&A Problms - ClassDocument14 pagesM&A Problms - ClassSeemaNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- Accounting Grade 12 Test 3Document4 pagesAccounting Grade 12 Test 3khandiekhash2k7No ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Session 7 - in Class 2Document20 pagesSession 7 - in Class 2IIT IIM Anubhav AnubhavNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Review Questions On Financial Planning and ForecastingDocument5 pagesReview Questions On Financial Planning and ForecastingGadafi FuadNo ratings yet

- Math Solution - Session 11Document8 pagesMath Solution - Session 11Saoda Feel IslamNo ratings yet

- Team Green - Task 1 - Drafting of Financial Documents and Conducting of A Financial AnalysisDocument14 pagesTeam Green - Task 1 - Drafting of Financial Documents and Conducting of A Financial AnalysisRoche ChenNo ratings yet

- SI Session Valuations QuestionDocument2 pagesSI Session Valuations QuestionLuyanda MhlongoNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Tut 8 Submission QuestionsDocument6 pagesTut 8 Submission Questionsxabaandiswa8No ratings yet

- JK Shah StudyMat-Paper 1-Advanced AccountingDocument518 pagesJK Shah StudyMat-Paper 1-Advanced AccountingSamyukt GNo ratings yet

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21No ratings yet

- Financial Forecasting Homework ProblemsDocument3 pagesFinancial Forecasting Homework ProblemsRobert IronsNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- PFS - LO1 LTD Company Accounts - Questions 2021Document5 pagesPFS - LO1 LTD Company Accounts - Questions 2021Ludmila DorojanNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Problems On Profits and Gains of Business and ProfessionDocument11 pagesProblems On Profits and Gains of Business and ProfessionNikithaNo ratings yet

- CF Assignment 1 06102022 091143pmDocument1 pageCF Assignment 1 06102022 091143pmhadsem78No ratings yet

- Eng 111 S20 HW2Document6 pagesEng 111 S20 HW2Edward LuNo ratings yet

- Ratio Analysis SolutionDocument7 pagesRatio Analysis SolutionYakub Ali SalimNo ratings yet

- Financial Forecasting: Mutya L. SilvaDocument11 pagesFinancial Forecasting: Mutya L. SilvaRobelyn LacorteNo ratings yet

- Business Analysis and Report Ex 5Document7 pagesBusiness Analysis and Report Ex 5lehoangminhchau21No ratings yet

- Valuation Report: JD SportsDocument10 pagesValuation Report: JD SportsJunaid IqbalNo ratings yet

- The Stupidity of Using MultiplesDocument2 pagesThe Stupidity of Using MultiplesHesham TabarNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- Institute of Business Management: Assignment - Spring 2020Document7 pagesInstitute of Business Management: Assignment - Spring 2020Sussi HizbullahNo ratings yet

- MBA Session 2 Carrick QuestionDocument2 pagesMBA Session 2 Carrick QuestionTafsir-i- AliNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- Quiz 2 MBA 29032023 123453pmDocument1 pageQuiz 2 MBA 29032023 123453pmArisha KhanNo ratings yet

- Quick LBO ModelDocument10 pagesQuick LBO Modelraphael varaneNo ratings yet

- CFROIDocument15 pagesCFROImakrantjiNo ratings yet

- FGFGDocument3 pagesFGFGgs randhawaNo ratings yet

- ACCN 101-Jan 2022Document6 pagesACCN 101-Jan 2022Chapo madzivaNo ratings yet

- SFM Dawn Merger and AcquisitionDocument29 pagesSFM Dawn Merger and AcquisitionAmnNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sermon Matthew Chapter 12Document1 pageSermon Matthew Chapter 12shruthisreehkNo ratings yet

- ALACDocument18 pagesALACshruthisreehkNo ratings yet

- Valuation IntroductionDocument1 pageValuation IntroductionshruthisreehkNo ratings yet

- Sermon Chapter 15 The Journey of FaithDocument1 pageSermon Chapter 15 The Journey of FaithshruthisreehkNo ratings yet

- Valuation PTADocument1 pageValuation PTAshruthisreehkNo ratings yet

- Bible Sermon Part1Document1 pageBible Sermon Part1shruthisreehkNo ratings yet

- Matthew Chapter 7 SermonDocument1 pageMatthew Chapter 7 SermonshruthisreehkNo ratings yet